Are you constantly struggling to keep your finances in order? Do you find it challenging to keep track of your expenses and manage your income effectively? It’s time to take control of your financial life with the help of a powerful budget planner.

Introducing an innovative solution that will revolutionize the way you handle your money – an easy-to-use template tailored specifically for your budgeting needs. Designed to simplify the complex world of financial planning, this template will empower you to make informed decisions and achieve your financial goals.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

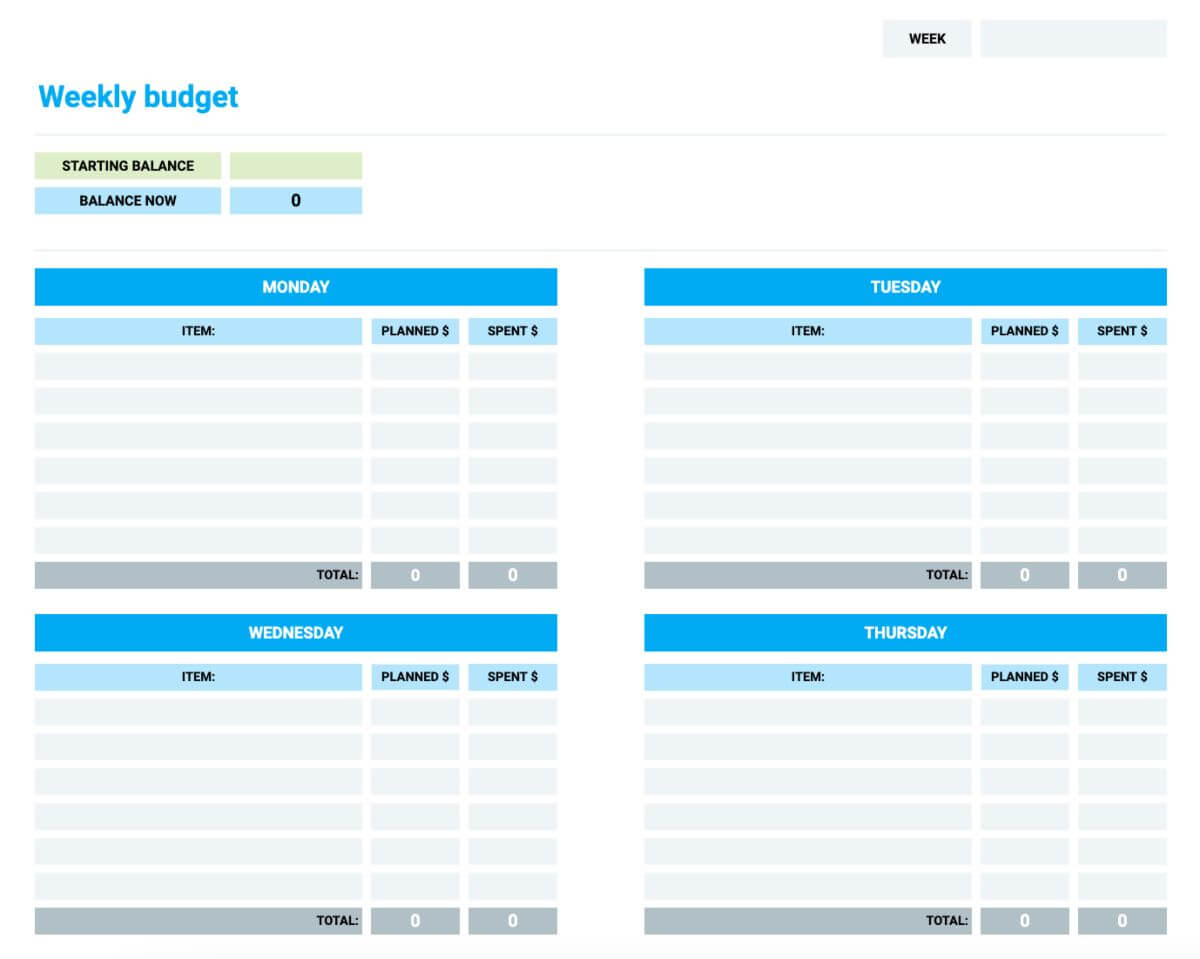

Learn MoreWith this intuitive budget planner, you can effortlessly monitor your income, categorize your expenses, and track your savings. Whether you’re saving up for a dream vacation, building an emergency fund, or aiming to pay off debts, this tool will ensure that you stay on top of your finances and maintain a healthy budget.

