Embrace the key to achieving financial independence. Discover the roadmap that empowers individuals to take control of their financial destinies. Our comprehensive guide demystifies the secrets behind Dave Ramsey’s renowned 7-step system, allowing you to pave your way towards a stable and prosperous future with confidence.

Unleash the power of financial wellness by adopting Dave Ramsey’s tried and tested principles. These ingenious strategies, carefully designed to optimize your wealth building potential, propel you towards a life of security and abundance. Embark on a journey that prioritizes fiscal responsibility, nurturing your financial health, and unlocking the door to untapped opportunities.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreWithin these remarkable seven steps lies the foundation for your financial transformation. Step beyond the limitations of conventional thinking and embrace a mindset shift that will revolutionize your approach to money. Develop a laser-like focus on intentional spending, ruthless debt eradication, and a steadfast commitment to building a formidable emergency fund, allowing you to face life’s uncertainties head-on.

Embrace the principles that have transformed the lives of millions, guiding them towards freedom from the shackles of debt and scarcity. With the help of our expert-curated articles, explore the nuances of each step and gain a comprehensive understanding of the intricacies involved. Leverage the wisdom within these pages to navigate the treacherous waters of financial planning, firmly establishing a solid footing along the way.

- Dave Ramsey’s Path to Financial Freedom

- Understanding the Significance of Financial Stability

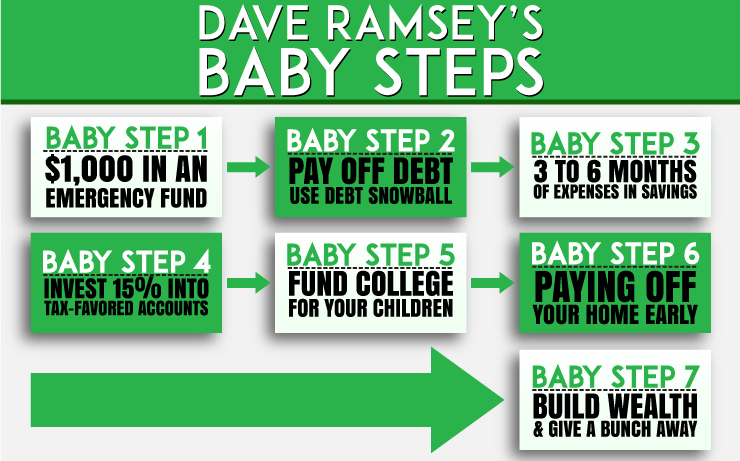

- Introducing Dave Ramsey’s 7 Baby Steps

- Step 1: Set Aside

,000 for an Emergency Fund

- Building a safety net for unexpected expenses

- Tips for saving and managing your emergency fund

- Step 2: Eliminate All Debt (Except the Mortgage)

- Creating a Debt Snowball to Efficiently Eradicate Your Debt

- Strategies to Stay Motivated on the Journey to Debt Freedom

- Step 3: Build a Robust Emergency Fund to Cover 3-6 Months of Expenses

- Why a fully funded emergency fund is crucial for long-term financial stability

- Steps to Attain Savings Targets and Maintain an Emergency Fund

- Step 4: Invest 15% of Household Income into Retirement

- Understanding the Significance of Retirement Savings

- Questions and answers

Dave Ramsey’s Path to Financial Freedom

Embarking on a journey towards financial stability requires a clear roadmap, and Dave Ramsey has formulated a proven plan known as the 7 Baby Steps. These steps serve as a guide to help individuals achieve their financial goals, paving the way for long-term success and prosperity.

Starting with the first step, individuals are encouraged to build an emergency fund. This serves as a safety net, providing a sense of security and peace of mind in the face of unexpected expenses or emergencies. With this foundation in place, one can move on to step two, which involves paying off all debts using the debt snowball method. By focusing on one debt at a time and gradually eliminating them, one can gain momentum and gradually become debt-free.

