Are you tired of feeling stuck in a never-ending cycle of financial instability? Do you dream of a future where money worries are a thing of the past? Look no further – we have the solution you’ve been waiting for.

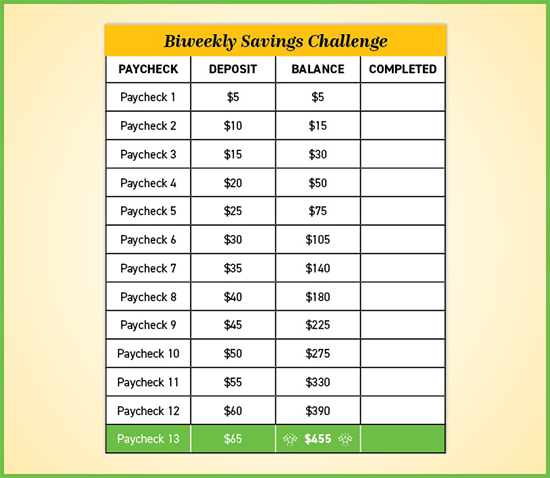

Introducing an innovative approach that will empower you to take control of your finances and pave the way for a prosperous tomorrow. Say goodbye to the limitations of conventional saving methods and say hello to a biweekly savings plan that will redefine your financial journey.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreUnlock the potential of your hard-earned income with this strategic approach, which enables you to maximize the benefits of regular saving. Embrace the power of saving on a biweekly basis and witness the transformation as your wealth grows exponentially.

Forget about the zero-sum game of traditional saving. By utilizing a biweekly savings plan, you’ll tap into the immense potential of compounding interest – allowing your money to work harder and smarter for you. Watch as your savings soar towards hero-like heights, propelling you towards the future you’ve always envisioned.

- Why You Should Consider a Biweekly Savings Plan

- Achieve Financial Stability Faster

- Maximize Your Savings Potential

- Reduce Debt and Interest

- Take Control of Your Financial Future

- Build an Emergency Fund

- Plan for Long-Term Goals

- Develop Better Money Management Habits

- Create a Budget

- Track Your Expenses

- How to Get Started with a Biweekly Savings Plan

- Set Your Savings Goals

- Determine Your Short-Term and Long-Term Needs

- Questions and answers

Why You Should Consider a Biweekly Savings Plan

If you want to secure a brighter financial future, it’s crucial to adopt effective saving strategies. One such strategy worth considering is a biweekly savings plan. By saving money on a regular basis, you can achieve your financial goals faster and with less stress.

A biweekly savings plan offers several advantages compared to other saving methods. Firstly, it promotes consistency and discipline in your saving habits. By automatically setting aside a fixed amount from each paycheck, it becomes easier to stay committed to your savings goals. This approach helps you build a strong financial foundation and develop a habit of saving, leading to long-term financial success.

Secondly, a biweekly savings plan allows you to take advantage of compound interest. By consistently saving on a biweekly basis, you increase the potential for your money to grow over time. When your savings generate interest, it compounds, meaning your account balance will grow at a faster rate. This can result in significant financial gains over the long term and help you reach your financial milestones sooner.

Moreover, a biweekly savings plan provides flexibility and adaptability to your financial situation. It allows you to adjust your savings amount based on changes in your income or expenses. Whether you receive a raise or encounter unexpected expenses, you can easily modify your savings contribution accordingly. This flexibility ensures that your savings plan remains realistic and achievable, even in the face of life’s uncertainties.

Additionally, a biweekly savings plan fosters a sense of financial security and peace of mind. By consistently saving, you are better prepared to handle emergencies or unforeseen circumstances. Having a financial cushion can alleviate stress and offer a sense of stability. Knowing that you have an ongoing savings plan in place brings you closer to achieving financial freedom and provides a safety net for the future.

In conclusion, considering a biweekly savings plan is a wise decision if you want to improve your financial well-being. Its consistency, potential for compound interest, flexibility, and security make it an effective savings strategy. Start implementing a biweekly savings plan today and pave the way for a brighter and more secure financial future.

Achieve Financial Stability Faster

Attaining a secure financial position with ease and speed is an aim that many individuals strive for. By implementing a well-designed financial strategy and making conscious choices, it is possible to expedite the journey towards financial stability.

One crucial aspect to focus on is the regularity and frequency of savings. With a systematic approach, the accumulation of funds can occur more rapidly. By adopting a biweekly savings plan, individuals can optimize their savings potential and achieve their financial goals more efficiently.

