Unlocking the secrets to financial stability and long-term success begins with one crucial skill: creating a comprehensive financial plan and diligently adhering to it. Whether you desire to build a strong foundation for your future, eliminate debt, or achieve a specific financial goal, budgeting and maintaining fiscal discipline are the essential stepping stones towards attaining financial freedom.

Within the realm of personal finance, learning the art of astute money management is indeed an ongoing journey. Cultivating a solid budget entails far more than merely jotting down income and expenses; it entails embracing a mindset centered around responsible decision-making, prioritizing needs over wants, and discovering innovative ways to optimize available resources.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreEmbedded within the ethos of effective budgeting lies the power to seize control of your financial situation, fostering a sense of empowerment and reducing anxiety surrounding money matters. By crafting a comprehensive budget tailored to your unique circumstances, not only will you gain a deeper understanding of your financial position, but you will also harness the ability to navigate unforeseen circumstances and financial setbacks with resilience and confidence.

- Creating a Budget: The Key to Financial Stability

- Step 1: Assessing Your Current Financial Situation

- Calculate Your Income and Expenses

- Analyze Your Spending Habits

- Step 2: Setting Financial Goals

- Identify Short-term and Long-term Goals

- Quantify Your Goals

- Step 3: Creating a Realistic Budget

- Determine Fixed and Variable Expenses

- Allot Money for Savings and Emergency Fund

- Account for Debt Repayment

- Step 4: Tracking Your Expenses

- Establish a System for Recording Expenses

- Regularly Review and Adjust Your Budget

- Questions and answers

Creating a Budget: The Key to Financial Stability

Establishing a well-crafted financial plan is essential for achieving long-term stability and security in managing your money. By carefully managing your income and expenses, you can take control of your financial future and ensure a prosperous and stress-free life.

