In today’s fast-paced world, it has become increasingly vital to secure our financial future. Planning for a successful journey towards financial stability requires a comprehensive understanding of effective methods to accumulate wealth. By adopting a set of pragmatic techniques, individuals can establish a robust foundation for their monetary growth, heralding a prosperous tomorrow.

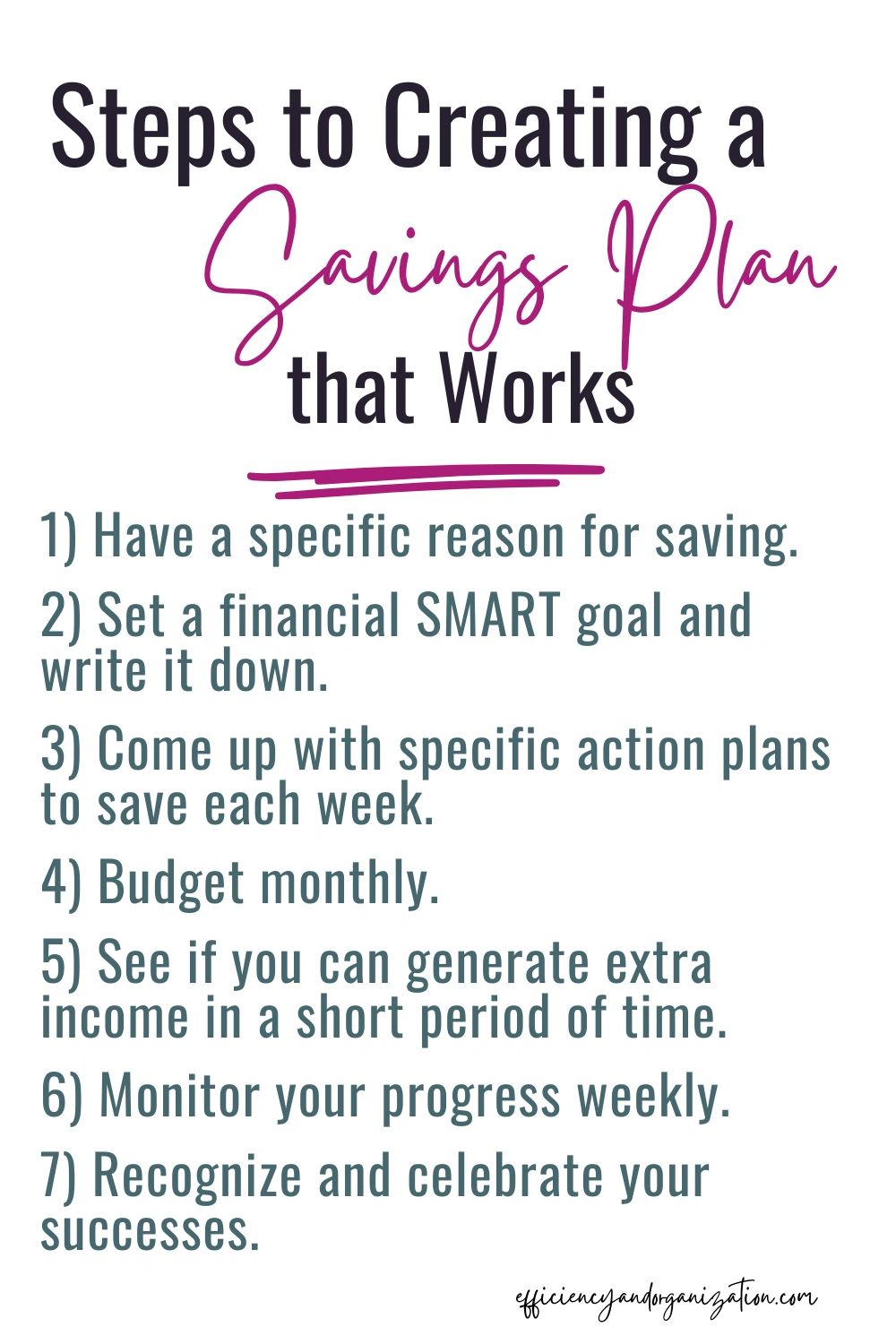

Developing a sound savings plan acts as an essential building block in achieving long-term financial success. It involves cultivating a mindset focused on accumulating assets and mitigating unnecessary expenses. By following this approach, individuals can pave the way for a secure financial future, enabling them to meet both short and long-term goals.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreFormulating a realistic budget is a fundamental aspect of an effective savings plan. This critical step involves evaluating one’s income and expenditures, identifying areas where expenses can be reduced, and diverting those funds towards savings. Budgeting empowers individuals with greater control over their financial decisions and helps prioritize saving as a key objective.

- Start Saving Today

- Set Clear Financial Goals

- Create a specific savings goal

- Break down your goal into smaller milestones

- Track your progress regularly

- Determine Your Budget

- Analyze your income and expenses

- Identify areas where you can cut back

- Create a Realistic Budget Plan

- Automate Your Savings

- Set up automatic transfers to your savings account

- Choose a specific amount or percentage to save

- Ensure you have a separate savings account

- Maximize Your Savings

- Questions and answers

Start Saving Today

Embark on your journey towards financial security by taking the first step in saving for the future. Begin implementing effective techniques and strategies that can lead to a more stable financial state.

Commence the process by creating a realistic budget that aligns with your income and expenses. Identify areas where you can cut back on unnecessary spending and redirect those funds towards your savings goals. By establishing a clear understanding of your financial situation, you can start allocating a portion of your income towards savings regularly.

Take advantage of automated savings options offered by banks and financial institutions. Set up automatic transfers from your checking account to a designated savings account, ensuring consistent contributions without any additional effort. By automating your savings, you create a habit of putting money aside and remove the temptation to spend it elsewhere.

