Imagine being in full control of your financial destiny, effortlessly laying the groundwork for a prosperous tomorrow. It may seem like an unattainable goal, but fear not! The solution lies in the powerful art of disciplined money management. By embarking on a thrilling journey of one entire year, where every week brings you one step closer to financial stability, you can build a solid financial foundation that will withstand any storm.

Picture this: a simple yet powerful technique that allows you to amass a significant sum without feeling overwhelmed or burdened. No, this is not a magic trick, but rather an ingenious strategy known as the 52-Week Money Saving Challenge. By following this method, you will gradually but surely accumulate a substantial financial reserve by saving a specific amount each week. This challenge has captured the attention of individuals around the world, revolutionizing the way we perceive and approach our finances.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreThe beauty of the 52-Week Money Saving Challenge lies in its adaptability and versatility. Whether you are a seasoned saver or completely new to the concept of budgeting, this challenge is tailor-made for you. It accommodates varying income levels and spending habits, ensuring that anyone can partake in the journey towards financial freedom. So, don your saving armor and embark on this fascinating adventure; the rewards that await you on the other side are well worth the effort.

- What is the 52 Week Money Saving Challenge?

- How the Challenge Works

- The Benefits of the Challenge

- Setting Realistic Goals

- Creating a Weekly Savings Plan

- Tracking Your Progress

- Tips for Successful Money Management

- Automate Your Savings

- Cut Back on Non-Essential Expenses

- Staying Motivated Throughout the Journey

- Rewarding Yourself Milestone by Milestone

- Visualizing Your Long-Term Goals

- Continuing the Saving Habit Beyond the Challenge

- Questions and answers

What is the 52 Week Money Saving Challenge?

In this section, we will explore the concept behind the 52 Week Money Saving Challenge and its purpose in helping individuals achieve financial goals.

Have you ever wanted to improve your financial situation and build a stronger foundation for the future? The 52 Week Money Saving Challenge offers an effective method for accomplishing this. This challenge is designed to help individuals save money consistently over the course of a year, enabling them to accumulate a significant amount of savings by the end of the challenge.

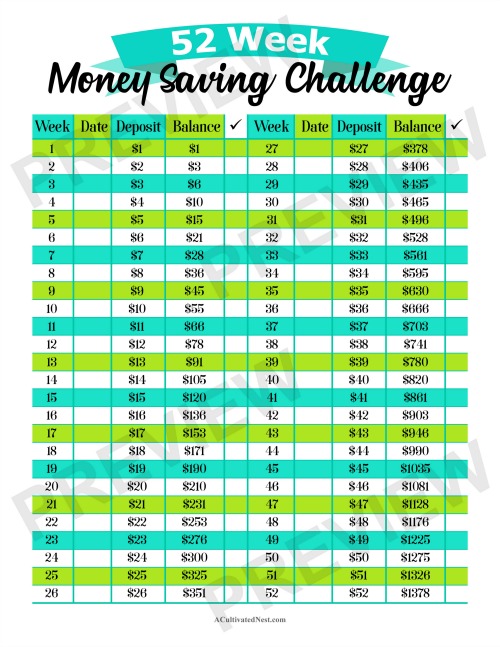

The 52 Week Money Saving Challenge operates on a simple premise: each week, participants save a specific amount of money. The savings amount increases gradually over time, starting with a small sum and gradually building up throughout the year. By following this structured approach, individuals can develop a habit of regular saving and gradually increase their financial discipline.

This challenge can be customized to suit individual preferences and financial capabilities. Some people choose to start with a small amount, such as $1, and increase the savings by $1 each week. Others may choose a higher starting amount and a larger increment. The key is to find a balance that is challenging yet achievable, ensuring a steady progress towards the ultimate savings goal.