Step three emphasizes the importance of saving and creating a fully funded emergency fund. This fund should cover 3-6 months of living expenses, ensuring that individuals are prepared for any unexpected financial circumstances. Following this, step four introduces the concept of investing for retirement, with the goal of creating long-term wealth and financial security.

Step five revolves around saving for children’s college education, providing them with the means to pursue higher education without the burden of student loans. By diligently saving and investing in a college fund, parents can give their children a head start in life.

Once all major financial obligations and goals are taken care of, step six involves paying off the mortgage early. This not only eliminates the largest debt for most individuals but also accelerates the journey towards complete financial freedom.

Finally, step seven celebrates the ultimate goal of financial success: building wealth and giving back. This step focuses on investing, saving, and ultimately being able to make a positive impact on the lives of others through generous donations, charitable contributions, and acts of kindness.

Dave Ramsey’s 7 Baby Steps offer a comprehensive and practical framework for individuals to take control of their financial future. Following these steps diligently can lead to financial stability, freedom from debt, and the ability to live a life of abundance and generosity.

Understanding the Significance of Financial Stability

Recognizing the relevance of maintaining a strong financial foundation is crucial for long-term prosperity and security. Establishing a firm grip on one’s financial situation is an essential aspect of leading a fulfilling life.

Comprehending the value of financial stability involves grasping the importance of managing personal finances effectively and making informed decisions to ensure a secure future. It necessitates developing healthy financial habits, such as budgeting, saving, and investing wisely.

Financial stability encompasses various aspects, including the ability to meet daily expenses without incurring excessive debt, being prepared for unforeseen circumstances, and having the freedom to pursue opportunities and goals without being hindered by financial constraints. It provides a sense of peace and control over one’s financial life, reducing stress and offering the ability to plan for the future confidently.

Moreover, financial stability empowers individuals to build a solid foundation for their families, increase their financial resilience, and achieve personal milestones, such as homeownership, higher education, and retirement. It fosters independence and allows individuals to make choices based on their aspirations rather than being driven solely by financial limitations.

By understanding the significance of financial stability, individuals can create a path towards financial freedom and security. It involves taking responsibility for one’s financial well-being, setting realistic goals, and adhering to a disciplined approach to money management. Ultimately, financial stability not only impacts individual lives but also contributes to the overall economic progress and well-being of societies.

Introducing Dave Ramsey’s 7 Baby Steps

Welcome to an introduction to the foundational principles that pave the way towards financial prosperity. Delve into the empowering journey designed to guide individuals in their pursuit of monetary stability and wealth accumulation. As we embark on this transformative exploration, we will be uncovering a set of strategies that have the potential to revolutionize one’s financial standing and lead to lasting financial freedom.

Step one involves establishing a solid foundation. This initial phase concentrates on creating an emergency fund to safeguard against unexpected expenses. By setting aside a reserve, individuals gain peace of mind and a sense of security, as well as the ability to proactively deal with unanticipated events that may otherwise derail their financial progress.

Progressing to step two, focus shifts towards eradicating debt. This stage is dedicated to developing a powerful debt repayment plan, enabling individuals to break free from the shackles of financial dependency. By systematically eliminating debt obligations, the path towards financial independence becomes clearer, allowing for the allocation of resources towards future goals and aspirations.

The next phase, step three, emphasizes the importance of creating a fully funded emergency fund. This not only reinforces the earlier emergency fund created in step one but also establishes a more substantial financial buffer. By saving a predetermined amount, individuals become capable of navigating unforeseen circumstances and managing life’s expenses without jeopardizing their long-term financial objectives.

Moving on to step four, attention is directed towards retirement. This vital stage focuses on investing a substantial proportion of income for one’s golden years. By securing a comfortable retirement nest egg, individuals can look forward to a future brimming with financial tranquility, free from reliance on others and full of the possibilities that come with financial independence.

