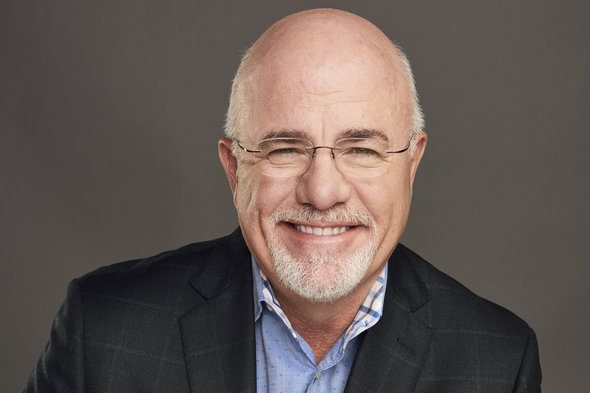

Preparing for the future is crucial, and there’s no better way to secure a comfortable life after active employment than by implementing a well-thought-out strategy. In this article, we will explore the invaluable advice and innovative approaches recommended by renowned financial expert Dave Ramsey. By following his expert recommendations, individuals can gain peace of mind and enjoy their golden years without financial worries.

Investing wisely and making informed decisions about savings and wealth preservation are vital components of a stable and prosperous future. Dave Ramsey, a celebrated financial mentor, emphasizes the importance of understanding the principle of long-term financial planning. Through his insightful guidance, individuals can navigate the complex world of investments, ensuring their assets grow steadily over time.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreDave Ramsey’s teachings emphasize financial literacy and the mastery of essential skills that enable individuals to make sound financial decisions independently. By empowering people to take control of their monetary future, he equips them with the tools necessary to weather economic storms and make smart choices that align their financial goals with lifelong happiness and security.

Furthermore, Dave Ramsey encourages individuals to develop a mindset rooted in discipline and consistency. Building and maintaining a solid emergency fund, managing debt responsibly, and prioritizing wise spending habits are all principles he advocates for to ensure a stable financial foundation. With these principles in place, individuals can confidently face the uncertainties that come with retirement, knowing they have taken the necessary steps to safeguard their financial well-being.

- Retirement Planning Guidance: Essential Steps Toward a Solid Future

- Why Retirement Planning Matters

- The Importance of a Solid and Assured Tomorrow

- Dave Ramsey’s Expert Tips

- Start Early

- Set Clear Financial Goals

- Create a Realistic Budget

- Investment Strategies for a Sound Future

- Diversify Your Investments

- Consider Employer-Sponsored Retirement Accounts

- Seek Professional Advice

- Saving for Retirement

- Maximize Your Contributions

- Questions and answers

Retirement Planning Guidance: Essential Steps Toward a Solid Future

In this segment, we will explore crucial strategies to ensure a prosperous and worry-free post-working life. Discover practical tips, expert advice, and key considerations for effective retirement planning.

Retirement Planning Guidance signifies a deliberate and calculated approach to lay the groundwork for a secure future. It involves making key decisions, devising a personalized strategy, and diligently saving and investing funds for the long term. This comprehensive process encompasses various facets, including financial preparation, healthcare considerations, lifestyle adjustments, and estate planning. By taking proactive steps and adhering to sound principles, individuals can attain financial freedom and peace of mind in later years.

Retirement Planning: A Holistic Perspective

Retirement planning is not solely about financial security. It also entails considering personal aspirations, health-related factors, and managing changing circumstances. By taking a holistic approach, individuals can create a roadmap that aligns with their unique goals and circumstances. This involves evaluating one’s desired standard of living, assessing potential healthcare needs, and adapting to evolving lifestyles. Recognizing that retirement is a significant life transition, it necessitates thoughtful and well-informed decision-making throughout the entire journey.

The Power of Early Planning

One of the most impactful steps towards a secure future is starting retirement planning early. Time can be an individual’s greatest ally, as it allows for longer-term investment growth, taking advantage of compounding interest, and building a substantial retirement nest egg. By beginning the process sooner rather than later, individuals can maximize their returns and cushion against unforeseen challenges. Early planning also affords more flexibility, enabling individuals to adjust their strategy as needed and make informed decisions regarding asset allocation, retirement accounts, and Social Security benefits.

