Are you looking for practical ways to optimize your budget and enhance your lifestyle without compromising on quality? In this insightful article, we will explore a range of clever methods that can help you to achieve just that. By adopting a few simple habits and making some minor adjustments to your daily routine, you can successfully stretch your hard-earned dollars further than you ever thought possible.

1. Embrace Resourcefulness: One of the keys to living frugally involves cultivating a mindset of resourcefulness. Learn to appreciate and utilize what you already have, instead of constantly seeking new purchases. Think creatively and find innovative ways to repurpose items, make use of leftovers, or borrow instead of buying.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn More2. Cultivate a Thrift Store Mentality: Rather than indulging in the allure of brand-new items, embrace the thrill of thrift shopping. Browse through second-hand stores and online marketplaces to find great deals on clothing, furniture, appliances, and other essentials. Not only will this save you money, but it will also contribute to sustainable and eco-friendly practices.

- Prioritize Essential Expenses to Maximize Savings

- Trimming Non-Essential Costs

- Optimizing Utility Bills

- Create and Stick to a Budget

- Tracking Income and Expenses

- Eliminating Unnecessary Spending

- Reduce Food Expenses without Sacrificing Nutrition

- Meal Planning and Bulk Cooking

- Shopping Smart: Discounts and Coupons

- Cut Down Transportation Costs

- Using Public Transport or Carpooling

- Considering Alternative Travel Options

- Embrace DIY and Repurposing

- Creating Homemade Cleaning Products

- Questions and answers

Prioritize Essential Expenses to Maximize Savings

In order to optimize your savings and make the most out of your budget, it is crucial to prioritize essential expenses. By carefully evaluating your needs and differentiating them from wants, you can identify the necessary aspects of your life that require financial attention. This approach allows you to allocate your resources effectively and focus on the most important areas, ultimately resulting in significant savings.

Identify Necessities: The first step is to identify and categorize your essential expenses. These are the costs that directly contribute to your basic needs and well-being, such as housing, utilities, food, and healthcare. By clearly defining what is essential, you can allocate a portion of your income towards these priorities and avoid overspending on non-essential items.

Set Priorities: Once you have identified your necessities, it is important to establish priorities within this category. Determine which expenses are crucial for your daily life and which ones can be adjusted or minimized. For example, while it is essential to have a roof over your head, you may find ways to reduce housing costs by downsizing or exploring alternative housing options. By setting priorities, you can make informed choices about where to spend your money.

Review Your Lifestyle: Take a close look at your lifestyle and evaluate whether certain expenditures align with your long-term financial goals. Assess your habits and consider making adjustments to reduce non-essential expenses. For instance, if dining out frequently is draining your budget, explore cost-effective cooking options at home or seek affordable alternatives. By reviewing your lifestyle, you can identify areas where you can make changes to maximize savings.

Be Mindful of Impulse Purchases: Impulse purchases can quickly derail your budget and drain your savings. Avoid making spontaneous purchases and instead cultivate a habit of thoughtful consideration. Before buying something, ask yourself if it is truly essential and aligns with your priorities. This mindful approach will help you eliminate unnecessary expenses and stay focused on your financial goals.

Revisit and Adjust: Regularly revisit your essential expenses and reassess their importance and cost-effectiveness. As your circumstances change or you identify new areas for improvement, make adjustments accordingly. By consistently reviewing and adjusting your priorities, you can ensure that your savings are maximized and your budget remains efficient.

By prioritizing essential expenses, you can effectively manage your finances and optimize your savings. This approach empowers you to make informed choices and allocate your resources towards what truly matters, enabling you to achieve your long-term financial goals.