Participating in the 52 Week Money Saving Challenge provides several benefits. It allows individuals to establish a financial routine and develop responsible money management skills. Additionally, the gradual increase in savings amount helps individuals adapt to larger financial commitments over time. By the end of the challenge, participants can feel a sense of accomplishment as they witness their savings grow significantly.

| Key Takeaways: |

|---|

| The 52 Week Money Saving Challenge is a method to save money consistently over the course of a year. |

| Participants save a specific amount each week, gradually increasing their savings over time. |

| This challenge helps individuals develop a habit of saving and improve their financial discipline. |

| Participants can customize the challenge based on their financial capabilities and preferences. |

| The challenge offers various benefits, including establishing a financial routine and witnessing significant savings growth. |

How the Challenge Works

In this section, we will examine the mechanics and principles behind the 52 Week Money Saving Challenge. This innovative approach to financial planning aims to empower individuals to secure a more prosperous future by employing a systematic and disciplined savings method. Through the utilization of various strategies and techniques, participants can gradually accumulate funds over the course of a year, ultimately realizing significant financial growth.

We will explore the step-by-step process of the challenge, discussing the adaptable nature of this method and its potential for customization to suit individual circumstances. By breaking down the challenge into manageable weekly increments, participants are able to develop a habit of regular saving while witnessing the growth of their savings pool. Additionally, we will delve into the importance of consistent participation and the benefits of gradually increasing the contribution amount as the challenge progresses.

Furthermore, we will outline a variety of tips and tricks that can be employed to enhance the effectiveness of the challenge, including the incorporation of automation tools, the utilization of budgeting techniques, and the exploration of supplementary income sources. By implementing these strategies and incorporating them into the challenge, participants can further optimize their financial journey and increase the likelihood of achieving their long-term savings goals.

Ultimately, understanding how the challenge works is fundamental to successfully navigate its intricacies and extract the greatest benefits from this innovative savings approach. By exploring the underlying principles and methodologies, participants can embark on a transformative journey towards financial security and a better future.

The Benefits of the Challenge

Embarking on the 52 Week Money Saving Challenge can bring about a multitude of advantages that extend beyond just financial growth. By participating in this innovative savings plan, individuals can experience a variety of benefits that ultimately contribute to a more secure and fulfilling future.

-

Enhanced Financial Stability: Engaging in the 52 Week Money Saving Challenge enables individuals to develop a strong savings habit and improve their overall financial stability. By consistently setting aside money each week, participants can build a substantial emergency fund, achieve financial goals, and gain a sense of control over their finances.

-

Improved Money Management Skills: Taking part in this challenge provides an opportunity to refine money management skills. Participants learn the importance of budgeting, prioritizing expenses, and distinguishing between needs and wants. These valuable skills can be applied not just during the challenge but also in managing finances throughout their lifetime.

-

Heightened Discipline and Self-Control: The 52 Week Money Saving Challenge necessitates discipline and self-control to consistently meet the required savings goals. Through this process, individuals develop important character traits that can extend beyond financial matters, positively impacting other areas of life such as work performance, health goals, and personal relationships.

-

Reduced Financial Stress: By committing to this challenge and steadily building a savings buffer, individuals can significantly reduce financial stress. Having a financial safety net provides peace of mind, enabling individuals to handle unexpected expenses and navigate life’s uncertainties with greater ease and confidence.

-

Opportunity for Future Investments: Saving money through the 52 Week Money Saving Challenge opens up doors for future investments. Whether it is funding higher education, starting a business venture, or saving towards a dream vacation, the accumulated savings can be used to seize opportunities that can enhance one’s quality of life and bring long-term fulfillment.

In conclusion, the 52 Week Money Saving Challenge offers a range of benefits that extend beyond simple financial gain. By participating in this challenge, individuals can experience enhanced stability, improved money management skills, heightened discipline, reduced financial stress, and exciting opportunities for future investments. It is an effective tool for fostering a strong financial foundation and creating a better future.

Setting Realistic Goals

When it comes to achieving financial success, it is crucial to set realistic goals that align with your individual circumstances and aspirations. By establishing attainable targets, you can create a roadmap towards a brighter financial future without feeling overwhelmed or discouraged.

One way to set realistic goals is by evaluating your current financial situation. Take into account your income, expenses, and any existing debts or financial obligations. This assessment will help you identify areas where you can make adjustments and allocate funds towards your savings goal.

