Embarking on a journey towards financial stability is a wise decision that can shape your future in more ways than one. In our increasingly complex world, it becomes imperative to have a solid grasp on financial planning and navigate the turbulent waters with confidence. This comprehensive guide is designed to equip you with the necessary tools and knowledge to build a secure future for yourself and your loved ones.

Creating a strong foundation

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

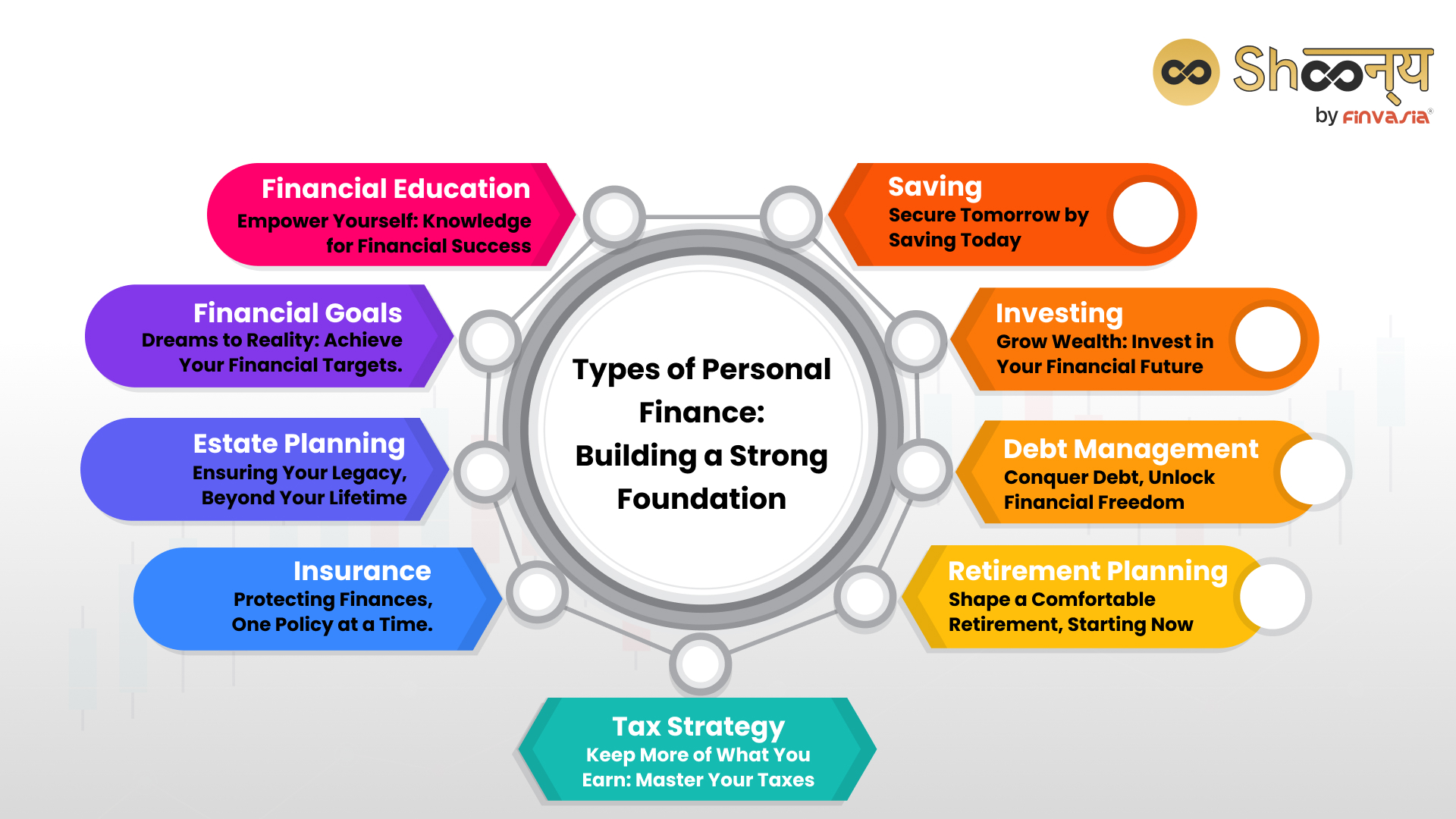

Learn MoreLike a well-constructed building, a secure financial future relies on a solid foundation. This entails developing a clear understanding of your financial goals and aspirations. Whether it’s buying a dream home, providing for your children’s education, or planning for retirement, having a firm grasp of your long-term objectives will help you chart a course towards success.

