The world of finance is a vast ocean of opportunities, where investors and traders strive to surf the waves of market fluctuations. To succeed in this dynamic realm, one must possess a deep understanding of the intricate mechanisms that drive the ebb and flow of financial trends. This article delves into innovative strategies that can help you ride the tides of trading and navigate the unpredictable currents of the market.

As you embark on your trading journey, it is essential to equip yourself with the knowledge to recognize and interpret the subtle shifts in market dynamics. Astute observation and the ability to differentiate between trends and noise are key to finding profitable opportunities amidst the chaos of market fluctuations. This article elucidates proven methodologies for identifying market trends and distinguishing them from short-lived fluctuations.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreOnce you have identified an emerging trend, the next challenge is devising a strategic approach to capitalize on its potential. The art of successful trading lies not in predicting the future with certainty, but in intelligently managing risk and reward. In this article, we explore a range of trading tactics, from fundamental analysis to technical indicators, that can empower you to make strategic decisions and profitably surf the waves of market movements.

While the path of a trader is never smooth sailing and can be fraught with challenges, it is crucial to develop a resilient mindset that can weather the storms of uncertainty. Embracing a disciplined approach to trading, anchoring yourself in a strong risk management framework, and maintaining an unyielding focus on long-term goals are all essential elements of navigating the market’s unpredictable tides.

So grab your board, strap on your trading gear, and dive into the world of market trends. Let this article be your compass, guiding you through the exhilarating highs and testing lows of trading, and helping you to master the art of riding the waves with finesse and profitability.

- Understanding Market Trends: Key to Successful Trading

- Analyzing Historical Data for Market Trend Identification

- Utilizing Technical Indicators as Tools in Trend Analysis

- Interpreting News and Events that Shape Market Patterns

- Mastering the Art of Timing: Catching the Right Wave

- Identifying Entry and Exit Points in Changing Market Trends

- Using Stop-Loss Orders for Risk Management and Capital Preservation

- Adaptation and Flexibility: Reacting to Changing Market Conditions

- Implementing Short-Term and Long-Term Trading Strategies

- Diversifying Trading Portfolio to Minimize Risk Exposure

- Continuous Learning: Staying Ahead of the Curve

- Keeping Abreast of the Latest Market Trends and News

- Studying Successful Traders and their Strategies

- Emotional Discipline: Controlling the Fear and Greed

- Questions and answers

Understanding Market Trends: Key to Successful Trading

Mastering the art of successful trading requires a deep comprehension of the constantly evolving market trends. Being able to accurately analyze and interpret these trends is crucial for making informed investment decisions and maximizing profits.

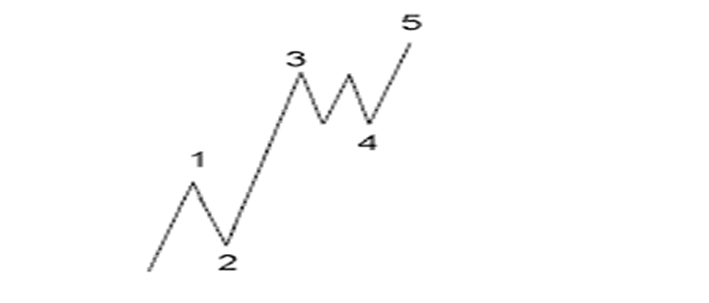

One of the fundamental aspects of understanding market trends is recognizing the patterns and movements that occur in the financial markets. These patterns can provide valuable insights into the direction and volatility of various assets. By closely monitoring these patterns and identifying their significance, traders can effectively anticipate market movements and adjust their strategies accordingly.

Moreover, understanding market trends involves keeping a keen eye on various economic indicators and news events that can impact the financial markets. Factors such as interest rate changes, geopolitical developments, and economic reports can profoundly influence market sentiment and direction. Traders who stay informed and stay ahead of these events are better equipped to adapt their trading strategies and capitalize on the resulting opportunities.

An essential component of comprehending market trends is utilizing technical analysis tools and indicators. These tools enable traders to examine historical price data, identify support and resistance levels, detect trend reversals, and generate signals for potential entry and exit points. By incorporating these technical analysis techniques into their trading approach, traders can enhance their ability to interpret market trends and make well-informed trading decisions.

