As entrepreneurs, we are always on the lookout for ways to optimize our financial performance. One crucial aspect that cannot be overlooked is the management of our business taxes. By strategically utilizing various deductions and write-offs, small enterprises can significantly reduce their tax liability and maximize their profits.

1. Enhance Your Tax-Efficiency

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreInvesting time and effort into understanding and implementing tax-efficient strategies is paramount for small business owners. By employing smart financial planning techniques, entrepreneurs can ensure that they are fully utilizing their available deductions and credits to legally minimize their tax obligations.

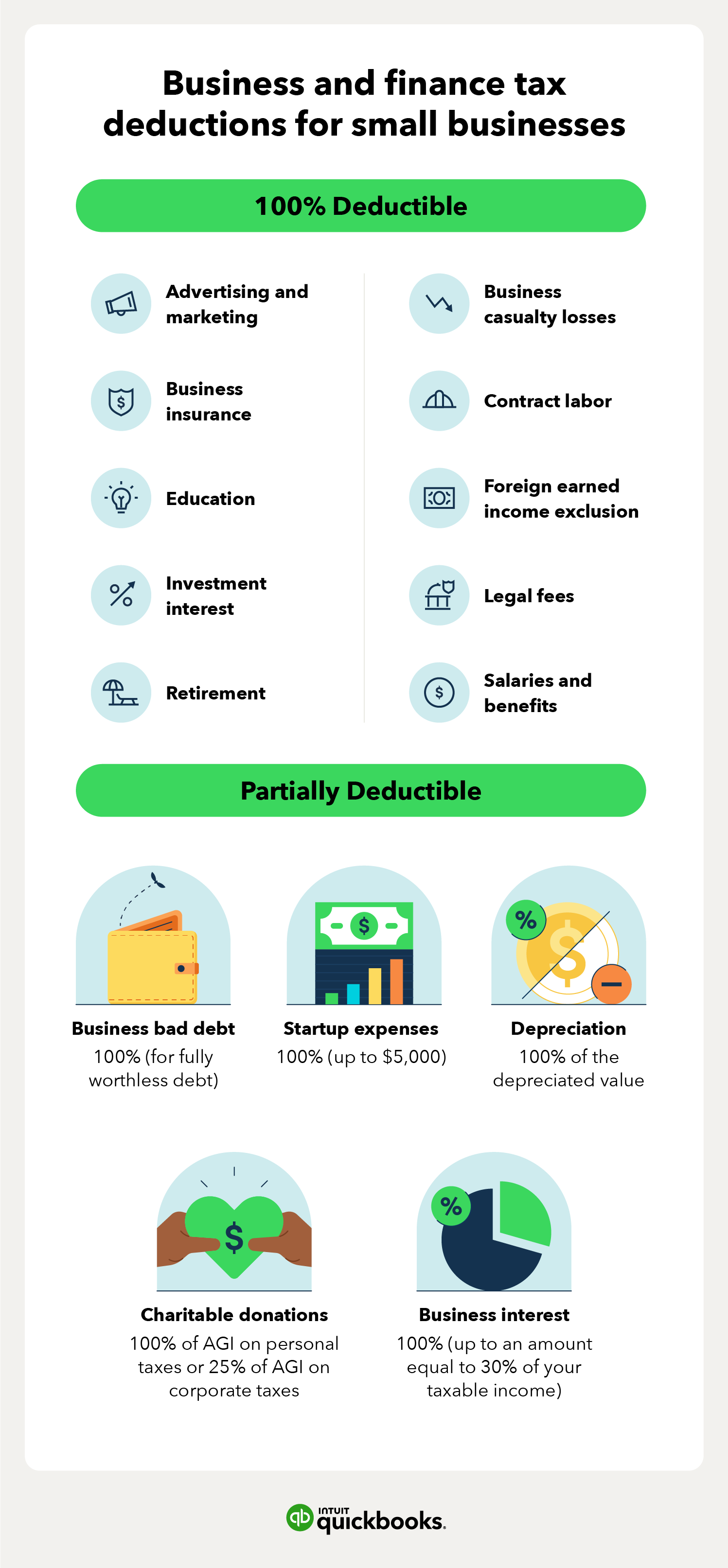

2. Take Advantage of All Applicable Deductions

While tax codes may seem complex, familiarizing yourself with the deductions applicable to your industry is essential. From regular operating expenses to specific industry-related deductions, such as research and development costs or educational expenses, identifying and claiming every eligible write-off can result in substantial tax savings for your small enterprise.

