Rising above monetary burdens and paving your way towards prosperity is a dream cherished by many. Achieving financial freedom isn’t as elusive as it may seem; it simply requires a strategic approach, unwavering determination, and key insights into steering your life towards abundance. In this article, we will unravel ten crucial guidelines that can transform your financial trajectory, allowing you to take control of your destiny and attain the long-awaited liberation from financial constraints.

1. Cultivate a Money Mindset: Shaping a positive attitude towards money is the first step towards achieving financial freedom. Harnessing your thoughts and beliefs about wealth will enable you to make conscious choices and utilize resources effectively. Embrace the notion that abundance is within your reach, and watch as opportunities unfold before your eyes.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn More2. Embrace the Power of Budgeting: The cornerstone of any prosperous journey lies in maintaining a well-structured budget. By creating a comprehensive financial plan, you can track your income, expenses, and savings, ensuring that every penny is accounted for. Embracing budgeting will not only increase your financial awareness but also allow you to make informed decisions about your spending habits.

3. Diversify Your Income Streams: Relying solely on one source of income can be risky. Consider exploring alternative avenues, such as investing in stocks, starting a side business, or investing in real estate. By diversifying your income streams, you create a safety net that can withstand unexpected financial challenges and propel you towards prosperity.

4. Prioritize Debt Repayment: Freeing yourself from the shackles of debt is paramount in your journey towards financial freedom. Crafting a debt repayment plan and diligently adhering to it will relieve the burden of interest payments and allow you to allocate your resources wisely. Prioritize clearing high-interest debts to accelerate your progress on the path to prosperity.

5. Become an Informed Investor: Educate yourself about the world of investments to capitalize on lucrative opportunities. Develop a deep understanding of stocks, bonds, mutual funds, and other financial instruments to make sound investment decisions. By expanding your financial literacy, you can make your money work for you and inch closer to your financial goals.

6. Foster a Thrifty Lifestyle: Embracing frugality doesn’t mean sacrificing your happiness; rather, it enables you to lead a conscious and value-oriented life. Evaluate your expenses, distinguish between needs and wants, and make mindful choices. Each small saving contributes towards your financial well-being and propels you towards greater prosperity.