Managing Expenses and Budgeting

A critical aspect of retirement planning involves effectively managing expenses and developing a realistic budget. Careful consideration should be given to both essential and discretionary expenses, taking into account inflation, healthcare costs, and potential lifestyle changes. Identifying and prioritizing one’s core needs and understanding discretionary spending patterns can help individuals allocate resources wisely and maintain a balanced financial outlook. Implementing a budgeting system and regularly reviewing and adjusting it as circumstances evolve is vital in ensuring long-term financial stability.

Estate Planning and Legacy Preservation

Retirement planning also encompasses the crucial task of estate planning and preserving one’s legacy. This involves creating a comprehensive will, establishing trusts, designating beneficiaries, and ensuring the seamless transfer of assets. By planning for the distribution of wealth and minimizing tax implications, individuals can provide for their loved ones and leave behind a lasting impact. Estate planning allows individuals to retain control over their assets and protect their financial interests, thereby securing a legacy that extends beyond their lifetime.

Retirement Planning: A Journey Toward Financial Independence

Retirement planning is an ongoing process that evolves as individuals progress through different life stages. By staying informed, seeking professional guidance when necessary, and adapting as circumstances warrant, individuals can navigate the complexities of retirement with greater confidence and financial independence. It is never too early or too late to embark on this journey, and the rewards of careful planning and foresight can positively transform one’s retirement years into a time of fulfillment, security, and enjoyment.

Why Retirement Planning Matters

As we journey through life, it is important to not only focus on the present but also take into consideration our future needs and aspirations. A well-thought-out retirement plan plays a crucial role in ensuring financial security and peace of mind during our golden years. Investing time and effort into retirement planning sets the foundation for a comfortable and fulfilling future.

Retirement planning encompasses a range of aspects that go beyond simply saving money. It involves envisioning the lifestyle we desire to have after we have finished working, identifying our financial goals, and developing strategies to achieve them. By taking the necessary steps today, we can take control of our future and work towards a retirement that is free from financial worries and limitations.

- Financial Independence: Retirement planning allows us to attain financial independence, enabling us to have the freedom and flexibility to pursue our passions and dreams without worrying about money.

- Security and Stability: By planning ahead, we can build a nest egg that provides a sense of security and stability when we are no longer earning a regular income. This financial cushion can help cover unexpected expenses and emergencies.

- Maintaining Lifestyle: Retirement planning ensures that we can maintain our desired standard of living even after we stop working. It helps us create a realistic budget that takes into account inflation and rising costs of living.

- Healthcare Needs: Planning for retirement includes considering healthcare costs and insurance options. Adequate coverage for medical expenses is crucial to protect our well-being and financial stability during retirement.

- Legacy Planning: Retirement planning allows us to leave a lasting legacy for our loved ones. It involves strategies like estate planning and setting up trusts to ensure that our assets are distributed according to our wishes.

In summary, retirement planning holds immense significance in our lives. It provides the opportunity to take charge of our financial future, maintain our lifestyle, and ensure peace and security in our retirement years. By actively engaging in retirement planning, we can enjoy the rewards of a well-prepared and fulfilling retirement.

The Importance of a Solid and Assured Tomorrow

When it comes to planning for the future, one cannot underestimate the significance of having a secure and stable tomorrow. As we journey through life, it is crucial to prepare ourselves financially and mentally for the uncertainties that lie ahead. A prosperous and assured future provides us with the freedom to live life on our own terms, pursue our passions, and enjoy a sense of peace and fulfillment.

Having a solid and assured tomorrow means being equipped to handle unexpected expenses, medical emergencies, and other financial challenges that may arise. It means having a strong foundation that safeguards us against the uncertainties of life, allowing us to have a peace of mind even during difficult times. It also provides us with the opportunity to create a legacy for our loved ones, ensuring that they are well taken care of and have the resources they need to thrive.

