Embarking on a transformative journey towards financial stability is a desire that resonates with individuals from all walks of life. Whether it’s to secure a comfortable retirement, fulfill long-held aspirations, or simply gain peace of mind in managing one’s finances, the quest for building a solid savings foundation is a universal pursuit.

Introducing the 52-Week Money Saving Challenge, a strategic approach to gradually amassing wealth and unlocking a future full of possibilities. Delve into a step-by-step plan designed to empower you with the knowledge, discipline, and actionable strategies required to navigate the complex landscape of personal finance.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreThis comprehensive guide unveils a compelling blueprint for maximizing your savings potential while encouraging incremental progression. By adhering to a structured timeline and cultivating sound financial habits, you will forge a path towards an empowered future, one small milestone at a time.

Understand the nuances of this groundbreaking savings technique, as you discover alternative routes to bolster your revenue streams and optimize your financial resources. Dive deeper into the mechanics of this transformative journey, gaining insights into effective ways of managing expenses, increasing income, and developing the necessary mindset to achieve enduring financial stability.

- The Ultimate Guide to the 52 Week Money Saving Challenge

- What is the 52 Week Money Saving Challenge?

- Benefits of the 52-Week Money Saving Challenge

- How does the Challenge work?

- Step 1: Setting Your Weekly Savings Goal

- Determining your financial goals

- Calculating your weekly savings target

- Tips for staying motivated

- Step 2: Creating a Savings Plan

- Identifying potential sources of savings

- Creating a budget

- Questions and answers

The Ultimate Guide to the 52 Week Money Saving Challenge

The Comprehensive Manual to the Year-Long Financial Saving Endeavor

In this section, we will explore a step-by-step approach to the 52 Week Money Saving Challenge. This guide will provide you with all the necessary information and strategies to successfully complete this year-long endeavor to improve your financial well-being and build up your resources.

Throughout the challenge, you will embark on a journey of disciplined savings, exploring various methods and techniques to allocate your funds effectively. By adhering to a predetermined plan, you will gradually accumulate savings over the course of 52 weeks, enhancing your financial stability and future prospects.

Within this guide, you will discover a meticulously outlined roadmap, incorporating practical tips and insights to optimize your savings potential. As you progress through the challenge, each week will present a new opportunity to increase your savings incrementally, fostering a sense of achievement and fostering the habit of consistent financial planning.

A structured table will be provided to guide your savings journey, outlining the weekly savings targets and corresponding amounts. By adhering to this systematic approach, you will be able to monitor your progress and stay motivated, reinforcing your commitment to this challenge and ensuring its successful completion.

Furthermore, we will explore different strategies and alternatives to personalize your experience, accommodating different financial circumstances and preferences. By tailoring the challenge to suit your individual needs, you will be able to adapt the saving process to fit your lifestyle, maximizing its effectiveness and ensuring long-term financial success.

By dedicating yourself to the 52 Week Money Saving Challenge, you will embark on an empowering journey to financial stability. Through careful planning, discipline, and perseverance, you will witness the growth of your savings, gaining control over your finances, and enabling future opportunities and endeavors.

What is the 52 Week Money Saving Challenge?

In this section, we will explore the concept and essence behind the popular 52 Week Money Saving Challenge, an innovative approach to saving money. As we delve into the details, we will uncover the fundamental principles that underpin this challenge and outline how it can potentially transform your financial habits.

Imagine a unique opportunity to embark on a savings journey that encourages you to set aside funds for a whole year. The 52 Week Money Saving Challenge involves gradually increasing the amount of money you save each week, starting small and progressively building up your savings over time. This method stimulates discipline, patience, and perseverance, as it challenges you to consistently save a little bit more each week.

By incorporating various synonyms for key terms, we aim to present a fresh perspective on this money-saving endeavor. This innovative endeavor encourages participants to embark on a year-long financial voyage, where they gradually augment their deposited sums each week. This method fosters a strong sense of self-control, resilience, and dedication, as individuals are inspired to regularly accumulate modest yet increasingly substantial amounts of money.

