Are you finding it difficult to put aside funds for your future goals? Do you often find yourself struggling to save money due to unexpected expenses? Well, fret not, because we have the perfect solution for you! Introducing the revolutionary 52-Week Money Saving Challenge, a practical and effective method to ensure financial stability and achieve your dreams!

Unlock the potential of your savings journey with this simple yet powerful challenge. Empower yourself and take control of your financial destiny as you embark on a 52-week adventure, gradually accumulating funds every single week. No matter what your financial situation may be, this challenge is designed to fit your budget and allow you to save at your own pace. So, whether you’re a seasoned saver or just beginning your journey towards financial independence, this challenge is perfect for you!

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreLeave behind the struggles of traditional saving methods and embrace a dynamic approach that keeps you motivated and excited throughout the entire process. Witness the power of consistency as you contribute a small amount each week, creating a habit that will transform your financial landscape. Imagine the satisfaction of watching your savings grow steadily, week after week, bringing you one step closer to your dreams.

With this 52-Week Money Saving Challenge, you’ll soon discover that saving money is not a burdensome task, but rather a rewarding and empowering journey. So, are you ready to take a leap towards financial freedom? Join us on this thrilling adventure today!

- Discover the 52 Week Money Saving Challenge

- What is the 52 Week Money Saving Challenge?

- How does the challenge work?

- Why should you take on the challenge?

- Plan Your Savings Journey

- Set attainable savings objectives

- Create a personalized savings strategy

- Stay Motivated Throughout the Challenge

- Track your progress

- Find support and accountability

- Start Saving Money Today!

- Questions and answers

Discover the 52 Week Money Saving Challenge

In this section, we invite you to explore the exciting and rewarding journey of the 52 Week Money Saving Challenge. Prepare yourself for a unique experience that will empower you to grow your savings without feeling overwhelmed. This challenge offers a systematic approach to saving money gradually over the course of a year, making it accessible to everyone, regardless of their financial situation.

During this 52-week adventure, you will discover a structured plan that encourages discipline and consistency, ensuring steady progress towards your savings goals. Through small and manageable weekly deposits, you will witness your savings grow in a sustainable and enjoyable way. The challenge also provides flexibility, allowing you to adjust your contributions based on your individual circumstances.

By participating in the 52 Week Money Saving Challenge, you’ll develop a habit of saving, improve your financial literacy, and gain a sense of accomplishment with each milestone you reach. This challenge is not just about money; it’s about building a solid foundation for your financial future.

Are you ready to embark on this transformative journey? Join us in discovering the 52 Week Money Saving Challenge and take control of your finances today!

What is the 52 Week Money Saving Challenge?

The 52 Week Money Saving Challenge is a popular savings method that encourages individuals to save money over the course of a year. This challenge provides a structured and effective way to gradually build up savings, allowing participants to reach their financial goals with ease.

- Are you looking to develop a disciplined saving habit?

- Do you want to create an emergency fund or save up for a specific goal or purchase?

- Would you like to improve your financial well-being?

If you answered yes to any of these questions, the 52 Week Money Saving Challenge is a perfect opportunity for you. By following this challenge, you can save a significant amount of money by starting small and gradually increasing your savings contribution each week.

The concept behind the challenge is simple. It involves saving a specific amount of money each week, starting with a small amount and incrementally increasing it as the weeks progress. People often choose to save a few dollars or more each week, but you can adjust the amount based on your financial situation and goals.

This challenge is designed to be flexible and customizable, allowing individuals to tailor it according to their needs. Whether you prefer saving physical cash or using a savings account, the 52 Week Money Saving Challenge can be adapted to your preferred saving method.

Furthermore, this challenge promotes consistency and regular savings habits. By saving regularly, even if it’s a small amount at first, you can develop financial discipline and establish a healthy saving routine. Over time, these regular contributions will accumulate and help you reach your savings target.

So, if you’re ready to embark on a journey of financial empowerment and watch your savings grow, join the 52 Week Money Saving Challenge today!

How does the challenge work?

