Discovering the art of frugality can result in a multitude of benefits that extend far beyond your financial stability. By adopting a thrifty lifestyle, you can unlock a world of opportunities aimed at safeguarding your economic future and improving your overall well-being.

Embracing a mindful approach to managing your expenses opens up a plethora of possibilities to maximize your savings and allocate your resources wisely. By making conscious decisions and prioritizing your needs, you can cultivate a state of financial resilience, allowing you to weather unforeseen circumstances and emergencies more effectively.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreThe concept of frugality transcends mere penny-pinching and tight budgeting. It encompasses the development of practical skills that empower you to live a fulfilling life while avoiding unnecessary expenditure. Such wisdom enables you to balance your desires with your fiscal responsibilities, fostering a sense of control and satisfaction with your financial decisions.

- The Advantages of Embracing a Frugal Lifestyle

- Financial Stability

- Manage Your Money Wisely

- Build an emergency fund

- Debt Reduction

- Pay off loans faster

- Reduce stress and financial burden

- Increased Savings

- Save for important goals

- Grow your wealth over time

- Ways Frugal Living Can Improve Your Overall Well-being

- Reduced Financial Stress

- Eliminate the constant worry about money

- Questions and answers

The Advantages of Embracing a Frugal Lifestyle

Discover the numerous rewards that come with adopting a frugal way of life, where prudent spending and wise financial decisions lead to a more secure and fulfilling future.

1. Enhanced Financial Stability:

- By prioritizing needs over wants and focusing on saving, individuals can attain a greater sense of financial security, ensuring a stable financial footing for unforeseen circumstances and future goals.

- Through diligent budgeting and practicing thrifty habits, one can effectively manage their expenses and develop a comprehensive understanding of their finances, leading to improved financial stability.

2. Increased Savings and Investments:

- A frugal lifestyle encourages individuals to save a significant portion of their income, enabling them to build a substantial nest egg that can be utilized for emergencies, retirement, or future investments.

- By embracing thriftiness, one can potentially free up extra funds to invest in lucrative opportunities, such as stocks, real estate, or starting a business, ultimately creating additional income streams and increasing their wealth.

3. Reduced Debt and Financial Stress:

- Living frugally promotes a debt-free existence, as it encourages individuals to avoid unnecessary borrowing and prioritize debt repayment.

- By consciously spending within their means and utilizing cost-cutting strategies, individuals can alleviate financial stress, ensuring a healthier and more peaceful mindset.

4. Environmental Benefits:

- A frugal lifestyle often aligns with sustainable living practices, as it promotes the reuse, repair, and repurposing of goods, reducing waste and excess consumption.

- By embracing frugality, individuals contribute to the preservation of the environment, minimizing their carbon footprint and promoting a greener planet for future generations.

5. Better Quality of Life:

- Contrary to common belief, a frugal lifestyle does not mean sacrificing joy and fulfillment; instead, it encourages individuals to find happiness in experiences, relationships, and personal growth, rather than material possessions.

- By embracing simplicity, individuals can prioritize what truly matters in life, leading to increased contentment, stronger relationships, and a more meaningful existence.

Start embracing a frugal lifestyle today and unlock the array of advantages it offers, enabling you to achieve financial stability, reduce stress, and experience a more fulfilling and environmentally conscious life.

Financial Stability

One crucial aspect of achieving sound financial health is attaining and maintaining financial stability. Financial stability refers to the state of having a solid and secure financial foundation that can withstand various economic challenges.

Achieving financial stability involves prudent and responsible financial practices, such as budgeting, saving, and investing. It requires individuals to make wise decisions regarding their income, expenses, and debt management.

By embracing frugal living and adopting a thrifty mindset, individuals can significantly enhance their chances of attaining financial stability. Living frugally means being mindful of one’s spending habits, finding ways to cut costs, and making conscious choices about how and where money is allocated.

The path to financial stability is not always easy, but it offers numerous long-term benefits. It can provide a sense of security and peace of mind, as individuals who are financially stable are better equipped to handle unexpected financial emergencies.

