Creating a solid financial foundation is essential for long-term stability and peace of mind. However, the process of budgeting can seem overwhelming and confusing, often leaving individuals feeling unsure of where to start. That’s why we’ve gathered expert insights to share seven essential strategies for effectively managing your finances and achieving financial stability.

1. Prioritize Your Expenses: The first step in successful budgeting is understanding your financial priorities. Take the time to evaluate your expenses and determine what is truly necessary versus what may be considered discretionary. By identifying your most important financial obligations, you can allocate your resources accordingly and ensure that your essential needs are always met.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn More2. Track Your Spending: Keeping track of your expenses is key to maintaining control over your finances. Start by creating a comprehensive list of your monthly expenditures, including both fixed costs (such as rent or mortgage payments) and variable expenses (such as groceries or entertainment). Regularly reviewing your spending habits will allow you to make informed decisions and identify areas where you can cut back and save.

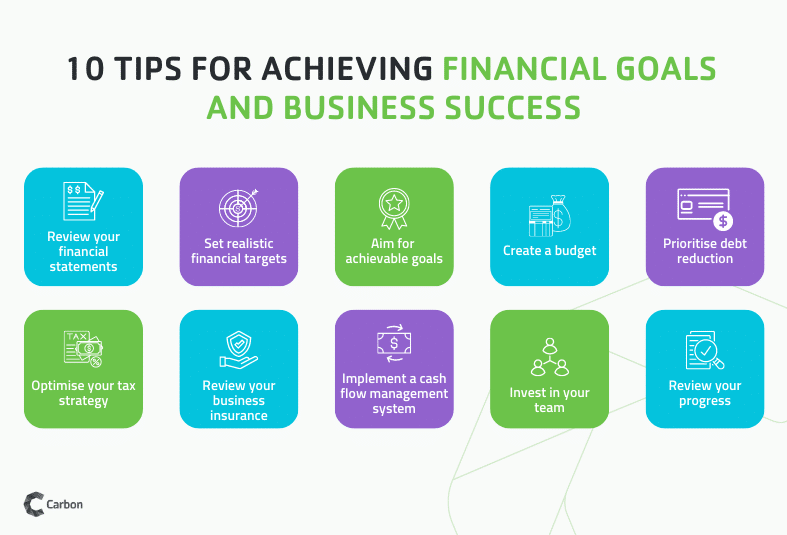

3. Set Realistic Goals: Setting financial goals is important for staying motivated and focused on achieving long-term stability. Whether you’re saving for a down payment on a house, planning for retirement, or aiming to pay off debt, establish realistic targets that align with your current financial situation. Breaking down your goals into smaller, actionable steps will help you stay on track and make progress over time.

4. Establish an Emergency Fund: Unexpected expenses can arise at any time, causing financial strain and derailing your budgeting efforts. Building an emergency fund is crucial to safeguarding yourself against these unforeseen circumstances. Aim to save at least three to six months’ worth of living expenses in a separate account, ensuring that you have a safety net to rely on during challenging times.

- 7 Key Strategies for Effective Budgeting: Professional Guidance for Attaining Financial Stability

- Define Your Financial Objectives

- Establish Clear Objectives

- Identify Short and Long-Term Targets

- Track Your Income and Expenses

- Create a Comprehensive Budget

- Analyze Your Spending Habits

- Prioritize Your Expenses

- Distinguish Between Needs and Wants

- Allocate Funds for Essential Costs

- Cut Back on Unnecessary Expenditure

- Questions and answers

7 Key Strategies for Effective Budgeting: Professional Guidance for Attaining Financial Stability

In the pursuit of sound financial management, understanding and employing effective budgeting strategies is of utmost importance. By implementing these strategic approaches, individuals can establish a solid foundation for attaining financial stability. The following seven key strategies, curated by industry professionals, provide expert guidance and insights to support individuals in their quest for better money management.