Furthermore, understanding market trends requires a holistic perspective that goes beyond solely relying on technical analysis. Fundamental analysis, which involves evaluating a company’s financial health, industry trends, and macroeconomic factors, can provide a comprehensive understanding of the underlying forces driving market movements. By combining technical and fundamental analysis, traders can obtain a more complete picture of market trends and make more accurate predictions.

In conclusion, grasping the intricacies of market trends is a key determinant of successful trading. It involves recognizing patterns, staying informed about economic events, utilizing technical analysis tools, and engaging in fundamental analysis. By honing their understanding of market trends, traders can gain a competitive edge and increase their chances of achieving profitable trading outcomes.

Analyzing Historical Data for Market Trend Identification

In this section, we will explore the process of analyzing historical data to identify trends in the market. By studying the past performance of various assets and securities, traders can gain valuable insights into the potential direction of future market trends.

One effective approach to analyzing historical data is to examine patterns and trends that have emerged in the past. By identifying repeating patterns, traders can make informed decisions about when to enter or exit positions in order to maximize their profits.

Another important aspect of analyzing historical data is the use of technical indicators. These indicators provide traders with mathematical calculations based on historical price and volume data. By utilizing these indicators, traders can identify potential market trends and gain a better understanding of the current market conditions.

Furthermore, studying historical data allows traders to assess the impact of various events and market factors on previous trends. By analyzing how certain news, economic data, or external factors influenced past market movements, traders can anticipate similar reactions in the future and adjust their trading strategies accordingly.

It is also essential to consider the importance of data accuracy and reliability when analyzing historical data. Traders should ensure that the data they are using is sourced from reputable and trustworthy platforms. Additionally, they should cross-reference multiple sources to validate the accuracy of the data and minimize the potential for errors in their trend identification process.

In conclusion, analyzing historical data plays a crucial role in identifying market trends. By studying past patterns, utilizing technical indicators, considering the impact of external factors, and ensuring data accuracy, traders can enhance their ability to make informed trading decisions and increase their chances of success in the market.

Utilizing Technical Indicators as Tools in Trend Analysis

In the realm of analyzing market trends, being able to effectively identify and understand the direction of price movements is essential for successful trading. To accomplish this, traders often utilize technical indicators as powerful tools in trend analysis. These indicators provide valuable insights into the behavior of financial instruments, helping traders make informed decisions based on historical price data.

Technical indicators serve as mathematical calculations applied to historical price data, helping traders identify patterns and trends in the market. They utilize various mathematical formulas to generate visual representations of price movements, aiding traders in identifying potential entry and exit points. These indicators can provide valuable information about the strength and momentum of a trend, as well as potential reversals or shifts in market sentiment.

Some commonly used technical indicators include:

- Moving averages: These indicators calculate the average price over a specific period of time, smoothing out price fluctuations and providing a clearer picture of the overall trend.

- Relative strength index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. It helps identify overbought or oversold conditions in the market.

- Bollinger Bands: Bollinger Bands consist of a moving average and two standard deviation bands. They help identify volatility and potential price breakouts.

- MACD (Moving Average Convergence Divergence): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages. It helps identify bullish or bearish signals.

By incorporating these technical indicators into their analysis, traders can gain a deeper understanding of market trends and make more informed trading decisions. However, it’s essential to remember that technical indicators should not be used in isolation but rather as part of a comprehensive trading strategy that considers other factors such as fundamental analysis and risk management.

Interpreting News and Events that Shape Market Patterns

In the ever-evolving realm of trading, understanding the impact of news and events on market trends is crucial for successful navigation. This section delves into the art of interpreting the various factors that shape and influence the direction of financial markets.

Staying attuned to the pulse of current affairs is imperative for any trader seeking to make informed decisions. News and events have the potential to serve as catalysts, sparking fluctuations in market trends. By carefully analyzing the implications of breaking headlines, economic reports, political developments, and global happenings, traders gain valuable insights into the underlying forces affecting asset prices.

