In the fast-paced world we live in, it is essential to find ways to stretch your hard-earned dollars without compromising your quality of life. Whether you are a seasoned saver or just starting your journey towards financial freedom, this article will unveil the top 10 expert-recommended tips to significantly cut down on your daily expenses.

Are you tired of feeling like your money slips through your fingers, leaving you with little to show for all your hard work? Well, fret no more! We have gathered an array of ingenious strategies that will empower you to make smart choices and effortlessly trim your spending.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreWithin these pages, you will find insightful advice, backed by financial experts, tailored to fit anyone’s budget. From small daily adjustments to more substantial long-term changes, we have sifted through a wealth of information to bring you only the most effective and practical tips. Get ready to embark on a journey towards a more prosperous future!

Unlock the secrets that will revolutionize the way you approach your everyday expenses. Discover how to make the most of what you have without sacrificing what truly matters to you. With the combination of strategic thinking and a little discipline, you can alter your spending habits, freeing up funds for the things and experiences that truly bring joy to your life.

So, whether you dream of taking that dream vacation, saving for a down payment on a house, or simply want a little extra cushion for emergencies, read on to uncover the hidden gems that will empower you to take control of your financial destiny. It’s time to unleash your saving potential and start living a life of abundance!

Smart Shopping Strategies

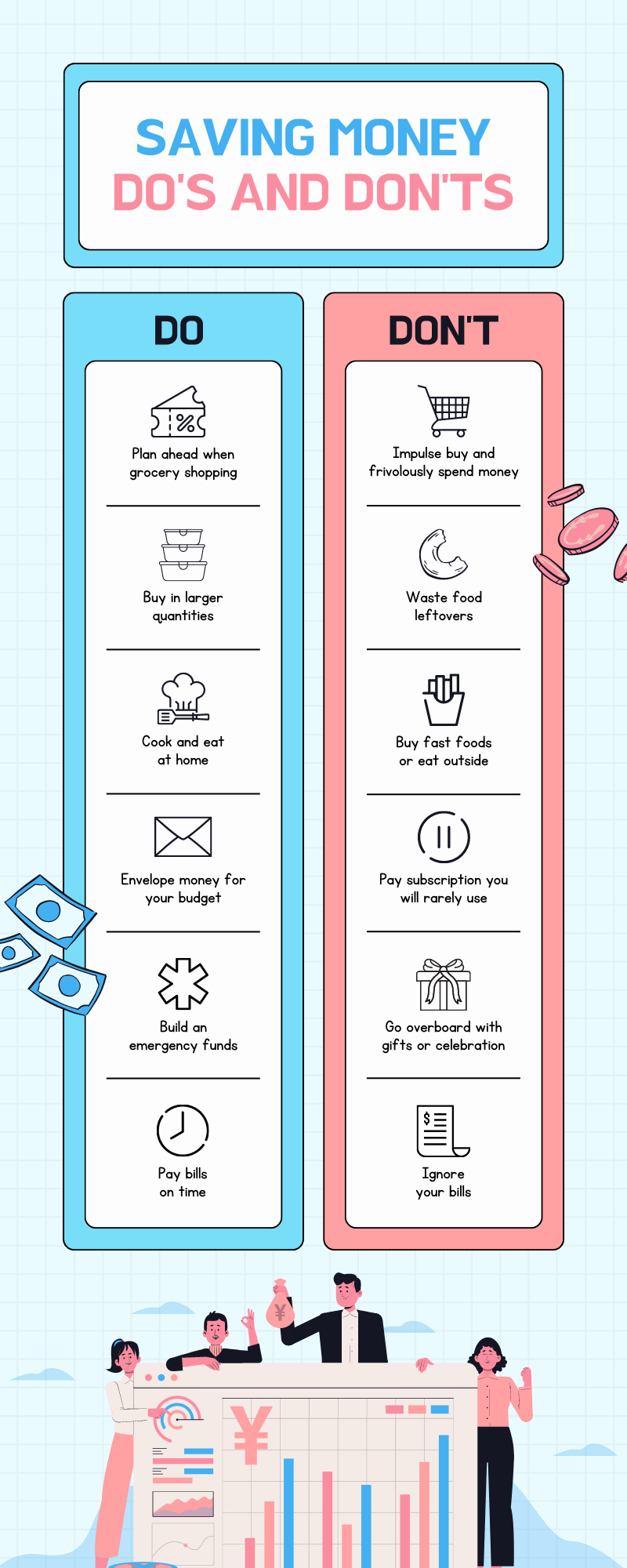

When it comes to making purchases, it’s essential to be strategic and mindful of your spending habits. By adopting smart shopping strategies, you can maximize your savings without compromising on quality or sacrificing your lifestyle. In this section, we will explore effective approaches that can help you make wise and informed purchasing decisions.

