Are you tired of living paycheck to paycheck? Do you constantly find yourself worrying about your financial future? It’s time to put an end to the stress and take control of your money. With the right budget planner template, you can effectively manage your finances and achieve your financial goals.

Money management doesn’t have to be complicated or overwhelming. By utilizing a budget planner template, you can simplify the process and gain a clear understanding of your income and expenses. This powerful tool allows you to track your spending, identify areas where you can cut back, and save money.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreBut a budget planner is not just about tracking your expenses – it’s also about setting financial goals and working towards them. Whether you want to save for a dream vacation, pay off debt, or build an emergency fund, a budget planner template can help you stay on track and achieve your aspirations.

Don’t let your financial goals remain dreams. Take charge of your money today and start working towards a secure and prosperous future. Download our budget planner template and take the first step towards achieving financial freedom.

- Plan Your Finances with Budget Planner Template: Take Control of Your Money

- Get Started on Pursuing Your Financial Objectives

- Create a Comprehensive Budget Plan

- Identify Your Income and Expenses

- Set Realistic Saving and Spending Goals

- Track Your Monthly Budget

- Monitor Your Income and Expenses Regularly

- Allocate Funds for Essential and Non-Essential Categories

- Utilize Budget Planner Template for Effective Money Management

- Download and Customize a Budget Planner Template

- Manage Your Budget with Ease

- Boost Your Financial Management with the Right Tools

- Questions and answers

Plan Your Finances with Budget Planner Template: Take Control of Your Money

Manage your financial situation effectively by making use of a comprehensive budget planner template. This powerful tool will assist you in organizing and tracking your expenses, income, and savings, allowing you to take charge of your money and achieve your desired financial outcomes.

Take the reins of your financial future by creating a solid plan with the help of a budget planner template. This user-friendly resource enables you to monitor your expenditures, identify areas where you may be overspending, and make necessary adjustments to ensure a healthy financial balance.

With the aid of a budget planner template, you can gain a clear understanding of your financial situation and develop practical strategies to manage your money more efficiently. This resource empowers you to prioritize your spending and savings goals, making it easier to achieve financial stability.

Utilizing a budget planner template allows you to analyze your income, expenses, and savings in a holistic manner. By identifying patterns and trends in your financial habits, you can make informed decisions and take control of your money like never before.

Maximize your financial potential by utilizing a budget planner template that suits your specific needs. Whether you are aiming to save for a big purchase, pay off debt, or build an emergency fund, this tool will provide you with the structure and guidance required to effectively navigate your financial journey.

Don’t leave your financial success to chance. Implement a budget planner template today and take charge of your money. By organizing, prioritizing, and tracking your expenses, income, and savings, you can confidently work towards achieving your financial aspirations.

Get Started on Pursuing Your Financial Objectives

Embarking on the journey to fulfill your financial aspirations is an essential step towards realizing your dreams of financial stability and success. By taking control of your financial situation and setting clear objectives, you can proactively work towards securing a prosperous future.

Start by establishing a well-defined roadmap that outlines your desired financial outcomes. This roadmap will serve as a guide throughout your journey, helping you stay on track and make informed decisions along the way. Whether it’s paying off debt, saving for a down payment on a house, or building an emergency fund, each goal requires careful planning and dedication.

One effective approach to achieving your financial goals is by creating a detailed budget. A budget acts as a blueprint for managing your income and expenses, allowing you to track your spending habits and identify areas where you can make adjustments to maximize savings. Through careful budgeting, you can allocate funds towards your priorities, ensuring that your financial objectives take precedence.

Additionally, it’s crucial to regularly evaluate your progress towards achieving your financial goals. This involves monitoring your budget, reviewing your savings and investment accounts, and making adjustments as necessary. By staying attentive and adaptable, you can overcome obstacles and maintain steady progress towards realizing your financial aspirations.

Remember, pursuing your financial goals requires discipline, commitment, and a willingness to make necessary sacrifices. It may involve cutting back on certain expenses or finding creative ways to increase your income. Nonetheless, the rewards of financial security and peace of mind are well worth the effort.