Throughout this guide, we will explore the intricacies, benefits, and potential obstacles of the 52 Week Money Saving Challenge. By the end, you will have a comprehensive understanding of how to seize the opportunity to enhance your financial wellbeing and build up a commendable nest egg over the course of a year.

Benefits of the 52-Week Money Saving Challenge

Embarking on the 52-week money saving challenge can bring about a host of benefits that go beyond simply accumulating savings. This savings approach offers a structured and gradual way to build up financial resources, effectively cultivating discipline, resilience, and improved money management skills.

One of the main advantages of the 52-week money saving challenge is its adaptability to individual financial situations. Whether you have a modest income or a higher disposable income, this challenge allows you to tailor your savings goals to your specific needs and capabilities. By starting with smaller weekly savings amounts, you can gradually increase your contributions over time, building momentum and confidence in your ability to save.

Another benefit of this challenge is the ability to develop a savings habit. By committing to setting aside a predetermined amount each week, you establish a routine that becomes second nature. This consistent savings habit can have a transformative effect on your financial well-being, as it helps create a buffer for unexpected expenses, provides greater financial security, and ultimately leads to a more stress-free financial future.

Furthermore, the 52-week money saving challenge encourages a mindful approach to spending. As you become more conscious of your saving goals, you develop a heightened awareness of your spending habits and can make more informed choices about where and how you allocate your resources. This increased consciousness can lead to healthier financial decisions, such as reducing unnecessary expenses and prioritizing long-term goals over short-term gratification.

An additional advantage of this challenge is the sense of accomplishment and motivation that comes with achieving each savings milestone. As you consistently meet your weekly targets, you experience a tangible sense of progress and accomplishment, which fuels your motivation to continue saving. This positive reinforcement can significantly enhance your financial mindset and drive, reinforcing the importance of saving and providing the confidence to tackle larger financial goals in the future.

| Summary: | The 52-week money saving challenge offers numerous benefits, ranging from its adaptability to individual financial situations to the development of a savings habit and improved financial decision-making. Additionally, the challenge provides a sense of accomplishment and motivation that supports long-term financial goals. |

How does the Challenge work?

In this section, we will delve into the mechanics of the 52 Week Money Saving Challenge. Discover how this challenge can help you gradually build up your savings over the course of a year. We will explore the step-by-step process of the challenge, providing a clear plan to follow.

To begin, the challenge involves saving money on a weekly basis. Each week, you will set aside a specific amount of money. The amount you save increases incrementally each week, creating a progressive savings plan. This gradual approach allows you to adjust to the increasing amounts, making it more manageable.

There are various methods to determine the amount to save each week. Some people prefer starting with a small amount and gradually increase it, while others opt for a consistent weekly savings goal. The choice depends on your financial capabilities and personal preferences.