- Start by breaking down your long-term goals into smaller, more manageable milestones. This approach allows you to track your progress and celebrate small victories along the way.

- Consider your timeline and determine a reasonable timeframe for achieving each milestone. It is important to be flexible and adaptable as circumstances may change over time.

- Take into consideration any potential roadblocks or challenges that may arise. By anticipating obstacles, you can develop contingency plans and stay on track towards your goals.

- Ensure that your goals are specific, measurable, achievable, relevant, and time-bound (SMART). This framework provides clarity and structure, increasing the likelihood of success.

- Seek support from friends, family, or financial advisors who can provide guidance and accountability throughout your savings journey.

Remember, setting realistic goals is crucial to maintain motivation and avoid feeling overwhelmed. It is okay to start small and gradually increase the level of savings as you become more comfortable. With consistent effort and perseverance, you can achieve a better financial future.

Creating a Weekly Savings Plan

Developing a strategy for managing your finances on a weekly basis is key to achieving your savings goals. By implementing a well-thought-out plan, you can ensure that you consistently set aside money each week for future endeavors and emergencies.

Step 1: Assess your current financial situation and determine how much you can realistically save each week without compromising your essential expenses. Consider any existing debts, bills, and other financial obligations that need to be taken into account.

Step 2: Set specific savings targets for each week. Break down your long-term savings goal into smaller, manageable increments to stay motivated and track your progress effectively. This can be done by allocating a fixed amount or a percentage of your income for savings each week.

Step 3: Identify areas where you can cut back on expenses to maximize your weekly savings. Analyze your spending habits and find opportunities to reduce unnecessary costs, such as dining out, entertainment, or impulse purchases. Consider alternatives or budget-friendly options to help you save more effectively.

Step 4: Automate your savings by setting up automatic transfers from your paycheck or checking account to a dedicated savings account. This way, you won’t have to rely on remembering to save each week, and the money will be set aside before you have a chance to spend it.

Step 5: Keep track of your weekly savings progress. Use a spreadsheet, a savings app, or a simple pen and paper to monitor your savings growth over time. Celebrate milestones and use them as motivation to continue with your savings plan.

Step 6: Stay consistent and disciplined with your weekly savings plan. Avoid the temptation to dip into your savings unless absolutely necessary. Stick to your plan, adjust as needed, and prioritize your financial goals.

Step 7: Revise and reassess your weekly savings plan periodically. As your financial situation and goals evolve, it’s important to review and make necessary adjustments to your plan. Revisit your expenses, savings targets, and priorities to ensure that your plan remains aligned with your aspirations.

By following these steps and taking a proactive approach to managing your finances each week, you can create a strong foundation for reaching your savings goals and securing a better future.

Tracking Your Progress

Keeping track of your advancement on the journey towards financial stability and prosperity can greatly contribute to your success. Monitoring your progress can help you stay motivated, accountable, and make adjustments as needed along the way.

One effective way to track your progress is by maintaining a record of your savings milestones. This can be easily done by listing the amount you save each week and the corresponding week number. Consider using a spreadsheet or a dedicated savings tracker application to streamline this process.

Another useful method to track your progress is by visually representing your achievements. Create a visual chart where you can plot your savings milestones and watch as the line rises week by week. This visual reminder can serve as a inspiring tool to keep you focused and motivated on your savings journey.

In addition to tracking your savings, it is also beneficial to reflect on your spending habits. Take note of your expenses and identify areas where you can make adjustments or cut back. This self-reflection can help you make informed choices and optimize your saving plan.

Furthermore, celebrating your milestones along the way is crucial to maintaining your drive. Reward yourself when you reach certain goals to acknowledge your hard work and dedication. However, remember to choose rewards that align with your overall financial goals, such as treating yourself to something affordable or allocating those funds towards your ultimate savings objective.

- Record your weekly savings and week number

- Create a visual chart to track your progress

- Reflect on your spending habits and make adjustments

- Celebrate milestones to stay motivated

By diligently tracking your progress, you can develop a clear understanding of your financial situation, stay motivated, and stay on track to achieve your long-term goals. Remember, every small step you take today can lead to a brighter financial future tomorrow.