1. Prioritizing

One of the essential aspects of effective budgeting is the ability to prioritize expenses. By differentiating between needs and wants, individuals can allocate their financial resources sensibly. This process requires an understanding of one’s essential obligations, such as bills and debts, and ensuring that these commitments are fulfilled before indulging in non-essential expenses.

2. Tracking and Monitoring

A critical step towards achieving financial stability is to develop a habit of tracking and monitoring expenses. By diligently recording all income and expenditures, individuals gain a comprehensive view of their spending patterns. This analysis helps in identifying areas where unnecessary expenses can be minimized, leading to better budget allocation.

3. Setting Realistic Goals

Effective budgeting involves setting realistic financial goals that are both attainable and measurable. By defining clear objectives, individuals can strive towards enhancing their financial situation. Whether it’s saving for a down payment, clearing off debts, or planning for retirement, setting achievable goals acts as a motivational tool and helps in maintaining financial focus.

4. Creating and Adhering to a Budget

A crucial component of successful budgeting is the creation of a detailed budget plan. This plan should encompass all anticipated income and expenses to provide a comprehensive overview of one’s financial situation. By adhering to this budget plan, individuals can effectively manage their finances, control unnecessary spending, and cultivate a long-term path to financial stability.

5. Establishing an Emergency Fund

Financial emergencies are inevitable, and establishing an emergency fund is paramount. Allocating a portion of one’s income towards a separate account ensures a safety net for unexpected expenses or income disruptions. This practice not only provides peace of mind but also prevents individuals from relying on credit cards or loans during emergencies.

6. Regularly Reviewing and Adjusting

Regularly reviewing and adjusting one’s budget is essential to maintain its effectiveness. Financial situations change over time, and being proactive in reassessing and adapting the budget accordingly allows individuals to stay on track. Adjustments can be made in response to income changes, life events, or emerging financial goals.

7. Seeking Professional Advice

A final strategy for effective budgeting is seeking professional guidance when needed. Financial advisors or planners can offer specialized insights and suggestions tailored to one’s unique financial circumstances. Utilizing their expertise can provide valuable assistance in achieving financial stability and optimize one’s budgeting efforts.

Incorporating these seven key strategies into one’s approach to budgeting offers individuals a strong framework for attaining financial stability. By combining consistent discipline, conscious decision-making, and regular assessment, individuals can navigate their financial journey with confidence and achieve their long-term financial goals.

Define Your Financial Objectives

Establishing clear financial goals is a crucial component of effective budgeting. By defining your financial objectives, you can create a roadmap for your financial journey, guiding you towards the achievement of long-term stability. Clearly identifying your aspirations and desires in terms of finances allows you to set specific targets and stay motivated throughout the budgeting process.

Clearly Identify Your Ambitions: Begin by reflecting on what you hope to achieve in terms of your finances. Consider both short-term goals, such as paying off debt or saving for a vacation, as well as long-term goals, such as buying a house or retiring comfortably. By clearly identifying your ambitions, you can create a sense of purpose and direction in your budgeting efforts.

Establish Realistic Targets: While it is important to dream big, it is equally important to set realistic targets. Take into account your current financial situation, income, and expenses, and ensure that your goals are achievable within a reasonable timeframe. Setting realistic targets will help you stay motivated and avoid becoming overwhelmed or discouraged during the budgeting process.

Track Your Progress: Once you have established your financial goals, it is essential to regularly track your progress. Keep a close eye on your income, expenses, savings, and debt reduction to ensure that you are moving steadily towards your objectives. Tracking your progress allows you to make necessary adjustments to your budgeting strategy and celebrate milestones along the way.

Reassess and Adjust: As your circumstances change, it is important to reassess and adjust your financial goals accordingly. Life is unpredictable, and factors such as job changes, unexpected expenses, or shifts in priorities may require you to revise your objectives. By remaining flexible and adapting your goals as needed, you can maintain momentum and continue progressing towards financial stability.