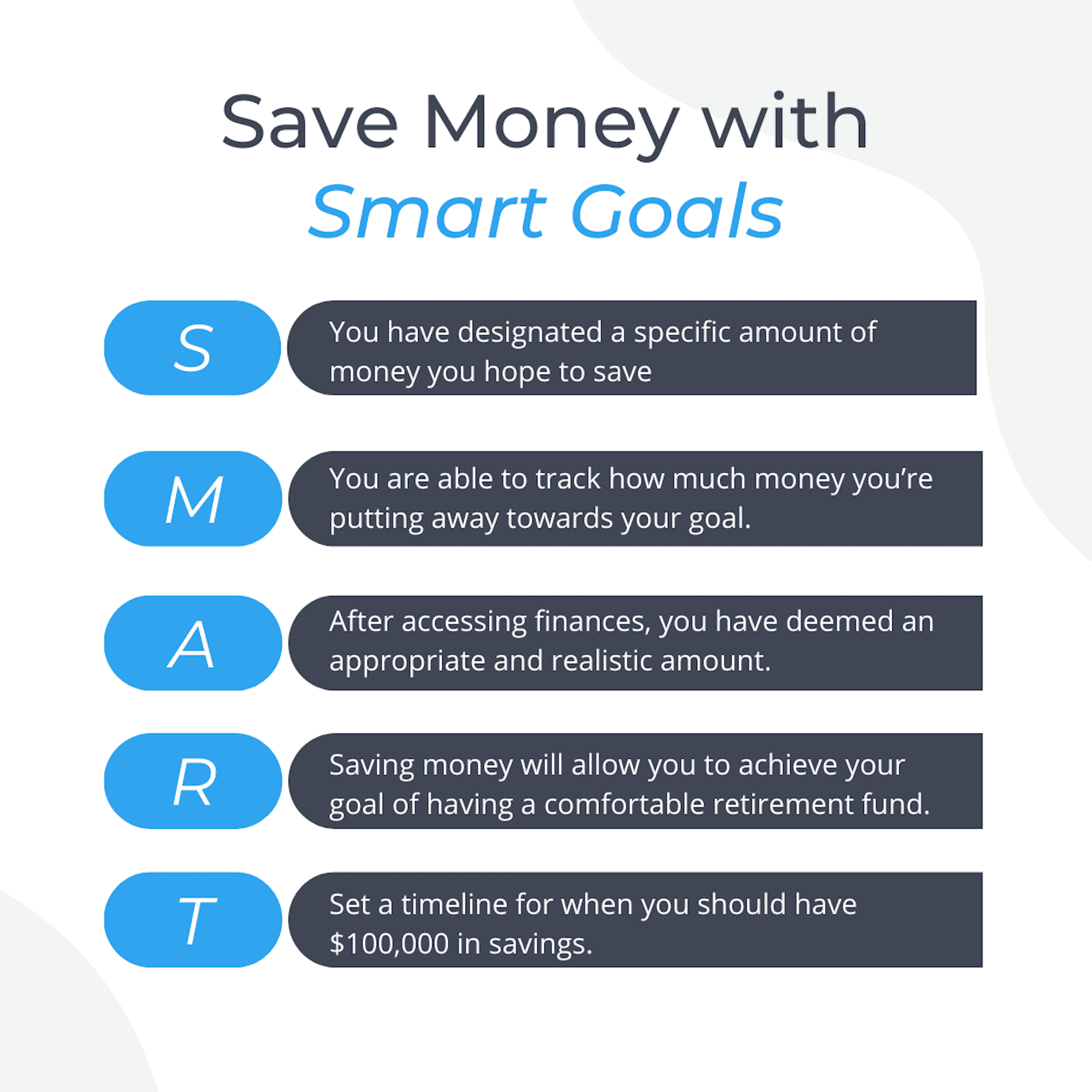

7. Set Realistic Goals: Chart your financial journey by setting tangible goals that inspire and challenge you. Whether it’s saving for a dream vacation, purchasing a new home, or retiring early, clear goals allow you to stay focused and motivated. Break these goals into smaller milestones and celebrate each achievement along the way.

8. Build an Emergency Fund: Life’s unforeseen emergencies can thwart your path to financial freedom if you’re caught unprepared. Establish an emergency fund that cushions you during challenging times, ensuring that an unexpected expense doesn’t deplete your hard-earned savings. Aim to have at least three to six months’ worth of living expenses saved to face any storm that may come your way.

9. Seek Professional Guidance: Financial advisors can serve as valuable allies on your journey towards financial freedom. With their expertise, they can help you create customized strategies, optimize your investment portfolio, and navigate complex financial decisions. Collaborating with a professional will empower you to make informed choices and accelerate your progress.

10. Stay Committed and Flexible: The road to prosperity may present challenges, requiring adaptability and resilience. Stay committed to your financial goals, adjusting your strategies as needed. Remember that setbacks are temporary, and perseverance is the key to ultimately achieving the financial freedom you desire.

By implementing these essential insights and taking charge of your financial destiny, you can embark on a transformative journey towards financial freedom. Empower yourself with knowledge, make conscious choices, and embrace the possibilities that await you on this path towards abundance. Your future of financial prosperity begins now.