3. Accurately Document and Track Expenses

Properly maintaining records is crucial for substantiating your deduction claims and avoiding any potential disputes with tax authorities. Keeping meticulous records of all business-related expenses, including receipts, invoices, and contracts, is a vital step in maximizing your tax deductions.

4. Leverage Retirement Plan Contributions

Contributing to retirement plans not only secures your financial future but also offers attractive tax benefits. By maximizing your contributions to retirement accounts like IRAs or 401(k)s, you can potentially defer a significant portion of your taxable income and lower your overall tax liability.

5. Understand and Utilize Tax Credits

While deductions reduce your taxable income, tax credits directly decrease your tax bill. Taking advantage of available credits can result in notable savings. Familiarize yourself with the various tax credits available to small businesses, such as the Research and Development Tax Credit or the Small Business Health Care Tax Credit, and explore how they can apply to your specific circumstances.

6. Seek Professional Assistance

Given the complexity of tax laws and the ever-evolving regulations, partnering with knowledgeable tax professionals can be a wise decision. Enlisting the expertise of accountants or tax advisors who specialize in small business tax planning can help you navigate the intricacies of the tax system while ensuring compliance and maximizing your potential savings.

By actively incorporating these strategies into your tax planning efforts, your small enterprise can position itself for greater financial success. Remember, every dollar saved in taxes is a dollar that can be reinvested in growing your business, improving your products or services, or rewarding your hard-working employees.

- Research and Development (R&D) Expenses

- Exploring Opportunities for Tax Savings through R&D Deductions

- Understanding Eligible R&D Expenses for Small Businesses

- Tips for Documenting and Claiming R&D Write-Offs

- Home Office Expenses

- Navigating the Tax Advantages of Running a Home-Based Business

- Calculating and Deducting Expenses for Home Offices in Small Businesses

- Important Considerations for Home Office Tax Deductions

- Travel and Entertainment Expenses

- Unveiling Deductible Travel and Entertainment Expenses for Small Businesses

- Tips for Proper Documentation and Record-Keeping of Business Travel

- Exploring Entertainment Write-Offs: When and How to Claim

- Questions and answers

Research and Development (R&D) Expenses

Innovation and advancement are crucial for the growth and success of small enterprises. In today’s competitive business landscape, staying ahead requires continuous research and development (R&D) efforts. While these activities can be costly, they can also be advantageous when it comes to optimizing tax deductions.

Investing in R&D allows small enterprises to explore new technologies, develop innovative products and services, and improve existing offerings. By conducting research and experimenting with new ideas, businesses can gain a competitive edge, increase efficiency, and drive growth.

The expenses associated with R&D can encompass a wide range of activities, including but not limited to:

- Salaries and wages of R&D personnel

- Costs of materials used in experiments and prototypes

- Rental or lease expenses for research facilities or equipment

- Consulting fees for specialized expertise

- Patent and intellectual property expenses

- Software and technology licensing fees

By properly documenting and tracking these R&D expenses, small enterprises can potentially benefit from tax deductions or credits. It is important to consult with a tax professional to ensure compliance with applicable regulations and to maximize the available deductions.

Overall, understanding the potential tax benefits associated with R&D expenses allows small enterprises to allocate resources more effectively, encourage innovation, and foster growth in a tax-efficient manner.