Investing in our future also allows us to achieve our long-term goals and aspirations. Whether it’s starting a business, traveling the world, or retiring comfortably, having financial security enables us to turn our dreams into reality. It provides us with the freedom to make choices based on what truly matters to us, rather than being limited by financial constraints.

Furthermore, a secure and assured future brings a sense of empowerment and independence. It allows us to have control over our own lives, rather than being reliant on others or circumstances. By preparing for the future, we are able to take proactive steps towards building a strong financial foundation, ensuring that we have the resources to support ourselves and our loved ones.

In conclusion, the importance of a solid and assured tomorrow cannot be overstated. It is a key aspect of living a fulfilled and meaningful life. By investing in our future, we gain the ability to navigate life’s uncertainties, pursue our dreams, and maintain a sense of control and independence. Take the necessary steps today to secure your tomorrow and enjoy the peace of mind that comes with it.

Dave Ramsey’s Expert Tips

Discover the invaluable insights of financial guru Dave Ramsey as he shares his wealth of knowledge and experience in preparing for the future. Gain a deeper understanding of effective strategies for securing a stable and prosperous life, fostering financial confidence for yourself and your loved ones.

1. Acquire a Financial Mindset: Cultivate a mindset that prioritizes long-term financial stability and security. Embrace the notion that small, consistent actions today can lead to significant results in the future. Through careful planning and disciplined decision-making, lay the foundation for a prosperous tomorrow.

2. Build a Solid Emergency Fund: Establishing an emergency fund is essential for weathering unexpected financial storms. Aim to save a minimum of six months’ worth of living expenses in a separate account that is easily accessible. This will provide a safety net and peace of mind in times of crisis.

3. Eliminate Debt: Liberating yourself from the burden of debt is vital to achieving financial freedom. Prioritize paying off high-interest debts first and gradually work towards becoming debt-free. Utilize Ramsey’s renowned Debt Snowball method to tackle debts systematically and accelerate the path to financial independence.

4. Invest Wisely: Take advantage of the power of compound interest through smart and informed investing. Engage in thorough research and consider seeking professional advice to make informed investment decisions. Diversify your portfolio and remain patient, allowing your investments to grow steadily over time.

5. Create a Detailed Budget: Craft a comprehensive budget that accurately reflects your income, expenses, and financial goals. Prioritize essential needs, allocate funds for savings and investments, and identify areas where expenses can be reduced. Regularly review and evaluate your budget, making necessary adjustments to stay on track.

6. Plan for Retirement: While avoiding the term retirement in this section, it’s important to consider long-term financial planning. Start early and contribute consistently to retirement accounts such as IRAs and 401(k)s. Maximize employer matches and seek expert advice to ensure your retirement savings strategy aligns with your future goals.

By embracing these expert tips from Dave Ramsey, you can pave the way towards financial independence, security, and a prosperous future. Adopting a disciplined approach to finances and implementing these strategies will empower you to achieve your dreams and enjoy a life of financial well-being.

Start Early

One of the key factors in ensuring a secure future is to begin preparing early. By taking action ahead of time, you give yourself a greater opportunity to build a solid foundation for your retirement.

Commencing the process of planning for your post-work years at an early stage is vital. The sooner you start, the more time you have to develop a comprehensive strategy that aligns with your financial goals. Initiating this process early enables you to take advantage of the power of compounding, which allows your investments to grow over time.

Embracing the concept of starting early means taking proactive steps to set yourself up for long-term success. By prioritizing saving and investing as soon as possible, you lay the groundwork for a financially stable and comfortable retirement.

Begin by creating a budget that allows you to allocate a portion of your income towards retirement savings each month. Cultivate the habit of regularly contributing to retirement accounts such as 401(k)s or IRAs to maximize your potential returns. Additionally, explore opportunities for automatic contributions or employer matching, which can further bolster your retirement savings.