Furthermore, financial stability can help individuals plan for their future and achieve their financial goals. By living within their means, saving regularly, and investing wisely, individuals can build a solid financial foundation that serves as a base for their aspirations, such as purchasing a home, starting a business, or retiring comfortably.

In addition to the personal benefits, financial stability also positively impacts the overall economy. When individuals and households are financially stable, it reduces the risk of financial crises and contributes to economic growth. Financial stability promotes more responsible financial behavior and fosters a healthier and more sustainable economy.

Therefore, adopting a frugal lifestyle and making conscious choices to enhance one’s financial stability not only benefits individuals and families but also has a wider positive impact on society as a whole.

Manage Your Money Wisely

When it comes to effectively managing your finances, making wise decisions is paramount. By adopting prudent financial practices, you can achieve better control over your money and enhance your overall financial well-being. In this section, we will explore various strategies and tips for managing your money wisely, enabling you to make sound financial decisions and secure a stable future.

- Create a budget: One of the fundamental ways to manage your money wisely is by creating a budget. A budget allows you to track your income and expenses, helping you prioritize your spending and identify areas where you can cut back. By setting clear financial goals and allocating your funds accordingly, you can ensure that your money is being used effectively and efficiently.

- Save consistently: Building a habit of saving money regularly is crucial for managing your finances wisely. Allocating a portion of your income towards savings not only provides you with a safety net for emergencies but also enables you to work towards your long-term financial goals. Whether it’s setting aside a fixed amount each month or automating your savings, consistent saving helps in building wealth and creating a secure financial future.

- Reduce unnecessary expenses: Another essential aspect of managing your money wisely is identifying and reducing unnecessary expenses. By scrutinizing your spending habits and distinguishing between wants and needs, you can make conscious choices to cut back on non-essential purchases. This habit of mindful spending ensures that your money is being used purposefully and allows you to allocate more funds towards your financial priorities.

- Invest wisely: Investing your money intelligently is an effective strategy for managing your finances wisely. Whether you choose to invest in stocks, bonds, mutual funds, or real estate, it’s important to conduct thorough research and seek professional advice. By diversifying your investment portfolio and making informed decisions, you can potentially grow your wealth and secure your financial future.

- Stay informed: Keeping yourself updated and knowledgeable about financial matters is key to managing your money wisely. Stay informed about current economic trends, financial markets, and investment opportunities. By understanding the implications of financial decisions and staying on top of market changes, you can make informed choices that align with your financial goals and aspirations.

By implementing these strategies and embracing a mindset of mindful money management, you can take control of your finances and pave the way for a healthier financial future.

Build an emergency fund

Creating a safety net for unexpected financial situations is crucial for maintaining stability and securing your future. Setting aside funds specifically for emergencies can provide a sense of security and peace of mind in times of crisis.

Establishing an emergency fund allows you to be prepared for unforeseen circumstances such as medical expenses, job loss, or unexpected home repairs. It acts as a financial cushion, providing you with the means to cover immediate and unexpected expenses without resorting to high-interest loans or accumulating debt.

By consistently contributing to your emergency fund, you are taking a proactive approach to financial planning and protecting yourself from potential financial setbacks. This fund acts as a safety barrier, shielding you from the stress and anxiety that may arise when faced with unexpected costs.

Moreover, having an emergency fund can help you avoid dipping into your regular savings or retirement funds, ensuring that you can maintain your long-term financial goals. It serves as a separate pot of money specifically dedicated to handling emergency situations.

Building an emergency fund requires discipline and a commitment to regularly contribute a portion of your income. By making small but consistent contributions, you can gradually build up this fund over time, ensuring that you are prepared for any future emergencies that may arise.

Remember, emergencies can happen to anyone at any time. By building an emergency fund, you are taking an important step towards financial security, ensuring that unforeseen circumstances do not derail your overall financial health.

Debt Reduction

Striving to achieve financial freedom and stability is a journey that often requires adopting a frugal approach to managing personal finances. One integral aspect of this journey is debt reduction, which plays a significant role in improving your overall financial health.