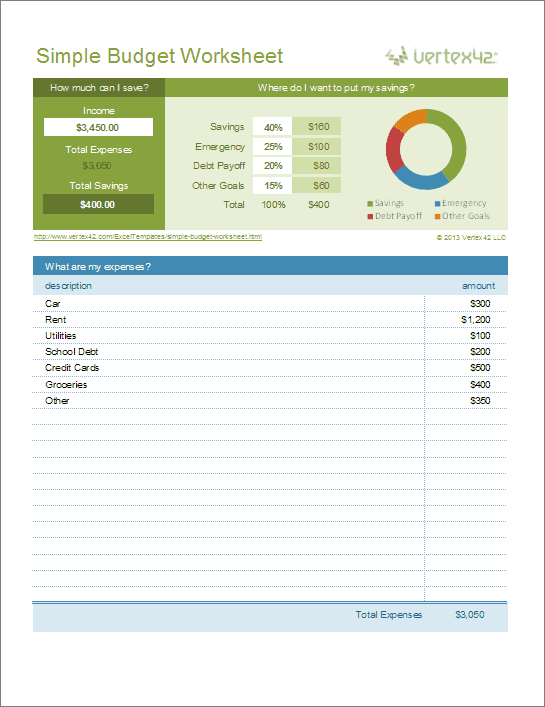

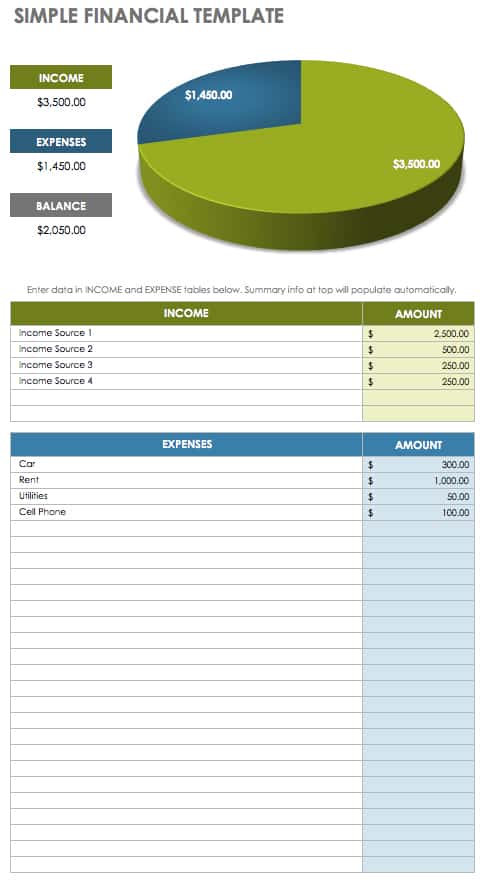

Forget about the time-consuming and error-prone manual calculations. This cutting-edge template will do all the heavy lifting for you, allowing you to focus on what matters most – taking charge of your financial future. It will provide you with accurate reports, insightful graphs, and customizable features, enabling you to have a clear overview of your financial status at all times.

Don’t let financial stress hold you back from living your best life. Take advantage of this groundbreaking budget planner template and embark on a journey towards financial freedom. Prepare to say goodbye to financial worries and hello to a more secure and prosperous future.

- Simplify Your Financial Planning

- Save Time and Effort

- Streamline Your Budgeting Process

- Automate Your Expense Tracking

- Stay Organized with a Digital Solution

- Take Control of Your Finances

- Create a Personalized Budget Plan

- Set Realistic Financial Goals

- Track Your Progress and Adjust Accordingly

- Easy-to-Use Budget Planner Template

- Customize Categories and Expenses

- Effortlessly Calculate Income and Expenses

- Visualize Your Financial Data with Graphs and Charts

- Questions and answers

Simplify Your Financial Planning

Streamline and streamline your financial management with the help of an all-in-one tool that takes the complexity out of tracking your finances. By utilizing a budget planner template designed specifically for your needs, you can effortlessly keep tabs on your income, expenses, and financial goals, allowing you to make educated decisions and achieve financial stability.