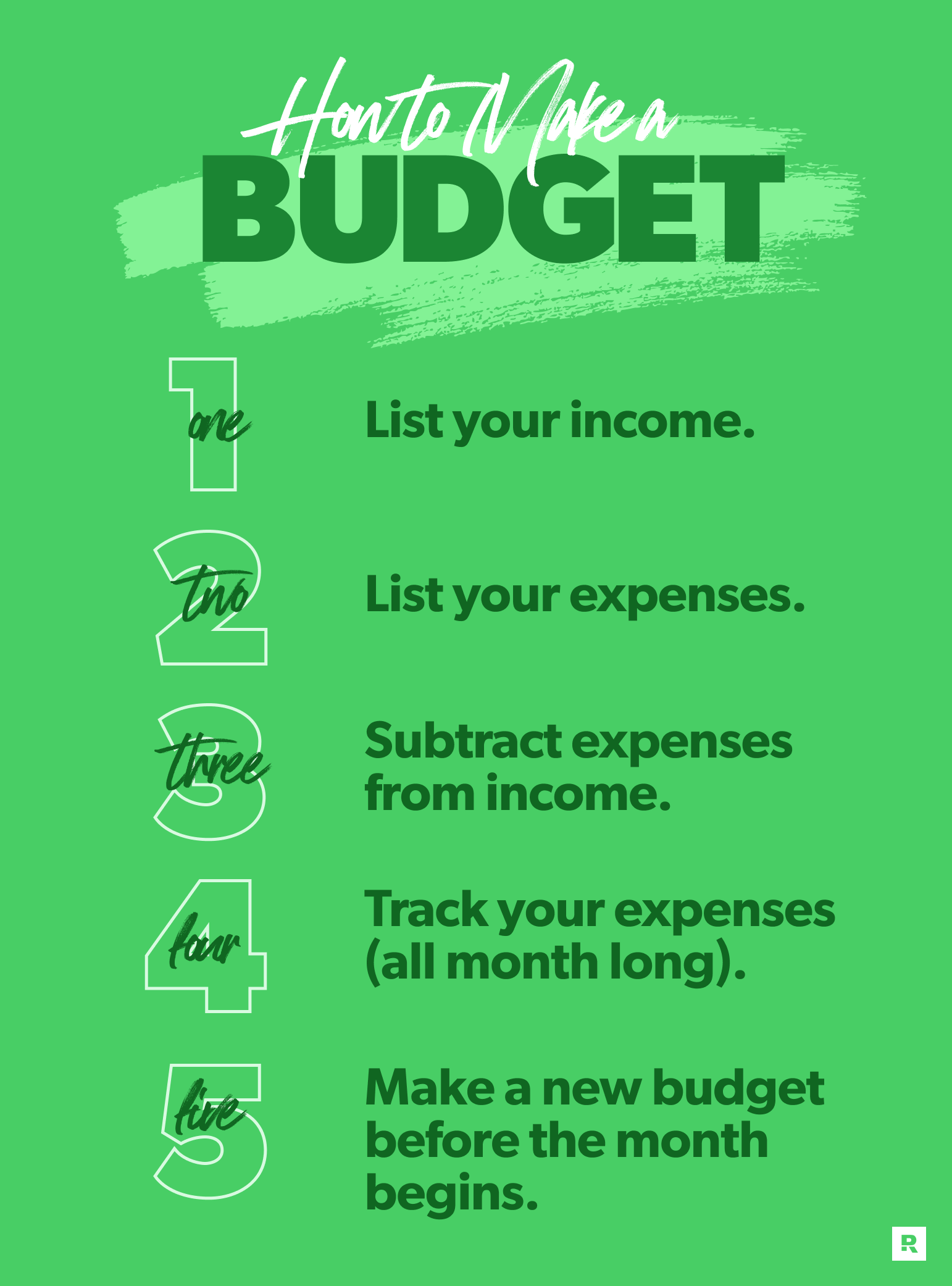

Building a budget is the fundamental step towards financial stability. It involves creating a detailed plan that outlines your income sources and sets limits on your expenses. With a thoughtfully constructed budget, you can allocate your funds wisely, prioritize your financial goals, and eliminate unnecessary spending.

Budgeting enables you to have a comprehensive understanding of your financial situation and empowers you to make informed decisions about your money. It allows you to track your income and expenses, ensuring that your spending aligns with your financial goals and helps you save for the future.

Moreover, budgeting provides a clear roadmap for managing debt and achieving long-term financial milestones. By identifying areas where you may be overspending or wasting money, you can make necessary adjustments and redirect those funds towards paying off debts or building an emergency savings fund.

Creating a budget also promotes discipline and self-control when it comes to managing your finances. It encourages you to make conscious spending choices and avoid impulse purchases, helping you develop healthier financial habits and reduce financial stress.

Ultimately, by actively maintaining and sticking to your budget, you gain a sense of financial freedom and security. You can build an emergency fund, save for important life events, invest for the future, and enjoy a worry-free financial journey.

In conclusion, developing and adhering to a budget is a crucial step towards achieving financial stability. It provides a clear picture of your income and expenses, allowing you to make informed decisions, eliminate debt, and build a solid financial foundation. By prioritizing your financial goals and practicing discipline, you can enjoy a financially stable and fulfilling life.

Step 1: Assessing Your Current Financial Situation

In the first step of our comprehensive guide on creating a budget and sticking to it, we will focus on evaluating your present monetary circumstances. Understanding your current financial situation is essential to establish a solid foundation for your budgeting journey.

This stage involves a thorough examination of your income, expenses, debts, and savings. By assessing these key components, you can gain a clear understanding of where you stand financially and identify areas that require attention. It’s crucial to accurately determine the state of your finances in order to make informed decisions when creating your budget.

| Income |

| Start by analyzing your sources of income. This includes your salary, freelance work, rental income, investments, or any other means of earning money. Calculate your total monthly income and document it. |

| Expenses |

| List down all your monthly expenses, including fixed bills such as rent/mortgage, utilities, insurance, and loan payments. Additionally, record variable expenses like groceries, transportation, entertainment, and miscellaneous costs. It’s important to be thorough and account for all your expenditures. |

| Debts |

| Assess your existing debts, such as credit card balances, loans, or any other outstanding obligations. Determine the outstanding amounts, interest rates, and minimum payment requirements for each debt. This information will help you in formulating debt management strategies as you proceed with your budgeting plan. |

| Savings |

| Evaluate your savings and investment accounts. Consider any emergency funds, retirement savings, or other long-term investments you may have. It’s vital to have a clear picture of your current savings as it will play a vital role in building financial stability and achieving your future goals. |

By thoroughly assessing your current financial situation in these four key areas, you will have a solid foundation to begin the budgeting process. This step will provide valuable insights into your income, expenses, debts, and savings, allowing you to make informed decisions when creating a budget that suits your financial goals and aspirations.