So, get started on your journey to financial success today. By setting clear objectives, creating a realistic budget, and regularly evaluating your progress, you can take control of your finances and pave the way for a brighter future.

Create a Comprehensive Budget Plan

Develop a thorough and all-encompassing strategy for managing your finances by creating a comprehensive budget plan. This essential tool will empower you to effectively allocate your income and expenses, ensuring that you are making informed financial decisions and maximizing your savings.

Establish Clear Financial Objectives: Start by setting clear and achievable financial objectives. Whether it’s saving for a down payment on a house, paying off debt, or funding your dream vacation, clarify your goals to provide a focus for your budget plan.

Analyze Your Income and Expenses: Carefully examine your income sources and identify all your expenses, including both regular fixed expenses and variable expenses. Categorize your spending to gain a clear understanding of where your money is going and identify areas where you can potentially cut back.

Create Realistic Budget Categories: Create budget categories that align with your spending habits and goals. Include essential categories such as housing, transportation, utilities, groceries, and debt repayment. Additionally, consider discretionary categories for entertainment, travel, and personal indulgences.

Set Realistic Spending Limits: Determine realistic spending limits for each budget category based on your income and financial goals. Be mindful of not exceeding these limits and adjust your spending habits accordingly to stay on track.

Track Your Income and Expenses: Regularly track your income and expenses to ensure that you are sticking to your budget plan. Employ financial management tools or utilize spreadsheet templates to record and analyze your financial transactions.

Review and Adjust Regularly: Continuously review your budget plan and make adjustments as needed. Life circumstances and financial priorities may change over time, so remain flexible and update your plan to reflect these changes.

Monitor Your Progress: Keep a close eye on your progress towards your financial goals. Celebrate milestones and stay motivated by seeing how your budget plan is helping you make steady progress towards achieving your objectives.

By creating a comprehensive budget plan, you will take control of your finances and pave the way towards financial stability and success.

Identify Your Income and Expenses

In order to effectively manage your finances and work towards achieving your financial goals, it is important to first identify your sources of income and your expenses. By understanding where your money comes from and where it goes, you can make more informed decisions and take control of your financial situation.

Start by creating a detailed list of all your sources of income. This can include your salary or wages from your job, any freelance or side income, rental income, or income from investments. Take into account both your regular income and any irregular or one-time payments that you may receive.

Next, make a comprehensive list of all your expenses. This should include all your regular monthly bills such as rent or mortgage payments, utilities, transportation costs, groceries, and any loan repayments or credit card bills. Don’t forget to also include less frequent expenses such as annual insurance premiums or quarterly tax payments.

To ensure that you don’t miss any expenses, consider reviewing your bank statements and credit card statements from the past few months. This can help jog your memory and remind you of any recurring or discretionary expenses that you may have overlooked.

Once you have identified all your income and expenses, it can be helpful to categorize them. This will allow you to better understand where your money is going and identify areas where you may be able to cut back or make adjustments. You can categorize your expenses into broad categories such as housing, transportation, food, entertainment, and savings.

By taking the time to identify your income and expenses, you will have a clearer picture of your financial situation and be better equipped to create a budget and work towards achieving your financial goals.

Set Realistic Saving and Spending Goals

Creating realistic saving and spending goals is an essential part of effective money management. By setting clear objectives for both saving and spending, you can develop a practical and achievable plan to improve your overall financial situation.

When it comes to saving, it’s important to determine how much money you want to set aside and why. Whether you’re saving for a specific purpose, such as a down payment on a house or a dream vacation, or simply building an emergency fund, having a clear goal in mind will help you stay motivated and focused.

Consider your current financial situation and identify a realistic amount to save each month. Remember, it’s crucial to set a savings target that won’t strain your budget too much, as it’s important to maintain a balance between saving for the future and meeting your immediate financial needs.