Drafting a blueprint

Once the foundation is in place, it’s time to create a blueprint that outlines the steps required to achieve your goals. This entails conducting a comprehensive analysis of your current financial situation, including income, expenses, assets, and debts. Armed with this information, you can then develop a personalized financial plan that takes into account factors such as budgeting, saving, investments, and insurance.

Navigating the financial landscape

Building a secure financial future requires a deep understanding of the ever-changing financial landscape. From the intricacies of different investment options to the nuances of tax laws and retirement strategies, it’s crucial to stay informed and adapt your plan accordingly. This guide will provide you with insightful tips and expert advice to help you navigate the financial maze and make informed decisions that align with your long-term goals.

- The Ultimate Guide to Financial Planning: Tips for a Secure Future

- Step-by-Step Strategies for Effective Financial Planning

- Set Clear Financial Goals

- Budgeting: Take Control of Your Expenses

- Build an Emergency Fund

- Investing Wisely for a Brighter Tomorrow

- Diversify Your Investment Portfolio

- Understand the Power of Compound Interest

- Seek Professional Advice for Complex Investments

- Protecting Your Financial Future: Insurance and Estate Planning

- Choose the Right Insurance Coverage for Your Needs

- Plan Your Estate for Smooth Wealth Transfer

- Consider Long-Term Care Insurance for Peace of Mind

- Questions and answers

The Ultimate Guide to Financial Planning: Tips for a Secure Future

In today’s rapidly changing financial landscape, it is crucial to have a well-crafted roadmap for achieving long-term financial security. This section of the guide will provide valuable insights and actionable tips to help pave the way towards a stable and prosperous future.

First and foremost, it is important to establish a solid foundation for your financial journey. This involves setting clear and realistic financial goals, which will serve as the building blocks of your plan. Whether your aim is to save for retirement, purchase a home, or start a business, having a clear direction will help you make informed decisions and stay on track.

Once your goals are defined, the next step is to assess your current financial situation. This entails taking stock of your income, expenses, assets, and liabilities. By analyzing this information, you can gain a comprehensive understanding of your financial standing and identify areas for improvement.

One crucial aspect of financial planning is managing your cash flow effectively. This involves creating a budget that aligns with your goals and allows for both saving and spending. By tracking your income and expenses, you can gain control over your finances and make necessary adjustments to ensure you are on the right path towards your financial objectives.

Another essential component of financial planning is building a diversified investment portfolio. This involves spreading your investments across different asset classes, such as stocks, bonds, and real estate. Diversification helps mitigate risk and maximize potential returns, ensuring that your wealth grows steadily over time.

Insurance also plays a vital role in securing your financial future. By ensuring that you have adequate coverage for life, health, and property, you can protect yourself and your loved ones against unexpected events that could derail your financial plans.

Lastly, regular monitoring and periodic adjustments are essential to maintain the effectiveness of your financial plan. Economic conditions, personal circumstances, and financial goals may change over time, requiring you to reassess and tweak your plan accordingly.

| Tips for a Secure Financial Future: |

|---|

| 1. Set clear and realistic financial goals |

| 2. Assess your current financial situation |

| 3. Manage your cash flow effectively |

| 4. Build a diversified investment portfolio |

| 5. Secure adequate insurance coverage |

| 6. Regularly monitor and adjust your financial plan |

By following these tips and incorporating them into your financial planning, you can lay the groundwork for a secure and prosperous future. Remember, financial planning is not a one-time task but an ongoing process that requires diligence, discipline, and adaptability.

Step-by-Step Strategies for Effective Financial Planning

In this section, we will explore a comprehensive set of methodologies to help you craft a strong financial plan for a prosperous future. Whether you are a novice or an experienced investor, these step-by-step strategies will guide you in making informed financial decisions and achieving your long-term goals.

1. Evaluate Your Current Financial Situation: Begin by assessing your current income, expenses, debts, and assets. This analysis will provide a clear picture of where you stand financially and serve as a foundation for future planning.

2. Set SMART Goals: Establish specific, measurable, attainable, relevant, and time-bound goals that align with your aspirations. SMART goals help you stay focused and motivated throughout the financial planning process.