Tips for Successful Money Management

In this section, we will discuss practical strategies and techniques that can help you save money effectively without compromising your financial stability. By implementing these tips, you will be able to allocate your resources wisely and achieve your savings goals.

1. Budgeting: Creating a budget is crucial for successful money management. Take the time to track your expenses and categorize them to identify areas where you can cut back and save. Set realistic financial goals and allocate a certain amount of your income towards savings each month.

2. Setting Priorities: Prioritize your expenses and determine what is essential and what can be considered as discretionary. By distinguishing between needs and wants, you can make better spending decisions and save money by cutting back on unnecessary expenses.

3. Eliminating Debt: Paying off high-interest debts should be a priority. Consider consolidating your debts and creating a payment plan to reduce the interest burden and save money in the long run.

4. Automating Savings: Setting up automatic transfers to a separate savings account can make saving money effortless. By allocating a portion of your income directly to savings, you will be less tempted to spend it on non-essential items.

5. Researching Before Purchasing: Before making a purchase, do thorough research to find the best deals and discounts available. Compare prices, read reviews, and consider waiting for sales or promotions to save money on your purchases.

6. Saving on Utilities: Reduce your utility bills by implementing energy-saving strategies. Use energy-efficient appliances, turn off lights when not in use, and adjust thermostat settings. Small changes can add up to significant savings.

7. Meal Planning and Cooking at Home: Plan your meals in advance and cook at home as much as possible. This not only saves money but also allows you to eat healthier. Invest in ingredients that can be used in multiple dishes to minimize waste.

8. Avoiding Impulse Buying: Resist the temptation of impulse buying by implementing the 24-hour rule. Give yourself a day to evaluate whether a purchase is necessary or just a spur-of-the-moment desire.

9. Sharing Expenses: Consider sharing expenses with friends or family members whenever possible. For example, carpooling or sharing subscription services can significantly reduce individual costs.

| Tips for Successful Money Management |

|---|

| 1. Budgeting |

| 2. Setting Priorities |

| 3. Eliminating Debt |

| 4. Automating Savings |

| 5. Researching Before Purchasing |

| 6. Saving on Utilities |

| 7. Meal Planning and Cooking at Home |

| 8. Avoiding Impulse Buying |

| 9. Sharing Expenses |

Automate Your Savings

In today’s fast-paced world, it can be challenging to find the time and discipline to save money consistently. However, by automating your savings, you can effortlessly build a secure financial future without even realizing it.

By setting up automatic transfers from your checking account to a separate savings account, you can develop a habit of saving regularly. This approach allows you to allocate a fixed portion of your income towards your savings without any effort or reminders. It’s like having a personal assistant, diligently working in the background to grow your nest egg.

Automating your savings has several benefits. Firstly, it eliminates the temptation to spend the money that you intended to save. By diverting the funds before they reach your spending account, you reduce the risk of frivolous purchases that could derail your financial goals.

Additionally, automating your savings helps to ensure consistency in your saving habits. With regular deposits, you build momentum towards your financial objectives, inching closer to achieving them each month. This approach provides peace of mind and eliminates the stress of constantly reminding yourself to save.

Furthermore, automation allows your money to work for you. By consistently contributing to your savings, you can take advantage of compound interest, which increases your accumulated savings over time. This strategy not only helps you reach your goals faster but also allows your money to grow exponentially.

To make the most out of automated savings, consider setting up automatic transfers immediately after receiving your paycheck. This way, you prioritize saving as soon as your income is deposited, ensuring that your financial goals take precedence over discretionary spending.

In conclusion, automating your savings is a powerful technique to effortlessly set aside money for a better future. By eliminating the need for manual transfers and relying on regular automatic deposits, you can build a solid financial foundation without even thinking about it. Start automating today and watch your savings grow steadily over time!

Cut Back on Non-Essential Expenses

In order to successfully save money for a more prosperous future, it is important to evaluate and reduce unnecessary expenses. By minimizing spending on non-essential items or activities, individuals can prioritize their financial goals and allocate more resources towards building a solid foundation for tomorrow.