Consistency is key in this pursuit. Committing to scheduled biweekly contributions allows individuals to steadily build their savings and increase their financial security. This approach provides a structured framework that encourages disciplined saving habits, preventing procrastination or impulsive spending.

An additional advantage of a biweekly savings plan is the ability to capitalize on compounding interest. By consistently depositing funds into a savings account, individuals can maximize their investment returns over time, as interest is earned not only on the principal amount but also on the accumulated interest. This compounding effect can significantly accelerate the growth of one’s savings and contribute to achieving financial stability at a faster pace.

Furthermore, a biweekly savings plan promotes a heightened sense of financial control and awareness. Regularly evaluating expenses and adjusting savings goals accordingly allows individuals to proactively manage their financial resources. This active participation in personal finance empowers individuals to make informed decisions and prioritize their long-term financial stability.

By embracing a biweekly savings plan, individuals can confidently navigate the path towards financial stability with greater speed and efficacy. With consistent contributions, capitalizing on interest compounding, and maintaining financial awareness, the goal of achieving a secure financial future can be within reach sooner than anticipated.

Maximize Your Savings Potential

Enhance your ability to save more money by implementing effective strategies and optimizing your financial habits. By following these simple yet powerful techniques, you can significantly increase your savings and achieve your desired financial goals.

1. Exploit Opportunities:

Identify and make use of every available opportunity to save money. Explore various avenues such as discounts, promotions, and loyalty programs to maximize your savings potential. Look for alternative solutions and consider cost-saving options to minimize expenses without compromising on quality.

2. Leverage Compound Interest:

Make compound interest work in your favor by starting early and consistently contributing to your savings. By allowing your money to grow over time, you can optimize your returns and build a larger financial cushion for the future. Take advantage of investment vehicles that offer compound interest, such as fixed deposits or retirement accounts.

3. Budgeting and Tracking:

Create a realistic budget that aligns with your financial goals and track your expenses regularly. By monitoring your spending habits, you can identify areas where you can cut back and divert more funds towards savings. Utilize budgeting apps or spreadsheets to simplify the tracking process and gain better control over your finances.

4. Automate Savings:

Set up automatic transfers or deductions from your paycheck to a separate savings account. By automating your savings, you remove the temptation to spend the money elsewhere and ensure a consistent contribution towards your financial future. Start with a small amount and gradually increase it as your income grows.

5. Diversify Your Investments:

Explore different investment options to diversify your portfolio and maximize your potential returns. Consider a mix of low-risk and high-risk investments based on your risk tolerance and financial objectives. Consult with a professional financial advisor to make informed decisions and mitigate investment risks.

| Benefits | Techniques |

|---|---|

| Increased savings | Exploit opportunities, automate savings |

| Compound interest growth | Leverage compound interest |

| Better financial control | Budgeting and tracking |

| Optimal investment returns | Diversify your investments |

Reduce Debt and Interest

The path to achieving financial stability often requires reducing debt and minimizing interest payments. By adopting effective strategies and making intentional choices, you can take control of your financial situation and pave the way towards a debt-free future.

One of the first steps towards reducing debt is to assess your current financial obligations. This includes mapping out all outstanding loans, credit card balances, and any other forms of debt. Understanding the full scope of your debt allows you to prioritize and develop a repayment plan.

Consolidating high-interest debts can be a smart move to minimize interest payments. By merging multiple debts into a single loan or balance transfer credit card, you can simplify your financial commitments and potentially secure a lower interest rate. This consolidation approach not only helps you streamline your payments but also saves money in the long run.

Another effective method to reduce debt is to prioritize repayment of high-interest debts first. By directing more funds towards these debts, you can minimize the amount of interest that accrues over time. Paying off high-interest debts early can have a significant impact on your overall financial wellbeing and provide you with a greater sense of financial freedom.

Additionally, adopting a budgeting system is instrumental in reducing debt and interest. By carefully tracking your income and expenses, you can identify areas where you can cut back on unnecessary expenditures and allocate more funds towards debt repayment. Sticking to a budget allows you to stay on track and make progress towards your financial goals.

Lastly, it is essential to resist the temptation of taking on new debt while trying to reduce existing debt. This means avoiding unnecessary purchases and focusing on building a savings cushion. By creating an emergency fund, you can cover unexpected expenses without resorting to credit cards or loans, thereby reducing the risk of further debt accumulation.

