In a world dominated by instant gratification and impulse purchases, it’s becoming increasingly challenging to establish healthy spending habits and keep track of your hard-earned money. If you’ve ever found yourself wondering where all your money went at the end of the month or struggling to save up for an important goal, we have a game-changing solution for you.

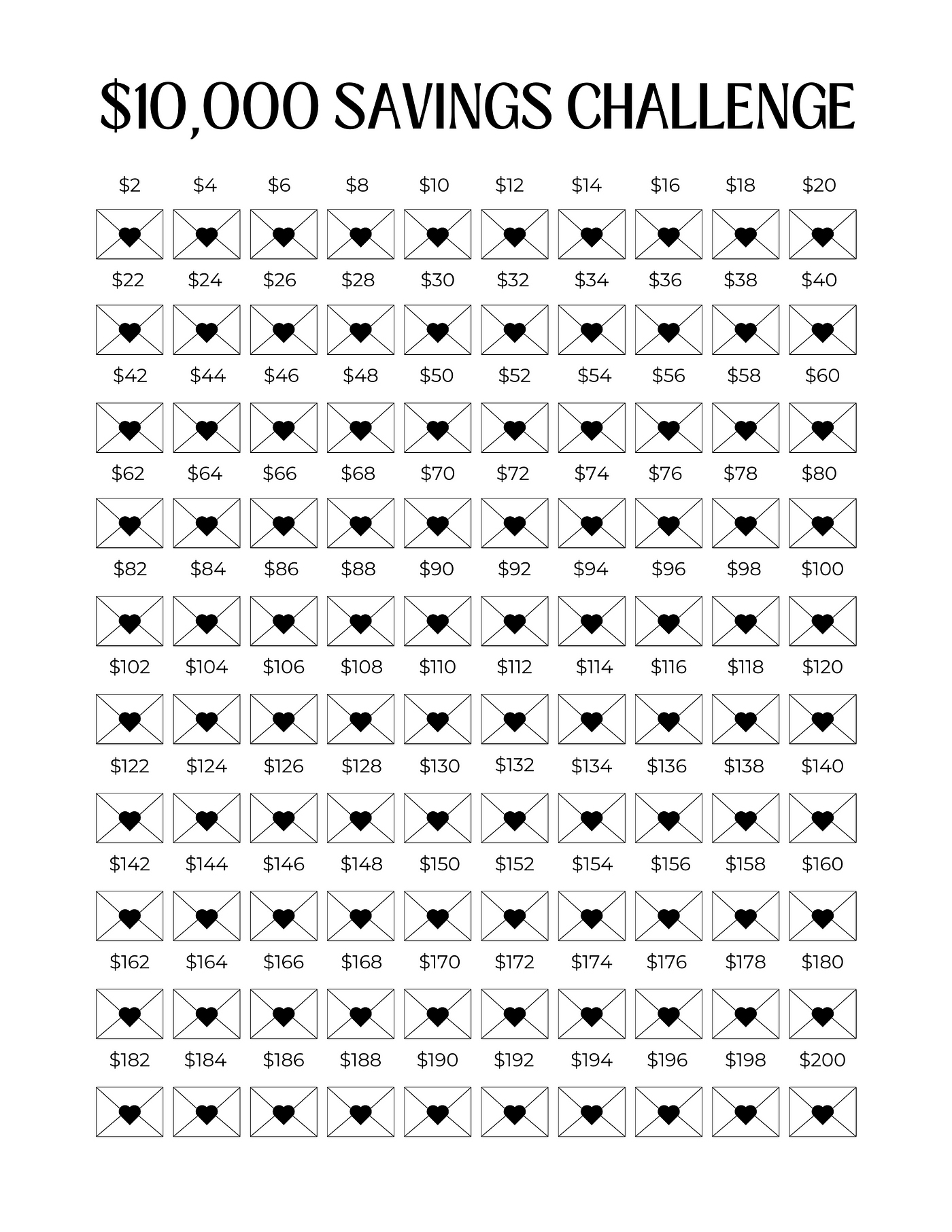

Introducing the ingenious 100 Envelope Savings Challenge – a simple yet effective method that will transform the way you think about money. This innovative approach leverages the power of tangible envelopes to revolutionize your saving habits and supercharge your financial goals.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreImagine a world where every dollar has a purpose, where your financial aspirations are within reach, and where you can confidently say no to impulsive purchases. The 100 Envelope Challenge empowers you to take control of your finances and make mindful choices that align with your long-term goals.