Consider utilizing different savings vehicles, such as high-interest savings accounts or certificates of deposit, to maximize the growth potential of your savings. Research and compare various options to find the ones that offer the best rates and terms suited to your financial goals and timeline.

Stay motivated by setting specific savings targets and regularly monitoring your progress. Celebrate milestones along the way to keep yourself encouraged and inspired to continue saving. Remember that every small step you take today brings you closer to a financially secure future.

Set Clear Financial Goals

Define your targets and aspirations for your financial future by setting clear financial goals. Establishing specific objectives allows you to focus and work toward a successful savings plan. By creating a roadmap for your financial journey, you can effectively manage your resources, make informed decisions, and take steps toward achieving financial stability and independence.

In order to set clear financial goals, it is essential to assess your current financial situation and determine what you want to achieve. Consider your short-term and long-term objectives, such as saving for a down payment, starting a retirement fund, or paying off debts. These goals should be realistic, measurable, and achievable within a certain timeframe.

| Benefits | Guidelines |

| 1. Increased financial discipline | 1. Prioritize your goals |

| 2. Greater motivation to save | 2. Set measurable targets |

| 3. Enhanced financial decision-making | 3. Establish a realistic timeframe |

| 4. Improved financial stability | 4. Regularly review and adjust goals |

Setting clear financial goals allows you to identify the actions, habits, and strategies necessary to achieve them. It enables you to track your progress and make any necessary adjustments along the way. Additionally, having measurable objectives can provide a sense of accomplishment when milestones are reached, further reinforcing your commitment to your savings plan.

Remember, setting clear financial goals is just the first step. It is important to regularly review and reassess your goals as circumstances change or as you achieve your objectives. By setting clear financial goals, you are putting yourself on the path to financial success and securing a brighter future.

Create a specific savings goal

Setting a clear and specific savings target is essential for building a successful financial plan. By defining a tangible objective, you can establish a sense of purpose and motivation towards saving money.