Starting early also empowers you to weather potential challenges or unforeseen circumstances that may arise down the road. By building a robust financial safety net, you can mitigate risks and protect yourself from future uncertainties.

In summary, beginning your retirement planning journey early is crucial for establishing a secure future. By taking proactive steps, creating a budget, and making consistent contributions to retirement accounts, you can lay the foundation for a financially stable retirement and prepare for any potential challenges that may come your way.

Set Clear Financial Goals

Creating a clear vision for your financial future is an essential step towards achieving long-term financial security. By setting clear financial goals, you can provide yourself with a roadmap to success, guiding your decisions and actions to ensure a stable and prosperous future.

When establishing financial goals, it is important to articulate your aspirations in a manner that is both specific and measurable. By clearly defining what you want to achieve, you can better evaluate your progress and stay motivated. This involves identifying your desired financial milestones and outlining the steps required to reach them.

Furthermore, setting realistic financial goals also entails aligning your aspirations with your current financial situation, taking into consideration factors such as income, expenses, debt, and investments. Taking an honest assessment of your present circumstances will enable you to develop a strategy that is attainable and sustainable in the long run.

Additionally, it is crucial to set a timeline for achieving your financial goals. By establishing clear deadlines, you can create a sense of urgency and ensure that you stay focused and committed to your objectives. Breaking down your goals into short-term, medium-term, and long-term targets can help you monitor your progress and make necessary adjustments along the way.

Remember that setting clear financial goals is not merely about wishful thinking – it requires taking proactive steps towards financial literacy, seeking expert advice, and continuously educating yourself on personal finance. Armed with a clear roadmap, determination, and a willingness to adapt, you can pave the way for a secure and prosperous financial future.

Create a Realistic Budget

In order to achieve financial stability and prepare for the future, it is crucial to establish a realistic budget that aligns with your goals and priorities. By carefully assessing your expenses and income, you can gain a clear understanding of where your money is going and make informed decisions about your financial choices.

Start by evaluating your current spending habits and identifying areas where you can make adjustments. Consider differentiating between essential expenses, such as housing and utilities, and discretionary expenses, such as entertainment and dining out. This will help you prioritize your spending and allocate resources accordingly.

Research and compare prices for necessary items and services, as well as evaluate different options to reduce costs. It may be worthwhile to consider alternative brands or shop during sales to save money. Additionally, you can explore opportunities to cut back on non-essential expenses and redirect those funds towards savings or investments.

Creating a budget is not only about cutting expenses; it’s also about setting realistic financial goals. Determine how much you want to save each month and establish a plan to achieve that target. This could involve setting up automatic transfers to a savings account or working towards paying off debts to free up additional funds for saving.

Regularly tracking your expenses and reviewing your budget is essential to stay on target. Make adjustments as needed, especially if there are changes in your income or expenses. Consistency and discipline in following your budget will lay the foundation for a secure financial future.

- Evaluate current spending habits and identify areas for adjustment

- Differentiate between essential and discretionary expenses

- Research and compare prices for necessary items and services

- Consider cutting back on non-essential expenses

- Set realistic financial goals and establish a plan to achieve them

- Regularly track expenses and review the budget

Investment Strategies for a Sound Future

As you plan for your retirement, it is crucial to consider effective investment strategies that can help secure a comfortable and financially stable future. By strategically allocating your assets, diversifying your portfolio, and carefully managing risks, you can maximize your returns and build a robust retirement nest egg.

One of the key investment strategies for retirement is asset allocation. This involves spreading your investments across different asset classes, such as stocks, bonds, real estate, and cash equivalents, based on your risk tolerance and time horizon. By diversifying your portfolio, you can potentially reduce the impact of market volatility and increase your chances of achieving long-term growth.

In addition to asset allocation, it is vital to consider the concept of dollar-cost averaging. This strategy involves regularly investing a fixed amount of money into your portfolio, regardless of market conditions. By consistently investing over a period of time, you can take advantage of market fluctuations and potentially buy more shares when prices are low, resulting in a lower average cost per share over the long run.