3. Create a Budget: Develop a monthly budget that outlines your income and expenses. Categorize your spending and identify areas where you can reduce unnecessary expenses to save more effectively.

4. Build an Emergency Fund: Set aside a portion of your income regularly to create an emergency fund that can cover unexpected expenses or provide a safety net during times of financial uncertainty.

5. Manage and Minimize Debt: Prioritize debt repayment by formulating a strategy to pay off high-interest debts first. Explore options like debt consolidation or negotiation to reduce interest rates and minimize financial burden.

6. Protect Yourself with Insurance: Evaluate your insurance needs and ensure you have adequate coverage for life, health, property, and disability. Insurance protects against unforeseen events and provides financial security for you and your loved ones.

7. Invest for the Future: Develop an investment strategy based on your risk tolerance, time horizon, and financial goals. Diversify your portfolio by investing in a mix of stocks, bonds, real estate, and other assets to mitigate risks and maximize potential returns.

8. Plan for Retirement: Start saving for retirement early to take advantage of compounding interest. Explore retirement savings options such as employer-sponsored plans, individual retirement accounts (IRAs), or annuities to secure a comfortable retirement.

9. Review and Adjust: Regularly review your financial plan and make necessary adjustments as your circumstances change. Track your progress, set new goals, and adapt your strategies to ensure continued financial success.

By following these step-by-step strategies, you can take control of your financial future and pave the way for long-term stability and prosperity.

Set Clear Financial Goals

One of the key steps towards securing a stable financial future is setting clear and achievable financial goals. By establishing specific objectives for your financial well-being, you can effectively plan and manage your finances to meet these targets.

Having well-defined financial goals provides you with a sense of direction and purpose. It enables you to prioritize your spending, saving, and investment activities in order to work towards attaining your desired financial outcomes.

When setting financial goals, it is important to ensure they are realistic and measurable. Consider your current financial situation, future aspirations, and timeline for achieving these goals. This will help you determine the steps and actions required to reach them.

Additionally, it is beneficial to set both short-term and long-term financial goals. Short-term goals may include building an emergency fund, paying off debts, or saving for a vacation, while long-term goals could encompass buying a house, planning for retirement, or funding your children’s education.

Remember, setting clear financial goals is just the first step. Regularly review and reassess your objectives as your financial circumstances evolve. Adjust your goals accordingly, and celebrate your achievements along the way. With a clear vision and disciplined approach, you can pave the way for a financially secure future.

Budgeting: Take Control of Your Expenses

Managing your finances effectively is crucial for achieving a secure future. One key aspect of financial planning is budgeting, which allows you to take control of your expenses and make smarter financial decisions. By creating a budget, you can track your income and expenses, identify areas where you can cut back or save, and ensure that you are living within your means.

When it comes to budgeting, it’s important to prioritize your spending. Start by listing your essential expenses, such as housing, utilities, and groceries. These are the necessities that you need to cover each month. Next, consider your discretionary expenses, such as dining out, entertainment, and travel. While these expenses can bring enjoyment to your life, it’s essential to allocate a reasonable amount of your income towards them.

One effective way to track your expenses is by using a budgeting tool or app. These tools allow you to input your income and expenses and categorize them accordingly. By doing so, you can easily see where your money is going and identify any areas of overspending. This can help you make necessary adjustments and stay on track towards your financial goals.

Another important aspect of budgeting is regularly reviewing and reassessing your budget. As your income and expenses may change over time, it’s essential to ensure that your budget remains realistic and aligned with your financial situation. By monitoring and adjusting your budget regularly, you can make sure that your financial plan is still on track and adapt as needed.

- Create a budget to track your income and expenses.

- Prioritize your spending by distinguishing between essential and discretionary expenses.

- Utilize budgeting tools or apps to easily track and categorize your expenses.

- Regularly review and reassess your budget to ensure it reflects your current financial situation.

By implementing effective budgeting strategies, you can gain control over your expenses and make informed financial decisions. This will not only help you in the present but also contribute to a more secure and stable future.

Build an Emergency Fund

In this section, we will explore the importance of creating a financial safety net to prepare for unexpected situations or emergencies. Having an emergency fund is a proactive measure that provides security and peace of mind for your future financial needs.

