In an ever-evolving financial landscape, characterized by volatility, unpredictability, and fluctuating market conditions, the ramifications of economic ambivalence can be far-reaching and profound. The ongoing uncertainties can significantly alter the course of industries, businesses, and individual financial trajectories. This article delves into the multifaceted nature of economic perplexity, examining its potential influence on various sectors and providing valuable insights into effective methodologies for mitigating and managing financial jeopardy.

Experimenting with fiscal intricacies, economic ambiguity leads to an environment where decision-making can be an intricate dance on shifting sands. The consequences stretch far beyond conventional calculations, as intricate webs of interdependencies and complex magnifications come into play. Understanding and navigating the uncharted waters of economic instability demand a fresh mindset and a careful evaluation of the ramifications and potential opportunities. This article aims to equip individuals, businesses, and entities with the requisite knowledge and tools to confront and combat the challenges posed by monetary uncertainty.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreMoreover, amidst economic obscurity, proactive and adaptive strategies are essential for survival and prosperity. The ability to foresee potential risks, identify trends, and adapt swiftly becomes the bedrock of resilience and success. By expanding our comprehension of the intricate relationships between different aspects of the financial ecosystem, gaining insights into risk factors, and adopting prudent measures to mitigate potential losses, individuals and organizations can fortify their positions in the face of ambiguity.

- Understanding the Significance of Economic Uncertainty

- Exploring the Causes of Economic Uncertainty

- Assessing the Effects of Economic Uncertainty on Businesses

- 1. Disruption to Consumer Behavior

- 2. Supply Chain Disruptions

- 3. Financing Difficulties

- 4. Market Volatility

- 5. Regulatory and Policy Changes

- 6. Competitive Landscape Shifts

- Analyzing the Impact of Economic Uncertainty on Individuals

- Strategies to Mitigate Financial Uncertainty

- Diversifying Investment Portfolios

- Implementing Risk Management Techniques

- Adapting to Evolving Market Conditions

- Questions and answers

Understanding the Significance of Economic Uncertainty

Comprehending the importance of economic uncertainty encompasses grasping the weighty implications it brings to various aspects of our modern society. As a dynamic force that permeates through the fabric of economies and individual lives, economic uncertainty represents a state of flux and unpredictability in financial markets, investments, and decision-making processes. It involves a lack of confidence in the future direction of economic indicators, such as inflation, interest rates, and employment, leading to ambiguity and hesitancy in economic planning and resource allocation.

Exploring the Causes of Economic Uncertainty

:max_bytes(150000):strip_icc()/TermDefinitions_FinancialRisk_4-3-edit-77707a14d4c44c75b3e32d9c1b9e45b1.jpg)

In this section, we will delve into the underlying factors that contribute to the unpredictable nature of the economy, examining the various elements that give rise to uncertainty in the financial realm. By understanding these causes, individuals and businesses can develop an informed approach to managing financial risk.

One of the primary drivers of economic uncertainty is market volatility, which can result from fluctuations in supply and demand, changes in government policies, or unexpected disruptions in key industries. This instability can create a ripple effect throughout the economy, leading to uncertain investment climates, unpredictable consumer behavior, and a general sense of unease in the financial markets.

Additionally, geopolitical factors play a significant role in economic uncertainty. Political tensions, trade disputes, and geopolitical events can introduce unforeseen risks that impact global markets. These factors can disrupt supply chains, alter trade agreements, and generate economic upheaval, causing a heightened level of uncertainty for businesses and individuals alike.

Economic uncertainties can also stem from financial imbalances and structural weaknesses within economies. These imbalances can manifest in the form of excessive debt, asset bubbles, or unsustainable fiscal policies. When these imbalances reach a tipping point, they can trigger economic crises and financial instability, further fueling uncertainty and making it challenging for individuals and businesses to plan for the future.

Last but not least, technological advancements and the rapid pace of innovation can contribute to economic uncertainty. While technology has the potential to drive economic growth and efficiency, it can also disrupt established industries and job markets, creating uncertainties about the future of work, income inequality, and the overall stability of the economy.