Instead of simply aiming to save more, it is advisable to identify a specific area where you want to allocate your funds. This could be anything from building an emergency fund, saving for a down payment on a house, or planning for a dream vacation.

By having a specific savings goal in mind, you can tailor your saving strategies and make informed decisions about where to allocate your resources. It also allows you to calculate how much money you need to set aside regularly to reach your objective within a certain timeframe.

Consider breaking down your larger goal into smaller milestones or targets along the way. This approach can help you stay motivated and track your progress more effectively.

- Identify a specific area for saving money

- Set a clear objective for your savings goal

- Tailor your saving strategies to meet your goal

- Create smaller milestones to track your progress

Remember, having a specific savings goal not only provides direction but also allows you to celebrate your achievements along the way. Stay focused, stay determined, and watch your savings grow!

Break down your goal into smaller milestones

Dividing your objective into smaller milestones is an effective strategy for achieving success in your savings plan. When you break down your goal into more manageable tasks, it becomes easier to track your progress and stay motivated along the way.

By setting smaller milestones, you can create a clear roadmap towards your financial target. Each milestone represents a mini goal that you can work towards, making your overall objective seem less daunting and more attainable. These milestones act as stepping stones towards your ultimate savings goal.

One approach for breaking down your goal is to set specific savings targets for different time periods. For example, you could establish a monthly or weekly savings target and strive to meet or exceed that amount consistently. By focusing on short-term targets, you can maintain a sense of accomplishment and momentum as you work towards your larger objective.

Another way to break down your goal is to identify specific actions or habits that will contribute to your savings plan. For instance, you could aim to reduce unnecessary expenses, increase your income, or automate your savings contributions. These actionable steps can help you gradually build up your savings and ensure that you are making consistent progress.

Tracking your progress towards each milestone is crucial for staying on track and adjusting your approach if necessary. Regularly evaluate your savings plan, reassess your milestones, and make any necessary modifications to keep yourself motivated and accountable.

- Set short-term savings targets to stay motivated

- Identify actionable steps that contribute to your savings

- Regularly track your progress and make adjustments accordingly

Breaking down your goal into smaller milestones is an important strategy for building a successful savings plan. By setting achievable targets and taking consistent actions, you can make significant progress towards your ultimate financial objective.

Track your progress regularly

Monitoring your progress regularly is essential for successfully developing and maintaining a solid savings strategy. By regularly assessing how you are progressing towards your savings goals, you can make adjustments and stay motivated to achieve financial success.

Stay on track:

Regularly reviewing your savings plan allows you to stay focused on your financial goals. By tracking your progress, you can identify any areas where you may be falling behind or where adjustments need to be made. This will help you make informed decisions about your finances and ensure that you are staying on track.

Measure your milestones:

Tracking your progress also allows you to measure milestones and celebrate achievements along the way. Break down your savings goals into smaller milestones and regularly evaluate your progress towards them. This will give you a sense of accomplishment and motivation to continue working towards your ultimate goals.

Identify areas for improvement:

Regularly tracking your progress enables you to identify areas for improvement in your savings plan. If you notice that you are not saving as much as you had initially planned, you can analyze your spending habits and make necessary adjustments. By being aware of any shortcomings, you can take proactive steps to improve and optimize your savings plan.

Stay motivated:

Another benefit of tracking your progress regularly is the ability to stay motivated. Seeing your savings grow over time and witnessing the progress you have made in reaching your goals can be incredibly rewarding. Use this as a source of inspiration to continue saving diligently and make your financial dreams a reality.

In conclusion, regularly tracking your progress is crucial for building and maintaining a successful savings plan. By staying on track, measuring milestones, identifying areas for improvement, and staying motivated, you can make the most of your savings journey and achieve long-term financial stability.

Determine Your Budget

Setting a clear budget is essential when it comes to attaining financial success. By determining your budget, you can effectively manage your expenses and allocate your money wisely. Having a budget provides you with a roadmap for reaching your financial goals and helps you make informed decisions about your spending habits.

