Embarking on a journey towards financial freedom requires more than just a basic understanding of money management. It demands a deep dive into the world of strategic investments and calculated risks. By equipping yourself with the knowledge and mindset of a seasoned financial guru, you can unlock the true potential of your hard-earned money.

Embracing the art of astute investment

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreSuccessful investing is not a mere game of chance; it is an art form that requires careful planning, analysis, and foresight. The world of finance is dynamic and ever-evolving, presenting a diverse range of opportunities and challenges. To navigate this intricate landscape and emerge as a savvy investor, one must possess a keen eye for market trends, understanding of risk management, and the ability to make informed choices.

Mastering the art of intelligent investments

Immersing oneself in the world of intelligent investing involves honing a set of critical skills and adopting a calculated approach towards financial decisions. It requires embracing the principles of patience, discipline, and long-term thinking. By focusing on building a diverse portfolio, exploring innovative investment vehicles, and staying updated with the latest market developments, you can position yourself to seize the most promising opportunities and maximize your returns.

Unlocking your financial potential

Armed with the knowledge and expertise of seasoned investors, you hold the keys to unlock your financial potential. By cultivating a proactive mindset and embracing a continuous learning process, you can harness the power of smart money moves to make the most of your investments. Now is the time to step into the realm of financial mastery and embark on a transformative journey towards a secure and prosperous future.

- Discover the Power of Strategic Investments

- Maximize Returns with Targeted Portfolio Allocation

- Gain an Edge with Advanced Risk Management Strategies

- Unleash the Potential of Diversification

- Expand Your Investment Horizons through Asset Allocation

- Learn the Art of Balancing Risk and Reward

- Master the Art of Timing

- Identify Opportunities in Market Cycles

- Stay Ahead of the Game with Tactical Entry and Exit Strategies

- Questions and answers

Discover the Power of Strategic Investments

In this section, we will explore the tremendous potential that lies within strategic investments. By employing well-thought-out and carefully planned financial decisions, individuals can tap into a world of opportunities that can significantly enhance their wealth and financial stability.

Strategic investments enable individuals to make shrewd choices that maximize returns while minimizing risks. These investments are driven by thorough analysis, market insights, and the ability to identify trends and opportunities that others may miss. By embracing strategic investments, individuals can leverage their capital to generate consistent and sustainable profits.

Strategic investments also provide individuals with the chance to diversify their portfolios, spreading their risk across a variety of asset classes, industries, and geographies. This diversification helps safeguard against potential losses and creates a more stable investment foundation. By creating a well-balanced portfolio, individuals can navigate volatile market conditions with confidence and protect their assets from unforeseen market downturns.

Moreover, strategic investments foster long-term financial growth and enable individuals to secure their future. By prioritizing long-term goals and making calculated choices, investors can embark on a journey towards financial freedom and achieve their desired lifestyle. Strategic investments empower individuals to make informed decisions that align with their aspirations and build a solid foundation for their wealth management strategies.

Lastly, strategic investments underline the importance of staying ahead of the curve and being proactive in the ever-evolving financial landscape. By staying attuned to market trends, technological advancements, and emerging industries, individuals can identify lucrative opportunities before they become mainstream. This proactive approach allows investors to position themselves advantageously and capitalize on emerging trends or industries, maximizing their returns.

In conclusion, discovering the power of strategic investments can revolutionize your financial journey. By embracing a strategic mindset, diversifying your portfolio, prioritizing long-term goals, and staying ahead of the curve, you can unlock the potential of smart money moves and set yourself up for financial success.

Maximize Returns with Targeted Portfolio Allocation

Discover how strategic portfolio allocation can unlock the full potential of your investments and optimize your returns. By carefully selecting and diversifying your investments across various asset classes and sectors, you can effectively manage risk and maximize your overall performance.

Portfolio allocation involves the process of distributing your investment capital across different assets and markets based on your financial goals, risk tolerance, and time horizon. It is a crucial strategy for achieving a well-balanced and diversified investment portfolio, which can help mitigate potential losses while aiming for higher returns.