Reducing debt involves strategically and intentionally working towards eliminating financial obligations, such as loans, credit card balances, and other forms of borrowed money. By actively tackling your debts, you pave the way for increased financial stability, lower stress levels, and enhanced control over your financial future.

1. Creating a Repayment Plan:

When aiming to reduce debt, it is crucial to start by creating a well-structured repayment plan. This plan should outline your debts, their interest rates, and prioritize them based on factors such as highest interest rates or smallest balances. By identifying a clear path towards debt reduction, you can better focus your efforts and resources towards paying off outstanding balances.

2. Minimizing Unnecessary Expenses:

One of the most effective ways to expedite debt reduction is by minimizing unnecessary expenses. Practicing frugality in daily life can involve making small but meaningful adjustments, such as cutting back on dining out, entertainment subscriptions, or impulsive purchases. By consciously making these choices, you free up additional funds that can be allocated towards debt repayment, ultimately giving you the opportunity to accelerate your progress.

3. Seeking Professional Guidance:

If you find yourself overwhelmed with debt and struggling to make progress despite your efforts, seeking professional guidance can be immensely helpful. Debt counseling services or financial advisors can provide expert advice tailored to your specific situation, offering strategies and support to further optimize your debt reduction journey.

4. Celebrating Milestones:

Debt reduction is not an easy feat, and it is essential to acknowledge and celebrate milestones along the way. Each time you successfully pay off a significant portion of your debt, take a moment to appreciate your accomplishments and re-energize yourself for the remaining journey. Recognizing your progress reinforces the positive impact of following a frugal lifestyle and encourages you to persevere towards becoming debt-free.

In conclusion, debt reduction is a vital component of frugal living and achieving long-term financial health. By developing a well-structured repayment plan, minimizing unnecessary expenses, seeking professional guidance when needed, and celebrating milestones, you can effectively reduce your debt burden and take significant strides towards a more secure financial future.

Pay off loans faster

Accelerate the repayment of your loans through the incorporation of thrifty habits and smart financial decisions. By adopting frugal living practices, you can expedite the process of eliminating your debts and achieving long-term financial freedom.

1. Prioritize loan payments: Make paying off your loans a top priority in your budget. Allocate a significant portion of your income towards loan repayment, minimizing unnecessary expenses so that you can allocate more funds towards debt reduction.

2. Create a repayment plan: Develop a structured repayment plan to ensure that you stay on track and steadily make progress towards eliminating your loans. Set specific goals and deadlines to motivate yourself and measure your progress along the way.

3. Cut down on interest: Minimize the amount of interest you pay by making additional payments towards the principal amount of your loans. By reducing the principal balance, you can lower the overall interest charges and effectively pay off your loans faster.

4. Utilize windfalls wisely: If you receive unexpected bonuses, tax refunds, or other windfall amounts, resist the temptation to splurge. Instead, use these extra funds to make extra loan payments, accelerating your progress towards becoming debt-free.

5. Seek additional income: Explore opportunities to increase your income through side hustles or freelancing. By earning extra money, you can contribute more towards your loan payments, helping you pay off your loans faster.

6. Refinance your loans: Consider refinancing your loans to secure lower interest rates and better repayment terms. By refinancing, you can reduce your monthly payment amounts or shorten the loan term, allowing you to pay off your loans more quickly.

7. Resist unnecessary debt: Avoid taking on new debt that is not absolutely necessary. By resisting the temptation to borrow more, you can focus your financial resources on repaying existing loans and ultimately achieve debt-free status sooner.

8. Stay motivated and disciplined: Maintaining a frugal mindset and staying focused on your financial goals is crucial in paying off your loans faster. Remind yourself of the rewards of being debt-free and consider the long-term financial benefits of living a thrifty lifestyle.

By implementing these strategies and prioritizing loan repayment, you can expedite your journey towards financial freedom, reduce stress, and build a solid foundation for a healthier financial future.