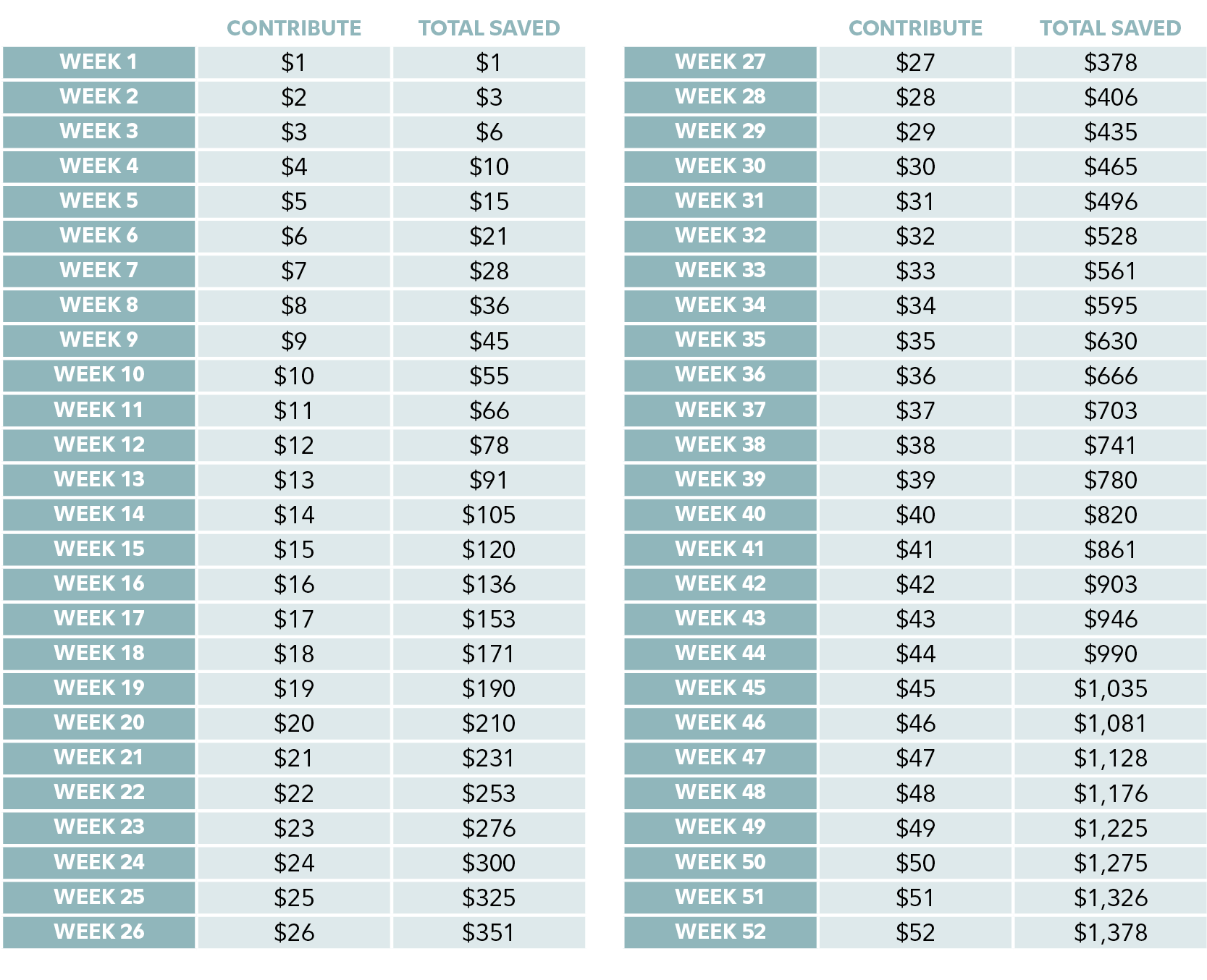

One popular strategy is to follow a specific pattern, such as saving $1 on the first week, $2 on the second week, $3 on the third week, and so on. This pattern continues until the end of the challenge, where you would save $52 on the last week. By following this pattern, you will save a total of $1,378 by the end of the year.

It is essential to stay consistent and committed throughout the challenge. Develop a habit of setting aside the designated amount every week. You can use techniques such as automatic transfers or setting reminders to help you stay on track.

As you progress through the challenge, keep track of your savings. This could be in a notebook, spreadsheet, or savings app. Reviewing your progress regularly will provide motivation and keep you accountable to your savings goals.

Remember, the key to success in the 52 Week Money Saving Challenge is consistency and discipline. By following the step-by-step plan and gradually increasing your savings, you will build a solid foundation for your financial future.

Step 1: Setting Your Weekly Savings Goal

Achieving financial stability starts with setting a weekly savings goal, which serves as your roadmap to a more secure future. This step will guide you through the process of determining how much money you aim to save each week, allowing you to take control of your finances and work towards your desired objectives.

Why is setting a weekly savings goal important?

By establishing a clear and measurable savings goal, you create a sense of purpose and direction for your financial journey. It helps you prioritize and allocate your resources wisely, making it easier to resist unnecessary expenses and focus on building your savings.

Identifying your weekly savings goal also provides clarity and motivation, making it easier to track your progress and celebrate small victories along the way.