In conclusion, defining your financial goals is a fundamental step in successful budgeting. By clearly identifying your aspirations, setting realistic targets, tracking your progress, and remaining adaptable, you can create a solid foundation for financial stability and work towards achieving your dreams.

Establish Clear Objectives

Setting clear objectives is a crucial step in ensuring the success of your budgeting efforts. By clearly defining what you want to achieve with your finances, you can create a roadmap that will guide your financial decisions and actions.

When establishing your objectives, it is important to focus on specific outcomes that align with your long-term financial goals. Consider what you want to accomplish, such as saving for a down payment on a house, paying off debt, or building an emergency fund. These objectives will serve as targets to strive for and will provide you with motivation along your budgeting journey.

- Be Specific: Clearly define your objectives in measurable terms. For example, instead of saying save money, specify an amount or percentage you aim to save each month.

- Set Realistic Goals: Ensure that your objectives are attainable within your current financial situation. Setting unrealistic goals can lead to frustration and discouragement.

- Prioritize: Determine the order in which you want to achieve your objectives. This will help you allocate your financial resources effectively and focus on what matters most to you.

- Make it Time-Bound: Set a timeline for achieving your objectives. Having a deadline will create a sense of urgency and keep you accountable.

Remember, establishing clear objectives is the foundation of successful budgeting. It provides you with direction, purpose, and motivation to make informed financial decisions and achieve long-term financial stability.

Identify Short and Long-Term Targets

Set Clear Objectives for Immediate and Future Financial Goals

In order to achieve financial stability, it is crucial to establish both short and long-term targets for your budgeting. By setting clear objectives, you can effectively plan and prioritize your financial decisions. Short-term targets focus on immediate financial goals, such as paying off debts or saving for a vacation, while long-term targets encompass broader aspirations like purchasing a house or building a retirement fund.

Distinguish between Immediate Needs and Future Aspirations

By identifying short and long-term targets, you can differentiate between immediate needs and future aspirations. Immediate needs require attention and allocation of available resources, while future aspirations require consistent effort and planning. Being able to distinguish between the two will help you make informed decisions and allocate your financial resources effectively.

Take into Account Financial Constraints and Opportunities

When identifying short and long-term targets, it is important to consider your financial constraints and opportunities. Evaluate your current financial situation and determine what is realistic and achievable. This will help you set attainable targets that take into account both your financial limitations and potential opportunities for growth.

Create a Timeline and Prioritize Targets

By creating a timeline and prioritizing your targets, you can effectively allocate your financial resources and stay focused on achieving your goals. Determine which targets need immediate attention and which can be pursued in the long run. This will enable you to create a strategic plan and make informed decisions regarding your budgeting.

Adjust Targets as Needed, but Maintain Overall Direction

Your financial situation may change over time, and it is important to be flexible and adjust your targets accordingly. However, it is crucial to maintain an overall direction and focus on achieving your financial stability. Regularly review and reassess your targets to ensure they align with your current circumstances and adapt them as needed.

Monitor Your Progress and Celebrate Milestones

Tracking your progress towards your identified targets is essential. Regularly monitor your budgeting and assess whether you are on track to achieving your goals. Celebrate milestones along the way to stay motivated and maintain the discipline required for successful budgeting. Recognizing your achievements will further encourage you to continue working towards financial stability.

Seek Professional Advice for Complex Targets

If you have complex targets or are unsure about how to approach certain financial goals, it is advisable to seek professional advice. Financial experts can provide guidance and help you navigate through challenging situations. Don’t hesitate to reach out for assistance when needed, as their expertise can greatly enhance your chances of achieving long-term financial stability.

Track Your Income and Expenses

One crucial step towards achieving financial stability is to closely monitor your earnings and expenditures. By keeping a record of your income and expenses, you can gain a clear understanding of your financial habits and make informed decisions to improve your budgeting skills.

Tracking your income involves recording all the money you receive on a regular basis, whether it be from your job, investments, or other sources. By identifying the different channels through which you earn money, you can assess the stability and reliability of your income streams.

