Imagine a life free from the burdensome weight of debt, where financial freedom and peace of mind reign supreme. Despite its seemingly insurmountable nature, paying off debt is within reach for anyone willing to embark on a journey of discipline and strategic planning.

In this comprehensive guide, we will unveil a series of key steps and powerful strategies that will empower you to conquer your debt and regain control over your financial future. Through a blend of insightful advice, practical tips, and expert guidance, you will learn how to break free from the shackles of debt and embark on a path towards long-term financial stability.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreStep 1: Assess and Acknowledge

The first crucial step in your debt repayment journey is to confront the reality of your situation. It requires an honest assessment of the scope and magnitude of your debts, as well as a deep acknowledgment of the emotional and psychological toll debt can have on your well-being.

By taking stock of all your debts, categorizing them based on interest rates and outstanding balances, you will gain a clear understanding of the financial landscape that lies ahead. This knowledge will serve as the foundation for devising a personalized debt repayment plan that is tailored to your unique circumstances.

Step 2: Create a Budget and Trim Expenses

Building a comprehensive budget is the cornerstone of your debt repayment journey. It allows you to gain full visibility into your income, expenses, and discretionary spending, enabling you to make informed decisions about where to allocate your hard-earned money.

During this step, it is essential to identify areas in your budget where expenses can be trimmed or eliminated altogether. Seemingly small changes, such as reducing dining out, canceling unused subscriptions, and forgoing luxury purchases, can accumulate substantial savings that can be directed towards paying off your debts more aggressively.

Step 3: Explore Strategic Repayment Approaches

While there is no one-size-fits-all approach to debt repayment, exploring various strategic tactics can significantly accelerate your progress. Consider implementing the debt avalanche method, where you target debts with the highest interest rates first, or the debt snowball method, where you focus on paying off smaller debts initially to gain momentum.

Another effective strategy is to negotiate with creditors for lower interest rates or reduced settlement amounts. By communicating openly and honestly about your financial situation, you may be able to secure more favorable terms, ultimately decreasing the overall amount you owe and shortening the repayment timeframe.

The road to debt freedom requires discipline, perseverance, and a deep commitment to change. By following these key steps and implementing the proven strategies outlined in this guide, you will lay the groundwork for a brighter financial future. You have the power to take control of your debts and embark on a journey towards financial liberation. The time to start is now!

- The Best Ways to Pay Off Debt and Achieve Financial Freedom

- Key Steps Towards Debt Elimination

- Creating a Budget to Track and Minimize Expenses

- Developing a Debt Payoff Plan and Setting Realistic Goals

- Considering Debt Consolidation or Refinancing Options

- Effective Strategies for Paying Off Debt

- Using the Debt Snowball Method to Tackle Small Debts First

- Utilizing the Debt Avalanche Method to Prioritize High-Interest Debts

- Exploring Additional Sources of Income to Accelerate Debt Repayment

- Questions and answers

The Best Ways to Pay Off Debt and Achieve Financial Freedom

When it comes to becoming debt-free and gaining control over your financial future, adopting effective strategies is crucial. In this section, we will explore some of the most powerful methods to pay off debt and attain financial freedom, without being burdened by the weight of loans or borrowings.

1. Accelerate your Debt Repayment: Speeding up the process of repaying your debt can help you avoid unnecessary interest payments and reduce the overall time it takes to become debt-free. Consider allocating a larger portion of your monthly income towards debt repayment or utilizing windfalls, such as bonuses or tax refunds, to make additional payments and get ahead of interest accrual.

2. Prioritize your Debts: Not all debts are created equal. By identifying and prioritizing your debts based on interest rates and terms, you can strategically allocate your resources to pay off high-interest debts first, saving money in the long run. This approach allows you to free up more funds to tackle other debts progressively.

3. Create a Budget and Stick to It: Establishing a detailed budget that clearly outlines your income, expenses, and savings goals is essential. By tracking your expenditures and identifying areas where you can reduce or eliminate unnecessary spending, you can redirect those funds towards debt repayment, expediting your path to financial freedom.

4. Utilize Debt Consolidation: If you have multiple high-interest debts, consider consolidating them into a single loan with a lower interest rate. Debt consolidation simplifies your repayment process by combining your debts into one affordable monthly payment, enabling you to save on interest charges and have a clear repayment plan.