To create a budget, start by evaluating your current income and expenses. Take a close look at your monthly income and list down all your sources of revenue. This could include your salary, investments, or any other sources of income. Next, analyze your expenses by categorizing them into fixed expenses (such as rent or mortgage payments, utilities, and insurance) and variable expenses (such as groceries, entertainment, and transportation).

Once you have a clear understanding of your income and expenses, it’s time to designate amounts for each category. Consider your financial goals and priorities, and decide how much you want to allocate to savings, debt payments, and other necessary expenditures. Be realistic and aim to save a portion of your income while also allowing for some flexibility in your budget for unexpected expenses.

Creating a budget is not a one-time process. It requires regular monitoring and adjustments based on your changing financial circumstances. Review your budget periodically to ensure that you are staying on track and making progress towards your savings goals. If necessary, make adjustments to your spending habits and reallocate funds between categories to achieve a more balanced and efficient budget.

- Start by determining your budget based on your current income and expenses.

- Categorize your expenses into fixed and variable categories.

- Allocate amounts for each category based on your financial goals and priorities.

- Regularly monitor and adjust your budget as needed.

By determining your budget and sticking to it, you can take control of your finances and pave the way for a successful savings plan.

Analyze your income and expenses

Examining your earnings and expenditures is a crucial step towards developing a solid financial strategy. By thoroughly assessing your income and expenses, you can gain valuable insights into your financial habits and identify potential areas for improvement.

Firstly, it is essential to comprehensively evaluate your sources of income. This involves examining not only your primary salary or wages but also any additional income streams such as freelance work, investments, or rental properties. Understanding the total amount of money flowing into your accounts will give you a clearer picture of your financial situation.

Equally important is examining your expenses. Closely analyze your various spending categories, including fixed expenses like rent or mortgage payments, utilities, and insurance premiums. Additionally, take into account variable expenses such as groceries, transportation, entertainment, and discretionary purchases. Identifying where your money is going will enable you to prioritize your spending and make adjustments if necessary.

Once you have a thorough understanding of your income and expenses, consider categorizing them further. This can help you identify patterns and trends that may be impacting your ability to save effectively. For example, grouping your expenses into categories such as housing, transportation, food, and entertainment can highlight areas where you may be overspending or where potential savings opportunities exist.

Furthermore, it is crucial to differentiate between essential and non-essential expenses. While some costs, like basic necessities, are unavoidable, others may be discretionary and can potentially be reduced or eliminated. Evaluating your expenses in this manner allows you to focus on optimizing essential spending while minimizing non-essential outlays to maximize your potential for saving.

By carefully analyzing your income and expenses, you can gain a clearer understanding of your financial situation and identify areas for improvement. This knowledge forms the foundation for building a successful savings plan that aligns with your financial goals and aspirations.

Identify areas where you can cut back

Discovering ways to reduce expenses and save money is a vital aspect of building an effective financial plan. By analyzing your spending habits and identifying areas where you can trim unnecessary costs, you can free up extra funds for savings.

One crucial step in this process is to review your monthly expenses thoroughly. Carefully examine your bills, receipts, and bank statements to gain a comprehensive understanding of where your money goes every month. Take note of any recurring expenses that seem excessive or unnecessary.

Once you have a clear picture of your spending patterns, it’s time to assess each category and find potential areas for cutbacks. Look for synonyms like reduce, trim, or curtail to diversify the text and avoid repetition. For example, you could consider cutting back on dining out or entertainment expenses, searching for cheaper alternatives for your everyday necessities, or finding ways to save on transportation costs.

| Categories | Potential Cutbacks |

|---|---|

| Groceries | Consider purchasing generic brands or buying in bulk to save money on food expenses. |

| Utilities | Find ways to reduce energy consumption, such as using energy-efficient appliances or adjusting thermostat settings. |

| Transportation | Explore carpooling, public transportation, or cycling as alternatives to driving alone, reducing gas and parking expenses. |

| Entertainment | Limit dining out, attending pricey events, or subscribing to multiple streaming services. Look for free or low-cost alternatives for entertainment. |

It’s essential to be realistic and select cutbacks that won’t significantly impact your quality of life. Start with small adjustments and gradually increase your savings goals over time.

