Have you ever wondered why some people seem to effortlessly achieve their financial goals while others struggle to make ends meet? The answer lies in the power of effective money management. By utilizing a strategic approach to budgeting, individuals can take control of their financial future and overcome financial hurdles that may otherwise seem insurmountable.

An outstanding financial plan is like a compass that guides you towards your goals, enabling you to make informed decisions and prioritize your financial resources effectively. A well-structured financial plan provides a roadmap that outlines your income, expenses, and potential savings, ensuring that every hard-earned dollar is put to good use. By allocating funds wisely and tracking your spending patterns, you can make better financial choices that align with your aspirations.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreBut here’s the catch: creating a comprehensive financial plan from scratch can be a daunting task. It requires meticulous attention to detail and a deep understanding of personal finance principles. This is where a budget planner template comes into play, simplifying the process and providing a solid foundation on which to build your financial success.

Utilizing a budget planner template saves you time and effort by providing a pre-designed framework tailored to your financial needs. With just a few clicks, you can have a customized budgeting tool at your fingertips, allowing you to allocate your income, categorize expenses, and set realistic savings targets. This invaluable resource not only enables you to stay organized but also empowers you to track your progress and make adjustments as needed, ultimately propelling you closer to your financial aspirations.

- Why Should You Use a Budget Planner Template?

- Efficiently Track Your Expenses

- Set Clear Financial Goals

- How to Choose the Right Budget Planner Template

- Consider Your Financial Needs

- Look for User-Friendly Features

- Customize to Fit Your Lifestyle

- Tips for Effectively Utilizing a Budget Planner Template

- Regularly Update Your Income and Expenses

- Analyze Your Spending Patterns

- Make Adjustments for Better Financial Management

- Questions and answers

Why Should You Use a Budget Planner Template?

Discover the benefits of incorporating a budget planner template into your financial management strategy. By utilizing a budget planner template, you can effectively organize and track your income, expenses, and savings. This tool provides a structured framework that can help you gain better control over your personal finances and make informed decisions.

Using a budget planner template allows you to visualize your financial situation clearly. It enables you to document your income sources and categorize your expenses, giving you an overview of where your money is being spent. By having this visual representation, you can identify areas for potential savings and make necessary adjustments to your spending habits.

A budget planner template also facilitates goal setting and financial planning. By setting realistic financial goals, such as saving for a vacation or paying off debt, you can effectively allocate your income towards these objectives. The template provides a dedicated space to track progress towards your goals, thus helping you stay motivated and focused on achieving them.

Furthermore, a budget planner template promotes better financial decision-making. By regularly updating and reviewing your budget, you can evaluate the financial impact of potential purchases or investments. This allows you to make informed decisions based on your financial priorities and long-term objectives, ensuring that every expenditure aligns with your overall financial plan.

Using a budget planner template also promotes accountability and responsibility. By setting specific budget categories and assigning limits, you can hold yourself accountable for your spending habits. This helps you develop discipline and avoid unnecessary splurges, ultimately leading to better financial stability and improved savings habits.

- Gain better control over your personal finances

- Visualize your financial situation clearly

- Facilitate goal setting and financial planning

- Promote better financial decision-making

- Encourage accountability and responsibility

Incorporating a budget planner template into your financial routine can have numerous advantages. By providing structure and organization to your financial management, it empowers you to make smarter financial decisions, achieve your goals, and ultimately attain financial success.

Efficiently Track Your Expenses

Effectively monitoring and managing your spending is a crucial aspect of achieving financial stability. By keeping track of your expenses, you gain a better understanding of where your money is going, allowing you to make informed decisions and successfully attain your financial goals.

Tracking your expenses efficiently involves maintaining a record of both your regular and unexpected expenditures. This includes tracking recurring bills, such as rent or mortgage payments, utilities, and insurance premiums, as well as day-to-day expenses like groceries, transportation, and entertainment.

Minimize surprises and overspending:

By diligently tracking your expenses, you can identify trends and patterns in your spending habits. This serves as a powerful tool in managing your finances effectively and avoiding unnecessary expenditures. Whether it’s cutting down on excessive dining out, optimizing your monthly subscriptions, or reducing impulse purchases, a detailed expense tracker helps you make conscious financial decisions and reduces the chances of overspending.

