In today’s fast-paced world, it can be challenging to keep track of your finances and achieve your desired financial outcomes. However, with the help of innovative budget planner tools, you can take control of your money and pave the way towards a prosperous future.

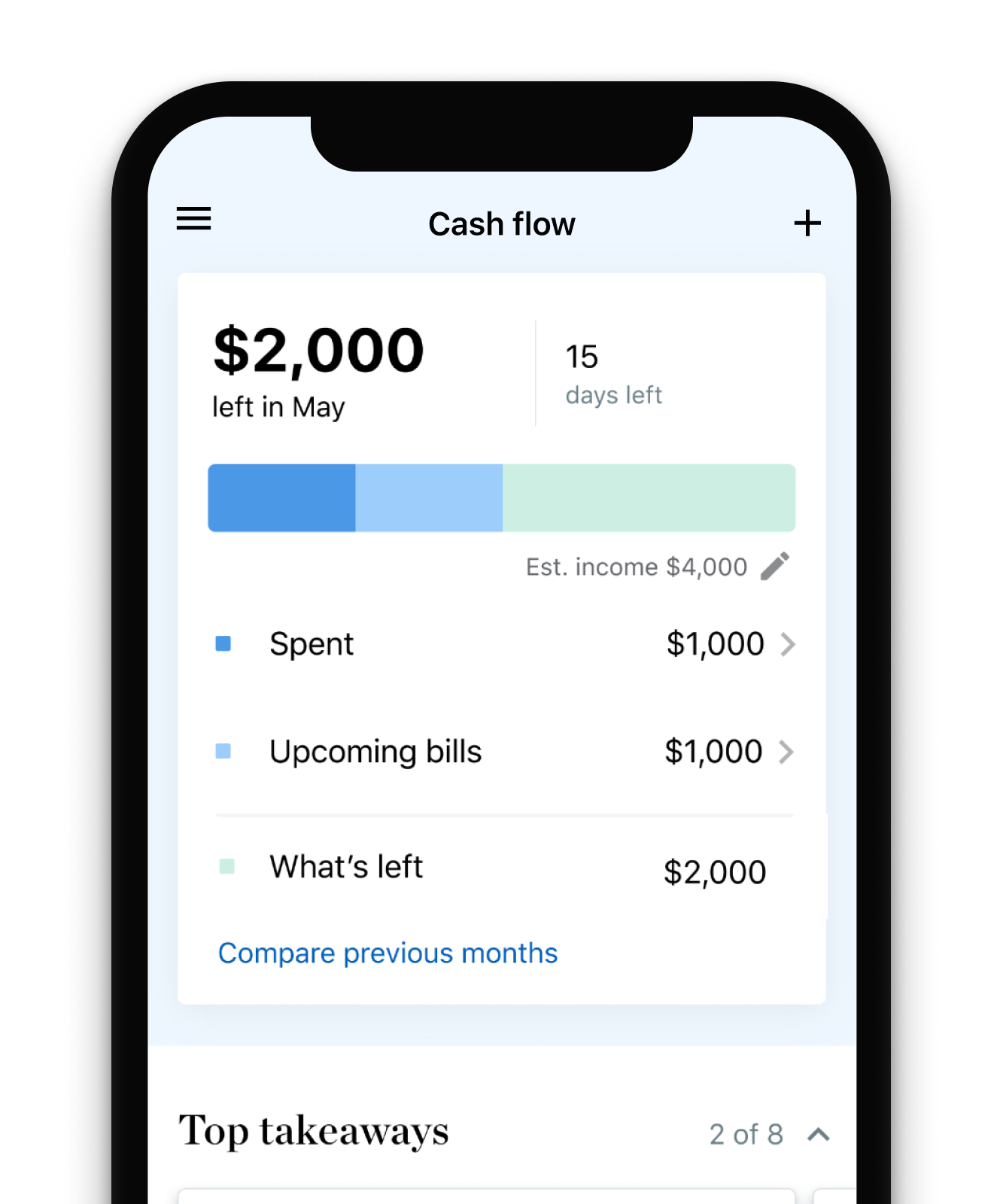

Take advantage of the wide range of financial management applications available, designed to simplify the process of budgeting and empower you to make informed decisions about your money. These tools provide a comprehensive overview of your income, expenses, and savings, allowing you to identify areas where you can optimize your spending and maximize your savings potential.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreWith a budget planner tool, you can set realistic financial goals and stay motivated as you witness your progress over time. Whether you wish to save for a dream vacation, pay off outstanding debts, or build an emergency fund, these tools offer a visual representation of your financial journey, making it easier to stay focused and track your achievements.