Reduce stress and financial burden

Living a frugal lifestyle can have a significant impact on reducing stress and alleviating the financial burden that many individuals face. By embracing a thrifty mindset and making smart financial decisions, individuals can unlock a sense of freedom and peace of mind.

One of the key advantages of practicing frugality is the ability to eliminate excessive debt and avoid living paycheck to paycheck. By cutting back on unnecessary expenses and focusing on prioritizing needs over wants, individuals can achieve a greater sense of financial stability. This, in turn, leads to a reduction in stress levels as the constant worry of bills and financial obligations is diminished.

Furthermore, living frugally encourages individuals to develop healthy financial habits and cultivate a disciplined approach to money management. By actively seeking out ways to save and increase their savings, individuals become better equipped to handle unexpected financial emergencies. This preparedness helps to alleviate the anxiety and burden that typically accompanies financial uncertainty.

Embracing a frugal lifestyle also encourages individuals to embrace the mindset of contentment and gratitude. By focusing on what truly matters and appreciating the simple pleasures in life, individuals can reduce the pressure to constantly keep up with societal norms and expectations. This shift in mindset promotes a more positive outlook on life and reduces the stress associated with constantly striving for more material possessions.

In conclusion, incorporating frugality into one’s lifestyle can lead to a significant reduction in stress and financial burden. By making wise financial decisions, eliminating debt, and cultivating a content mindset, individuals can enjoy a healthier and more fulfilling financial future.

Increased Savings

One of the key advantages of adopting a frugal lifestyle is the ability to significantly boost your savings. By incorporating thrifty habits into your daily routine, you can enhance your financial stability and achieve long-term financial goals.

Frugality allows you to carefully manage your expenses and prioritize your spending, resulting in a greater portion of your income being saved. By being mindful of your purchases and actively seeking cost-effective alternatives, you can minimize unnecessary expenses and allocate a larger portion of your earnings towards savings.

Furthermore, a frugal lifestyle encourages you to develop a proactive mindset towards saving, instilling discipline and self-control in your financial decisions. By embracing the concept of delayed gratification, you can resist impulsive purchases and focus on building a solid financial foundation.

Being frugal also fosters a sense of resourcefulness and creativity in managing your finances. By finding innovative ways to cut costs, such as repurposing items, DIY projects, or sharing resources with others, you not only save money but also develop useful skills and reduce waste in the process.

In addition to these tangible benefits, adopting a frugal lifestyle can also lead to increased peace of mind and reduced financial stress. By having a well-padded savings account, you are better prepared to handle unexpected emergencies or financial setbacks without relying on credit or taking on debt.

To sum up, embracing a frugal lifestyle offers numerous advantages, including increased savings, improved financial stability, and reduced financial stress. By making conscious choices and being mindful of your spending habits, you can pave the way towards a secure and prosperous future.

Save for important goals

Setting aside money for important goals is a crucial aspect of responsible financial management. By adopting a frugal lifestyle and being mindful of our spending habits, we can carve out the necessary funds to achieve our aspirations and dreams.

One of the key advantages of embracing thriftiness is the ability to allocate resources towards significant objectives. Whether it’s saving for a down payment on a home, investing in higher education, or starting a business, being frugal allows us to accumulate the necessary funds over time.

Through careful budgeting and conscious decision-making, we can prioritize our financial goals and make consistent progress towards them. By cutting unnecessary expenses and reevaluating our spending habits, we can free up additional funds to contribute towards fulfilling our most important aspirations.

It’s important to recognize that saving for important goals not only enhances our financial health but also provides us with a sense of direction and purpose. By working towards meaningful objectives, we can cultivate a stronger sense of motivation and satisfaction in our financial journey.

In addition, being proactive in saving for important goals allows us to anticipate and mitigate potential future financial challenges. By building up a safety net of funds, we can better navigate unexpected expenses, emergencies, or financial downturns without jeopardizing our progress towards our long-term objectives.

In conclusion, saving for important goals is a fundamental aspect of frugal living that empowers us to create a brighter financial future. By making conscious choices, setting priorities, and consistently allocating resources towards our aspirations, we can attain a greater level of financial security and fulfillment.