- Transforming Debt into Prosperity: Strategies for Financial Freedom

- Creating a Solid Budget Plan

- Organize your finances and set realistic goals

- Track your income, expenses, and savings

- Minimizing and Managing Debt

- Consolidate high-interest debts and negotiate lower rates

- Develop a Repayment Strategy and Prioritize Debt Payments

- Seek professional guidance when necessary

- Building an Emergency Fund

- Save a Reserve Fund Equal to 3-6 Months of Living Expenses

- Automate savings to ensure consistent contributions

- Questions and answers

Transforming Debt into Prosperity: Strategies for Financial Freedom

Revamping your financial situation to achieve true freedom from debt and embrace a life of prosperity requires careful planning and deliberate actions. In this section, we will explore a range of effective strategies that can empower you to turn your debt into wealth and secure your path towards financial freedom.

|

1. Debt Repayment Plan |

By devising a well-structured and realistic plan to repay your debts, you can take control of your financial situation. Prioritize your debts based on interest rates, and allocate a portion of your income towards clearing them systematically. Commit to consistent payments and resist the temptation to accumulate further debt. |

|

2. Budgeting and Expense Tracking |

Developing a comprehensive budget and tracking your expenses is essential to understand where your money is going. By identifying unnecessary expenses and making conscious choices about your spending habits, you can create room for debt repayment and future wealth accumulation. |

|

3. Increasing Income Streams |

Exploring additional sources of income, such as part-time jobs or freelancing opportunities, can help improve your financial situation. Diversifying your income streams allows you to generate more funds to repay debt, build savings, and invest in assets that lead to financial prosperity. |

|

4. Negotiating with Creditors |

If you find yourself struggling to meet debt obligations, don’t hesitate to negotiate with your creditors. Open communication and willingness to find mutually beneficial solutions can lead to revised payment terms, reduced interest rates, or even debt forgiveness, easing the burden on your financial journey. |

|

5. Building an Emergency Fund |

Creating a dedicated emergency fund safeguards you from unforeseen financial setbacks and reduces the need to rely on credit in times of crisis. Set aside a portion of your income each month and strive to build a sufficient safety net to cover expenses during unexpected situations. |

|

6. Learning and Improving Financial Literacy |

Take the time to educate yourself about personal finance management and investment strategies. By enhancing your financial literacy, you can make informed decisions, identify lucrative opportunities to grow your wealth, and prevent falling into debt traps in the future. |

|

7. Minimizing Expenses and Simplifying Lifestyle |

Adopting a frugal mindset and reassessing your lifestyle choices can significantly impact your journey towards financial freedom. Cut back on unnecessary expenses, prioritize essential needs, and embrace a simpler lifestyle that focuses on long-term financial stability. |

|

8. Seeking Professional Advice |

If you feel overwhelmed or unsure about how to manage your debt and secure your finances, don’t hesitate to seek guidance from financial professionals. They can provide personalized advice, create tailored strategies, and offer valuable insights to expedite your path towards prosperity. |

|

9. Investing Wisely |

Once you have successfully tackled your debt, prioritize investing in assets that can generate long-term wealth. Whether it’s real estate, stocks, or other investment avenues, make informed decisions, diversify your portfolio, and carefully assess risks to maximize your returns. |

|

10. Staying Committed and Being Patient |

Transforming debt into prosperity is a journey that requires commitment and patience. Maintain your focus, stay disciplined with your financial strategies, and remind yourself of the ultimate goal of attaining long-lasting financial freedom. Celebrate small victories along the way and stay motivated to achieve your desired financial state. |

Creating a Solid Budget Plan

Establishing a robust financial framework is vital for achieving economic independence and stability. In this section, we will delve into the essential steps to develop an effective budget plan that will serve as the cornerstone of your financial journey towards prosperity.

1. Assess Your Income and Expenses: Begin by evaluating your sources of income and carefully analyzing your spending habits. This comprehensive assessment will provide you with a clear understanding of the funds available for allocation towards various financial goals.

2. Prioritize Your Financial Goals: Define and prioritize your short-term and long-term financial aspirations. Whether it is building an emergency fund, paying off debts, or saving for retirement, establishing clear goals will help you direct your financial resources efficiently.

3. Categorize Your Expenses: Divide your expenses into different categories based on their significance and regularity. This systematic approach will enable you to identify areas where you can trim unnecessary costs and allocate funds towards more crucial aspects of your financial plan.