By assigning a specific purpose to each envelope, whether it’s your dream vacation, a down payment on a new home, or a safety net for unexpected expenses, you’ll embark on a transformative journey towards financial freedom and true peace of mind. Gone are the days of frivolous spending and regretful purchases – with the 100 Envelope Savings Challenge, you’ll embark on a life-changing adventure that will leave you feeling empowered and in control of your financial destiny.

Are you ready to embark on this groundbreaking savings adventure and transform your financial future? Join us in exploring the incredible benefits, practical tips, and success stories that stem from the 100 Envelope Savings Challenge. It’s time to embark on a journey towards financial freedom, one envelope at a time!

- Discover the Power of the 100 Envelope Savings Challenge

- Save Big with a Fun and Effective Money-Saving Method

- Why the 100 Envelope Savings Challenge Works

- Track Your Progress and Achieve Your Savings Goals Faster

- Enjoy the Rewards of Disciplined Spending and Smart Saving

- Getting Started with the 100 Envelope Savings Challenge

- Create Your Envelope System and Set Realistic Savings Targets

- Establish a Budget and Allocate Funds to Your Savings Envelopes

- Implement Strategies to Stay Motivated and Avoid Temptation

- Tips and Tricks for Maximizing Savings with the 100 Envelope Challenge

- Find Creative Ways to Reduce Expenses and Boost Your Savings

- Explore the Power of Automation and Technology for Easy Money Management

- Questions and answers

Discover the Power of the 100 Envelope Savings Challenge

Unveiling the Potential of the 100 Envelope Savings Challenge

In this section, we will explore the immense benefits and transformative power of participating in the 100 Envelope Savings Challenge. Through a unique and engaging approach, this challenge promises to revolutionize the way you save money.

Embark on a rewarding journey that enables you to strengthen your financial discipline, develop a consistent savings habit, and reach your financial goals faster than ever before. Say goodbye to traditional savings methods and embrace this innovative challenge that takes a fresh approach to attaining financial stability.

With the 100 Envelope Savings Challenge, you’ll find yourself taking small yet systematic steps towards saving, allowing you to customize your savings journey according to your unique needs and aspirations. By using envelopes as financial tools, you’ll gain a tangible and visual representation of your progress, which serves as a constant motivation to stay on track.

As you delve deeper into the 100 Envelope Savings Challenge, you’ll discover the true power of this method lies in its simplicity yet effectiveness. By breaking down your savings into manageable amounts, you’ll effortlessly build up a significant sum over time without feeling overwhelmed.

Through the strategic allocation of funds into different envelopes, you’ll be able to prioritize your financial goals and allocate resources accordingly. This not only makes saving more enjoyable but also empowers you to make better financial decisions that align with your long-term objectives.

Whether you aspire to fund your dream vacation, pay off debts, or build an emergency fund, the 100 Envelope Savings Challenge provides a versatile and adaptable framework that caters to your specific intentions. Discover how embracing this challenge can bring you closer to financial freedom and a more secure future.

In the following sections, we will delve deeper into the practical aspects of the 100 Envelope Savings Challenge, helping you kick-start your savings journey and unlock the full potential it offers. Get ready to witness the transformative power of this innovative approach and take control of your financial well-being like never before.

Save Big with a Fun and Effective Money-Saving Method

.png)

Discover an exciting and efficient way to maximize your savings with a unique and entertaining approach. By embracing a fun and effective money-saving method, you can achieve significant financial benefits while enjoying the process.

Immerse yourself in a distinctive technique that not only helps you save money but also adds a touch of adventure to your financial journey. This innovative approach is designed to make the process of saving more enjoyable, motivating, and rewarding.

With this engaging method, you can explore creative ways to cut down on unnecessary expenses without feeling deprived. By thinking outside the box and incorporating a sense of excitement into your saving routine, you’ll find yourself motivated to stick with your financial goals and surpass them.