How to set your weekly savings goal?

Setting your weekly savings goal requires evaluating your current financial situation and understanding your long-term aspirations. Consider factors such as your income, expenses, debt, and desired timeframe for achieving your savings target.

Analyze your budget to determine how much you can realistically save each week without compromising your essential needs. It’s essential to strike a balance between stretching yourself to save more and ensuring your savings target remains attainable.

Stay motivated and adjust when necessary

Setting a weekly savings goal is not a one-time decision – it’s an ongoing process. As circumstances change and unexpected expenses arise, you might need to reassess and adjust your target. Remember to regularly review and monitor your progress, making necessary modifications to stay on track towards achieving your financial objectives.

Determining your financial goals

Determining your desired financial outcomes is a crucial step in achieving financial success. By setting clear objectives, you create a roadmap that guides you towards making effective financial decisions and building a solid foundation for your future.

Identifying your financial goals involves understanding what you want to achieve with your money. It means determining your personal aspirations, whether they are short-term or long-term, and aligning your financial habits and behaviors accordingly.

First and foremost, take the time to reflect on your dreams and aspirations in life. Consider the things that truly matter to you, such as buying a house, starting a family, pursuing higher education, or retiring comfortably. These aspirations will serve as the basis for setting your financial goals.

Next, break down your goals into manageable steps. This involves establishing specific milestones and timelines for achieving each objective. For instance, if your goal is to save for a down payment on a house within five years, determine how much you need to save each month to reach that target.

It’s important to prioritize your goals based on their significance and feasibility. You may have multiple objectives, but focusing on one at a time can help you stay motivated and avoid feeling overwhelmed. By prioritizing, you can allocate your resources and efforts accordingly.

Regularly reassess your goals as your circumstances change. Life is dynamic, and your financial goals may need to evolve along with it. Therefore, periodically review and adjust your objectives to ensure they remain aligned with your current situation and aspirations.

In conclusion, determining your financial goals is a critical step in managing your finances effectively. By considering your dreams, breaking down goals into actionable steps, prioritizing, and remaining flexible, you can create a blueprint for financial success and work towards a brighter financial future.

Calculating your weekly savings target

When embarking on the 52-week money saving challenge, it is important to determine your weekly savings target. This target amount will guide you throughout the year and help you stay on track towards reaching your savings goals.

One way to calculate your weekly savings target is to divide your desired savings amount by 52, which represents the number of weeks in a year. For example, if your goal is to save $1,000 over the course of a year, your weekly savings target would be $19.23. This method ensures that you save a consistent amount each week, making it more manageable and predictable.

Another approach to calculating your weekly savings target is to start small and gradually increase the amount as the weeks progress. You can choose to start with a lower amount, such as $1, in the first week and then increase it by $1 each week. By doing so, your weekly savings target will gradually grow, and you’ll be able to adjust to saving larger amounts over time.

It’s also important to consider your financial situation and personal preferences when determining your weekly savings target. While some people may be comfortable saving a larger percentage of their income each week, others may prefer to start with a smaller amount and gradually increase it. Remember, the ultimate goal is to find a savings target that is challenging yet attainable for you.

Tracking your progress is crucial to ensure you’re meeting your weekly savings target. Keep a record of the amount you save each week and compare it to your desired target. If you’re falling behind, you may need to adjust your spending habits or find additional ways to generate extra income to reach your savings goal.

- Calculate your desired savings amount divided by 52 to determine your weekly savings target.

- Consider starting small and gradually increasing your savings amount each week.

- Personalize your savings target based on your financial situation and preferences.

- Track your progress to ensure you’re staying on track towards your savings goal.

By calculating your weekly savings target and staying committed to your savings plan, you’ll be well on your way to building a solid financial foundation and achieving your long-term savings goals.