In conclusion, economic uncertainty arises from a combination of market volatility, geopolitical factors, financial imbalances, and technological advancements. By comprehending the interconnected nature of these causes, individuals and businesses can take proactive measures to mitigate risks, adapt to changing circumstances, and navigate the complex landscape of economic uncertainties.

Assessing the Effects of Economic Uncertainty on Businesses

Evaluating the Consequences of Financial Instability for Enterprises

In this section, we delve into the impacts that economic uncertainty can have on businesses, exploring the wide-ranging effects that arise from unstable financial conditions. By examining how businesses are affected, we gain a comprehensive understanding of the challenges they face and the measures they can take to mitigate the risks.

1. Disruption to Consumer Behavior

When economic uncertainty emerges, it often leads to a shift in consumer behavior. Consumer spending habits may undergo significant transformations, as individuals become more cautious about their finances. This alteration in behavior may result in reduced demand for certain products or services, affecting businesses across various sectors.

2. Supply Chain Disruptions

Uncertainty in the economy can also disrupt the supply chain, causing delays or interruptions in the availability of crucial resources and materials. Businesses heavily reliant on imported goods or global suppliers may encounter challenges in maintaining smooth operations, leading to potential production bottlenecks and increased costs.

3. Financing Difficulties

Economic uncertainty often triggers a tightening of credit markets and reduced availability of financing options for businesses. This limited access to capital can hinder expansion plans, hinder innovation, and impede investment in critical areas. It becomes crucial for businesses to adapt their financial strategies to navigate these difficulties effectively.

4. Market Volatility

In times of economic uncertainty, financial markets tend to experience heightened volatility. Fluctuations in stock prices, interest rates, and currency exchange rates can impact businesses with significant exposure to these variables. Companies need to carefully monitor and manage their financial positions to mitigate potential losses caused by market turbulence.

5. Regulatory and Policy Changes

Uncertainty in the economy often leads to shifts in regulatory and policy frameworks. Government interventions, changes in taxation, and alterations in trade agreements can directly affect business operations, placing additional burdens or providing unexpected opportunities. Staying abreast of these changes and promptly adapting strategies is vital for businesses to navigate the evolving landscape.

6. Competitive Landscape Shifts

Economic uncertainty can prompt shifts in the competitive landscape as businesses grapple with changing market conditions. Market consolidation, industry disruptions, or the emergence of new competitors can pose challenges to established businesses, requiring them to adapt their strategies to maintain their competitive edge.

By evaluating the effects of economic uncertainty on businesses across these dimensions, organizations can develop proactive strategies to safeguard their operations and minimize the financial risks they face. Understanding the multifaceted implications of uncertainty equips businesses with the knowledge necessary to navigate through challenging economic landscapes successfully.

Analyzing the Impact of Economic Uncertainty on Individuals

Examining the consequences of economic unpredictability on individuals is crucial for understanding the effects it has on various aspects of their lives. By exploring the repercussions of financial insecurity, instability, and ambiguity, we gain valuable insights into how people’s behaviors, emotions, and decision-making processes are influenced.

| Psychological Impact | Socioeconomic Consequences | Changes in Lifestyle |

|---|---|---|

| The psychological well-being of individuals is often significantly affected by economic unpredictability. In times of uncertainty, people may experience heightened stress, anxiety, and a sense of insecurity. The fear of job loss, financial hardship, and unstable markets can lead to increased levels of stress-related health issues and psychological disorders. | Economic uncertainty can have wide-ranging socioeconomic repercussions for individuals. It can result in reduced consumer spending and investment, leading to decreased overall economic activity. Individuals may struggle to secure stable employment, experience income fluctuations, and face challenges in accessing credit or loans. These factors can contribute to increased poverty rates and inequality within society. | The impact of economic uncertainty on individuals can extend to their lifestyle choices. Facing financial risk, individuals may adopt more conservative spending habits, prioritize savings and investments, or postpone major life decisions such as buying a house or starting a family. They may also face difficulties in pursuing education, healthcare, or other essential services due to affordability concerns. |

Understanding the multifaceted consequences of economic uncertainty on individuals is essential for devising effective strategies to mitigate its negative effects. By identifying the specific challenges faced by individuals and addressing their unique needs, policymakers, financial institutions, and individuals themselves can better navigate and adapt to uncertain economic conditions.

