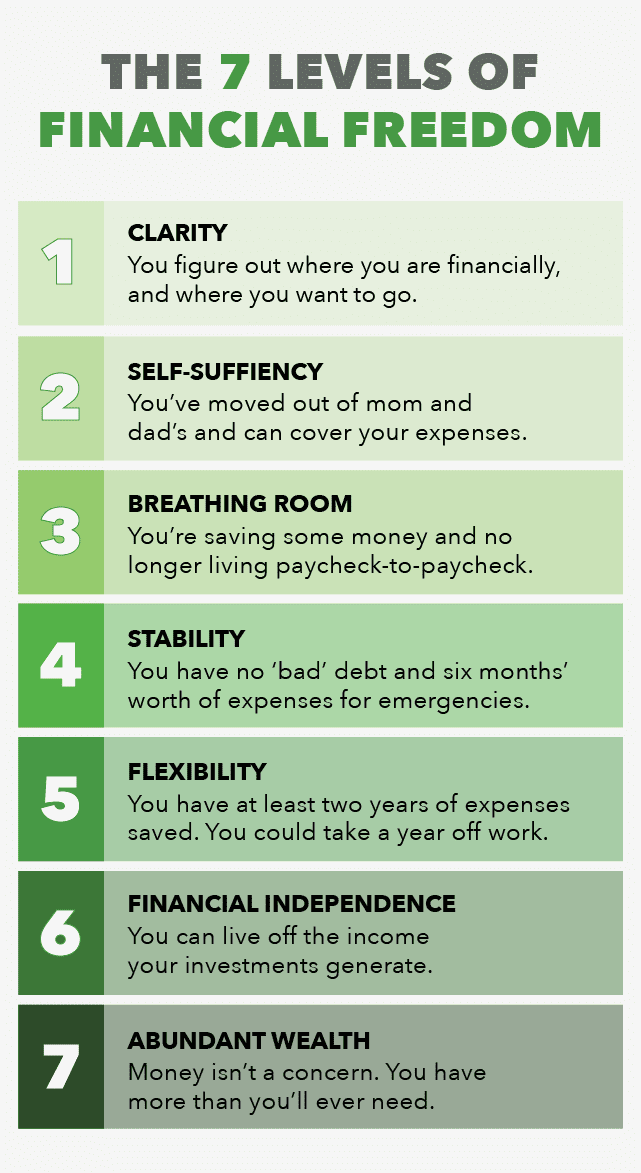

When it comes to achieving financial freedom, certain principles have proven to be consistently effective for individuals who have successfully eliminated debt and achieved stability in their financial lives. The path to financial independence is paved with a set of habits that empower individuals to take control of their finances and build a secure future. By understanding and implementing these principles, anyone can embark on a journey towards financial success and ultimately attain the peace of mind that comes with being debt-free.