Additionally, many budget planner tools incorporate advanced features, such as personalized notifications and reminders, to help you stay on top of your financial responsibilities. These reminders can be customized according to your preferences, ensuring that you never miss a payment deadline or overlook an important financial commitment.

- Evaluate Your Financial Situation

- Understanding your current financial standing

- Analyze your income and expenses

- Identify areas where you can cut back

- Effective Budgeting Strategies

- Create a realistic monthly budget

- Allocate funds for essential expenses

- Set aside money for savings and investments

- Track Your Expenses

- Monitor your daily spending habits

- Use budget tracker apps or spreadsheets

- Identify unnecessary expenses and eliminate them

- Utilize Online Budgeting Tools

- Explore user-friendly budgeting software

- Questions and answers

Evaluate Your Financial Situation

Assessing and understanding your current financial state is key to effectively managing your money and achieving your financial goals. By evaluating your financial situation, you can gain insight into your income, expenses, debts, and overall financial health. This evaluation will provide you with a clear picture of where you stand financially and help you make informed decisions to improve your financial well-being.

Firstly, take a comprehensive look at your income sources and determine the amount of money you earn on a regular basis. This includes salaries, wages, bonuses, investment returns, and any other sources of income. Understanding your income will enable you to create a realistic budget and identify areas where you can increase your earnings.

Next, analyze your expenses to gain clarity on how you are spending your money. Categorize your expenses into essential and non-essential items. Essential expenses encompass basic necessities such as housing, utilities, transportation, and groceries, while non-essential expenses include entertainment, dining out, and other discretionary purchases. By examining your expenses, you can identify areas where you can cut back and save money.

In addition to income and expenses, it is crucial to evaluate your debts. Take stock of all your outstanding loans, credit card balances, and any other financial obligations. Calculate the total amount owed, the interest rates, and the monthly payments. Understanding your debt situation will help you prioritize repayment strategies and avoid unnecessary interest charges.

Finally, consider your financial goals and ambitions. Determine what you want to achieve in terms of savings, investments, retirement planning, and major purchases. By setting specific, measurable, achievable, relevant, and time-bound (SMART) goals, you can align your financial decisions with your long-term aspirations and track your progress along the way.

Evaluating your financial situation is an ongoing process that requires regular assessment and adjustment. By taking the time to evaluate your financial standing, you can make informed decisions, develop effective strategies, and ultimately work towards achieving financial stability and success.

Understanding your current financial standing

Having a clear understanding of your current financial situation is essential in order to effectively manage your money and work towards your financial goals. By gaining a comprehensive overview of your income, expenses, assets, and debts, you can make informed decisions about budgeting, saving, and investing.

Assessing your income

Begin by evaluating all sources of income, including salaries, wages, bonuses, dividends, and any additional income streams. Identifying the total amount of money coming in each month will provide a solid foundation for your budgeting efforts.

Evaluating your expenses

Next, it is important to carefully analyze your expenses and categorize them into fixed expenses, such as rent or mortgage payments, utility bills, and loan repayments, as well as variable expenses, such as groceries, entertainment, and transportation. This evaluation will help you understand where your money is going and where potential savings opportunities lie.

It is important to be thorough and include all expenses, regardless of their size or frequency, in order to get an accurate picture of your spending habits.

Understanding your assets

Your assets include any possessions or investments that hold value and contribute to your overall net worth. This may include cash in bank accounts, real estate, stocks, bonds, or retirement accounts. Understanding the value and accessibility of these assets will help you make informed decisions when setting financial goals.

Remember that assets can also serve as a safety net during unexpected financial emergencies.

Assessing your debts

In addition to understanding your assets, it is crucial to evaluate your debts. This may include student loans, credit card debt, car loans, or mortgages. Knowing the full extent of your debts and their interest rates will allow you to prioritize debt repayment strategies and work towards becoming debt-free.