Additionally, this money-saving technique encourages you to assess your spending habits, identify areas that can be reduced, and develop a sustainable budget. By actively participating in this method, you’ll gain a deeper understanding of your financial situation and make mindful decisions that contribute to your long-term financial well-being.

By adopting this fun and effective savings method, you can enjoy the journey of reaching your financial goals while building a strong foundation for your future. Begin your money-saving adventure today, and witness the remarkable difference it can make in your financial life.

Why the 100 Envelope Savings Challenge Works

Understanding the effectiveness of the 100 Envelope Savings Challenge requires delving into the psychology of saving and financial management. This unique savings method taps into our natural inclination to compartmentalize our finances and set clear goals. By breaking down our savings into 100 envelopes, each representing a small portion of our overall target, we are able to make progress and stay motivated throughout the journey.

One of the key reasons the 100 Envelope Savings Challenge works is its simplicity. Unlike traditional savings methods that may involve complex calculations or strict budgeting, this challenge offers a straightforward approach that anyone can adopt. It doesn’t require any special skills or knowledge, making it accessible to people from all walks of life.

Moreover, the 100 Envelope Savings Challenge leverages the power of visualization. By physically seeing and holding each envelope, we create a tangible representation of our savings goals. This visual reminder serves as a constant motivator, reminding us of our financial aspirations and encouraging us to stay committed to our saving journey.

In addition, the challenge fosters discipline and self-control. As we gradually fill each envelope with money, we develop a sense of achievement and a stronger will to resist unnecessary spending. This leads to improved financial habits and a greater ability to resist impulsive purchases, ultimately resulting in substantial savings over time.

Another reason why the 100 Envelope Savings Challenge is effective is that it encourages regular and consistent saving habits. Rather than relying on sporadic or irregular contributions to savings, this challenge promotes the importance of setting aside a fixed amount on a regular basis. This instills a sense of responsibility towards our financial well-being and helps develop long-term saving habits.

Lastly, the 100 Envelope Savings Challenge creates a positive savings mindset. It transforms the act of saving from a mundane task into an exciting and rewarding experience. Each envelope represents progress towards financial security and financial freedom, making the journey itself enjoyable and empowering.

- The 100 Envelope Savings Challenge leverages psychological factors to keep individuals motivated.

- It offers a simple and accessible approach that doesn’t require special skills or knowledge.

- Visual representation through envelopes acts as a constant motivator.

- It fosters discipline, self-control, and improved financial habits.

- The challenge promotes regular and consistent saving habits.

- It creates a positive savings mindset, making the journey enjoyable and empowering.

Track Your Progress and Achieve Your Savings Goals Faster

Monitoring your progress and staying focused on your savings goals is crucial for achieving financial success. By implementing effective tracking methods, you can accelerate your savings journey and reach your targets faster than ever.

One way to track your progress is by keeping a detailed record of your income and expenses. This will give you a clear understanding of where your money is going and help you identify areas where you can cut back to save more. By categorizing your expenses, such as housing, transportation, groceries, and entertainment, you can easily see which areas require adjustments.

Another method to track your progress is by creating a visual representation of your savings goals. This can be done through a savings tracker, either on paper or digitally. A savings tracker allows you to visually track your progress, giving you a sense of accomplishment as you see your savings grow. You can break down your goals into smaller milestones and celebrate each milestone you achieve along the way.

In addition to tracking your progress, it’s important to regularly assess and adjust your savings goals. As circumstances change, such as a pay raise, a decrease in expenses, or unexpected expenses, you may need to revise your goals to stay on track. Regularly reviewing your progress will help you stay motivated and make necessary adjustments to ensure your success.

Lastly, consider seeking support from friends, family, or online communities. By sharing your savings goals with others, you can gain valuable advice, encouragement, and accountability. Connecting with like-minded individuals who are also working towards financial freedom can provide a sense of community and inspiration to achieve your goals.

In conclusion, tracking your progress and staying focused on your savings goals are essential steps to achieving financial success. By implementing effective tracking methods, creating visual representations of your goals, regularly assessing and adjusting, and seeking support, you can accelerate your savings journey and achieve your goals faster than you thought possible.