Interpreting news and events involves a multi-dimensional approach. It entails not only comprehending the factual information but also discerning the underlying market sentiment. Traders must distinguish between noise and significant market-moving events, filtering out the noise to focus on the events that have the greatest impact on trends. They must also consider the potential short-term versus long-term effects of each event, as market reactions can vary depending on the timeframe.

Language plays a pivotal role in interpreting news and events. Traders must pay close attention to the rhetoric used by influential figures, as well as the tone of news articles and official statements. By analyzing the words, phrases, and sentiments conveyed, traders can decipher potential shifts in market sentiment and subsequently adjust their strategies accordingly.

Furthermore, it is crucial to understand the interrelationships between different news and events. One development can trigger a chain reaction, affecting multiple market sectors and asset classes. Often, seemingly unrelated events can have indirect implications for trading, highlighting the interconnectedness of global markets and emphasizing the need for a comprehensive approach to interpreting news.

Ultimately, mastering the skill of interpreting news and events requires a combination of analytical prowess, critical thinking, and a deep understanding of the intricacies of global markets. By honing this skill, traders can anticipate potential market trends, capitalize on opportunities, and navigate the ever-changing landscape of the financial world with greater confidence and success.

Mastering the Art of Timing: Catching the Right Wave

In the realm of market dynamics, the ability to accurately time trades is a crucial skill for successful traders. Understanding and predicting market movements can determine whether one catches the wave of profit or is left struggling in the undertow of losses. This section explores the strategies and techniques employed by skilled traders to master the art of timing and capitalize on the right market waves.

Timing the market involves identifying key entry and exit points based on an analysis of various factors, such as technical indicators, fundamental data, and market sentiment. Successful traders employ a range of techniques to gauge market conditions and determine when to enter or exit positions. These techniques include trend analysis, momentum indicators, chart patterns, and statistical models.

One popular method used by traders is trend analysis, which involves studying price movements over time to identify patterns and predict future direction. By analyzing historical data, traders can identify trends and forecast potential market movements. Additionally, momentum indicators, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), can provide insights into market strength and direction.

Another important aspect of timing trades effectively is understanding the impact of market sentiment. Sentiment analysis involves evaluating the prevailing emotions and attitudes of market participants towards a particular asset or market as a whole. By monitoring news, social media, and investor sentiment indicators, traders can gain valuable insights into the mentality of the market and make more informed decisions.

Furthermore, chart patterns, such as support and resistance levels, head and shoulders patterns, and triangles, can provide visual cues for timing trades. These patterns are formed by price movements and can offer potential entry or exit signals. Traders often combine pattern recognition with other technical indicators to increase the accuracy of their timing strategies.

Lastly, statistical models, such as regression analysis and machine learning algorithms, are increasingly used in timing trades. These models analyze large sets of historical data and identify correlations and patterns that may not be apparent to human traders. By leveraging advanced computational techniques, traders can gain an edge in timing their trades based on statistical probabilities.

- The ability to master the art of timing requires a comprehensive understanding of market dynamics and the utilization of various techniques.

- Timing trades involves analyzing trends, utilizing momentum indicators, monitoring market sentiment, identifying chart patterns, and employing statistical models.

- Successful timing depends on accurately identifying key entry and exit points to capitalize on market waves.

- Traders combine multiple techniques and indicators to increase the accuracy of their timing strategies and improve their profitability.

Identifying Entry and Exit Points in Changing Market Trends

In the dynamic world of trading, it is crucial to have a clear understanding of when to enter and exit the market in order to capitalize on changing trends. This section aims to explore effective strategies for identifying optimal entry and exit points in shifting market conditions without relying on traditional definitions.

When navigating the fluctuations of market trends, traders need to have a comprehensive toolkit at their disposal. Rather than solely relying on standardized approaches, it is important to consider alternative techniques to recognize opportune moments to enter or leave the market. By diversifying the methods used, traders can gain a competitive edge and make informed decisions that reflect the ever-changing dynamics of the market.

