Small businesses face numerous challenges in today’s competitive market. From managing limited resources to staying current with ever-changing regulations, entrepreneurs must navigate a complex landscape to ensure their success. One area that often presents a significant burden for small enterprises is taxes. Paying the right amount while maximizing deductions can be a daunting task, but with the right knowledge, small business owners can unlock substantial tax advantages to help grow their bottom line.

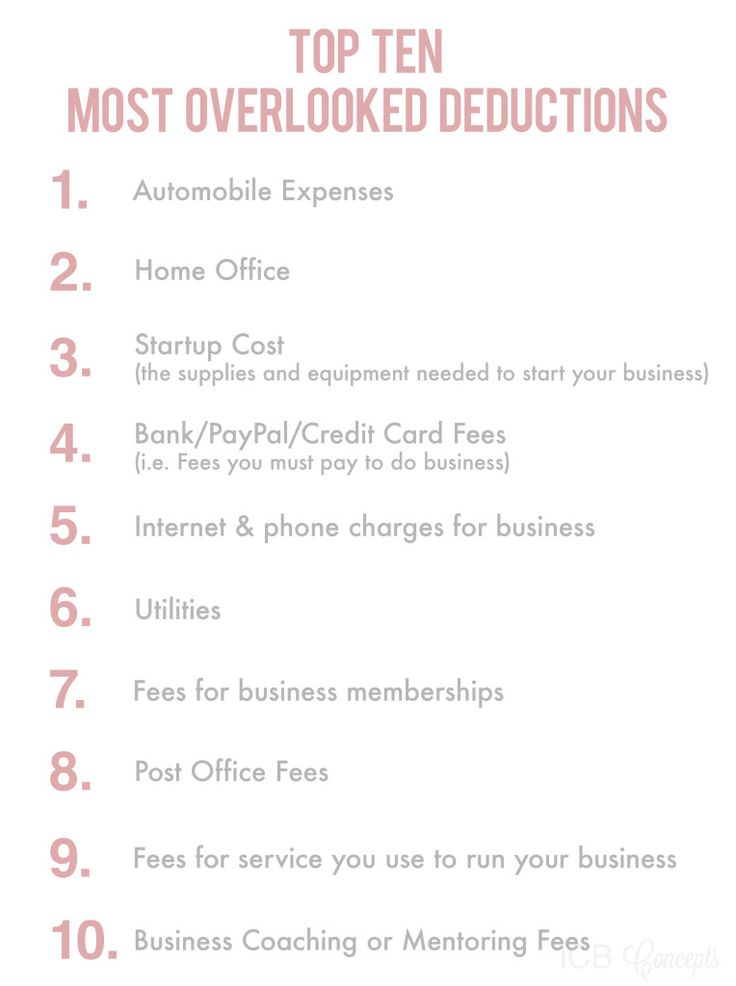

In this article, we will explore six essential deductions that can{‘t’} afford to be overlooked by small business owners. By carefully examining these write-offs and understanding how they apply to your specific industry, you can potentially reduce your tax liability and free up funds to reinvest in your business. By taking advantage of these tax-savings opportunities, you can unlock a variety of benefits, such as increasing your cash flow, improving your financial stability, and enhancing your overall business performance.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreThe first deduction we’ll explore is the research and development (R&D) tax credit. R&D activities are not limited to scientific laboratories; instead, they encompass a broad range of innovative endeavors undertaken by businesses of all sizes. By leveraging this deduction, small business owners can recoup a portion of their expenditures on qualifying R&D activities, such as product improvement, software development, and process enhancements. The R&D tax credit can significantly reduce your tax burden and bolster your finances, allowing you to channel more resources into innovation and growth.