5. Seek Professional Advice: If you find yourself overwhelmed or unsure about the best strategies for paying off your debt, don’t hesitate to seek guidance from a financial advisor or credit counseling service. These professionals can provide personalized advice and develop a tailored plan to help you tackle your debt effectively.

6. Stay Motivated and Celebrate Milestones: Paying off debt can be a challenging journey, so it’s crucial to stay motivated along the way. Set milestones to track your progress and celebrate each accomplishment, no matter how small. This positive reinforcement will keep you focused and motivated to achieve your ultimate goal of financial freedom.

7. Build an Emergency Fund: To avoid falling back into debt, it’s important to establish an emergency fund to cover unforeseen expenses. By setting aside a portion of your income regularly, you can ensure that you have a safety net to rely on instead of resorting to credit cards or loans when faced with unexpected financial burdens.

By implementing these strategies and taking control of your debts, you are paving the way for a financially secure future. Remember, becoming debt-free requires discipline, patience, and perseverance, but the freedom and peace of mind that await you are well worth the effort.

Key Steps Towards Debt Elimination

In this section, we will explore essential actions that can help you achieve the goal of eliminating debt and regaining financial freedom. By implementing these steps, you can pave the way to a debt-free future and take control of your financial well-being.

1. Assess your debt: Begin by evaluating the extent of your debt and creating a comprehensive list of all your outstanding obligations. This includes credit card balances, loans, mortgage payments, and any other forms of debt. Understanding the full scope of your financial liabilities is crucial for creating an effective repayment plan.

2. Analyze your spending habits: Take a close look at how you spend your money and identify areas where you can cut back. Consider making a budget that outlines your income and expenses, allowing you to allocate funds towards debt repayment while still covering essential living expenses.

3. Prioritize high-interest debts: Focus on paying off debts with high-interest rates first. By tackling these obligations early on, you can minimize the financial burden of accumulating interest over time. This approach can help you save money and accelerate your path to debt freedom.

4. Create a debt repayment plan: Develop a strategic plan for paying off your debt, taking into account your financial capabilities and goals. This plan can involve allocating a certain amount of money each month towards debt repayment, utilizing different repayment strategies, and establishing milestones to track your progress.

5. Explore debt consolidation options: Consider consolidating multiple debts into a single loan or credit account with a lower interest rate. Debt consolidation can simplify your repayment process by combining various debts into one, potentially reducing your monthly payments and overall interest charges.

6. Increase your income: Look for opportunities to boost your income, such as taking up a side gig, freelancing, or negotiating a raise with your current job. The additional money you earn can be allocated towards debt repayment, helping to expedite the elimination of your financial obligations.

7. Seek professional advice: If you find yourself overwhelmed or unsure about the best course of action, don’t hesitate to consult a financial advisor or credit counselor. These experts can provide personalized guidance and support in developing a customized debt repayment strategy.

8. Stay disciplined and motivated: Remember that paying off debt requires discipline and commitment. Stay motivated by celebrating small victories along the way and reminding yourself of the benefits that come with financial freedom. Embrace frugal habits and make conscious choices that align with your debt elimination goals.

By following these key steps, you can navigate the path towards debt elimination and take significant strides towards a financially secure future.

Creating a Budget to Track and Minimize Expenses

In this section, we will explore the importance of creating a budget as a crucial step towards managing and reducing expenses effectively. By implementing a budget, you will gain control over your finances and make informed decisions about your spending habits. Let’s dive into the key aspects of creating a budget and how it can help you in your journey towards financial freedom.

1. Assess Your Current Financial Situation

- Evaluate your income sources and determine your overall monthly income.

- Review your expenses from the past few months to identify patterns and areas where you can cut back.

- Analyze your debt obligations, such as loan payments or credit card balances.

2. Set Clear Financial Goals

- Define your short-term and long-term financial goals, such as paying off specific debts or saving for a major purchase.

- Establish realistic timelines for achieving these goals based on your income and expenses.

- Break down your goals into smaller milestones to stay motivated and track your progress.

3. Categorize and Prioritize Your Expenses

- Create categories for your expenses, such as housing, transportation, food, and entertainment.