One approach to identifying entry and exit points is through careful analysis of price patterns. These patterns can reveal valuable insights into potential market movements. By studying a range of chart patterns, such as triangles, wedges, and double tops, traders can establish key levels of support and resistance. These inflection points can serve as potential entry or exit points, allowing traders to capitalize on emerging trends.

Moreover, incorporating technical indicators can enhance the accuracy of identifying entry and exit points in changing market trends. Indicators such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) can provide invaluable clues about the strength and momentum of a trend. By carefully analyzing these indicators in conjunction with other tools, traders can spot favorable entry and exit opportunities with greater precision.

Another aspect to consider when identifying entry and exit points is the broader market sentiment and news events. Traders should monitor economic indicators, company news, and geopolitical developments to gauge market sentiment and potential impacts on trends. By staying informed and adjusting strategies accordingly, traders can position themselves advantageously during changing market conditions.

| Key Takeaways |

|---|

|

Using Stop-Loss Orders for Risk Management and Capital Preservation

Implementing stop-loss orders is a valuable technique that traders can employ to effectively manage risks and safeguard their capital during market fluctuations. This section explores the concept and benefits of stop-loss orders, highlighting their significance in reducing potential losses and preserving valuable investments.

Stop-loss orders serve as a protective tool in trading, allowing investors to set predetermined price levels at which their positions will automatically be sold. By placing a stop-loss order, traders can limit their losses by exiting a trade once the price reaches a specified threshold, minimizing the impact of adverse market conditions.

The primary objective of using stop-loss orders is to establish a risk management framework that helps traders protect their capital. By implementing this strategy, traders can effectively manage their exposure to potential losses and prevent significant drawdowns. Stop-loss orders act as a safety net, allowing traders to exit positions when market trends turn unfavorable, ensuring that losses are kept within predefined limits.

Moreover, stop-loss orders provide traders with a disciplined approach to trading by removing emotions from the decision-making process. Instead of making impulsive choices based on temporary market fluctuations, traders can rely on the predetermined stop-loss levels to guide their exit strategies. This approach helps maintain a strategic and objective perspective, preventing emotional biases from affecting trading decisions.

In addition to risk management, stop-loss orders also contribute to capital preservation. By limiting potential losses, traders can preserve their capital and ensure its long-term growth. This enables traders to allocate their resources efficiently, protect their initial investment, and have a solid foundation for further trading activities.

In conclusion, incorporating stop-loss orders into trading strategies is an essential practice for managing risks and preserving capital. By setting predetermined exit levels, traders can effectively control potential losses and maintain a disciplined approach to trading. This technique not only ensures risk mitigation but also helps safeguard valuable investments, allowing traders to navigate the market with greater confidence and success.

Adaptation and Flexibility: Reacting to Changing Market Conditions

In the ever-evolving realm of trading, being able to adapt and remain flexible is crucial when dealing with changing market conditions. Recognizing and understanding the fluctuations and trends within the market is fundamental to making informed decisions and maximizing profits. This section delves into the importance of adaptation and flexibility in order to effectively navigate the unpredictable nature of the market.

Implementing Short-Term and Long-Term Trading Strategies

Exploring the Execution of Trading Approaches Over Different Time Horizons

When it comes to navigating the ever-changing landscape of financial markets, traders must adapt their strategies to effectively capitalize on short-term and long-term trends. By implementing a diverse range of trading approaches, traders can increase their chances of success and maximize their potential profits.

Short-term trading strategies are designed to capitalize on immediate market fluctuations, typically ranging from a few minutes to a few days. These strategies require close monitoring of market conditions, quick decision-making, and the ability to identify short-term trends. Traders utilizing short-term strategies often employ techniques such as scalping, day trading, and momentum trading to take advantage of intraday price movements and fleeting opportunities for profit.

In contrast, long-term trading strategies focus on identifying and capitalizing on broader market trends that can last for weeks, months, or even years. These strategies involve conducting in-depth analysis of fundamental and technical factors to identify assets that have the potential for long-term growth. Traders utilizing long-term strategies often take positions in assets and hold them for extended periods, aiming to maximize profits as the market moves in their favor over time.