Trimming down non-essential expenses involves making mindful choices and distinguishing between needs and wants. This could mean cutting back on entertainment subscriptions, dining out less frequently, or reducing impulse purchases. By being more deliberate with spending habits, individuals can free up funds that can then be directed towards savings or investments.

It is vital to identify areas where unnecessary expenses often occur and take appropriate measures to curtail them. This may involve implementing a practical budgeting strategy, tracking expenses diligently, and adhering to a predefined spending plan. Additionally, seeking out cost-effective alternatives or opting for free activities can also help in reducing non-essential expenditures without compromising on quality of life.

Furthermore, developing the habit of assessing the value and long-term impact of potential purchases can be beneficial. By considering whether a particular expense aligns with personal goals or adds genuine value to one’s life, individuals can avoid impulsive spending and prioritize saving for a more secure and fulfilling future.

In conclusion, cutting back on non-essential expenses is a crucial step towards mastering the art of saving for a better future. By consciously reducing frivolous spending, individuals can cultivate a mindset of thoughtful financial management and ensure that their resources are appropriately allocated towards achieving their long-term aspirations.

Staying Motivated Throughout the Journey

Embarking on a financial quest towards a brighter and prosperous tomorrow requires unwavering determination and unwavering motivation. Throughout this transformative expedition, it is crucial to constantly fuel your motivation, keeping your sights firmly fixed on the ultimate goal. By employing various strategies and cultivating a positive mindset, you can stay motivated and committed to the challenges that lie ahead, ensuring your success.

Embracing the Power of Visualizations: Visualizations can be a powerful tool to keep your motivation levels high. Envision the future you desire, imagining the financial freedom and security that awaits you. Create a mental image of the life you will lead once you have achieved your savings goals. By regularly visualizing your success, you will maintain your excitement and drive as you progress through the challenge.

Setting Milestones and Celebrating Achievements: Breaking down your savings journey into smaller milestones can help you stay motivated along the way. Set achievable weekly, monthly, or even quarterly targets, and celebrate your accomplishments when you reach them. Treat yourself to a small indulgence as a reward for your progress, reinforcing the positive outcomes of your efforts.

Building a Support System: Surrounding yourself with like-minded individuals who share your goals and aspirations can greatly enhance your motivation. Join online communities or find local groups of individuals also striving to save for a better future. Sharing your challenges, triumphs, and strategies with others who understand your journey will provide a valuable support system that can keep you motivated during the highs and lows of the challenge.

Practicing Self-Care: Taking care of your physical and mental well-being is essential for staying motivated throughout the challenge. Prioritize activities that rejuvenate and energize you, such as exercise, meditation, or spending quality time with loved ones. By maintaining a healthy work-life balance and nourishing your mind and body, you will have the resilience and motivation to persist through any obstacles that come your way.

Adopting a Growth Mindset: Embrace the belief that your financial journey is an opportunity for growth and learning. Approach setbacks and hurdles as valuable lessons that will only make you stronger in the long run. Cultivate a positive attitude towards challenges, and remember that each step forward, no matter how small, brings you closer to a better future. With a growth mindset, you can transform obstacles into stepping stones, maintaining your motivation and resilience throughout the challenge.

Remaining Focused on the Why: Lastly, always keep in mind the reasons why you chose to embark on this savings challenge. Whether it is financial security, a dream vacation, or creating a better life for your loved ones, regularly remind yourself of the purpose behind your efforts. When faced with temptation or moments of doubt, reconnecting with your why will reignite your motivation and keep you on track towards a brighter future.

In conclusion, staying motivated throughout the journey of the 52 Week Money Saving Challenge is essential for achieving your financial goals. By utilizing visualization, setting milestones, building a support system, practicing self-care, adopting a growth mindset, and staying focused on your why, you can maintain unwavering motivation and successfully conquer the challenges that come your way.