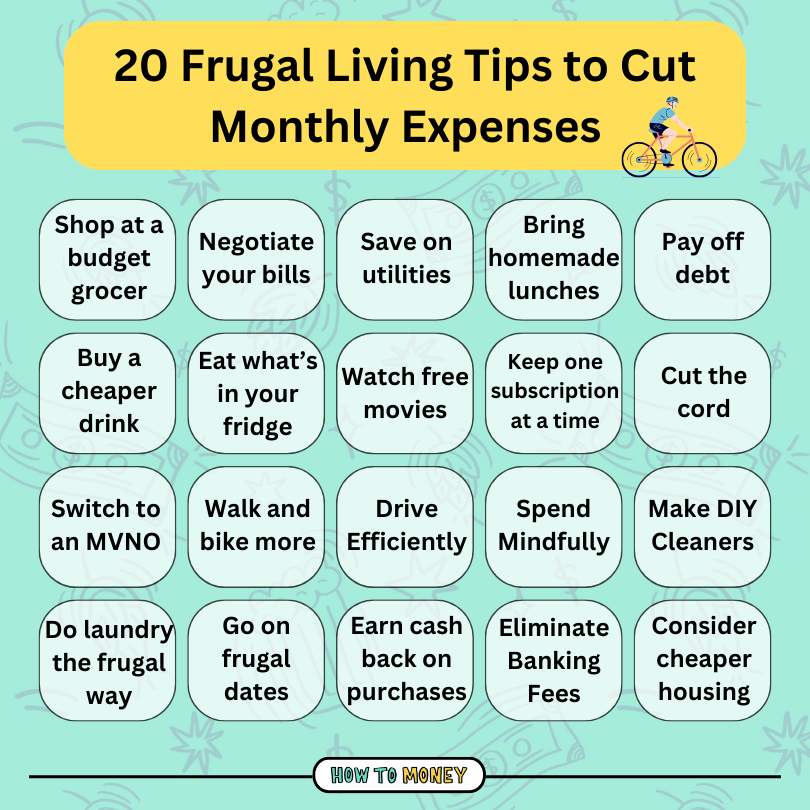

Trimming Non-Essential Costs

Reducing unnecessary expenses is a fundamental aspect of managing finances wisely. By examining our spending habits and identifying areas where we can make adjustments, we can find ways to cut down on non-essential costs without sacrificing our quality of life.

- 1. Evaluate subscription services: Review the monthly subscriptions you have, such as streaming platforms, gym memberships, or magazine subscriptions. Consider whether you are utilizing these services enough to justify the cost, and cancel any that are not providing sufficient value.

- 2. Minimize dining out: While dining at restaurants can be enjoyable, it often comes with a higher price tag. Set a budget for eating out and limit it to special occasions, opting instead for home-cooked meals that are not only more cost-effective but also allow you to control the ingredients and portion sizes.

- 3. Make a shopping list: Before heading to the grocery store, make a list of the items you truly need. Stick to the list and avoid impulse purchases, as they can add up quickly and lead to unnecessary spending.

- 4. Reduce energy consumption: Implement energy-saving practices in your home, such as turning off lights and appliances when not in use, using energy-efficient light bulbs, and adjusting your thermostat to conserve energy. These small changes can add up to significant savings on your utility bills.

- 5. Eliminate unused memberships: Assess any memberships or subscriptions that you no longer use or benefit from. Whether it’s a club membership, online service, or even a frequent flyer program, canceling these unused accounts can help trim costs.

- 6. Opt for generic brands: When shopping for groceries or household items, consider choosing generic or store-brand options. These products are often of similar quality to their branded counterparts but come at a lower price point.

- 7. Cut back on convenience items: Convenience comes at a price. Minimize your reliance on convenience items such as pre-packaged meals, single-use products, or excessive takeout orders. Instead, opt for homemade alternatives that are not only more cost-effective but also healthier.

- 8. Reduce transportation costs: Explore alternative transportation options, such as carpooling, public transit, or walking or biking for shorter distances. Not only will this save you on fuel costs, but it can also provide health and environmental benefits.

- 9. Plan outings and entertainment in advance: Rather than making spontaneous and potentially expensive plans, plan your outings and entertainment activities in advance. Look for discounts, deals, or free events to maximize your enjoyment while minimizing expenses.

- 10. Avoid unnecessary upgrades: Before upgrading or replacing electronic devices or other durable goods, carefully consider whether it is truly essential. Often, we get tempted by the latest models or features, but sticking with what we already have can save us a substantial amount of money in the long run.

By implementing these strategies and being mindful of our spending habits, we can effectively trim non-essential costs and improve our financial well-being without compromising on our overall quality of life.

Optimizing Utility Bills

In this section, we will explore effective ways to maximize your savings on utility bills without compromising your quality of life. By implementing some smart choices and making small changes around your home, you can significantly reduce your expenses related to water, electricity, gas, and other utility services.

- 1. Minimize water wastage:

- Fix any leaks in faucets or pipes promptly.

- Install low-flow showerheads and faucets.

- Limit shower time and use a water-efficient shower timer.

- Collect rainwater for watering plants and cleaning purposes.

- 2. Optimize energy usage:

- Switch to energy-efficient appliances and light bulbs.

- Unplug electronics when not in use.

- Use power strips with surge protectors to easily turn off multiple devices at once.

- Make use of natural light during the day to reduce reliance on artificial lighting.

- 3. Adjust thermostat settings:

- Lower the temperature in winter and raise it in summer to minimize heating and cooling costs.

- Invest in a programmable thermostat to automatically control temperature settings.

- Make use of curtains, blinds, or shades to regulate indoor temperatures.

- 4. Opt for energy-saving habits:

- Wash clothes in cold water instead of hot.

- Hang-dry laundry whenever possible.

- Use your dishwasher efficiently by fully loading it and selecting energy-saving cycles.

- 5. Reduce waste in the kitchen:

- Plan meals and create grocery lists to avoid purchasing unnecessary items.

- Store leftovers properly to prevent food spoilage.

- Compost organic waste to reduce landfill contributions and create nutrient-rich soil.

- 6. Manage electronic devices:

- Turn off computers and screens when not in use.