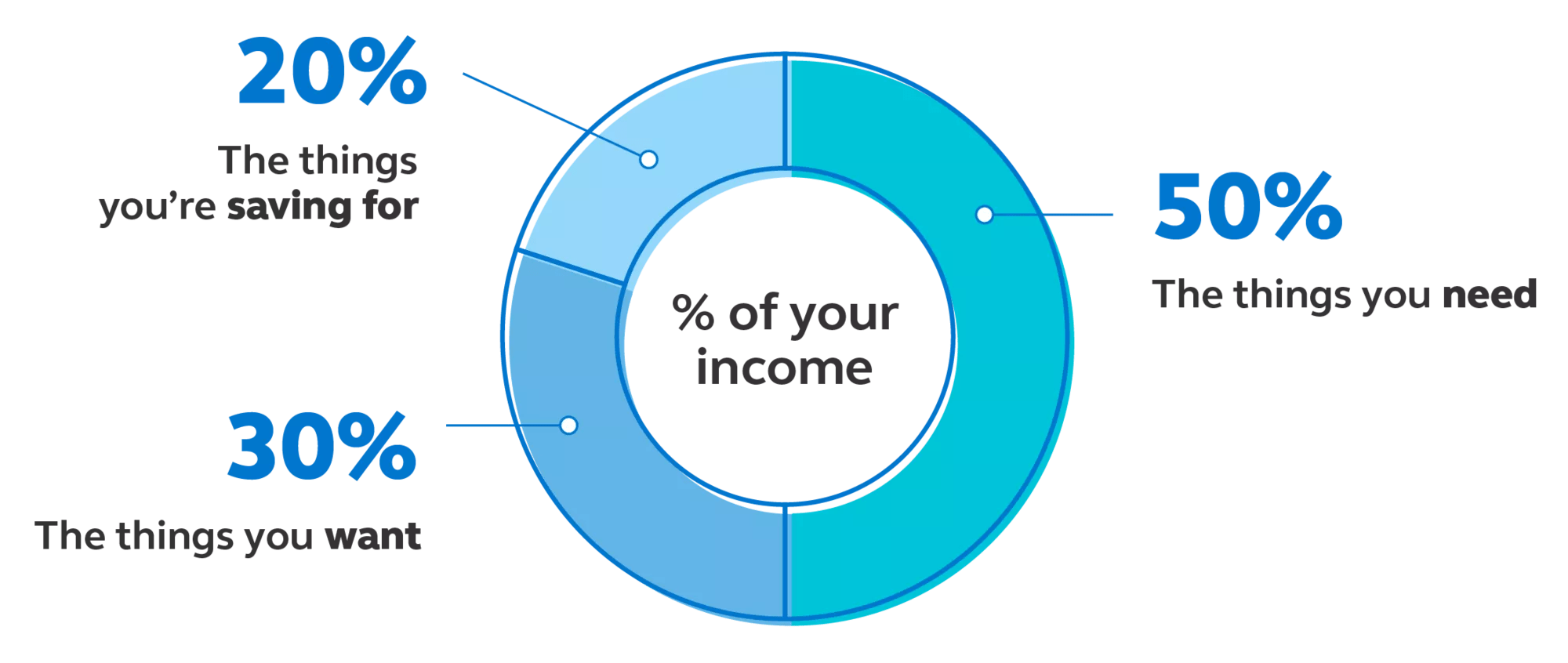

- Assign a set amount or a percentage of your income to each category based on your priorities and financial goals.

- Identify expenses that can be reduced or eliminated to free up more money for debt repayment or savings.

4. Track Your Expenses

- Keep a record of all your expenses using a budgeting app, spreadsheet, or a pen-and-paper method.

- Regularly review and update your expense tracker to ensure you stay within your set budget for each category.

- Identify any overspending or areas where you need to adjust your budget to stay on track.

5. Make Adjustments and Stay Disciplined

- Evaluate your budget regularly to identify areas where you can make further adjustments to reduce expenses.

- Consider negotiating bills, finding cheaper alternatives, or cutting out unnecessary expenses altogether.

- Stay disciplined and committed to your budget, making conscious spending decisions aligned with your financial goals.

By creating and following a budget, you can gain control over your expenses and make significant progress towards paying off your debt. It will empower you to identify areas where you can minimize spending and allocate more funds towards debt repayment, ultimately leading you towards financial freedom.

Developing a Debt Payoff Plan and Setting Realistic Goals

Planning your debt repayment journey and establishing achievable goals is essential to successfully eliminating your debt burden. This section will guide you through the process of developing a personalized debt payoff plan and setting realistic milestones to keep you motivated along the way.

- Understand Your Current Financial Situation: Before you can create a debt payoff plan, it’s crucial to have a clear understanding of your current financial standing. Take the time to gather all relevant information, such as your outstanding debts, interest rates, and minimum monthly payments. This will serve as the foundation for your plan.