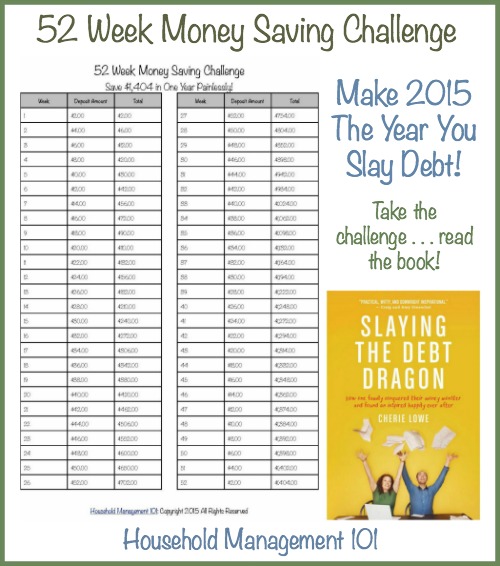

The 52 Week Money Saving Challenge is a popular method for individuals to save money throughout the year. The challenge encourages participants to set aside a specific amount of money each week, gradually increasing the saved amount over time. By following this structured approach, participants can build a substantial savings fund without feeling overwhelmed.

Here is a breakdown of how the challenge works:

| Week | Saved Amount |

|---|---|

| 1 | $1 |

| 2 | $2 |

| 3 | $3 |

| 4 | $4 |

Participants start by saving $1 during the first week, $2 during the second week, and continue increasing the saved amount by $1 each week. By the end of the challenge, they will have saved a total of $1,378. It is essential to stick to the schedule and contribute the specified amount each week to achieve the desired savings goal.

To keep track of the progress, individuals can use a savings tracker or chart, marking off each week as they contribute the designated amount. This visual representation helps to stay motivated and accountable.

Whether the savings are intended for a specific goal, such as a vacation or emergency fund, the 52 Week Money Saving Challenge provides a structured and achievable method to gradually build savings over time.

Why should you take on the challenge?

Are you looking for a way to embark on an exciting and rewarding financial journey? Look no further than the 52 Week Money Saving Challenge! By accepting this challenge, you are taking a step towards building a brighter financial future for yourself.

This challenge offers you a unique opportunity to develop a disciplined savings habit without feeling overwhelmed. It encourages you to start small and gradually increase your savings over time, allowing you to create a strong foundation for your financial goals.

By participating in the 52 Week Money Saving Challenge, you will gain a sense of empowerment and control over your finances. It will help you prioritize your savings, making it easier to achieve both short-term and long-term financial objectives.

Financial security

Completing this challenge will provide you with a financial safety net. By diligently saving each week, you are safeguarding yourself against unexpected expenses or emergencies that may arise. This will grant you peace of mind and eliminate the stress that comes with financial instability.

Reaching your goals

The 52 Week Money Saving Challenge serves as a pathway to achieving your dreams. Whether you are saving for a down payment on a house, planning a dream vacation, or aiming for early retirement, this challenge will keep you motivated and focused on your ultimate financial aspirations.

Building financial resilience

Participating in this challenge will teach you the value of resilience and perseverance. As you progress through the weeks, you will encounter moments when sticking to the savings plan feels challenging. However, by staying committed and staying the course, you will develop the ability to overcome financial obstacles and build resilience that will benefit you in all areas of life.

Join the 52 Week Money Saving Challenge today and unlock the potential for a financially stable and prosperous future!

Plan Your Savings Journey

Embark on a strategic path towards achieving your financial goals by carefully planning your savings journey. By mapping out your route towards financial freedom, you can effectively navigate through the ups and downs of life’s financial challenges.

Identify Your Objectives: Begin your planning process by determining what you hope to achieve through your savings journey. Whether it’s purchasing a new home, starting a business, or building an emergency fund, having clear objectives will provide you with a sense of purpose and motivation.

Set Realistic Goals: Break down your objectives into manageable steps to ensure that they are attainable. Set specific targets and deadlines for each milestone, allowing yourself enough time to achieve them without feeling overwhelmed.

Create a Budget: Analyze your income and expenses to create a comprehensive budget. Track your spending habits and identify areas where you can cut back to allocate more funds towards your savings. Remember, every penny counts!

Establish an Emergency Fund: Prioritize the creation of an emergency fund to protect yourself from unexpected financial setbacks. Aim to save at least three to six months’ worth of living expenses, ensuring that you have a safety net to rely on during times of crisis.

Explore Saving Strategies: Research different saving strategies and find one that suits your preferences and circumstances. Whether it’s the 52 Week Money Saving Challenge, automatic transfers, or incremental increases, experiment with various methods to find the one that keeps you motivated and engaged.