Reducing and managing your debts is an important step in achieving long-term financial stability.

By taking the time to understand your current financial standing, you are better equipped to develop a budget, set financial goals, and make informed decisions regarding your financial future. With this knowledge in hand, you can actively work towards achieving your desired financial outcomes.

Analyze your income and expenses

Explore the details of your earnings and expenditures to gain a comprehensive understanding of your financial situation. By delving into the intricate aspects of your income and outflows, you can effectively manage your finances and make informed decisions to achieve your monetary objectives.

Evaluate your income: Begin by closely examining your various sources of income, such as salaries, freelancing gigs, or investments. Analyze the stability, frequency, and size of each income stream to understand the patterns and trends that contribute to your financial well-being. Identifying the aspects that positively impact your earnings can help you strategize and maximize your income potential.

Alternatives: Assess your financial gain, Scrutinize your revenue, Appraise your earnings

Analyze your expenses: Thoroughly review your expenditures, categorizing them into essential and non-essential items. Pinpoint areas where you can potentially reduce costs or find more cost-effective alternatives. By understanding your spending habits, you can identify areas of improvement and make necessary adjustments to ensure better financial stability and savings.

Alternatives: Examine your outflows, Assess your spending, Scrutinize your expenses

Track your financial trends: Utilize budgeting tools or spreadsheets to record and organize your income and expenses. Regularly monitor your inflows and outflows to identify any irregularities or unexpected fluctuations. By visualizing your financial trends, you can effectively plan and adjust your budget to align with your long-term financial goals.

Alternatives: Monitor your monetary patterns, Follow your financial trends, Keep tabs on your income and outflows

Identify areas for improvement: Through a thorough analysis of your income and expenses, you can uncover areas where you may be overspending or where additional income could be generated. By identifying these opportunities for improvement, you can make proactive changes to your financial habits and prioritize areas that require attention, ultimately leading to better financial outcomes.

Alternatives: Uncover opportunities for enhancement, Spot areas of financial optimization, Identify avenues for growth

By meticulously analyzing your income and expenses, you can gain valuable insights into your financial behavior and develop effective strategies to enhance your financial management skills. With a clearer understanding of your financial situation, you can take proactive steps towards achieving your long-term financial goals.

Identify areas where you can cut back

When it comes to managing your finances, it’s important to identify areas where you can reduce your spending. By assessing your expenses and finding areas where you can cut back, you can free up money to save or invest towards your financial goals. Here are some strategies to help you identify these areas and make the necessary adjustments:

- Track your expenses: Start by tracking your expenses for a few weeks or a month. This will provide you with a clear picture of where your money is going and help you identify any unnecessary or excessive spending.

- Create a budget: After understanding your expenses, create a budget that allocates your income towards essential needs such as housing, food, and transportation, while leaving room for savings and discretionary spending.

- Review your subscriptions: Take a look at your subscriptions, such as streaming services, gym memberships, or monthly boxes. Consider cancelling any that you don’t use frequently or that don’t align with your financial priorities.

- Reduce dining out: Eating out can quickly add up, so consider preparing meals at home more often. Meal planning and cooking in bulk can be cost-effective and allow you to enjoy homemade meals while saving money.

- Lower utility bills: Assess your utility bills and see if there are any areas where you can reduce costs. This could include adjusting the thermostat, using energy-efficient appliances, or being mindful of water consumption.

- Shop smart: Take the time to compare prices, look for discounts, and use coupons when shopping for groceries or other necessities. Additionally, consider buying used or refurbished items instead of always opting for new ones.

- Avoid impulse buying: Before making a purchase, ask yourself if you really need it or if it’s an impulse buy. Wait a few days or a week before deciding to ensure it’s something you genuinely want or need.

- Limit entertainment expenses: While it’s important to have some downtime and enjoy leisure activities, be conscious of excessive spending on entertainment. Look for free or low-cost activities such as exploring local parks or attending community events.

By taking the time to identify areas where you can cut back, you can make meaningful changes to your spending habits and allocate your resources towards your financial goals. Remember, small adjustments can add up over time, leading to greater financial stability and success.