- Evaluate Your Income and Expenses: Assess your monthly income and expenses to determine how much extra money you can allocate towards debt repayment. Identify areas where you can cut back on discretionary spending and redirect those funds towards paying off your debts.

- Assess Debt Repayment Options: Familiarize yourself with different debt repayment strategies, such as the snowball method or avalanche method. The snowball approach involves paying off the smallest debt first, while the avalanche method focuses on tackling debts with the highest interest rates. Choose the strategy that aligns best with your financial goals and preferences.

- Create a Realistic Debt Payoff Timeline: Setting a timeline for debt repayment will help you stay focused and motivated. Consider your financial capabilities and commitments to set realistic targets. Break down your total debt into manageable chunks and assign a timeframe for paying off each debt, ensuring that your goals are achievable.

- Establish Milestones and Celebrate Progress: Divide your debt payoff journey into milestones to mark your achievements along the way. Celebrate each milestone, whether it’s paying off a particular debt or reaching a specific percentage of total debt repayment. Recognizing your progress will keep you motivated and determined to continue working towards a debt-free future.

By developing a personalized debt payoff plan and setting realistic goals, you can take control of your financial situation and gradually eliminate your debt. Remember to regularly revisit and adjust your plan as needed to accommodate any changes in your income or expenses. Stay committed and consistent, and you will eventually experience the liberating feeling of being free from debt.

Considering Debt Consolidation or Refinancing Options

Exploring alternatives to manage your existing financial obligations more effectively can be a wise decision. When it comes to successfully paying off debt, it is crucial to consider debt consolidation or refinancing options. These strategies can provide you with a chance to streamline your outstanding debts, potentially lower interest rates, and simplify your repayment process.

Debt consolidation involves combining multiple debts, such as credit card balances and personal loans, into a single loan with a fixed interest rate. This approach can simplify your payments by providing one monthly installment, making it easier to keep track of your debt and manage your monthly budget. Additionally, consolidating your debt may help streamline your finances by eliminating high-interest debts and reducing the number of payments you need to make each month.

On the other hand, refinancing refers to the process of obtaining a new loan to replace an existing one, typically with better terms and interest rates. When refinancing debt, you essentially take out a new loan to pay off the existing ones. This can be particularly advantageous if you have loans with high interest rates, as it allows you to secure a new loan with a lower interest rate, potentially saving you money in the long run.

Both debt consolidation and refinancing options have their own pros and cons, and it is vital to thoroughly evaluate your financial situation and goals before deciding which option is best for you. Consulting with a financial advisor or seeking guidance from reputable lending institutions can provide you with valuable insights to make an informed decision.

By considering debt consolidation or refinancing options, you can take a proactive step towards effectively managing your debt, potentially saving money on interest, and achieving your goal of becoming debt-free.

Effective Strategies for Paying Off Debt

Developing a successful plan to eliminate debt requires careful consideration and thoughtful strategies. By implementing effective tactics and adopting a disciplined approach, individuals can gradually free themselves from the burden of debt and pave the way towards financial freedom.

One key strategy is to prioritize debt repayment by evaluating the interest rates attached to each debt. By targeting high-interest debts first, individuals can minimize the long-term interest payments and expedite the debt payoff process. This method, often referred to as the avalanche method, allows individuals to save money by tackling the most costly debts upfront.

Another effective approach is the snowball method where individuals begin by paying off their smallest debts first. By focusing on these smaller victories, individuals gain a sense of accomplishment and motivation, which encourages them to stay on track with their debt repayment journey. As each debt is paid off, the money previously allocated to it can be reallocated towards larger debts, gradually gaining momentum towards total debt elimination.

Consolidating multiple debts into a single loan or credit facility is yet another viable strategy for paying off debt. This method allows individuals to simplify their repayment process by merging multiple payments into one, often at a lower interest rate. Additionally, consolidation can provide individuals with the opportunity to negotiate better repayment terms, allowing for faster and more efficient debt reduction.

Creating and maintaining a budget is an essential component of any successful debt repayment strategy. By tracking income and expenses, individuals can identify areas where spending can be reduced or eliminated. Cutting back on unnecessary expenditures and diverting those funds towards debt repayment can significantly expedite the process of becoming debt-free.

Lastly, seeking professional guidance can be a valuable strategy for paying off debt. Financial advisors or credit counselors can provide personalized advice and support individuals in developing a tailored repayment plan. These experts can offer insights into debt management techniques, negotiate with creditors on behalf of individuals, and provide the necessary tools for long-term financial stability.