On the other hand, tracking your expenses involves diligently jotting down every expenditure you make, both essential and discretionary. This includes bills, groceries, transportation costs, entertainment expenses, and any other payments you make regularly or occasionally. Capturing these details will help you identify areas where you can cut back on spending and save more.

To effectively track your income and expenses, consider using a digital tool or a spreadsheet where you can input your financial data. This will allow you to easily organize and update your records. Additionally, you can create categories to categorize your expenses and analyze where you are allocating the most money.

A monthly review of your income and expenses will provide insights into how your financial situation is evolving over time. You can compare your earnings and expenditures from one month to another, identify patterns, and spot any inconsistencies or areas for improvement.

| Income | Expenses |

|---|---|

| Job Income | Rent/Mortgage |

| Investment Income | Bills |

| Side Gig Income | Groceries |

| Gifts or Bonuses | Transportation |

Regularly tracking your income and expenses will help you make informed decisions about your financial goals. It will enable you to identify areas where you can save, invest, or allocate resources more effectively. Ultimately, by diligently monitoring your financial inflows and outflows, you can achieve greater control over your finances and work towards long-term financial stability.

Create a Comprehensive Budget

Developing a comprehensive budget is a crucial step towards achieving financial stability. By creating a detailed and all-encompassing budget, individuals can gain a clear understanding of their financial situation and make informed decisions about their spending and saving habits. A comprehensive budget considers all sources of income, expenses, and financial goals, allowing individuals to efficiently allocate their resources and work towards achieving their financial aspirations.

Get started with these steps:

1. Assess your income: Begin by thoroughly evaluating all sources of income, including salaries, bonuses, investments, and any additional earnings. By accurately determining your monthly income, you can effectively plan your budget without overestimating or underestimating your financial resources.

2. Track your expenses: Take the time to review your previous expenses and identify any patterns or areas where you may be overspending. Keep track of your monthly expenses, such as rent or mortgage payments, utility bills, groceries, transportation costs, and entertainment expenses. This will help you create a realistic and comprehensive budget.

3. Set financial goals: Determine your short-term and long-term financial goals, such as saving for an emergency fund, paying off debt, or saving for retirement. Setting specific and achievable goals will provide you with a clear direction and motivation to stick to your budget and make financial decisions that align with your objectives.

4. Categorize your expenses: Divide your expenses into different categories to better understand where your money is going. Common categories include housing, transportation, groceries, debt payments, entertainment, and miscellaneous expenses. This categorization will help you identify areas where you can potentially cut back and reallocate funds towards your financial goals.

5. Prioritize essential expenses: Ensure that your budget includes all necessary and recurring expenses, such as housing, utilities, and debt payments. By prioritizing these essential expenses, you can ensure that your basic needs are met and allocate the remaining funds towards savings and non-essential expenses.

6. Monitor and adjust: Regularly monitor your budget and track your expenses to ensure that you are staying on track and making progress towards your financial goals. If necessary, make adjustments to your budget to accommodate any unexpected expenses or changes in income.

7. Seek professional advice: If you are struggling to create or stick to a comprehensive budget, consider seeking advice from financial experts or professionals. They can provide valuable insights and guidance tailored to your specific financial situation, helping you develop a budget that aligns with your goals and aspirations.

Creating a comprehensive budget requires time and effort, but it is a crucial step towards achieving financial stability and ensuring a secure future. By following these steps and making budgeting a priority, individuals can gain control over their finances and work towards their financial aspirations with confidence.

Analyze Your Spending Habits

Understanding how you allocate your money is crucial for achieving financial stability. By analyzing your spending habits, you can gain valuable insights into your financial decision-making and identify areas where you may be able to make improvements. This section will guide you through the process of examining your expenses and taking proactive steps towards smarter financial management.