Establishing an emergency fund involves setting aside a certain amount of money that is easily accessible. This fund serves as a cushion to cover unforeseen expenses, such as medical emergencies, car repairs, or job loss. By having a designated emergency fund, you can avoid relying on credit cards or loans and prevent falling into financial distress.

It is essential to contribute regularly to your emergency fund. Consider automating monthly transfers from your primary income source to ensure consistent savings. Start small if necessary and gradually increase the amount over time. Every contribution adds up and brings you closer to your financial goals.

When building an emergency fund, it’s crucial to keep the funds separate from your regular checking or savings account. By maintaining a separate account, you can easily distinguish between emergency funds and everyday expenses. Additionally, consider keeping your emergency fund in a high-yield savings account to maximize potential returns.

Remember that emergencies can happen to anyone at any time. It is better to be prepared than to face financial hardship when unexpected circumstances arise. Building an emergency fund is a key component of effective financial planning and is an investment in your overall financial well-being.

Start building your emergency fund today, and take a proactive step towards a more secure future!

Investing Wisely for a Brighter Tomorrow

Creating a prosperous future is within reach when you make smart choices when it comes to investing. By carefully allocating your resources into well-thought-out ventures, you can pave the way for a brighter and more secure tomorrow.

When it comes to making investment decisions, it is crucial to have a clear understanding of the potential risks and rewards associated with each choice. In order to maximize your returns, it is advisable to diversify your portfolio, spreading your investments across different sectors and asset classes. This approach can help mitigate the impact of market fluctuations and optimize your chances of achieving long-term financial growth.

While investing wisely can offer numerous advantages, it is important to exercise caution and conduct thorough research before making any significant financial decisions. Utilizing the expertise and guidance of professionals can provide valuable insights and help you navigate through complex investment strategies. Remember the old adage, Don’t put all your eggs in one basket, and seek a balanced and diversified investment portfolio.

Furthermore, it’s important to remember that investing wisely goes beyond financial considerations. Environmental, social, and governance (ESG) factors are becoming increasingly relevant in the investment world. By investing in companies and funds that align with your values, you can contribute to positive change while also seeking financial growth.

To optimize your investment choices, it is also advisable to keep a watchful eye on market trends and economic indicators. Staying informed about the latest developments and seeking professional advice will enable you to make informed decisions based on current market conditions. Remember, knowledge is power when it comes to investment planning.

In conclusion, investing wisely is an essential component of securing a brighter future. By diversifying your portfolio, conducting thorough research, considering ESG factors, and staying informed, you can position yourself for long-term financial success and a more prosperous tomorrow.

Diversify Your Investment Portfolio

Developing a well-rounded investment portfolio is a key strategy for ensuring financial stability and growth. By diversifying your investments, you can minimize risk and maximize potential returns. In this section, we will explore the importance of diversification and provide practical tips to help you create a diversified portfolio.

One of the fundamental principles of investing is not putting all your eggs in one basket. Instead of relying solely on one type of investment, such as stocks or real estate, diversification entails spreading your investments across different asset classes and sectors. This approach helps you mitigate the impact of market fluctuations, as different assets tend to perform differently under various economic conditions.

When diversifying your portfolio, it is essential to consider a variety of investments including stocks, bonds, mutual funds, real estate, and commodities. Each of these asset classes offers unique characteristics, risks, and potential returns. By allocating your funds across a range of assets, you lessen the impact of any one investment’s poor performance on your overall portfolio.

Additionally, diversification goes beyond investing in multiple asset classes; it also involves diversifying within each class. For instance, if you choose to invest in stocks, it is wise to have a mix of large-cap, mid-cap, and small-cap stocks, as well as companies from different industries. This way, you can spread your risk and potentially benefit from the performance of various stocks during different market conditions.

To implement effective portfolio diversification, it is crucial to regularly review and rebalance your investments. Market conditions and individual asset performances change over time, which can shift the weightings of your investments. By periodically reassessing your portfolio and adjusting your allocations, you can ensure that your investments align with your financial goals and risk tolerance.

In summary, diversifying your investment portfolio is a vital strategy for achieving long-term financial stability. By spreading your investments across different asset classes and within each class, you can potentially reduce risk and increase the likelihood of obtaining favorable returns. Remember to regularly review and rebalance your portfolio to maintain optimal diversification as market conditions evolve.