Establish a budget and save money:

Keeping track of your expenses also enables you to create a realistic budget and set financial goals. With a clear understanding of your income and outflows, you can allocate funds appropriately, ensuring that you have enough for your needs and also saving for your future. By comparing your actual spending against your planned budget, you can make adjustments as needed and allocate funds to savings or investments, helping you build a strong financial foundation.

Empower yourself with financial knowledge:

Tracking your expenses provides invaluable insights into your financial habits and priorities. It allows you to comprehend the areas where you tend to overspend and make informed decisions to address them. Additionally, it highlights areas where you are consistently saving, motivating you to continue making sound financial choices. Understanding your spending patterns and being aware of your financial standing can empower you to make confident financial decisions and stay on track with your long-term goals.

In conclusion, efficiently tracking your expenses is an essential component of taking control of your financial well-being. It helps you gain clarity on your spending habits, make necessary adjustments, and work towards financial success. With the help of a comprehensive expense tracker, you can navigate your financial journey with confidence, ensuring a more secure and prosperous future.

Set Clear Financial Goals

In order to achieve financial success, it is important to set clear and achievable goals for yourself. By identifying your financial aspirations and desires, you can create a roadmap for your financial journey and stay motivated along the way.

Identify Your Priorities: Take some time to reflect on what truly matters to you and what you want to achieve financially. This could include saving for a down payment on a house, paying off debt, starting a business, or planning for retirement. By understanding your priorities, you can focus your efforts and resources towards these goals.

Make SMART Goals: When setting financial goals, it is helpful to use the SMART framework – Specific, Measurable, Achievable, Relevant, and Time-bound. This means setting goals that are clearly defined, can be quantified, are realistic and attainable, align with your overall financial vision, and have a specific deadline for achievement. For example, instead of saying I want to save money, you could set a SMART goal such as I want to save $10,000 for a down payment on a house within the next two years.

Break Down Your Goals: It can be overwhelming to tackle a large financial goal all at once. To make it more manageable and less daunting, break down your goals into smaller, actionable steps. This will help you track your progress and provide a sense of accomplishment along the way. For instance, if your goal is to pay off $10,000 in credit card debt, you could break it down by setting monthly targets to pay off a certain amount.

Stay Accountable: Share your financial goals with someone you trust, such as a close friend or family member, who can provide support and hold you accountable. Consider creating a financial support system where you can regularly check in on your progress and celebrate milestones together.

Monitor and Adjust: Regularly monitor your progress towards your financial goals and make adjustments as needed. Life circumstances and priorities may change, so it is important to be flexible and adapt your goals accordingly. Regularly reviewing and adjusting your financial goals will help ensure that they continue to align with your values and aspirations.

By setting clear financial goals, you can take control of your financial future and make intentional decisions that align with your aspirations. Remember, it is never too late to start setting and working towards your financial goals. So take the first step today!

How to Choose the Right Budget Planner Template

When it comes to managing your personal finances effectively, using a budget planner template can be incredibly helpful. However, with a wide range of options available, it can be challenging to find the right template that suits your specific needs. This section will provide some key considerations to guide you in choosing the most suitable budget planner template for your financial goals and preferences.

1. Determine your financial objectives: Before selecting a budget planner template, it’s essential to have a clear understanding of your financial objectives. Are you looking to save for a specific goal, pay off debt, or simply track your monthly expenses? Identifying your precise goals will help you choose a template that aligns with your priorities.

2. Assess your level of detail: Budget planner templates can vary in terms of complexity and level of detail. Consider whether you prefer a template that provides a comprehensive overview or one that focuses on specific categories such as housing, transportation, or entertainment. Depending on your preference, you can opt for a high-level summary or a more detailed breakdown of your expenses.