When considering targeted portfolio allocation, it is important to identify and assess various investment opportunities that align with your investment objectives. This involves analyzing different asset classes, such as stocks, bonds, real estate, and commodities, as well as considering investments in different regions and industries.

By strategically allocating your investment capital, you can mitigate risks associated with individual investments and take advantage of potential opportunities in different market cycles. Allocating a portion of your portfolio to low-risk assets, such as bonds or cash, can provide stability during market downturns, while allocating a portion to higher-risk assets, such as stocks or alternative investments, can capture potential growth during market upswings.

Furthermore, a targeted portfolio allocation allows you to adapt your investment strategy based on market conditions, economic outlooks, and financial goals. You can adjust the percentages allocated to different asset classes or sectors to capitalize on emerging trends or adjust your risk exposure as needed.

In conclusion, targeted portfolio allocation is a powerful tool for maximizing returns and managing risk. By diversifying across asset classes, regions, and industries, you can create a balanced portfolio that aligns with your investment objectives and enhances the potential for long-term success.

Gain an Edge with Advanced Risk Management Strategies

In today’s ever-changing financial landscape, it is crucial for investors to stay one step ahead of potential risks. By implementing advanced risk management strategies, savvy individuals can enhance their chances of success and protect their investments.

These cutting-edge approaches allow investors to mitigate potential losses while maximizing potential gains. By identifying and analyzing potential risks, investors can make informed decisions and take calculated steps to protect their portfolios.

One key aspect of advanced risk management strategies is diversification. By spreading investments across different asset classes, sectors, and geographic regions, investors can reduce their exposure to any single risk factor. This approach helps to dampen the impact of market fluctuations and ensures that a single event does not have a significant negative impact on the overall portfolio.

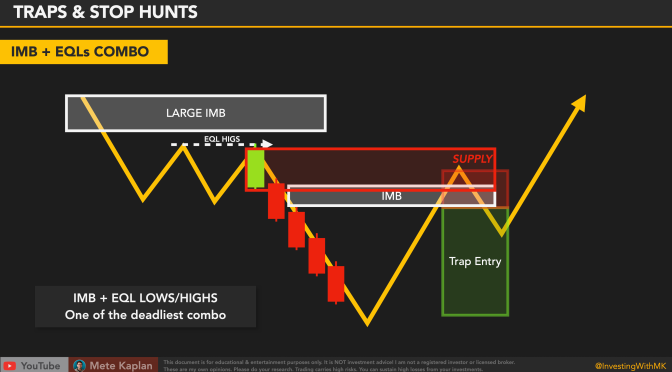

Another essential component is the practice of setting stop-loss orders. These orders allow investors to automatically sell a security if its price falls below a predetermined level. By implementing stop-loss orders, investors can limit potential losses and protect their capital in the event of an unexpected market downturn.

Furthermore, advanced risk management strategies involve thorough research and analysis. Investors need to carefully evaluate the potential risks associated with each investment opportunity. This includes assessing market trends, analyzing financial statements, and staying updated on relevant news and events that may impact a particular investment.

Lastly, advanced risk management strategies also involve utilizing options and derivatives. These financial instruments can provide investors with additional flexibility and hedging opportunities. By using options and derivatives, investors can protect their positions and mitigate potential losses in volatile market conditions.

In conclusion, advanced risk management strategies allow investors to gain an edge in their investment endeavors. By diversifying their portfolios, setting stop-loss orders, conducting thorough research, and utilizing options and derivatives, investors can navigate potential risks more effectively and increase their chances of long-term success.

Unleash the Potential of Diversification

Diversify your investment portfolio to maximize your potential for success and mitigate risks. By spreading your investments across a variety of asset classes and sectors, you can enhance your chances of earning consistent returns and protect yourself against potential losses.

Embrace diversification as a powerful strategy to optimize your investment outcomes. It involves allocating your capital across different types of assets, such as stocks, bonds, real estate, and commodities, as well as diversifying within each asset class. This approach enables you to tap into various sources of potential growth while minimizing the impact of any single investment’s performance.