Enjoy the Rewards of Disciplined Spending and Smart Saving

Reap the benefits of practicing controlled expenditures and intelligent financial preservation. By developing disciplined spending habits and implementing savvy saving strategies, individuals can unlock a world of rewards, both immediate and long-term.

Disciplined spending entails making thoughtful and intentional choices regarding the allocation of resources. By carefully considering needs versus wants and prioritizing expenditures accordingly, individuals can ensure that every dollar spent brings value and aligns with their personal financial goals. This practice empowers individuals to regain control over their finances and avoid impulsive and unnecessary purchases.

Smart saving, on the other hand, involves employing various techniques to maximize the growth and security of one’s savings. This includes building an emergency fund, contributing to retirement accounts, and exploring investment opportunities. By setting aside a portion of income on a regular basis and making it a priority, individuals can create a strong financial foundation and reap the rewards of compound interest and long-term wealth accumulation.

Engaging in disciplined spending and smart saving not only enables individuals to reach their financial goals faster, but it also provides a sense of security and peace of mind. By having control over their finances, individuals can withstand unforeseen circumstances and have the flexibility to pursue their dreams and aspirations. Furthermore, the ability to make informed financial decisions fosters a sense of empowerment and confidence in one’s own capabilities, leading to improved overall well-being.

In conclusion, embracing disciplined spending and smart saving practices offers a multitude of rewards, from financial stability to personal fulfillment. By exercising control over expenditures and implementing effective saving strategies, individuals can experience the freedom and peace that comes with financial security.

Getting Started with the 100 Envelope Savings Challenge

Begin your journey on the path to financial success with the 100 Envelope Savings Challenge. This unique savings method allows you to set aside money in designated envelopes each week, helping you reach your savings goals without much effort.

Before diving into the challenge, it’s important to understand the key steps involved in getting started:

| 1 | Create Envelopes |

| 2 | Assign Savings Goals |

| 3 | Establish a Savings Routine |

| 4 | Track Progress |

Firstly, start by creating physical envelopes or digital equivalents to represent your savings categories. It could be specific goals like Emergency Fund, Vacation, or New Car. By designating envelopes for different purposes, you can easily track your progress and stay organized throughout the challenge.

Next, assign realistic savings goals to each envelope. Determine how much money you want to save for each category and break it down into manageable weekly amounts. This way, the challenge becomes more achievable and less overwhelming.

Once you have your envelopes and goals set up, establish a savings routine. Decide on a regular time and day each week to contribute to your envelopes. It could be every payday or a specific day when you’re more likely to have extra cash. Consistency is key to making the challenge a habit and achieving your financial objectives.

Lastly, track your progress regularly. Keep a record of the amounts deposited into each envelope, update it weekly, and visually see how your savings are growing. This not only provides motivation but also helps you stay accountable and adjust your savings strategy if necessary.

By following these steps, you’ll be well on your way to success with the 100 Envelope Savings Challenge. Remember, it’s about taking small steps consistently to achieve big financial results. So start today and watch your savings grow!

Create Your Envelope System and Set Realistic Savings Targets

Developing a personalized envelope system is an effective method for managing your finances and working towards your savings goals. By allocating specific amounts of money to various categories, you can gain better control over your spending and optimize your savings. This section will guide you through the process of creating your own envelope system and setting realistic savings targets.

1. Determine your financial priorities: Before you start dividing your money into different envelopes, take some time to identify your financial priorities. Consider your short-term and long-term goals, such as saving for emergencies, paying off debts, or funding a vacation. Knowing your priorities will help you allocate your resources effectively.

2. Categorize your expenses: Next, categorize your expenses into different areas, such as groceries, transportation, entertainment, and utilities. This will enable you to get a clear overview of your spending habits and identify areas where you can potentially cut back and save. Be as specific as possible when categorizing your expenses, as this will help you track your progress more accurately.

3. Allocate funds to each envelope: Once you have identified your financial priorities and categorized your expenses, start allocating funds to each envelope. Determine how much money you are comfortable setting aside for each category and distribute it accordingly. Be realistic and flexible throughout this process, as your financial situation may change over time.