- Deductions for Home Offices

- Maximize Your Savings with These Tips

- Business Vehicle Expenses

- Find Out How to Legally Reduce Your Tax Liability

- Capital Equipment Depreciation

- Increase Your Bottom Line with This Tax Strategy

- Research and Development Tax Credits

- Learn How Your Innovations Can Reduce Your Taxes

- Qualified Business Income Deduction

- Find Out If You Qualify for This Valuable Tax Break

- Health Insurance Premiums

- 1. Medical Expense Deduction

- 2. Health Savings Accounts (HSAs)

- 3. Premiums for Self-Employed Individuals

- 4. Small Business Health Care Tax Credit

- 5. High-Deductible Health Plans (HDHPs)

- 6. Section 125 Cafeteria Plan

- Discover How to Deduct Your Healthcare Costs

- Questions and answers

Deductions for Home Offices

Unlock the potential tax savings available to small business owners who operate their businesses from the comfort of their own homes. By taking advantage of deductions specifically designed for home offices, you can maximize your financial benefits and reduce your overall tax liability.

When it comes to tax deductions for home offices, there are multiple opportunities available for small business owners. These deductions can help offset expenses related to the use of your home as a workspace, such as rent or mortgage payments, utilities, maintenance costs, and even depreciation of your property.

By utilizing the home office deduction, you can deduct a portion of these expenses based on the square footage of your home office in relation to your overall living space. Additionally, if you use your home office exclusively for business purposes, you may also be eligible for a deduction for the entire amount of your internet, phone, and office supplies expenses.

It is important to carefully track and document your home office expenses to ensure you meet the eligibility requirements set by the Internal Revenue Service (IRS) and avoid any potential audits. Keeping detailed records of your business-related expenses and maintaining a separate area within your home dedicated solely to your business activities can further strengthen your tax position.

Remember to consult with a tax professional or utilize tax software to accurately calculate and claim your deductions for home offices. They can provide guidance specific to your situation and help you take full advantage of all the deductions available to you as a small business owner.

By uncovering and utilizing deductions for home offices, you can effectively lower your taxable income, increase your savings, and ultimately contribute to the financial success of your small business.

Maximize Your Savings with These Tips

Increase your potential for financial gain by implementing these strategies that can help you maximize your savings. By incorporating these tips into your financial planning, you can enhance your ability to accumulate funds and secure a prosperous future for your business.

1. Optimize Deductions: Make sure you are taking advantage of all available deductions. Identify expenses that qualify as deductible and ensure you are properly documenting and recording them.

2. Leverage Tax Credits: Explore tax credits that are applicable to your industry or business activities. By utilizing these credits, you can significantly reduce your tax liability and boost your overall savings.

3. Invest in Retirement Plans: Take advantage of retirement plans specifically designed for small business owners. By contributing to these plans, you not only secure a financially stable future for yourself but also benefit from potential tax advantages.

4. Consider Equipment Purchases: If your business requires new equipment or technology, evaluate the option of purchasing them before year-end. This can allow you to take advantage of accelerated depreciation or immediate expensing, providing substantial tax savings.

5. Hire Veterans: By employing veterans, you may qualify for certain tax incentives and credits. This can not only contribute to your onboarding process but also result in significant tax savings for your business.

6. Consult a Tax Professional: Seek guidance from a knowledgeable tax professional who can assist you in uncovering additional tax savings opportunities specific to your business. Their expertise can help ensure you are maximizing your deductions and credits while staying compliant.

|

Note: The information provided in this article is for general informational purposes only and should not be considered as professional tax advice. It is recommended to consult with a qualified tax professional before making any financial decisions. |

Business Vehicle Expenses

When it comes to running a successful business, managing vehicle expenses plays a vital role in achieving financial efficiency. This section will explore the various deductions and write-offs that can be utilized by small businesses to maximize tax benefits related to their vehicles.

| Deductible Expenses | Benefits |

|---|---|

| Fuel Costs | Reduces taxable income and helps offset the expenses of transporting goods, services, or employees. |

| Maintenance and Repairs | Allows for deductions on routine maintenance, repairs, and necessary upgrades. |

| Leasing and Rental Fees | Provides opportunities for deductions on the costs associated with leasing or renting vehicles for business purposes. |

| Insurance Premiums | Allows for deductions on insurance premiums paid to cover business vehicles. |

| Depreciation | Enables businesses to deduct a portion of the vehicle’s value over time to reflect wear and tear. |

| Parking Fees and Tolls | Provides deductions on parking fees and tolls incurred during business-related travel. |

By taking advantage of these deductions, small business owners can significantly reduce their taxable income and ultimately, save money. However, it’s essential to maintain accurate records and adhere to the IRS guidelines to ensure compliance and avoid potential audits. Overall, leveraging business vehicle expenses is a smart strategy to unlock financial benefits and drive profitability for small businesses.