Understand the Power of Compound Interest

Discovering the magic behind compound interest is essential for anyone looking to secure their financial future. This section aims to provide a comprehensive understanding of the concept, without relying on complex financial jargon.

At its core, compound interest refers to the process of earning interest on both the initial amount of money invested or saved, as well as the accumulated interest over time. This allows your wealth to grow exponentially, leading to significant returns over the long term.

Imagine a snowball rolling down a hill, gathering more snow and growing larger as it goes. Similarly, compound interest works by reinvesting the interest earned, leading to a snowball effect that multiplies your initial investment over time.

The power of compound interest lies in its ability to generate wealth through time. By starting early and investing regularly, even small contributions can result in substantial growth over the years. The longer your money is allowed to compound, the more powerful the effect becomes.

- Compound interest allows your money to work for you, earning interest on top of interest.

- It rewards patience and long-term planning, as the impact of compounding becomes more significant over time.

- By harnessing the power of compound interest, individuals can achieve financial goals, such as saving for retirement or funding educational expenses.

- Understanding the concept of compound interest empowers individuals to make informed decisions about saving, investing, and debt management.

Overall, comprehending the power of compound interest is crucial for individuals seeking financial security. By grasping this concept and incorporating it into their financial planning, individuals can harness the potential of their money and pave the way for a prosperous future.

Seek Professional Advice for Complex Investments

When tackling complex investments, it is crucial to seek guidance from experienced professionals in the field. Managing intricate and multifaceted financial endeavors requires specialized knowledge and expertise, which can significantly impact the success of your future endeavors.

Engaging a competent advisor who possesses a deep understanding of the intricacies involved in complex investments can provide invaluable insights and minimize risks. These professionals possess the ability to analyze various investment options, identify potential pitfalls, and devise suitable strategies tailored to your financial goals.

By seeking professional advice, you gain access to a wealth of knowledge and experience that can help you navigate the complexities of the investment world. This guidance can assist you in making informed decisions about your portfolio, potentially maximizing returns, and minimizing unnecessary risks.

A knowledgeable advisor can also assist in diversifying your investment portfolio effectively. They can help identify opportunities in different industries and asset classes, reducing your exposure to any single investment and fostering a more balanced and resilient portfolio.

Furthermore, professional advice can provide you with a broader perspective on the current economic climate and how it might impact your complex investments. These experts stay abreast of the latest market trends, financial regulations, and changes in the global economy, allowing them to provide valuable insights and guidance specific to your investment needs.

Remember, complex investments require careful evaluation and analysis to ensure you are making informed decisions. Relying on professional advice can provide you with the confidence and peace of mind needed to navigate the challenges and uncertainties that come with investing in more intricate financial instruments.

Ultimately, seeking professional advice can be a crucial step towards securing a prosperous future and achieving your long-term financial goals. Embracing the expertise of experienced advisors can significantly enhance your chances of success and help you navigate the dynamic world of complex investments with confidence.

Protecting Your Financial Future: Insurance and Estate Planning

In this section, we will explore the crucial aspects of safeguarding your financial future through insurance and estate planning. By taking the necessary steps to protect yourself and your loved ones, you can ensure long-term financial security and peace of mind.

Security for Life’s Uncertainties

Life is full of unexpected events and uncertainties. Insurance serves as a safety net, offering financial protection against potential risks such as accidents, illness, or natural disasters. By understanding the different types of insurance available, you can choose the most suitable options for your needs.

Types of Insurance

There are various types of insurance that can address specific areas of your life. Health insurance provides coverage for medical expenses, while life insurance offers financial support for your loved ones in the event of your passing. Property and casualty insurance protect your assets, such as your home and car, from damage or theft. Disability insurance provides income replacement if you become unable to work due to an injury or illness.

Estate Planning: Protecting Your Legacy

Estate planning involves making important decisions regarding the distribution of your assets after your passing. It ensures that your loved ones are taken care of and prevents any potential disputes over your estate. By creating a will or trust, you can designate beneficiaries and determine how your assets should be managed. Additionally, estate planning allows you to minimize taxes and administrative costs, protecting the value of your estate.

The Role of a Financial Advisor

When it comes to insurance and estate planning, seeking the assistance of a skilled financial advisor can be highly beneficial. They can evaluate your unique financial situation, provide expert guidance, and help you make informed decisions. A financial advisor can help you navigate complex insurance policies and ensure that your estate planning documents are legally sound.