Compare Prices

In the quest to make the most of your hard-earned money, it’s essential to have a keen eye for bargains and cost-effective options. One effective way to save on your everyday expenses is by comparing prices. The practice of comparing prices allows you to make informed decisions, ensuring you get the best value for your money without compromising on quality.

When you compare prices, you’re essentially conducting research to determine the most affordable options available in the market. By evaluating different sellers, brands, or stores, you can identify variations in pricing that could potentially lead to significant savings. Price comparison not only applies to physical products but also to services, subscriptions, and other expenses that form part of your daily life.

One tactic to employ when comparing prices is to create a list or utilize online platforms that provide price comparisons. This method helps you organize your search and track down the best deals available for a particular item or service. By utilizing these resources, you can discover alternative retailers, discount codes, or seasonal sales that can substantially reduce your expenses without sacrificing quality.

Another benefit of comparing prices is the ability to negotiate or haggle for a better deal. Armed with the knowledge of different prices, you can confidently approach sellers and leverage their competitors’ offerings to negotiate a lower price or additional benefits. This strategy can be particularly useful when purchasing larger items, such as appliances or electronics, where the potential savings can be significant.

It’s important to note that comparing prices doesn’t mean solely focusing on the cheapest option available. Instead, it involves evaluating different factors such as product quality, warranty or return policies, customer reviews, brand reputation, and overall value for money. By taking all these aspects into account, you can make an informed decision that optimizes both your budget and your satisfaction with the purchase.

- Make a list of the items you frequently purchase and compare prices at different stores or online retailers.

- Utilize price comparison websites to access a range of options.

- Consider timing your purchases to coincide with sales or promotional periods to maximize savings.

- Don’t forget to factor in additional costs such as shipping fees or installation charges when comparing prices.

- Negotiate with sellers or providers using the knowledge gained from price comparisons to secure better deals.

- Keep in mind that price isn’t the only factor to consider, and prioritize value for money over solely opting for the cheapest option.

By incorporating the habit of comparing prices into your everyday routine, you can optimize your expenses and make informed purchasing decisions. The practice empowers you to find the best deals, save money in the long run, and enhance your financial well-being.

Use Coupons and Discounts

Maximize your savings by taking advantage of coupons and discounts on your everyday expenses. By utilizing these cost-saving opportunities, you can reduce the amount you spend without sacrificing the quality of your purchases.

Make it a habit to search for coupons and discounts before making any purchase. Many retailers and online stores offer promotional deals and special offers that can significantly lower your expenses. Whether it’s groceries, clothing, or household items, exploring these options can help you save a substantial amount of money.

Check newspapers, magazines, and websites for coupons that can be redeemed at your favorite stores. Additionally, sign up for newsletters or loyalty programs offered by retailers, as they often provide exclusive discounts and coupons to their members. Taking the time to research and collect these money-saving opportunities is well worth the effort.

Another effective way to save is by using discount apps and websites. These platforms offer a wide range of discounts, vouchers, and promo codes for various products and services. Simply download the app or visit the website to browse through the available offers and select the ones that align with your needs.

The next time you plan a shopping trip, check if the stores you intend to visit have any ongoing sales or promotions. Many retailers host seasonal sales, clearance events, or offer discounts on specific days of the week. By planning your purchases around these sales, you can significantly reduce your expenses while still obtaining the items you need.

In addition to traditional coupons and discounts, consider utilizing cashback programs. These programs allow you to earn a certain percentage of your purchase amount back as cash or rewards. Look for credit cards, mobile apps, or online platforms that offer cashback on your everyday expenses. This way, you can save even more money while making your regular purchases.

To summarize, using coupons and discounts is a smart strategy to save money on your everyday expenses. By being proactive in finding and utilizing these cost-saving opportunities, you can stretch your budget further and attain your desired items without overspending. Remember to stay organized, plan ahead, and stay on top of the latest offers to make the most of these money-saving techniques.