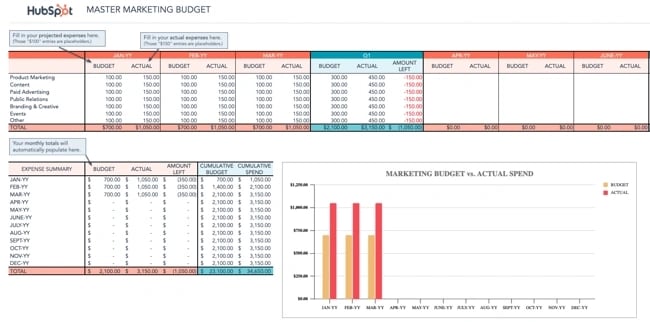

3. Evaluate the tracking features: Look for a budget planner template that offers effective tracking features to monitor your financial progress. Features like automatic calculations, expense categorization, and interactive graphs can enhance your ability to analyze your spending habits and make informed decisions. Determine which tracking features are crucial for you and choose a template that fulfills those requirements.

4. Consider customization options: Personalization is key when it comes to budgeting. Some budget planner templates provide the flexibility to customize categories, add additional sections, or modify existing sections according to your preferences. If you prefer a template that allows you to tailor it to your unique financial situation, look for options that offer customization features.

5. Look for ease of use: A user-friendly interface is essential for any budget planner template. Consider templates that have clear instructions and intuitive design, allowing you to easily input and update your financial information. Assessing user feedback and reviews can give you insights into the ease of use of different templates.

6. Compatibility and accessibility: Ensure that the budget planner template you choose is compatible with the software or device you plan to use. Whether you prefer using a spreadsheet application, mobile apps, or online platforms, it’s important to select a template that suits your preferred method of tracking and accessing your budget information.

By considering these factors, you will be well-equipped to choose the right budget planner template that empowers you to take control of your finances and achieve your financial goals.

Consider Your Financial Needs

When it comes to managing your money effectively, it is essential to take into account your individual financial requirements. Understanding and assessing your financial needs can provide you with a solid foundation for creating and maintaining a successful budget. By evaluating your income, expenses, and financial goals, you can develop a personalized plan that aligns with your unique circumstances.

One crucial aspect to consider is your income. Take an in-depth look at your earnings, whether it be from a regular job, freelance work, investments, or any other sources. Assess the stability and consistency of your income and identify any potential fluctuations or challenges that may arise. This will enable you to plan for both short-term and long-term financial obligations effectively.

Equally important is understanding your expenses. Categorize your expenses into fixed, variable, and discretionary costs. Fixed expenses, such as rent or mortgage payments and utility bills, tend to remain consistent each month. Variable expenses, such as groceries and transportation, can fluctuate but can often be estimated based on past spending habits. Discretionary expenses, like dining out or entertainment, are the ones that you have full control over and can choose to reduce or eliminate as necessary. By analyzing your expenses, you can identify areas where you can make adjustments to free up more funds for savings or other financial goals.

| Financial Goals | Description |

|---|---|

| Short-term goals | These are goals that you aim to achieve within the next year or so. They could include building an emergency fund, paying off a credit card debt, or saving for a vacation. |

| Mid-term goals | Mid-term goals generally span a few years and may involve saving for a down payment on a house, purchasing a car, or funding education. |

| Long-term goals | Long-term goals are usually those that require significant financial planning and span a decade or more. This could include retirement planning, investing for your children’s education, or building a substantial investment portfolio. |

Furthermore, it is essential to establish your financial goals. Determine what you want to achieve in the short, mid, and long term. Your goals will provide you with a clear direction and motivate you to stay on track with your budget. Be specific about the goals you set, assign them timelines, and regularly monitor your progress to ensure you are moving in the right direction.

In summary, considering your financial needs involves evaluating your income, assessing your expenses, and defining your financial goals. By understanding these key aspects, you can design a budget plan that caters to your specific circumstances and lays the groundwork for financial success.

Look for User-Friendly Features

When selecting a budget planner, it is important to consider the presence of user-friendly features that can simplify the process of managing your finances. These features are designed to enhance the usability and functionality of the template, allowing you to effortlessly track your expenses and savings without any confusion or frustrations.