Exploring Opportunities for Tax Savings through R&D Deductions

In this section, we will delve into the potential tax savings that small enterprises can achieve by taking advantage of Research and Development (R&D) deductions. By exploring the various opportunities available in this area, businesses can optimize their tax planning strategies and maximize their savings.

Research and Development (R&D) plays a crucial role in fostering innovation and driving business growth. Many governments offer tax incentives to encourage companies, especially small enterprises, to invest in R&D activities. These incentives aim to stimulate technological advancements, enhance competitiveness, and foster economic development.

- Exploring the R&D Tax Credit: One of the key opportunities for small enterprises to save on taxes is through the R&D tax credit. This credit allows eligible businesses to offset a portion of their R&D expenses against their tax liability. By carefully documenting and claiming their qualifying R&D activities, businesses can significantly reduce their tax burden.

- Identifying Qualifying R&D Expenditures: To maximize tax savings, it is important for small enterprises to understand the types of expenditures that qualify for R&D deductions. These may include salaries and wages of R&D personnel, costs of supplies and materials used in R&D activities, expenses related to contracted R&D services, and even a portion of overhead costs attributable to R&D.

- Documenting and Substantiating R&D Activities: Accurate documentation and substantiation of R&D activities are critical when claiming R&D deductions. Small enterprises should maintain detailed records of projects, expenses incurred, time spent, and the technical uncertainties addressed during the R&D process. Proper documentation strengthens the claim for deductions and minimizes the risk of audits or challenges from tax authorities.

- Collaborating with Universities and Research Institutions: Small enterprises can also explore collaborations with universities and research institutions to further enhance their R&D efforts. Such partnerships can yield additional opportunities for tax savings, as certain jurisdictions offer special incentives for businesses engaged in collaborative R&D projects.

- Considering the R&D Tax Relief for Startups: In certain jurisdictions, startups and early-stage companies may qualify for specific R&D tax relief schemes, providing them with more favorable tax benefits. Understanding and utilizing these specialized relief schemes can contribute to substantial tax savings for small enterprises in their initial stages of operations.

- Engaging Tax Professionals and Consultants: Given the complexities associated with R&D deductions, small enterprises can benefit from consulting tax professionals or R&D tax credit specialists. These experts possess the knowledge and experience to navigate the intricacies of tax laws, identify eligible R&D activities, and optimize tax savings opportunities, ensuring compliance and maximizing benefits for businesses.

By exploring and optimizing R&D deductions, small enterprises can not only reduce their tax liability but also reinvest the saved funds into further research, development, and innovation, enabling them to stay competitive and foster sustainable growth in their respective industries.

Understanding Eligible R&D Expenses for Small Businesses

Exploring the Potential for Cost Coverage: Insight into Qualified Research and Development Costs

For small businesses, identifying eligible research and development (R&D) expenses is crucial for maximizing tax benefits. By delving into the realm of qualified expenses, small enterprises can gain a clearer understanding of the potential deductions available to them.

Discovering the Scope of Qualified Costs

R&D expenses encompass a variety of activities that promote innovation and technological advancement within a business. These expenses are not limited to traditional scientific research, but can also include efforts to improve products, processes, or software development. By expanding the scope of what is considered as R&D expenses, small businesses can benefit from a wider range of deductible costs.

The Research Credit: A Valuable Incentive

Incentivizing innovation, the research credit is a valuable tool for small businesses. This credit allows eligible businesses to offset a portion of their tax liability based on qualified R&D expenses. Understanding the criteria for qualifying expenses is essential in order to fully utilize this credit and maximize its benefits.

Common Examples of Eligible Costs

Eligible R&D expenses can include an array of costs that contribute to the development and improvement of a product or process. These costs may involve wages, supplies, or even contract research expenses. By recognizing common examples of eligible costs, small businesses can effectively manage their expenses and optimize their overall tax deduction.