Grow your wealth over time

Increasing your financial prosperity through the passage of time is an achievable goal that can be attained through the practice of frugal living.

By embracing the principles of thriftiness and making wise spending choices, you have the ability to gradually accumulate and grow your wealth over the course of your life. This process involves consciously prioritizing your expenses and finding ways to reduce unnecessary costs, allowing you to save and invest more effectively.

One key aspect of growing your wealth over time is developing a long-term financial plan. This involves setting specific financial goals and creating a roadmap towards achieving them. By understanding your current financial situation and envisioning where you want to be in the future, you can make informed decisions about your spending and saving habits that align with your objectives.

A frugal lifestyle also allows you to take advantage of compounding interest, which can significantly accelerate the growth of your wealth. By consistently saving and investing your money, you can benefit from the power of compounding, where your money earns interest on both the initial amount as well as the accumulated interest over time. This compounding effect can lead to substantial growth in your investment portfolio, helping you reach your financial goals faster.

Additionally, living frugally enables you to build an emergency fund, which acts as a financial safety net in times of unforeseen circumstances. Having enough savings to cover unexpected expenses can protect your long-term financial health and prevent you from dipping into your investments or incurring debt. This further supports your ability to grow your wealth over time as you are not depleting your resources during challenging situations.

In conclusion, by adopting a frugal lifestyle and practicing thriftiness, you can embark on a journey to grow your wealth over time. As you make conscious decisions about your spending, set financial goals, take advantage of compounding interest, and build an emergency fund, you pave the way for a brighter financial future and improved long-term financial health.

Ways Frugal Living Can Improve Your Overall Well-being

Enhance Your Overall Well-being through Frugality

Living a frugal lifestyle offers various advantages that can significantly improve your overall well-being. By adopting thrifty habits, you can experience a multitude of benefits that go beyond just financial aspects. Frugal living encompasses making conscious choices to maximize your resources, reduce waste, and prioritize what truly matters, ultimately leading to a more fulfilling and balanced life.

Attain Peace of Mind and Reduced Stress

Frugal living can provide you with peace of mind and alleviate stress. By managing your finances wisely, you can avoid debt and financial burdens that can cause anxiety and sleepless nights. Making thoughtful decisions about your spending habits cultivates a sense of control and reduces the pressure to keep up with societal expectations, leading to increased contentment and tranquility in your daily life.

Foster Creativity and Resourcefulness

Embracing frugality encourages resourcefulness and creativity in all aspects of life. When you practice being thrifty, you are forced to think outside the box and find innovative solutions to everyday challenges. This mindset allows you to tap into your creativity and find new ways to repurpose items, reduce waste, and save money. By nurturing this resourceful spirit, you can not only live more sustainably but also discover new passions and interests along the way.

Strengthen Relationships and Community Connections

Frugal living can enhance your relationships and foster deeper connections within your community. Choosing frugality often means prioritizing experiences and quality time with loved ones over material possessions. By engaging in activities that do not require significant financial investment, such as picnics in the park or potluck dinners with friends, you can strengthen bonds and create lasting memories. Additionally, frugal living often involves sharing resources and participating in local initiatives, leading to a sense of community and belonging.

Promote Self-Discipline and Personal Growth

Adopting a frugal lifestyle requires self-discipline and self-awareness, which can lead to personal growth and development. By consciously monitoring your spending habits and distinguishing between wants and needs, you can better align your actions with your values and long-term goals. This practice instills a sense of self-control and empowers you to make deliberate choices that promote financial stability and personal well-being.

In conclusion, living frugally offers more than just financial advantages. It can significantly improve your overall well-being, bringing peace of mind, nurturing creativity, strengthening relationships, and promoting personal growth. By embracing frugality, you can achieve a more fulfilling and balanced life, focusing on what truly matters and finding contentment in simplicity.

Reduced Financial Stress

When adopting a frugal lifestyle, one can experience a notable reduction in financial stress. By embracing thrifty habits and making conscious choices regarding consumption, individuals can alleviate the burden of financial strain and enjoy a more peaceful and secure life.