Find Out How to Legally Reduce Your Tax Liability

Discover effective strategies to minimize the amount of taxes you owe without breaking any laws. Learn how to optimize your tax situation and take advantage of available opportunities to decrease your tax liability in a lawful manner.

Capital Equipment Depreciation

Managing the financial aspects of a small business involves understanding various strategies to minimize expenses and maximize profits. One such strategy is capital equipment depreciation, which allows businesses to gradually deduct the cost of their long-term assets over a period of time.

In simple terms, capital equipment depreciation refers to the reduction in value of assets that are used in a business over their useful life. This reduction in value is recognized as an expense and is deducted from the business’s taxable income, ultimately resulting in tax savings.

Depreciating capital equipment provides several benefits for small businesses. First and foremost, it helps spread out the cost of high-value assets over their useful life, rather than incurring a significant upfront expense. This means that businesses can allocate their financial resources more efficiently and invest in other areas of growth. Additionally, by deducting the depreciation expense, businesses are able to lower their taxable income and, consequently, reduce their tax liability.

It’s important to note that not all assets can be depreciated. Usually, assets that have a determinable useful life of more than one year and are used for business purposes are eligible for capital equipment depreciation. This includes items such as machinery, vehicles, computers, furniture, and buildings. Each asset is assigned a specific depreciation method and recovery period, which determines the timing and amount of deductions that can be claimed.

Overall, capital equipment depreciation is a valuable tool for small businesses in terms of minimizing taxes and managing expenses. By taking advantage of this strategy and properly calculating the depreciation of their assets, businesses can unlock significant cost savings and improve their financial position.

Increase Your Bottom Line with This Tax Strategy

Maximize your profits and boost your financial standing with this powerful method for reducing your tax liability. By effectively implementing this tax strategy, you can optimize your bottom line and keep more of your hard-earned money.

| 1. Boosting Deductions | Enhance your deductions by employing various legitimate techniques that can minimize your taxable income. |

| 2. Leveraging Tax Credits | Create opportunities to leverage tax credits available for small businesses, which can significantly reduce your overall tax burden. |

| 3. Capitalizing on Expense Write-Offs | Identify and capitalize on the expense write-offs specifically tailored for your business, allowing you to deduct eligible expenses and save money in the process. |

| 4. Utilizing Tax-Advantaged Accounts | Take advantage of tax-advantaged accounts such as Health Savings Accounts (HSAs) and retirement plans to both save for the future and reduce your taxable income. |

| 5. Incorporating Tax Planning Throughout the Year | Implement a comprehensive tax planning strategy that considers the entirety of the year, ensuring you make the most beneficial decisions for your business. |

| 6. Seeking Professional Guidance | Consult with a knowledgeable tax professional who can help you navigate the complex tax landscape, providing guidance and insights that can enhance your tax strategy. |

By following these effective tax strategies, you can effectively increase your bottom line and optimize your financial success. Remember, every dollar saved in taxes is an additional dollar that can be reinvested in your business, helping it grow and thrive.

Research and Development Tax Credits

Innovation and advancement are key drivers of successful businesses. Companies that invest in research and development (R&D) activities often face significant costs associated with these endeavors. However, to encourage and support their contributions to technological progress and economic growth, governments provide tax incentives in the form of research and development tax credits.

R&D tax credits are a means for businesses to recoup a portion of their R&D expenditures through tax savings. These credits aim to reward companies that invest in scientific research, experimental development, and technological innovation. By offsetting a portion of the costs incurred during the R&D process, businesses can free up capital to reinvest in further research or other areas of their operations.