The Importance of Documentation

Accurate and detailed documentation is essential when identifying eligible R&D expenses. Proper record-keeping ensures that expenses are adequately supported and can withstand potential audits. Implementing a reliable tracking system and maintaining comprehensive records enhances small businesses’ ability to claim the maximum deductions they are entitled to.

Seeking Professional Assistance

Given the complexity of tax regulations surrounding R&D expenses, seeking professional guidance is highly recommended for small businesses. Tax advisors specializing in small business deductions can provide invaluable assistance in identifying eligible expenses and navigating the intricacies of tax regulations, ultimately helping businesses maximize their tax savings.

Tips for Documenting and Claiming R&D Write-Offs

In this section, we will provide valuable insights on effectively documenting and claiming write-offs related to research and development (R&D) activities. When it comes to maximizing the tax benefits for small enterprises, the meticulous documentation of eligible R&D expenses is of utmost importance. By following these tips, businesses can ensure they are claiming the appropriate deductions while optimizing their overall tax position.

1. Thoroughly Document R&D Expenditures: Maintaining accurate records of all R&D expenses is essential for claiming write-offs. This includes keeping track of costs associated with employee salaries, materials, equipment, and any external services or consultants engaged in the R&D process. Ensuring that all expenses are properly documented with supporting invoices and receipts is crucial for successful deduction claims.

2. Identify Eligible R&D Activities: It is important to understand and identify which activities qualify for R&D write-offs. This can include activities such as developing new products, enhancing existing processes, or conducting experiments to improve efficiency or quality. Familiarize yourself with the legislation and guidelines in your region to determine which R&D activities are eligible for tax deductions.

3. Keep Detailed Project Records: Documenting the progress and outcomes of R&D projects is vital. This includes recording key milestones, project timelines, challenges faced, and the results achieved. These records serve as evidence of the purpose, nature, and outcomes of the R&D activities conducted, further supporting the claims for write-offs.

4. Seek Professional Assistance: Consulting with tax professionals or experts in R&D tax incentives can provide valuable guidance and ensure compliance with the complex regulations surrounding write-offs. These professionals can help identify eligible expenses, understand the documentation requirements, and navigate any specific criteria that need to be met in order to claim the deductions successfully.

5. Stay Updated on Tax Laws: Tax laws and regulations pertaining to R&D deductions can change over time. It is crucial for small enterprises to stay informed about any updates or revisions to ensure accurate documentation and compliant claims. Subscribing to relevant publications or seeking advice from tax authorities can help businesses stay up-to-date with the latest guidelines.

6. Maintain Clear Communication: Establishing effective communication channels and collaboration between various departments within the organization is essential. This helps ensure that all eligible R&D activities and associated expenses are adequately documented and reported. Regular communication can help identify any missed opportunities for write-offs and promote a comprehensive understanding of the tax benefits available.

By implementing these tips, small enterprises can maximize their tax deductions by effectively documenting and claiming R&D write-offs. It is essential to maintain accurate records, identify eligible activities, keep detailed project documentation, seek professional guidance when needed, stay updated on tax laws, and foster clear communication within the organization.

Home Office Expenses

In this section, we will explore the various costs that small businesses can deduct when it comes to their home office expenses. Creating a productive and comfortable workspace within the comforts of one’s own home can be an advantage for entrepreneurs, and it’s essential to understand the potential benefits when it comes to tax deductions.

1. Workspace Deduction

One of the primary deductions for home office expenses is the workspace deduction. This deduction allows small business owners to allocate a portion of their dwelling solely for business purposes. It could be a room or a designated area within a room that is used for work-related activities. By deducting the portion of your rent or mortgage related to your home office, you can potentially reduce your overall tax liability.

2. Utilities

When running a home office, certain utilities are necessary to maintain operations. These may include electricity, water, heating, and internet services. Small business owners can often deduct a proportionate amount of these utility expenses, reflecting the portion of the home used for business activities. Keeping records of these expenses can help you to maximize your deductions and reduce your tax burden.