Living frugally allows individuals to prioritize their financial well-being, focusing on saving money, minimizing unnecessary expenditures, and reducing debt. This newfound financial discipline leads to a sense of control over one’s financial situation and a decreased level of anxiety and worry about money-related issues.

Moreover, frugal living encourages individuals to develop a mindful and intentional relationship with money. By being mindful of their spending habits and evaluating purchases based on their true value and necessity, individuals can avoid impulsive and unnecessary expenses. This practice fosters a sense of empowerment and self-sufficiency, as individuals become more aware of their financial choices and their ability to manage their finances responsibly.

In addition to financial benefits, living frugally can also contribute to a healthier and more balanced lifestyle. By focusing on simplicity and prioritizing experiences and relationships over material possessions, individuals can reduce the pressure to keep up with the consumerist culture. This shift in mindset allows for a greater sense of contentment and fulfillment, reducing the desire for excessive spending and the associated stress it may bring.

In conclusion, embracing frugal living can lead to reduced financial stress by promoting mindful spending, empowering individuals to make responsible financial decisions, and fostering a sense of contentment. By prioritizing financial well-being and making conscious choices, individuals can truly improve their overall quality of life and achieve a greater sense of financial security and peace of mind.

Eliminate the constant worry about money

In today’s fast-paced world, many individuals find themselves constantly plagued by the nagging concern of financial instability. The never-ending cycle of bills, debt, and expenses often leads to an overwhelming sense of anxiety and stress. However, by embracing the principles of frugal living, individuals can liberate themselves from this perpetual worry about money.

One of the key advantages of adopting a frugal lifestyle is the ability to break free from the chains of financial burden. When one learns to prioritize needs over wants and make conscious decisions about spending, the constant anxiety about money dissipates. By living within their means and practicing mindful budgeting, individuals can enjoy a sense of control and stability over their finances, ultimately transforming their lives.

- Frugal living empowers individuals to create a safety net for unexpected expenses, thereby reducing the anxiety associated with financial emergencies.

- Embracing frugality allows individuals to save for future goals and aspirations, alleviating the constant worry about how to achieve them.

- By practicing frugal living, individuals gain a sense of financial independence and freedom, enabling them to pursue their passions and dreams without the burden of monetary stress.

- Frugal living encourages individuals to be resourceful and creative in finding cost-effective alternatives, fostering a sense of empowerment and resilience.

- By adopting a frugal mindset, individuals learn to appreciate the value of experiences and relationships over material possessions, leading to a greater sense of fulfillment and contentment.

In conclusion, frugal living offers an escape from the perpetual worry about money that often plagues individuals. By adopting a mindful approach to spending, focusing on needs rather than wants, and prioritizing financial stability, individuals can free themselves from the constant stress and anxiety associated with financial insecurity. Embracing the frugal lifestyle provides a pathway to a healthier and more secure financial future.

Questions and answers

What is frugal living?

Frugal living refers to a lifestyle where individuals consciously make choices to save money and live within their means. It involves cutting back on unnecessary expenses and finding ways to save money in different aspects of life.

How can frugal living benefit my financial health?

Frugal living can significantly improve your financial health by helping you save money, reduce debt, and build savings. By making conscious choices to cut back on expenses, you can have more money to allocate towards important financial goals, such as paying off debts or investing for the future.

