In today’s fast-paced society, it’s not uncommon for individuals to find themselves entangled in a web of debt, struggling to break free and achieve financial peace. However, there is a proven method that transcends conventional wisdom and equips you with the tools to eliminate your debts systematically.

Introducing a revolutionary approach that stands out from the crowd – the Debt Snowball Method. Developed by the renowned financial expert, Dave Ramsey, this groundbreaking strategy offers a fresh perspective on debt repayment and sets you on a transformative journey towards a debt-free lifestyle.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreObtaining financial freedom may appear overwhelming at first, but the Debt Snowball Method simplifies the process by redefining the way you approach your debts. By prioritizing your debts based on their size rather than their interest rates, this method instills a sense of momentum and motivation, propelling you towards rapid debt elimination.

As you embark on this transformative quest and witness the power of the Debt Snowball Method, you’ll begin to experience the psychological and emotional benefits associated with financial independence. The weight of your debts will gradually lift, allowing you to fully embrace life and make choices that align with your values and goals.

- Pay off Debt and Live Debt-Free with Dave Ramsey’s Debt Snowball Method

- What is the Debt Snowball Method?

- Getting Started with the Debt Snowball

- How Does the Debt Snowball Method Work?

- Ordering your Debts

- Paying Minimum Payments First

- Building Momentum with Small Debts

- The Benefits of the Debt Snowball Method

- Psychological Motivation

- Quick Wins and Progress

- Less Interest Paid

- Success Stories: Real People Achieving Financial Freedom

- Questions and answers

Pay off Debt and Live Debt-Free with Dave Ramsey’s Debt Snowball Method

Eliminating debt and achieving a life free from financial burdens is an attainable goal with the effective strategy known as Dave Ramsey’s Debt Snowball Method. This method offers a practical and proven approach to paying off debts, allowing individuals to take control of their finances and experience the freedom and peace of mind that comes with a debt-free lifestyle.

By following the Debt Snowball Method, individuals start by organizing their debts from smallest to largest, regardless of interest rates. This approach focuses on tackling the smallest debt first, as it provides a sense of accomplishment and motivation to move forward. As each debt is paid off, the funds that were previously allocated to that debt are then added to the payments for the next smallest debt. This method creates a snowball effect, as the payments gradually increase with each debt paid off, accelerating the overall debt repayment journey.

Implementing the Debt Snowball Method requires discipline and a commitment to budgeting and saving. It’s essential to create a realistic budget that ensures all necessary expenses are covered while allowing for extra funds to be allocated towards debt repayment. With diligent adherence to the budget and consistent payments, the debt snowball gains momentum, making it possible to pay off even larger debts over time.

One advantage of this method is the psychological boost individuals receive from paying off smaller debts quickly. It provides a sense of achievement and serves as a constant reminder of progress towards the ultimate goal of living debt-free. This positive reinforcement helps individuals stay motivated and dedicated to their financial journey, inspiring them to continue working towards a debt-free lifestyle.

Dave Ramsey’s Debt Snowball Method is not only about paying off debts; it also emphasizes the importance of building an emergency fund and saving for the future. This aspect ensures that individuals are prepared for unexpected expenses or financial emergencies, preventing them from falling back into debt. By prioritizing both debt repayment and savings, individuals can create a solid foundation for their financial well-being and achieve long-term stability.

In conclusion, the Debt Snowball Method, devised by Dave Ramsey, offers a powerful and effective strategy for paying off debt and living a debt-free life. By starting small and gradually increasing payments, individuals can gain momentum in their debt repayment journey and experience the significant benefits of financial freedom. With discipline, budgeting, and a focus on both debt repayment and savings, this method provides a clear path towards a debt-free lifestyle and a brighter financial future.

What is the Debt Snowball Method?

In this section, we will explore the fundamentals of a popular financial strategy that helps individuals regain control of their debts and work towards a debt-free future. The Debt Snowball Method is a systematic approach to managing and paying off outstanding debts.

With the Debt Snowball Method, individuals start by listing all their debts, regardless of the amount or interest rate. This creates a comprehensive overview of their financial obligations. The primary goal of the Debt Snowball Method is to eliminate debts one by one, beginning with the smallest balance and gradually progressing to larger balances.

By focusing on the smallest debt first, individuals can experience a psychological and emotional victory when they successfully pay it off. This initial achievement creates momentum and motivation to continue working towards debt elimination. The Debt Snowball Method emphasizes the power of small wins, creating a positive cycle that helps individuals stay committed to their financial goals.