Successful implementation of short-term and long-term trading strategies requires careful consideration of risk management techniques. Traders must establish clear entry and exit points, set stop-loss orders, and closely monitor market conditions to minimize potential losses and protect their capital. Additionally, traders should continuously evaluate and refine their strategies based on market conditions and adjust their approach accordingly.

In conclusion, incorporating both short-term and long-term trading strategies into one’s trading approach allows traders to navigate market trends effectively and potentially maximize their profits. By understanding the different time horizons and applying appropriate techniques, traders can adapt to changing market conditions and increase their chances of successful trading outcomes.

Diversifying Trading Portfolio to Minimize Risk Exposure

Reducing risk exposure is a crucial aspect of successful trading, and one effective way to achieve this is through portfolio diversification. By diversifying your trading portfolio, you can spread out your investments across different asset classes, sectors, and geographical regions, which helps to minimize the impact of any single market trend or event.

Diversification involves investing in a variety of assets that have different risk profiles and returns. This strategy aims to create a balance between high-risk and low-risk investments, thereby reducing overall portfolio volatility. By combining assets with negative or low correlations, you can potentially achieve smoother returns and protect against significant losses.

One popular method of diversification is investing in different sectors, such as technology, finance, healthcare, and energy. This approach spreads the risk across industries, as different sectors perform differently based on market conditions and economic factors. Additionally, it is beneficial to diversify geographically by investing in companies from various countries and regions. This helps to mitigate country-specific risks and exposure to regional events or political instability.

Furthermore, diversification can be achieved by investing in a mix of asset classes, including stocks, bonds, commodities, real estate, and alternative investments such as hedge funds or private equity. Each asset class has its own risk and return characteristics, and by combining them in a portfolio, you can potentially achieve a better risk-adjusted return.

To implement a diversified trading portfolio, it is essential to conduct thorough research and analysis of each potential investment. This includes evaluating the risk factors, performance history, and correlation with other assets. It is also important to regularly monitor and rebalance the portfolio to maintain the desired level of diversification.

| Benefits of Portfolio Diversification |

|---|

| Reduces exposure to individual market trends |

| Minimizes the impact of unexpected events |

| Offers potential for more consistent returns |

| Limits the downside risk |

In conclusion, diversifying your trading portfolio is a vital risk management strategy that can help minimize exposure to market volatility. By spreading your investments across different assets, sectors, and regions, you can achieve a more balanced and resilient portfolio.

Continuous Learning: Staying Ahead of the Curve

In the fast-paced world of trading, it is crucial to constantly evolve and adapt to new challenges. To remain successful and stay ahead of the competition, traders need to embrace continuous learning as a fundamental approach. By actively acquiring new knowledge and skills, traders can effectively anticipate market shifts, identify emerging trends, and make informed decisions to maintain an edge in the ever-changing trading landscape.

Continuous learning involves actively seeking out opportunities to expand one’s knowledge and deepen their understanding of various aspects of trading. This can be achieved through a variety of means, such as attending industry conferences and seminars, participating in online courses, engaging in mentorship programs, and avidly consuming relevant literature and research. By immersing themselves in a continuous learning mindset, traders can keep up with the latest developments, strategies, and techniques that can enhance their performance and profitability.

- Engaging in lifelong learning fosters a proactive approach, allowing traders to stay agile and adapt quickly to evolving market conditions.

- By staying updated with the latest financial news, traders can gain valuable insights into global economic trends that may impact their trading decisions.

- Actively participating in trading communities and forums provides an opportunity to exchange knowledge with like-minded individuals, discover new perspectives, and learn from the experiences of others.

- Exploring different trading methods and experimenting with various trading tools and technologies can expand a trader’s skill set and open up new avenues for success.

- Continuous learning also involves regularly reviewing and analyzing past trading strategies and outcomes, identifying strengths and weaknesses, and making appropriate adjustments for future trades.

Staying ahead of the curve in trading requires an unwavering commitment to continuous learning. By embracing a growth mindset and actively seeking opportunities to expand knowledge and improve skills, traders can navigate market trends with confidence, adapt to changing conditions, and ultimately achieve long-term success.