Strategies to Mitigate Financial Uncertainty

:max_bytes(150000):strip_icc()/risk-management-4189908-FINAL-2-976ae194e01848618ca94941ab9d2395.jpg)

In the dynamic landscape of economic unpredictability, it is essential for individuals and organizations to adopt effective techniques to minimize potential financial risks. This section will delve into a range of approaches and tactics that can help navigate the uncertain waters of the financial realm, ensuring stability and success amidst turbulent times.

Diversification of Investments

One of the key strategies in managing financial risk is diversifying one’s investment portfolio. By spreading investments across different asset classes, sectors, or geographical locations, individuals and organizations can minimize their exposure to any single financial instrument or market. A well-diversified portfolio helps mitigate the impact of market downturns and potential losses, as losses in one area can potentially be offset by gains in another.

Active Monitoring and Analysis

Staying vigilant and continuously monitoring the financial markets is crucial to mitigating potential risks. Regularly analyzing economic trends, market conditions, and macroeconomic factors allows individuals and organizations to make informed decisions, identify potential risks, and adapt their strategies accordingly. By being proactive and responsive to changes in the financial landscape, one can effectively navigate uncertainty and position themselves for long-term success.

Insurance and Risk Transfer

Insurance serves as a valuable tool in managing financial risk. By transferring the potential impact of certain risks to an insurance provider, individuals and organizations can protect themselves from significant financial losses. Insurance policies, such as property insurance, liability insurance, or business interruption insurance, offer a safety net in case of unforeseen events or disasters, providing financial stability and peace of mind.

Establishing Emergency Funds

Building a robust emergency fund is a prudent approach to mitigate financial risk. By setting aside funds specifically designated for emergencies, individuals and organizations can withstand unforeseen expenses or income disruptions without resorting to high-interest loans or compromising other financial goals. An emergency fund acts as a buffer, providing financial security and allowing for more strategic decision-making in times of uncertainty.

Strategic Partnerships and Collaborations

Forming strategic partnerships and collaborations can help mitigate financial risk by pooling resources and expertise. By collaborating with like-minded individuals or organizations, one can share risks and expenses, access new markets or customer bases, and leverage combined strengths to achieve common goals. Strategic partnerships provide opportunities for diversification and can enhance overall resilience in the face of economic volatility.

Continuous Education and Professional Development

Investing in continuous education and professional development is an effective strategy for mitigating financial risk. Staying updated with industry trends, acquiring new skills, and expanding knowledge can enhance one’s ability to adapt to changing circumstances. By being well-informed and equipped with relevant expertise, individuals can make informed financial decisions and navigate uncertain times with confidence.

In conclusion, by employing a combination of strategies such as diversification, active monitoring, insurance, establishing emergency funds, forming strategic partnerships, and investing in continuous education, one can effectively mitigate financial risk. These strategies provide a solid foundation for managing uncertainty and ensuring long-term financial stability and success.

Diversifying Investment Portfolios

In today’s unpredictable economic climate characterized by instability and the presence of unknowns, it is crucial to explore effective approaches for mitigating financial risks. One such strategy is the diversification of investment portfolios. This section delves into the concept and significance of diversification and highlights its potential impact on financial well-being.

Diversifying investment portfolios involves spreading investments across a variety of assets to reduce exposure to specific risks and increase the potential for returns. By allocating resources to a diverse range of sectors, industries, and geographic regions, individuals can enhance their potential for long-term success and minimize the vulnerability to imminent economic changes.

Through diversification, investors can mitigate the impact of economic uncertainty by reducing the reliance on any one specific investment. By not putting all their eggs in one basket, individuals can strive to achieve a balance between the potential for high returns and the need for risk management.

Furthermore, diversification can help investors capitalize on market opportunities. By funding various asset classes, such as stocks, bonds, real estate, and commodities, individuals can take advantage of different market conditions. For example, during times of economic growth, the stock market may flourish, while during periods of uncertainty, investments in bonds or gold may provide stability and protection.

In conclusion, diversifying investment portfolios is a crucial strategy for managing financial risk in the face of economic uncertainty. By spreading investments across various assets, individuals can enhance their potential for returns and reduce their exposure to specific risks. Embracing diversification enables individuals to navigate the intricacies of the financial landscape with greater resilience and adaptability.