Step five amplifies individuals’ financial growth through the establishment of college savings plans for their children. This phase recognizes the value of higher education and enables parents to provide their children with the opportunity to pursue academic excellence without the burden of crippling student loan debt. By planning for this significant expense in advance, individuals ensure a brighter future for the next generation.

The sixth step shines a light on paying off the mortgage. By eliminating this substantial monthly expense, individuals can redirect their resources towards other investment opportunities, accelerate savings, and continue to build wealth. This stage further solidifies one’s financial position and sets the stage for the ultimate goal of financial prosperity.

Finally, step seven encapsulates the pinnacle of financial success: building wealth and giving back. At this stage, individuals have achieved financial independence and possess the means to fulfill their dreams, make a positive impact in their communities, and leave a lasting legacy. Through wise investment choices and a spirit of generosity, individuals can find fulfillment by not only securing their own future but also by enriching the lives of others.

Step 1: Set Aside $1,000 for an Emergency Fund

One of the foundational steps on the journey to financial stability is to establish an emergency fund. This initial step involves saving an amount of $1,000 to create a safety net for unexpected expenses or emergencies that may arise in life. Having an emergency fund allows you to handle unforeseen situations without resorting to debt or disrupting your long-term financial goals.

By setting aside $1,000 for an emergency fund, you create a buffer that provides peace of mind and financial security. This fund can cover sudden car repairs, medical emergencies, or unexpected household repairs, among other unforeseen expenses. It acts as a safeguard against having to rely on credit cards, loans, or other high-interest debt options that can dig you into a financial hole.

Think of your emergency fund as a financial shield that protects you from having to dip into your regular savings or retirement accounts in times of crisis. It serves as a first line of defense, allowing you to handle any unexpected situations that come your way without derailing your overall financial plans.

By saving this initial amount, you create a solid foundation for your financial journey. It gives you a sense of accomplishment, motivates you to continue taking steps towards financial wellness, and provides you with the confidence to tackle the following steps of Dave Ramsey’s plan.

| Key Points |

|---|

| Create an emergency fund to cover unexpected expenses |

| Set aside $1,000 as a safety net |

| Avoid reliance on credit cards or loans in times of crisis |

| Think of the fund as a financial shield |

| Use this initial step as a foundation for your financial journey |

Building a safety net for unexpected expenses

In today’s unpredictable world, it is crucial to establish a solid financial foundation to protect yourself and your loved ones from unexpected expenses. This article aims to guide you on the path towards creating a safety net that will provide you with peace of mind and financial stability in times of unforeseen circumstances.

Understanding the importance of a safety net

Life is full of surprises, and these surprises often come with a price tag. Whether it’s a sudden medical emergency, car repairs, or unexpected home repairs, having a safety net in place can alleviate the stress and financial strain that these situations bring. A safety net acts as a cushion, ensuring that you are financially equipped to face the unexpected and prevent it from derailing your long-term financial goals.

Setting aside an emergency fund

One of the key steps to building a safety net is setting aside an emergency fund. This fund should be readily accessible and consists of three to six months’ worth of living expenses. Having this reserve of cash can provide a sense of security and allow you to navigate through challenging times without relying on credit cards or loans.

Automating savings for unexpected expenses

Consistency is key when it comes to building a safety net. Setting up automatic transfers from your paycheck or checking account to a designated emergency fund can ensure that you consistently contribute towards your financial security. By treating your savings as a non-negotiable expense, you are actively prioritizing your financial well-being.

Protecting yourself with insurance

In addition to an emergency fund, having the right insurance coverage is essential to protect yourself from unexpected financial burdens. Adequate health insurance, home insurance, and car insurance can safeguard you against substantial expenses that may arise from unexpected events. Taking the time to review and update your insurance policies regularly ensures that you are adequately covered.