Eliminate the hassle of manual spreadsheets and complicated formulas, and let the budget planner template do the work for you. With its user-friendly interface and intuitive features, you’ll be able to easily visualize your financial situation and identify areas where you can save or invest. Whether you’re a seasoned pro or new to budgeting, this template provides a simplified approach to financial planning that anyone can understand.

Take control of your finances and gain a clearer understanding of your financial health. The budget planner template allows you to track your income and expenses in one place, making it easier to monitor your cash flow and identify potential areas of improvement. With a wide range of customizable categories and subcategories, you can tailor the template to suit your specific needs and track your spending habits with precision.

Set realistic financial goals and track your progress with ease. The budget planner template provides a comprehensive overview of your financial goals, allowing you to set targets and monitor your progress over time. Whether you’re saving for a vacation, paying off debt, or planning for retirement, this template can help you stay on track and achieve your goals faster.

With the budget planner template, you no longer have to worry about missing deadlines or forgetting important financial responsibilities. Stay organized with built-in reminders and notifications, ensuring you never miss a bill payment or an opportunity to save. By automating these tasks, you can focus on what’s truly important – achieving your financial dreams.

Don’t let financial planning overwhelm you. Simplify your approach with a budget planner template and take control of your financial future. From tracking your income and expenses to setting and achieving financial goals, this all-in-one tool can help you navigate the complexities of personal finance with ease.

Save Time and Effort

Efficiency and productivity are key factors when it comes to managing your finances. With the right tools and techniques, you can simplify and streamline the process, saving valuable time and effort.

Avoid the hassle of manually tracking your expenses and creating complex financial plans. Our budget planner template offers an easy-to-use solution that saves you time and effort. By utilizing a pre-designed template, you eliminate the need to start from scratch, allowing you to focus on what truly matters – your financial goals.

With the budget planner template, you can quickly and accurately track your income, expenses, and savings. The template provides a structured format that helps you organize your finances, making it easier to identify areas where you can cut back on spending or increase your savings. By doing so, you can optimize your financial planning process and achieve your goals more efficiently.

In addition to providing a structured format, utilizing a budget planner template allows you to automate certain aspects of your financial planning. By simply inputting your income and expenses, the template can generate visual representations of your cash flow, allowing you to easily identify patterns or discrepancies. This automation saves you time and effort, freeing you up to focus on other important aspects of your life.

Furthermore, the budget planner template can assist with forecasting and goal setting. By inputting your financial goals, the template can calculate the necessary savings or investments required to achieve them. This proactive approach saves you time and effort in determining the steps needed to reach your objectives, allowing you to make informed decisions and take action more efficiently.

Overall, the budget planner template offers a time-saving solution to simplify your financial planning process. By utilizing this tool, you can automate certain tasks, organize your finances effectively, and optimize your decision-making. With more time and less effort spent on financial planning, you can focus on enjoying the present and building a secure future.

Streamline Your Budgeting Process

Enhance the efficiency of managing your financial resources by simplifying and streamlining your budgeting process. By utilizing effective strategies and tools, you can optimize your budgeting efforts and achieve better control over your finances.

- Implementing a systematic approach to budgeting can help you organize and prioritize your expenses effectively.

- Utilize a budget planning template to establish clear financial goals and allocate your income towards essential expenses, savings, and investments.

- By tracking your spending habits and analyzing your financial data regularly, you can identify areas where you can reduce expenses and save money.

- Automate your budgeting process by utilizing digital tools and apps that allow you to manage and monitor your finances conveniently.

- Consider consolidating your financial accounts and subscriptions to simplify your financial management process and gain a clear overview of your financial situation.

- Establish an emergency fund to ensure you have a financial safety net in case of unexpected expenses or income disruptions.

- Review and adjust your budget periodically to accommodate any changes in your financial circumstances or goals.

By streamlining your budgeting process, you can alleviate stress, improve your financial decision-making, and ultimately achieve a stronger financial future. Start implementing these strategies today and witness the positive impact on your financial well-being.

Automate Your Expense Tracking

In today’s fast-paced world, managing your finances can often feel like a daunting task. Keeping track of expenses, calculating budgets, and staying on top of your financial goals can become overwhelming. However, with the advancement of technology, automating your expense tracking has never been easier.