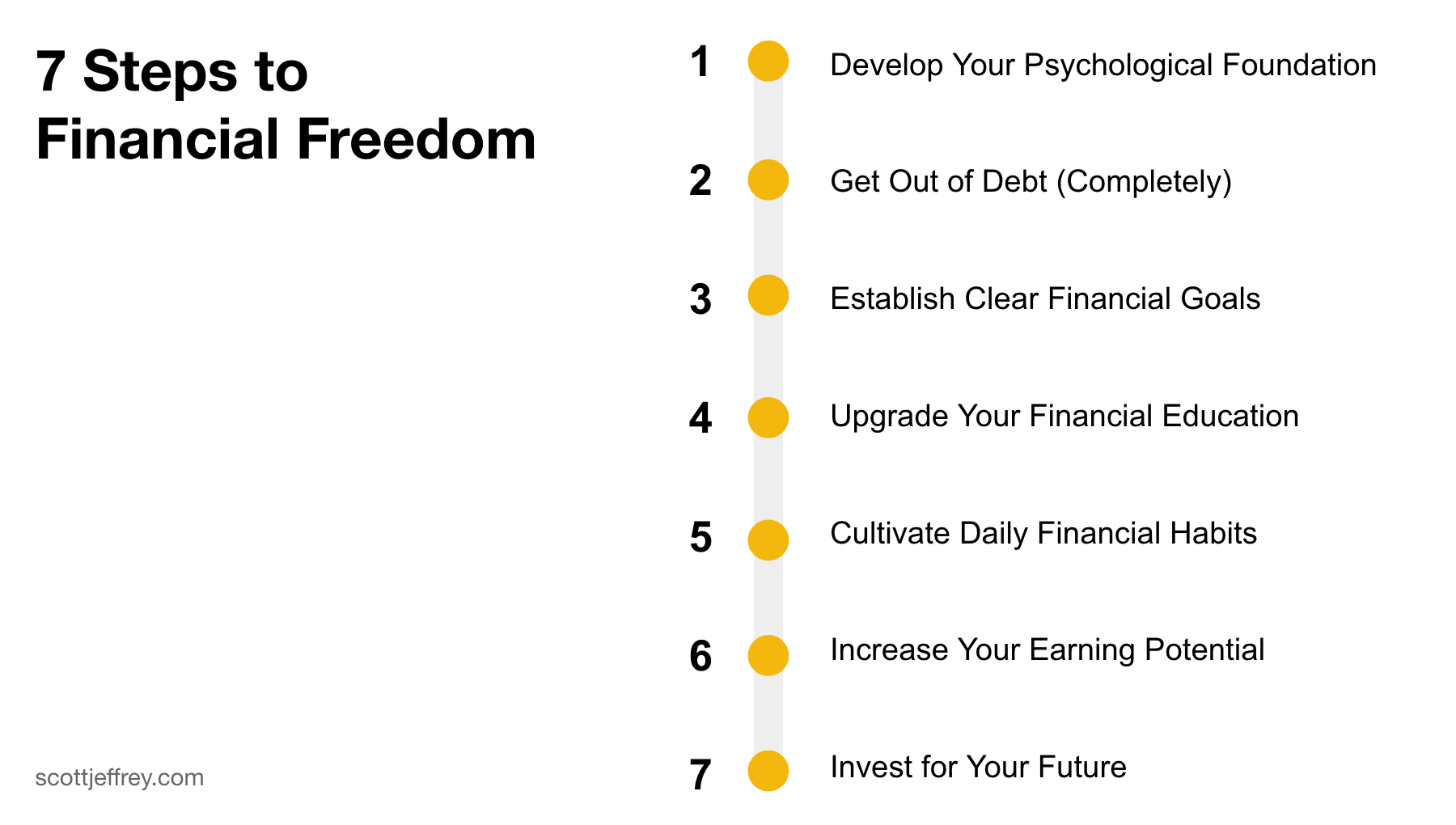

1. Cultivating a Mindset of Abundance: One of the fundamental aspects of achieving financial freedom is nurturing a mindset of abundance. This involves cultivating a positive outlook towards wealth and adopting a belief that there is always enough to go around. By shifting your mindset from scarcity to abundance, you open yourself up to new opportunities and possibilities for generating income and managing your finances.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn More2. Practicing Conscious Spending: In order to become debt-free and achieve financial independence, it is crucial to develop the habit of conscious spending. This means being mindful of every expense and consciously deciding whether it aligns with your financial goals and values. By distinguishing between wants and needs and prioritizing your financial well-being, you can avoid unnecessary debt and focus on building wealth.

- Clear Financial Goals

- Set Clear Objectives

- Establish a Realistic Timeline

- Monitor Progress Regularly

- Budgeting and Tracking Expenses

- Create a Detailed Budget

- Prioritize Essential Expenses

- Use Apps or Spreadsheets to Track Spending

- Cutting Unnecessary Expenses

- Identify Areas for Cost Reduction

- Eliminate Non-Essential Purchases

- Seek Lower Cost Alternatives

- Living Within Means

- Avoid Impulse Buying

- Questions and answers

Clear Financial Goals

In order to effectively manage your finances and achieve long-term financial stability, it is crucial to have clear and well-defined financial goals. These goals serve as a roadmap to guide your financial decisions and actions, helping you stay focused and motivated on your path to financial success.

When setting your financial goals, it is important to be specific and measurable. Rather than simply aiming to save money, specify a target amount or percentage of your income that you want to set aside each month or year. This will give you a clear target to work towards and allow you to track your progress.

Additionally, your financial goals should be realistic and attainable. Setting overly ambitious goals that are impossible to achieve can be discouraging and lead to frustration. Start with smaller, achievable goals and gradually increase the difficulty as you progress.

It is also beneficial to set both short-term and long-term financial goals. Short-term goals can help you stay motivated and give you a sense of accomplishment, while long-term goals provide a broader vision and direction for your financial future.