4. Establish Realistic Budget Limits: Set realistic spending limits for each category of expenses based on your income and financial goals. Ensuring that your expenditures do not exceed your income will facilitate savings and minimize the risk of accumulating debt.

| Expense Category | Budget Limit |

|---|---|

| Housing | $800 |

| Transportation | $400 |

| Food | $300 |

| Utilities | $200 |

| Entertainment | $150 |

5. Track Your Expenses: Maintain a record of your expenses and regularly track them against your budget plan. Utilize personal finance apps or digital spreadsheets to monitor your spending and identify areas where you need to make adjustments.

6. Automate Savings: Make saving a priority by automating regular contributions to your savings or investment accounts. Prioritizing savings as an essential part of your budget plan ensures that you set aside money for future financial stability.

7. Review and Adapt: Periodically review your budget plan and make necessary revisions to accommodate any changes in your income, expenses, or financial goals. Flexibility is key to maintaining a budget plan that aligns with your evolving financial needs.

8. Seek Professional Advice: If you find it challenging to create a solid budget plan or need expert guidance in managing your finances, consider consulting a financial advisor. Their expertise and experience can provide valuable insights and strategies tailored to your specific situation.

9. Stay Disciplined: Adhering to your budget plan requires discipline and determination. Avoid impulsive spending and regularly revisit your financial goals to stay motivated on your path to financial freedom.

10. Celebrate Milestones: Acknowledge and celebrate milestones achieved along your financial journey. Rewarding yourself for achieving specific goals will reinforce positive financial habits and further fuel your determination to maintain a solid budget plan.

A strong budget plan lays the foundation for your financial freedom. By carefully monitoring income, tracking expenses, and prioritizing goals, you can take control of your finances and pave the way towards a prosperous future.

Organize your finances and set realistic goals

Finding freedom from debt and achieving prosperity requires careful organization of your finances and the setting of realistic goals. By taking control of your financial situation, you can pave the way for a more secure and prosperous future.

Start by analyzing your current financial state and creating a budget. Identify your sources of income and track your expenses to gain a clear understanding of where your money is going. This will help you identify areas where you can cut back and save. Prioritize your financial goals, whether it be paying off debts, saving for a down payment on a house, or establishing an emergency fund.

Setting realistic goals is crucial for your financial success. It’s important to be specific and measurable when defining your goals. Instead of vague objectives like save money or get out of debt, set specific targets such as save $500 per month or pay off my credit card debt within two years. This will provide you with a clear roadmap and help you stay motivated.

Remember to be flexible in your approach to achieving these goals. It may be necessary to adjust your plans as circumstances change. Be prepared to make sacrifices and cut back on unnecessary expenses to stay on track. Consider seeking the help of a financial advisor who can provide guidance and support in reaching your goals.

By organizing your finances and setting realistic goals, you will be on your way to achieving financial freedom. Take control of your financial future today and enjoy the benefits of a more stable and prosperous life.

Track your income, expenses, and savings

Monitoring your earnings, spending, and savings is crucial for achieving financial stability and eventual freedom. Keeping a close eye on your financial inflows and outflows allows you to make informed decisions, identify areas for improvement, and work towards your financial goals.

By diligently tracking your income, you can gain a clear understanding of how much money you are earning and where it is coming from. This knowledge enables you to identify potential opportunities for increasing your earnings or diversifying your income sources. Additionally, tracking your income helps you ensure that you are receiving accurate compensation for your work or investments.

Equally important is tracking your expenses. By documenting every expense, whether big or small, you become aware of where your money is going. It allows you to identify any unnecessary or excessive spending, enabling you to make necessary adjustments and cut back on non-essential items or services. Tracking your expenses also helps you create a budget that aligns with your financial goals, ensuring that you are spending within your means and not accumulating unnecessary debt.