Building additional income streams

Another proactive approach to building a safety net involves diversifying your sources of income. Relying solely on a single job or income stream can leave you vulnerable to financial setbacks. Exploring side hustles, freelance work, or investment opportunities can provide you with additional financial stability and increase your resilience to unexpected expenses.

Conclusion

Building a safety net for unexpected expenses is an essential part of achieving long-term financial security. By understanding the importance of having a safety net, setting aside an emergency fund, automating savings, protecting yourself with insurance, and building additional income streams, you can establish a solid foundation that will protect you from the uncertainties of life and provide you with the peace of mind you deserve.

Tips for saving and managing your emergency fund

In this section, we will discuss some valuable tips that can help you effectively save and manage your emergency fund. It is imperative to have a reliable financial safety net in place to handle unforeseen expenses and emergencies.

- Start by setting a specific goal for your emergency fund. Determine how much money you want to save and establish a timeline for achieving this target.

- Create a separate savings account dedicated solely to your emergency fund. This will make it easier to track your progress and avoid dipping into these funds for non-emergency purposes.

- Consider automating your savings by setting up recurring transfers from your primary bank account to your emergency fund. This way, you can consistently contribute without having to manually transfer money each time.

- Reduce unnecessary expenses and evaluate your spending habits. By cutting back on non-essential purchases, you can save more money and accelerate your progress towards building your emergency fund.

- Keep track of your expenses and income using a budgeting tool or app. This will allow you to identify areas where you can further save and allocate additional funds towards your emergency fund.

- Avoid taking on unnecessary debt. By minimizing your reliance on credit cards and high-interest loans, you can avoid financial hardships and protect your emergency fund.

- Regularly reassess your emergency fund amount to ensure it aligns with your current financial situation. As your income and expenses change, it may be necessary to adjust the target amount to adequately cover any unexpected costs.

- Educate yourself on various investment options where you can potentially grow your emergency fund. However, ensure that these investments are low-risk and provide easy access to your money when needed.

- Lastly, review your insurance policies to make sure you are adequately protected in the event of emergencies. Having proper insurance coverage can significantly reduce financial burdens during challenging times.

By following these tips and consistently contributing towards your emergency fund, you can establish a strong financial safety net and gain peace of mind knowing that you are prepared for unexpected expenses.

Step 2: Eliminate All Debt (Except the Mortgage)

The second step in the journey to financial freedom is eliminating all debt, with the exception of your mortgage. This crucial step aims to free yourself from the burdens of debt and build a solid foundation for your future financial success.

Why is it important to pay off debt?

Debt can be a heavy weight on your shoulders, preventing you from reaching your financial goals and causing unnecessary stress. By eliminating debt, you regain control over your finances and pave the way towards financial independence.

What debts should you prioritize?

When tackling your debts, prioritize those with the highest interest rates first. These debts are typically the most costly and can accumulate quickly over time. By focusing on paying off high-interest debts, you can save money in the long run and expedite your journey towards debt-free living.

How can you accelerate debt repayment?

It’s essential to create a realistic budget to determine how much money you can allocate towards debt repayment each month. Additionally, consider adopting a frugal lifestyle and finding ways to increase your income. By cutting expenses and boosting your earnings, you can free up more money to put towards reducing your debt.

Should you save or pay off debt first?

While building an emergency fund is important, it’s typically recommended to focus on paying off debt before aggressively saving. By eliminating high-interest debt, you can save more money in interest payments and be better prepared to handle unexpected expenses.

Conclusion

Eliminating debt (except the mortgage) is a critical step towards achieving financial freedom. By prioritizing your debt repayment, you can regain control over your finances, save money in interest payments, and pave the way for a more secure future.

Creating a Debt Snowball to Efficiently Eradicate Your Debt

In this section, we will explore a powerful strategy to eliminate your debt efficiently: creating a debt snowball. This method involves tackling your debts in a systematic way, focusing on small victories that build momentum towards larger successes. By employing this approach, you can regain control of your finances and pave the way towards a debt-free future.