Research and development tax credits are designed to spark advancements across various industries, from pharmaceuticals and technology to manufacturing and engineering. They incentivize businesses to push the boundaries of knowledge and develop new products, processes, or services, ultimately driving economic growth and competitiveness.

| Benefits of Research and Development Tax Credits |

|---|

| 1. Financial Relief: R&D tax credits can significantly reduce a company’s tax liability, providing immediate financial relief by lowering their overall tax burden. |

| 2. Encouraging Innovation: By offering financial incentives, governments inspire businesses to invest in research and development, promoting the creation of new and improved products or services. |

| 3. Competitive Advantage: Companies that leverage R&D tax credits gain a competitive edge by being better equipped to invest in innovation, which can lead to a stronger market position. |

| 4. Job Creation and Economic Growth: Through increased investment in R&D, businesses create job opportunities and contribute to the overall growth and development of the economy. |

While the specifics of research and development tax credits vary by country and jurisdiction, they typically require businesses to meet certain criteria, such as engaging in qualifying R&D activities and documenting their expenditures. These credits serve as a powerful tool for small businesses to leverage their innovative efforts, stimulate growth, and optimize their financial performance.

Learn How Your Innovations Can Reduce Your Taxes

In this section, we will explore how your creative ideas and innovations can have a positive impact on your tax liabilities. By thinking outside the box and finding unique solutions to problems or implementing inventive strategies, you can legally reduce the amount of taxes your small business is required to pay.

By leveraging your ingenuity, you may be eligible for various tax deductions and incentives that reward innovation. These deductions can help lower your taxable income, potentially reducing the overall tax burden on your business. Instead of simply being seen as a cost, your innovations can be considered valuable assets that can contribute to your bottom line.

When you introduce a new product or service, or even improve an existing one, it demonstrates your commitment to advancement and growth. It shows that you are actively investing in your business and creating value for your customers. From a tax perspective, the expenses incurred during the development and implementation of these innovations might be deductible.

In addition to deductions, certain government programs and incentives exist specifically to encourage and reward innovation and research. Through these programs, you can receive tax credits or even grants that can help offset the costs associated with developing new technologies or processes. These incentives can provide a significant boost to your business and foster an environment of continued innovation.

However, it is important to remember that not all innovative activities will automatically qualify for tax benefits. The key is to understand the specific criteria and rules governing each deduction or incentive, as they can vary depending on your industry and jurisdiction. Consulting with a tax professional who specializes in small business taxation can help ensure that you maximize the tax savings available to you.

In conclusion, by leveraging your innovative ideas, you have the potential to reduce your tax liabilities and capitalize on tax savings. Embrace your entrepreneurial spirit and explore how your innovations can contribute to your financial success while complying with applicable tax laws. Your creativity and ingenuity can unlock tax advantages and potentially pave the way for continued growth and prosperity for your small business.

Qualified Business Income Deduction

In this section, we will explore the Qualified Business Income Deduction, an advantageous opportunity for small businesses to potentially reduce their taxable income. This deduction allows eligible businesses to deduct a portion of their qualified business income, resulting in potential tax savings. Understanding and optimizing this deduction can be beneficial for small businesses looking to maximize their profitability.

The Qualified Business Income Deduction provides small businesses with the opportunity to lower their taxable income by a certain percentage, based on their qualified business income. This deduction applies to businesses that qualify as pass-through entities, such as sole proprietorships, partnerships, S corporations, and limited liability companies (LLCs).

By effectively utilizing the Qualified Business Income Deduction, small businesses have the potential to significantly reduce their tax liability and retain more of their hard-earned profits. However, it is important to note that there are specific requirements and limitations associated with this deduction.

Meeting the criteria for the Qualified Business Income Deduction requires businesses to have qualified business income, which includes income generated from regular business activities. This deduction also takes into account various factors such as the nature of the business, the type of income generated, and the taxable income of the business owner.

It is essential for small business owners to understand the intricacies of the Qualified Business Income Deduction and consult with qualified professionals to ensure they are taking full advantage of this opportunity. Proper planning and strategic decision-making can result in substantial tax savings and contribute to the overall financial health and success of the business.

In conclusion, the Qualified Business Income Deduction presents a valuable opportunity for small businesses to reduce their taxable income and potentially realize significant tax savings. By carefully navigating the requirements and limitations associated with this deduction, business owners can optimize their tax strategy and enhance their financial stability.

Find Out If You Qualify for This Valuable Tax Break

Discover if you meet the criteria for a highly beneficial tax break that can help small businesses maximize their savings. By exploring the eligibility requirements, you can determine if you qualify for this valuable opportunity to reduce your tax liability.