- Enable power-saving features on mobile devices.

- Avoid unnecessary printing and opt for digital documents whenever possible.

- 7. Conduct regular maintenance:

- Clean and replace air filters to ensure efficient functioning of HVAC systems.

- Maintain proper insulation in your home to reduce heat transfer.

- Regularly check and clean refrigerator coils to improve energy efficiency.

- 8. Explore alternative energy options:

- Consider installing solar panels to generate clean and renewable energy.

- Use solar-powered outdoor lighting.

- Investigate local incentives and rebates available for adopting renewable energy sources.

- 9. Optimize water heating:

- Turn down the temperature of your water heater to save on energy consumption.

- Insulate hot water pipes to reduce heat loss during distribution.

- Consider investing in a tankless water heater for on-demand hot water.

- 10. Stay informed and compare rates:

- Regularly review your utility bills to identify any discrepancies or potential areas for savings.

- Research and compare utility providers to ensure you are getting the best rates and deals.

- Stay updated on energy-saving programs and initiatives offered by utility companies.

By incorporating these tips into your lifestyle, you can optimize your utility bills and contribute towards a more sustainable and cost-effective living environment.

Create and Stick to a Budget

Developing and adhering to a financial plan is crucial for effective money management. By establishing a budget, individuals can control their spending, allocate funds wisely, and achieve their financial goals.

1. Construct an Effective Financial Plan:

To start, it is important to craft a comprehensive financial plan, which entails determining your income and expenses, identifying financial goals, and setting realistic targets for savings. The process involves evaluating past spending habits, analyzing current financial obligations, and forecasting future expenses.

2. Monitor Your Spending:

Keep track of your expenditures meticulously. This can be done by recording all purchases, whether big or small, in a notebook or through a budgeting app. Regularly reviewing your spending patterns will help you identify areas where you can cut back and save more.

3. Prioritize Essentials:

Identify your needs versus your wants. Differentiate between necessary expenses, such as housing, utilities, and groceries, and non-essential discretionary spending. Prioritizing essential items ensures that you allocate funds where they are most needed.

4. Allocate Funds Wisely:

Once you have a clear understanding of your income and expenses, allocate your funds accordingly. Set aside a portion of your income for savings, emergency funds, debt repayment, and other financial goals. This will help you avoid overspending and realize your desired outcomes.

5. Control Impulsive Buying:

Avoid impulsive and unnecessary purchases, as they can quickly lead to overspending. Before making a purchase, consider if it aligns with your financial goals and if it is truly necessary. Developing mindful spending habits will help you save money in the long run.

6. Seek Cost-Effective Alternatives:

Look for ways to reduce expenses by exploring cost-effective alternatives. For example, consider buying generic brands, shopping during sales, utilizing coupons, or subscribing to services that offer discounts. Small changes in purchasing habits can add up to significant savings.

7. Stay Focused and Motivated:

Sticking to a budget requires discipline and perseverance. Find ways to stay motivated, such as regularly reviewing your financial goals, tracking your progress, and celebrating small milestones. Stay focused on the long-term benefits that financial stability brings.

8. Review and Adjust Your Budget:

A budget should be a flexible tool that adapts to changes in your life. Regularly review and adjust your budget as needed. Changes in income, expenses, or financial goals may require modifications to ensure your financial plan remains effective.

9. Seek Support and Accountability:

It can be helpful to seek support from friends, family, or financial advisors when creating and sticking to a budget. They can provide guidance, offer useful tips, and hold you accountable for your financial decisions. Consider joining online communities or local groups focused on frugal living for additional support.

10. Practice Patience and Long-Term Thinking:

Remember that achieving financial stability and reaching your goals takes time. Practice patience and maintain a long-term perspective. Each small step towards living within your means and managing your finances efficiently brings you closer to financial freedom.

Tracking Income and Expenses

In the quest for financial stability and efficiency, it is essential to have a clear understanding of your income and expenses. By tracking and monitoring these key financial elements, you can gain valuable insights into your spending habits and make informed decisions to save money and optimize your budget.

Tracking income involves keeping a comprehensive record of the money flowing into your life, including wages, salaries, bonuses, and any additional sources of income. By diligently documenting each influx of cash, you can accurately assess your financial situation and identify opportunities for growth and improvement.

Equally important is tracking expenses, which refers to the meticulous record-keeping of all expenditures, big and small. This includes tracking bills, rent or mortgage payments, groceries, transportation costs, entertainment expenses, and any other outlays. By capturing and categorizing every expense, you can gain a clear overview of where your money is going and identify areas where you have the potential to reduce spending.

An effective way to track income and expenses is by keeping a detailed budget. A budget acts as a guide to help you allocate your funds wisely and prioritize your spending. By creating different categories and assigning a specific amount to each, you can ensure that your income is being utilized efficiently and that you are not overspending in any particular area.