Finally, tracking your savings allows you to monitor your progress towards building a financial cushion and achieving long-term financial success. Recording your savings contributions and growth allows you to see the tangible results of your efforts. It also helps you stay motivated and committed to your savings goals, as you are able to visually track your journey from debt to prosperity.

| Benefits of Tracking | Income | Expenses | Savings |

|---|---|---|---|

| Identify opportunities for growth | Understand income sources | Identify unnecessary spending | Monitor progress towards financial goals |

| Make informed financial decisions | Ensure accurate compensation | Create a more realistic budget | Stay motivated and committed |

| Work towards financial goals | Identify potential income gaps | Avoid accumulating unnecessary debt | Visualize your journey |

Tracking your income, expenses, and savings puts you in control of your finances and empowers you to make meaningful changes. Whether you use digital tools, spreadsheets, or the traditional pen and paper method, the key is to stay consistent and dedicated to tracking your financial journey. With this valuable information at your disposal, you can pave the way to financial freedom and prosperity.

Minimizing and Managing Debt

Effective strategies for reducing and overseeing financial obligations are crucial components to attaining economic independence. By employing careful planning and adept handling of financial burdens, individuals can pave their path towards enhanced prosperity and freedom from economic constraints.

1. Streamlining Expenses: Recognize areas where expenditure can be minimized or eliminated by scrutinizing your budget and identifying non-essential or wasteful spending. Allocate resources towards debt repayment rather than unnecessary luxuries.

2. Implementing a Debt Repayment Plan: Devise a structured plan that prioritizes debt with higher interest rates or outstanding balances. Consistently make timely payments to reduce debt and continue moving towards financial freedom.

3. Negotiating with Creditors: Engage in open and transparent communication with creditors to explore potential options such as reduced interest rates, extended payment terms, or revised repayment plans. This can help alleviate the burden of debt and pave the way for more manageable financial obligations.

4. Consistent Budgeting: Develop a detailed budget that includes all sources of income and accounts for monthly expenses. By adhering to a budget, individuals can closely monitor their debt obligations and make necessary adjustments to ensure long-term financial stability.

5. Increasing Income: Explore opportunities for additional sources of revenue to accelerate debt repayment. This may involve taking on part-time work, freelancing, or seeking higher-paying job prospects to bolster financial resources and expedite the path to prosperity.

6. Seeking Professional Advice: Consider consulting with a financial advisor or credit counselor who can provide expert guidance, helping develop strategies tailored to your specific circumstances and ensuring effective debt management.

7. Avoiding Excessive Borrowing: Exercise caution when entering into new financial commitments and borrowing arrangements. Carefully assess the necessity and potential long-term implications of taking on additional debt before making any decisions.

8. Utilizing Debt Consolidation: Explore the option of consolidating multiple debts into a single loan with more favorable terms and reduced interest rates. Consolidation can simplify repayment processes and make monthly budgeting more manageable.

9. Building an Emergency Fund: Establish a savings account dedicated to emergencies to prevent reliance on credit cards or loans when unexpected expenses arise. Having a safety net can help prevent accruing further debt and reduce financial vulnerability.

10. Monitoring Credit Score: Regularly check your credit score and credit report to identify any errors or inaccuracies that could negatively impact your ability to obtain credit, secure favorable interest rates, or achieve financial goals. Addressing inaccuracies promptly can help maintain good credit and improve financial prospects.

By following these prudent strategies, individuals can successfully minimize debt and effectively manage their financial obligations, ultimately paving the way for a future of financial stability and prosperity.

Consolidate high-interest debts and negotiate lower rates

One effective strategy for gaining control of your finances and working towards financial freedom is consolidating high-interest debts and negotiating lower rates. By consolidating your debts, you can simplify your payment process and potentially lower your overall interest rates, ultimately saving you money in the long run.