The Debt Snowball Technique:

One of the most effective ways to eliminate debt efficiently is by utilizing the debt snowball technique. This method involves listing all of your outstanding debts, starting from the smallest to the largest. By prioritizing the smallest debt first, you can concentrate your efforts on paying it off while making minimum payments on all other debts.

Why start with the smallest debt?

The rationale behind this approach is to achieve quick wins and build momentum. By focusing on repaying the smallest debt, you can experience a sense of accomplishment sooner, providing you with the motivation to keep moving forward. As you eliminate each debt, you snowball the payments you were allocating towards the previous debt into the next one on your list.

How to implement the debt snowball:

Begin by making a comprehensive list of all your debts. Include the remaining balance, the minimum monthly payment, and the interest rates for each debt. Next, order your debts from the smallest balance to the largest, irrespective of interest rates.

Allocate any extra funds, beyond minimum payments, towards the smallest debt on your list. Continue making minimum payments on all other debts. Once the smallest debt is paid off, take the amount you were allocating towards it and add it to the minimum payment of the next debt on your list. Repeat this process until each debt is eliminated, incorporating the growing momentum and payments from the previous debts.

The Benefits of the Debt Snowball Technique:

The debt snowball technique offers a range of advantages for achieving efficient debt elimination. Firstly, it provides a systematic and manageable approach, breaking down your debt into smaller, more attainable goals. Secondly, the psychological impact of celebrating each debt payoff boosts motivation and confidence. Finally, as you eliminate debts one by one, you will experience an increasing cash flow from eliminated minimum payments, which can be redirected towards the next debt. By utilizing the debt snowball technique, you can create an effective plan to successfully eradicate your debt.

Strategies to Stay Motivated on the Journey to Debt Freedom

When working towards becoming debt-free, it’s important to stay motivated throughout the journey. Maintaining enthusiasm and determination can be challenging, but implementing effective strategies can make a significant difference. Here are some valuable approaches to help you stay on track and motivated while paying off debt.

1. Set Clear Goals: Defining specific and achievable goals is crucial for staying motivated. Consider creating a detailed plan with milestones to measure your progress. This will allow you to track your success and keep your motivation levels high.

2. Celebrate Small Wins: Celebrating small victories along the way can help boost your motivation and keep you focused on your ultimate goal. Whether it’s paying off a credit card or reaching a savings target, taking the time to acknowledge and reward yourself for your accomplishments can be highly motivating.

3. Surround Yourself with Supportive People: Building a strong support system is essential. Share your goals with your family, friends, or a close-knit community that can provide encouragement and hold you accountable. Engaging with like-minded individuals who understand your financial journey can be inspiring and help you stay motivated.

4. Visualize the End Result: Visualizing the life you will have once you are debt-free can serve as a powerful motivator. Imagine the financial freedom, reduced stress, and increased possibilities that will come with achieving your goals. By picturing the positive outcome, you can stay focused on the bigger picture and stay motivated along the way.

5. Track Your Progress: Keeping track of your progress can give you a sense of accomplishment and motivate you to continue. Use a budgeting tool, spreadsheet, or a debt payoff tracker to monitor your debt reduction and savings growth. Seeing the numbers decrease and your financial situation improve will provide tangible evidence of your efforts, helping you stay motivated.

6. Find Inspiration: Seek out stories of others who have successfully paid off their debt and achieved financial freedom. Reading about their experiences and the strategies they used can be both educational and inspiring. Their stories can serve as a reminder that your goals are attainable, no matter how daunting they may seem.

7. Take Breaks and Practice Self-Care: Constantly focusing on debt payoff can be mentally and emotionally draining. It’s crucial to take breaks and prioritize self-care to maintain your motivation. Engage in activities that bring you joy, practice stress-reducing techniques, and give yourself permission to relax and recharge. Taking care of yourself will help you sustain long-term motivation and prevent burnout.