Evaluate Your Current Expenditures: Take a close look at your current spending patterns and identify your major expenses. This could include categories such as housing, transportation, groceries, entertainment, and miscellaneous expenses. By categorizing your expenditures, you can get a clear picture of where your money is going and determine what areas you may need to adjust.

Track Your Spending: Keep a record of your daily expenses for a specified period of time. Whether it’s through a smartphone app, a spreadsheet, or a pen and paper, tracking your spending allows you to see the small, recurring expenses that can accumulate over time. This activity will help you become more conscious of your spending habits and where you could potentially cut back.

Identify Your Needs versus Wants: Distinguish between essential expenses, such as housing and groceries, and non-essential expenses, such as dining out or purchasing luxury items. Prioritize your needs over your wants and consider if there are any areas where you can make discretionary cuts.

Recognize Spending Triggers: Reflect on the emotional or situational triggers that drive your spending habits. Are you more prone to impulse purchases when you are stressed or bored? Understanding your triggers can help you develop healthier coping mechanisms, such as finding alternative activities that don’t involve spending money.

Create a Budget: Use the insights gained from analyzing your spending habits to create a personalized budget. Allocate your income towards necessary expenses, savings, and debt repayment, while allowing some room for discretionary spending. Sticking to a budget will help you stay on track and make progress towards your financial goals.

Set Realistic Goals: Based on your analysis, establish achievable financial goals. Whether it’s paying off debt, saving for a down payment, or funding a dream vacation, having specific targets will provide you with a sense of purpose and motivation. Break down these goals into smaller milestones to make them more manageable and celebrate your achievements along the way.

Review and Adjust Regularly: Revisit your spending habits periodically to monitor your progress. As your financial situation evolves, you may need to adjust your budget or priorities accordingly. Regularly reviewing your spending habits will ensure that you stay on top of your finances and continue to move towards financial stability.

By analyzing your spending habits, you can gain a comprehensive understanding of your financial behaviors and make informed decisions that align with your goals. It’s an ongoing process that requires dedication and self-awareness, but it is an essential step towards achieving the financial stability you desire.

Prioritize Your Expenses

When it comes to managing your finances effectively, understanding how to prioritize your expenses is crucial. By determining which expenses are most important and should take precedence over others, you can ensure that your financial stability is maintained.

One key aspect of prioritizing your expenses is identifying your needs versus your wants. It is essential to distinguish between essential necessities, such as housing, food, and utilities, and non-essential expenses, like entertainment or luxury items. By focusing on covering your needs first, you can ensure that your basic requirements are met.

Another factor to consider when prioritizing expenses is considering the potential consequences of not paying certain bills or obligations. For instance, neglecting loan payments or credit card bills may result in significant penalties or damage to your credit score, which can have long-term effects on your financial well-being. By understanding the potential repercussions, you can make informed decisions on how to allocate your resources.

When prioritizing your expenses, it is also important to take into account any outstanding debts or financial obligations. Allocating funds towards debt repayment can help alleviate financial stress and allow for greater flexibility in your budget. Prioritizing debt repayment can also lead to long-term financial freedom and help you save money on interest payments.

Emergency savings should also be a top priority when it comes to your expenses. By setting aside funds for unexpected events or emergencies, you can avoid relying on credit cards or loans in times of crisis. Having a financial safety net not only provides peace of mind but also protects you from falling into debt due to unforeseen circumstances.

Lastly, it is important to regularly review and adjust your priorities as your financial situation evolves. Life circumstances and goals can change over time, requiring a reassessment of your expenses. By staying proactive and adaptable, you can ensure that your budgeting efforts align with your current financial needs and aspirations.

In conclusion, prioritizing your expenses is an essential aspect of successful budgeting. By distinguishing between needs and wants, considering the consequences of non-payment, prioritizing debt repayment, setting aside emergency savings, and regularly reviewing and adjusting your priorities, you can achieve greater financial stability and successfully manage your budget.