As individuals pay off the smaller debts, they free up additional funds to allocate towards the next debt in line. This creates a snowball effect where the amount available for debt repayment increases over time. Consequently, larger debts can be targeted with higher monthly payments, accelerating the debt elimination process.

The Debt Snowball Method provides a clear roadmap for individuals to follow in order to become debt-free. By focusing on one debt at a time, individuals can avoid feeling overwhelmed, stay motivated, and build momentum towards financial freedom. It is a strategy that emphasizes discipline, perseverance, and a systematic approach to overcome debts and achieve long-term financial stability.

- Create a comprehensive overview of all debts, regardless of amount or interest rate.

- Start by paying off the smallest debt first.

- Celebrate each debt fully paid off to maintain motivation.

- Allocate additional funds towards the next debt in line.

- Continue the process until all debts are eliminated.

Getting Started with the Debt Snowball

Embarking on a journey towards financial freedom through the Debt Snowball method opens up a world of opportunities to achieve a debt-free existence. This section will guide you through the initial steps of starting your own Debt Snowball plan without relying on specific terminologies.

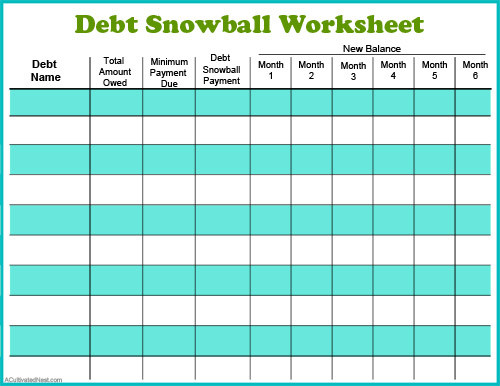

Beginning your Debt Snowball journey involves understanding the foundations of this effective strategy and implementing it in a way that suits your unique circumstances. Starting with a clear understanding of your debts and prioritizing them based on their size, interest rates, or other relevant factors is crucial. By taking a proactive approach, you will be able to create a tailored plan that focuses on eliminating one debt at a time.

When devising your Debt Snowball plan, it’s important to be strategic and balanced. Initially, identify the smallest debt in your portfolio. Although it may not have the highest interest rate, the aim is to build momentum by paying it off quickly. Once you’ve successfully eliminated the smallest debt, redirect the additional funds towards the next smallest debt, progressively gaining traction towards larger debts.

Consistency is key in the Debt Snowball method. By committing to regular payments and allocating any extra funds towards debt repayment, you’ll experience a noticeable acceleration in your progress. As you check off each debt from your list, the snowball effect becomes clear, increasing both your financial stability and motivation.

Remember that the Debt Snowball method is not a one-size-fits-all approach. Each person’s debt situation is unique. While some individuals may prefer to prioritize debts based on interest rates, others may find it more effective to focus on debts with emotional or psychological burdens. Choose a method that resonates with you and aligns with your personal financial goals.

Getting started with the Debt Snowball method may seem daunting at first, but with determination, discipline, and a step-by-step approach, you’ll be well on your way to a debt-free future. Stay motivated, seek support, and celebrate each milestone along the way as you take control of your financial well-being.

How Does the Debt Snowball Method Work?

The Debt Snowball Method is an effective strategy for paying off debts and achieving financial freedom. This approach prioritizes paying off smaller debts first, gradually building momentum and motivation to tackle larger debts. By focusing on one debt at a time, the Debt Snowball Method steers individuals towards a debt-free future.