High-interest debts such as credit card balances or personal loans can often become a burden, particularly when the interest rates are substantial. By consolidating these debts, you can combine multiple payments into one, making it easier to track and manage your finances. This can also be a helpful way to prioritize your debt repayment strategy and work towards becoming debt-free.

| Negotiating lower rates |

| Another crucial aspect of the debt consolidation process is negotiating lower interest rates with your creditors. This can help you decrease the amount of money you owe and potentially save thousands of dollars over time. |

| When negotiating with creditors, it’s important to showcase your willingness to pay off your debts and demonstrate that you are taking proactive steps towards improving your financial situation. Be prepared to provide a strong case for why you deserve a lower interest rate, such as evidence of consistent on-time payments and a stable income. |

| It’s also worth exploring other options, such as balance transfer offers or seeking assistance from reputable debt consolidation companies. These entities may be able to help you secure lower interest rates or negotiate more favorable repayment terms. |

| Remember that consolidation and negotiation are not guarantees, but by actively pursuing these options, you increase your chances of finding relief from high-interest debts. It is crucial to research and compare different consolidation options, seeking professional advice if needed, to ensure you make an informed decision. |

In summary, consolidating high-interest debts and negotiating lower rates can play a significant role in your journey towards financial freedom. By simplifying your payments and securing lower interest rates, you can work towards paying off your debts more efficiently and ultimately achieve a more prosperous financial future.

Develop a Repayment Strategy and Prioritize Debt Payments

In order to achieve your financial goals and move towards a debt-free life, it is crucial to develop a well-thought-out repayment strategy and prioritize your debt payments. By doing so, you can effectively manage your debts, reduce interest payments, and ultimately achieve financial freedom.

Firstly, start by assessing your current financial situation and understanding the extent of your debts. Take a comprehensive look at all your outstanding debts, including loans, credit card balances, and any other forms of debt. This will provide you with a clear overview of your financial obligations and help you determine where to focus your repayment efforts.

Next, consider setting achievable goals for paying off your debts. Break down your outstanding balances into smaller, manageable amounts and create a timeline for repayment. Having specific targets and deadlines will help you stay motivated and track your progress along the way. Additionally, consider using the debt-snowball or debt-avalanche method to prioritize your payments.

| Prioritize Method | Description |

|---|---|

| Debt-Snowball Method | This method involves paying off debts with the smallest balance first, regardless of interest rates. This approach allows you to experience small wins as you eliminate individual debts, providing motivation to continue your debt repayment journey. |

| Debt-Avalanche Method | This method involves prioritizing debts with the highest interest rates. By focusing on eliminating high-interest debts first, you can minimize the overall interest payments and save money in the long run. |

Furthermore, consider negotiating with your creditors to get better terms or reduced interest rates. Many creditors are willing to work with individuals who are proactive in managing their debts and may be open to renegotiating the terms of your repayment. This can be particularly beneficial if you are struggling to meet monthly payment obligations.

Lastly, to ensure successful implementation of your repayment strategy, it is crucial to create a budget and stick to it. Analyze your income and expenses, and identify areas where you can cut back or reduce spending. By allocating more funds towards debt payments, you can accelerate your progress towards becoming debt-free.

Developing a repayment strategy and prioritizing debt payments are essential steps on your journey toward financial freedom. By assessing your debts, setting goals, utilizing effective debt repayment methods, negotiating with creditors, and maintaining a budget, you can take control of your financial situation and work towards a prosperous future free from debt.

Seek professional guidance when necessary

It is crucial to seek the expertise of professionals in the field of finance and wealth management in order to navigate your way towards financial freedom. When facing complex financial situations or decisions, consulting with qualified individuals can provide valuable insights and guidance to help you make informed choices.

When it comes to managing debt, investing, or planning for your future, seeking professional advice can offer a fresh perspective and help you avoid costly mistakes. Financial advisors, accountants, or debt counselors can assess your specific circumstances, provide personalized recommendations, and assist in creating a tailored financial plan to meet your goals.

Professional advice can empower you to gain a deeper understanding of financial concepts, learn about potential risks, and explore various strategies to maximize your wealth accumulation and minimize debt. These experts possess in-depth knowledge of the financial industry and can keep you updated on the latest trends, regulations, and opportunities that may impact your financial success.

Remember, seeking professional advice should not be limited to times of crisis or uncertainty. Regular consultations can serve as a proactive approach to evaluate your financial health, track progress towards your goals, and make necessary adjustments along the way. By tapping into their experience and expertise, you can build a strong foundation for long-term financial prosperity.