3. Repairs and Maintenance

As with any workspace, home offices require occasional repairs and maintenance. Whether it’s fixing a leaky faucet or repairing a broken desk, these expenses can be deductible. It’s important to keep track of all repairs and maintenance costs to ensure you claim the appropriate deductions come tax time.

4. Office Supplies

From paper and printer ink to computers and software, the cost of office supplies can add up for small businesses. Fortunately, these expenses are typically deductible. By keeping receipts and records, you can include these costs as part of your deductions, ultimately reducing your tax liability.

5. Insurance

Homeowners insurance and Renter’s insurance policies may not fully cover the needs of a home-based business. Therefore, additional insurance coverage may be necessary. These additional premiums paid to insure your business assets and liabilities may be eligible for deduction when you file your taxes.

6. Depreciation

Over time, assets such as office furniture and equipment may lose value due to wear and tear. This decrease in value is called depreciation, and small business owners can often deduct a portion of this depreciation expense. By accounting for the depreciation of your home office assets, you can reduce your taxable income.

Understanding the various home office expenses that can be deducted is crucial for small business owners looking to optimize their tax advantages. By ensuring you meet all necessary requirements and keeping accurate records, you can maximize your deductions and minimize your tax burden.

For individuals who have chosen to operate their businesses from the comforts of their own homes, understanding the tax benefits that come along with this decision is crucial. By effectively navigating through the complex world of tax regulations, home-based entrepreneurs can enjoy significant advantages that can positively impact their financial bottom line.

1. Optimizing Home Office Deductions

One of the most valuable tax benefits available to home-based business owners is the ability to deduct expenses related to their designated office space. By properly calculating and documenting these expenses, such as rent or mortgage payments, utilities, and maintenance costs, entrepreneurs can potentially lower their taxable income and maximize their overall deductions.

2. Exploring the Self-Employment Tax Exemption

When running a home-based business, entrepreneurs may be eligible for the self-employment tax exemption. This exemption allows them to avoid paying the full 15.3% self-employment tax on their net earnings. By taking advantage of this exemption, individuals can reduce their tax burden and allocate those savings towards the growth and expansion of their business.

3. Deducting Business Expenses

Operating a home-based business requires various expenses, ranging from supplies and equipment to marketing and advertising costs. These expenses can be deducted from the business’s income, reducing the overall taxable amount. It is essential for entrepreneurs to keep accurate records and receipts to support their deductions and ensure compliance with tax regulations.

4. Capitalizing on Healthcare Deductions

Home-based business owners who are self-employed may qualify for deductions related to their healthcare expenses. By leveraging these deductions, entrepreneurs can not only reduce their tax liability but also receive valuable coverage for medical expenses critical to maintaining their health and well-being.

5. Utilizing Retirement Plan Contributions

Entrepreneurs running home-based businesses have the opportunity to establish and contribute to retirement plans, such as a Simplified Employee Pension (SEP) IRA or a Solo 401(k). These contributions not only help secure the business owner’s financial future but can also provide tax benefits by reducing their overall taxable income.

6. Maximizing Education and Training Deductions

Investing in education and training is crucial for the growth and success of any business. Home-based business owners can deduct eligible expenses related to professional development, including workshops, courses, and conferences. These deductions not only improve knowledge and skills but also provide financial benefits by reducing the tax burden.

Understanding and applying these tax benefits can have a significant impact on the overall profitability of a home-based business. However, it is essential for entrepreneurs to consult with a tax professional or accountant who can provide expert guidance tailored to their specific circumstances, ensuring compliance with tax laws while maximizing available deductions.

Calculating and Deducting Expenses for Home Offices in Small Businesses

When it comes to running a small business, maximizing deductions and minimizing expenses is crucial for financial success. One area where small business owners can potentially save money is through accurately calculating and deducting home office expenses.

Home office expenses can include a variety of costs related to your business operations conducted within your home. This could include rent or mortgage interest, utilities, insurance, repairs, and maintenance. By properly calculating and deducting these expenses, small business owners can reduce their taxable income and potentially lower their tax liability.