To effectively manage and prioritize your goals, consider creating a financial plan and breaking down your goals into smaller, actionable steps. This will help you stay organized and ensure that you are consistently working towards your objectives.

Lastly, regularly reviewing and reassessing your financial goals is essential. As your financial situation evolves and changes, it is important to adapt your goals accordingly. By regularly evaluating and adjusting your goals, you can ensure that they remain relevant and aligned with your current financial circumstances.

| Benefits of Clear Financial Goals |

|---|

| 1. Focus and Direction |

| 2. Motivation and Accountability |

| 3. Progress Measurement |

| 4. Organization and Prioritization |

| 5. Adaptability and Alignment |

Set Clear Objectives

Establishing clear and specific objectives is an essential element of achieving financial success and ultimately gaining personal freedom from debt. By clearly defining what you want to accomplish in terms of your finances, you can develop a focused plan and take deliberate actions to reach your goals. Setting specific objectives allows you to have a clearer understanding of what you need to do and helps you stay motivated and accountable throughout your financial journey.

When setting objectives, it is important to be specific and detailed. Avoid vague or general goals; instead, strive to be explicit in what you want to achieve. For example, rather than simply aiming to save money, set a specific target, such as saving $10,000 within the next year. This specificity gives you a clear target to work towards and enables you to break down your objectives into manageable steps.

- Identify your financial priorities: Take some time to reflect on what truly matters to you when it comes to your finances. Think about your long-term goals, such as purchasing a home or retiring comfortably. By identifying your financial priorities, you can align your objectives with what truly matters to you, increasing your motivation and determination.

- Quantify your objectives: Instead of general aspirations, quantify your objectives by attaching specific amounts or numbers to them. Whether it’s saving a certain amount of money, paying off a set amount of debt, or investing a specific percentage of your income, using precise figures helps you track your progress more effectively.

- Break down your objectives into smaller milestones: Large, long-term goals can sometimes seem overwhelming. Break down your objectives into smaller, more attainable milestones. This way, you can celebrate your achievements along the way, stay motivated, and maintain a sense of progress.

- Set deadlines: Establishing deadlines for your objectives provides a sense of urgency and helps you stay focused. Time-bound goals push you to take action and create a timeline for your financial success.

- Review and adjust regularly: As circumstances change or you make progress towards your goals, regularly review and adjust your objectives as necessary. This allows you to stay adaptable and make any necessary changes to ensure you’re always working towards your financial freedom.

Remember, setting clear and specific objectives is the foundation for achieving financial success. By clearly defining what you want to accomplish and breaking it down into actionable steps, you can pave the way towards a debt-free and financially secure future.

Establish a Realistic Timeline

Setting a practical timeline is vital when working towards financial stability and independence. Without a clear plan and achievable goals, it is easy to become overwhelmed and lose motivation. In this section, we will explore the importance of establishing a realistic timeline to guide your journey towards financial freedom.

Creating a timeline allows you to break down your financial goals into manageable tasks and milestones. It helps you track your progress and stay focused on what needs to be done. By setting realistic deadlines for each step along the way, you can ensure that you are making steady and measurable progress.

When establishing a timeline, it is important to consider both short-term and long-term objectives. Short-term goals, such as paying off a specific debt or saving a certain amount of money, can provide you with immediate gratification and motivation. Long-term goals, such as building an emergency fund or planning for retirement, require more time and discipline.

Remember, a realistic timeline takes into account your current financial situation, income, and expenses. It is essential to be honest with yourself about what you can realistically achieve within a given timeframe. Avoid setting unrealistic expectations that will only lead to disappointment and frustration.

In order to establish a realistic timeline, it may be helpful to seek guidance from financial advisors or experts. They can provide valuable insight based on their expertise and experience. Additionally, consider researching and learning from the experiences of others who have successfully achieved financial freedom.

- Break down your financial goals into smaller, achievable tasks

- Set deadlines for each task to track your progress

- Consider both short-term and long-term objectives

- Be honest with yourself about what you can realistically achieve

- Seek guidance from financial advisors or experts

- Learn from the experiences of others who have achieved financial freedom

In conclusion, establishing a realistic timeline is crucial when aiming to achieve financial freedom. By breaking down your goals, setting deadlines, and being honest about what you can realistically accomplish, you can stay on track and make steady progress towards your financial aspirations.