Stay Consistent and Accountable: Consistency is key when it comes to saving money. Make a habit of setting aside a portion of your income each month and stick to it. Consider enlisting an accountability partner, such as a friend or family member, who can provide guidance and support throughout your savings journey.

Adapt and Adjust: Life is full of unexpected twists and turns, and your savings journey should be flexible enough to adapt to these changes. Regularly reassess your goals and financial situation to ensure that your savings plan remains relevant and effective.

Remember, planning your savings journey is not only about accumulating wealth, but also about gaining financial security and peace of mind. With a well-thought-out plan in place, you’ll be well on your way to achieving your dreams and living a financially stable life.

Set attainable savings objectives

When it comes to saving money, it is essential to establish realistic and achievable goals. By setting attainable targets, you can stay motivated and on track throughout your savings journey.

Creating goals that are within reach allows you to maintain a sense of progress and accomplishment. It helps to break down your objectives into smaller milestones, making them more manageable and less overwhelming.

Start by assessing your financial situation and determining how much you can comfortably save on a regular basis. This could involve reevaluating your expenses, identifying areas where you can cut back, and reallocating funds towards your savings. Remember that every person’s financial circumstances are unique, so tailor your goals to align with your personal income and lifestyle.

Additionally, consider incorporating a timeframe for achieving your savings objectives. It could be a monthly, quarterly, or yearly target, depending on your needs and preferences. Having a specific timeframe will aid in tracking your progress and maintaining focus on your saving goals.

While it is important to challenge yourself, it is equally crucial not to set goals that are too lofty or unattainable. Unrealistic objectives can lead to frustration and may discourage you from further saving efforts. Remember, slow and steady progress is better than no progress at all.

Setting achievable savings goals not only helps you develop good habits but also instills a sense of discipline and responsibility in managing your finances. So take the time to evaluate your financial capabilities, break your goals into smaller milestones, and work towards them with determination.

Create a personalized savings strategy

Developing a customized plan to save money is essential for achieving your financial goals. By tailoring your savings strategy to your unique circumstances, you can optimize your saving potential and make progress towards your targets.

| 1. Assess your current financial situation |

|

Start by evaluating your current income, expenses, and debts. Understanding your financial standing will help you determine how much you can afford to save and identify areas where you can cut back on unnecessary expenses. |

| 2. Define your savings goals |

|

Clarify your short-term and long-term savings objectives. Whether you aim to build an emergency fund, save for a vacation, or plan for retirement, setting specific goals will give you a clear direction and motivation to save. |

| 3. Create a budget |

|

Establishing a budget is a fundamental step in developing a savings strategy. Determine your monthly income and allocate funds for essential expenses, savings contributions, and discretionary spending. Monitoring your budget regularly will help you stay on track and identify areas for improvement. |

| 4. Explore different saving options |

|

Investigate various saving methods, such as traditional savings accounts, certificates of deposit (CDs), or other investment opportunities. Consider the potential returns, risks, and accessibility of each option to determine what aligns best with your savings goals and risk tolerance. |

| 5. Automate your savings |

|

Take advantage of technology by setting up automatic transfers from your checking account to your savings account. Automating your savings will ensure consistent contributions without the temptation to spend the funds impulsively. |

| 6. Track your progress |

|

Maintain a record of your savings growth and regularly evaluate your progress towards your goals. Celebrate milestones and make adjustments to your strategy when necessary to stay motivated and committed. |

A personalized savings strategy is not a one-size-fits-all approach. It requires analysis, planning, and adaptability to suit your unique financial circumstances. By following these steps and staying disciplined, you can embark on a successful savings journey and achieve the financial security and freedom you desire.

Stay Motivated Throughout the Challenge

Remaining motivated is essential to successfully completing the 52 Week Money Saving Challenge. It is crucial to keep your enthusiasm and determination alive throughout the entire duration of the challenge. This section will provide you with useful tips and strategies to stay motivated and on track with your savings goals.

One way to maintain motivation is by setting clear and achievable milestones. Breaking down the overall savings target into smaller, manageable goals can help you stay focused and motivated. Celebrating each milestone reached will give you a sense of accomplishment and boost your motivation to continue saving.

Another effective method to stay motivated is by visualizing the end result. Imagine how achieving your savings goal will improve your financial situation and bring you closer to your dreams. Visualizing the positive impact of your efforts can provide a powerful source of motivation, especially during challenging times.