Tips for staying motivated

Here are some suggestions to help you maintain your enthusiasm and keep on track with the 52 Week Money Saving Challenge:

| 1. Stay focused | Remind yourself of your overall financial goals and why you started this challenge in the first place. Visualize the rewards and benefits that await you at the end of the journey. |

| 2. Track your progress | Keep a record of how much you save each week. Seeing the numbers grow can provide a sense of accomplishment and motivate you to continue. |

| 3. Celebrate milestones | Recognize and reward yourself when you reach certain milestones along the way. Treat yourself to a small indulgence or do something special to commemorate your progress. |

| 4. Join a support network | Surround yourself with like-minded individuals who are also taking part in the challenge or pursuing similar financial goals. Share your experiences, challenges, and triumphs with each other to stay motivated. |

| 5. Mix it up | Explore different methods of saving money to keep things interesting. Consider trying new strategies, such as finding creative ways to cut expenses or earning extra income to boost your savings. |

| 6. Visual cues | Use visual reminders to keep your motivation levels high. Create a vision board or display pictures depicting your financial goals in a prominent place to serve as constant reminders of what you are working towards. |

| 7. Stay inspired | Read inspiring stories or watch motivational videos related to personal finance and saving money. Surround yourself with positive messages and constant reminders of the advantages of saving. |

| 8. Take breaks without giving up | If you encounter a setback or face difficulties, take a short break to regroup and refocus. Remember that setbacks are temporary and shouldn’t deter you from continuing your savings journey. |

| 9. Challenge yourself | Set mini-goals or challenges within the 52 Week Money Saving Challenge to keep yourself engaged. Push yourself to save more than the designated amount for a certain week or find ways to save additional money whenever possible. |

| 10. Stay optimistic | Maintain a positive mindset throughout the challenge. Believe in your ability to succeed and envision the financial freedom and security you will attain by completing the 52 Week Money Saving Challenge. |

By implementing these tips, you can stay motivated and successfully complete the 52 Week Money Saving Challenge, resulting in improved financial well-being and increased savings.

Step 2: Creating a Savings Plan

In this section, we will discuss the essential steps involved in creating a strategic savings plan tailored to your financial goals. By following these steps, you can effectively manage your finances, track your progress, and achieve your savings targets.

- Assess Your Current Financial Situation: Before embarking on a savings plan, it is crucial to evaluate your current income, expenses, and debts. Understanding your financial standing will help you set realistic savings goals.

- Define Your Savings Goals: Take the time to identify your short-term and long-term savings objectives. Whether it’s saving for emergencies, a down payment on a house, or retirement, having clear goals will keep you motivated and focused.

- Create a Budget: Develop a monthly budget that outlines your income, fixed expenses, and discretionary spending. This will provide you with a clear picture of your cash flow and help you identify areas where you can cut back to save more.

- Choose a Savings Strategy: Select a savings strategy that suits your preferences and circumstances. You can opt for a percentage-based approach, where you allocate a specific percentage of your income to savings, or a fixed amount method, where you determine a specific dollar amount to save each week.

- Track Your Progress: Regularly monitor and evaluate your progress towards your savings goals. Use tools like spreadsheets or financial apps to track your income, expenses, and savings, making adjustments as necessary.

- Automate Your Savings: Make use of technology to automate your savings. Set up automatic transfers from your checking account to a dedicated savings account. This way, you won’t have to rely on willpower alone and ensure consistent savings contributions each week.

- Adjust and Adapt: Life circumstances and financial priorities may change over time. Be flexible and willing to adjust your savings plan accordingly. Periodically reassess your goals and make necessary modifications to stay on track.

By following these steps and creating a well-defined savings plan, you will take control of your finances and develop healthy saving habits. Remember, small, consistent contributions add up over time, leading to significant financial growth and security.

Identifying potential sources of savings

When embarking on a journey to build your savings, it is essential to identify potential sources of additional funds. These sources can come from various areas of your financial life and may require a bit of creativity and planning. By exploring different avenues, you can discover opportunities to save money and increase your overall savings.

One way to identify potential sources of savings is by examining your monthly expenses. Take a close look at your bills and subscriptions to determine if there are any services or memberships that you could do without or downgrade. Consider canceling unused gym memberships, cutting back on streaming services, or switching to a cheaper cable or internet plan. Small adjustments in your monthly expenses can add up over time and contribute to your savings goals.