Effective Budgeting Strategies

In this section, we will explore practical and efficient techniques for managing your finances and achieving your desired financial outcomes. By implementing these proven strategies, you can take control of your spending, save money, and work towards your financial objectives without the need for costly tools or services.

One fundamental approach to effective budgeting is analyzing your income and expenses to create a comprehensive overview of your financial situation. By identifying your sources of income and categorizing your expenses, you can gain insight into your spending habits and make informed financial decisions. This step will enable you to prioritize your spending, differentiate between needs and wants, and allocate your resources accordingly.

Another essential strategy is setting realistic financial goals and establishing a timeline for achieving them. Whether you aim to save for a dream vacation, pay off debt, or build an emergency fund, having clear objectives will guide your budgeting efforts and provide motivation along the way. It is important to be specific and measurable in your goals, ensuring that they are bound by a time frame and can be quantified. This approach will help you stay focused, track your progress, and adjust your budget as necessary.

One effective technique for budgeting is the envelope system. By allocating a certain amount of cash to different categories of expenses, you can physically separate your money and visually monitor your spending. This method can be particularly useful for controlling discretionary spending and preventing overspending in specific areas. By consistently using this system, you can establish discipline and mindfulness in your financial habits.

Additionally, it is crucial to regularly review and evaluate your budget to ensure its effectiveness and make any necessary adjustments. Circumstances may change over time, such as income fluctuations or unexpected expenses, and it is important to adapt your budget accordingly. By regularly reevaluating your financial situation, you can identify areas for improvement, make necessary modifications, and ensure that your budget continues to align with your financial goals.

Implementing these effective budgeting strategies can provide you with greater control over your finances, help you save money, and ultimately contribute to the achievement of your financial goals. By being proactive, disciplined, and adaptable in your approach to budgeting, you can take charge of your financial future and make informed decisions to improve your financial well-being.

Create a realistic monthly budget

Developing a practical and attainable financial plan for your monthly expenses is an essential step towards achieving your money-related objectives. By carefully outlining your income, tracking your spending habits, and identifying areas where you can make adjustments, you can create a budget that fits your lifestyle and helps you realize your financial ambitions.

Begin by assessing your monthly income, including all sources of revenue such as salary, bonuses, and freelance work. It is crucial to have a clear understanding of the funds available to you each month.

Next, evaluate your regular expenses, such as rent or mortgage payments, utility bills, and transportation costs. Identifying fixed expenses will provide a foundation for your budget and help you allocate your funds accordingly.

Once you have determined your fixed expenses, consider flexible expenses, which may include groceries, dining out, entertainment, and personal care. Take note of your spending habits in these areas and identify opportunities to reduce or eliminate unnecessary expenses.

Tracking your expenses is vital for maintaining a realistic budget. Whether you prefer to use budgeting apps, spreadsheets, or a good old-fashioned pen and paper, it is crucial to record your expenditures and compare them with your allotted budget. This step will allow you to identify any areas where you may be overspending and help you make informed decisions to stay on track.

Lastly, it is essential to periodically review and adjust your budget as circumstances change. Life is full of unpredictable expenses, such as medical emergencies or vehicle repairs, so having a flexible budget will ensure that you can handle unexpected costs without derailing your overall financial goals.

Creating a realistic monthly budget requires careful consideration of your income, expenses, and financial goals. By dedicating time and effort to this process, you can gain control of your finances, make progress towards your goals, and ultimately achieve financial stability.

Allocate funds for essential expenses

Effectively managing your finances means making smart decisions about how to allocate your money to cover essential expenses. This involves identifying the necessary costs for your daily life and finding ways to prioritize and budget for them.

When it comes to allocating funds for essential expenses, it is important to distinguish between needs and wants. Needs refer to the fundamental requirements for survival and basic well-being, such as food, shelter, utilities, and healthcare. Wants, on the other hand, encompass non-essential items and luxury goods that enhance your quality of life but are not necessary for your survival.

Creating a list of essential expenses can help you gain a clear understanding of where your money needs to be allocated. Start by listing your fixed monthly costs, such as rent or mortgage payments, utilities, loan repayments, and insurance premiums. Then, consider your variable expenses, such as grocery bills, transportation costs, healthcare expenses, and other essential purchases.