On the other hand, when setting spending goals, it’s essential to prioritize your expenses based on your personal values and priorities. Take some time to assess your spending habits and identify areas where you can cut back or make more conscious decisions. This could include reducing unnecessary expenses, comparing prices before making a purchase, or even finding ways to save on everyday necessities.

By creating a budget and tracking your expenses, you’ll be able to allocate your resources more efficiently and have a better understanding of where your money is going. This will enable you to make informed decisions about your spending and ensure that your financial goals remain attainable.

- Set a specific saving target

- Identify a realistic amount to save each month

- Prioritize your expenses based on personal values and priorities

- Assess spending habits and make conscious decisions

- Create a budget and track expenses

By setting realistic saving and spending goals, you’ll be able to take control of your financial future and make significant progress towards achieving your desired financial stability. Remember, small steps taken consistently can lead to great financial success in the long run.

Track Your Monthly Budget

Ensure financial stability and monitor your income and expenses with a comprehensive monthly budget tracker. By consistently tracking your budget, you can gain insight into your spending habits and make more informed decisions regarding your financial well-being.

Developing a monthly budget tracking system allows you to keep a close eye on your inflows and outflows of money. By documenting all sources of income and categorizing your expenses, you can identify areas where you may be overspending or where savings opportunities exist.

Using a budget tracker, you can analyze your spending patterns over time and make adjustments as necessary. This tool provides a clear overview of your financial health and enables you to set realistic goals, whether it’s saving for a vacation, paying off debts, or investing in your future.

The process of tracking your monthly budget also helps you identify potential areas for improvement in your expenses. It allows you to determine if certain expenses are essential or if they can be reduced or eliminated altogether.

With a monthly budget tracker, you can easily keep track of bills and due dates, ensuring that you stay on top of your financial obligations. By establishing a routine and consistently monitoring your budget, you can take control of your finances and work towards achieving your financial aspirations.

Monitor Your Income and Expenses Regularly

Keeping track of your financial transactions is essential for effective money management. By regularly monitoring your income and expenses, you can gain a better understanding of your financial situation, identify areas where you can make improvements, and stay on track towards reaching your financial goals.

By regularly monitoring your income, you can ensure that you are receiving the expected amount of money from various sources such as your job, investments, or any other income streams you may have. This allows you to assess the stability of your income and make any necessary adjustments accordingly. Identifying changes in your income can help you plan for any fluctuations in cash flow and make informed decisions about your spending.

Tracking your expenses is equally important as it helps you understand how your money is being spent. By categorizing your expenses into different categories such as housing, transportation, groceries, and entertainment, you can gain clarity on where your money is going. This allows you to identify areas of overspending or find opportunities to cut back and save money.

Monitoring your income and expenses regularly using a budget planner template can provide you with a visual representation of your financial activities. This can help you spot any patterns or trends in your spending habits and make more informed decisions about your financial goals. It also enables you to set realistic budgets for each category and allocate your income accordingly.

| Benefits of Monitoring Your Income and Expenses |

|---|

| • Greater control over your financial situation |

| • Improved decision-making regarding your spending and saving |

| • The ability to adjust your financial plans as needed |

| • Enhanced awareness of your financial habits and patterns |

| • Increased motivation to achieve your financial goals |

In conclusion, monitoring your income and expenses regularly is a crucial aspect of effective money management. By keeping track of your financial transactions and using a budget planner template, you can gain greater control over your finances, make informed decisions, and ultimately achieve your financial goals.

Allocate Funds for Essential and Non-Essential Categories

When it comes to managing your finances effectively, one of the key steps is to allocate funds appropriately for both essential and non-essential categories. By categorizing your expenses and income, you can gain a better understanding of where your money is going and make informed decisions about how to allocate it.

Essential categories include those expenses that are necessary for daily living, such as housing, transportation, utilities, and groceries. These are the costs that you cannot easily eliminate or reduce without impacting your basic needs. Allocating a portion of your budget to these essential categories ensures that you have the necessary funds to cover these expenses.