One key user-friendly feature to look for is an intuitive interface. A well-designed budget planner should have a clean and organized layout, making it easy for you to navigate and understand how to input your financial information. A user-friendly interface ensures that you can quickly find the necessary sections to update your income and expenses, helping you stay on top of your finances with ease.

Another important consideration is the availability of customizable categories. Every individual has unique financial goals and priorities, and a budget planner that allows you to customize categories according to your specific needs can be invaluable. Being able to add, modify, or delete categories gives you the flexibility to align the template with your personal financial situation, making it more effective in helping you reach your financial objectives.

In addition, look for features that offer automated calculations. Manual calculations can be time-consuming and prone to human error, but a budget planner template that automatically calculates your income, expenses, and savings can greatly simplify the budgeting process. This automation not only saves you time but also ensures accurate calculations, providing you with a clear overview of your financial situation at a glance.

Lastly, consider the ability to generate visual representations of your budget. Graphs, charts, and visual summaries can make it easier for you to analyze your financial data and identify patterns or areas where you can make improvements. User-friendly budget planner templates often include these visual features to present your financial information in a visually appealing and easy-to-understand format.

In conclusion, when choosing a budget planner template, keep an eye out for user-friendly features such as an intuitive interface, customizable categories, automated calculations, and visual representations. These features can greatly enhance your budgeting experience, making it simpler and more efficient to achieve your financial goals.

Customize to Fit Your Lifestyle

Create a personal financial plan that aligns with your unique lifestyle and goals. Tailor your budget planner template to suit your individual needs, whether you are a student, a busy professional, or a retiree. By customizing your budget template, you can take control of your finances and make informed decisions about your spending and saving habits.

Make it Personal: Adjust categories and income sources to reflect your specific financial situation. Whether you have multiple income streams, own a business, or receive passive income, you can customize your budget template to accurately track your earnings and allocate funds accordingly.

Flexible Expenses: Your spending habits and financial priorities are unique to you. Customize your budget planner template by adding or removing expense categories to accurately reflect your lifestyle. Including categories such as travel, hobbies, or entertainment will ensure that you allocate funds to activities that bring you joy and fulfillment.

Set Realistic Goals: Your financial aspirations may differ from others’. Customize your budget planner template to include short-term and long-term goals that are meaningful to you. Whether you’re saving for a vacation, a down payment on a house, or planning for retirement, tracking your progress and adjusting your budget accordingly will help you stay on track to achieve your objectives.

Remember, the effectiveness of your budget planner template lies in its ability to cater to your unique financial situation and goals. By customizing it to fit your lifestyle, you can ensure that it becomes a powerful tool in helping you take control of your finances with confidence.

Tips for Effectively Utilizing a Budget Planner Template

When it comes to making the most of a budget planner template, there are several key tips to keep in mind. By following these guidelines, you can ensure that you are effectively utilizing the template and maximizing its benefits.

1. Set Clear Goals: Before you start using the budget planner template, it’s important to establish clear financial goals. Whether you want to save for a down payment on a house, pay off debt, or simply increase your savings, having a clear objective will help you stay motivated and focused.

2. Track Your Expenses: One of the most important aspects of using a budget planner template is accurately tracking your expenses. This means keeping a record of every purchase, no matter how small. It’s important to be thorough and honest with yourself about where your money is going.

3. Categorize Your Spending: Once you have a clear picture of your expenses, it’s helpful to categorize them. This allows you to see where you are spending the most money and identify areas where you can cut back. Common categories include housing, transportation, groceries, entertainment, and debt payments.

4. Set Realistic Budget Limits: When using a budget planner template, it’s crucial to set realistic limits for each spending category. Be honest with yourself about what you can comfortably afford and aim to stick to these limits as closely as possible. This will help prevent overspending and ensure that you are on track to meet your financial goals.

5. Review and Adjust Regularly: Finally, it’s important to regularly review and adjust your budget planner template. As your financial situation changes, your budget may need to be modified to reflect these new circumstances. Additionally, reviewing your budget regularly allows you to identify any areas where you may be overspending or where you can allocate more funds towards your financial goals.