In conclusion, reducing debt and minimizing interest payments are crucial steps towards achieving financial stability. By taking a proactive approach, consolidating debts, prioritizing high-interest repayments, budgeting wisely, and avoiding new debt, you can effectively reduce your financial burden and pave the way for a stronger financial future.

Take Control of Your Financial Future

In this section, we will explore the ways in which you can gain mastery over your economic destiny. By implementing certain strategies and making prudent decisions, you can pave the way for a prosperous and secure financial future.

Empower Yourself: Seize the reins of your economic fate by making informed choices and taking deliberate actions. Arm yourself with knowledge about budgeting, saving, and investing. By gaining a deep understanding of these financial concepts, you can confidently navigate the complex landscape of personal finance and steer towards success.

Nurture Financial Discipline: Cultivate the habit of conscientious financial management. Develop a disciplined approach to budgeting and ensure that your income is appropriately allocated towards both necessities and savings. Embrace the concept of delayed gratification, understanding that short-term sacrifices can yield long-term rewards.

Build a Strong Foundation: Lay the groundwork for a stable and thriving financial future. Establish an emergency fund to provide a safety net during unforeseen circumstances. Pay off high-interest debts to reduce financial burdens and create space for investment opportunities. Prioritize building a solid foundation that can support your dreams and aspirations.

Invest in Your Future: Take advantage of the power of compound interest by investing wisely. Evaluate different investment options and select those that align with your risk tolerance and financial objectives. By consistently nurturing your investment portfolio, you can potentially generate long-term wealth and unlock opportunities for financial freedom.

Embrace Continuous Learning: The world of personal finance is constantly evolving. Stay abreast of new trends, strategies, and opportunities. Educate yourself through books, courses, and reputable financial resources. By continuously expanding your financial knowledge, you can adapt to changing economic landscapes, make informed decisions, and ensure a prosperous future.

Remember, the path to financial empowerment lies in your hands. By taking control of your financial future, you can pave the way for a life of abundance, security, and freedom.

Build an Emergency Fund

In this section, we will discuss the importance of creating an emergency fund and how it can positively impact your financial stability. An emergency fund serves as a safety net to protect you during unexpected financial setbacks or emergencies.

Many unforeseen circumstances can arise, such as medical emergencies, car repairs, or sudden unemployment. Without a sufficient emergency fund, these situations can lead to financial stress and even debt. Building an emergency fund is crucial to ensure you have the necessary funds to navigate through these unexpected events.

| Benefits of an Emergency Fund |

|---|

| 1. Financial Security |

| An emergency fund provides you with a sense of financial security. It ensures that you have funds readily available to cover any unexpected expenses, reducing anxiety and stress surrounding financial uncertainty. |

| 2. Avoiding Debt |

| Having an emergency fund allows you to avoid accumulating debt in case of an unexpected expense. Instead of relying on credit cards or loans, you can use your emergency savings to cover the necessary costs. |

| 3. Peace of Mind |

| Knowing that you have a safety net in the form of an emergency fund provides peace of mind. It allows you to focus on other aspects of your life without constantly worrying about potential financial crises. |

Building an emergency fund requires discipline and commitment. Start by setting a realistic savings goal, considering your monthly expenses and potential emergency costs. Create a budget that prioritizes savings and allocate a specific amount each pay period towards your emergency fund.

Consider automating your savings by setting up automatic transfers to your emergency fund. This way, a portion of your income will be deposited directly into your emergency fund without you having to think about it.

Remember, building an emergency fund is a gradual process. Start small and consistently contribute to your fund over time. As your savings grow, you will have a financial cushion that can protect you from unexpected events and provide you with greater financial freedom.

Plan for Long-Term Goals

Looking ahead and setting your sight on the future is a crucial aspect of achieving financial success. As you embark on your journey towards a brighter financial tomorrow, it is important to strategize and plan for your long-term goals. This involves considering your aspirations and dreams, and creating a roadmap to turn them into reality.

Developing a comprehensive plan that encompasses your long-term goals requires careful thought and consideration. It involves defining your objectives in a clear and specific manner. These goals can include saving for retirement, buying a home, or funding your child’s education. Each goal should be measurable, attainable, relevant, and time-bound. This ensures that you have a clear target and a timeframe within which to achieve it.