On the other hand, non-essential categories comprise expenses that are not necessary for survival but contribute to your overall quality of life. These may include dining out, entertainment, vacations, and luxury items. By setting aside some funds for non-essential categories, you can enjoy the finer things in life without jeopardizing your financial stability.

Creating a budget planner template can help you allocate funds for both essential and non-essential categories effectively. Start by listing out all your expenses and income sources and categorize them accordingly. This will give you a clear picture of how much money you are allocating to each category and allow you to make adjustments if needed. It’s important to find a balance between meeting your basic needs and allowing yourself some flexibility to enjoy the things you love.

- Divide your expenses into essential and non-essential categories

- Allocate a percentage or fixed amount of your budget to each category

- Regularly review and adjust your allocations based on your financial goals and priorities

- Consider automating your savings and essential expenses payments to ensure they are prioritized

- Set realistic expectations and be mindful of your spending habits

By consciously allocating funds for essential and non-essential categories, you can achieve a better balance between managing your financial responsibilities and enjoying the things that bring you joy. Remember, financial management is an ongoing process, so regularly revisiting and adjusting your budget planner template will help you stay on track and achieve your financial goals.

Utilize Budget Planner Template for Effective Money Management

Enhance your financial planning and optimize your monetary control by taking advantage of a budget planner template. This invaluable tool provides a framework for organizing your income and expenses, allowing you to strategize and monitor your financial activities efficiently and effectively.

By leveraging a budget planner template, you can achieve a heightened level of financial organization and stability. This powerful resource assists you in mapping out your financial objectives and guides you in making informed decisions about how to allocate your funds wisely.

The budget planner template serves as the cornerstone of effective money management, empowering you to assess your financial situation, control your spending, and allocate resources towards your priorities. It helps you identify areas where you can save money and make adjustments to optimize your financial well-being.

With the aid of a budget planner template, you can stay proactive in achieving your financial aspirations. By tracking your income and expenses, you gain clarity on your financial standing and can identify potential areas for improvement. This knowledge equips you with the necessary tools to make informed financial choices and steer your financial future towards success.

Make the most of your financial resources by utilizing a budget planner template. Reap the benefits of meticulous money management, financial organization, and strategic planning. Start today and pave the way to financial stability and growth.

Download and Customize a Budget Planner Template

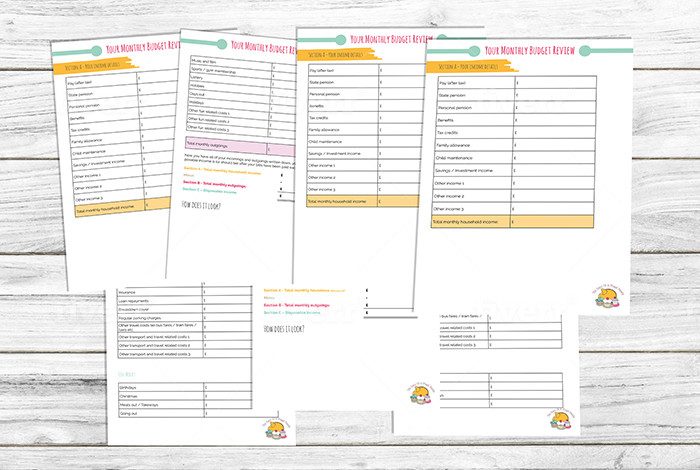

Streamline your financial planning process and take control of your finances with a downloadable and customizable budget planner template. This tool will assist you in managing your income, expenses, and savings effectively, helping you stay on track towards your financial objectives.

By downloading a budget planner template, you gain access to a pre-designed framework that simplifies the budgeting process. You can customize the template according to your unique financial situation and preferences. Tailoring the template to fit your needs allows you to prioritize specific categories, set realistic goals, and track your progress over time.

- Simplify financial tracking: With a budget planner template, you can streamline the process of tracking your income and expenses. By categorizing transactions and regularly updating the template, you can easily analyze your spending patterns and identify areas where adjustments can be made.