4. Regularly review and adjust: It is essential to regularly review and adjust your envelope system to ensure it remains aligned with your goals and current financial circumstances. Consider factors such as unexpected expenses, changes in income, or new financial aspirations. By staying proactive and making adjustments when necessary, you can stay on track towards your savings targets.

5. Track your progress: Keep a record of your expenses and savings to track your progress. Consider using apps or spreadsheets to make this process easier and more organized. Monitoring your progress will allow you to celebrate your achievements, identify areas for improvement, and stay motivated on your savings journey.

Remember, creating an envelope system and setting realistic savings targets is a personal process. Take the time to tailor it to your unique financial situation and adapt it as needed. With consistency and determination, you can make significant strides towards achieving your savings goals.

Establish a Budget and Allocate Funds to Your Savings Envelopes

In this section, we will explore the importance of creating a financial plan and distributing your money into designated savings envelopes. By creating a budget, you can effectively manage your expenses and prioritize your savings goals.

Outline Your Financial Goals:

The first step in establishing a budget is to determine your financial goals. Whether it’s saving for a dream vacation, paying off debt, or building an emergency fund, having clear objectives will help you stay motivated and focused on saving.

Delineate Spending Categories:

To better manage your finances, divide your expenses into categories such as groceries, utilities, transportation, entertainment, and discretionary spending. Analyzing your spending patterns will give you a better understanding of where your money goes and where you can make adjustments to allocate funds towards your savings envelopes.

Create a Realistic Budget:

Once you have a clear picture of your financial goals and spending patterns, it’s time to create a budget that aligns with your income and expenses. Consider your monthly income, fixed expenses, and estimated variable expenses. This will help you determine how much money you can allocate towards your savings envelopes.

Distribute Funds to Savings Envelopes:

Now that you have a budget, divide your available funds into different savings envelopes based on your financial goals. Assign a specific amount to each envelope and make sure it is consistent with your budget. This will ensure that you are regularly contributing to your savings and making progress towards achieving your goals.

Review and Adjust Regularly:

It’s important to review your budget and savings allocations regularly. Life circumstances and financial goals may change, requiring adjustments to your budget. Be flexible and adapt as needed to maximize your savings potential.

By establishing a budget and allocating funds to your designated savings envelopes, you are taking a proactive approach towards achieving your financial goals. This systematic approach will help you stay on track and save more effectively.

Implement Strategies to Stay Motivated and Avoid Temptation

In order to successfully save money and achieve your financial goals, it is important to stay motivated and resist the temptation to deviate from your savings plan. This section will discuss effective strategies to help you stay on track and avoid common pitfalls.

One key strategy is to set clear and specific savings goals. By setting measurable targets, such as saving a certain amount of money each month or reaching a specific milestone, you can stay motivated and focused on your progress. Additionally, it is helpful to break your goals down into smaller, achievable steps, allowing you to celebrate your accomplishments along the way.

Another important aspect of staying motivated is finding ways to make saving money enjoyable. Rather than viewing it as a sacrifice or a chore, try to see it as a positive and rewarding experience. You can do this by visualizing the benefits of achieving your goals, such as financial security or the ability to afford something you’ve always wanted.

Furthermore, surround yourself with reminders of your savings goals. Place visual cues, such as pictures or quotes, in your living space or workspace to serve as constant reminders of what you are working towards. Additionally, discussing your goals with supportive friends or family members can help keep you accountable and motivated.

It is also important to identify and address any potential sources of temptation that may hinder your savings efforts. This could include avoiding unnecessary shopping trips or unsubscribing from tempting promotional emails. Developing a mindset of delayed gratification can also be helpful, reminding yourself that the short-term sacrifice is worth the long-term financial gain.

In conclusion, there are various strategies you can implement to stay motivated and avoid temptation while saving money. By setting clear goals, finding enjoyment in the saving process, surrounding yourself with reminders, and addressing temptation, you will be well-equipped to achieve your financial objectives.

Tips and Tricks for Maximizing Savings with the 100 Envelope Challenge

In this section, we will explore various strategies and techniques that can help you make the most out of the 100 Envelope Challenge. By implementing these tips, you can enhance your savings journey and achieve your financial goals faster.