Calculate Your Income and Expenses

Understand your financial situation by determining your earnings and expenditures.

Begin by assessing your sources of income, including your salary, commissions, bonuses, and any other regular or occasional earnings. It is important to take into account both your primary source of income and any secondary or side incomes you may have.

Next, evaluate your monthly expenses. Consider fixed expenses such as rent or mortgage payments, utility bills, loan repayments, and insurance premiums. Additionally, take into account variable expenses like groceries, transportation costs, entertainment, and dining out. Be thorough in identifying all categories of expenses to ensure an accurate estimation.

Once you have a comprehensive list of your income and expenses, categorize and prioritize them. Differentiate between essential expenses, such as housing and utilities, and discretionary expenses, like entertainment and recreation. This will help you determine areas where you can potentially cut back or make adjustments in your spending habits.

It is essential to track your income and expenses consistently. Use a notebook, spreadsheet, or budgeting app to record your financial activities and ensure you have an accurate representation of your earnings and expenditures. Regularly review your records to identify patterns, trends, and areas for improvement.

By thoroughly calculating your income and expenses, you will gain a clear understanding of your financial situation. This knowledge will serve as a foundation for creating a realistic and effective budget that will help you achieve your financial goals.

Analyze Your Spending Habits

Understanding and evaluating your spending patterns is essential for creating and maintaining a successful budget. By closely examining your habits and preferences when it comes to spending money, you can identify areas where you may be overspending or making unnecessary purchases.

One effective way to analyze your spending habits is to categorize your expenses into different groups, such as groceries, entertainment, transportation, and personal care. This will provide you with a clear overview of where your money is going and help you identify any areas where you can potentially cut back.

- Make a list of all your regular expenses and categorize them accordingly.

- Examine each category and ask yourself if there are any expenditures that can be reduced or eliminated.

- Look for patterns in your spending behavior. Are there certain times or situations that trigger impulsive purchases?

- Consider the necessity and value of each expense. Are you spending money on things that bring you genuine satisfaction and contribute to your overall well-being?

- Identify any recurring expenses that you may have forgotten about or that could be renegotiated, such as subscriptions or memberships.

Another helpful tool for analyzing your spending habits is tracking your expenses over a specific period of time. Keep a record of every purchase you make, no matter how small, and categorize them accordingly. This will allow you to see exactly where your money is going and make more informed decisions about your spending.

Remember, the goal of analyzing your spending habits is not to restrict yourself excessively, but rather to gain control over your finances and make intentional choices that align with your financial goals and priorities.

Step 2: Setting Financial Goals

Establishing clear financial objectives is an essential part of creating a successful budget and achieving financial stability. In this step, we will discuss the importance of setting financial goals and provide guidance on how to define them effectively.

Financial goals serve as the foundation for your budgeting process and help you prioritize your spending and saving decisions. They provide direction and motivation, guiding your financial decisions towards long-term success. By setting specific, attainable, and measurable goals, you can better track your progress and hold yourself accountable to stay on track.

| Benefits of Setting Financial Goals | |

|---|---|

| 1. Focus and Clarity | Setting financial goals helps you direct your attention towards what matters most and avoids aimless spending. |

| 2. Motivation | Having clear goals in mind can provide the motivation needed to stick to your budget and make necessary sacrifices. |

| 3. Progress Measurement | Well-defined financial goals allow you to track your progress and make adjustments as needed to reach your desired outcome. |

When setting financial goals, consider both short-term and long-term objectives. Short-term goals can include paying off debts, building an emergency fund, or saving for a vacation, while long-term goals may involve retirement planning, buying a home, or funding a child’s education.

Additionally, it is vital to ensure your financial goals are realistic and aligned with your income and resources. Setting overly ambitious goals may lead to frustration and discouragement if they are unattainable. Break down larger goals into smaller milestones that are achievable within specific timeframes.

Remember, setting financial goals is a personal process, and each individual or family’s goals will differ based on their circumstances and aspirations. Take the time to reflect on your values and priorities to determine what financial success means to you.