- Set achievable financial goals: Personal finance is all about setting achievable goals. By utilizing a budget planner template, you can define your short-term and long-term financial objectives. Whether it’s saving for a vacation, paying off debt, or building an emergency fund, the template will help you break down your goals into manageable steps and track your progress along the way.

- Visualize your financial progress: Monitoring your financial progress is crucial for staying motivated and committed to your goals. A budget planner template allows you to visualize your income, expenses, and savings through charts, graphs, or tables. By seeing your progress visually, you can celebrate small victories and stay focused on your long-term financial success.

- Maximize savings and reduce debt: By using a budget planner template, you can identify areas where you can cut back on unnecessary expenses and allocate additional funds towards savings or debt repayment. The template helps you prioritize your spending and make informed decisions, ultimately boosting your savings and reducing your debt burden.

- Adjust and adapt as needed: Financial situations can change, and it’s important to have a flexible budgeting tool. With a customizable budget planner template, you can easily adapt to any changes in income, expenses, or financial goals. Whether it’s a pay raise, a new expense, or a different savings target, the template can be adjusted to reflect your current financial reality.

In conclusion, take advantage of a downloadable and customizable budget planner template to simplify your financial planning process, track your progress towards your financial goals, and enhance your money management skills. This tool will empower you to make informed financial decisions and achieve financial success in the long run.

Manage Your Budget with Ease

In this section, we will explore how you can effortlessly handle your personal finances and keep your budget under control. By implementing effective strategies and utilizing useful tools, you can establish a solid foundation for financial stability and achieve your desired monetary outcomes.

Enhance your financial management skills by employing a systematic approach to budget planning. By organizing your income and expenses, you can gain a clear understanding of your financial situation and make informed decisions to optimize your spending and savings. This proactive approach will allow you to allocate your resources efficiently and work towards accomplishing your financial objectives.

Take advantage of various budgeting techniques to effectively manage your money. One such technique is the envelope system, which involves allocating cash for different spending categories and keeping them in separate envelopes. This tangible method helps you visually see how much money you have left for each category, promoting mindful spending and preventing overspending. Another technique is the zero-based budgeting method, which ensures that every dollar is assigned a specific purpose, leaving no room for unnecessary expenses.

Utilize digital budgeting tools and apps to simplify the process of managing your budget. These tools provide a convenient way to track your income and expenses, set financial goals, and monitor your progress. Whether it’s a user-friendly budgeting app or a comprehensive online platform, these resources offer features like automatic transaction categorization, bill reminders, and financial insights to assist you in making informed financial decisions.

In addition to implementing effective budgeting strategies and utilizing helpful tools, it’s crucial to establish good financial habits. This includes regularly reviewing your budget, tracking your spending, and adjusting your allocations as necessary. By staying proactive and consistently monitoring your financial situation, you can adapt to any changes in your income or expenses and maintain a strong financial position.

By managing your budget with ease, you will gain control over your finances and work towards achieving your desired financial outcomes. With diligent planning, effective strategies, and the right tools at your disposal, you can confidently navigate the world of personal finance and secure a brighter and more stable financial future.

Boost Your Financial Management with the Right Tools

Improving your financial management skills is crucial for achieving success in managing your money. To effectively enhance your financial management abilities, it is essential to utilize the appropriate tools and resources. By utilizing the right tools, you can streamline your financial processes, track your expenses, and make informed decisions about your money.

One of the key tools that can significantly boost your financial management is a budget planner. With a budget planner, you can create a comprehensive plan for allocating your income, tracking your expenses, and ensuring that you stay within your financial limits. By using a budget planner, you can gain a better understanding of your spending habits, identify areas where you can cut costs, and set realistic financial goals.

Another valuable tool for enhancing your financial management is financial software or apps. These tools enable you to track your income and expenses, categorize your transactions, and generate detailed reports on your financial activities. By having a clear overview of your financial situation, you can identify areas for improvement, make informed decisions regarding investments or savings, and monitor your progress towards achieving your financial goals.