By automating your expense tracking, you can streamline the process of monitoring and categorizing your spending. Instead of manually recording every transaction, you can utilize software or apps that automatically track your expenses and generate detailed reports. This not only saves you time and effort but also ensures accuracy in recording your financial information.

Automated expense tracking also provides you with a comprehensive overview of your spending habits. The software can categorize your expenses into different categories such as groceries, transportation, entertainment, and more. With this information at your fingertips, you can easily identify areas where you may be overspending and make necessary adjustments to stay within budget.

Additionally, automating your expense tracking allows you to easily analyze your spending patterns and trends. By generating customized reports and visualizing your financial data, you can gain valuable insights into your financial habits. These insights can help you make informed decisions, set realistic financial goals, and develop effective strategies to achieve them.

| Benefits of Automating Your Expense Tracking |

|---|

| Time-saving |

| Increased accuracy |

| Comprehensive overview of spending |

| Identify areas of overspending |

| Gain insights into spending patterns |

In conclusion, automating your expense tracking can simplify your financial management process and provide you with valuable insights into your spending habits. By utilizing modern technology, you can save time, increase accuracy, and make informed financial decisions. Take advantage of the various software and apps available today to streamline your expense tracking and take control of your finances.

Stay Organized with a Digital Solution

Managing your finances can be a daunting task, but it doesn’t have to be. Embracing a digital solution can be the key to staying organized and on top of your financial planning. By utilizing the benefits of technology, you can simplify and streamline your budgeting process, ensuring that you have a clear overview of your financial situation at all times.

Take Control of Your Finances

Empower yourself with the ability to manage your money effectively and efficiently. By gaining control of your finances, you can make informed decisions, achieve your financial goals, and live a more stress-free life.

Get a grasp on your financial situation by creating a comprehensive budget that outlines your income, expenses, and savings. Establishing a budget allows you to track your spending, identify potential areas for improvement, and make adjustments as needed. With a clear understanding of your financial inflows and outflows, you can make informed decisions about where to allocate your funds.

Organize your finances by categorizing your expenses into different types, such as housing, transportation, groceries, and entertainment. This will enable you to identify any overspending in specific areas, allowing you to make necessary adjustments to stay within your budget. Visualizing your expenses through charts or graphs can also be helpful in identifying patterns and areas for improvement.

Set realistic financial goals to help guide your budgeting efforts. Whether it’s saving for a down payment on a house, paying off debt, or building an emergency fund, having specific goals in mind will motivate you to stick to your budget and make necessary sacrifices. Break down larger goals into smaller milestones to make them more attainable and celebrate each milestone as you achieve it.

- Track your expenses: Keep a record of all your expenditures to ensure that they align with your budget. This will help you identify any unnecessary spending and make adjustments accordingly.

- Review and adjust: Periodically review your budget to ensure it remains relevant and accurate. Life circumstances change, and your budget should adapt accordingly.

- Seek professional advice: If you’re struggling to take control of your finances, consider consulting with a financial advisor who can provide expert guidance tailored to your specific situation.

- Stay disciplined: Establishing good financial habits takes time and discipline. Stick to your budget and resist the temptation of impulsive spending to achieve long-term financial stability.

Remember, taking control of your finances is a journey, and it requires dedication and perseverance. Embrace the process and enjoy the peace of mind that comes with knowing you are in control of your financial future.

Create a Personalized Budget Plan

Achieving financial stability begins with a personalized budget plan tailored to your unique financial situation. By crafting a budget plan that caters to your individual needs and goals, you can gain control over your finances and make informed decisions about how to allocate your income.

Identify your financial goals: Before creating a budget plan, it is essential to define your short-term and long-term financial goals. Consider objectives such as saving for a comfortable retirement, paying off debt, or funding a dream vacation. Once you have a clear vision of what you want to achieve, you can align your budget plan accordingly.

Track your income and expenses: Begin by evaluating your current income sources and the amount of money you earn each month. Next, analyze your expenses – both regular and irregular. It is crucial to distinguish between essential expenses, such as housing and utilities, and discretionary expenses, such as entertainment or dining out. Understanding the breakdown of your income and expenses will help you determine where adjustments can be made.

Create budget categories: Categorize your expenses into specific categories, such as groceries, transportation, housing, debt repayment, and savings. This categorization will provide a clear overview of how much money you spend in each area and enable you to identify areas where you may be overspending or where you could potentially save.