In summary, protecting your financial future requires careful consideration of insurance and estate planning. By understanding the different types of insurance available and implementing a comprehensive estate plan, you can safeguard your assets, provide for your loved ones, and achieve long-term financial security.

Choose the Right Insurance Coverage for Your Needs

Deciding on the appropriate insurance coverage can provide peace of mind and financial security in the face of unforeseen circumstances. Properly selecting insurance policies tailored to your specific needs ensures you are adequately protected against potential risks and can help safeguard your future.

| Types of Insurance | Description |

| Health Insurance | Protection against medical costs related to illness or injury, ensuring access to quality healthcare. |

| Life Insurance | Provides financial support to beneficiaries in the event of the policyholder’s death, assisting them in covering expenses and maintaining their quality of life. |

| Auto Insurance | Offers financial protection against vehicle-related accidents or theft, covering damages and liability. |

In addition to these common insurance types, there are various other options available, such as disability insurance, homeowners insurance, and umbrella insurance, each serving different purposes and addressing specific risks.

When choosing insurance coverage, carefully assess your individual circumstances and consider factors such as your age, occupation, health status, and financial responsibilities. It is essential to evaluate your potential risks and determine the appropriate level of coverage to adequately protect yourself and your loved ones.

Compare different insurance providers and policies to find the best coverage options that align with your needs and budget. Pay attention to details such as coverage limits, deductibles, and exclusions to ensure you fully understand the terms of each policy before making a decision.

Regularly review your insurance coverage to ensure it remains relevant and sufficient as your circumstances evolve over time. Making adjustments and keeping your policies up to date will help ensure you are adequately protected in the long run.

By selecting the right insurance coverage for your needs, you can minimize financial risks and protect your assets and loved ones in case of unexpected events. Prioritize this crucial aspect of financial planning to attain a secure and stable future.

Plan Your Estate for Smooth Wealth Transfer

Ensure a seamless transition of your assets and wealth to the next generation by carefully planning your estate. By strategically organizing and distributing your financial resources, you can protect your family’s financial well-being and leave a lasting legacy.

Effective estate planning involves developing a comprehensive strategy to manage your assets, minimize tax liabilities, and ensure your loved ones are provided for. It entails creating a legally binding document that outlines your wishes regarding the distribution of your assets, guardianship of minors, and medical care in case of incapacity.

With proper estate planning, you can safeguard your assets from unnecessary taxes and legal complications. By establishing trusts, creating a will, and designating beneficiaries, you can direct how your assets should be distributed, ensuring your intentions are honored.

Moreover, estate planning allows you to make provisions for the financial well-being of your loved ones. You can establish trust funds or designate beneficiaries for insurance policies or retirement accounts to provide for your family’s future needs. By doing so, you can provide financial security for your children, spouse, or other dependents even after you’re gone.

In addition to securing your family’s financial future, estate planning can help you leave a philanthropic legacy. By including charitable giving in your estate plan, you can support causes that are important to you and make a positive impact on society. Whether you choose to establish a charitable foundation or make specific bequests, your estate plan can serve as a tool for continued support of the causes you care about.

Overall, estate planning is an essential aspect of financial planning that ensures your assets are transferred smoothly and according to your wishes. By seeking professional advice and carefully crafting your estate plan, you can gain peace of mind and protect your loved ones’ futures.

Consider Long-Term Care Insurance for Peace of Mind

In the pursuit of securing a worry-free future, it is essential to carefully consider long-term care insurance. This type of insurance provides coverage for extended care services that may be required in the later stages of life. By taking proactive measures and investing in long-term care insurance, individuals can safeguard their financial stability and ensure peace of mind for themselves and their loved ones.

Why is long-term care insurance important?

As life expectancy increases and the cost of healthcare rises, it is crucial to plan for the potential need for long-term care. This care can range from assistance with daily activities to medical treatment in specialized facilities. Without proper insurance coverage, individuals may find their savings depleted rapidly or face the burden of high expenses.

Long-term care insurance acts as a financial safety net, helping to cover the costs associated with extended care services.