Rewarding Yourself Milestone by Milestone

As you progress through the 52 Week Money Saving Challenge, it’s important to acknowledge and celebrate your achievements along the way. By setting milestones and rewarding yourself for reaching them, you can stay motivated and continue on your journey towards financial stability.

Each milestone represents a significant point in your savings journey. It could be reaching a specific savings amount, completing a certain number of weeks, or achieving a financial goal you’ve set for yourself. These milestones serve as markers of your progress and dedication, reminding you of how far you’ve come and inspiring you to keep going.

| Milestone | Reward |

|---|---|

| Save $500 | Treat yourself to a nice dinner at your favorite restaurant |

| Save $1,000 | Buy a new book or indulge in a spa treatment |

| Reach the halfway point | Take a weekend getaway or plan a fun day trip |

| Save $2,500 | Purchase a new gadget or upgrade your electronics |

| Complete the challenge | Reward yourself with a well-deserved vacation or a special splurge |

By incorporating rewards into your savings plan, you create a positive association with saving money. Each milestone becomes an opportunity to treat yourself for your hard work and dedication. It’s important to choose rewards that align with your values and priorities, so they feel meaningful and satisfying.

Remember, the 52 Week Money Saving Challenge is not just about the end goal but also about the journey. Rewarding yourself milestone by milestone adds a sense of enjoyment and accomplishment to your savings experience, making it more likely that you’ll stick with it and achieve financial success in the long run.

Visualizing Your Long-Term Goals

When it comes to planning for the future and working towards a more prosperous tomorrow, it is essential to have a clear vision of your long-term goals. Creating a mental picture of what you want to achieve can inspire and motivate you throughout your savings journey. By visualizing your aspirations and dreams, you can stay focused and determined, making smart financial decisions that align with your ultimate objectives.

Imagining yourself in a desirable future allows you to define and manifest your goals into reality. Consider visualizing a peaceful retirement where you have the freedom to do what you love and the financial stability to support your desired lifestyle. Picture yourself traveling to exotic locations, spending quality time with loved ones, and pursuing hobbies that bring you joy and fulfillment. By capturing these thoughts and emotions, you can establish a specific direction for your saving efforts.

Visualizing your long-term goals is not just wishful thinking; it serves as a powerful tool for manifestation and achievement. Imagine owning your dream home, driving a car you adore, or starting a business that aligns with your passions. These mental images create a sense of clarity and purpose, setting the stage for your financial success.

Visualizing and regularly revisiting your long-term goals can help you stay motivated and disciplined in your saving practices. Whenever doubts or temptations arise, remind yourself of the future you aspire to create. Visualize the financial freedom and security you’ll have when you achieve your goals. This mental exercise provides the inspiration needed to overcome obstacles and make financial choices that align with your ultimate vision.

Remember, visualizing your long-term goals is not just about dreaming; it’s about actively working towards turning those dreams into reality. Use this visualization as a guide for setting smaller, achievable milestones along your savings journey. Breaking your goals down into manageable steps will make the process less overwhelming and increase your chances of success. Keep your vision at the forefront of your mind, adjust your savings strategies as needed, and continue to visualize the life you are working towards.

Continuing the Saving Habit Beyond the Challenge

Building on the momentum gained from successfully completing the 52 Week Money Saving Challenge, it is important to maintain a consistent approach to saving in order to ensure long-term financial stability. This section explores strategies and techniques to sustain the saving habit beyond the initial challenge, fostering a lifelong commitment to financial well-being.

Cultivating Financial Discipline: Developing a strong sense of discipline is vital when it comes to continuing the saving habit. Emphasizing the importance of delayed gratification and mindful spending can help individuals resist impulsive purchases and prioritize their financial goals.

Expanding Saving Methods: While the 52 Week Money Saving Challenge is an effective approach, it is essential to explore different saving methods to suit individual preferences and circumstances. This could include setting up automatic transfers to a dedicated savings account, engaging in regular budgeting and tracking expenses, or even seeking professional advice to optimize savings strategies.

Setting New Savings Targets: Once the initial challenge has been completed, it is crucial to set new savings targets to maintain motivation and momentum. Whether it is saving for a dream vacation, a down payment on a house, or retirement, having specific goals helps individuals stay focused and committed to the saving habit.