Keep in mind that selecting the right professional is essential. Take the time to research and choose individuals with relevant credentials, solid experience, and positive reputations. Don’t hesitate to ask for references or conduct interviews to ensure they align with your values and financial objectives.

Ultimately, seeking professional guidance when needed demonstrates a commitment to your financial well-being and a willingness to gain expert insights. By working together with these professionals, you can confidently navigate your way towards achieving true financial freedom.

Building an Emergency Fund

In times of crisis or unexpected expenses, having a financial cushion could be the difference between financial security and disaster. This section aims to guide you on the importance of building an emergency fund and the steps you can take to achieve it.

Creating a safety net for unforeseen circumstances is crucial for anyone seeking financial stability and peace of mind. An emergency fund acts as a protective shield against sudden job loss, medical emergencies, car repairs, or any other unexpected financial burdens that may come your way.

Building an emergency fund requires discipline and commitment. Start by setting a goal for the amount you want to save, whether it’s three to six months’ worth of living expenses or a specific dollar amount. Make saving a priority by setting aside a portion of your income each month.

It’s essential to make your emergency fund easily accessible but separate from your regular checking or savings account. Consider opening a separate high-yield savings account specifically designated for emergencies. This will not only make it easier to track your progress but also prevent you from dipping into the funds for non-emergency expenses.

Another useful strategy is automating your savings by setting up automatic transfers from your primary account to your emergency fund. Treat these transfers as a monthly bill or a fixed expense, ensuring that you consistently contribute to your fund and avoid the temptation to skip contributions.

During the process of building your emergency fund, you may encounter unexpected windfalls such as tax refunds, bonuses, or monetary gifts. While it can be tempting to spend these windfalls on discretionary items or vacations, consider redirecting a portion or all of them towards your emergency fund to expedite its growth.

Remember that building an emergency fund is a journey, and it takes time. Stay committed to your goal and remain disciplined in cutting unnecessary expenses to free up more funds for savings. As your emergency fund grows, you will gain a sense of financial security and peace knowing that you have a safety net to rely on during difficult times.

In summary, building an emergency fund is a fundamental step towards achieving financial freedom. By prioritizing and consistently saving for unexpected expenses, you’re taking control of your financial situation and setting the stage for a more secure and prosperous future.

Save a Reserve Fund Equal to 3-6 Months of Living Expenses

One crucial step towards achieving financial security is building a reserve fund that covers your living expenses for an extended period of time. Investing time and effort into saving and creating a safety net can provide peace of mind and protect against unexpected financial setbacks.

It is important to have a substantial amount of money set aside that can cover your essential expenses, such as rent or mortgage payments, utility bills, groceries, and transportation costs, in case of emergencies or a sudden loss of income. Having this reserve fund allows you to maintain financial stability and avoid falling into debt.

By diligently saving a minimum of 3-6 months’ worth of living expenses, you protect yourself from unforeseen circumstances such as job loss, illness, or unforeseen expenses. Consider it as a financial buffer that ensures your ability to handle unexpected situations without resorting to credit cards or loans.

Start by assessing and tracking your monthly expenses to determine an accurate estimate of your living costs. Review your budget regularly and identify areas where you can cut unnecessary expenses or save money. Dedicate a portion of your income towards building your reserve fund, making it a priority in your financial planning.

Creating a reserve fund takes time, discipline, and commitment. Consistently setting aside a portion of your income, regardless of the amount, will gradually help you achieve your goal. Consider automating your savings by setting up automatic transfers from your paycheck to a separate savings account.

Additionally, explore ways to increase your income, such as finding alternative sources of revenue or pursuing new opportunities. The more you can save, the better prepared you will be to face unforeseen financial challenges.

Remember that building a reserve fund is an ongoing process. As your financial situation improves, aim to save beyond the recommended 3-6 months’ worth of living expenses. The larger your reserve fund, the more secure you will feel and the more financial freedom you will have.