Distinguish Between Needs and Wants

Understanding the distinction between our needs and wants is crucial when it comes to effective budgeting and achieving financial stability. This concept revolves around differentiating between the essential requirements for survival and the desires and preferences that enhance our quality of life.

When managing your budget, it is important to prioritize your needs over your wants. Needs refer to the fundamental necessities of life, such as food, shelter, clothing, and healthcare. These are the items and services that are essential for your well-being and cannot be compromised. On the other hand, wants are the things that bring pleasure and satisfaction, but are not necessary for your basic survival. They often include luxury items, entertainment, and non-essential experiences.

Identifying and distinguishing between your needs and wants is the first step towards creating a realistic and sustainable budget. It helps you allocate your financial resources efficiently, ensuring that you can cover your essential needs while also indulging in some of your wants within your means. By understanding the difference between needs and wants, you can make informed decisions about where to allocate your money and identify areas where you can cut back or make adjustments.

It is important to reassess your needs and wants regularly as your circumstances and priorities change. By consistently evaluating and reevaluating your financial goals and spending habits, you can adapt your budget to align with your evolving needs and wants. This ongoing process of distinguishing between needs and wants will enable you to prioritize your financial stability and make conscious decisions that support your long-term financial well-being.

Overall, understanding the difference between your needs and wants is a fundamental aspect of successful budgeting. By recognizing and prioritizing your needs while also considering your wants, you can strike a balance between fulfilling your essential requirements and enjoying the non-essential aspects of life. With this awareness, you can gain control over your finances and work towards achieving financial stability in a mindful and sustainable way.

Allocate Funds for Essential Costs

:max_bytes(150000):strip_icc()/understanding-and-preventing-financial-stress-3144546_final1-6d778f5604df4e3fa8fcb6831c6b72fd.png)

One crucial aspect of effective financial management is properly allocating funds for essential expenses. By carefully prioritizing and budgeting for necessary costs, individuals can ensure that their financial stability is maintained.

- Identify and categorize necessary expenses: Begin by identifying all essential expenses, such as housing, utilities, transportation, groceries, healthcare, and loan payments. Categorize them to easily visualize where your money is being spent.

- Create a realistic budget: Once you have identified your essential expenses, create a budget that allocates a specific amount of your income for each category. Consider your income, fixed costs, and any potential fluctuation in expenses.

- Estimate variable expenses: Some essential costs, such as groceries or utilities, may vary from month to month. Estimate an average amount for these expenses and include them in your budget accordingly.

- Set priorities: Prioritize your essential costs based on their importance and urgency. Ensure that you allocate enough funds to cover your most critical expenses before allocating money towards discretionary spending.

- Consider emergency savings: Allocate a portion of your budget towards building an emergency savings fund. This will provide a safety net for unexpected expenses or financial hardships that may arise.

- Regularly review and adjust: Periodically review your budget to ensure that it still aligns with your financial goals and current circumstances. Make adjustments as necessary to accommodate any changes in income or expenses.

- Seek professional advice if needed: If you are struggling with allocating funds for essential costs or managing your budget effectively, consider seeking advice from a financial professional who can provide personalized guidance and assistance.

By consistently and thoughtfully allocating funds for essential costs, individuals can achieve greater financial stability and ensure that their necessary expenses are covered. Practicing this fundamental aspect of budgeting can help pave the way for long-term financial success.

Cut Back on Unnecessary Expenditure

Eliminating unnecessary expenses is a crucial step towards achieving financial stability. By identifying and reducing non-essential spending, you can free up funds to allocate towards your financial goals. It’s essential to carefully evaluate your expenditures, distinguishing between essential and non-essential items or services.

1. Prioritize your needs over wants: Differentiating between needs and wants is essential in managing your budget effectively. Start by identifying your basic needs, such as housing, food, utilities, and transportation. Then, evaluate your wants, which are discretionary expenditures that can be reduced or eliminated altogether.

2. Create a realistic budget: Develop a budget that reflects your financial goals and income level. Be honest with yourself about your spending habits and make adjustments where necessary. This will help you allocate funds more efficiently and leave room for saving or investing.