By identifying areas where you can cut back and making conscious decisions to reduce expenses, you’ll be well on your way to building a successful savings plan.

Create a Realistic Budget Plan

In order to achieve financial success and meet your savings goals, it is crucial to establish a realistic budget plan. A budget plan serves as a road map for your finances, helping you track your income and expenses, prioritize your spending, and make informed choices about where to allocate your money.

When creating a budget plan, it is important to accurately assess your current financial situation. This involves calculating your total income from all sources and identifying your regular expenses, such as rent or mortgage payments, utility bills, transportation costs, and groceries. It is also essential to consider any irregular expenses that may arise periodically, such as car repairs or medical bills.

Once you have a clear understanding of your income and expenses, it is time to set your financial goals. These goals can include saving a certain percentage of your income, paying off debts, or building an emergency fund. It is important to set realistic and achievable goals that align with your current financial situation.

Next, you can begin allocating your income to different spending categories. It is advisable to prioritize essential expenses, such as housing and utilities, before allocating money for discretionary spending. This way, you can ensure that your basic needs are met before indulging in non-essential purchases.

A helpful tool to assist in budgeting is the use of budgeting apps or spreadsheets. These tools can automatically track your income and expenses, making it easier to visualize your spending habits and identify areas where you can save money. Additionally, keeping track of your expenses on a daily or weekly basis can help you stay accountable and make adjustments if necessary.

Remember, creating a budget plan is not a one-time task. It requires regular review and adjustment as your financial situation changes. By actively managing your budget and making informed financial choices, you can build a solid foundation for achieving your savings goals and ensuring long-term financial stability.

Automate Your Savings

Simplify the process of saving money by automating your savings. By setting up automatic transfers from your checking account to your savings account, you can effortlessly build your savings without having to think about it. This method ensures that a portion of your income is regularly allocated to your savings, allowing you to consistently grow your financial reserves.

Instead of manually transferring money to your savings account each month, automation takes the guesswork out of saving. It eliminates the possibility of forgetting or neglecting to save, making it easier to stay on track with your financial goals. By setting up automatic transfers, you prioritize saving and make it a seamless part of your financial routine.

Furthermore, automating your savings can help you resist the temptation to spend money impulsively. Since the transferred funds are out of immediate reach in your savings account, you are less likely to dip into them for unnecessary expenses. This method promotes financial discipline and helps you maintain a focused approach to saving.

- Review your budget and determine the amount you can comfortably save each month.

- Contact your bank or financial institution to set up automatic transfers from your checking to your savings account.

- Choose a specific date each month for the transfer to ensure consistency.

- Monitor your savings regularly to track your progress and make adjustments if necessary.

- Consider increasing the amount of the automatic transfer as your financial situation improves to accelerate your savings growth.

By automating your savings, you create a structured and efficient system for building wealth. It simplifies the saving process and helps you stay committed to your financial goals. Start automating your savings today and watch your funds grow without even lifting a finger!

Set up automatic transfers to your savings account

Facilitating regular automatic transfers to your designated savings account is a smart and effortless way to bolster your savings. By automating this process, you eliminate the need for manual transfers, making it convenient and hassle-free to contribute to your savings consistently. By setting up automatic transfers, you can establish a reliable savings routine, ensuring that a portion of your income is allocated towards your savings goals without fail.

Automatic transfers enable you to prioritize saving without the risk of forgetting or being tempted to spend the funds elsewhere. This method helps cultivate discipline and ensures that you consistently put money away for future financial security or specific goals such as purchasing a house, saving for retirement, or even enjoying a well-deserved vacation.