In the next step, we will delve into creating a comprehensive budget that aligns with your financial goals and helps you achieve them.

Identify Short-term and Long-term Goals

In this section, we will discuss the process of identifying your short-term and long-term goals as a crucial step in creating and sticking to a budget. It is important to have a clear understanding of what you want to achieve in the near future and in the long run, as this will help you make informed financial decisions.

Short-term goals are those that can be achieved within a relatively short period, typically within a year or less. These goals are often focused on immediate needs or desires, such as paying off a debt, saving for a vacation, or purchasing a new gadget. They can provide a sense of accomplishment and motivation as you work towards achieving them.

On the other hand, long-term goals are those that require longer planning and effort and usually span over several years or even decades. These goals are often aimed at major milestones or life events, such as buying a house, saving for retirement, or funding a child’s education. Long-term goals require consistent savings and investment strategies to ensure their achievement.

When identifying your goals, it is essential to make them specific, measurable, achievable, relevant, and time-bound (SMART). This means breaking down your goals into smaller, actionable steps, setting deadlines, and regularly tracking your progress. By doing so, you can stay focused and motivated on your financial journey.

Furthermore, it is important to prioritize your goals based on their urgency and importance. Consider the impact each goal will have on your overall financial well-being and make adjustments accordingly. For example, if you have high-interest debts, it may be wise to prioritize paying them off before focusing on other goals.

| Short-term Goals | Long-term Goals |

|---|---|

| Pay off a debt | Buy a house |

| Save for a vacation | Save for retirement |

| Purchase a new gadget | Fund a child’s education |

In conclusion, identifying your short-term and long-term goals is a crucial step in creating a budget that aligns with your financial aspirations. By breaking down goals into actionable steps and prioritizing them based on urgency and importance, you can make informed decisions and stay on track towards achieving your financial objectives.

Quantify Your Goals

Setting clear and measurable goals is key to successfully managing your finances and sticking to a budget. By quantifying your goals, you can ensure that they are specific, attainable, and relevant to your financial situation. In this section, we will explore the importance of defining your financial objectives and how to effectively quantify them.

Establishing concrete targets

When it comes to managing your money, vague aspirations like saving more or reducing debt are not enough. To make real progress, you need to establish clear and concrete targets that you can track and measure. For example, instead of simply aiming to save more, consider setting a specific goal of saving 20% of your monthly income. By quantifying your objective, you can track your progress and stay motivated along the way.

Setting realistic expectations

While it’s important to dream big, it’s equally vital to set realistic expectations for your financial goals. Assess your current financial situation and consider factors such as your income, expenses, and debt obligations. By ensuring that your goals are attainable, you increase the likelihood of staying committed to your budget and achieving financial success.

Aligning goals with priorities

Each individual has unique financial priorities, whether it’s paying off student loans, saving for a down payment on a house, or starting a business. By quantifying your goals and aligning them with your personal priorities, you can create a budget that reflects your values and ambitions. This will help you stay focused and motivated as you work towards achieving your financial objectives.

Tracking progress and making adjustments

Quantifying your goals allows you to easily track your progress and make necessary adjustments along the way. Regularly evaluating your financial situation and comparing it to your established targets will help you identify areas where you may need to cut back or areas where you can increase your savings. By staying accountable and adaptable, you can ensure that your budget remains effective and aligned with your evolving financial needs.

In conclusion, quantifying your goals is an essential step in creating a budget and sticking to it. By setting clear and measurable objectives, you can track your progress, align your goals with your priorities, and make necessary adjustments to achieve financial success.

Step 3: Creating a Realistic Budget

In this section, we will focus on the crucial task of developing a practical and attainable financial plan. By taking a thoughtful and strategic approach, you can create a budget that aligns with your financial goals while considering factors such as income, expenses, and savings.

To create a realistic budget, it is essential to assess your financial situation accurately. This involves carefully evaluating your sources of income, including wages, commissions, or any other sources of revenue. It is important to consider both fixed income sources and irregular or variable income streams.

Next, identify and categorize your expenses to have a clear understanding of where your money is going. This includes differentiating between essential expenses, such as rent or mortgage payments, utilities, groceries, and transportation costs, and discretionary expenses like entertainment, dining out, or shopping.