Utilizing tools such as mobile apps or spreadsheets can greatly simplify the process of tracking income and expenses. These tools can automate calculations, generate visual representations of your financial data, and even send you reminders for upcoming payments. By utilizing technology to streamline this task, you can save time and effort, allowing you to focus on other aspects of frugal living.

Regularly reviewing and analyzing your income and expense records is key to identifying patterns, trends, and areas for improvement. By paying attention to the data, you can make informed decisions about your spending habits and develop strategies to save money and live more efficiently.

In summary, tracking income and expenses provides a foundation for achieving financial stability and efficiency. By understanding your financial inflows and outflows, you can make informed decisions about your spending, prioritize your budget, and work towards the goal of living a fulfilling and frugal lifestyle.

Eliminating Unnecessary Spending

In this section, we will explore effective strategies to reduce unnecessary expenses, allowing you to allocate your resources more wisely and enhance your financial well-being. By identifying and eliminating unnecessary spending habits or purchases, you can achieve a more efficient and sustainable approach to managing your finances.

1. Prioritize Needs Over Wants

- Instead of succumbing to impulsive purchases or luxury items, focus on fulfilling your essential needs first.

- Analyze your spending habits and differentiate between what you truly need and what you want, to make informed financial decisions.

2. Embrace Minimalism

- Adopting a minimalist lifestyle encourages intentional and mindful consumption.

- Declutter your living space and reassess your belongings to distinguish what truly adds value to your life.

- By reducing material possessions and simplifying your lifestyle, you can avoid unnecessary spending on excessive or unused items.

3. Create a Budget

- Develop a comprehensive budget that clearly outlines your income and expenses.

- Identify areas where you can cut back on discretionary spending, such as dining out, entertainment, or subscriptions.

- Regularly review and adjust your budget to stay on track and ensure your financial goals are being met.

4. Comparison Shopping

- Prioritize researching and comparing prices before making any purchase.

- Take advantage of online platforms and tools that allow you to compare prices across different retailers, ensuring you get the best deal.

5. Utilize Coupons and Discounts

- Look for coupons, promo codes, or discounts before making any online or in-store purchases.

- Subscribe to newsletters or follow your favorite brands on social media to stay updated on exclusive offers and deals.

6. Avoid Impulse Buying

- Instead of making spontaneous purchases, practice delayed gratification by giving yourself time to think before buying.

- Create a wishlist and revisit it after a few days to determine if the items are truly necessary or if the initial desire has subsided.

7. DIY and Repurposing

- Explore do-it-yourself (DIY) projects or repurposing items to fulfill your needs and save money.

- Consider refurbishing furniture, repairing appliances, or making homemade gifts instead of buying new.

8. Reduce Subscription Services

- Evaluate your subscription services and determine which ones bring genuine value to your life.

- Cut back on unnecessary subscriptions that are rarely used or can be replaced by free alternatives.

9. Plan Meals and Cook at Home

- Create a weekly meal plan and stick to grocery shopping lists to avoid unnecessary spending on dining out or ordering takeout frequently.

- Invest time in learning simple and cost-effective recipes to prepare meals at home.

10. Practice Mindful Spending

- Develop a habit of being mindful when making any purchase.

- Ask yourself if the item is truly necessary, if it aligns with your values, and if it will truly enhance your life in the long run.

By implementing these strategies and consciously eliminating unnecessary spending, you can make significant progress towards your financial goals while living a more fulfilling and efficient life.

Reduce Food Expenses without Sacrificing Nutrition

In today’s challenging economic climate, it’s essential to find ways to cut costs without compromising our health. One area where we can make significant savings is our food expenses. By making strategic choices and being mindful of our nutrition, it’s possible to reduce our grocery bills without sacrificing the quality of our meals.

1. Plan Meals in Advance: Take some time each week to plan your meals and create a shopping list. This will help you avoid impulse purchases and ensure that you only buy what you need. By having a detailed plan, you can utilize ingredients efficiently and minimize waste.

2. Buy in Bulk: Purchasing staples like grains, legumes, and spices in bulk can be a cost-effective way to stock your pantry. Look for local co-ops or wholesale suppliers that offer discounted prices when buying in larger quantities. Just remember to store these items properly to maintain their freshness.

3. Embrace Seasonal Produce: Opt for fruits and vegetables that are in season, as they tend to be more affordable and flavorful. Additionally, local produce is often fresher and supports local farmers. Get creative with recipes and experiment with new ingredients to make the most out of what’s available during each season.

4. Reduce Meat Consumption: Meat can be one of the most expensive items on our grocery list. Consider incorporating more plant-based proteins, such as beans, lentils, and tofu, into your meals. These alternatives are not only budget-friendly but also provide essential nutrients and reduce your environmental footprint.

5. Make Your Own Meals: Instead of relying on processed and pre-packaged foods, try cooking from scratch. Not only is this a more affordable option, but it also allows you to control the quality and nutritional content of your meals. Plan time for meal preparation and batch cooking to save time and effort throughout the week.