Implementing Risk Management Techniques

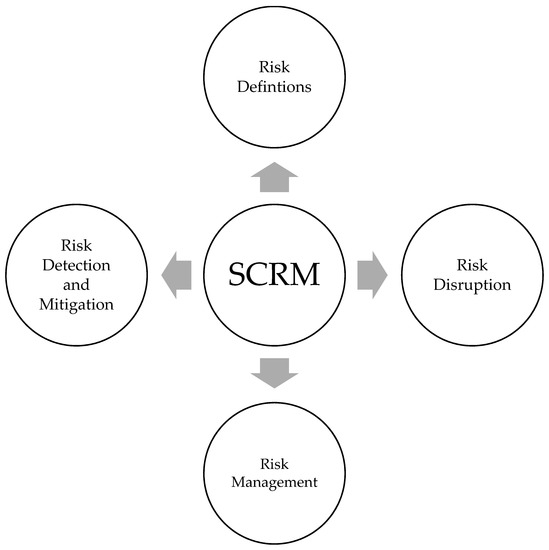

In this section, we explore the practical measures that can be taken to effectively manage and mitigate financial uncertainties resulting from the ever-changing economic landscape. By incorporating specific risk management techniques, businesses can enhance their ability to navigate uncertain times and ensure long-term sustainability.

One key aspect of implementing risk management techniques is identifying potential risks and evaluating their potential impact on financial stability. This involves conducting thorough risk assessments and employing strategic forecasting to anticipate potential challenges. By understanding the various risks associated with economic uncertainties, businesses can develop comprehensive plans to mitigate their impacts.

Another vital aspect of risk management is diversification. By diversifying investments and income streams, businesses can reduce their exposure to a single point of failure. This can be achieved through a strategic allocation of resources across different markets, industries, and assets. Diversification not only helps mitigate potential losses but also provides opportunities for growth and resilience in times of economic instability.

Furthermore, effective risk management involves implementing robust internal controls and monitoring mechanisms. By establishing clear procedures and guidelines, businesses can ensure consistent adherence to risk management protocols. Regular performance evaluations and continuous monitoring of key risk indicators enable businesses to detect potential problems early on and take corrective actions proactively.

Additionally, fostering a risk-aware culture within the organization is crucial for successful risk management. It is essential to promote open communication, transparency, and knowledge sharing regarding risk management practices. By providing comprehensive training and education on risk identification and mitigation techniques, businesses can empower their employees to actively participate in risk management efforts.

Lastly, the implementation of risk management techniques requires ongoing evaluation and adjustment. Regular reviews of risk management strategies and their effectiveness enable businesses to adapt to new economic challenges and refine their approach accordingly. By staying proactive and responsive, organizations can significantly enhance their resilience to economic uncertainties and maintain long-term financial stability.

| Benefits of Implementing Risk Management Techniques |

|---|

| 1. Enhanced financial stability |

| 2. Reduced exposure to uncertainties |

| 3. Opportunities for growth and resilience |

| 4. Early detection of potential problems |

| 5. Empowered employees and improved organizational culture |

| 6. Adaptability to changing economic landscapes |

Adapting to Evolving Market Conditions

In the face of fluctuating economic circumstances and an ever-changing business landscape, it becomes crucial for individuals and organizations alike to adapt to evolving market conditions. The ability to recognize and respond to shifts in the market is essential for mitigating financial risks and ensuring long-term stability.

Being able to adapt to changing market conditions involves staying vigilant and observant of the trends and factors that impact the economy. It requires a proactive approach in analyzing market data, studying consumer behavior, and monitoring industry developments. By maintaining a thorough understanding of the market dynamics, individuals and organizations can make informed decisions and adjust their strategies accordingly.

One effective way to adapt to changing market conditions is through diversification. By allocating resources across different industries, products, or geographies, individuals and organizations can spread their risk and minimize the potential negative impact of economic uncertainty. Diversification allows for exposure to a variety of market conditions, providing a buffer against unforeseen challenges and enhancing opportunities for growth.