Benefits of long-term care insurance

Long-term care insurance offers numerous benefits that can contribute to one’s peace of mind. Firstly, it provides financial protection, ensuring that the funds necessary for quality care are available when needed. Secondly, having this type of insurance allows individuals to have control and flexibility over the care they receive, whether it be at home or in a specialized facility. Additionally, it can alleviate the burden on family members who may otherwise become caregivers, allowing them to maintain their own financial security and well-being.

By investing in long-term care insurance, individuals can have peace of mind knowing that they have taken proactive steps to protect their financial stability and ensure quality care when needed.

Factors to consider when choosing long-term care insurance

Selecting the most suitable long-term care insurance policy requires careful consideration. Factors that should be evaluated include the scope of coverage, benefit amounts, waiting periods, and premium costs. It is important to assess individual needs and preferences to find a policy that aligns with personal circumstances.

By thoroughly researching and assessing the available options, individuals can make informed decisions about long-term care insurance that will provide the most comprehensive coverage.

Start planning for a secure future today

Planning for long-term care is an important aspect of comprehensive financial planning. By considering long-term care insurance early on, individuals can ensure peace of mind for themselves and their loved ones. With the availability of financial protection and the ability to choose quality care, a secure future becomes a realistic goal that can be achieved with careful planning and consideration.

Take the necessary steps today to secure a worry-free tomorrow.

Questions and answers

What is financial planning and why is it important?

Financial planning is the process of setting and achieving financial goals through careful management of finances. It is important because it allows individuals to have a clear roadmap for their financial future, helps in budgeting, saving, and investing effectively, and provides financial security and peace of mind.

What are the key components of a financial plan?

A financial plan typically includes an assessment of current financial situation, setting financial goals, creating a budget, evaluating investment options, managing debt, planning for retirement, and safeguarding against risks through insurance.

How can I start my financial planning?

You can start your financial planning by assessing your current financial situation, including income, expenses, assets, and debts. Then, set clear financial goals that you want to achieve. Create a budget to track your income and expenses, start saving and investing, manage your debts effectively, and regularly review and adjust your financial plan.

How can I save money effectively?

To save money effectively, you can start by tracking your expenses and identifying areas where you can cut back or reduce unnecessary spending. Automate your savings by setting up a direct deposit from your paycheck to a dedicated savings account. Look for ways to increase your income, such as taking up a side job or selling unused items. Additionally, prioritize your savings goals and avoid impulsive purchases.

Why is it important to have an emergency fund?

Having an emergency fund is important because it provides a financial safety net in case of unexpected events, such as medical emergencies, job loss, or car repairs. It helps to cover immediate expenses without relying on credit cards or loans and prevents individuals from going into debt during challenging times. An emergency fund should ideally cover 3-6 months’ worth of living expenses.

What is financial planning?

Financial planning is the process of setting goals, evaluating resources, and creating a plan to achieve those goals. It involves analyzing one’s current financial situation, creating a budget, managing debt, saving for emergencies, retirement, and other long-term goals, and making wise investment choices.

Why is financial planning important?

Financial planning is important because it helps individuals and families to have a clear understanding of their financial goals and how to achieve them. It provides a roadmap for managing money effectively, allocating resources wisely, and making informed financial decisions. It can help secure a stable and prosperous future for individuals and their loved ones.

How can I start with financial planning?

To start with financial planning, you can begin by assessing your current financial situation. This includes evaluating your income, expenses, assets, and debts. Then, set specific financial goals, such as saving for a down payment on a house or paying off high-interest debt. Create a budget to track your spending and identify areas where you can save. Finally, consider consulting with a financial advisor who can provide guidance and help you create a comprehensive financial plan.

What are some common mistakes to avoid in financial planning?

Some common mistakes to avoid in financial planning include failing to set clear and realistic financial goals, not budgeting effectively, neglecting to save for emergencies or retirement, taking on excessive debt, making impulsive or emotional financial decisions, and not regularly reviewing and adjusting your financial plan. It is important to be disciplined, seek professional advice when needed, and stay proactive in managing your finances.

How can financial planning contribute to a secure future?

Financial planning can contribute to a secure future by helping individuals to build a strong financial foundation. It can ensure that there is enough money set aside for emergencies, reduce debt and increase savings, plan for retirement, and make wise investment choices. By having a comprehensive and well-executed financial plan, individuals can have peace of mind knowing that they are on track to achieve their financial goals and build a secure future for themselves and their families.