1. Optimize your budget: One of the key steps to maximize your savings with the 100 Envelope Challenge is to carefully analyze and optimize your budget. Identify areas where you can cut back on expenses or find more cost-effective alternatives. By reallocating funds to your savings envelopes, you can accelerate your progress.

2. Automate your savings: Make use of technology to simplify your savings process. Set up automatic transfers from your checking account to your savings envelopes on a regular basis. This ensures consistent contributions and eliminates the temptation to spend the money elsewhere.

3. Prioritize savings: Treat your savings envelopes as a priority expense. Just like you pay your bills or meet other financial obligations, allocate a fixed amount to your envelopes each month. This mindset shift will help you proactively save and stay consistent with your savings goals.

4. Seek out discounts and deals: Look for opportunities to save money through discounts, sales, and special offers. Always compare prices and consider alternative purchasing options to get the best value for your money. Every dollar you save can be allocated towards your savings envelopes.

5. Establish an emergency fund envelope: In addition to your regular savings envelopes, create a separate envelope specifically dedicated to emergency funds. This envelope will act as a safety net for unexpected expenses and help prevent you from dipping into your other savings categories.

6. Set realistic targets: While it is important to push yourself to save more, it is equally crucial to set realistic targets. Create achievable milestones that encourage consistent progress and keep you motivated throughout the 100 Envelope Challenge.

7. Stay accountable: Find ways to hold yourself accountable during the savings challenge. This could include sharing your progress with a friend or family member, joining an online community of like-minded savers, or even using a digital tracking tool to monitor your savings journey.

8. Celebrate milestones: Take the time to celebrate your savings milestones along the way. Treat yourself to a small reward or indulge in a favorite activity to acknowledge your achievements and maintain a positive mindset throughout the challenge.

By implementing these tips and tricks, you can optimize your savings approach and make the most out of the 100 Envelope Challenge. Remember, small changes and consistent efforts can lead to significant results in the long run.

Find Creative Ways to Reduce Expenses and Boost Your Savings

Discovering innovative methods to decrease your spendings and increase your savings rate can have a significant impact on your financial well-being. By exploring alternative approaches and thinking outside the box, you can identify creative ways to cut expenses and accelerate your savings growth.

One strategy is to carefully analyze your monthly budget and identify areas where you can make adjustments. This can include evaluating your recurring bills and subscriptions to see if there are any services or memberships that you no longer need or use frequently. Canceling these unnecessary expenses can free up more money to allocate towards savings.

Another approach is to explore cheaper alternatives or more cost-efficient options for products or services you regularly use. This could involve comparing prices at different stores or online platforms, seeking out discounts or promotions, or even considering making DIY solutions for certain items. By being resourceful and proactive, you can find ways to cut costs without sacrificing your quality of life.

Additionally, it can be beneficial to develop a minimalist mindset and declutter your living space. Selling or donating items that you no longer need not only frees up physical space but can also generate extra income that can be put towards saving. Embracing a simplified lifestyle can help you prioritize your financial goals and reduce unnecessary expenses.

Exploring alternative transportation options is another avenue to cut down on expenses. This could involve carpooling with colleagues or friends, using public transportation, biking, or walking for shorter distances. By reducing fuel costs or eliminating the need for a personal vehicle altogether, you can significantly reduce your transportation expenses and increase your savings potential.

Lastly, developing smart shopping habits can play a crucial role in cutting costs. This includes making shopping lists and sticking to them, looking for sales or discounts before making purchases, and avoiding impulse buying. Planning ahead and being mindful of your spending habits can help you stay on track with your savings goals.

- Analyze your monthly budget to identify areas for adjustment

- Explore cheaper alternatives for products and services

- Embrace minimalism and declutter your living space

- Consider alternative transportation options

- Develop smart shopping habits and avoid impulse buying

Explore the Power of Automation and Technology for Easy Money Management

In today’s fast-paced world, managing finances can be a daunting task. However, with the help of automation and technology, it has become easier than ever to stay on top of your money. This section aims to shed light on the numerous benefits that automation and technology offer for effortless money management.