By following these tips, you can effectively utilize a budget planner template to take control of your finances and work towards your financial objectives. Remember, consistency and accuracy are key, so make sure to keep up with your budget tracking and adjustments on a regular basis.

Regularly Update Your Income and Expenses

One essential aspect of effectively managing your financial situation is to regularly update and track your income and expenses. By keeping a detailed record of your earnings and expenditures, you can gain a clearer picture of where your money is going and make more informed decisions regarding your finances.

An important step in this process is to regularly review and update your income sources. This includes any salary or wages you receive from your job, as well as any additional sources such as freelance work, rental income, or investments. By accurately tracking your income, you can better understand your total earnings and plan your budget accordingly.

Similarly, keeping track of your expenses is crucial for maintaining control over your financial situation. It is important to categorize your expenses into different types, such as housing, transportation, groceries, utilities, and entertainment. By doing so, you can identify areas where you may be overspending and make adjustments as necessary.

To make the process of updating your income and expenses more manageable, utilizing a budget planner template can be highly beneficial. This template can provide a structured format for recording and organizing your financial data, making it easier to visually analyze your income and expenses.

| Income | Amount |

|---|---|

| Salary | $3,000 |

| Freelance Work | $500 |

| Rental Income | $700 |

| Expenses | Amount |

|---|---|

| Housing | $1,200 |

| Transportation | $200 |

| Groceries | $300 |

| Utilities | $150 |

| Entertainment | $100 |

By regularly updating your income and expenses, you can track your financial progress, determine areas where you can save or invest more, and adjust your budget accordingly. With a comprehensive understanding of your financial situation, you can make decisions that align with your long-term goals and aspirations.

Analyze Your Spending Patterns

Gain insights into your financial habits by analyzing your expenditure trends and patterns. Understanding how you spend your money can help you make informed decisions and manage your finances more effectively.

By examining your spending patterns, you can identify areas of excessive spending or areas where you can potentially cut back. This analysis allows you to prioritize your financial goals, such as saving for emergencies, paying off debts, or investing in long-term plans.

Take a closer look at your monthly expenses and categorize them into different spending categories. This will enable you to see where your money is going and if there are any recurring patterns. Are you spending more on dining out or entertainment than you thought? Is your monthly grocery bill higher than expected? Identifying these patterns can help you make necessary adjustments and reallocate your funds accordingly.

Moreover, tracking your spending habits over time gives you a clearer picture of your financial progress. It allows you to assess whether you are making positive changes and achieving your financial goals. Regularly analyzing your spending patterns empowers you to make informed decisions about your budget and ensure that your money is aligned with your priorities.

Using a budget planner template can make the process of analyzing your spending patterns more organized and efficient. It provides a structured format to input your expenses and categorize them easily. With the help of visual charts and graphs, the template simplifies the process of identifying spending patterns and trends.

Ultimately, analyzing your spending patterns is a crucial step towards financial fitness. It helps you gain a comprehensive understanding of your expenses and make necessary adjustments to improve your financial well-being. By actively monitoring and managing your spending habits, you can work towards achieving your financial goals and living a more financially secure life.

Make Adjustments for Better Financial Management

Improving your financial management requires making certain changes and adjustments to your current approach. By implementing these adjustments, you can enhance your ability to effectively handle your finances and achieve your financial goals.

1. Reassess your spending habits: Take a close look at your current spending patterns and identify areas where you can make adjustments. Consider cutting back on unnecessary expenses and finding more affordable alternatives without compromising your lifestyle.

2. Prioritize your financial goals: Establish clear financial goals and determine the order of importance among them. This will help you allocate your resources more effectively and ensure you’re working towards what matters most to you.

3. Create a realistic budget: Develop a comprehensive budget that aligns with your financial goals and reflects your income and expenses accurately. Factor in both fixed and variable expenses, saving for emergencies and future investments, and leave room for flexibility.

4. Track your expenses: Keep a record of all your expenses to monitor your spending habits and identify areas where you may be overspending. This awareness will enable you to make necessary adjustments and make better financial decisions.