Implementing a combination of these strategies, tailored to an individual’s unique circumstances, can lay the foundation for successfully paying off debt. It requires commitment, discipline, and perseverance, but with the right strategies in place, individuals can achieve their goal of becoming debt-free and enjoy a brighter financial future.

Using the Debt Snowball Method to Tackle Small Debts First

Empower yourself to conquer your debts by exploring the effective strategy known as the Debt Snowball Method. This approach focuses on prioritizing and paying off small debts initially, creating momentum and motivation as you progress towards your larger financial goals.

Unleashing the power of the Debt Snowball Method:

1. Identify all your debts, whether it be credit card balances, personal loans, or outstanding bills. Organize them in ascending order based on their respective balances.

2. Begin by allocating as much money as possible towards paying off the smallest debt. While continuing to make minimum payments on your larger debts, consistently commit additional funds to tackling this initial small debt.

3. Experience the thrill of accomplishing your first debt payoff goal. The successful elimination of the smallest debt encourages a sense of achievement and motivates you to continue progressing towards your larger financial objectives.

4. Utilize the funds that were previously allocated to the now paid-off debt and direct them towards the next smallest debt on your list. This creates a compounding effect, whereby the snowball gains momentum as you advance through each debt.

5. Recognize that patience and consistency are key. The Debt Snowball Method requires discipline and perseverance, but each small victory brings you closer to eventual debt freedom.

6. Stay focused on your long-term financial goals. As you continue to pay off debts, the amount of available money for debt payments increases. Maintain your commitment to the Debt Snowball Method, allocating additional funds towards your debts each month.

7. Revel in the joy of debt freedom. By consistently applying the Debt Snowball Method, you will eventually pay off all your debts, experience financial relief, and establish a solid foundation for a brighter financial future.

In summary, the Debt Snowball Method is a powerful debt payment strategy that empowers you to tackle your debts one by one, starting with the small ones. By consistently allocating additional funds towards your smallest debt and celebrating each victory, you can gain momentum and motivation to continue paying off larger debts until you ultimately achieve debt freedom.

Utilizing the Debt Avalanche Method to Prioritize High-Interest Debts

In the pursuit of achieving financial freedom and regaining control over your financial situation, it is crucial to prioritize your debts effectively. One popular strategy for debt repayment is the debt avalanche method. This method focuses on tackling high-interest debts first, allowing you to save money on interest payments over time.

Understanding the concept of the debt avalanche method

The debt avalanche method is a strategic approach to debt repayment that prioritizes debts based on their interest rates. The key principle behind this method is to target the debts with the highest interest rates first. By doing so, you can minimize the amount of interest you accrue and expedite your journey towards becoming debt-free.

Identifying high-interest debts

The first step in implementing the debt avalanche method is to identify your high-interest debts. These are the debts that accrue the highest interest rates, which may include credit card balances, personal loans, or other types of debt. By carefully reviewing your debts and their respective interest rates, you can determine which ones should be prioritized using the debt avalanche method.

Create a repayment plan

Once you have identified your high-interest debts, it is essential to create a repayment plan. This plan should outline how much you will allocate towards each debt, with a focus on paying more towards the debt with the highest interest rate. By allocating more funds towards high-interest debts, you can reduce the overall amount of interest you pay, allowing you to repay your debts more quickly.

Consistency and discipline

Implementing the debt avalanche method requires consistency and discipline. It may take time to completely eliminate your high-interest debts, but maintaining a consistent repayment schedule and avoiding the accumulation of new debt is crucial. By staying committed to the process, you will gradually chip away at your debt, one payment at a time.

The benefits of utilizing the debt avalanche method

Utilizing the debt avalanche method offers several advantages. Firstly, by targeting high-interest debts, you can save significant amounts of money on accrued interest over time. Additionally, this method allows you to create a clear repayment plan and encourages financial discipline. Finally, successfully implementing the debt avalanche method can provide a sense of accomplishment as you reach milestones and eventually become debt-free.

In conclusion

The debt avalanche method is a powerful strategy for effectively paying off high-interest debts. By prioritizing these debts, creating a repayment plan, and remaining consistent in your efforts, you can regain control of your financial situation and work towards a debt-free future. Remember, every small step you take towards paying off high-interest debts brings you closer to achieving financial freedom.