Another important investment strategy is to manage risk through proper portfolio rebalancing. As you approach retirement age, it is crucial to periodically review and adjust your portfolio to maintain the desired asset allocation. Rebalancing entails selling some of the investments that have appreciated significantly and reinvesting the proceeds into other asset classes to restore the target allocation. This helps ensure that your investments remain aligned with your goals and risk tolerance.

Furthermore, it is worth considering the benefits of investing in tax-advantaged retirement accounts such as Individual Retirement Accounts (IRAs) and 401(k) plans. These accounts offer potential tax advantages, such as tax-deferred growth or tax-free withdrawals in retirement, depending on the type of account. By taking advantage of these accounts and contributing regularly, you can potentially reduce your taxable income and increase your retirement savings.

| Investment Strategies for Retirement: |

|---|

| – Asset allocation |

| – Dollar-cost averaging |

| – Portfolio rebalancing |

| – Tax-advantaged retirement accounts |

In conclusion, effective investment strategies play a crucial role in securing a prosperous retirement. By diversifying your portfolio through asset allocation, utilizing dollar-cost averaging, practicing portfolio rebalancing, and making use of tax-advantaged retirement accounts, you can enhance your chances of achieving long-term financial stability and enjoy the retirement you deserve.

Diversify Your Investments

Managing your financial portfolio in preparation for the future involves making wise decisions regarding your investments. One crucial principle is to diversify your investments, which means spreading your money across a variety of assets to mitigate risks and maximize potential returns.

Having a diverse investment portfolio allows you to distribute your funds across different assets such as stocks, bonds, real estate, and mutual funds. This strategy minimizes the impact of any individual investment’s performance on your overall portfolio. By not placing all your eggs in one basket, you can protect yourself from potential losses caused by the underperformance of a particular investment.

When diversifying your investments, it is important to consider your risk tolerance and investment goals. A well-diversified portfolio can accommodate different risk levels and help you achieve a balance between stability and growth. It is also beneficial to invest in different sectors, as economic conditions can affect industries differently.

One way to diversify is by investing in index funds, which provide exposure to a wide range of stocks within a particular market index. This approach spreads your investment across multiple companies, reducing the impact of any single stock’s performance on your overall returns. Another option is diversifying across asset classes, such as allocating some funds to stocks, bonds, and real estate, based on your risk tolerance and long-term goals.

- Consider investing in international markets to further diversify your portfolio. Different countries have varying economic cycles and political climates, which can provide additional diversification benefits.

- Regularly review and rebalance your portfolio to ensure it remains diversified. Market conditions and the performance of different asset classes can change over time, so adjusting your investment allocations can help maintain an optimal mix.

- Seek professional advice from a certified financial planner or investment advisor. They can provide insights and help you create a well-diversified portfolio based on your specific financial circumstances and goals.

In conclusion, diversifying your investments is a vital strategy to protect and grow your wealth over time. By spreading your money across different assets, sectors, and even international markets, you can mitigate risks and increase the potential for long-term financial success.

Consider Employer-Sponsored Retirement Accounts

Exploring options for ensuring a financially stable future involves looking beyond traditional retirement plans. Employer-sponsored retirement accounts can offer valuable benefits and opportunities for long-term financial security. It is crucial to understand and consider the advantages of these accounts in order to make informed decisions regarding retirement planning.

- Company contributions: Many employers offer retirement plans that include company contributions. These contributions can significantly boost saving efforts and provide additional funds for retirement.

- Tax advantages: Employer-sponsored retirement accounts often come with tax benefits. Contributions made to these accounts are typically tax-deferred, meaning they are deducted from your taxable income for the year, potentially reducing your overall tax liability.

- Investment opportunities: These retirement accounts generally allow employees to choose from various investment options. This flexibility allows individuals to customize their investment portfolios based on their risk tolerance and financial goals.

- Automatic deductions: One of the advantages of employer-sponsored retirement accounts is the ability to have contributions automatically deducted from your paycheck. This automated approach ensures consistent saving and eliminates the need for manual transfers.