Another strategy for adapting to evolving market conditions is to stay agile and flexible. This involves being open to change and willing to adjust business models, product offerings, or marketing strategies as needed. By embracing innovation and being adaptable, individuals and organizations can quickly respond to market shifts and capitalize on emerging opportunities.

Effective communication and collaboration are also essential in adapting to changing market conditions. By fostering strong relationships with stakeholders and maintaining open lines of communication, individuals and organizations can gather valuable insights and receive timely feedback, enabling them to make accurate adjustments to their strategies. Collaboration with industry peers and experts can also provide a broader perspective and access to shared experiences, enhancing the ability to adapt effectively.

| Key Points |

|---|

| Recognize and respond to shifts in the market |

| Stay vigilant and observant of market trends and factors |

| Diversify resources to spread risk |

| Stay agile and flexible in adjusting strategies |

| Facilitate effective communication and collaboration |

Questions and answers

How does economic uncertainty affect financial risk management strategies?

Economic uncertainty can have a significant impact on financial risk management strategies. During times of economic uncertainty, such as recessions or market fluctuations, the level of risk typically increases. This means that businesses and individuals need to adjust their risk management strategies accordingly. They may need to be more conservative in their investments, diversify their portfolios, or take other measures to protect themselves from potential financial losses.

What are some effective strategies for managing financial risk during times of economic uncertainty?

During times of economic uncertainty, there are several effective strategies for managing financial risk. One strategy is to diversify investments across different asset classes and regions, as this can help reduce exposure to specific risks. Another strategy is to maintain a sufficient cash reserve, which provides a buffer in case of unexpected circumstances. Additionally, staying informed about macroeconomic trends and factors that could impact the market can help individuals and businesses make more informed decisions about their financial risk management strategies.

Are there any industries that are more susceptible to economic uncertainty?

Yes, certain industries are generally more susceptible to economic uncertainty than others. Industries such as hospitality, travel, and retail tend to be more vulnerable during economic downturns as consumer spending decreases. Additionally, sectors heavily reliant on commodities or energy prices may also be more affected by economic uncertainty. On the other hand, industries related to essential goods and services, such as healthcare or utilities, may be more resistant to economic fluctuations.

What are the potential consequences of not effectively managing financial risk during times of economic uncertainty?

The consequences of not effectively managing financial risk during times of economic uncertainty can be severe. Businesses that fail to adapt their risk management strategies may face bankruptcy or significant financial losses. Individuals may suffer from a decline in their investment portfolios, job losses, or difficulty in meeting financial obligations. Economic uncertainty can also lead to increased market volatility and decreased consumer confidence, which can further exacerbate the negative consequences.

Are there any government policies or programs that can help mitigate the impact of economic uncertainty?

Yes, governments can implement various policies and programs to help mitigate the impact of economic uncertainty. These can include fiscal stimulus measures, such as increased government spending or tax cuts, to stimulate the economy during downturns. Central banks can also employ monetary policies, such as lowering interest rates or implementing quantitative easing, to encourage borrowing and investment. Additionally, governments may offer financial assistance programs to help individuals and businesses cope with the effects of economic uncertainty.

What is economic uncertainty?

Economic uncertainty refers to a situation where the future outlook for the economy is uncertain, making it difficult for individuals and businesses to predict economic conditions and make informed financial decisions.

How can economic uncertainty impact financial risk?

Economic uncertainty can increase financial risk by making it harder to accurately assess the potential returns and outcomes of investment decisions. It can lead to market volatility, decreased consumer spending, and increased unemployment, all of which can have significant impacts on financial stability.

What are some effective strategies for managing financial risk during economic uncertainty?

Some effective strategies for managing financial risk during economic uncertainty include diversifying investments, maintaining an emergency fund, reducing debt, adjusting spending habits, and regularly reviewing and adjusting financial plans.

How can businesses navigate economic uncertainty?

Businesses can navigate economic uncertainty by closely monitoring market trends, diversifying their customer base, reducing operating costs, evaluating and adjusting their business strategies, and maintaining strong relationships with key stakeholders.

What are the long-term effects of economic uncertainty?

The long-term effects of economic uncertainty can vary, but they often include reduced consumer and business spending, decreased investment levels, lower GDP growth, increased unemployment rates, and overall economic instability.