Automation is the key to streamlining your financial processes. By setting up automatic transfers, bill payments, and savings contributions, you can ensure that your finances are being managed consistently and efficiently. This not only saves you time and effort but also reduces the risk of overlooking important financial obligations.

Technology plays a crucial role in simplifying money management. With the availability of various personal finance apps and online tools, you have the power to track your expenses, create budgets, and monitor your investments effortlessly. These tools provide real-time updates, allowing you to make informed financial decisions on the go.

| Benefits of Automation and Technology for Easy Money Management: |

|---|

| 1. Time-saving: Automation reduces manual work and frees up your valuable time. |

| 2. Accuracy: Technology eliminates human errors and ensures accurate financial calculations. |

| 3. Organization: Automated systems help in keeping track of your financial transactions and records. |

| 4. Financial discipline: Regular notifications and reminders keep you accountable and encourage disciplined money management. |

| 5. Goal-oriented: Automation allows you to set financial goals and track your progress easily. |

With the power of automation and technology at your fingertips, gone are the days of manual calculations and cumbersome paperwork. Embrace the convenience and efficiency that automation offers, and take control of your finances effortlessly.

Questions and answers

What is the 100 Envelope Savings Challenge?

The 100 Envelope Savings Challenge is a money-saving technique where you save a specific amount of money each week based on envelopes labeled from 1 to 100. Each week, you save the corresponding dollar amount that matches the envelope number.

How does the 100 Envelope Savings Challenge work?

The challenge requires you to label 100 envelopes from 1 to 100. Each week, you save the amount of money that matches the envelope number. For example, in week 1, you save $1; in week 2, you save $2, and so on until week 100 where you save $100. By the end of the challenge, you would have saved a total of $5,050.

Is the 100 Envelope Savings Challenge suitable for everyone?

Yes, the 100 Envelope Savings Challenge is suitable for anyone who wants to save money systematically. It is a simple and flexible method that allows you to adjust the savings amount according to your financial capability.

What are the benefits of the 100 Envelope Savings Challenge?

The 100 Envelope Savings Challenge has several benefits. Firstly, it helps you develop the habit of saving regularly. Additionally, it allows you to save a significant amount of money over time, which can be used for emergencies, vacations, or future financial goals. Lastly, the challenge encourages discipline and financial responsibility.

Are there any variations to the 100 Envelope Savings Challenge?

Yes, there are variations to the 100 Envelope Savings Challenge. Some people choose to save in reverse order, starting with week 100 and ending with week 1. Others modify the challenge by focusing on a shorter time frame, such as 50 or 20 weeks, and adjusting the savings amounts accordingly.

How does the 100 Envelope Savings Challenge work?

The 100 Envelope Savings Challenge is a simple savings method where you divide your income into 100 different envelopes and allocate a specific amount to each envelope. This helps you save money for various categories, such as groceries, transportation, entertainment, and more.

Why should I try the 100 Envelope Savings Challenge?

The 100 Envelope Savings Challenge is a great way to save money because it promotes discipline and budgeting. By allocating your income into different envelopes, you become more aware of your spending habits and can effectively save for different expenses. It also helps you avoid overspending and ensures that you have money set aside for emergencies.

Do I need to use actual envelopes for this challenge?

No, you don’t necessarily need to use physical envelopes. While some people prefer the tangible aspect of using envelopes, others choose to go digital and use budgeting apps or spreadsheets to track their savings. The important thing is to allocate your income into different categories and keep track of your progress.

How can I determine the amount to allocate to each envelope?

The amount you allocate to each envelope will depend on your income and expenses. Start by listing all of your monthly expenses, including bills, groceries, transportation, and entertainment. Then, prioritize these expenses and allocate a reasonable amount to each envelope accordingly. It may require some trial and error at first, but you can adjust the amounts as you go.

Can I still save money if I have a low income?

Absolutely! The 100 Envelope Savings Challenge is suitable for all income levels. While the actual amount you allocate to each envelope may be smaller with a lower income, the principle remains the same. It’s all about allocating a portion of your income to different categories and setting aside money for savings. Every little bit adds up, and over time, you’ll be able to save a significant amount.