Set realistic spending limits: Based on your income and expenses, it’s crucial to set realistic spending limits for each budget category. Consider adjusting your discretionary spending to align with your financial goals. Be mindful of your current financial situation and be willing to make necessary sacrifices to stay within your budget.

Track your progress regularly: Monitoring your budget plan regularly is vital for its success. Keep track of your expenses and compare them to your set spending limits. By staying accountable to your budget, you can identify any potential issues or areas for improvement and make adjustments accordingly.

Review and revise your budget plan: As life circumstances and financial goals change, it is important to review and revise your budget plan accordingly. Regularly assess your budget to ensure it aligns with your evolving needs and aspirations. Adjustments may be necessary to accommodate changes in income, expenses, or financial priorities.

In conclusion, creating a personalized budget plan allows you to take control of your financial journey and work towards achieving your financial goals. By identifying your objectives, tracking your income and expenses, setting spending limits, and regularly reviewing your budget plan, you can make informed and responsible financial decisions, leading to a more secure and prosperous future.

Set Realistic Financial Goals

When it comes to managing your finances effectively, it is essential to set realistic financial goals. These goals serve as a roadmap to help you achieve your desired financial outcomes and create a secure financial future. By defining clear and attainable milestones, you can stay motivated, track your progress, and make informed financial decisions based on your priorities.

One key aspect of setting realistic financial goals is understanding your financial situation. Assess your current income, expenses, debts, and savings to gain a comprehensive picture of your financial health. This evaluation will help you determine where you stand and identify areas that require improvement or adjustment.

- Identify your priorities: Consider your short-term and long-term financial aspirations. Are you planning for a major purchase, such as a house or a car? Or are you focused on building an emergency fund or saving for retirement? Different goals require different strategies, so it’s important to prioritize them based on their significance to your overall financial well-being.

- Make your goals specific: Instead of vague goals like save money or reduce debt, make your goals specific and measurable. For instance, aim to save a certain amount each month or pay off a specific credit card balance within a set timeframe. This specificity will make it easier to track your progress and maintain a sense of achievement as you reach each milestone.

- Set achievable targets: While it’s great to dream big, it’s also crucial to set practical and attainable financial goals. Consider your current income, expenses, and lifestyle when establishing targets. Setting goals that are too ambitious or unrealistic can lead to frustration and disappointment, potentially derailing your financial progress.

- Break down your goals into actionable steps: Divide your long-term goals into smaller, manageable steps. This approach allows you to focus on incremental achievements and prevents overwhelm. For example, if your goal is to save a significant amount for a down payment on a house, break it down into monthly savings targets. This way, you can consistently work towards your larger objective without feeling overwhelmed by the magnitude of the task.

- Track and reassess: Regularly monitor your progress towards your financial goals and make adjustments as necessary. Life circumstances and priorities may change over time, and it’s important to adapt your goals accordingly. By keeping track of your finances and reviewing your goals periodically, you can ensure that they remain relevant and aligned with your evolving needs and aspirations.

Setting realistic financial goals provides a clear vision of what you want to achieve and helps you stay focused on your financial journey. By following these steps and regularly reviewing your progress, you can make informed decisions, stay motivated, and work towards a more secure and prosperous financial future.

Track Your Progress and Adjust Accordingly

Monitoring your progress and making appropriate adjustments is essential for successful financial planning. By regularly tracking your financial goals and expenses, you can stay on top of your budget and make informed decisions to improve your financial situation.

Start by setting specific financial goals that align with your long-term aspirations. Whether it’s saving for a vacation, paying off debt, or building an emergency fund, having clear objectives gives you a sense of direction and purpose. Break down these goals into smaller, manageable targets, and track your progress towards achieving them.

Keep a record of your income and expenses to gain a better understanding of your financial habits. Utilize a detailed spreadsheet, a budget tracking app, or a simple pen and paper system to categorize and monitor your spending. This will help you identify areas where you can cut back on unnecessary expenses and allocate more funds towards your financial goals.

Regularly review your budget to determine if any adjustments need to be made. Life circumstances, such as changes in income or unexpected expenses, may require you to modify your financial plan. By regularly assessing your budget, you can ensure that it remains realistic and aligned with your current situation.