Additionally, automating your savings transfers allows you to take advantage of the pay yourself first principle. By diverting a portion of your income to your savings account before allocating money for expenses or discretionary spending, you establish a firm financial foundation. This approach places your savings as a priority, ensuring that money is set aside for your future before it gets consumed by other financial obligations.

Another benefit of setting up automatic transfers is the ease it brings to your financial planning. With a predetermined amount set aside regularly, you can map out future savings goals more accurately. Whether you choose to transfer a fixed amount or a percentage of your income, automating the transfer provides consistency and predictability, allowing you to better gauge your progress towards achieving your savings objectives.

Setting up automatic transfers can also help curb impulsive spending. By immediately moving a portion of your income into savings, you reduce the temptation to use those funds for unnecessary purchases. As a result, you become more mindful of your spending habits and develop a heightened sense of financial responsibility, which, in turn, strengthens your savings strategy and increases the potential for long-term financial success.

Choose a specific amount or percentage to save

Deciding on a fixed amount or percentage to save is a crucial step towards building a successful savings plan. By setting a specific target, you create a clear and tangible goal to work towards.

When determining the amount or percentage to save, it is important to consider your current financial situation, income, and expenses. It is recommended to analyze your budget and prioritize your financial goals to determine what is feasible for you.

Choosing a specific amount to save allows you to have a clear understanding of how much money you need to set aside from each paycheck or month. This helps you track your progress and stay accountable to your savings goals.

Alternatively, you can opt for saving a fixed percentage of your income. This approach ensures that your savings grow proportionally with your earnings, allowing you to maintain a consistent savings habit even if your income varies.

It is worth noting that the amount or percentage you choose to save should be challenging but realistic. Striking a balance between saving efficiently and maintaining a comfortable lifestyle is key to staying motivated and committed to your savings plan.

In conclusion, choosing a specific amount or percentage to save provides a clear target and helps you stay on track towards achieving your financial goals. Whether you opt for a fixed amount or a percentage, finding the right balance is vital for building a successful savings plan.

Ensure you have a separate savings account

Creating a dedicated savings account is imperative when it comes to building a successful financial plan. Having a separate account specifically for savings helps you keep track of your progress and separates your savings from your everyday expenses.

By having a separate savings account, you are able to set clear boundaries between your spending and your savings. This ensures that you are not tempted to use your savings for unnecessary expenses or impulse purchases. It also allows you to easily monitor your savings growth and hold yourself accountable to your savings goals.

Not only does a separate savings account provide a physical distinction between your spending and saving habits, but it also helps to establish a psychological separation. With a dedicated account, your savings become a tangible and concrete representation of your financial goals.

Furthermore, a separate savings account grants you the opportunity to make the most out of interest rates and investment opportunities. Many banks offer higher interest rates on savings accounts than on regular checking accounts, meaning your money can grow faster by simply having it in a savings account.

Lastly, having a separate savings account provides you with a sense of security and peace of mind. Knowing that you have a designated safety net in case of emergencies or unexpected expenses can alleviate financial stress and give you confidence in your ability to tackle future financial challenges.

All in all, establishing a separate savings account is an essential step in building a successful savings plan. It creates a clear separation between your spending and saving habits, allows you to track your progress, and provides financial security for the future.

Maximize Your Savings

Discover effective strategies to optimize your savings and make the most out of your financial goals. By implementing a variety of tactics and approaches, you can enhance your savings potential and achieve greater financial security.

- 1. Set Clear Objectives: Clearly define your savings goals and establish a timeframe for achieving them. Setting specific targets will help you stay focused and motivated along the way.

- 2. Develop a Budget: Creating a comprehensive budget is essential for maximizing your savings. By tracking your income and expenses, you can identify areas where you can cut back or reallocate funds towards your savings.

- 3. Embrace Frugality: Emphasize frugal living by adopting cost-saving habits and making conscious spending decisions. Prioritize needs over wants and find creative ways to stretch your budget without sacrificing quality of life.