Once you have outlined your income and expenses, it’s time to set realistic financial goals. These goals should be specific, measurable, attainable, relevant, and time-bound (SMART goals). Whether you aim to pay off debt, build an emergency fund, or save for the future, having clear objectives will help guide you in creating a budget that aligns with your aspirations.

With your goals in mind, allocate your income towards your various expenses and savings efforts. It is crucial to prioritize your expenses based on their importance and your financial goals. This may involve making difficult decisions and potentially reducing spending in certain areas to ensure that you are directing your money towards what matters most.

Regularly reviewing and adjusting your budget is another critical aspect of creating a realistic financial plan. As circumstances change, such as an increase in income or unexpected expenses, you may need to modify your budget to reflect these changes. By regularly monitoring and adjusting your budget, you can ensure that it remains relevant and effective in helping you achieve your financial goals.

Remember, creating a realistic budget involves careful consideration of your financial situation, setting meaningful goals, prioritizing expenses, and regularly monitoring and adjusting your budget. By following these steps, you can develop a budget that empowers you to make informed financial decisions and ultimately achieve your desired financial outcomes.

Determine Fixed and Variable Expenses

In order to effectively manage your finances and create a successful budget, it is crucial to understand the distinction between fixed and variable expenses. These two categories play a vital role in determining how you allocate your income and track your spending habits.

Fixed expenses are the regular, predictable costs that you incur on a recurring basis. These expenses tend to stay consistent from month to month, making it easier to plan for and allocate a specific portion of your income towards them. Examples of fixed expenses may include rent or mortgage payments, car loan payments, insurance premiums, and subscription services.

Instead of fluctuating, fixed expenses typically remain steady and require careful budgeting to ensure that you meet these obligations each month.

Variable expenses, on the other hand, are costs that vary from month to month and tend to be more flexible in nature. These expenses are typically discretionary and can be adjusted based on your financial priorities and circumstances. Examples of variable expenses include groceries, entertainment, dining out, clothing purchases, and utility bills that may vary based on usage.

Unlike fixed expenses, variable expenses offer more flexibility in terms of spending and can be adjusted based on your income availability and financial goals.

By determining the difference between fixed and variable expenses, you can gain a better understanding of your spending patterns and make informed decisions when allocating your income. This knowledge will serve as the foundation for creating a comprehensive budget that allows you to prioritize your financial goals and ensure your expenses align with your income streams.

Allot Money for Savings and Emergency Fund

In order to ensure financial stability and preparedness for unexpected events, it is essential to designate a portion of your income for savings and the creation of an emergency fund.

Setting aside money for savings allows you to build a financial safety net and work towards achieving your long-term financial goals. Whether you are saving for a down payment on a house, retirement, or a dream vacation, consistently putting money aside is a crucial step towards securing your financial future.

Additionally, establishing an emergency fund is equally important. Life can throw unexpected hurdles our way, such as medical emergencies, job loss, or unforeseen repairs, and having a dedicated fund for these situations can provide a sense of security and peace of mind. It acts as a financial cushion, allowing you to navigate unforeseen circumstances without jeopardizing your financial stability.

When allocating money for savings and an emergency fund, it is recommended to prioritize these categories before considering discretionary expenses. By making saving a priority, you ensure that you are proactively working towards your financial well-being rather than simply spending whatever is left over after expenses.

Creating a budget that includes a specific percentage or fixed amount for savings and emergency funds allows you to automate this process. By directly allocating a portion of your income towards these categories, you remove the temptation to use that money for other purposes. This disciplined approach helps you stay on track and develop healthy financial habits.

- Determine a percentage or fixed amount to allocate for savings and emergency fund

- Automate the process of setting aside this designated amount

- Regularly review and reassess your savings and emergency fund goals

- Consider using separate accounts for each savings category to ensure clarity and organization

- Explore different savings options such as high-yield savings accounts or investment vehicles to maximize your funds’ growth potential

By allotting money for savings and an emergency fund, you take proactive steps towards financial security, enabling you to handle unexpected expenses and work towards your long-term financial goals.