By diversifying your portfolio, you can reduce the overall volatility and potential downside. Certain assets perform well under specific market conditions, while others may struggle. By having a mix of investments, you can potentially benefit from different factors affecting each asset class, offsetting losses in one area with gains in another.

Furthermore, diversification helps to manage risks by protecting your investments against unforeseen events and market fluctuations. By not putting all your eggs in one basket, you spread the risk and can potentially recover more easily from any adverse events that may occur.

It’s important to note that diversification does not guarantee profits or protect against all losses. However, it does provide a way to potentially optimize your investment outcomes by harnessing the power of spreading your risk and tapping into different sources of potential growth. So, unlock the potential of diversification and take a proactive approach to build a well-rounded investment portfolio.

Remember, diversifying your investments requires careful analysis of your risk tolerance, time horizon, and financial goals. Consider seeking advice from a qualified financial professional to help you craft a diversified portfolio tailored to your unique circumstances.

Expand Your Investment Horizons through Asset Allocation

In order to diversify your investment portfolio and maximize your returns, it is essential to explore various asset allocation strategies. By employing intelligent distribution of your investments across different asset classes, you can effectively spread your risks and tap into new opportunities.

Discover Wider Investment Avenues: Asset allocation allows you to broaden your investment horizons by investing in a wide range of assets, such as stocks, bonds, real estate, commodities, and alternative investments. This approach enables you to take advantage of varying market cycles and capitalize on different sector performances.

Manage Risk and Optimize Returns: Through careful asset allocation, you can mitigate potential losses by diversifying your investments across uncorrelated or negatively correlated assets. This way, if one asset class underperforms, others may compensate, enabling you to achieve a more balanced and resilient portfolio. Consequently, you increase your chances of generating sustainable returns over the long term.

Align with Your Investment Goals: Asset allocation is not a one-size-fits-all strategy. You have the flexibility to customize your investment mix based on your risk tolerance, investment timeframe, and overall financial goals. By aligning your investments with your specific objectives, you can ensure that your portfolio is optimized to meet your unique needs and aspirations.

Stay Ahead of Market Volatility: Asset allocation provides a strategic framework for navigating market turbulence. By diversifying your investments, you can maintain a level of stability and potentially benefit from the outperformance of certain asset classes during uncertain times. This approach helps you weather market fluctuations and avoid the pitfalls of putting all your eggs in one basket.

Seek Professional Advice: While asset allocation is a powerful investment strategy, it requires careful planning and expertise. Consulting with a financial advisor or investing professional can help you develop a personalized asset allocation plan that aligns with your goals and risk profile. Their guidance and insights can also contribute to making informed investment decisions and optimizing your portfolio’s performance.

By expanding your investment horizons through asset allocation, you can enhance your investment strategy and unlock the potential for superior returns. Embrace the power of diversification and carefully allocate your assets to achieve your financial goals while managing risk effectively.

Learn the Art of Balancing Risk and Reward

Understanding how to effectively manage risk and reward is essential for successful investing. Investing is not just about making money; it is about making informed decisions that can yield profitable returns without exposing yourself to unnecessary risks. Balancing risk and reward requires a delicate approach, where careful analysis, diversification, and a thorough understanding of market trends come into play.

When it comes to investing, risk and reward go hand in hand. Investing without taking any risks may provide short-term stability, but it often limits the potential for significant returns. However, taking too many risks without a proper strategy can result in financial losses. The key lies in finding the optimal balance between risk and reward that aligns with your investment goals and risk tolerance.

One of the essential tools for balancing risk and reward is diversification. By spreading your investments across different asset classes, industries, and geographic regions, you can minimize the impact of any single investment on your overall portfolio. Diversification acts as a hedge against market volatility, as it is unlikely that all your investments will perform poorly at the same time.

In addition to diversification, keeping a close eye on market trends and conducting thorough research is crucial. By analyzing market data, assessing financial reports, and staying informed about industry developments, you can make more informed investment decisions. This knowledge helps you identify opportunities with the potential for high returns while also considering the associated risks.