First, prioritize your long-term goals by assessing their importance and potential impact on your life. Consider the timeline and financial resources required for each goal. This will allow you to allocate your savings and resources accordingly, ensuring that you are on track to achieve each objective.

Next, break down each long-term goal into smaller, manageable milestones. This approach will help you stay motivated and focused, as you can celebrate your progress along the way. For example, if your long-term goal is to save for a down payment on a house, you can set smaller milestones such as saving a certain percentage of your target amount each month.

Additionally, it is important to regularly review and reassess your long-term goals. Life circumstances and priorities can change over time, so it is crucial to adapt your plan accordingly. By staying flexible and open to adjustments, you can ensure that your financial roadmap remains aligned with your evolving aspirations.

In conclusion, planning for long-term goals is a vital component of securing your financial future. By setting clear objectives, prioritizing them effectively, and breaking them down into manageable milestones, you can make steady progress towards achieving your dreams. Remember to regularly review and adapt your plan to ensure alignment with your changing circumstances.

Develop Better Money Management Habits

In this section, we will explore the importance of cultivating improved financial habits and behaviors that can lead to a more secure and prosperous future. By adopting effective money management practices, individuals can gain control over their finances, reduce debt, and build wealth.

One crucial aspect of developing better money management habits is creating a budget. A budget helps individuals track their income and expenses, enabling them to understand where their money is going and make informed financial decisions. With a budget in place, individuals can prioritize their spending, save for future goals, and avoid unnecessary debt.

Another important habit to cultivate is regular saving. By setting aside a portion of their income on a consistent basis, individuals can build an emergency fund, prepare for retirement, and achieve their financial goals. Saving regularly also helps develop discipline and resilience, as it requires individuals to resist the temptation of impulse spending and focus on long-term financial security.

Effective money management also involves wise spending decisions. It is essential to differentiate between wants and needs, prioritize essential expenses, and avoid unnecessary splurges. By making conscious and mindful choices about how money is spent, individuals can avoid wasteful spending and maximize the value they get from their hard-earned income.

Furthermore, individuals can benefit from educating themselves about personal finance. By understanding concepts such as investing, compound interest, and financial planning, individuals can make informed decisions about their money and take advantage of opportunities to grow their wealth. Learning about personal finance also empowers individuals to navigate the complex world of money and make choices that align with their long-term financial goals.

In summary, developing better money management habits is crucial for anyone seeking to improve their financial well-being. By creating a budget, saving consistently, making wise spending decisions, and educating themselves about personal finance, individuals can lay a strong foundation for a secure and prosperous financial future.

Create a Budget

Developing a budget is an essential component in managing your finances effectively. By establishing a budget, you gain a clear understanding of your income, expenses, and savings goals. It allows you to make informed decisions about how to allocate your money and ensure that you are living within your means.

One useful method to create a budget is by categorizing your expenses into different groups. Start by listing your fixed expenses, such as rent or mortgage payments, utility bills, and insurance premiums. Then, identify your variable expenses, such as groceries, dining out, entertainment, and transportation. Categorizing your expenses in this way will help you prioritize your spending and identify areas where you can potentially reduce costs.

Next, it is essential to track your income. Take into account your regular salary or wage, as well as any additional sources of income, such as freelance work or rental income. By understanding your total income and comparing it to your expenses, you can determine how much you can allocate towards savings, debt repayment, and discretionary spending.

When creating a budget, it is crucial to set realistic goals. Consider your short-term and long-term financial objectives, such as saving for a down payment on a house or paying off student loans. Break down these goals into achievable milestones and determine how much you need to set aside each month to reach them. This will help you stay motivated and on track with your financial plans.

Lastly, regularly review and adjust your budget as necessary. Life circumstances and priorities can change, so it is essential to adapt your budget accordingly. By regularly reviewing your budget, you can ensure that you stay on top of your finances and make any necessary adjustments to meet your goals.

In conclusion, creating a budget is a fundamental step towards achieving financial success. It provides you with a clear roadmap of your income and expenses, enabling you to make informed decisions and prioritize your financial goals. By following these steps and consistently reviewing your budget, you will be well on your way to improving your financial situation and securing a brighter future.

Track Your Expenses

Take control of your financial situation by closely monitoring how you spend your hard-earned money. Tracking your expenses is an essential step towards achieving financial stability and making smarter financial decisions.

By keeping a detailed record of your expenses, you can gain a clearer understanding of where your money is going and identify any areas where you may be overspending. This knowledge will empower you to make adjustments to your spending habits and allocate your funds more efficiently.