Keeping Abreast of the Latest Market Trends and News

In today’s dynamic and ever-evolving business landscape, staying informed about the most recent developments in the market is a vital aspect of successful trading strategies. Maintaining a comprehensive understanding of market trends and news enables traders to make well-informed decisions, adapt to changing conditions, and seize profitable opportunities.

Remaining up-to-date with the latest market trends involves actively monitoring and analyzing various indicators, such as price movements, volume patterns, and sentiment analysis. By assessing these indicators, traders can gain insights into the current market sentiment, identify potential shifts in supply and demand, and pinpoint emerging investment themes.

Additionally, regularly following market news and updates is crucial for traders to stay ahead of the curve. This includes monitoring economic reports, company earnings releases, geopolitical developments, and other news events that can directly impact the financial markets. By keeping an eye on these factors, traders can anticipate market reactions and adjust their trading strategies accordingly.

Utilizing technology and reliable information sources is essential for effectively keeping pace with the latest market trends. Trading platforms and tools equipped with real-time data can provide traders with accurate and timely information, enabling them to make informed decisions based on current market conditions. Furthermore, leveraging reputable news sources, financial journals, and industry research can provide valuable insights into market trends and help traders stay informed about critical developments.

Moreover, networking and engaging with fellow traders, analysts, and industry professionals can offer invaluable perspectives and information on market trends. Participating in forums, attending conferences, and joining online trading communities can provide opportunities for knowledge sharing, idea generation, and obtaining unique insights into emerging trends.

In conclusion, keeping up with the latest market trends and news is an essential component of successful trading strategies. By actively monitoring indicators, staying informed about market news, utilizing technology, and actively engaging with the trading community, traders can confidently navigate market fluctuations and position themselves for profitable opportunities.

Studying Successful Traders and their Strategies

In this section, we delve into the fascinating world of accomplished traders and the methods they employ to achieve market success. By closely examining their approaches and tactics, we can gain valuable insights and knowledge to help us navigate the ever-changing waters of trading.

We will explore the strategies utilized by highly effective traders, without requiring any specific definitions or terms. Throughout this analysis, we will employ various synonyms and alternative expressions to maintain a diverse and engaging presentation.

By studying the techniques employed by these accomplished individuals, we can uncover the secrets to their triumphs in the market. This examination will provide us with a well-rounded understanding of their methods and equip us with the tools necessary to pursue successful trading strategies of our own.

Through a detailed examination of the practices utilized by these skilled traders, we will gain valuable know-how and practical wisdom. Their various approaches and procedures will highlight the adaptability and versatility required to thrive amidst the volatility inherent in trading.

We will explore the innovative methods employed by these prosperous traders and understand how they harness market trends to their advantage. By closely analyzing their strategies, we will uncover the crucial factors that contribute to their consistent success.

This section will serve as a valuable resource for traders of all experience levels, providing a comprehensive overview of the strategies used by the most accomplished individuals in the field. By learning from their techniques and adapting them to our own trading styles, we can enhance our ability to navigate market trends effectively and improve our chances of success.

Emotional Discipline: Controlling the Fear and Greed

Mastering emotional discipline is paramount when it comes to successful trading. In this section, we will delve into the crucial concept of managing both fear and greed, two powerful emotions that can significantly impact trading outcomes.

When engaging in the dynamic world of trading, fear and greed often lurk within the minds of investors. Fear can paralyze decision-making, leading to missed opportunities or untimely exits. Greed, on the other hand, can cloud judgment, causing investors to take unnecessary risks and potentially suffer significant losses.

Developing emotional discipline is a journey that requires self-awareness and a deep understanding of one’s triggers and reactions. Traders must learn to maintain a level-headed approach, even in the face of market volatility and uncertainty.

One way to combat fear and greed is through implementing a well-defined trading strategy based on thorough research and analysis. By relying on a predetermined plan, traders can avoid impulsive decision-making influenced by emotions. This systematic approach helps to reduce the impact of fear and greed, allowing for rational and calculated trading decisions.