Account for Debt Repayment

When establishing and maintaining a financial plan, it is crucial to consider the allocation of funds towards clearing outstanding debts. Successfully managing and prioritizing debt repayment can help alleviate the burden of financial obligations and promote healthier financial well-being.

One of the first steps in accounting for debt repayment is to assess your current debt situation. Compile a comprehensive list of all outstanding debts, including credit card balances, student loans, mortgages, or any other forms of borrowing. It is essential to accurately track the amount owed, interest rates, minimum payments, and repayment terms for each debt.

After identifying your debts, it is necessary to prioritize them based on their urgency and/or interest rates. Consider focusing on high-interest debts first, as they tend to accrue higher costs over time. It is crucial to allocate a portion of your budget towards paying off these debts systematically and consistently.

When allocating funds towards debt repayment, it is advisable to adhere to the snowball or avalanche method. The snowball method involves paying off the smallest debts first and progressively working towards larger debts, while the avalanche method prioritizes debts with the highest interest rates. Choose the method that aligns with your financial goals and motivations.

Additionally, it is important to create a realistic budget that includes a specific portion dedicated to debt repayment. This ensures that you consistently allocate funds towards reducing overall debt and prevents overspending in other areas. Regularly reviewing your budget and making necessary adjustments is key to staying on track with your debt repayment plan.

In some cases, seeking professional advice or assistance from a financial advisor can be beneficial. They can provide guidance on debt management strategies, negotiate with creditors, or explore consolidation and refinancing options. Remember that seeking help when needed is a sign of financial responsibility.

Finally, staying committed to your debt repayment plan requires discipline and perseverance. It may be challenging at times, but maintaining a positive mindset and a long-term perspective can help you overcome any obstacles along the way. Celebrate small victories and milestones to stay motivated on your journey towards financial freedom.

Step 4: Tracking Your Expenses

Once you have established your financial plan and set a budget, it is important to track your expenses to ensure that you are staying on track with your financial goals. Monitoring and keeping a record of your expenses allows you to have a clear understanding of where your money is going, giving you the ability to make informed decisions about your spending habits.

One effective way to track your expenses is to maintain a detailed record of all your purchases and expenses. This can be done by either using a dedicated budgeting app or by creating a simple spreadsheet. By categorizing your expenses into different categories such as groceries, transportation, utilities, and entertainment, you can easily identify areas where you may be overspending and make adjustments accordingly.

Additionally, it is important to regularly review and analyze your spending patterns. This can help you identify any unnecessary expenses or areas where you can cut back. By examining your spending habits, you can make proactive decisions and find ways to prioritize your financial goals.

Setting spending limits can also be an effective strategy for tracking your expenses. By allocating a specific budget for different categories, you can monitor your spending more closely and avoid overspending. This can be done by setting monthly or weekly spending limits for each category and regularly comparing your actual expenses to your budgeted amounts.

Lastly, tracking your expenses also requires discipline and consistency. Make it a habit to record every expense, no matter how small. This will give you a comprehensive overview of your spending habits and allow you to make necessary adjustments as needed. Remember, tracking your expenses is an essential step towards achieving your financial goals and maintaining a healthy financial lifestyle.

Establish a System for Recording Expenses

Creating a comprehensive budget is only the first step towards financial stability and responsible money management. In order to effectively stick to your budget, it is essential to establish a system for recording and tracking your expenses.

Developing a reliable system that accurately captures all your expenses allows you to have a clear understanding of where your money is going, which in turn enables you to make informed financial decisions and identify areas where you can potentially cut back or save.

One approach to tracking your expenses is to maintain a categorized list or spreadsheet. This can help you easily identify and classify your expenditures, making it easier to analyze your spending patterns. Categorizing expenses can typically include areas such as housing, transportation, groceries, entertainment, debt payments, and more. By labeling each expense accordingly, you can gain valuable insights into your spending habits.

In addition to categorizing your expenses, it is important to establish a regular schedule for recording them. Whether it’s daily, weekly, or monthly, setting aside dedicated time to document your expenses ensures that you don’t overlook or forget any transactions. Additionally, recording expenses in a timely manner helps maintain accuracy and prevents any discrepancies.