Once you have compiled a comprehensive list of your essential expenses, analyze your income and determine how much you can afford to allocate towards each category. This requires careful consideration of your current financial circumstances and goals. Prioritize the most crucial expenses to ensure they are covered each month.

Aside from budgeting for your essential expenses, it is essential to leave room for unexpected costs and savings. Set aside a portion of your income for emergency funds and savings, as they provide a safety net for unforeseen circumstances and contribute towards achieving your long-term financial goals.

Regularly reviewing and adjusting your budget for essential expenses is crucial, as it enables you to adapt and optimize your finances based on changes in income, expenses, and priorities. Being proactive in this process will ensure that your financial goals remain within reach and that you can effectively allocate funds for both your immediate needs and long-term aspirations.

Set aside money for savings and investments

Allocating funds for your future financial security and growth is an essential aspect of effective budget planning. By setting aside money for savings and investments, you are taking proactive steps towards achieving your long-term financial goals.

One way you can start this process is by creating a dedicated savings account or investment portfolio. These accounts can be used to accumulate funds over time, ensuring that you have a monetary cushion for any unexpected expenses or future financial endeavors.

In addition to traditional savings accounts, you may also consider exploring alternative investment options such as stocks, bonds, or mutual funds. These investment avenues have the potential to generate higher returns over time, helping your money grow and work for you.

Another approach to effectively setting aside money for savings and investments is by incorporating automation into your budget. By automating regular contributions to your savings or investment accounts, you can ensure consistent progress towards your financial goals without any additional effort.

It’s worth mentioning that setting aside money for savings and investments doesn’t have to be limited to large sums. Even small, regular contributions can have a significant impact over time. The key is to develop the habit of saving and committing to regular contributions.

To stay motivated and track your progress, consider setting specific goals for your savings and investments. Whether it’s saving for a down payment on a house, funding your child’s education, or preparing for retirement, having clear objectives will help you stay focused and committed to your financial plan.

- Start saving and investing now to secure your future

- Explore different savings accounts and investment options

- Automate contributions for consistent progress

- Remember that even small contributions can make a difference

- Set specific goals for your savings and investments

By implementing these strategies and making a conscious effort to set aside money for savings and investments, you are taking control of your financial future and increasing your potential for long-term financial success.

Track Your Expenses

Monitor your spending and keep a close eye on where your money goes with efficient expense tracking tools and methods.

Knowing how to track your expenses is essential for successfully managing your finances. By regularly monitoring your spending habits, you can gain a better understanding of your overall financial situation and make informed decisions to achieve your financial goals.

Tracking your expenses allows you to identify areas where you may be overspending and find opportunities to cut back or make adjustments. It also helps you prioritize your spending, plan for future expenses, and ensure that you are staying within your budget.

There are various tools and methods available to track your expenses. One popular approach is to use smartphone apps that allow you to input and categorize your expenses on the go. These apps often provide visual representations of your spending patterns and offer insights into your financial behavior.

Another effective method is to maintain a detailed written record of your expenses. This can be done using a traditional pen and paper method or by creating a spreadsheet on your computer. By manually recording your expenses, you can closely analyze each item and spot any unnecessary or excessive spending.

In addition to tracking your expenses, it is important to regularly review and analyze your spending data. This will help you identify trends, evaluate your progress towards your financial goals, and make any necessary adjustments to your budget or spending habits.

Remember, tracking your expenses is a valuable habit to develop as it allows you to gain control over your finances and make informed decisions towards achieving your financial aspirations.

Monitor your daily spending habits

Track your everyday expenses to gain insight into your financial patterns and make informed decisions that align with your monetary objectives. By regularly monitoring your spending habits, you can establish a clear understanding of where your money goes and identify opportunities for improvement.

- Keep a detailed record of your daily transactions, categorizing them according to different expenditure categories such as utilities, groceries, transportation, entertainment, and others.

- Utilize budget tracking tools or mobile applications to simplify the process. These tools can help you effortlessly record and analyze your spending, providing you with visual representations of your expenses and highlighting any areas of concern or overspending.

- Set spending limits for various categories and track your progress towards staying within these limits. This will help you prioritize your spending and make adjustments as needed to achieve your financial goals.