Furthermore, it is essential for traders to monitor their emotions and recognize when fear or greed may be taking over. Implementing techniques such as meditation, journaling, or seeking support from like-minded individuals can help maintain emotional balance and prevent irrational actions.

Controlling fear and greed is an ongoing process, and it requires constant vigilance and self-reflection. By mastering emotional discipline, traders can increase the chances of making sound decisions, protecting their investments, and ultimately achieving success in the ever-changing world of trading.

Questions and answers

What are some strategies to successfully navigate market trends?

There are several strategies that traders can use to navigate market trends successfully. One popular strategy is trend-following, where traders identify and follow the direction of a trend. Another strategy is range trading, which involves identifying support and resistance levels and trading within that range. Additionally, some traders use momentum trading, where they capitalize on the strength of a particular trend. It is important to note that these strategies require careful analysis, risk management, and discipline.

How can trend-following help in trading?

Trend-following can be a valuable strategy in trading as it enables traders to ride the waves of market trends. By identifying the direction of a trend, traders can enter positions and ride the trend until it reverses. Trend-following strategies aim to capture the majority of a trend’s move, whether it is an uptrend or a downtrend. However, it is essential to use appropriate risk management techniques and set stop-loss orders to protect against potential reversals and losses.

What is range trading?

Range trading is a trading strategy where traders identify support and resistance levels within which the price of an asset is expected to move. Traders who employ this strategy aim to buy at the support level and sell at the resistance level. Range trading is suitable for markets that lack a clear trend and tend to trade within a specific range. Traders using this strategy must closely monitor price movements and be prepared to exit their positions if the price breaks out of the established range.

How does momentum trading work?

Momentum trading is a strategy that relies on the strength and continuation of an existing market trend. Traders using this strategy aim to identify assets with significant upward or downward price momentum and enter positions to capture further price moves in the same direction. Momentum traders often follow technical indicators, such as moving average crossovers or the Relative Strength Index (RSI), to confirm the strength of a trend. It is crucial for traders to have a solid understanding of market dynamics and manage their risk effectively when employing momentum trading.

What are some important considerations when using trading strategies?

When using trading strategies, there are several crucial considerations to keep in mind. Firstly, traders must have a well-defined trading plan and stick to it. This plan should include entry and exit points, risk management rules, and profit targets. Additionally, traders should conduct thorough market analysis using technical and fundamental analysis tools. It is essential to stay disciplined and control emotions, as impulsive decisions can lead to losses. Finally, continuous learning and adaptation are important to stay updated with market trends and refine trading strategies.

What are some common trading strategies used to successfully navigate market trends?

Some common trading strategies used to successfully navigate market trends include trend following, mean reversion, breakout trading, and momentum trading. Traders can analyze various technical indicators and patterns to identify potential trading opportunities based on these strategies.

How can trend following be used as a trading strategy?

Trend following is a strategy where traders aim to identify and ride the existing trends in the market. Traders can use technical tools such as moving averages or trendlines to determine the direction of the trend. They then enter trades in the direction of the trend and exit when the trend shows signs of reversing. This strategy seeks to benefit from sustained price movements.

What is mean reversion trading strategy?

Mean reversion trading strategy is based on the assumption that asset prices tend to move towards their average or mean value over time. Traders who employ this strategy identify situations where a price has moved significantly away from its mean and place trades in anticipation of the price reverting back to its average. This strategy involves monitoring price deviations and utilizing various indicators to identify potential mean reversion opportunities.

How does breakout trading strategy work?

Breakout trading strategy involves identifying key levels of support or resistance on a price chart. Traders anticipate that when these levels are broken, it indicates a strong momentum in the market. They enter trades in the direction of the breakout, expecting the price to continue moving in that direction. This strategy seeks to capture significant price movements that occur after price breaks through important levels.

What is momentum trading and how does it work?

Momentum trading is a strategy where traders aim to take advantage of the continuation of existing price trends. Traders identify assets that are exhibiting strong upward or downward momentum and enter trades in the same direction. They hope to ride the trend until signs of reversal or exhaustion are observed. Momentum traders often utilize technical indicators such as the relative strength index (RSI) to identify overbought or oversold conditions, which can assist in timing their trades.