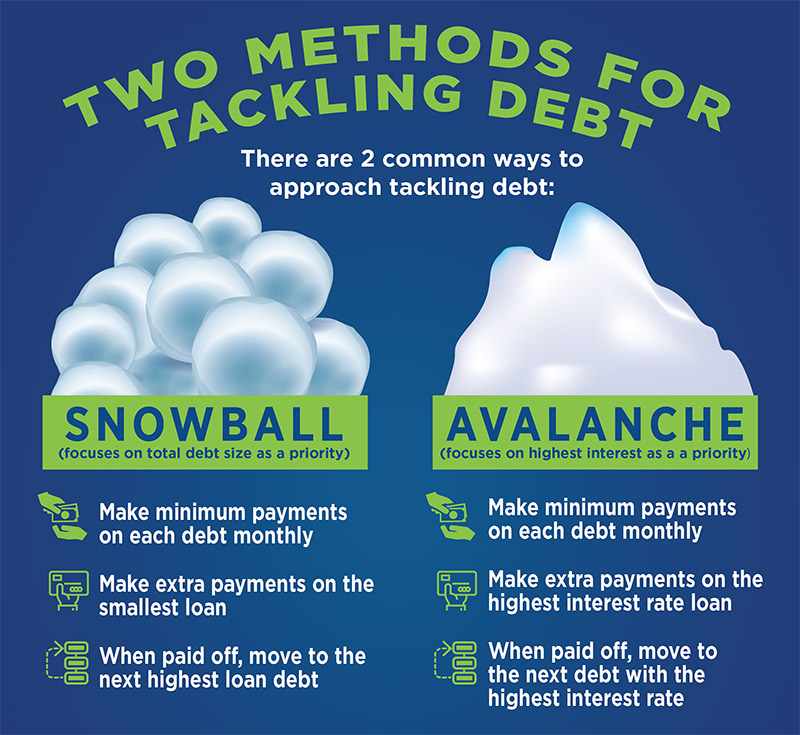

When implementing the Debt Snowball Method, it is important to identify all outstanding debts and list them in order from smallest to largest, regardless of interest rates. This approach differs from other debt repayment methods, such as the Debt Avalanche Method, which prioritizes paying off debts with the highest interest rates first. However, the Debt Snowball Method recognizes the psychological and emotional benefits of gaining quick wins and celebrating small victories.

Once the debts are listed, individuals allocate their available budget towards making minimum payments on all debts. Any additional funds are then directed towards paying off the smallest debt. By doing so, individuals experience a sense of accomplishment as they quickly eliminate smaller debts one by one.

As the smallest debts are paid off, the momentum and motivation grow, enabling individuals to redirect the payments towards the next smallest debt on the list. This snowball effect continues until all debts are paid off. The process may take time and require discipline, but the Debt Snowball Method offers a structured approach to clearing debts and gaining financial independence.

The Debt Snowball Method also emphasizes the importance of budgeting and minimizing unnecessary expenses. By creating a realistic budget and making conscious spending choices, individuals can increase their available funds for debt repayment. This not only accelerates the debt repayment process but also cultivates healthy financial habits for the future.

In conclusion, the Debt Snowball Method provides a systematic approach to paying off debts and achieving a debt-free lifestyle. By focusing on smaller debts first, individuals gain momentum and motivation, leading them towards financial freedom and peace of mind.

Ordering your Debts

Arranging your debts in a specific order is a crucial step towards achieving a debt-free future. By prioritizing your outstanding balances strategically, you can streamline your repayment process and take control of your financial journey. In this section, we will explore the importance of organizing your debts and provide guidance on how to determine the most effective repayment order.

Creating an orderly repayment plan allows you to approach your debts systematically, tackling each one with a targeted approach. Rather than making random payments across multiple debts, prioritizing them based on specific criteria can maximize your progress and keep you motivated throughout the debt elimination process.

One approach to consider is ordering your debts based on their interest rates. Start by identifying the loans or credit cards with the highest interest rates, as these typically have the most significant impact on your overall debt burden. By targeting these high-interest debts first, you can minimize the amount of interest you’ll accrue over time and accelerate your path to becoming debt-free.

Another method of ordering your debts is by their outstanding balances. This approach involves tackling debts with the smallest balances first, also known as the snowball method. By focusing on paying off small debts initially, you’ll experience quick wins and build momentum as you gradually eliminate your outstanding balances one by one. This approach can provide a psychological boost and keep you motivated to tackle larger debts in the future.

Considering your own financial situation and goals, it’s important to choose an ordering strategy that aligns with your specific needs. Whether you opt for the prioritization based on interest rates or outstanding balances, the key is to have a clear plan in place that empowers you to take control of your financial life.

| Ordering Strategy | Description |

|---|---|

| Interest Rate | Prioritize debts with the highest interest rates first to minimize long-term interest costs. |

| Outstanding Balances | Tackle debts with the smallest balances first for quick wins and psychological motivation. |

Paying Minimum Payments First

Start by prioritizing the minimum payments you make towards your debts. By focusing on fulfilling these minimum amounts, you can lay the foundation for managing your debt effectively and moving towards a debt-free lifestyle. This approach allows you to address the immediate financial obligations without taking on additional debt.

When you choose to pay the minimum payments first, you take a strategic step towards gaining control over your finances. Instead of spreading yourself thin by trying to make larger payments on multiple debts, paying the minimum amounts ensures that you meet your financial responsibilities across all your debts.