- Employer matching programs: Some employers offer matching contributions to incentivize employees to save for retirement. These programs effectively double your contributions, providing a significant financial boost to your retirement savings.

- Portability: In many cases, employer-sponsored retirement accounts are portable, meaning they can be transferred to another employer’s retirement plan or an individual retirement account (IRA) if you change jobs. This portability ensures that your retirement savings remain intact and continue to grow.

Considering employer-sponsored retirement accounts as part of your retirement planning strategy can be a wise decision. These accounts offer unique benefits and opportunities to enhance your financial future, providing you with increased financial security and peace of mind for your retirement years.

Seek Professional Advice

When it comes to preparing for the years ahead, it is essential to seek guidance from experienced professionals who can provide invaluable expertise and insights. Obtaining advice from experts in the field can help individuals make informed decisions and navigate potential complexities.

Engaging with professionals who specialize in financial planning and investment management can ensure that your retirement strategy is tailored to your specific needs and goals. These skilled advisors have a deep understanding of the financial landscape and can offer personalized recommendations that take into account factors such as risk tolerance, timeline, and desired outcomes.

By entrusting your retirement planning to professionals, you can tap into a wealth of knowledge and resources that may not be readily available to you otherwise. Their expertise can help identify potential blind spots, evaluate different options and scenarios, and ultimately establish a solid foundation for your secure future.

Professional advisors can also play a vital role in helping you stay on track and adjust your retirement plan as circumstances change. With their guidance, you can proactively adapt your strategy to accommodate unexpected events or make necessary course corrections to ensure you remain on a path toward financial security.

Remember, seeking professional advice is not a sign of weakness but rather a smart move towards securing a prosperous retirement. By tapping into the wisdom and experience of experts, you can optimize your retirement planning process and have confidence in your financial future.

Saving for Retirement

Planning for your financial future during your later years is a vital step towards ensuring a stable and comfortable life after you stop working. Setting aside funds specifically designated for your retirement is a strategic way to achieve financial security during your golden years.

By making regular contributions to a retirement savings account, you can accumulate a substantial nest egg that will provide you with the means to support yourself and your desired lifestyle after you retire. Putting money away for retirement allows you to benefit from compound interest, which allows your savings to grow over time.

It is important to start saving for retirement as early as possible to take advantage of the power of compounding. Making consistent and disciplined contributions to your retirement savings will help you build a solid foundation for your future. Consider consulting with a financial planner to create a customized retirement savings plan that aligns with your goals and risk tolerance.

Furthermore, diversifying your retirement savings portfolio can help protect you from market fluctuations and reduce the overall risk. This can be achieved by investing in a variety of assets such as stocks, bonds, mutual funds, and real estate. However, it is crucial to carefully assess your investment options and make informed decisions based on your individual circumstances.

Lastly, it is essential to regularly monitor and reassess your retirement savings plan to ensure it remains aligned with your financial goals and changing life circumstances. Life events such as marriage, children, or unexpected expenses may require adjustment to your retirement savings strategy. Stay proactive and make necessary revisions to stay on track.

Remember, saving for retirement is a long-term commitment that requires discipline and careful planning. By starting early, diversifying your investments, and regularly reviewing your savings strategy, you can pave the way towards a secure and prosperous future.

Maximize Your Contributions

One of the key strategies for securing your financial future involves maximizing your contributions. By increasing the amount you contribute to your retirement savings, you can set yourself up for a more comfortable and secure future. Here are some effective ways to boost your contributions:

- 1. Automate your savings: By setting up automatic contributions from your paycheck or bank account, you can ensure a consistent and disciplined approach to saving for retirement.

- 2. Take advantage of employer matches: If your employer offers a matching contribution to your retirement plan, make sure you contribute enough to maximize this benefit. It’s essentially free money that can significantly boost your overall savings.

- 3. Consider catch-up contributions: As you near retirement age, you may be eligible to make additional catch-up contributions to your retirement accounts. This can help you bridge any savings gaps and maximize your overall tax-advantaged savings.