In addition to budget planners and financial software, another useful tool for improving your financial management is education and knowledge. By investing time in learning about personal finance, understanding different financial concepts, and staying up-to-date with financial trends, you can enhance your financial management skills and make more knowledgeable decisions about your money. There are various online resources, books, and courses available that can provide you with the necessary knowledge to boost your financial management abilities.

By utilizing the right tools and resources, you can take control of your financial situation, achieve financial stability, and make progress towards your long-term financial goals. Whether it is a budget planner, financial software, or educational resources, these tools can provide you with the guidance and support needed to make informed decisions and manage your money effectively. Start incorporating these tools into your financial management strategy and experience the positive impact they can have on your financial well-being.

Questions and answers

How can a budget planner template help me achieve my financial goals?

A budget planner template can help you achieve your financial goals by giving you a clear overview of your income and expenses. It allows you to track your spending, identify areas where you can save money, and set realistic saving targets. By using a budget planner template consistently, you can stay on top of your finances and make informed decisions to reach your financial goals.

Where can I find a budget planner template?

There are many resources available where you can find a budget planner template. You can search online for free budget planner templates that can be downloaded and printed. Alternatively, you can use budgeting apps or software that provide pre-designed budget templates. It’s important to choose a template that suits your needs and preferences.

What are the key features to look for in a budget planner template?

When looking for a budget planner template, there are a few key features to consider. Firstly, it should have sections to track your income and expenses, allowing you to calculate your monthly savings. Secondly, it should provide categories to organize your expenses, such as housing, transportation, and groceries. Additionally, it should have space to set financial goals and track your progress towards them. Finally, it should be easy to use and understand.

How often should I update my budget planner template?

It is recommended to update your budget planner template regularly, at least once a month. This allows you to review your spending habits and make adjustments if needed. It’s also important to update your budget whenever there are significant changes in your income or expenses, such as a raise, a new job, or an increase in rent. By keeping your budget planner template up to date, you can ensure that it remains an effective tool for managing your finances.

How can a budget planner template help me achieve my financial goals?

A budget planner template can help you achieve your financial goals by providing a structured plan for managing your money. It allows you to track your income, expenses, and savings in an organized manner, helping you to stay on top of your financial situation and make informed decisions. By having a clear overview of your financial picture, you can identify areas where you can cut back on spending, increase savings, and ultimately reach your financial goals.

What are the benefits of using a budget planner template?

Using a budget planner template offers several benefits. Firstly, it helps you gain a better understanding of your financial situation by tracking your income and expenses in one place. Secondly, it allows you to set specific financial goals and allocate funds accordingly. Thirdly, it helps you identify unnecessary expenses and make adjustments to save more money. Lastly, it provides a visual representation of your progress, which can serve as a motivator to stick to your budget and achieve your financial goals.

Are budget planner templates easy to use?

Yes, budget planner templates are designed to be user-friendly and easy to use. They typically come with pre-defined categories for income and expenses, making it easier to input your financial data. Additionally, many templates provide built-in formulas and calculations, saving you time and effort in manually calculating your budget. Even if you are not familiar with spreadsheet software, most budget planner templates come with instructions or video tutorials to guide you through the process.

Can a budget planner template help me save money?

Absolutely! A budget planner template can be a powerful tool for saving money. By tracking your expenses and income, you can identify areas where you can cut back and allocate more funds towards savings. The template allows you to set savings goals and monitor your progress, providing a visual reminder of your savings targets. Additionally, by having a budget in place, you can make more conscious spending decisions, reducing impulsive purchases and increasing your savings over time.

Is it necessary to use a budget planner template if I already have a budget?

While it is not necessary to use a budget planner template if you already have a budget, it can greatly simplify and improve your money management process. Budget planner templates provide a structured framework for organizing your finances, making it easier to track and analyze your income and expenses. It allows you to visualize your financial goals and progress, providing motivation and accountability. If you find yourself struggling to maintain your current budget or want to optimize your money management, using a budget planner template can be a beneficial addition to your financial toolkit.