Exploring Additional Sources of Income to Accelerate Debt Repayment

Discovering alternative ways to boost your income can significantly expedite the process of paying off your debts. By supplementing your regular earnings with additional sources of income, you can allocate more funds towards debt repayment and achieve financial freedom sooner.

Here are some strategies to explore when seeking additional sources of income:

- Diversify Your Skills: Consider acquiring new skills or expanding your existing expertise to increase your marketability. This can open up opportunities for freelance work, consulting, or other side gigs.

- Utilize the Gig Economy: Tap into the growing gig economy by taking on part-time jobs or leveraging platforms that offer freelance work, such as ride-sharing, delivery services, or online marketplaces.

- Monetize Your Hobbies: If you have a passion or talent, explore ways to turn it into a profitable venture. Whether it’s selling handmade crafts, offering music lessons, or providing photography services, transforming your hobby into a source of income can help accelerate your debt repayment.

- Rent Out Assets: If you have unused assets, such as a spare room, a car, or equipment, consider renting them out to generate extra income. This could include participating in home-sharing platforms, car-sharing programs, or offering your tools or equipment for rent.

- Create Online Content: Explore opportunities to monetize your online presence, such as starting a blog, creating videos on platforms like YouTube, or becoming an affiliate marketer. With dedication and persistence, these ventures can generate passive income over time.

- Participate in Market Research: Sign up for market research programs that compensate participants for sharing their opinions and insights. Online surveys, focus groups, and product testing can provide additional income streams without requiring a significant time commitment.

- Seek Additional Employment: Consider taking on a part-time job in addition to your regular work. This could involve weekend work, evening shifts, or remote employment opportunities that align with your skills and schedule.

- Invest Wisely: Explore investment opportunities that have the potential to generate passive income, such as dividend-paying stocks, rental properties, or peer-to-peer lending. However, make sure to thoroughly research and assess the risks associated with each investment option.

Remember, exploring additional sources of income requires dedication, time management, and a willingness to expand your skill set. By adopting a proactive approach and implementing these strategies, you can accelerate your debt repayment and achieve your financial goals sooner than expected.

Questions and answers

What are the key steps to successfully paying off debt?

The key steps to successfully paying off debt include: creating a budget, minimizing expenses, increasing income, prioritizing debt repayment, and staying motivated.

How can I create a budget to help pay off debt?

To create a budget, start by tracking your monthly income and expenses. Identify areas where you can cut back, such as dining out or entertainment expenses. Allocate the saved money towards paying off debt. Make sure to prioritize debt repayments in your budget.

What strategies can I use to minimize expenses and save money?

There are several strategies you can use to minimize expenses and save money. These include cutting back on non-essential expenses, negotiating bills, using coupons or shopping during sales, and opting for generic brands. Additionally, you can save money by canceling unused subscriptions or memberships.

How can I increase my income to pay off debt faster?

To increase your income, consider taking on a part-time job, freelancing, or starting a side business. You can also explore opportunities for career advancement or requesting a raise at your current job. Any extra income should be directed towards debt repayment.

How do I stay motivated during the debt repayment process?

Staying motivated during the debt repayment process can be challenging. It helps to set specific financial goals, such as paying off a certain amount by a certain date. Celebrate small victories along the way, and find support through online communities or friends who are also on a debt repayment journey. Remember the long-term benefits of being debt-free.

What are some key steps to successfully paying off debt?

Some key steps to successfully paying off debt include creating a budget, reducing expenses, increasing income, prioritizing debt repayment, and sticking to a repayment plan.

How can I create a budget to effectively pay off my debt?

To create a budget for debt repayment, start by listing all your income and expenses. Identify areas where you can cut back on expenses and allocate more towards debt repayment. It is crucial to track your spending and adjust your budget as needed.

Is it better to focus on paying off debts with higher interest rates first?

Yes, it is generally advisable to prioritize debts with higher interest rates. By paying off high-interest debts first, you can save money on interest payments and accelerate your debt payoff journey.

What are some strategies to increase income for debt repayment?

To increase income for debt repayment, you can consider taking up a part-time job, freelancing, starting a side business, or monetizing your skills. You can also explore opportunities for salary negotiations or asking for a raise at your current job.

How long does it usually take to pay off debt?

The time it takes to pay off debt varies depending on factors such as the total amount of debt, interest rates, monthly payments, and individual financial situations. It can range from a few months to several years. However, with consistent effort and proper planning, it is possible to achieve debt freedom sooner than expected.