It is important to note that risk and reward preferences can vary from one individual to another. Some investors may prioritize stability and focus on low-risk investments, while others may be more willing to take on higher levels of risk for the possibility of greater returns. Understanding your risk tolerance and aligning it with your investment strategy is essential for achieving long-term financial success.

| Key Points to Remember: |

| 1. Balancing risk and reward is crucial for successful investing. |

| 2. Diversification is a valuable tool to minimize risk. |

| 3. Staying informed and conducting thorough research is essential. |

| 4. Risk and reward preferences vary among individuals. |

Master the Art of Timing

Time plays a crucial role in the world of investments, and mastering the art of timing is essential for successful financial ventures. Understanding the optimal moments to buy or sell stocks, bonds, and other assets can significantly impact the profitability and effectiveness of your investments.

Timing, within the context of investment, refers to the ability to anticipate and capitalize on market fluctuations. It involves analyzing historical data, economic indicators, and market trends to identify patterns and make informed decisions. Proper timing can help investors maximize returns and reduce risks by strategically entering or exiting positions at opportune moments.

While timing may seem like a complex and unpredictable aspect of investing, there are several strategies and techniques you can employ to improve your skills. One approach is technical analysis, which involves using charts, indicators, and mathematical formulas to identify potential market reversals or trends. Another technique is fundamental analysis, which focuses on evaluating the underlying financial health and prospects of a company before making investment decisions.

In addition to these techniques, it is crucial to stay informed about global events, economic reports, and industry news that may impact the markets. Being aware of geopolitical tensions, policy changes, or technological advancements can provide valuable insights and assist in making timely investment choices.

Timing also involves understanding your own risk tolerance, investment goals, and time horizon. Different investment strategies and opportunities may be more suitable for long-term investors seeking steady growth compared to short-term traders looking for quick profits.

Ultimately, mastering the art of timing requires a combination of knowledge, experience, and discipline. It requires you to constantly analyze and interpret market conditions, assess risks, and make calculated decisions based on available information. By honing your timing skills, you can enhance your ability to navigate the financial markets and optimize your investment outcomes.

| Key Takeaways: |

|---|

| – Timing is an essential aspect of successful investing, involving the ability to predict and take advantage of market fluctuations. |

| – Techniques such as technical and fundamental analysis can aid in timing investment decisions. |

| – Staying informed about global events and understanding personal preferences and goals is crucial in mastering timing. |

| – Mastering timing requires knowledge, experience, and discipline in analyzing and interpreting market conditions. |

Identify Opportunities in Market Cycles

Uncovering potential prospects within market cycles presents a valuable strategy for astute investors seeking to maximize their returns. By recognizing patterns and trends in the ebb and flow of market conditions, individuals can make informed decisions and capitalize on emerging opportunities.

Understanding market cycles involves studying the fluctuating dynamics and behaviors of various industries and sectors. By comprehending the distinct characteristics of each cycle, investors can anticipate the potential for growth or decline in specific areas of the market.

Identifying opportunities within market cycles requires a keen eye for detail and an analytical approach. Investors must objectively analyze historical data, economic indicators, and market fundamentals to identify patterns that can guide their investment decisions.

By identifying the different stages within a market cycle – such as expansion, peak, contraction, and trough – investors can align their investment strategies accordingly. During expansion, when the market is experiencing growth, investors may seek out industries or sectors that are poised for further development. Conversely, during contraction or trough phases, investors may adopt a defensive approach by focusing on more stable investments.

In addition to recognizing the stages of market cycles, investors should also pay attention to external factors that can influence market conditions. Changes in government policies, economic indicators, or global events can significantly impact the direction of market cycles, creating new opportunities or posing potential risks.

Ultimately, the ability to identify opportunities within market cycles requires a combination of comprehensive research, data analysis, and a deep understanding of market dynamics. By staying vigilant and adapting their investment strategies as market cycles evolve, investors can position themselves to make smart and profitable moves.