Remember, staying motivated throughout your debt payoff journey is key to achieving financial freedom. Implement these strategies and find what works best for you to stay focused, determined, and inspired. Keep your eyes on the prize and stay committed to your financial goals for a better, debt-free future.

Step 3: Build a Robust Emergency Fund to Cover 3-6 Months of Expenses

In this crucial step towards achieving financial security, it is essential to establish a fully-funded emergency fund that can safeguard against unexpected financial setbacks. This fund acts as a financial cushion, providing peace of mind and stability in uncertain times.

By saving 3-6 months’ worth of expenses, you prepare yourself to handle any unexpected events like job loss, medical emergencies, or major home repairs without relying on debt or struggling to make ends meet. This sizable fund ensures that you have the necessary resources to navigate through challenging times without derailing your long-term financial goals.

During the process of building your emergency fund, it is vital to cut back on unnecessary expenses, implement a budget, and prioritize saving over immediate gratification. By living within your means and practicing disciplined spending habits, you can steadily increase your emergency fund until it reaches the desired level.

Consider automating your savings by setting up regular transfers to your emergency fund. This automated approach removes the temptation to spend the money elsewhere and ensures a consistent contribution towards your financial safety net.

While the ideal amount in an emergency fund may vary depending on individual circumstances, it is essential to carefully evaluate your monthly expenses and determine a realistic target. Remember that this fund is not meant for discretionary spending but is solely intended to cover the essentials during unforeseen circumstances.

By diligently building a fully funded emergency fund, you create a solid foundation for your financial journey. It empowers you to face unexpected challenges with confidence, safeguards your progress, and enables you to focus on long-term financial goals without the constant worry of potential financial crises.

Why a fully funded emergency fund is crucial for long-term financial stability

In this section, we will explore the importance of having a well-funded emergency fund when striving for long-term financial stability. Having a stable financial foundation can provide peace of mind, security, and resilience when facing unexpected expenses or economic downturns.

Building a fully funded emergency fund serves as a vital safeguard against unforeseen events, such as job loss, medical emergencies, or major household repairs. By setting aside a designated amount of money, individuals and families can weather financial storms without resorting to high-interest credit card debt, loans, or depleting their savings earmarked for other goals.

A fully funded emergency fund acts as a safety net, instilling confidence and reducing financial stress in times of uncertainty. It provides a cushion to cover necessary living expenses, such as food, housing, utilities, and transportation, during a crisis. Having this financial buffer allows individuals to focus on finding new employment opportunities, recovering from illness or injury, or addressing any other unexpected challenges that may arise.

Moreover, a well-funded emergency fund allows long-term financial planning to continue uninterrupted. It safeguards investments, retirement savings, and other financial goals from being prematurely disrupted due to unforeseen circumstances. By having a readily accessible emergency fund, individuals can stay on track with their long-term financial plans and pursue their dreams without constantly worrying about unexpected financial burdens.

It’s important to note that a fully funded emergency fund does not mean hoarding excessive amounts of cash. Rather, it means having a sufficient amount set aside specifically for emergencies, typically around three to six months’ worth of living expenses. This balance allows for both financial security and the ability to invest in wealth-building endeavors, ensuring a diversified and holistic approach to long-term financial stability.

In conclusion, a fully funded emergency fund is a cornerstone of long-term financial stability. It provides a solid foundation that protects individuals and families from unexpected financial hardships, allowing them to navigate through challenging times with greater ease and confidence. By prioritizing the establishment and maintenance of an emergency fund, individuals can proactively safeguard their financial well-being and continue working towards their long-term financial goals.

Steps to Attain Savings Targets and Maintain an Emergency Fund

In this section, we will explore the essential steps to effectively achieve your savings goals and ensure the sustainability of your emergency fund. By implementing these strategies, you can create a reliable financial safety net and work towards a secure future.