Embracing a Frugal Lifestyle: Adopting a frugal lifestyle can further enhance savings beyond the challenge. This involves making conscious decisions to reduce expenses, such as cutting back on unnecessary subscriptions, dining out less frequently, and finding alternative ways to enjoy leisure activities without overspending.

Seeking Continued Education: Staying informed about personal finance and investing is key to sustaining the saving habit. Individuals can further their knowledge through reading financial books, attending seminars or workshops, and utilizing online resources to make informed decisions and maximize their savings potential.

By incorporating these strategies and maintaining the saving habit beyond the initial challenge, individuals can ensure a secure financial future and build a strong foundation for their long-term goals.

Questions and answers

What is the 52 Week Money Saving Challenge?

The 52 Week Money Saving Challenge is a popular savings method that helps individuals gradually save money over the course of a year. It involves saving a specific amount of money each week, starting with $1 in the first week and increasing the amount by $1 each week. By the end of 52 weeks, you will have saved a total of $1,378.

How can I participate in the 52 Week Money Saving Challenge?

To participate in the 52 Week Money Saving Challenge, you need to set a goal and commit to saving money consistently each week. You can start by saving $1 in the first week and increase the amount by $1 every week thereafter. It is recommended to create a dedicated savings account or jar to track your progress and make it easier to save.

What are the benefits of the 52 Week Money Saving Challenge?

The 52 Week Money Saving Challenge is a great way to cultivate a savings habit and build financial discipline. By saving a small amount each week, you gradually accumulate a significant sum of money by the end of the year. This challenge also helps you save for specific goals or future expenses, such as a vacation, emergency fund, or down payment for a house.

Is the 52 Week Money Saving Challenge suitable for everyone?

Yes, the 52 Week Money Saving Challenge is suitable for anyone who wants to save money and build a better financial future. It is a flexible savings method that can be adapted to individual circumstances and financial capabilities. If the suggested weekly amounts are too high, you can adjust them to fit your budget and still benefit from the saving habit it promotes.

Are there any alternative saving methods similar to the 52 Week Money Saving Challenge?

Yes, there are several alternative savings methods that are similar to the 52 Week Money Saving Challenge. Some examples include the 365-day penny challenge, where you save one penny on the first day, two pennies on the second day, and so on, gradually increasing the amount each day. Another method is the reverse 52 Week Money Saving Challenge, where you start by saving $52 in the first week and decrease the amount by $1 each week.

What is the 52 Week Money Saving Challenge?

The 52 Week Money Saving Challenge is a popular savings method that encourages people to save a small amount of money each week for a year. The amount to be saved each week follows a specific pattern, starting with $1 in the first week and increasing by $1 every week.

How does the 52 Week Money Saving Challenge work?

The 52 Week Money Saving Challenge is based on the idea of gradually increasing savings over time. In the first week, you save $1. In the second week, you save $2, and the amount continues to increase by $1 each week. By the end of the 52nd week, you will have saved a total of $1,378.

Is the 52 Week Money Saving Challenge suitable for anyone?

Yes, the 52 Week Money Saving Challenge is suitable for anyone who wants to develop a saving habit, regardless of age or financial situation. It is a flexible method that can be adjusted based on individual circumstances, allowing anyone to participate and save money for a better future.

What are the benefits of the 52 Week Money Saving Challenge?

The 52 Week Money Saving Challenge offers several benefits. Firstly, it provides a structured approach to saving, making it easier to reach financial goals. Additionally, the gradual increase in savings helps to develop discipline and consistency in saving habits. Finally, the saved money can be used for emergencies, vacations, or any other financial goals.

Are there any strategies to make the 52 Week Money Saving Challenge easier?

Yes, there are strategies that can make the 52 Week Money Saving Challenge easier. Some people prefer to start with a higher amount and gradually decrease it, while others save the same amount each week. It can also be helpful to automate savings transfers or use dedicated savings accounts. The key is to find a strategy that works best for your financial situation and stick to it.