Buy in Bulk

When it comes to managing your expenses and getting the most value for your money, purchasing items in bulk can be a game-changer. By buying in larger quantities, you can often enjoy significant savings and reduce your overall spending without sacrificing quality or convenience.

Opting for bulk purchases allows you to stock up on essentials and frequently used items, which can help you avoid frequent trips to the store and save on transportation costs. Not only does this strategy save you time and effort, but it also reduces the chances of impulse buying and unnecessary expenses.

Buying in bulk is particularly beneficial for non-perishable items that have a long shelf life, such as paper products, cleaning supplies, and pantry staples. By purchasing these items in larger quantities, you can take advantage of bulk discounts and promotions, effectively lowering the cost per unit.

In addition to the financial benefits, buying in bulk can also contribute to reducing packaging waste and environmental impact. Since bulk items often come with less individual packaging, it can help minimize the use of plastic and other non-recyclable materials, promoting a more sustainable lifestyle.

However, it’s important to consider your own needs and storage limitations before buying in bulk. While it can be tempting to take advantage of every bulk deal you come across, it’s essential to assess whether you have enough space to accommodate larger quantities and if the items will be used before their expiration dates.

In conclusion, buying in bulk is a practical and cost-effective approach to managing everyday expenses. By purchasing items in larger quantities, as long as you plan accordingly, you can save money, reduce waste, and ensure you always have essential items on hand. So next time you’re considering a purchase, think about buying in bulk to maximize your savings and simplify your life.

Reduce Utility Bills

Lowering your monthly utility bills can be a significant way to cut down on your expenses and save money in the long run. By implementing a few simple strategies, you can reduce the amount of money you spend on essential services like electricity, water, and gas without compromising your comfort or lifestyle.

1. Energy-efficient appliances: Invest in energy-efficient appliances that consume less electricity and help reduce your utility bills.

2. Unplug unused devices: Make it a habit to unplug electric devices when they are not in use to prevent phantom power usage.

3. Weatherproofing: Seal gaps and cracks around windows and doors to prevent air leaks and maintain a consistent indoor temperature, reducing the need for excessive heating or cooling.

4. Optimize thermostat settings: Adjust your thermostat to a slightly higher temperature in summer and lower in winter to reduce the energy usage of your HVAC system.

5. Use natural lighting: Make the most of natural daylight by opening curtains or blinds during the day, reducing the need for artificial lighting.

6. Water-saving fixtures: Install low-flow showerheads, faucets, and toilets to reduce water consumption without sacrificing convenience.

7. Efficient laundry practices: Wash your clothes with cold water and only run full loads to save energy and water.

8. Smart power strips: Use smart power strips that automatically turn off devices when not in use to eliminate standby power usage.

9. Regular system maintenance: Keep your HVAC system, water heater, and other appliances properly maintained to ensure they operate efficiently and consume less energy.

10. Monitor and adjust usage: Keep track of your utility usage and analyze your bills regularly to identify any unusual spikes or areas where you can further reduce consumption.

By implementing these eco-friendly and cost-effective measures, you can significantly reduce your utility bills and contribute towards a more sustainable future.

Lower Heating and Cooling Costs

Discover effective strategies to reduce expenses associated with heating and cooling your home or office. Learn practical tips to decrease your energy consumption and save up on utility bills.

One way you can optimize your heating and cooling expenses is by improving the insulation of your living or working space. Enhancing the insulation of your walls, windows, and doors can help maintain a comfortable temperature without relying heavily on heating or air conditioning systems. This can lead to significant savings in the long run.

Additionally, consider utilizing natural ventilation methods to regulate the indoor temperature. Opening windows strategically during appropriate times of the day can allow for fresh air circulation and decrease the need for mechanical cooling. This can be particularly beneficial during mild weather conditions.

Adopting energy-efficient practices and investing in advanced technologies can also contribute to lowering heating and cooling costs. Replace outdated appliances with energy-saving alternatives and ensure regular maintenance to optimize their performance. Consider installing a programmable thermostat that can automatically adjust the temperature based on your routine and preferences.

Furthermore, implementing effective shading solutions can minimize heat gain during the summer and prevent heat loss during the winter. Install blinds, curtains, or window films that provide insulation and UV protection. These measures can help maintain a comfortable indoor environment while reducing the workload of heating and cooling systems.

Lastly, don’t overlook the significance of proper maintenance and timely repairs. Regularly clean and service your heating and cooling equipment to ensure optimal efficiency. Address any issues promptly to prevent further damage and avoid unnecessary energy consumption.