- Regularly review your spending patterns and assess whether they align with your overall financial objectives. Identify areas where you can cut back on unnecessary expenses and redirect those funds towards savings or other investments.

- Monitor fluctuations in your spending habits over time and evaluate the effectiveness of any changes you make to your budget. Adjust your strategies accordingly to ensure continued progress towards your financial goals.

By actively monitoring your daily spending habits, you empower yourself with the knowledge and control necessary to effectively manage your finances and make informed choices that align with your long-term financial aspirations. Start tracking your expenses today to take charge of your financial future.

Use budget tracker apps or spreadsheets

If you’re looking to effectively manage your finances and track your expenses, utilizing budget tracker apps or spreadsheets can be incredibly beneficial. These tools provide you with a user-friendly interface to monitor your spending habits and help you stay on top of your financial goals.

With the help of budget tracker apps or spreadsheets, you can efficiently categorize and analyze your income and expenses. These tools enable you to create a comprehensive overview of your financial situation, making it easier to identify areas where you can save money and cut back on unnecessary expenses. Whether you prefer the convenience of mobile apps or the flexibility of spreadsheets, there are various options available to suit your personal preference.

Budget tracker apps are designed to simplify the process of managing your finances. They offer features such as automated expense tracking, customizable budget categories, and real-time updates on your spending patterns. Additionally, many apps provide interactive charts and graphs to visualize your financial progress, helping you make informed decisions about your budget.

Alternatively, spreadsheets offer a more traditional approach to budget tracking. With their versatility and customizable formulas, spreadsheets allow you to tailor your budgeting system to fit your specific needs. You can create detailed expense sheets, input formulas to calculate savings and debts, and even generate graphs to visualize your financial data. Spreadsheets provide a high level of control and can be easily adapted to accommodate any changes in your financial circumstances.

Ultimately, whether you choose to use a budget tracker app or a spreadsheet, the key is to find a tool that aligns with your financial management style and effectively helps you achieve your financial goals. By utilizing these tools, you can gain a clearer understanding of your spending habits, make informed financial decisions, and take steps towards a more secure financial future.

Identify unnecessary expenses and eliminate them

In order to successfully manage your finances and work towards your financial objectives, it is crucial to be aware of and minimize unnecessary expenses. By carefully evaluating your spending habits, you can identify areas of overspending and make necessary adjustments to eliminate wasteful expenditures.

One way to begin this process is to analyze your monthly budget and categorize your expenses. Take a close look at each category and assess whether the expenses within it are essential or non-essential. Non-essential expenses refer to those that are not necessary for your basic needs or long-term financial well-being.

It is important to note that unnecessary expenses can vary from person to person, depending on individual priorities and financial situations. What might be considered essential for one person could be seen as a luxury or unnecessary for another. It is essential to align your expenses with your financial goals and priorities.

In order to identify unnecessary expenses, consider asking yourself the following questions:

- Do I truly need this item or service, or is it merely a desire?

- Can I find a more cost-effective alternative?

- Does this expense align with my financial goals and priorities?

By critically evaluating your expenses and making informed decisions, you can effectively eliminate unnecessary expenditures and redirect those funds towards your financial goals. This can involve making small changes, such as cutting down on dining out or subscription services, or more significant adjustments like downsizing your living arrangement.

Remember, eliminating unnecessary expenses is not about depriving yourself of enjoyment or necessary indulgences. It is about finding a balance between enjoying your present lifestyle and securing your financial future. With careful consideration and ongoing evaluation, you can achieve financial freedom and better control over your budget.

Utilize Online Budgeting Tools

Take advantage of the plethora of online resources available to assist you in managing your finances and achieving your goals. By utilizing these online budgeting tools, you can gain control over your expenses, track your income, and make informed decisions about your financial future.

Online budgeting tools offer a variety of features and functionalities that can simplify the process of managing your money. These tools provide a comprehensive overview of your financial situation, allowing you to create personalized budgets, set savings goals, and monitor your progress over time.

One of the key advantages of online budgeting tools is their accessibility. With just a few clicks, you can access your financial information from anywhere, at any time, using any device with an internet connection. This convenience enables you to stay on top of your finances, even when you’re on the go.