While paying the minimum may feel counterintuitive, this approach helps you maintain a consistent payment routine, avoiding late fees and penalties that can further burden your financial situation. By meeting the minimum payment requirements, you demonstrate your commitment to financial responsibility, building a solid foundation for debt management.

Prioritizing the minimum payments also allows you to allocate any extra funds towards the debt with the highest interest rate. By chipping away at this high-interest debt, you can reduce the overall amount of interest paid over time, helping you progress towards your goal of becoming debt-free.

Remember, while paying the minimum payments may not provide immediate results, it is an essential step in your journey to financial freedom. By mastering this approach and consistently meeting your obligations, you can gradually tackle larger portions of your debt until you achieve a debt-free lifestyle.

Building Momentum with Small Debts

In the journey towards financial freedom, it’s important to recognize the power of starting small. By tackling your smallest debts first, you can build momentum and gain motivation to continue on the path towards a debt-free life. This approach, popularized by Dave Ramsey, involves prioritizing your debts based on their size rather than their interest rates or other factors.

Instead of feeling overwhelmed by your larger debts, focusing on the smaller ones allows you to experience quick wins. Paying off these smaller debts not only reduces the number of debts you have but also provides a sense of accomplishment and progress. Small victories like these can be incredibly motivating, inspiring you to stay committed to your debt repayment journey.

As you eliminate small debts one by one, you create a snowball effect. Each successful debt repayment adds to your momentum, giving you more confidence and encouragement to tackle the next debt on your list. By consistently applying the debt snowball method, you can build a positive financial snowball that rolls faster and faster towards your ultimate goal of becoming debt-free.

It’s important to note that while the debt snowball method prioritizes debt size over interest rates, it’s still essential to consider your overall financial situation. It’s crucial to make minimum payments on all debts and to continue managing your budget effectively. Consulting with a financial advisor can help you create a personalized debt repayment plan that takes into account your specific circumstances and goals.

In summary, building momentum with small debts through the debt snowball method is a proven strategy for achieving a debt-free lifestyle. By starting small and celebrating each milestone along the way, you create a powerful snowball effect that propels you towards financial freedom. Stay consistent, stay motivated, and keep your eyes on the prize.

The Benefits of the Debt Snowball Method

When it comes to tackling your debts and working toward a debt-free future, the Debt Snowball Method offers a range of advantages. By implementing this strategy, you can experience various benefits that can ultimately lead you to financial freedom.

1. Accelerated Progress: The Debt Snowball Method helps you make quick progress in paying off your debts by focusing on the smallest balances first. By starting with your smallest debt and then gradually moving on to larger debts, you build momentum and stay motivated as you see your progress firsthand.

2. Psychological Boost: This method offers a psychological boost as you experience the satisfaction of paying off debts one by one. By eliminating small debts early on, you gain a sense of accomplishment and the confidence to take on larger debts, knowing that you are capable of successfully clearing them.

3. Simplified Approach: The Debt Snowball Method simplifies the debt repayment process by streamlining your payments. With this method, you focus on one debt at a time, making it easier to manage and track your progress. This approach allows you to prioritize your debts and avoid feeling overwhelmed.

4. Motivation and Momentum: As you pay off each debt, you create a snowball effect of motivation and momentum. The sense of achievement you gain from clearing a debt drives you to tackle the next one with even more determination. This continuous progress keeps you motivated and committed to your goal of attaining a debt-free lifestyle.

5. Improved Financial Habits: By following the Debt Snowball Method, you develop and enhance crucial financial habits. The discipline required to adhere to this strategy encourages you to budget effectively, control your spending, and avoid unnecessary debt in the future. These habits contribute to long-term financial stability and success.

Overall, the Debt Snowball Method offers a systematic and empowering approach to debt repayment. By considering the unique benefits it provides, you can confidently embark on your journey to achieving a life free from the burden of debt.

Psychological Motivation

When it comes to managing and paying off debts, the role of psychological motivation cannot be underestimated. It encompasses the mindset, emotions, and attitudes that play a crucial role in successfully achieving financial freedom. By understanding and harnessing the power of psychological motivation, individuals can take control of their debt situation and pave the way towards a debt-free future.

One key aspect of psychological motivation is the power of determination. It involves having a strong will and resolve to overcome financial challenges, even in the face of adversity. Rather than viewing debt as a burden, individuals can choose to perceive it as an opportunity for growth and change. By adopting a positive mindset and focusing on the end goal of debt freedom, the journey towards financial stability becomes more manageable.