6. Shop Sales and Use Coupons: Keep an eye out for sales and promotions at your local grocery stores. Use coupons and discounts wisely to maximize your savings. However, only purchase items that you need and would use to avoid wastage.

7. Minimize Food Waste: Be conscious of the food you throw away and find ways to reduce waste. Use leftovers creatively, freeze excess food, and repurpose ingredients to avoid letting anything go to waste. Composting is also an eco-friendly solution for food scraps.

8. Grow Your Own Herbs and Vegetables: Even if you have limited space, cultivating a small herb garden or growing some vegetables in containers can save you money in the long run. It provides you with fresh produce and adds a touch of greenery to your surroundings.

9. Plan for Eating Out: If dining out is part of your routine, plan it in advance. Look for special deals, happy hours, or discounted menus. Additionally, consider packing your own snacks or beverages when going on outings to avoid unnecessary expenses.

10. Be Mindful of Portion Sizes: Pay attention to portion sizes when preparing meals to avoid overeating and wasting food. Not only will this help you save money, but it is also beneficial for your health. Proper portion control ensures you’re getting the right nutrients while avoiding unnecessary expenses.

By implementing these strategies and being mindful of our food choices, we can significantly reduce our food expenses while still maintaining a nutritious and satisfying diet. With a little planning, creativity, and resourcefulness, you can achieve financial goals without compromising your well-being.

Meal Planning and Bulk Cooking

Streamlining your meal planning and embracing the benefits of bulk cooking can greatly contribute to a more efficient and cost-effective lifestyle. By strategically planning your meals in advance and preparing them in larger quantities, you can save both time and money while also enjoying delicious and nutritious homemade meals.

Meal planning involves carefully organizing your weekly or monthly meals, taking into consideration your dietary preferences, nutritional needs, and budget. By creating a schedule and writing down your meal ideas, you can eliminate the stress of deciding what to cook each day, avoid unnecessary trips to the grocery store, and prevent food wastage.

Bulk cooking, on the other hand, refers to preparing multiple servings of a particular dish at once, which can be stored for future consumption. This approach not only saves you time by minimizing the number of times you need to cook, but it also allows you to take advantage of bulk discounts on ingredients and reduce the energy costs associated with cooking.

When implementing meal planning and bulk cooking, it is essential to consider ingredients that are versatile, budget-friendly, and have a longer shelf life. For instance, grains such as rice, pasta, and quinoa can be used in various recipes and can be purchased in bulk. Similarly, proteins like chicken, beef, or tofu can be cooked in larger quantities and repurposed into different meals throughout the week.

In addition to saving time and money, meal planning and bulk cooking promotes healthier eating habits. By preparing homemade meals in advance, you are less likely to rely on expensive and unhealthy takeout or convenience foods. This approach gives you greater control over your ingredients, portion sizes, and overall nutritional value, enabling you to make healthier choices for you and your family.

To make the most of meal planning and bulk cooking, it is helpful to invest in suitable food storage containers and labels. Portioning out your meals into individual servings and properly labeling them with dates and contents ensures easy access and minimizes the risk of food spoilage.

By incorporating meal planning and bulk cooking into your frugal and efficient lifestyle, you can enjoy the benefits of time-saving, cost-effective, and nutritionally balanced meals. Not only does this approach empower you to take control of your budget, but it also allows you to savor delicious homemade meals that are tailored to your preferences and dietary needs.

Shopping Smart: Discounts and Coupons

In today’s consumer-driven society, finding ways to maximize your savings while shopping is essential. The art of shopping smart lies in discovering the best discounts and utilizing coupons to get the most out of your money. By taking advantage of these money-saving opportunities, you can make your purchases more cost-effective and efficient.

One strategy for shopping smart is to keep a keen eye out for discounts offered by various retailers. Retailers often provide sales, promotions, and special offers that can significantly reduce the cost of the items you wish to purchase. Whether it’s a seasonal sale or a clearance event, staying informed about these discount opportunities can help you save a substantial amount of money.

Additionally, coupons are powerful tools that can help you save even further. You can find coupons in various forms, from paper cut-outs in magazines and newspapers to digital codes and printable vouchers available online. These coupons typically offer price reductions or special deals for specific products or brands. By utilizing coupons, you can stretch your budget and make your purchases more economical.

When shopping smart, it’s crucial to plan your purchases ahead of time. By creating a shopping list and identifying the items you need, you can focus on finding the best discounts and coupons for those specific products. This approach ensures that you don’t fall into impulse buying traps and only purchase what is necessary while taking advantage of available savings.

Furthermore, it’s advantageous to research and compare prices before making a purchase. Comparing prices can help you identify the best deal and establish whether a discount or coupon is truly as beneficial as it seems. With the internet providing easy access to multiple retailers, you can conveniently compare prices and make an informed decision that maximizes your savings.