There are various tools and methods available that can assist you in recording your expenses. Some people prefer to use mobile apps or online platforms that provide features such as automatic expense tracking, receipt scanning, and expense categorization. Others may opt for more traditional methods, such as using a notebook or a dedicated spreadsheet application. The key is to find a system that works best for you, based on your preferences and lifestyle.

Remember that establishing a system for recording expenses is not a one-time task. It requires consistent effort and commitment to maintain the practice over time. By making expense tracking a habit, you will have a better understanding of your financial situation, make more informed decisions, and stay on track with your budgeting goals.

Regularly Review and Adjust Your Budget

In order to achieve financial stability and reach your financial goals, it is crucial to regularly review and adjust your budget. By consistently evaluating your budget and making necessary adjustments, you can ensure that it remains effective and aligned with your current financial situation.

Periodically reviewing your budget allows you to track your progress, identify any areas of overspending or underspending, and make the necessary modifications to stay on track. This ongoing process helps you stay accountable and make informed decisions about your finances.

When reviewing your budget, consider examining your income and expenses to ensure they are accurately reflected. This includes taking into account any changes in income, such as promotions, job changes, or additional sources of revenue. Similarly, carefully analyze your expenses to determine if any adjustments need to be made based on changes in your needs or priorities.

It’s important to note that budgeting is not a one-time event but rather an ongoing practice. As your financial situation evolves, your budget should evolve with it. Regularly evaluating and adjusting your budget allows you to adapt to changes in your life, such as fluctuations in income, unexpected expenses, or new financial goals.

During the review process, it can be helpful to compare your actual income and expenses to the budgeted amounts. This analysis enables you to identify any discrepancies and understand where you may need to make adjustments. It may also highlight areas where you can find additional savings or allocate more funds towards your financial priorities.

Remember, a budget is a dynamic tool that requires regular attention and fine-tuning. By regularly reviewing and adjusting your budget, you can stay in control of your finances and work towards achieving your financial goals.

Questions and answers

What is the importance of creating a budget?

Creating a budget is important because it allows you to have a clear understanding of your income and expenses. It helps you prioritize your spending, save money, and achieve your financial goals.

How do I start creating a budget?

To start creating a budget, you need to gather all your financial information, such as bank statements, bills, and pay stubs. Then, calculate your monthly income and expenses. Categorize your expenses into fixed (e.g. rent, insurance) and variable (e.g. groceries, entertainment). Consider any debt repayment and allocate money for savings.

What strategies can I follow to stick to my budget?

There are several strategies to stick to your budget. Firstly, track your expenses regularly and compare them to your budgeted amounts. Secondly, avoid impulsive purchases and try to differentiate between needs and wants. Thirdly, cut down on non-essential expenses and find ways to save money, such as shopping for discounts and using coupons. Lastly, review and adjust your budget periodically to meet your changing financial needs.

How can I deal with unexpected expenses that disrupt my budget?

Dealing with unexpected expenses requires flexibility in your budget. Consider creating an emergency fund to cover unexpected costs. If you encounter an unexpected expense, re-evaluate your budget and adjust your spending in other areas if needed.

What are the benefits of sticking to a budget?

Sticking to a budget offers numerous benefits. It helps you gain control over your finances, reduce debt, and save money. It allows you to prioritize your financial goals and work towards them. Additionally, sticking to a budget reduces financial stress and encourages responsible spending habits.

What is the importance of creating a budget?

A budget is crucial because it helps you track your income and expenses, ensuring that you have control over your finances and avoid unnecessary debt.

How do I start creating a budget?

Begin by identifying your income sources and then listing all your expenses, including fixed and variable costs. This will give you a clear overview of your financial situation.

What are some tips for sticking to a budget?

Firstly, set realistic financial goals that align with your income and expenses. Additionally, track and review your expenses regularly, prioritize savings, and find ways to cut back on unnecessary spending.

What should I do if I exceed my budget one month?

If you go over your budget, do not panic. Re-evaluate your expenses, identify where you overspent, and make adjustments accordingly. It’s important to learn from your mistakes and make necessary changes to avoid exceeding your budget in the future.

Is it possible to create a budget if I have an irregular income?

Yes, although it might be more challenging, you can still create a budget with irregular income. It’s important to estimate your average income, prioritize essential expenses, build an emergency fund, and have a plan to handle months with lower earnings.