Another aspect of psychological motivation is the impact of emotions on debt repayment. Debt can often bring about feelings of stress, anxiety, and even shame. It is important to acknowledge and address these emotional responses in order to stay motivated. By openly discussing and seeking support from loved ones or financial professionals, individuals can mitigate negative emotions and stay on track with their debt repayment plan.

Creating a solid plan and setting achievable goals can also enhance psychological motivation. Breaking down the debt into smaller, manageable amounts makes the goal of becoming debt-free more attainable. Celebrating small victories along the way, such as paying off a credit card or reducing the total debt balance, further boosts motivation. Additionally, visualizing the future benefits of being debt-free, such as increased financial stability and freedom, can provide additional motivation to stay disciplined in the repayment journey.

In conclusion, psychological motivation plays a vital role in achieving a debt-free lifestyle. By cultivating determination, addressing emotions, and setting achievable goals, individuals can stay motivated throughout their debt repayment journey. The power of the mind is a powerful tool when it comes to managing and overcoming financial challenges, and by harnessing psychological motivation, individuals can pave the way towards a brighter and debt-free future.

Quick Wins and Progress

In the journey towards financial freedom, there are small victories and consistent steps that contribute to a debt-free lifestyle. This section focuses on highlighting the immediate accomplishments and overall progress anyone can experience when following a strategy like Dave Ramsey’s debt snowball method.

When taking control of your finances, it’s vital to celebrate the small wins along the way. These quick wins serve as powerful motivators and reinforce the positive habits needed to achieve lasting change. By implementing the debt snowball method, individuals can witness tangible progress as they start paying off their smallest debts first, creating a sense of accomplishment and momentum.

As you continue on your debt-free journey, it’s important to recognize that progress is not solely measured by the amount of debt paid off. In addition to the financial advances, individuals will also experience personal growth and empowerment. Taking charge of your financial situation cultivates discipline, perseverance, and a sense of control over your own destiny. Each milestone reached and obstacle overcome brings you closer to a debt-free life and a brighter financial future.

Furthermore, by actively engaging in debt repayment and adopting a structured approach, you proactively address the root causes of your debt, paving the way for a sustainable change in your financial habits. By prioritizing debts and consistently paying them off, you gain confidence in your ability to manage your money and make wise financial decisions. This newfound control not only improves your current financial situation but also sets you up for success in achieving your long-term financial goals.

In summary, quick wins and progress are fundamental elements of the debt snowball method. Celebrating the small victories and recognizing personal growth and empowerment fuels the motivation to continue on the path towards financial freedom. With each debt paid off and each milestone reached, you become one step closer to a debt-free lifestyle and a brighter future.

Less Interest Paid

Minimizing the amount of interest paid can have a significant impact on your financial journey. By implementing Dave Ramsey’s debt snowball method, you can work towards reducing the total interest accrued on your outstanding debts.

With the debt snowball method, you prioritize paying off debts with the smallest balances first. This approach allows you to gain a sense of accomplishment early in the process, as you eliminate smaller debts more quickly. By doing so, you are not only reducing the number of debts you owe but also the potential interest that would have continued to accumulate over time.

As you focus on paying off smaller balances first, you gradually build momentum and motivation. This renewed sense of determination enables you to stay on track and remain committed to your debt-free journey. By consistently making payments and eliminating debts, you can effectively minimize the overall interest paid on your outstanding obligations.

By paying off smaller debts and rolling the payments towards larger balances, you further accelerate the debt repayment process. The more debts you eliminate, the more surplus funds you have available to tackle higher interest debts. This method not only enables you to reduce the principal balance but also cuts down on the interest that would have accumulated had you followed a different approach.

By adopting Dave Ramsey’s debt snowball method, you will not only experience the satisfaction of becoming debt-free but also enjoy the financial benefits of paying less interest. This approach empowers individuals with a clear and structured plan to eliminate debts efficiently, leading to a brighter and more financially secure future.

Success Stories: Real People Achieving Financial Freedom

In this section, we will share inspiring stories of individuals who have successfully transformed their financial situations and achieved a life free from the burden of debt. These real-life examples will demonstrate the power of adopting effective strategies to eliminate debt and provide motivation for those seeking a debt-free lifestyle.

One remarkable story is that of Jane, a single mother who was drowning in credit card debt and struggling to make ends meet. Determined to improve her situation, Jane discovered a debt-repayment method that enabled her to take control of her finances. With perseverance and discipline, she followed the steps outlined in this method, slowly chipping away at her debts with each payment. Through her commitment to the process, Jane was not only able to eliminate her debt but also build a savings fund for future financial security. Today, she enjoys a debt-free life and can confidently provide for her family.