By implementing these strategies, you can lower your heating and cooling costs while still enjoying a comfortable and pleasant indoor environment. Taking proactive steps to reduce energy usage not only benefits your wallet but also contributes to a more sustainable future.

Conserve Water

In this section, we will discuss practical and effective strategies for reducing water consumption in your everyday life. By implementing these techniques, you can contribute to the conservation of our precious water resources and promote sustainability.

One way to limit water usage is by optimizing your daily routine. This can be achieved by taking shorter showers, turning off the faucet while brushing your teeth or washing dishes, and only running the washing machine and dishwasher with full loads. These small changes can add up to significant water savings over time.

Another way to conserve water is by being mindful of outdoor usage. Consider installing a rain barrel to collect rainwater for watering plants and gardens instead of relying on hose water. Additionally, landscaping with native and drought-resistant plants can help minimize the need for excessive irrigation.

Furthermore, addressing leaks and fixing faulty plumbing is crucial in reducing water wastage. Regularly check faucets, toilets, and pipes for any leaks and promptly repair them to avoid unnecessary water loss. A small leak can add up to hundreds of gallons wasted per month, so it’s essential to be proactive in identifying and resolving these issues.

In addition to the aforementioned strategies, implementing water-saving devices and appliances can make a significant difference. Consider installing low-flow showerheads and faucets, as well as dual-flush toilets, which provide options for different water volumes depending on the need. Similarly, choosing efficient washing machines and dishwashers that meet Energy Star standards can help minimize water consumption and energy usage simultaneously.

| Benefits of Conserving Water |

|---|

| 1. Preserving natural resources |

| 2. Reducing water bills |

| 3. Promoting environmental sustainability |

| 4. Mitigating water scarcity |

| 5. Supporting ecosystem health |

By incorporating these water conservation practices into your daily life, you not only contribute to a sustainable future but also reap the benefits of reduced water bills and a healthier environment for generations to come.

Switch to Energy-Efficient Appliances

In today’s world, it is more important than ever to be mindful of our energy consumption. By switching to energy-efficient appliances, you can not only reduce your impact on the environment but also save money in the long run. This section will explore the benefits and features of energy-efficient appliances, providing you with valuable information to make informed decisions for your home.

Energy-efficient appliances are designed to use less energy while still providing the same level of performance. They are equipped with advanced technologies and features that optimize energy usage, resulting in lower electricity bills. These appliances can be found in various categories, including refrigerators, washing machines, air conditioners, and more.

One of the key advantages of energy-efficient appliances is their ability to lower your energy consumption. By using less electricity, you can significantly reduce your monthly utility bills and save money in the long term. Additionally, these appliances often come with energy-saving modes and settings that allow you to further maximize their efficiency.

Furthermore, energy-efficient appliances contribute to a greener environment. With reduced energy consumption, fewer greenhouse gas emissions are produced, helping to mitigate climate change. By taking the step to switch to energy-efficient appliances, you are playing your part in creating a sustainable future for generations to come.

To help you make informed decisions, it is important to understand the energy efficiency ratings and labels associated with appliances. These ratings, such as Energy Star certification, indicate the level of energy efficiency of the appliance. By choosing products with higher ratings, you can ensure that you are selecting the most energy-efficient options available.

When it comes to purchasing energy-efficient appliances, it is essential to consider the long-term savings and benefits. While these appliances may have a higher upfront cost, the money saved on energy bills over time can outweigh the initial investment. Additionally, many energy-efficient appliances come with warranties and rebates, providing further incentives for making the switch.

| Benefits of Switching to Energy-Efficient Appliances: |

|---|

| – Lower energy consumption |

| – Reduced monthly utility bills |

| – Environmental sustainability |

| – Energy efficiency ratings and labels |

| – Long-term savings and benefits |

Overall, switching to energy-efficient appliances is a smart and responsible choice. Not only will you be able to save money in the long run, but you will also be contributing to a cleaner and more sustainable future. Take the time to research and compare different models to find the best energy-efficient appliances that suit your needs and budget.

Cut Transportation Expenses

Reducing your transportation costs can be a practical way to save money on a regular basis. By modifying how you commute, choosing alternative modes of transportation, and making smart decisions about vehicle usage, you can significantly decrease the amount of money you spend on getting around.