1. Establish Clear Saving Goals: Begin by identifying specific targets for your savings, whether it’s for a down payment on a house, a dream vacation, or retirement. Setting clear and tangible goals will give you a sense of purpose and motivation.

2. Create a Realistic Budget: Develop a comprehensive budget that outlines your income, expenses, and savings. Be mindful of your spending habits and look for areas where you can cut back and redirect funds towards your savings objectives.

3. Automate Savings: Set up automatic transfers from your income to a separate savings account. By making saving a priority and automating the process, you will be less tempted to spend those funds elsewhere.

4. Reduce Debt: Prioritize paying off high-interest debts, such as credit card balances, as they can hinder your savings progress. Allocating a portion of your budget towards debt repayment will free up more resources for savings in the long run.

5. Explore Frugal Living Techniques: Embrace a frugal lifestyle by adopting cost-saving practices. This can include meal planning, buying in bulk, comparing prices, and cutting unnecessary expenses. Small adjustments in daily habits can lead to significant savings over time.

6. Regularly Review and Adjust: Monitor your progress regularly and make adjustments as needed. Life circumstances and financial goals may change, requiring periodic reassessment and modification of your savings strategy.

7. Maintain an Emergency Fund: Establish and maintain an emergency fund to cover unexpected expenses or financial setbacks. Aim to have three to six months’ worth of living expenses readily available in a separate account, ensuring you are prepared for any unforeseen circumstances.

By following these steps, you can work towards achieving your savings goals and enjoy the peace of mind that comes with having a robust emergency fund. Remember, consistency and discipline are key to long-term financial success.

Step 4: Invest 15% of Household Income into Retirement

Building a secure financial future requires careful planning and wise money management. In the fourth step of the journey towards financial stability, it is essential to allocate a significant fraction of your household income towards retirement savings. By setting aside 15% of your earnings, you can secure a comfortable retirement and enjoy the fruits of your labor in later years.

Why is investing for retirement crucial?

Investing a portion of your income into retirement ensures you have a robust financial cushion for your golden years. The act of investing involves putting your hard-earned money to work by allowing it to grow over time through various investment vehicles. This approach harnesses the power of compound interest and enables you to multiply your wealth exponentially, ultimately providing you with the financial freedom to enjoy a comfortable retirement.

How to allocate 15% of your household income?

It is essential to develop a systematic approach to allocate 15% of your household income for retirement savings. Begin by assessing your current expenses and exploring areas where you can cut back and create room for retirement contributions. Consider automating these contributions to ensure consistent saving habits, maximizing employer-sponsored retirement plans, like 401(k)s or IRAs, and diversifying your investments to minimize risk.

The power of consistency and long-term planning

Saving and investing for retirement is not a one-time endeavor but rather a lifelong commitment. Developing a habit of setting aside a significant portion of your income and consistently investing it into retirement accounts is key. By staying focused on long-term goals, you can build significant wealth over time and secure a stable financial future for yourself and your loved ones.

Remember, investing 15% of your household income into retirement is a critical step towards securing financial independence and enjoying a worry-free retirement. Start planning today to ensure a brighter future!

Understanding the Significance of Retirement Savings

Retirement savings play a crucial role in securing your financial future and ensuring a comfortable lifestyle during your golden years. It is essential to comprehend the importance of setting aside money specifically for retirement, as it allows you to maintain your current standard of living and meet your financial goals even after you stop working.

Retirement savings act as a financial cushion, providing you with the means to cover your living expenses, healthcare costs, and other necessities when you no longer have a regular income. By consistently saving and investing for retirement, you can mitigate the risk of financial uncertainty and achieve financial freedom in your later years.

- Financial Independence: Building a substantial retirement savings nest egg enables you to maintain your independence and enjoy the lifestyle you desire. It allows you to pursue your interests, travel, and engage in activities you may not have had time for during your working years.