Another opportunity for savings lies in reducing your everyday expenses. Look for ways to cut back on groceries by shopping at discount stores, using coupons, and planning your meals in advance. Limit eating out and opt for cooking at home more often. Additionally, consider carpooling or using public transportation to save on fuel costs. Small changes to your daily habits can make a significant difference in your overall savings.

Identifying potential sources of savings also involves evaluating your lifestyle choices. Take a closer look at your leisure activities and hobbies to identify areas where you can cut expenses. Instead of going to expensive concerts or movies, consider exploring free or low-cost community events or pursuing inexpensive hobbies such as reading, hiking, or practicing yoga at home. By reevaluating your recreational choices, you can have fun while saving money.

Furthermore, it is important to review your financial services and make sure you are getting the best deals. Research different banks and credit unions to compare interest rates on savings accounts and consider transferring your funds to a higher-yield account. Additionally, analyze your insurance policies to ensure you are not overpaying for coverage. Shop around for competitive rates and consider bundling your policies for potential discounts.

In conclusion, identifying potential sources of savings requires a thorough examination of your financial situation and a willingness to make changes. By looking closely at your monthly expenses, everyday spending, lifestyle choices, and financial services, you can uncover opportunities to allocate more funds towards building your savings. Remember, every little bit counts, and by taking proactive steps, you can achieve your savings goals.

Creating a budget

Establishing a financial plan is an essential step towards achieving your savings goals. This section will guide you on how to create a budget that aligns with your income, expenses, and savings targets.

| Step 1: Calculate your income |

|---|

| Determine your monthly income by considering all sources of revenue, including your salary, freelance work, rental income, and any side hustles. It’s crucial to have an accurate estimate of your total earnings. |

| Step 2: Track your expenses |

| Keep a record of all your expenses for a month to gain insight into your spending habits. Categorize your expenditures into essential and non-essential items, such as rent, groceries, utilities, entertainment, and dining out. |

| Step 3: Set financial goals |

| Identify your short-term and long-term savings objectives, whether it’s purchasing a new car, saving for a down payment on a home, or planning for retirement. Having specific goals will motivate you to save consistently. |

| Step 4: Analyze and adjust |

| Analyze your income and expenses to determine where you can make adjustments. Evaluate your non-essential spending and consider areas where you can cut back. Make sure your expenses don’t exceed your income and prioritize saving. |

| Step 5: Create a budget plan |

| Based on your income, expenses, and savings goals, develop a comprehensive budget plan. Allocate appropriate amounts for your necessities, savings, and discretionary spending. Remember to leave room for unexpected expenses and emergencies. |

| Step 6: Monitor and review |

| Regularly monitor your budget to track your progress. Review your expenses, adjust your plan if necessary, and identify areas for improvement. Consider using budgeting tools or apps to simplify the process and ensure financial success. |

By creating a budget tailored to your financial situation and goals, you’ll gain control over your spending, maximize your savings, and ultimately achieve financial stability.

Questions and answers

What is the 52 Week Money Saving Challenge?

The 52 Week Money Saving Challenge is a step-by-step plan for building your savings over the course of a year. It involves saving a specific amount of money each week, starting with $1 on week one and increasing the amount by $1 each week until reaching $52 on week 52.

How can the 52 Week Money Saving Challenge help me build my savings?

The challenge helps you develop a saving habit by starting with small amounts and gradually increasing them. By saving consistently each week, you can accumulate a significant amount of money by the end of the year. It also helps you track your progress and stay motivated.

Is the 52 Week Money Saving Challenge suitable for everyone?

Yes, the challenge is suitable for anyone who wants to start saving money or increase their savings. It is a flexible plan that can be adjusted to fit your financial situation. If the original increment is too high, you can modify it to a smaller increment that suits your budget.

How can I stay motivated throughout the 52 Week Money Saving Challenge?