One method of calculating home office expenses is the simplified method, which allows eligible businesses to deduct $5 per square foot of their home office space. This method simplifies the process by not requiring detailed calculations or record-keeping of actual expenses incurred. It provides a straightforward and efficient way to claim deductions for qualifying home office expenses.

Alternatively, the regular method involves determining the actual expenses associated with your home office space. This includes calculating the percentage of your home used for business purposes and deducting a portion of the total expenses such as mortgage interest, property taxes, utilities, and maintenance costs. This method requires more detailed record-keeping and documentation but may result in higher deductions if you have significant home office expenses.

It’s important to note that in order to qualify for home office deductions, the space must be used regularly and exclusively for business purposes. This means that a designated area of your home should be used solely for conducting business activities, such as meeting with clients, managing paperwork, or performing administrative tasks.

By accurately calculating and deducting home office expenses, small business owners can potentially save money and maximize their deductions. It’s important to consult with a tax professional or use reliable tax software to ensure compliance with tax regulations and make the most of these deductions.

Important Considerations for Home Office Tax Deductions

When it comes to maximizing the benefits of your home office, there are several important considerations to keep in mind. Being aware of these factors can help small business owners make the most of the tax deductions available to them.

First and foremost, it is crucial to understand the specific criteria that need to be met in order to qualify for a home office write-off. While the requirements may vary depending on the jurisdiction, generally, the area designated as a home office must be used exclusively for business purposes. This means that any personal use of the space, such as using it for recreational activities or as a storage area, can jeopardize the eligibility for this deduction.

Another key consideration is the calculation of the deductible amount for your home office expenses. This is typically based on the percentage of your home that is used for business purposes. It is important to keep accurate records of the square footage of your home office relative to the total square footage of your home, as well as document any expenses directly related to maintaining and operating the office.

Additionally, it is essential to be aware of any limitations or restrictions imposed by local tax laws when it comes to home office deductions. Some jurisdictions may have specific rules regarding the maximum amount that can be claimed or may require regular reporting and documentation to support the deduction. Familiarizing yourself with these rules can help you avoid potential penalties or audits in the future.

Furthermore, it is advisable to consult with a tax professional or seek expert advice to ensure that you fully understand the implications of claiming a home office deduction. They can provide guidance on the specific rules and regulations applicable to your location and help you make informed decisions to maximize your tax benefits.

In conclusion, home office write-offs can be a valuable opportunity for small business owners, but it is important to navigate this potential tax deduction with care. By understanding the criteria, calculating the deductible amount accurately, being aware of local limitations, and seeking professional advice, entrepreneurs can optimize their tax savings and ensure compliance with tax regulations.

Travel and Entertainment Expenses

In this section, we will explore the various deductions that small enterprises can take advantage of when it comes to their travel and entertainment expenses. These deductions allow businesses to reduce their taxable income by including eligible expenses incurred during business-related travel and entertainment activities.

When it comes to travel expenses, small business owners can deduct costs such as transportation fares, hotel accommodations, and meals while traveling for business purposes. These deductions are aimed at recognizing the financial burden that business travel can impose and provide relief through reducing taxable income.

Entertainment expenses can also be deductible for small enterprises, as long as they meet certain criteria. Business owners can deduct expenses associated with client entertainment, such as meals, tickets to shows or sporting events, and even recreational activities that have a clear business purpose. However, it is important to keep detailed records and receipts to substantiate these expenses.

| Travel Expenses | Entertainment Expenses |

|---|---|

| Transportation fares | Client meals |

| Hotel accommodations | Tickets to shows or sporting events |

| Meals while traveling | Recreational activities with a business purpose |

It is essential for small business owners to keep accurate records of their travel and entertainment expenses, including receipts, invoices, and documentation of business-related purposes. By maintaining proper documentation, businesses can ensure that they are in compliance with tax regulations and maximize their deductions.