Start by creating a comprehensive list of all your expenses, including both fixed costs and variable expenses. Fixed costs are recurring expenses that remain relatively stable from month to month, such as rent or mortgage payments, utility bills, and insurance premiums. Variable expenses, on the other hand, are flexible costs that can fluctuate, such as groceries, entertainment, and dining out.

Once you have a list of your expenses, categorize them to get a clearer picture of where your money is being allocated. Common expense categories include housing, transportation, groceries, entertainment, debt payments, and savings. By categorizing your expenses, you can easily identify areas where there may be room for improvement.

To track your expenses effectively, consider using a budgeting tool or an app that allows you to input and categorize your expenses automatically. This can save you time and make the process more convenient, ensuring that you stay on top of your spending habits consistently.

In addition to monitoring your expenses, it is also important to set spending limits and establish financial goals. By setting clear objectives, such as saving a specific amount of money each month or paying off debt within a certain timeframe, you can stay motivated and focused on your financial aspirations.

Remember, tracking your expenses is an ongoing process. Regularly reviewing and analyzing your spending habits will help you make adjustments, meet your financial goals, and ultimately transform your financial future.

How to Get Started with a Biweekly Savings Plan

Embarking on a biweekly savings plan can be a game changer when it comes to building your financial security and achieving your goals. This section will guide you through the essential steps to kick-start your savings journey.

1. Set Clear Financial Goals: Before diving into a biweekly savings plan, it’s crucial to identify your financial objectives. Whether you are planning for a down payment on a house, saving for a vacation, or building an emergency fund, clearly define your goals to stay motivated and focused.

| 2. Create a Budget: | Developing a comprehensive budget is essential to determine your income and expenses accurately. Analyze your spending patterns, prioritize your essential needs, and identify areas where you can cut back to free up money for savings. |

| 3. Calculate Your Savings Amount: | Once you have a budget in place, calculate how much you can comfortably save from each paycheck. Consider allocating a specific percentage or a fixed amount towards savings and ensure it aligns with your goals. |

| 4. Set Up Automatic Transfers: | To make saving effortless, set up automatic transfers from your paycheck or main bank account into a separate savings account. This way, the designated amount will be transferred directly, ensuring consistent progress towards your goals. |

| 5. Track and Monitor: | Regularly track and monitor your savings progress. Use financial apps or spreadsheets to keep a record of your deposits, withdrawals, and any adjustments to your savings plan. This will help you stay accountable and make necessary adjustments along the way. |

| 6. Stay Committed and Adapt: | Building a solid financial future requires commitment and adaptability. Stay committed to your savings plan even during challenging times and be willing to adapt your strategy as needed. Remember, consistent efforts will yield positive results over time. |

By following these steps, you’ll lay a strong foundation for a successful biweekly savings plan. Keep in mind that small, consistent contributions can make a significant difference in the financial security and peace of mind you’ll enjoy in the long run.

Set Your Savings Goals

Establishing clear and achievable savings goals is crucial in ensuring a successful financial journey. By identifying specific objectives, you can motivate yourself to save consistently and effectively. In this section, we will explore the importance of setting savings goals and provide practical tips on how to define and prioritize them.

| 1. Define Your Priorities |

|

Before diving into the details, take some time to reflect on your financial aspirations and determine what matters most to you. Consider short-term goals, such as building an emergency fund or saving for a vacation, as well as long-term goals like buying a house or planning for retirement. By identifying your priorities, you can align your savings efforts accordingly. |

| 2. Be Specific |

|

Ambiguous savings goals can be challenging to achieve, so it is essential to be specific in your target. Instead of vaguely aiming to save more money, set a specific amount or percentage to save regularly. This clarity will help you track your progress and stay motivated along the way. |

| 3. Set Realistic Milestones |

|

It’s important to set realistic milestones that are attainable within a defined timeframe. Break your savings goals into smaller, manageable targets that you can achieve incrementally. Celebrating each milestone reached will give you a sense of accomplishment and keep you motivated to continue saving diligently. |

| 4. Review and Adjust Regularly |

|

Savings goals are not set in stone, and it’s crucial to review and adjust them periodically. As circumstances change, your priorities and financial situation may shift, requiring you to reassess your goals. Regularly reviewing and adjusting your savings targets will ensure they remain relevant and achievable. |

| 5. Track Your Progress |

|

Monitoring your progress is key to staying on track with your savings goals. Keep a record of your savings and regularly evaluate your achievements. This will not only help you gauge your progress but also provide an opportunity to make any necessary adjustments to reach your goals more efficiently. |

By setting clear savings goals and following these practical tips, you can take control of your financial future and work towards achieving your desired level of financial security and independence.