In addition to tracking your progress, it’s important to celebrate your achievements along the way. Recognize and reward yourself when you reach important milestones or exceed your financial targets. This positive reinforcement will motivate you to continue working towards your goals and maintain the discipline required for effective financial planning.

- Set specific financial goals that align with your aspirations.

- Break down goals into smaller targets and track your progress.

- Monitor your income and expenses using a budget tracking system.

- Identify areas where you can cut back and allocate more funds towards goals.

- Regularly review and adjust your budget as needed.

- Celebrate achievements and milestones along the way.

By continuously tracking your progress and adjusting your financial plan accordingly, you’ll be able to stay on track towards achieving your long-term financial goals. Remember that financial planning is a dynamic process that requires flexibility and adaptability.

Easy-to-Use Budget Planner Template

Effortlessly manage your finances with our user-friendly budget planner template. This comprehensive tool is designed to simplify the process of organizing your expenses and income, allowing you to effectively track your financial goals without any hassle.

With our easy-to-use template, you can effortlessly create a personalized budget plan tailored to your specific needs. The intuitive interface and clear layout make it simple to input your financial information and analyze your spending habits. This user-friendly approach ensures that you can stay on top of your finances without feeling overwhelmed by complex calculations or confusing terminology.

- Accurately track your income and expenses.

- Set realistic financial goals and monitor your progress.

- Easily categorize and prioritize your expenses.

- Visualize your budget with clear charts and graphs.

- Create customized reports to gain insights into your financial habits.

- Efficiently plan for future expenses and savings.

Whether you’re a budgeting pro or just getting started on your financial journey, our easy-to-use budget planner template is the perfect tool to simplify your financial management. Take control of your money and achieve your financial goals effortlessly with this intuitive and accessible template.

Customize Categories and Expenses

In this section, we will explore the flexibility and adaptability of the budget planner template by discussing how you can customize categories and expenses. By tailoring your budget to your individual needs and preferences, you can effectively track and manage your financial goals.

One of the key advantages of using a budget planner template is its ability to accommodate a wide range of categories and expenses. Instead of being limited to pre-determined categories, you have the freedom to create and modify categories based on your unique financial situation. This customization allows you to categorize your expenses in a way that makes the most sense to you, enabling better organization and analysis of your spending habits.

Additionally, the budget planner template allows you to personalize your expenses by assigning specific amounts to each category. This level of customization gives you greater control over your finances, allowing you to allocate funds according to your priorities and financial goals. Whether you want to emphasize savings, debt repayment, or specific spending categories, the flexibility of the template ensures that you have the tools to create a budget that aligns with your individual financial objectives.

- By customizing categories and expenses, you can create a budget that reflects your unique financial situation.

- Tailoring your budget allows for better organization and analysis of your spending habits.

- Personalizing your expenses allows you to allocate funds according to your priorities and financial goals.

Overall, customizing categories and expenses in your budget planner template empowers you to take control of your finances and make informed financial decisions. By adapting the template to suit your individual needs, you can simplify and enhance your financial planning process.

Effortlessly Calculate Income and Expenses

Managing your finances can be a daunting task, requiring careful consideration of income and expenses. However, with the help of a budget planner template, you can simplify the process and effortlessly calculate your financial state. By utilizing this tool, you can efficiently track your income and expenses, ensuring that you are always aware of your financial situation.

With the budget planner template, you can conveniently input your various sources of income, such as your salary, freelance earnings, or investment returns. This template allows you to categorize and organize your income, making it easier to comprehensively assess your financial inflows.

In addition to income, it is crucial to keep track of your expenses to maintain a balanced financial plan. The budget planner template enables you to categorize and monitor your expenses, including essential costs like rent or mortgage payments, utilities, groceries, transportation, and discretionary spending. By accurately tracking your expenses, you can identify areas for potential savings and make informed financial decisions.

The budget planner template provides a comprehensive overview of your financial situation, allowing you to effortlessly calculate and analyze your income and expenses. This tool helps you gain a clear understanding of where your money is going and how much you are saving. With accurate calculations, you can better manage your finances and make informed decisions about investments, savings goals, and spending habits.

In conclusion, utilizing a budget planner template allows you to effortlessly calculate and manage your income and expenses. By having a clear understanding of your financial state, you can make informed decisions to achieve your financial goals and maintain a balanced financial plan.