Monitor Progress Regularly

Keep track of your advancements consistently and regularly to ensure steady growth and improvement towards your financial goals.

Regularly monitoring your progress allows you to stay focused and motivated on your journey towards financial freedom. By regularly assessing and analyzing your financial situation, you can identify areas that need improvement and make necessary adjustments to achieve your goals efficiently.

Consider creating a table or spreadsheet to track your income, expenses, savings, investments, and debts. This visual representation will help you visualize your financial progress and provide a clear overview of your current financial situation.

Monitoring your progress regularly also enables you to celebrate small victories along the way. As you see your debt decreasing or your savings increasing, it serves as a constant reminder of the progress you’ve made and motivates you to continue working towards your financial goals.

In addition to tracking your financial numbers, make sure to periodically assess your habits and behaviors. Are you staying disciplined with your budget? Are you consistently saving a portion of your income? Reflecting on these aspects will help you identify any areas where you may be falling short and allow you to adjust your actions accordingly.

Regular progress monitoring isn’t just about numbers and figures; it’s also about self-reflection and personal growth. Take the time to evaluate your values and priorities to ensure that your financial goals align with what truly matters to you. This self-awareness will contribute to a more fulfilling and purpose-driven journey towards financial freedom.

| Benefits of Regular Progress Monitoring: |

|---|

| Keeps you focused and motivated. |

| Identifies areas that need improvement. |

| Helps you make necessary adjustments. |

| Celebrates small victories. |

| Encourages self-reflection and personal growth. |

Budgeting and Tracking Expenses

In the pursuit of achieving financial stability and independence, one vital aspect that highly successful individuals with no debt prioritize is budgeting and tracking expenses. They understand the significance of managing their financial resources and maintaining a detailed record of their expenditures. Adopting effective budgeting techniques and diligently monitoring expenses can provide a strong foundation for achieving long-term financial goals.

Creating a budget allows individuals to allocate their income towards different categories such as housing, transportation, groceries, entertainment, and savings. By allocating specific amounts to each category, individuals can make informed decisions and ensure that their spending aligns with their priorities and financial aspirations. Budgeting helps in understanding where the money is being spent, highlighting areas that require attention or potential improvements.

Tracking expenses is an essential practice that helps individuals gain insights into their spending habits and identify areas where they can reduce costs. It involves diligently recording all expenses, whether small or significant, to create a comprehensive overview of one’s financial transactions. Tracking expenses can be done through various methods, such as maintaining a physical or digital journal, using expense tracking apps, or utilizing specialized budgeting software.

By regularly reviewing and analyzing their expenditure patterns, individuals can identify unnecessary expenses and implement cost-cutting measures. This proactive approach allows them to optimize their spending, redirecting funds towards savings or investments that contribute to their long-term financial security. Tracking expenses also enables individuals to track progress towards their financial goals and make necessary adjustments along the way.

In conclusion, budgeting and tracking expenses play a crucial role in the journey towards financial freedom. Successful individuals who are debt-free recognize the value of managing their finances effectively and paying close attention to their expenditure. By creating a budget and tracking expenses diligently, individuals can make informed financial decisions, identify areas for improvement, and ultimately achieve their desired financial outcomes.

Create a Detailed Budget

In this section, we will delve into the importance of establishing a comprehensive financial plan that outlines your income, expenses, and financial goals. By developing a detailed budget, you can effectively manage your resources, allocate funds wisely, and work towards achieving your financial objectives. This crucial step in attaining financial stability involves careful assessment, planning, and prioritization of your monetary resources.

Gain a Clear Understanding of Your Income and Expenses

Before creating a detailed budget, it is essential to have a clear understanding of your income and expenses. Take time to assess your regular income sources, whether it is from your primary job, freelance work, or investments. Additionally, identify and calculate your monthly expenses, including essential needs like housing, utilities, transportation, and groceries, as well as discretionary spending such as entertainment and dining out. This thorough evaluation will provide a basis for accurately budgeting and allocating funds.

Set Achievable Financial Goals

Within your budget, it is crucial to establish achievable financial goals. These goals can range from clearing existing debts, saving for emergencies, investing in long-term assets, or even planning for retirement. By setting specific, measurable, attainable, relevant, and time-bound (SMART) goals, you can focus your financial efforts and track your progress effectively. Prioritize your goals based on urgency and importance and ensure that they align with your long-term financial aspirations.