- Peace of Mind: Saving for retirement provides peace of mind, knowing that you have a safety net in place to cover unexpected expenses, emergencies, or any financial hurdles that may arise. It eliminates the stress and worry that can come with financial instability during retirement.

- Preserving Your Legacy: By diligently saving for retirement, you not only secure your own future but also have the opportunity to leave a lasting legacy for your loved ones. Your retirement savings can serve as a financial gift, ensuring that your family’s financial well-being is safeguarded even in your absence.

- Protecting Against Inflation: Retirement savings act as a protection against inflation, which erodes the purchasing power of your money over time. By investing in retirement accounts that offer potential growth, you can combat the impact of inflation and maintain the value of your savings.

- Enjoying Retirement: Having adequate retirement savings allows you to enjoy your post-work years without financial limitations. It grants you the freedom to pursue new hobbies, interests, or even start a new venture, knowing that you have taken the necessary steps to secure your financial future.

Understanding the importance of retirement savings can motivate you to start saving early, consistently contribute to your retirement funds, and make wise investment decisions. By prioritizing your retirement goals and taking the necessary steps, you can set yourself on a path towards financial stability and a fulfilling retirement.

Questions and answers

What is the purpose of Dave Ramsey’s 7 baby steps?

The purpose of Dave Ramsey’s 7 baby steps is to provide a clear roadmap for individuals to achieve financial independence and success. They are meant to help people eliminate debt, save emergency funds, invest for retirement, and build long-term wealth while also being able to give generously.

How can I start following Dave Ramsey’s 7 baby steps?

You can start following Dave Ramsey’s 7 baby steps by first saving $1,000 as your initial emergency fund. Then, focus on paying off all non-mortgage debt using the debt snowball method, where you prioritize paying off the smallest debt first while making minimum payments on the rest. The next steps include building a fully funded emergency fund, investing for retirement, saving for college, paying off the mortgage, and then building wealth and giving generously.

Is it really necessary to follow all 7 baby steps?

No, it is not necessary to follow all 7 baby steps exactly as outlined by Dave Ramsey. However, they provide a comprehensive plan that has helped many individuals achieve financial success. Depending on your personal circumstances, you might choose to adapt the steps to better suit your needs and priorities. The key is to focus on eliminating debt, saving for emergencies, and investing for the future.

Can I start Dave Ramsey’s 7 baby steps even if I have a low income?

Absolutely! Dave Ramsey’s 7 baby steps can be applied regardless of income level. While some steps, such as saving for an emergency fund or investing 15% for retirement, might be more challenging with a lower income, it’s still important to implement strategies that prioritize saving, reducing debt, and building wealth. Taking even small steps in the right direction can make a significant impact on your financial well-being.

Why is it important to save $1,000 for an emergency fund as the first step?

Saving $1,000 for an emergency fund as the first step is important because it provides a small safety net for unexpected expenses that may arise, such as car repairs or medical bills. It helps to prevent individuals from going further into debt when faced with emergencies.

What is the debt snowball method mentioned in the second step?

The debt snowball method is a debt reduction strategy where an individual pays off their debts starting with the smallest balance first, regardless of interest rates. As each small debt is paid off, the money that was being used to pay that debt is then applied to the next smallest debt. This method provides a psychological boost by offering a sense of accomplishment for paying off debts one by one.

How long does it typically take to complete the 7 baby steps?

The time it takes to complete the 7 baby steps varies depending on an individual’s financial situation and income. It can take several months to a few years to complete all the steps. Some may be able to complete them more quickly, while others may take longer due to larger amounts of debt or lower incomes.

Why is it important to pay off the home early, as mentioned in the sixth step?

Paying off the home early is important because it allows individuals to save a significant amount of money on interest payments over the life of the loan. It also provides homeowners with a sense of financial security and the ability to redirect mortgage payments towards other financial goals, such as retirement savings or investing.