Visualize Your Financial Data with Graphs and Charts

Enhance your understanding of your financial situation and track your progress towards your financial goals with the help of graphs and charts. These visual representations of your financial data provide a clear and easy-to-understand overview of your income, expenses, savings, and investments.

By using graphs and charts, you can quickly identify trends and patterns in your financial data, allowing you to make informed decisions about your budget and financial planning. Visualizing your data in this way can make it easier to identify areas where you can cut back on expenses, increase savings, or invest more strategically.

There are various types of graphs and charts that you can use to visualize your financial data. Pie charts are great for illustrating your expenses and showing which categories consume the most of your budget. Bar and line graphs can be used to compare your income and expenses over different time periods, allowing you to see how your financial situation has changed over time.

In addition to providing a comprehensive view of your financial data, graphs and charts can also help you set and track financial goals. You can create a graph that shows your progress towards a specific savings goal, making it easier to stay motivated and on track.

Furthermore, sharing your financial graphs and charts with a financial advisor or spouse can facilitate discussions about your financial health and help in making joint financial decisions. These visual aids can simplify complex financial concepts and make them more accessible to everyone involved.

Overall, visualizing your financial data with graphs and charts can greatly enhance your financial planning and decision-making process. It allows you to see your financial situation from a different perspective, identify opportunities for improvement, and track your progress towards your financial goals. Incorporating these visual aids into your budgeting and financial management toolkit can ultimately lead to a more secure and successful financial future.

Questions and answers

What is a budget planner template?

A budget planner template is a pre-designed format or layout that helps individuals or businesses to organize and track their income, expenses, and savings. It acts as a tool to simplify financial planning and enable better control over personal or business finances.

How can a budget planner template simplify financial planning?

A budget planner template simplifies financial planning by providing a structured format that allows individuals or businesses to set financial goals, track income and expenses, allocate funds for various categories, and monitor progress. It eliminates the need to create a budget from scratch and provides a systematic approach to managing finances.

What are the benefits of using a budget planner template?

Using a budget planner template offers several benefits. It helps in better understanding of financial standing, facilitates better decision making regarding expenses, assists in setting realistic financial goals, reduces overspending, identifies potential areas of saving, and helps in tracking progress towards financial targets.

Where can I find a budget planner template?

A budget planner template can be found in various places. There are many websites and online platforms that offer free or paid budget planner templates. Additionally, software applications or financial planning tools may also provide built-in templates for budget planning. Some examples include Microsoft Excel, Google Sheets, and financial management apps.

Can a budget planner template be customized according to specific needs?

Yes, a budget planner template can be customized to suit individual or business requirements. Most templates provide flexibility in adding or removing categories, adjusting time periods, setting specific financial goals, and tailoring it according to personal preferences. Customization allows users to personalize the template and make it more effective for their financial planning needs.

Why should I use a budget planner template?

Using a budget planner template can help simplify your financial planning by providing a structured framework to track your income and expenses. It allows you to see a clear picture of your financial situation and helps you make informed decisions about how to allocate your money.

Where can I find a budget planner template?

You can find budget planner templates online on various websites and platforms. Some popular options include Microsoft Excel templates, Google Sheets templates, and personal finance apps. These templates are often customizable and can be tailored to suit your specific financial goals and needs.

What information should be included in a budget planner template?

A budget planner template typically includes categories for income, expenses, savings goals, and any debts or loans. It is recommended to break down your expenses into different categories such as housing, transportation, groceries, entertainment, etc. This allows you to have a comprehensive view of your spending habits and identify areas where you can cut back or save.

How can a budget planner template help me save money?

A budget planner template can help you save money by allowing you to track your expenses and identify areas where you may be overspending. It helps you set realistic savings goals and allocate a certain amount of money towards saving each month. By following your budget and monitoring your progress, you can make adjustments as needed and work towards achieving your financial goals.

Are there any drawbacks to using a budget planner template?

While using a budget planner template can be highly beneficial, it may require some time and effort initially to set up and maintain. You also need to ensure that you consistently update your budget with accurate information to get the most accurate results. Additionally, a budget planner template is a tool for managing your finances, but it still requires discipline and commitment from your side to stick to your budget and financial goals.