- 4. Automate Savings: Take advantage of automation tools provided by your bank to regularly transfer a portion of your income into a dedicated savings account. This helps you save consistently without relying solely on willpower.

- 5. Cut Unnecessary Expenses: Identify unnecessary or excessive expenses that can be eliminated or reduced. This could include subscriptions, dining out, and impulse purchases. Redirect the money saved towards your savings account.

- 6. Seek Professional Advice: Consult with a financial advisor to develop a personalized savings strategy based on your unique circumstances. They can provide expert guidance and recommend investment opportunities to accelerate your savings growth.

- 7. Explore Additional Income Streams: Look for ways to supplement your main source of income by taking on side gigs or freelance work. This extra income can be allocated towards your savings, boosting your progress.

- 8. Review and Adjust: Regularly review your savings plan and make adjustments as needed. Changes in circumstances or financial goals may require you to modify your approach to ensure continued success.

By implementing these strategies and taking control of your finances, you can maximize your savings and pave the way for a more secure and prosperous future.

Questions and answers

What are some effective tips for building a successful savings plan?

Some effective tips for building a successful savings plan include setting specific savings goals, creating a budget, cutting unnecessary expenses, automating savings, and finding additional sources of income.

How can I set specific savings goals?

To set specific savings goals, you need to determine exactly what you are saving for, whether it’s a down payment for a house, a vacation, or an emergency fund. Once you have identified your goals, you can calculate how much money you need to save and set a timeline for achieving them.

What are some strategies for cutting unnecessary expenses?

There are several strategies for cutting unnecessary expenses. These include canceling unused subscriptions, reducing eating out and entertainment expenses, shopping with a list, and negotiating bills and expenses. By identifying and eliminating unnecessary expenses, you can free up additional funds to put towards your savings plan.

How can I automate my savings?

To automate your savings, you can set up automatic transfers from your checking account to your savings account. This way, a portion of your income will be automatically deposited into your savings without you having to remember to do it manually. Automating your savings can help you stay consistent and make saving a habit.

What are some additional sources of income that can help with building a successful savings plan?

There are several additional sources of income that can help with building a successful savings plan. These can include finding a side job or freelance work, renting out a spare room or property, starting a small business, or investing in stocks or real estate. These additional sources of income can supplement your regular income and accelerate your savings growth.

What are some effective tips for building a successful savings plan?

Building a successful savings plan involves several key strategies. Firstly, create a budget to track your income and expenses, and identify areas where you can cut back. Secondly, set specific savings goals and establish a timeline for achieving them. Thirdly, automate your savings by setting up automatic transfers from your checking account to a savings account. Additionally, consider reducing debt to free up more money for savings, and try to increase your income through side hustles or additional employment.

How can creating a budget help in building a successful savings plan?

Creating a budget is essential for building a successful savings plan. It allows you to track your income and expenses, identify areas where you are overspending, and make necessary adjustments to increase your savings. By setting a budget, you can allocate a specific amount of money towards savings each month, which helps you stay on track towards your financial goals.

Why is automating your savings important for a successful savings plan?

Automating your savings is crucial for a successful savings plan because it takes the temptation out of spending the money. By setting up automatic transfers from your checking account to a savings account, a predetermined amount of money is saved without any effort on your part. This ensures that you consistently save money and prevents you from using it for unnecessary expenses.

Is it necessary to reduce debt in order to build a successful savings plan?

Reducing debt is highly recommended when building a successful savings plan. The more debt you have, the more money you are paying in interest, which decreases the amount you can save. By prioritizing debt repayment, you will free up more money in your budget, allowing you to save a larger portion of your income towards your financial goals.

What are some ways to increase income to accelerate savings?

Increasing your income is a great way to accelerate savings. You can consider taking on a part-time job or starting a side hustle to earn extra money. Additionally, you could explore opportunities for career advancement or seek a higher-paying job. Cutting back on non-essential expenses and redirecting that money towards savings is also a way to increase your overall savings.