5. Consider additional sources of income: Explore opportunities to increase your income, such as taking on a side job or starting a small business. By diversifying your sources of income, you can improve your financial stability and have more resources to allocate towards your financial goals.

6. Review and adjust regularly: Regularly review your financial situation and progress towards your goals. Make adjustments to your budget and spending habits as needed to ensure you stay on track and adapt to any changes in your financial circumstances.

By making these adjustments and consistently managing your finances, you can optimize your financial management and work towards a more secure and prosperous future.

Questions and answers

How can a budget planner template help me manage my finances?

A budget planner template can help you manage your finances by providing a structured framework to organize your income, expenses, and savings. It allows you to set specific financial goals, track your spending, create a realistic budget, and identify areas where you can cut costs or save money. This template enables you to have a clear and visual representation of your financial situation, making it easier to make informed decisions and take control of your money.

Are there any free budget planner templates available?

Yes, there are many free budget planner templates available online. You can find them on various websites, financial blogs, or even download them as mobile applications. These templates come with different features and designs, allowing you to choose the one that suits your needs best. Whether you prefer a basic spreadsheet format or a more comprehensive budgeting tool, you can certainly find a free template that can help you get started on managing your finances effectively.

Can a budget planner template help me save money?

Absolutely! A budget planner template plays a crucial role in helping you save money. By using this template, you can allocate a portion of your income towards savings and track your progress regularly. It enables you to set specific savings goals, monitor your expenses, and identify potential areas where you can reduce spending. Additionally, the visual representation of your budget makes it easier to stay focused on your financial goals and motivates you to make healthier financial decisions.

Is it necessary to stick strictly to a budget planner template?

While it is not necessary to strictly adhere to a budget planner template, it is highly recommended to utilize its framework as a guide. The template provides a structured approach to managing your finances, but it can be adjusted according to your personal circumstances and preferences. It is important to customize the budget planner to reflect your income, expenses, and financial goals accurately. By doing so, you can create a budget that is realistic and achievable, providing you with a clear roadmap for financial success.

What are the key benefits of using a budget planner template?

Using a budget planner template offers several key benefits. Firstly, it helps you gain better control over your finances by providing a systematic approach to managing your money. Secondly, it allows you to track your spending and identify areas where you can cut costs or save money. Thirdly, it enables you to set financial goals and monitor your progress towards achieving them. Finally, a budget planner template can help you reduce financial stress, improve your financial literacy, and make informed decisions about your money, ultimately leading to a more stable and secure financial future.

Why is budget planning important for managing finances?

Budget planning is important for managing finances because it allows individuals to track their income and expenses, set financial goals, and make informed decisions about their spending. It helps to ensure that they have enough money to cover their necessary expenses while also saving for the future.

What is a budget planner template and how does it work?

A budget planner template is a pre-designed document or tool that helps individuals create and manage their budgets effectively. It typically includes categories for income and expenses, as well as sections for savings and debt. Users can fill in their financial information and use the template to track their spending, plan for future expenses, and monitor their progress towards their financial goals.

Are there any free budget planner templates available online?

Yes, there are plenty of free budget planner templates available online. Many websites and financial blogs offer downloadable templates in various formats, such as Excel or PDF. These templates can be personalized to fit an individual’s specific financial situation and provide a convenient way to start budget planning without the need for creating a budgeting spreadsheet from scratch.

What are the benefits of using a budget planner template?

Using a budget planner template offers several benefits. It helps individuals gain a clearer understanding of their financial situation by providing a comprehensive overview of their income and expenses. It enables them to identify areas where they can cut back on spending and save money. Additionally, a budget planner template promotes accountability and discipline in money management, as it encourages individuals to regularly review and update their budget.

Can a budget planner template help individuals achieve their financial goals?

Absolutely! A budget planner template can be a valuable tool in helping individuals achieve their financial goals. By accurately tracking income and expenses, individuals can allocate funds towards their goals, such as saving for a down payment on a house, paying off debt, or building an emergency fund. The template allows individuals to create a realistic plan and monitor their progress, making it easier to stay on track and achieve financial success.