Create Categories and Allocate Funds

When creating a detailed budget, it is helpful to categorize your expenses to gain a better understanding of where your money is being allocated. Common categories include housing, transportation, groceries, debt payments, savings, and discretionary spending. Allocate a specific amount to each category based on your income and goals. Ensure that you have sufficient funds allocated for essential expenses while still allowing room for savings and future investments.

Monitor and Adjust Regularly

A detailed budget requires regular monitoring and adjustments to ensure its effectiveness. Keep track of your spending and income regularly, noting any variances from your initial budget. Analyze the reasons behind any discrepancies and adjust your budget as necessary. By maintaining a flexible approach, you can adapt to changing circumstances and proactively manage your finances.

Conclusion

Creating a detailed budget is an imperative step towards financial stability and achieving your long-term goals. By gaining a clear understanding of your income and expenses, setting achievable financial goals, categorizing and allocating funds, and regularly monitoring and adjusting your budget, you can take control of your finances and work towards a debt-free and financially independent future.

Prioritize Essential Expenses

When striving for financial stability and independence, it is crucial to focus on prioritizing essential expenses. This means allocating your financial resources effectively and ensuring that your basic needs are met without compromising your long-term financial goals.

By prioritizing essential expenses, you are consciously recognizing the fundamental aspects of your life that require financial attention. It involves identifying and categorizing expenses that are necessary for your survival, such as food, housing, transportation, and healthcare. Prioritizing these expenses allows you to establish a solid foundation from which you can build and grow your financial well-being.

Allocating your financial resources

To effectively prioritize your essential expenses, it is important to allocate your financial resources wisely. This involves creating a budget that reflects your income, needs, and long-term financial goals. By tracking your expenses and income consistently, you can determine how much you can afford to allocate towards essential expenses, ensuring that you stay within your means and avoid unnecessary debt.

Ensuring your basic needs are met

Prioritizing essential expenses also means ensuring that your basic needs are met. This includes adequately budgeting for and securing the essentials, such as nutritious food, safe and comfortable housing, reliable transportation, and access to healthcare. By prioritizing these necessities, you are investing in your overall well-being and setting the stage for financial stability.

Balancing short-term needs and long-term goals

While prioritizing essential expenses, it is important to strike a balance between meeting your immediate needs and working towards your long-term financial goals. This requires careful planning and decision-making, as it may involve making sacrifices in certain areas to allocate more resources towards your future financial freedom. By maintaining this balance, you can ensure that you are not only meeting your immediate needs but also actively working towards a financially secure and debt-free future.

In conclusion, prioritizing essential expenses is a fundamental part of achieving financial freedom. It involves allocating your financial resources effectively, ensuring your basic needs are met, and striking a balance between immediate needs and long-term goals. By focusing on these priorities, you can create a solid foundation for your financial well-being and work towards a future free of debt and financial constraints.

Use Apps or Spreadsheets to Track Spending

Manage your expenses effectively by utilizing the convenience and efficiency of modern technology. Utilize applications or spreadsheets to keep track of your spending habits and monitor your financial progress.

With the help of user-friendly budgeting apps, you can easily input your income, expenses, and savings goals. These apps provide various features such as categorizing expenses, setting up spending limits, and generating comprehensive reports. By using these tools, you can gain a clear understanding of where your money is going and identify areas where you can cut back on unnecessary spending.

Alternatively, if you prefer a traditional approach, spreadsheets are an excellent way to track your spending. Create a customized spreadsheet where you can list your expenses and income for each month. Use formulas and functions to automatically calculate totals, analyze trends, and visualize your financial data. By regularly updating your spreadsheet and reviewing the information, you can make informed financial decisions and ensure that you stay on track towards your debt-free goals.

Both apps and spreadsheets offer the advantage of accessibility and flexibility. You can access your financial information anytime and anywhere, whether it’s on your smartphone, tablet, or computer. These tools also provide insight into your spending patterns, allowing you to identify areas of improvement and make necessary adjustments to achieve better financial management.

- Choose a reliable budgeting app that suits your preferences and goals.

- Create a spending plan based on your income and prioritize your expenses accordingly.

- Consistently update your app or spreadsheet with your latest financial transactions.

- Regularly review your spending patterns and identify areas where you can make adjustments.