Unravel whether you are eligible to take advantage of this advantageous tax break by understanding the specific qualifications. By meeting the necessary criteria, you can potentially unlock significant savings for your small business.

Learn more about the potential benefits this tax break can offer to business owners. By delving into the details, you can uncover how this opportunity can positively impact your financial situation and provide a boost to your business’s bottom line.

Gain insights into the key factors that determine eligibility for this tax break. By identifying the essential requirements, you can determine if your business meets the necessary conditions and is eligible to claim this valuable deduction.

Discover the potential advantages of this tax break for your small business. By understanding the unique benefits it offers, you can make an informed decision about pursuing this opportunity to maximize your tax savings.

Examine the specific criteria that must be met to qualify for this tax break. By evaluating your business’s situation against these requirements, you can assess whether you are eligible to take advantage of this valuable deduction.

Uncover valuable tips and advice on how to navigate through the qualifying process for this tax break. By following these recommendations, you can increase your chances of meeting the criteria and accessing the potential tax savings it offers.

Health Insurance Premiums

One significant aspect of managing a small business is considering the various expenses and benefits associated with health insurance. Health insurance premiums play a crucial role in providing financial protection and access to healthcare services for business owners and their employees.

Ensuring that small businesses can provide quality healthcare coverage to their employees without breaking the bank is an essential goal for many entrepreneurs. By understanding the tax implications and potential write-offs associated with health insurance premiums, small businesses can save valuable funds and provide valuable benefits to their workforce.

1. Medical Expense Deduction

- Claiming medical expense deductions can help small businesses offset the cost of health insurance premiums. These deductions cover a range of medical expenses, including premiums paid for health coverage.

- Small business owners should keep all relevant receipts and documentation to support their claim for medical expense deductions.

- Consulting with a tax professional can provide further guidance on eligibility and maximizing deductions.

2. Health Savings Accounts (HSAs)

- Health Savings Accounts (HSAs) offer a tax-advantaged way for small business owners and employees to save and pay for medical expenses.

- The contributions made to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

- Small businesses can contribute to their employees’ HSAs, providing a valuable benefit while potentially reducing their own taxable income.

3. Premiums for Self-Employed Individuals

- Self-employed individuals can deduct 100% of their health insurance premiums, making it a significant advantage for entrepreneurs.

- The premiums can be deducted as an adjustment to income on the individual’s tax return.

- Note that this deduction is only available for self-employed individuals and not for employees who receive health insurance coverage from their employers.

4. Small Business Health Care Tax Credit

- The Small Business Health Care Tax Credit is available for eligible small businesses that provide health insurance coverage to their employees.

- The credit can offset a portion of the premiums paid by the business, providing valuable tax savings.

- Understanding the eligibility criteria and requirements for this credit can help small businesses take advantage of this cost-saving opportunity.

5. High-Deductible Health Plans (HDHPs)

- Choosing a High-Deductible Health Plan (HDHP) can offer potential tax savings for small businesses.

- HDHPs are associated with lower monthly premiums, allowing businesses to allocate their funds strategically while still providing coverage for major medical expenses.

- Small business owners considering HDHPs should weigh the potential tax benefits against the higher out-of-pocket costs for employees.

6. Section 125 Cafeteria Plan

- A Section 125 Cafeteria Plan allows employees to contribute a portion of their pre-tax salary toward health insurance premiums.

- By utilizing this plan, small businesses can reduce their employees’ taxable income, while also potentially reducing their own tax liability.

- It is crucial for small business owners to understand the requirements and restrictions associated with implementing a Section 125 Cafeteria Plan.

Exploring and understanding the various tax deductions, credits, and savings opportunities related to health insurance premiums can significantly benefit small businesses. By maximizing these write-offs, entrepreneurs can prioritize their employees’ well-being while also optimizing their financial resources.

Discover How to Deduct Your Healthcare Costs

When it comes to managing your small business, one area that can often be overlooked is healthcare costs. However, understanding how to deduct these expenses can lead to significant tax savings for your business.