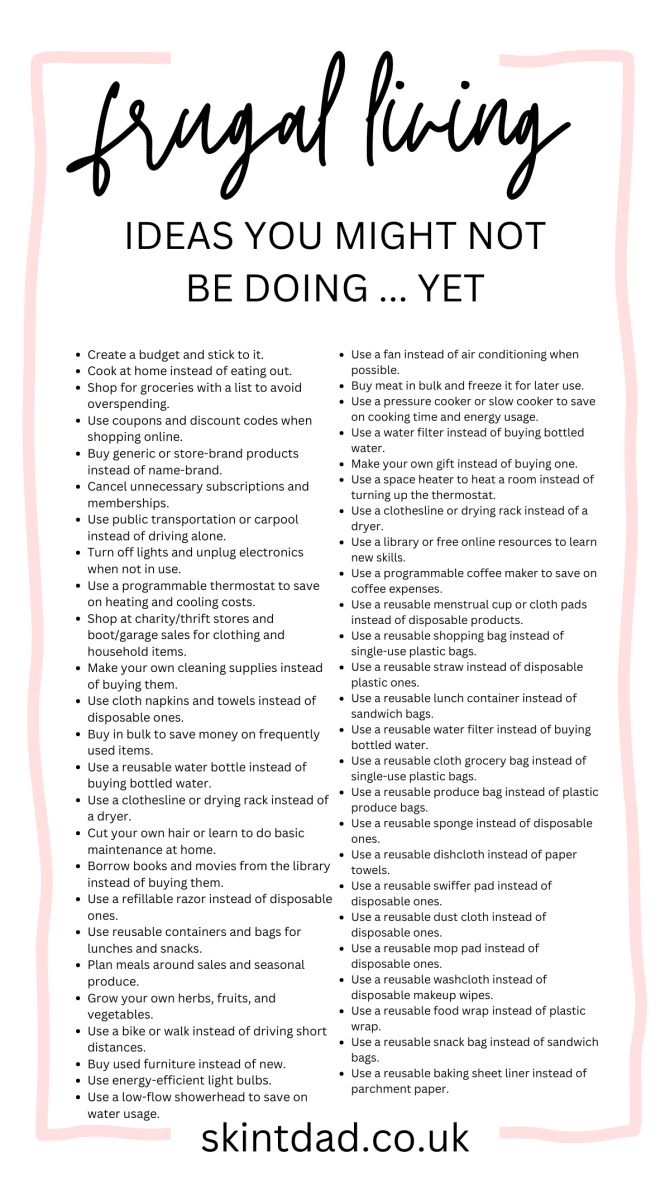

What are some practical ways to practice frugal living?

There are various ways to practice frugal living. Some practical tips include creating a budget and sticking to it, avoiding impulse purchases, seeking out discounts and deals, using coupons, buying items in bulk, reducing energy consumption, cooking meals at home instead of eating out, and finding free or low-cost entertainment options.

Are there any other benefits of frugal living besides financial health?

Yes, besides improving financial health, frugal living can also bring about benefits such as reduced stress and increased contentment. By learning to live with less and finding fulfillment in experiences rather than material possessions, individuals often report feeling happier and more satisfied with their lives.

Is frugal living suitable for everyone?

Frugal living can be suitable for anyone who wants to improve their financial health and make conscious choices to save money. However, it is important to strike a balance and not sacrifice essential needs and quality of life. It is crucial to assess individual circumstances and prioritize financial goals before fully embracing frugal living.

What exactly is frugal living?

Frugal living refers to a lifestyle that focuses on careful and intentional spending, avoiding unnecessary expenses, and making the most of resources. It involves practicing mindful money management and being thrifty.

How can frugal living improve my financial health?

Frugal living can greatly improve your financial health by helping you save money, reduce debt, and develop good financial habits. By being thrifty, you can avoid unnecessary expenses, increase your savings, and have more control over your finances.

What are some practical benefits of adopting a frugal lifestyle?

By embracing frugal living, you can experience several practical benefits such as being able to pay off debts faster, having the freedom to pursue your passions or hobbies without financial stress, and enjoying a sense of security from having savings for emergencies.

Can anyone start living frugally, or is it only for people with low income?

Frugal living is suitable for everyone, regardless of income level. It is not solely about cutting expenses but also about making wise financial decisions and prioritizing what truly matters to you. Regardless of your income, adopting a frugal lifestyle can significantly improve your financial situation.

Are there any downsides to frugal living?

While frugal living can have numerous financial benefits, it may require making certain sacrifices and adjusting one’s lifestyle. It might involve giving up some luxuries or temporarily reducing spending on certain areas. However, the long-term benefits usually outweigh any initial challenges.