- Set realistic financial goals and monitor your progress towards achieving them.

By utilizing user-friendly apps or creating personalized spreadsheets, you can effectively track your spending and take control of your finances. Consistency and discipline in monitoring your expenses are key habits for successful individuals on their journey towards financial freedom.

Cutting Unnecessary Expenses

In this section, we will explore the importance of eliminating unnecessary expenditures as a key strategy to attain financial independence. It is crucial to optimize our spending habits and make conscious choices to avoid superfluous costs and expenses that do not contribute to our overall financial well-being.

By trimming down unnecessary expenses, we gain control over our financial resources, allowing us to allocate funds towards more meaningful and impactful purposes. Through a mindful evaluation of our spending patterns, we can distinguish between essential and non-essential expenditures, and thus make informed decisions to reduce or eliminate the latter.

Identifying and curbing unnecessary expenses is not about depriving ourselves of enjoyment or necessities, but rather about streamlining our priorities and focusing on what truly adds value to our lives. This can mean consciously cutting back on luxury purchases, reevaluating subscription services, finding more cost-effective alternatives, and being more mindful of impulse buying, among other strategies.

One way to identify unnecessary expenses is by carefully reviewing our monthly budget and tracking our spending habits. By analyzing our financial statements and identifying patterns, we can identify areas where we may be overspending or where we can make more cost-effective choices. This process allows us to make informed decisions and take necessary actions to cut back on unnecessary expenses.

Moreover, it is crucial to adopt a mindset of conscious spending. By considering the long-term impact of each purchase and weighing it against our financial goals, we can resist the temptation of impulsive buying and make choices that align with our overall financial objectives. This shift in mindset enables us to prioritize our financial stability and work towards achieving lasting financial freedom.

Identify Areas for Cost Reduction

It is important for individuals to examine and evaluate various aspects of their financial lives in order to identify areas where costs can be reduced. By carefully analyzing their expenses and making necessary adjustments, individuals can work towards achieving financial stability and freedom.

One method to identify areas for cost reduction is by scrutinizing monthly bills and expenses. Reviewing utility bills, such as electricity, water, and internet, can help identify opportunities to reduce usage or seek out more cost-effective options. Additionally, evaluating subscriptions, such as streaming services, magazine subscriptions, and gym memberships, can unveil areas where savings can be made by canceling unnecessary or underutilized subscriptions.

Another avenue to explore when seeking areas for cost reduction is personal spending habits. Tracking daily expenses and categorizing them based on necessity and discretionary spending allows individuals to identify areas where they might be overspending or where they can cut back. This could include reducing dining out expenses, limiting impulse purchases, or finding more affordable alternatives for everyday items.

In addition to analyzing bills and personal spending, evaluating and adjusting housing expenses can also significantly contribute to cost reduction. Considering options like downsizing to a smaller living space, refinancing mortgages to lower interest rates, or negotiating rent agreements can help individuals save a substantial amount of money in the long run.

Furthermore, individuals should regularly review their insurance policies to ensure they are obtaining the best coverage for the most reasonable price. Shopping around for better rates or consolidating policies with a single provider can often result in significant savings without compromising necessary coverage.

| Benefits of Identifying Areas for Cost Reduction: |

| – Increased savings |

| – Reduced financial burden |

| – Improved budget management |

| – Enhanced financial freedom |

In conclusion, by diligently analyzing and identifying areas for cost reduction, individuals can make informed decisions and take proactive steps towards achieving financial stability and freedom. Through careful evaluation of expenses and making necessary adjustments, individuals can cut unnecessary costs, increase savings, and ultimately improve their overall financial well-being.

Eliminate Non-Essential Purchases

In order to achieve financial independence and eliminate debt, it is crucial to make smart choices when it comes to spending money. One effective strategy is to cut down on non-essential purchases. By avoiding unnecessary expenses and focusing on essential needs, individuals can save significant amounts of money over time.

A key aspect of eliminating non-essential purchases is identifying what truly matters and prioritizing accordingly. It involves carefully assessing the value and necessity of each potential purchase before making a decision. Instead of impulse buying or giving in to momentary wants, it is important to consider the long-term benefits and implications of each transaction.

A useful approach to managing non-essential purchases is creating a budget and sticking to it. This involves setting specific spending limits for different categories and strictly adhering to them. By keeping track of expenses and regularly reviewing the budget, individuals can make conscious choices that align with their financial goals and avoid unnecessary spending.