In conclusion, shopping smart involves being proactive in seeking out discounts and coupons to save money on your purchases. By staying informed about ongoing sales, promotions, and special offers, and by utilizing coupons effectively, you can optimize your savings and make your shopping experience more efficient. Having a well-structured plan, researching prices, and comparing options are all vital components in the pursuit of frugal living.

Cut Down Transportation Costs

Reducing transportation expenses is an essential aspect of budget-friendly living. Finding ways to decrease the amount of money you spend on transportation can significantly impact your overall financial situation. By adopting a mindful approach and exploring alternative options, you can effectively cut down on transportation costs without compromising your daily activities.

Explore Public Transportation: Utilizing public transportation systems can be a cost-efficient solution for daily commuting. By replacing private vehicles with buses, trains, or trams, you can save money on fuel, parking fees, and vehicle maintenance expenses. Additionally, public transportation allows you to contribute to a greener environment by reducing your carbon footprint.

Embrace Carpooling and Ride-Sharing Services: Carpooling with colleagues, friends, or neighbors who have similar daily routes can help reduce transportation costs. Sharing rides not only saves money but also promotes social interactions and fosters a sense of community. Alternatively, using ride-sharing services can be a convenient and affordable way to travel shorter distances without the need for owning a personal vehicle.

Opt for Walking or Bicycling: Incorporating walking or cycling into your daily routine can be a great way to save money while staying active. For short distances, consider walking instead of taking public transportation or driving. Additionally, investing in a bicycle and using it for commuting or running errands can provide long-term financial benefits, as it eliminates the need for fuel and parking expenses.

Plan Efficient Routes: Properly planning your routes can help you minimize transportation costs. By mapping out the most efficient paths and avoiding congested areas, you can reduce travel time and fuel consumption. Take advantage of GPS apps or navigation systems to find the quickest and most fuel-efficient routes for your regular journeys.

Combine Errands: Consolidating your errands into one trip can save both time and money. Instead of making multiple trips throughout the week, plan your tasks in advance and accomplish them together in a single trip. This approach not only reduces transportation costs but also optimizes your time and energy.

Consider Remote Work or Flexible Schedules: If possible, explore opportunities for remote work or flexible schedules. Working from home or adjusting your work hours can eliminate the need for daily commuting and substantially reduce transportation expenses. This option also provides greater freedom and work-life balance.

Conduct Regular Vehicle Maintenance: Maintaining your vehicle properly can prevent unexpected breakdowns and costly repairs. Routine check-ups, oil changes, and tire rotations can extend the lifespan of your vehicle and improve its fuel efficiency. By keeping your vehicle in optimal condition, you can save money on fuel and reduce the likelihood of major repairs.

Monitor Fuel Prices and Seek Discounts: Keeping an eye on fluctuating fuel prices can help you identify the most affordable times to refuel. Additionally, explore options for discounted fuel cards or loyalty programs offered by gas stations and supermarkets. These initiatives can help you save money on fuel expenses over time.

Share Vehicle Expenses: If you have multiple vehicles in your household, consider sharing expenses with family members or close neighbors. By splitting costs such as insurance, maintenance, and parking fees, you can substantially reduce the financial burden associated with owning and operating a vehicle.

Investigate Alternative Transportation Methods: Research and explore alternative transportation methods available in your area. This could include electric scooters, electric bikes, or even public car-sharing initiatives. Assess the feasibility and cost-effectiveness of these options to determine if they align with your transportation needs and budget.

By implementing these strategies and being mindful of your transportation choices, you can successfully cut down transportation costs and contribute to your overall financial well-being.

Using Public Transport or Carpooling

Efficient commuting is a crucial aspect of managing expenses and optimizing resources. Choosing to utilize public transport systems or carpooling with others can significantly reduce transportation costs and promote sustainability. By embracing alternative modes of transportation, individuals can experience financial savings while also contributing to a greener environment.

Public transport offers an affordable and convenient way to travel within a city or between different locations. Buses, trains, trams, and subways provide reliable services that cater to a wide range of destinations. Opting for public transport not only helps individuals bypass the expenses associated with owning and maintaining a personal vehicle but also reduces traffic congestion and air pollution.

Carpooling, on the other hand, involves sharing a ride with others who have a similar route or destination. This collaborative approach allows individuals to split the cost of fuel, tolls, and parking, resulting in substantial savings. Carpooling not only benefits participants financially but also reduces the number of vehicles on the road and decreases overall carbon emissions.

In addition to the financial advantages, using public transport or carpooling also offers numerous other benefits. It can provide opportunities for social interactions, allowing individuals to network and build connections during their daily commute. Moreover, relying on these modes of transportation can help individuals minimize the stress and hassle associated with driving, such as finding parking spaces or dealing with traffic jams.