- Consider carpooling or ridesharing with others who have similar destinations. This can help split the costs of fuel and parking fees, while also reducing the wear and tear on your vehicle.

- Explore public transportation options such as buses, trains, or subways. These alternatives often offer discounted fares for regular commuters, and can be a more cost-effective way to travel, particularly in urban areas.

- Utilize cycling or walking as a means of transportation whenever possible. This not only saves you money, but also promotes a healthier lifestyle and reduces your carbon footprint.

- Plan your trips efficiently to minimize unnecessary driving. Combining multiple errands into a single outing can help save time and money spent on fuel expenses.

- Consider downsizing to a more fuel-efficient vehicle. Smaller cars or hybrid models tend to consume less fuel, resulting in savings at the pump.

- Regularly maintain your vehicle to ensure optimal fuel efficiency. Properly inflated tires, regular oil changes, and maintaining a clean air filter can all contribute to lowering your fuel consumption.

- Compare prices at different gas stations to find the most affordable options in your area. Utilize mobile apps or websites that track and display real-time gas prices to help you find the best deals.

- If possible, work remotely or try to negotiate a flexible work schedule that allows you to commute during non-peak hours. This can help you avoid heavy traffic and reduce the time and money spent on commuting.

- Avoid unnecessary use of toll roads or bridges by planning alternative routes. Planning ahead can help you find free or cheaper alternatives to reach your destination.

- Consider sharing the cost of vehicle ownership with a family member, friend, or neighbor. This can help reduce the financial burden of owning a vehicle while still enjoying the convenience it offers.

By implementing these transportation expense-saving strategies, you can keep more money in your pocket while still getting to your destination efficiently and conveniently.

Use Public Transportation

Opting for public transportation is an excellent way to cut down on your daily expenses and achieve substantial savings. By utilizing the various modes of public transportation available in your area, you can significantly reduce your transportation costs without compromising your mobility or convenience.

Travelling by public transportation not only helps in conserving your financial resources but also has a positive impact on the environment. Instead of relying on private vehicles that consume fuel and generate greenhouse gas emissions, using public transportation contributes to reducing air pollution and traffic congestion, making cities cleaner and more sustainable.

Public transportation offers a wide range of options, including buses, trams, trains, subways, and ferries. These modes of transport are often well-connected and provide comprehensive coverage, allowing you to reach your desired destinations conveniently. You can plan your trips ahead by checking the schedules and routes, ensuring that you can efficiently navigate your daily commute.

By utilizing public transportation, you can save money on fuel expenses, parking fees, and vehicle maintenance costs. Additionally, public transportation often offers discounted fares for students, seniors, and regular commuters, further enhancing your savings potential. Investing in a monthly pass or a travel card can provide significant long-term savings, making it a smart financial decision.

Another advantage of using public transportation is the reduced stress and hassle associated with driving, such as finding parking spaces or dealing with traffic jams. Instead, you can relax, read a book, catch up on work, or simply enjoy the sights during your commute, making your journey more enjoyable and productive.

- Discover the convenience of public transportation and save money on your daily commute.

- Reduce air pollution and traffic congestion by opting for greener transportation methods.

- Explore the various modes of public transportation available in your area.

- Plan your trips efficiently by checking schedules and routes beforehand.

- Save on fuel expenses, parking fees, and vehicle maintenance costs.

- Take advantage of discounted fares for students, seniors, and regular commuters.

- Invest in a monthly pass or travel card for long-term savings.

- Eliminate the stress and hassle of driving and enjoy a more relaxed commute.

Looking for new ways to cut down on transportation expenses? Consider carpooling or sharing rides with others to save money and reduce your impact on the environment. This practice involves multiple individuals traveling together in a single vehicle, sharing the cost of fuel and other expenses. By joining or initiating a carpool, you can enjoy a more affordable and sustainable way of commuting.

Sharing rides not only helps you save on transportation costs, but it also reduces traffic congestion and lowers carbon emissions. It allows you to split the expenses, such as fuel, tolls, and parking fees, with fellow passengers, making your daily commute more budget-friendly. Carpooling also helps in promoting social connections and building relationships with others who share the same commuting route as you do.

When considering carpooling or ride-sharing, it is essential to find reliable and trustworthy individuals to share your rides with. You can reach out to colleagues, neighbors, or friends who live nearby and have similar commuting schedules. Alternatively, you can explore online platforms or mobile apps that connect individuals seeking ride-sharing opportunities.