Another effective tactic is to explore alternative options for non-essential purchases. This could involve researching and comparing prices, looking for sales or discounts, and considering second-hand or refurbished items. By being open to different possibilities and actively seeking out the most cost-effective options, individuals can maximize their savings without sacrificing their needs and desires.

| Benefits of Eliminating Non-Essential Purchases |

|---|

| 1. Financial stability and freedom |

| 2. Reduced debt and increased savings |

| 3. Better ability to achieve long-term financial goals |

| 4. Improved decision-making skills |

| 5. Increased awareness of personal spending habits |

Eliminating non-essential purchases requires discipline and a shift in mindset. It involves consciously evaluating the true value and necessity of each expense and making choices that align with long-term financial goals. By adopting this habit, individuals can gain control over their finances and pave the way towards a debt-free and financially secure future.

Seek Lower Cost Alternatives

In the pursuit of financial independence, it is crucial to explore options that can help reduce expenses and save money. By actively seeking lower cost alternatives, individuals can make significant progress towards achieving their financial goals without compromising their lifestyle or wellbeing.

One approach to seeking lower cost alternatives is to evaluate everyday expenses and identify areas where cost-saving measures can be implemented. This can include exploring different brands or generic products that offer similar quality at a lower price, comparing prices between different stores or online platforms, and taking advantage of discounts or promotional offers.

Another effective strategy is to embrace frugality and adopt a more minimalist lifestyle. By focusing on needs rather than wants and practicing mindful spending, individuals can reduce unnecessary expenses and allocate their resources towards their financial priorities. This can involve reevaluating subscription services, cutting back on dining out or entertainment expenses, and finding enjoyment in simpler and more affordable activities.

Furthermore, seeking lower cost alternatives can extend beyond consumer choices. It can also involve exploring alternative transportation methods, such as biking or carpooling, to save on fuel and vehicle maintenance costs. Additionally, individuals can consider downsizing their living arrangements, refinancing loans to secure lower interest rates, or exploring cheaper utilities providers to further reduce monthly expenses.

In conclusion, seeking lower cost alternatives is a vital habit for individuals aiming to achieve financial freedom. By proactively exploring various options and making conscious choices, individuals can effectively manage their money, reduce expenses, and accelerate their journey towards a debt-free and financially secure future.

Living Within Means

One essential aspect of managing one’s finances effectively and achieving financial stability and independence is the ability to live within one’s means. This concept revolves around the idea of spending less than what one earns and avoiding unnecessary or excessive expenses.

Living within means involves making conscious and informed choices about how to allocate one’s financial resources. It requires individuals to carefully prioritize their needs and wants, distinguish between essential and non-essential expenses, and make wise decisions about saving and investing.

A key component of living within means is creating and sticking to a budget. By creating a detailed budget, one can effectively track their income and expenses, identify areas for potential savings, and ensure that they are not overspending. This includes setting limits on discretionary spending, such as dining out or shopping, and prioritizing saving for future goals.

Another important aspect of living within means is avoiding the temptation to keep up with others’ lifestyles or to succumb to societal pressures. It is crucial to understand that financial success and freedom are not determined by material possessions or indulging in lavish expenditures. Rather, it is about making responsible choices that align with one’s long-term financial goals.

| Key Points |

|---|

| Spending less than what one earns |

| Prioritizing needs over wants |

| Creating and following a budget |

| Avoiding unnecessary expenses |

| Resisting societal pressures to overspend |

Living within means not only provides individuals with financial stability, but it also fosters a sense of control and peace of mind. It empowers individuals to make deliberate financial decisions, build emergency funds, and work towards achieving their long-term financial aspirations.

By embracing the concept of living within means, individuals can lay a strong foundation for their financial future, avoid accumulating debt, and ultimately achieve the financial freedom they desire.

Avoid Impulse Buying

In the journey towards achieving financial stability, one must learn to resist the temptation of impulse buying. It is essential to cultivate the habit of carefully considering purchases before making them, rather than giving in to impulsive decisions that can lead to unnecessary expenses and hinder progress towards financial freedom.

One effective strategy to avoid impulse buying is to create a detailed budget. By planning and allocating funds for necessary expenses, it becomes easier to resist the urge to make impulsive purchases. Prioritizing needs over wants helps keep spending in check and prevents unnecessary debt accumulation.