In conclusion, utilizing public transport or carpooling presents a frugal and eco-friendly approach to commuting. By embracing these alternatives, individuals can save money, reduce their environmental footprint, and enjoy additional benefits such as social interactions and reduced stress levels. Making the choice to use public transport or carpooling is not only financially prudent but also contributes to a more sustainable and efficient way of life.

Considering Alternative Travel Options

Exploring alternative modes of transportation can be a smart approach to achieving financial savings and maximizing efficiency in your travels. By venturing beyond the conventional means of getting from point A to point B, you can not only save money on transportation expenses but also reduce your carbon footprint and discover new adventures along the way.

1. Embrace Public Transportation: Utilizing buses, trains, and trams can be a cost-effective way to navigate through cities and towns. Not only is it often cheaper than driving, but it also eliminates the hassle of parking and minimizes the stress of traffic.

2. Opt for Carpooling: Sharing rides with friends, colleagues, or even strangers who have similar destinations can significantly cut down on transportation costs. Carpooling not only saves money but also reduces traffic congestion, fuel consumption, and the wear and tear of vehicles.

3. Cycle Your Way Around: If the distance allows and the weather permits, consider biking as a mode of transportation. It is not only a great way to save money but also promotes a healthier lifestyle and helps reduce pollution. Invest in a sturdy bike, and you’ll find that it’s an enjoyable and efficient way to travel short distances.

4. Take Advantage of Ride-Sharing Services: Ride-sharing platforms have gained popularity in recent years, offering convenient and affordable transportation solutions. By sharing rides with other passengers heading in a similar direction, you can reduce your travel expenses while also reducing the number of vehicles on the road.

5. Explore Walking Routes: For shorter distances, consider walking instead of relying on transportation. Not only will you save money, but you’ll also have the opportunity to immerse yourself in the local environment, observe hidden gems, and enjoy the journey itself.

6. Investigate Alternative Air Travel Options: When planning long-distance trips, explore different airlines and airports to find the most economical and convenient options available. Sometimes, flying to a neighboring city and then taking a bus or train to your final destination can be more budget-friendly and enjoyable than a direct flight.

7. Consider House-Swapping: If you’re planning a vacation, house-swapping allows you to stay in someone else’s home while they stay in yours. This mutually beneficial arrangement eliminates accommodation costs and provides a unique opportunity to experience a new locale from a local’s perspective.

8. Look for Travel Discounts and Deals: Be on the lookout for discounted airfare, hotel rates, and package deals. Many travel websites and apps offer exclusive promotions, loyalty programs, and rewards, helping you save money while exploring new destinations.

9. Prioritize Off-Season Travel: Traveling during off-peak seasons can result in significant cost savings. Accommodation, attractions, and transportation options are often more affordable during these times, allowing you to stretch your travel budget further and avoid crowds.

10. Consider Alternative Accommodations: Instead of booking traditional hotels, research alternative accommodations such as hostels, guesthouses, or vacation rentals. These options can offer unique experiences, often at lower prices, and may provide you with a chance to engage with locals and immerse yourself in the local culture.

By adopting alternative travel options, you can not only save money but also enhance your travel experiences. Embrace the opportunities to explore beyond conventional methods and create unforgettable memories while contributing to a more sustainable and efficient way of traveling.

Embrace DIY and Repurposing

Explore the world of do-it-yourself projects and the art of repurposing to maximize your savings and add a unique touch to your living space. By embracing the power of DIY and repurposing, you can unleash your creativity and unleash a wave of cost-effective solutions.

Instead of relying on expensive store-bought items, consider repurposing old furniture, clothing, or household items to give them a new life. With a little imagination and some basic tools, you can transform discarded objects into functional and stylish pieces that fit your personal taste.

- Repurpose an old wooden ladder into a trendy bookshelf or a rustic display for plants.

- Turn old mason jars into charming candle holders or storage containers for small items.

- Transform worn-out jeans into fashionable patches or trendy tote bags.

- Create unique wall art by repurposing old picture frames or using leftover fabric.

- Give new life to empty wine bottles by turning them into chic vases or candle holders.

DIY projects not only save you money, but they also enable you to customize your possessions to reflect your personal style. Additionally, they offer a sense of satisfaction and accomplishment as you witness the transformation of something old and unwanted into something useful and beautiful.

Furthermore, embracing DIY and repurposing allows you to reduce waste and be more environmentally friendly. By giving a second chance to items that would otherwise end up in a landfill, you contribute to the preservation of natural resources.

So, instead of rushing to the store for new purchases, take a moment to consider how you can utilize your creative skills to repurpose and reinvent what you already have. Embrace the world of DIY and repurposing, and discover a frugal and fulfilling way of living.

Creating Homemade Cleaning Products

Discover the art of making your own cleaning products right at home. With simple ingredients and easy-to-follow recipes, you can create effective and eco-friendly alternatives to store-bought cleaners. Not only will this help you avoid unnecessary expenses, but it will also promote a healthier living environment.