- Coordinate schedules: Find individuals with similar work or school schedules to efficiently plan your carpool. This ensures a smooth and convenient commuting experience for everyone involved.

- Agree on cost sharing: Discuss and mutually agree on how to split the expenses of fuel, tolls, and parking fees. Have an open conversation about expectations and ensure fairness among all carpool participants.

- Establish rules and guidelines: Set guidelines on punctuality, car cleanliness, and any other preferences to maintain harmony within the carpool. Regular communication is key to addressing any potential issues or conflicts.

- Enjoy the benefits: Not only will carpooling save you money, but it can also reduce stress by sharing the driving responsibilities. You can use the time spent in the car to relax, catch up on work, or simply enjoy each other’s company.

By carpooling or sharing rides with others, you can make a positive impact on your finances, the environment, and your overall commuting experience. This simple yet effective practice allows you to maximize efficiency and enjoy the benefits of sharing transportation costs with others, all while creating meaningful connections.

Questions and answers

How can I save money on everyday expenses?

There are several ways you can save money on everyday expenses. Start by creating a budget and tracking your expenses. This will help you identify areas where you can cut back. Additionally, consider buying generic brands, using coupons, and shopping during sales. Cutting back on eating out, bringing your lunch to work, and brewing your own coffee at home can also save you a significant amount of money.

Is it really worth it to buy generic brands?

Yes, buying generic brands can be a great way to save money. Many generic brands offer products of similar quality to their brand-name counterparts but at a lower price. It’s worth giving generic brands a try, especially for products like food, cleaning supplies, and personal care items.

How can I save money on groceries?

There are several ways to save money on groceries. First, make a shopping list and stick to it to avoid impulse purchases. Plan your meals in advance and buy only what you need for those meals. Use coupons and look for sales and discounts. Compare prices at different stores and consider buying in bulk for items you frequently use. Finally, try to avoid shopping when you’re hungry as this can lead to unnecessary purchases.

What are some tips for saving money on utilities?

To save money on utilities, start by reducing your energy consumption. Turn off lights when you’re not using them, unplug electronics when they’re not in use, and adjust your thermostat to a slightly lower temperature in the winter and a slightly higher temperature in the summer. Use energy-efficient light bulbs and appliances, and consider installing a programmable thermostat. Also, make sure your home is properly insulated to prevent energy loss.

How can I save money on transportation expenses?

There are several ways to save money on transportation expenses. Consider using public transportation or carpooling instead of driving alone. If possible, walk or bike for short distances. Keep up with regular car maintenance to improve fuel efficiency. Compare gas prices and use apps that help you find the cheapest prices in your area. Also, consider downsizing to a more fuel-efficient vehicle if it’s financially feasible for you.

How can I save money on everyday expenses?

There are several ways to save money on everyday expenses. One tip is to create a budget and track your spending. This will help you identify areas where you can cut back. Another tip is to shop for items on sale or use coupons. Additionally, you can save money by reducing energy usage, cooking at home instead of eating out, and canceling unnecessary subscriptions.

Is it really worth it to track my expenses?

Yes, tracking your expenses is definitely worth it. It allows you to see exactly where your money is going and identify any unnecessary or excessive spending. By keeping track, you can make informed decisions about where to cut back and save money. It also helps you stay accountable to your budget and financial goals.

How can I reduce my energy usage and save money?

There are several ways to reduce energy usage and save money. You can start by turning off lights and electronics when not in use, using energy-efficient light bulbs, and adjusting your thermostat to conserve energy. It’s also a good idea to unplug devices that are not in use, as they can still draw power when plugged in. Finally, consider using natural light instead of artificial lighting during the day.

What are some easy ways to cut back on eating out?

One easy way to cut back on eating out is to meal plan and cook at home. This allows you to control the ingredients and portion sizes, ultimately saving money. You can also try packing your own lunches for work or school instead of eating out. Additionally, consider exploring affordable meal options, such as cooking in bulk and freezing leftovers for future meals.

Are there any specific tips for saving money on groceries?

Absolutely! When it comes to saving money on groceries, it’s important to plan your meals and make a shopping list before heading to the store. This helps you avoid impulse purchases and ensures you only buy what you need. It’s also beneficial to compare prices, shop at discount grocery stores, and take advantage of loyalty programs or cashback apps. Lastly, consider buying generic brands instead of name brands for certain items.