Another helpful approach is to practice mindful shopping. This involves taking a step back and evaluating the necessity and long-term value of each potential purchase. Asking questions like Do I really need this? or Will this item contribute to my financial goals? can help curb impulsive spending habits.

Utilizing lists can also be beneficial in avoiding impulse buying. Whether it is a grocery list or a list of desired items, having a well-defined list helps focus on necessary purchases and prevents being swayed by impulse-driven desires. Additionally, it is important to stick to the list and resist the temptation of adding extra items that are not essential.

Engaging in activities that provide alternative forms of gratification can also help avoid impulse buying. Instead of relying on shopping as a source of entertainment or emotional fulfillment, exploring hobbies, spending time with loved ones, or engaging in physical activities can provide a sense of satisfaction without the need for unnecessary purchases.

- Creating a budget and sticking to it

- Practicing mindful shopping and questioning the necessity of purchases

- Using lists to stay focused on necessary items

- Finding alternative sources of satisfaction

By implementing these strategies, individuals can develop the discipline needed to avoid impulse buying and make sound financial decisions that align with their long-term goals. This will contribute to their journey towards financial freedom and ultimately ensure a more secure and prosperous future.

Questions and answers

How can I achieve financial freedom?

Achieving financial freedom requires implementing healthy habits such as creating a budget, saving regularly, avoiding unnecessary debt, and investing wisely. It is important to set specific financial goals, be disciplined, and stay focused on long-term success.

What are some common habits of debt-free individuals?

Debt-free individuals tend to have several habits in common. They practice frugality, spend money responsibly, and live within their means. They prioritize saving and investing, avoid impulse buying, and maintain a budget to track their expenses.

Is it possible to become debt-free while earning a low income?

Absolutely! While it may be more challenging, becoming debt-free is achievable on a low income. It requires careful budgeting, cutting unnecessary expenses, and finding ways to increase income. It may take longer, but setting realistic goals and making consistent progress is key.

How do successful individuals avoid falling into debt?

Successful individuals avoid falling into debt by practicing financial discipline. They prioritize needs over wants, avoid impulsive spending, and save for emergencies. They also maintain a good credit score, pay bills on time, and only take on debt when absolutely necessary and manageable.

What are the benefits of achieving financial freedom?

Achieving financial freedom brings numerous benefits, including peace of mind, reduced stress, and improved mental and physical well-being. It offers the flexibility to pursue dreams and passions, provides security for unexpected situations, and allows for a comfortable retirement. Financial freedom empowers individuals to live life on their own terms.

How can I achieve financial freedom?

To achieve financial freedom, it is important to develop and maintain good financial habits. Some habits that highly successful debt-free individuals practice include setting a budget, living below their means, saving consistently, and investing wisely. By consistently following these habits, you can gradually eliminate debt and achieve financial freedom.

Is it possible to become debt-free without making sacrifices?

No, becoming debt-free usually requires making some sacrifices. Highly successful debt-free individuals understand the importance of living below their means and making intentional choices about their spending. This may involve cutting back on certain expenses, prioritizing needs over wants, and making long-term financial goals a priority. While sacrifices may be necessary, the end goal of achieving financial freedom is well worth it.

What are some effective strategies for paying off debt?

There are several effective strategies for paying off debt. Two popular methods include the snowball method and the avalanche method. The snowball method involves paying off the smallest debts first while making minimum payments on larger debts, while the avalanche method focuses on paying off debts with the highest interest rates first. Both strategies have their advantages, so it’s important to choose the one that best suits your financial situation and goals.

How can I stay motivated while paying off debt?

Staying motivated while paying off debt can be challenging, but there are a few strategies that can help. One effective approach is to track your progress by regularly reviewing your debt reduction goals and celebrating each milestone achieved. Setting smaller, achievable goals along the way can also help maintain motivation. Additionally, finding a support system, whether it’s a friend, family member, or online community, can provide encouragement and accountability throughout the debt repayment journey.

What are some common habits that lead to financial success?

There are several common habits that highly successful debt-free individuals practice. These include budgeting and tracking expenses, living below their means, avoiding unnecessary debt, saving consistently, investing wisely, and continuously educating themselves about personal finance. By adopting and consistently practicing these habits, individuals can significantly increase their chances of achieving financial success and ultimately, financial freedom.