Automate savings to ensure consistent contributions

One crucial step towards achieving financial stability and freedom is to automate your savings. By setting up automatic transfers from your checking account to your savings account, you can ensure consistent contributions without having to rely on your own willpower.

Instead of manually depositing money into your savings account each month, automate the process. This means that a fixed amount will be transferred automatically from your checking account to your savings account on a specified date every month. By doing so, you eliminate the temptation to spend the money before you have a chance to save it.

Automating your savings not only eliminates the risk of forgetting to save or making excuses to spend the money, but it also establishes a healthy financial habit. By treating savings as a regular bill that needs to be paid, you prioritize your financial goals and put them ahead of impulsive spending.

Consistent contributions to your savings account have several benefits:

- You build a safety net: By regularly saving money, you create a financial cushion for unexpected expenses or emergencies. This safety net can provide peace of mind and prevent you from falling into debt or relying on credit cards to cover unexpected costs.

- You achieve your financial goals faster: Consistent savings allow you to reach your financial goals more quickly, whether it’s saving for a down payment on a house, starting a business, or planning for retirement. Automating your savings ensures you make progress towards these goals without any additional effort.

- You take advantage of compound interest: By consistently contributing to your savings account, you allow your money to grow through compound interest over time. This means that the earlier you start saving and the more you contribute, the more your money will grow exponentially.

- You develop financial discipline: Automating your savings helps you develop discipline and avoid the temptation of impulsive spending. It encourages you to stick to your budget and prioritize saving for your future.

In conclusion, automating your savings is an essential strategy for achieving financial freedom. It ensures consistent contributions, builds a safety net, accelerates your progress towards financial goals, takes advantage of compound interest, and cultivates financial discipline. Start automating your savings today and take control of your financial future.

Questions and answers

What are some practical tips for achieving financial freedom?

Some practical tips for achieving financial freedom include creating a budget, reducing unnecessary expenses, saving and investing wisely, paying off debts, and setting financial goals.

Is it possible to achieve financial freedom even with existing debt?

Yes, it is possible to achieve financial freedom even with existing debt. The key is to create a plan to pay off the debt efficiently while also focusing on saving and investing for the future.

How can I effectively budget my income to achieve financial freedom?

You can effectively budget your income by tracking your expenses, categorizing them, and identifying areas where you can reduce or eliminate unnecessary spending. Allocating a certain portion of your income towards savings and investments is also essential.

What steps can I take to pay off my debts faster?

To pay off debts faster, you can start by paying more than the minimum required payment each month. Prioritize high-interest debts first, consider debt consolidation or balance transfer options, and look for ways to increase your income to allocate more towards debt repayment.

Why is it important to set financial goals when aiming for financial freedom?

Setting financial goals provides you with direction and motivation. It helps you stay focused on your long-term vision and enables you to make informed decisions about your spending and saving habits. Financial goals also give you a sense of accomplishment when achieved.

What are some essential tips for achieving financial freedom?

Some essential tips for achieving financial freedom include creating a budget, paying off debt, saving money, investing wisely, and setting financial goals.

How can I create a realistic budget to achieve financial freedom?

To create a realistic budget, start by tracking your income and expenses. Determine your fixed expenses, such as rent or mortgage payments, and allocate a portion of your income towards savings and investments. Cut down on unnecessary expenses and prioritize your financial goals.

Is it important to pay off debt in order to achieve financial freedom?

Yes, it is crucial to pay off debt in order to achieve financial freedom. Debt can limit your financial options and increase your financial stress. Implement a debt repayment plan and focus on paying off high-interest debts first.

What are some effective strategies for saving money?

Some effective strategies for saving money include automating your savings, reducing discretionary spending, shopping for the best deals, and avoiding unnecessary expenses. It is also important to build an emergency fund to cover unexpected expenses.

How can I invest my money wisely to achieve financial freedom?

To invest your money wisely, educate yourself about different investment options and consider diversifying your investments. Consult with a financial advisor to develop an investment strategy that aligns with your financial goals and risk tolerance.