Determine Your Short-Term and Long-Term Needs

Understanding and evaluating your immediate and future financial requirements is a crucial step towards creating a successful savings plan. By analyzing both short-term and long-term needs, you can prioritize your financial goals and make informed decisions to secure your financial well-being.

Short-term needs refer to those expenses that you need to cover in the near future, typically within a year or less. These may include monthly bills, rent or mortgage payments, groceries, transportation costs, and emergency funds. By identifying and setting aside funds for these short-term needs, you can ensure that you have a stable foundation and are prepared for unexpected expenses.

On the other hand, long-term needs encompass your financial goals and aspirations that you want to achieve over an extended period, such as years or even decades. These may include saving for retirement, buying a house, funding your children’s education, or starting a business. By defining your long-term needs, you can develop a strategic savings plan that allows you to accumulate wealth and work towards achieving these goals.

It is important to note that determining your short-term and long-term needs requires careful consideration of your current financial situation, income, expenses, and future expectations. This process can be facilitated by creating a budget to track your expenses and assessing your financial priorities.

By understanding your short-term and long-term needs, you can proactively plan for both your immediate requirements and future goals. Allocating your savings accordingly will not only provide you with financial security in the present, but also pave the way for a prosperous future.

Questions and answers

How does a biweekly savings plan work?

A biweekly savings plan is a method of saving money where you contribute to your savings account every two weeks instead of once a month. By doing this, you can save more money over time because you are making more frequent deposits.

Why is a biweekly savings plan beneficial?

A biweekly savings plan is beneficial because it helps you save money more consistently and in a disciplined manner. It allows you to make smaller but regular contributions, which can add up to a significant amount over time. Additionally, it helps you develop a habit of saving.

What are the potential advantages of using a biweekly savings plan?

There are several advantages of using a biweekly savings plan. Firstly, it can help you build an emergency fund or save for a specific financial goal such as a down payment on a house or a vacation. Secondly, it can increase the amount of interest you earn on your savings by making more frequent deposits. Finally, it can help you avoid the temptation of spending the money instead of saving it.

Are there any downsides to a biweekly savings plan?

While a biweekly savings plan has many benefits, there are a few potential downsides to consider. One downside is that you may need to adjust your budget to accommodate the more frequent savings contributions. This can require careful planning and discipline. Additionally, some financial institutions may charge fees for making frequent transfers or withdrawals from your savings account.

How can I get started with a biweekly savings plan?

Getting started with a biweekly savings plan is relatively simple. First, determine the amount you want to save from each paycheck. Then, set up automatic transfers from your checking account to your savings account every two weeks. It’s important to stick to your savings plan consistently and avoid withdrawing the money except for emergencies or your designated financial goals.

What is a biweekly savings plan?

A biweekly savings plan is a strategy where you contribute money towards your savings every two weeks instead of the traditional monthly contributions. This enables you to save more by making 26 payments in a year instead of 12.

How can a biweekly savings plan transform my financial future?

A biweekly savings plan can transform your financial future by helping you save more efficiently. By making more frequent contributions, you can potentially accumulate a larger sum of money over time and reach your financial goals quicker.

Does a biweekly savings plan work for everyone?

Yes, a biweekly savings plan can work for anyone who wants to save more effectively. It is particularly beneficial for those who receive biweekly paychecks, as it aligns with their income schedule. However, even if you receive monthly paychecks, you can still adapt the plan to fit your needs.

What are the advantages of a biweekly savings plan compared to a monthly savings plan?

There are several advantages of a biweekly savings plan compared to a monthly plan. Firstly, you make more frequent contributions, which helps to build discipline and consistency in saving. Secondly, you can take advantage of the power of compounding by investing your money earlier. Lastly, you can potentially save more by making an additional annual payment.

Are there any potential drawbacks to a biweekly savings plan?

While a biweekly savings plan offers numerous benefits, there are a few potential drawbacks to consider. Some individuals may find it challenging to manage their budget with more frequent payments. Additionally, if you have a fixed monthly expense, such as rent, it may be difficult to align the payments perfectly. However, these challenges can be overcome with proper planning and budgeting.