Maximizing your healthcare deductions:

In order to maximize your healthcare deductions, it is essential to carefully track all of your medical expenses throughout the year. This includes not only premiums for health insurance coverage, but also any out-of-pocket expenses such as doctor visits, prescriptions, and medical treatments.

Separating personal and business healthcare expenses:

An important step in deducting your healthcare costs is separating personal and business expenses. This means keeping separate records and receipts for any medical expenses that are directly related to your business. By doing so, you can ensure that you only deduct the eligible expenses that pertain to your business operations.

Utilizing a Health Savings Account (HSA):

An HSA is a tax-advantaged savings account that can be used to pay for qualified medical expenses. By contributing to an HSA, you not only save money on taxes but also have a dedicated fund to cover your healthcare costs. Contributions to an HSA are tax-deductible and any withdrawals for qualified medical expenses are tax-free.

Considering the Small Business Health Care Tax Credit:

If you meet certain criteria, you may be eligible for the Small Business Health Care Tax Credit. This credit can significantly reduce your healthcare costs by offsetting a portion of your premium expenses. To qualify, you must have fewer than 25 full-time employees, pay average annual wages below a certain threshold, and contribute a percentage towards employee premiums.

Consulting with a tax professional:

In order to ensure that you are taking full advantage of healthcare deductions and credits, it is advisable to consult with a tax professional who specializes in small business taxes. They can provide guidance tailored to your specific situation and help you navigate the complex rules and regulations surrounding healthcare deductions.

Conclusion:

Deducting healthcare costs can be a valuable strategy for small businesses looking to save on taxes. By carefully tracking and separating expenses, utilizing tax-advantaged accounts, and exploring available credits, you can maximize your deductions and reduce your overall healthcare costs.

Questions and answers

What are some tax write-offs that can benefit small businesses?

Some tax write-offs that can benefit small businesses include home office deduction, business vehicle expenses, equipment purchases, travel expenses, and employee benefits.

How does the home office deduction work for small businesses?

The home office deduction allows small business owners to deduct expenses related to the use of their home for business purposes. This includes a portion of rent or mortgage interest, utilities, and other expenses directly associated with the home office.

Can small businesses deduct the expenses of their business vehicles?

Yes, small businesses can deduct expenses related to their business vehicles. This includes fuel costs, maintenance and repairs, insurance, and even depreciation expenses.

What equipment purchases can small businesses write off?

Small businesses can write off expenses for purchasing equipment used for business purposes. This can include computers, printers, office furniture, machinery, and other necessary tools.

Are travel expenses tax-deductible for small businesses?

Yes, travel expenses related to business purposes are tax-deductible for small businesses. This includes costs for transportation, accommodation, meals, and even certain entertainment expenses.

What are some tax write-offs that can benefit small businesses?

There are several tax write-offs that can benefit small businesses. Some of them include deductions for home office expenses, business-related travel and entertainment expenses, equipment purchases, health insurance premiums, and contributions to retirement plans.

Can you explain how small businesses can deduct home office expenses?

Small businesses can deduct home office expenses if they use a part of their home exclusively for business purposes. The deduction can be calculated by either using the simplified method of multiplying the square footage of the office space by a prescribed rate or by using the regular method, which involves allocating specific expenses such as rent, utilities, and internet costs.

What are some examples of business-related travel and entertainment expenses that small businesses can deduct?

Examples of business-related travel and entertainment expenses that small businesses can deduct include the cost of airfare or transportation, accommodation, meals, and entertainment expenses incurred while attending business meetings, conferences, or networking events.

How can small businesses deduct equipment purchases?

Small businesses can deduct equipment purchases by taking advantage of the Section 179 deduction, which allows them to deduct the full cost of qualifying equipment in the year it was purchased, rather than depreciating it over several years. There are certain limits and restrictions associated with this deduction, so it’s important to consult with a tax professional.

What types of retirement plans can small businesses contribute to for tax savings?

Small businesses have various retirement plan options that they can contribute to for tax savings. Some of these include Simplified Employee Pension (SEP) IRA, Savings Incentive Match Plan for Employees (SIMPLE) IRA, and individual 401(k) plans. Each plan has its own rules and contribution limits, so it’s advisable to seek guidance from a financial advisor or tax professional.