There are several strategies to stay motivated during the challenge. You can visualize your savings goal by creating a vision board or setting reminders. Sharing your progress with a friend or joining online communities can also provide support and accountability. Additionally, celebrating small milestones can help maintain motivation.

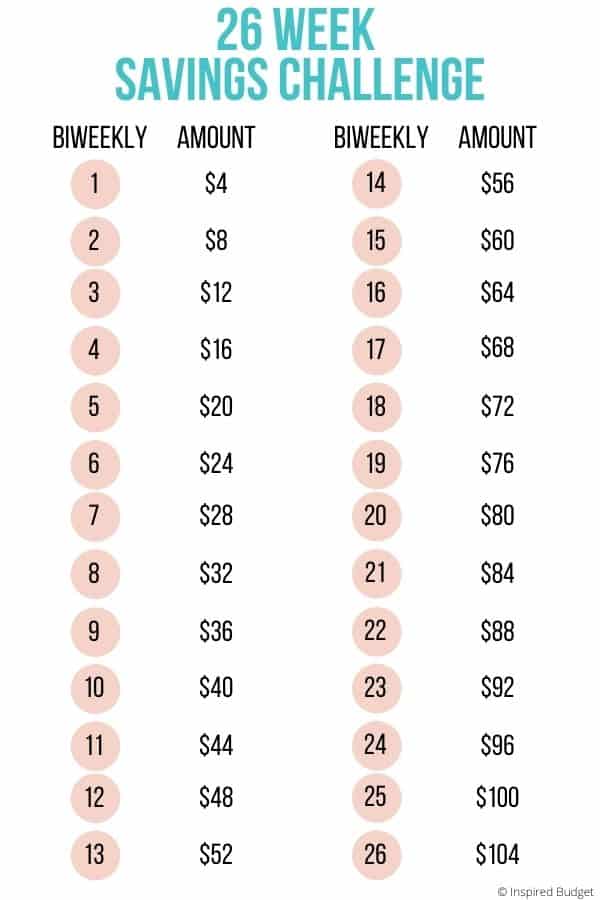

Are there any alternatives to the 52 Week Money Saving Challenge?

Yes, there are alternative savings challenges such as the reverse 52 Week Challenge, where you start with a higher amount and decrease it each week. Another option is the monthly challenge, where you save a fixed amount each month. It’s important to choose a challenge that aligns with your financial goals and preferences.

Can you explain what the 52 Week Money Saving Challenge is?

Of course! The 52 Week Money Saving Challenge is a savings plan that encourages individuals to save a specific amount of money each week for a year. The amount you save increases gradually over time, starting with $1 in the first week and ending with $52 in the final week. By the end of the challenge, you will have saved a total of $1,378.

How does the 52 Week Money Saving Challenge work?

The challenge is designed to be simple and easy to follow. Each week, you save a specific amount of money, starting with $1 in the first week and adding one additional dollar each week. For example, in week two, you save $2, in week three, you save $3, and so on. By the end of the 52 weeks, you will have accumulated a total of $1,378 in savings.

Is the 52 Week Money Saving Challenge suitable for everyone?

Yes, the 52 Week Money Saving Challenge is suitable for anyone looking to build their savings. Whether you are just starting to save or have been saving for a while, this challenge can help you develop a consistent saving habit and reach your financial goals. It is a flexible plan that can be adjusted to fit your personal financial situation.

What are the benefits of participating in the 52 Week Money Saving Challenge?

There are several benefits to participating in the challenge. Firstly, it helps you develop a saving habit by gradually increasing the amount you save each week. It also allows you to set a specific savings goal and track your progress over the course of a year. Additionally, by the end of the challenge, you will have accumulated a significant amount of money that can be used for emergency funds, vacations, or any other financial goals you may have.

What if I am unable to save the suggested amount each week?

The suggested weekly amounts are just a guideline, and it’s understandable if you are unable to save the full amount each week. The key is to save consistently and contribute what you can. If the suggested amounts are too high for your current financial situation, you can modify the challenge by starting with a lower amount or saving on a bi-weekly or monthly basis instead. The most important thing is to develop a habit of saving regularly.