Another success story is Mark, a recent college graduate burdened with student loans. Feeling overwhelmed by the weight of his educational debt, Mark turned to the debt-snowball method to tackle his financial obligations. By prioritizing his debts, starting with the smallest ones first, Mark gained momentum and empowered himself to overcome his financial challenges. Through persistence and responsible money management, Mark managed to pay off his student loans ahead of schedule, setting himself up for a debt-free future and the ability to pursue his dreams without the burden of debt holding him back.

These success stories are just a few examples of individuals from diverse backgrounds who have applied the principles of effective debt management to achieve financial freedom. Their experiences demonstrate that with the right mindset, determination, and the right strategies, it is possible for anyone to break free from the cycle of debt and create a debt-free lifestyle. By making a plan, taking consistent action, and staying committed to their financial goals, these individuals have proven that a brighter financial future is within reach for everyone.

Questions and answers

How does Dave Ramsey’s debt snowball method work?

The debt snowball method is a debt repayment strategy popularized by Dave Ramsey. It works by listing all your debts from smallest to largest and tackling the smallest debt first while making minimum payments on the others. Once the smallest debt is paid off, you take the money you were paying towards that debt and apply it to the next smallest debt, creating a snowball effect until all your debts are paid off.

Can the debt snowball method really help you achieve a debt-free lifestyle?

Yes, the debt snowball method can definitely help you achieve a debt-free lifestyle. By focusing on paying off one debt at a time, starting with the smallest, it provides a sense of progress and motivation. As each debt is eliminated, you have more money to put towards the next one, accelerating the debt repayment process.

Is the debt snowball method suitable for all types of debt?

The debt snowball method is applicable to most types of consumer debts, such as credit cards, personal loans, and medical bills. However, it may not be the most optimal strategy for debts with high interest rates. In such cases, it might be more financially beneficial to prioritize debts based on interest rates rather than their size.

Are there any disadvantages to using Dave Ramsey’s debt snowball method?

While the debt snowball method is effective in helping people eliminate debts, it does have some drawbacks. One disadvantage is that it may not save you as much money in interest compared to alternative repayment strategies that prioritize higher interest debts first. Additionally, it might take longer to pay off larger debts when using the debt snowball method.

How long does it typically take to become debt-free using the debt snowball method?

The time it takes to become debt-free using the debt snowball method depends on various factors, such as the total amount of debt, income, and monthly budget. It could take anywhere from a few months to several years. The key is to stay committed, consistently make payments, and avoid incurring new debts during the repayment process.

How does Dave Ramsey’s debt snowball method work?

Dave Ramsey’s debt snowball method involves listing all your debts from smallest to largest and focusing on paying off the smallest debt first, while making minimum payments on the rest. Once the smallest debt is paid off, the extra money is then put towards the next smallest debt, creating a snowball effect as each debt is paid off.

What are the benefits of using the debt snowball method?

Using Dave Ramsey’s debt snowball method provides several benefits. First, it allows you to build momentum as you pay off small debts quickly, which can be motivating. Additionally, as each debt is paid off, you have more money available to put towards larger debts. This method also provides a sense of accomplishment and satisfaction as you see progress towards becoming debt-free.

Is the debt snowball method better than other debt repayment strategies?

Whether the debt snowball method is better than other debt repayment strategies depends on individual preferences and financial situations. While some argue that focusing on high-interest debts first is more financially efficient, the debt snowball method emphasizes psychological and motivational benefits. Ultimately, it is important to choose a strategy that works best for you and helps you stay motivated to pay off your debts.

Can the debt snowball method be applied to all types of debts?

Yes, the debt snowball method can be applied to all types of debts. It works for credit card debt, student loans, car loans, and even mortgages. The key is to list your debts from smallest to largest, regardless of interest rates, and focus on paying them off one by one. By targeting the smallest debt first, you gain momentum and motivation to tackle the larger ones.

Are there any potential drawbacks to using the debt snowball method?

While the debt snowball method has its advantages, there are potential drawbacks to consider. By prioritizing small debts first, you may end up paying more in interest compared to methods that target higher interest rates. Additionally, if you have a high amount of debt or debts with very high interest rates, it may take longer to see significant progress. It is essential to evaluate your financial situation and consider the pros and cons before deciding on a debt repayment strategy.