3. Track your expenses: Keep a record of all your expenses, whether big or small. This will allow you to identify patterns and areas where you can cut back. Consider using expense tracking apps or spreadsheets to make the process more manageable and accurate.

4. Shop strategically: Before making a purchase, research prices and compare different options. Consider buying in bulk, waiting for sales, or using coupons to reduce costs. Additionally, avoid impulse buying and take the time to evaluate whether a purchase aligns with your budget and financial goals.

5. Review your subscriptions and memberships: Take stock of all your subscriptions and memberships, such as streaming services, gym memberships, or magazine subscriptions. Determine whether they are worth the cost and cancel any that you rarely utilize or are no longer interested in.

6. Reduce dining out expenses: Dining out can quickly add up and strain your budget. Limit eating out to special occasions and opt for cooking meals at home more often. Not only is homemade food generally healthier, but it’s also more cost-effective.

7. Cut back on unnecessary conveniences: Evaluate conveniences that may be costing you more than they’re worth. For example, consider canceling unnecessary delivery services, downgrading to a more affordable phone plan, or reducing your cable TV package.

By implementing these practical tips, you can significantly reduce unnecessary expenditures and allocate your money towards what truly matters, helping you achieve financial stability in the long run.

Questions and answers

How can I achieve financial stability through successful budgeting?

Achieving financial stability through successful budgeting requires a few essential tips. Some of these tips include tracking your expenses, setting financial goals, creating a realistic budget, cutting unnecessary expenses, saving for emergencies, prioritizing debt repayment, and seeking expert advice if needed.

What are the benefits of successful budgeting?

Successful budgeting brings several benefits. It helps you gain control over your finances, reduce financial stress, achieve your financial goals, save money, and prepare for unexpected expenses. It also allows you to be more organized with your finances and make more informed financial decisions.

How can I track my expenses effectively?

To track your expenses effectively, you can start by keeping all your receipts and recording your daily expenses. You can also use budgeting apps or spreadsheet templates to categorize and track your expenses. Reviewing your bank and credit card statements regularly can also help you identify your spending patterns and areas where you can cut back.

What are some common mistakes to avoid when budgeting?

When budgeting, it’s important to avoid common mistakes such as not setting realistic goals, underestimating expenses, failing to track all expenses, not including savings in the budget, and not adjusting the budget periodically. It’s also crucial to avoid impulse buying and overspending on unnecessary items.

Is it important to seek expert advice for budgeting?

Seeking expert advice for budgeting can be beneficial, especially if you’re facing financial difficulties or find it challenging to manage your finances. Financial experts can provide personalized guidance, help you create a tailored budget, suggest effective strategies to save money, and offer solutions to your specific financial concerns.

What are some essential tips for successful budgeting?

Some essential tips for successful budgeting include tracking expenses, creating a realistic budget, prioritizing financial goals, cutting unnecessary expenses, and creating an emergency fund.

How can I track my expenses effectively?

To track your expenses effectively, you can use a budgeting app or spreadsheet, collect receipts, categorize your expenses, and review your spending regularly. This will help you identify areas where you can cut back and save money.

What is the importance of creating a realistic budget?

Creating a realistic budget is crucial for financial stability. It allows you to have a clear understanding of your income and expenses, helps you avoid overspending, and enables you to allocate funds towards your financial goals.

How can I prioritize my financial goals?

To prioritize your financial goals, you should list them in order of importance. Consider short-term goals, such as paying off debt, followed by long-term goals like saving for retirement. It’s also important to regularly review and update your goals as your financial situation changes.

What is the purpose of creating an emergency fund?

Creating an emergency fund is essential to provide a safety net for unexpected expenses. It helps you avoid going into debt and provides financial security in case of job loss, medical emergencies, or unforeseen events. Aim to save at least three to six months’ worth of living expenses in your emergency fund.