These tools also offer valuable insights and recommendations to help you make smarter financial decisions. By analyzing your spending patterns and financial habits, online budgeting tools can identify areas where you may be overspending and suggest ways to cut back. They can also provide alerts and notifications to remind you of upcoming bills or savings targets.

Moreover, online budgeting tools often provide visual representations of your financial data, such as charts and graphs. These visualizations can make it easier to understand and interpret your financial situation, enabling you to identify trends, spot areas for improvement, and stay motivated on your journey towards financial success.

So, whether you’re a seasoned budgeter or just starting out on your financial journey, utilizing online budgeting tools can be invaluable in helping you take control of your finances, make informed decisions, and achieve your long-term goals. Start exploring the many options available to find the tool that best suits your needs and begin your path towards financial freedom.

Explore user-friendly budgeting software

Discover intuitive and easy-to-use financial management solutions that can help you effectively organize and control your expenses. These user-friendly budgeting software options provide a seamless way to track your income and expenditure, set financial goals, and monitor your progress towards achieving them.

When it comes to managing your finances, convenience and simplicity are key. That’s why these budgeting software tools offer user-friendly interfaces and functionality designed to make your financial planning effortless. With intuitive features and customizable settings, they enable you to easily input your financial data, categorize expenses, and generate detailed reports.

Stay on top of your budget with these powerful tools that allow you to monitor your spending habits, identify areas where you can save money, and make informed decisions based on your financial goals. From expense tracking and bill management to creating personalized budgets and analyzing financial data, these software options give you the tools you need to stay in control of your finances.

- Track your income and expenses with ease

- Set financial goals and monitor your progress

- Create personalized budgets and manage your bills

- Analyze your financial data to make informed decisions

- Get reminders and alerts to avoid missed payments

- Access your budgeting software from anywhere, anytime

Whether you are new to budgeting or have been managing your finances for years, these user-friendly budgeting software options provide a convenient and effective way to achieve your financial goals. Start exploring them today and take control of your financial future!

Questions and answers

What are some of the best budget planner tools available?

Some of the best budget planner tools available include Mint, Personal Capital, You Need a Budget (YNAB), EveryDollar, and Goodbudget.

Which budget planner tool is the most user-friendly?

The most user-friendly budget planner tool is Mint. It offers a simple and intuitive interface, making it easy to track your expenses and set financial goals.

Are there any budget planner tools specifically designed for couples?

Yes, Goodbudget is a budget planner tool specifically designed for couples. It allows you to sync and share your budget with your partner, making it easier to manage finances together.

Can budget planner tools help me save money?

Yes, budget planner tools can definitely help you save money. They provide you with a clear overview of your income and expenses, allowing you to identify areas where you can cut back and save.

Are there any budget planner tools that offer mobile apps?

Yes, many budget planner tools offer mobile apps for added convenience. Mint, YNAB, and EveryDollar are among the budgeting tools that have mobile app versions.

What are the benefits of using budget planner tools?

Using budget planner tools can help you track your expenses, create a realistic budget, and achieve your financial goals. They provide a clear overview of your income and expenses, enabling you to make informed financial decisions and avoid unnecessary debt.

Are budget planner tools suitable for individuals with varying levels of financial knowledge?

Absolutely! Budget planner tools are designed to cater to individuals with different levels of financial knowledge. They offer user-friendly interfaces, step-by-step guides, and resources to assist users in understanding and managing their finances effectively.

What features should I look for when choosing a budget planner tool?

When choosing a budget planner tool, consider features such as expense tracking, goal setting, debt management, bill reminders, and automatic categorization of expenses. It is also crucial to assess the compatibility of the tool with your devices and whether it offers mobile apps or web-based platforms.

Are there any free budget planner tools available?

Yes, there are numerous free budget planner tools available. Some popular options include Mint, Personal Capital, and Goodbudget. While they may offer limited features compared to paid tools, they still provide valuable budgeting and expense tracking functionalities.

Can budget planner tools help me save money and reduce my debts?

Definitely! Budget planner tools are specifically designed to help individuals save money and reduce debts. By tracking expenses, setting financial goals, and providing insights into spending patterns, these tools can identify areas where you can cut back and allocate more funds towards debt repayment or savings.