Small enterprises should consult with a tax professional or accountant specializing in small business taxes to ensure they understand all the rules and regulations related to travel and entertainment deductions. By doing so, businesses can take full advantage of the available deductions and minimize their taxable income, ultimately maximizing their financial position.

Unveiling Deductible Travel and Entertainment Expenses for Small Businesses

Exploring the realm of eligible deductions, this section dives into the intriguing world of travel and entertainment expenses that small businesses can include in their tax deductions. We unveil the various costs associated with business travel and entertainment that can be legitimately claimed, helping small enterprises maximize their allowable deductions.

Among the deductible expenses for small businesses, travel and entertainment costs prove to be significant components. Understanding what expenses are classified as eligible deductions can provide small business owners with the knowledge needed to make informed decisions and optimize their tax planning strategies. In this section, we shed light on the essential aspects of deductible travel and entertainment expenses, showcasing the potential benefits they can offer to forward-thinking entrepreneurs.

Strong record-keeping is crucial when it comes to claiming travel and entertainment deductions, highlighting the importance of keeping detailed records to substantiate the expenses incurred. By adhering to the regulations and guidelines set by the tax authorities, small businesses can confidently navigate the intricacies of deducting travel and entertainment costs, reducing their tax burdens while staying compliant with the law.

Additionally, we delve into the diverse array of expenses that fall under the travel and entertainment umbrella, emphasizing the breadth of opportunities for businesses to reduce their taxable income. Ranging from transportation and accommodation expenses to meals and entertainment, small business owners can strategically leverage these deductions to alleviate their overall tax liability.

In this section, we also underscore the importance of maintaining proper documentation and adhering to substantiation requirements, enabling small businesses to prove the legitimacy of their travel and entertainment expenses if audited. By proactively managing these expenses, entrepreneurs can enhance their credibility and protect their deductions during the tax filing process.

Maximizing the potential of deductible travel and entertainment expenses can provide small enterprises with the opportunity to allocate resources effectively, fueling their growth and success. By closely examining the regulations surrounding these deductions and employing sound record-keeping practices, small business owners can unlock substantial tax advantages and navigate the intricacies of tax planning with confidence.

Tips for Proper Documentation and Record-Keeping of Business Travel

Efficiently documenting and keeping records of your business travel is essential for maximizing deductions and ensuring compliance with tax regulations. This section provides valuable tips to help small enterprises effectively manage their documentation and record-keeping processes for business travel expenses.

1. Maintain detailed travel logs: Keeping an accurate and comprehensive travel log is crucial in proving the business purpose of your travel expenses. Include dates, destinations, purpose of the trip, and specific activities conducted.

2. Retain all travel-related receipts: Ensure you secure and preserve all receipts related to your business travel, such as airfare, accommodation, meals, transportation, and other relevant expenses. Properly categorize and organize these receipts for easy reference.

3. Capture electronic records: In today’s digital age, it is essential to capture electronic records of your business travel expenses. Utilize mobile apps or online platforms that allow you to easily record and store electronic receipts, emails, and other important digital documents.

4. Separate personal and business expenses: It is crucial to maintain a clear separation between personal and business expenses during your travel. Clearly document and allocate expenses that are directly related to your business activities to avoid any confusion or issues during tax audits.

5. Understand IRS guidelines: Familiarize yourself with the Internal Revenue Service (IRS) guidelines regarding business travel deductions. Stay informed about the specific rules and limitations imposed by the IRS to ensure accurate and compliant record-keeping.

6. Seek professional guidance: If you find the process of documenting and maintaining records for business travel overwhelming, consider seeking professional assistance. Tax professionals or accountants with expertise in small business tax deductions can provide valuable guidance and ensure compliance with relevant regulations.

Proper documentation and record-keeping of your business travel expenses play a vital role in maximizing eligible deductions and minimizing the risk of audits. By following these tips, small enterprises can effectively manage their documentation processes and potentially reduce their tax liabilities.