- 4. Diversify your investments: By spreading your contributions across different investment vehicles, such as stocks, bonds, and mutual funds, you can potentially maximize your returns while reducing risk.

- 5. Monitor and adjust your contributions: Regularly review your contributions to ensure they align with your financial goals and make adjustments as needed. Taking advantage of opportunities to increase your contributions when possible can have a significant impact on your long-term savings.

By implementing these strategies and maximizing your contributions, you have the potential to build a solid financial foundation for your retirement years. Remember, the key is to start early, be consistent, and make informed decisions based on your individual circumstances.

Questions and answers

What are the key tips for retirement planning according to Dave Ramsey?

Dave Ramsey suggests a few key tips for retirement planning. First, he advises individuals to start saving early and consistently. He recommends setting aside at least 15% of your income for retirement. Second, Ramsey emphasizes the importance of getting out of debt and staying debt-free during retirement. He encourages individuals to pay off their mortgage and any outstanding loans before entering retirement. Third, he suggests diversifying your investments by spreading your funds across different assets, such as stocks, bonds, and mutual funds. Lastly, Ramsey urges individuals to work with a trusted financial advisor to create a detailed retirement plan and regularly review and adjust it as needed.

Is it really necessary to start saving for retirement early?

Yes, according to Dave Ramsey, it is crucial to start saving for retirement as early as possible. The earlier you start, the more time your money has to grow through compound interest. Starting early allows you to take advantage of the power of compounding and maximize your retirement savings. By delaying saving for retirement, you miss out on potential growth and may have to save a significantly larger amount later on to catch up.

Why does Dave Ramsey emphasize the importance of being debt-free during retirement?

Dave Ramsey believes that being debt-free during retirement is essential because it provides financial peace and security. Having debt during retirement can drain your savings, limit your cash flow, and increase financial stress. When you’re debt-free, you have more control over your financial resources, can better cover unexpected expenses, and enjoy a higher quality of life during your golden years.

How can someone create a retirement plan?

To create a retirement plan, Dave Ramsey recommends working with a trusted financial advisor. A financial advisor can help you assess your current financial situation, determine your retirement goals, and develop a strategy to achieve them. They will consider your age, income, expenses, expected retirement age, and risk tolerance to create a tailored plan. They will also assist in selecting appropriate investment options and regularly reviewing and adjusting the plan as necessary.

What is the significance of diversifying investments for retirement planning?

Diversifying investments is crucial for retirement planning according to Dave Ramsey. By spreading your funds across different asset classes, such as stocks, bonds, and mutual funds, you reduce the risk of losing all your retirement savings if one investment performs poorly. Diversification helps balance the potential for higher returns with the goal of minimizing risk. It is an effective risk management strategy that can increase the likelihood of a secure and comfortable retirement.

What is Dave Ramsey’s Retirement Planning Guide about?

Dave Ramsey’s Retirement Planning Guide is a comprehensive resource that provides tips and advice on how to secure a financially stable future during retirement.

Who is Dave Ramsey and why should I trust his retirement advice?

Dave Ramsey is a renowned financial expert and best-selling author known for his practical and proven methods of managing finances. He has helped millions of people successfully navigate their way to secure retirements.

What are some key points or strategies addressed in the Retirement Planning Guide?

The Retirement Planning Guide covers various important aspects such as setting financial goals, building an emergency fund, eliminating debt, investing wisely, and creating a retirement budget.

Are there any specific age groups or individuals that can benefit from Dave Ramsey’s retirement tips?

Dave Ramsey’s retirement tips and strategies are applicable to individuals of all age groups. Whether you are just starting your career or are close to retirement, his advice can help you secure a financially stable future.

Are there any potential risks or challenges mentioned in the Retirement Planning Guide?

Yes, the Retirement Planning Guide highlights potential risks such as market volatility, inflation, and unexpected expenses. It also provides strategies to mitigate these risks and protect your retirement savings.