Stay Ahead of the Game with Tactical Entry and Exit Strategies

Gain an edge in the world of investment by mastering the art of tactical entry and exit strategies. These savvy techniques allow you to anticipate market movements, capitalize on opportunities, and mitigate risks effectively. By understanding when and how to enter or exit a position strategically, you can optimize your returns and safeguard your investments.

One key aspect of tactical entry and exit strategies is timing. Timing the market can be challenging, but having a well-thought-out plan in place can help you make informed decisions. Whether you’re looking to enter a position at the most opportune moment or exit before a potential downturn, having a tactical approach is vital.

Another crucial component is risk management. Tactical entry and exit strategies enable you to protect your investments from adverse market conditions. By setting stop-loss orders and profit targets, you can limit potential losses and secure profits when certain thresholds are reached. Balancing risk and reward is essential in achieving long-term investment success.

Furthermore, staying informed and conducting thorough research is essential to implementing effective tactical entry and exit strategies. Keeping tabs on industry trends, company news, and economic indicators can give you a competitive edge. By analyzing data and making data-driven decisions, you can stay ahead of the game and identify opportunities that others may overlook.

Additionally, diversification plays a significant role in tactical investing. By spreading your investments across different asset classes, sectors, and geographies, you can minimize the impact of market fluctuations on your portfolio. Diversification allows you to capitalize on various market conditions and achieve a more stable and resilient investment portfolio.

In conclusion, mastering tactical entry and exit strategies is crucial to achieve success in the world of investment. By perfecting the art of timing, managing risks, staying informed, and diversifying your portfolio, you can stay ahead of the game and unlock the full potential of your investments.

Questions and answers

What are some smart money moves to consider when investing?

Some smart money moves to consider when investing include diversifying your portfolio, regularly investing a set amount of money, avoiding emotional decisions, and staying updated on market trends.

Is it necessary to hire a financial advisor to invest like a pro?

No, it is not necessary to hire a financial advisor to invest like a pro. With access to online resources and investment platforms, individuals can educate themselves and make informed investment decisions.

How can I identify potential investment opportunities?

Identifying potential investment opportunities requires thorough research and analysis. It is important to assess the company’s financial health, growth prospects, competitive advantage, and industry trends. Additionally, keeping an eye on news and market developments can provide valuable insights.

How much money should I invest in the stock market?

The amount of money to invest in the stock market depends on individual financial circumstances and risk tolerance. It is generally recommended to only invest what one can afford to lose and to have a well-diversified portfolio to mitigate risk.

What are some common mistakes to avoid when investing?

Some common mistakes to avoid when investing include chasing quick returns, not diversifying the portfolio, letting emotions drive decision-making, and failing to regularly review and adjust investment strategies. It is also important to avoid making impulsive investment decisions based on market rumors or unreliable information.

What is Smart Money Moves?

Smart Money Moves refers to investment strategies and decisions made by professional investors or experienced individuals that aim to maximize returns or minimize risks in financial markets.

How can I start investing like a pro?

To start investing like a pro, it is important to educate yourself about financial markets, understand different investment vehicles, create a diversified portfolio, set clear financial goals, and stay updated with market trends. Seeking advice from a financial advisor or mentor can also be helpful.

What are the potential benefits of smart money moves?

The potential benefits of smart money moves include higher returns on investments, reduced risks, improved financial security, the ability to take advantage of market opportunities, and the potential for long-term wealth accumulation.

Are there any risks involved in smart money moves?

Yes, there are risks involved in smart money moves just like any other form of investment. The risks may include market volatility, fluctuations in the value of investments, economic uncertainties, and the possibility of incurring losses. It is important to carefully assess risks and make informed investment decisions.

Can anyone invest like a pro or is it only for experts?

While investing like a pro may require knowledge, experience, and expertise, anyone can start learning and implementing smart money moves. It takes time and effort to gain the necessary skills, but with dedication and a disciplined approach, anyone can improve their investment strategies and make smarter financial decisions.