Exploring Entertainment Write-Offs: When and How to Claim

Delving into the realm of deductibles for entertainment expenses can provide small businesses with valuable opportunities to reduce their taxable income. Understanding the when and how of claiming such write-offs can lead to significant savings for enterprises. Let’s explore the world of entertainment write-offs and learn how to make the most of them.

| Write-Off | Description | Eligibility Criteria |

|---|---|---|

| Client Entertainment | Expenses incurred while entertaining clients or potential clients to discuss business matters can often be deducted. This includes meals, tickets to events, and other forms of entertainment. | – Entertainment must be directly related to the active conduct of your business. – You must have a clear business purpose and be able to establish a substantial business discussion took place during the entertainment. |

| Employee Entertainment | Businesses can also deduct expenses incurred for entertaining employees, such as company outings or holiday parties. These events can foster team building and boost morale. | – Entertainment must be for the benefit of all employees. – The event should be occasional and non-lavish. – Business discussions or activities should occur during the entertainment. |

| Trade Shows and Conventions | Expenses related to attending trade shows or conventions, including registration fees, transportation, lodging, and meals, are generally deductible. These events allow businesses to promote their products or services and network with industry professionals. | – The trade show or convention must be directly related to your business. – You should actively engage in promoting your business during the event. – Entertainment expenses during the event may also be eligible for deduction. |

Remember to keep accurate records of all entertainment expenses, including receipts, invoices, and documentation of the business purpose. Thoroughly understanding the eligibility criteria for entertainment write-offs can help small businesses maximize their deductions and minimize their tax liabilities.

Questions and answers

What are some commonly overlooked business tax deductions for small enterprises?

Some commonly overlooked business tax deductions for small enterprises include home office expenses, vehicle expenses, professional fees, marketing and advertising expenses, and education and training expenses.

Can you explain the concept of a home office deduction for small businesses?

Certainly! A home office deduction allows small business owners to deduct a portion of their home expenses, such as rent, mortgage interest, utilities, and maintenance, if they use a part of their home exclusively for business purposes. The IRS has specific criteria that need to be met for this deduction to be valid.

What type of vehicle expenses can be deducted by small enterprises?

Small enterprises can deduct a variety of vehicle expenses, including mileage for business-related trips, fuel costs, insurance premiums, repairs and maintenance, parking fees, and even vehicle loan interest. However, it is important to accurately track and document these expenses to claim the deduction.

Are professional fees deductible for small businesses?

Yes, professional fees incurred by small businesses are deductible. This includes fees paid to attorneys, accountants, consultants, and other professionals who provide services directly related to the operation of the business. However, fees for personal services like tax preparation for individual tax returns are not typically deductible.

How can small enterprises maximize their deductions for marketing and advertising expenses?

Small enterprises can maximize their deductions for marketing and advertising expenses by keeping detailed records of all expenses related to advertising campaigns, website development, graphic design, printing costs, promotional materials, and even social media marketing. By properly documenting these expenditures, businesses can claim them as tax deductions.

What are tax deductions?

Tax deductions are expenses that can be subtracted from a business’s taxable income, reducing the amount of tax owed to the government.

How can small enterprises maximize their tax deductions?

Small enterprises can maximize their tax deductions by keeping detailed records of their expenses, understanding the tax laws and regulations, and utilizing available write-offs.

What are some common tax deductions for small enterprises?

Some common tax deductions for small enterprises include expenses for home offices, employee wages, equipment purchases, travel expenses, and business-related subscriptions and memberships.

Is it possible to deduct business-related travel expenses?

Yes, it is possible to deduct business-related travel expenses, such as airfare, lodging, meals, and transportation, as long as they are directly related to the business and properly documented.

Are there any specific requirements for home office deductions?

Yes, there are specific requirements for home office deductions. The space must be used exclusively for business purposes, regularly used, and the primary place of business for the business owner.