One of the benefits of creating homemade cleaning products is the customization it allows. You can choose the specific ingredients and scents that suit your preferences, ensuring a personalized cleaning experience. Not to mention, making your own cleaning products produces less waste and reduces the need for single-use plastic containers.

When it comes to creating homemade cleaning products, essential oils are your best friends. These natural extracts not only add a pleasant scent to your cleaners but also possess antimicrobial properties that help fight germs and bacteria. From lemon and lavender to tea tree and eucalyptus, there are endless options to choose from.

- All-Purpose Cleaner: Mix equal parts of white vinegar and water in a spray bottle. Add a few drops of your favorite essential oil for a refreshing scent. This versatile cleaner is perfect for countertops, glass surfaces, and even removing stains.

- Bathroom Scrub: Create a paste by combining baking soda, liquid castile soap, and a few drops of tea tree oil. This powerful scrub cuts through grime and leaves your bathroom shining without the harsh chemicals found in commercial cleaners.

- Window Cleaner: Mix water, rubbing alcohol, and a tablespoon of cornstarch in a spray bottle. Shake well before use and apply to windows using a microfiber cloth for a streak-free shine.

By making your own cleaning products, you not only save money but also prioritize the well-being of your family and the environment. Experiment with different recipes and ingredients, and soon you’ll be amazed at the effectiveness and affordability of your homemade cleaning arsenal.

Questions and answers

How can I save money on my monthly bills?

There are several ways to save money on your monthly bills. One of the most effective methods is to assess your usage and look for ways to conserve energy. This can include turning off lights and appliances when not in use, using energy-efficient light bulbs, and setting your thermostat at a moderate temperature. Additionally, shopping around for the best deals on services like internet and cable can also help reduce your monthly expenses.

Are there any tips for cutting down on grocery expenses?

Yes, there are many ways to cut down on grocery expenses. Planning your meals ahead of time and creating a shopping list can help you avoid impulsive purchases. Buying in bulk and taking advantage of sales and discount offers can also help save money. Furthermore, considering generic or store brands instead of name brands and utilizing coupons can significantly reduce your grocery bill.

What are some frugal habits to adopt in order to save money?

There are several frugal habits to adopt in order to save money. These include cooking at home instead of dining out, limiting unnecessary spending on non-essential items, avoiding impulse purchases, and regularly tracking your expenses. Additionally, embracing minimalism and decluttering your living space can help reduce the temptation to buy unnecessary items.

How can I save money on transportation costs?

There are various ways to save money on transportation costs. One option is to use public transportation whenever possible instead of driving a car. If public transportation is not accessible, carpooling with coworkers or friends can significantly reduce fuel expenses. Another tip is to combine errands and plan efficient routes to minimize travel distance. Additionally, considering alternatives like biking or walking for short distances can save money and provide health benefits.

What are the benefits of maintaining a budget?

Maintaining a budget can have numerous benefits for your financial wellbeing. Firstly, it helps you gain a clear understanding of your income and expenses, allowing you to effectively manage your money. A budget enables you to set financial goals and track your progress towards them. It also helps identify unnecessary spending and areas where you can cut back. Ultimately, a budget provides financial security and allows you to save money for future needs.

How can I save money on groceries?

One of the best ways to save money on groceries is to plan your meals in advance. Make a list of the items you need and stick to it when you go shopping. Avoid impulse buying and take advantage of discounts and coupons. Additionally, consider buying in bulk and opting for store brands instead of name brands to save even more.

What are some effective ways to reduce electricity bills?

There are several ways you can reduce your electricity bills. Start by switching to energy-efficient appliances and LED light bulbs. Unplug electronic devices when they are not in use and turn off lights in rooms that are not occupied. Make sure your home is well-insulated and consider using natural lighting during the day. Finally, take advantage of off-peak electricity rates and use energy-saving settings on your appliances.

How can I save money on transportation expenses?

To save money on transportation expenses, consider using public transportation instead of driving your car. Carpooling with colleagues or friends is another cost-effective option. If possible, walk or bike for short distances. Regular vehicle maintenance and proper tire inflation can also improve fuel efficiency. Furthermore, comparing gas prices and using apps to find the cheapest gas stations can help you save money on fuel.

What are some effective ways to save money on clothing?

To save money on clothing, start by shopping during sales and clearance events. Consider buying second-hand clothes from thrift stores or online marketplaces. Take good care of your clothes by following proper washing and storage instructions to make them last longer. Additionally, try to mend or alter clothes instead of buying new ones. Finally, create a capsule wardrobe with versatile pieces that can be mixed and matched.

How can I save money on entertainment expenses?

To save money on entertainment expenses, look for free or low-cost activities in your community, such as public parks, museums with discounted days, or local events. Cancel unnecessary subscriptions or memberships and consider sharing entertainment platforms with family or friends. Instead of eating out, try cooking meals at home and having a movie night. Lastly, borrow books, movies, or games from the library instead of buying them.