Additionally, finding an accountability partner can greatly enhance your motivation. Sharing your progress and challenges with someone who has similar financial goals can provide support and encouragement. By keeping each other accountable, you are more likely to stay motivated and committed to the saving challenge.

Remember to reward yourself along the way. Treating yourself for reaching significant milestones can be a great incentive to stay motivated. However, it is important to choose rewards that are aligned with your savings goals, such as a small indulgence or a memorable experience that does not compromise your progress.

Lastly, maintaining a positive mindset is crucial to staying motivated throughout the challenge. Recognize that there may be setbacks along the way, but view them as learning opportunities rather than failures. Stay focused on the bigger picture and the long-term benefits of your savings journey.

By implementing these strategies, you will be able to remain motivated and on track throughout the 52 Week Money Saving Challenge. Remember, developing a habit of saving takes time and effort, but the rewards are well worth it in the end.

Track your progress

Keeping track of your progress is an essential part of successfully completing the 52 Week Money Saving Challenge. By regularly monitoring and documenting your savings journey, you can stay motivated and accountable throughout the entire process. This section provides helpful tips and strategies to effectively track your progress, ensuring you stay on track towards achieving your financial goals.

One popular method to track your progress is through the use of a savings tracker. This can be done either digitally or manually. A digital savings tracker can be easily accessed through various personal finance apps and websites, allowing you to conveniently input your savings amount and monitor your progress in real-time. On the other hand, a manual savings tracker involves using a physical chart or spreadsheet to visually represent your savings progress. This hands-on approach can be a great way to visually see your accomplishments and motivate you to continue saving.

In addition to using a savings tracker, you can also consider setting milestones along the way. Breaking down your savings goal into smaller, achievable targets can make your progress more tangible and rewarding. For example, you can set milestones for saving a certain amount by the end of each month or quarter. Celebrating these milestones and rewarding yourself for reaching them can help maintain your motivation and enthusiasm.

Another effective way to track your progress is by keeping a journal or log of your savings journey. This can include writing down your thoughts, challenges faced, and successes achieved along the way. By documenting your experiences, you can reflect on the lessons learned and gain valuable insights into your saving habits. This journal can serve as a source of inspiration and motivation during times of difficulty or temptation.

Lastly, consider finding an accountability partner or joining a community of like-minded individuals who are also participating in the 52 Week Money Saving Challenge. Sharing your progress, setbacks, and achievements with others can provide a sense of support and encouragement. It can also create a friendly competition, spurring you to stay committed and consistent with your savings efforts.

In conclusion, tracking your progress is crucial in successfully completing the 52 Week Money Saving Challenge. By utilizing methods such as savings trackers, setting milestones, keeping a journal, and seeking support, you can effectively monitor your savings journey and stay motivated along the way. Remember, every small step counts towards achieving your financial goals!

Find support and accountability

In order to successfully complete the 52 Week Money Saving Challenge and achieve your savings goals, it is important to find support and hold yourself accountable. Surrounding yourself with like-minded individuals who share similar financial goals can provide encouragement, motivation, and helpful tips along the way.

A great way to find support is by joining online communities or forums dedicated to saving money and personal finance. These platforms allow you to connect with others who are also participating in the challenge, providing a space to share your progress, ask questions, and offer advice. Additionally, social media groups and pages focused on personal finance can be a valuable source of support and inspiration.

Forming an accountability partnership or joining a savings challenge group can also be beneficial. Partnering with someone who is also committed to saving money can create a sense of mutual obligation, increasing your motivation to stay on track. You can set weekly check-ins or share your progress with each other to stay accountable and celebrate your milestones together.

Tracking your progress is another effective way to remain accountable. Keep a record of how much you save each week and review it regularly. This visual representation of your progress will not only help you stay motivated but also allow you to identify any areas where you may need to adjust your saving strategies.

Remember, finding support and accountability is crucial to successfully completing the 52 Week Money Saving Challenge. By connecting with others, forming partnerships, and tracking your progress, you can stay motivated and focused on achieving your financial goals.

Start Saving Money Today!

Begin your journey to financial stability by taking small steps towards saving money. It’s never too late to start building a strong financial foundation. By adopting simple habits and making conscious choices, you can pave the way for a secure future.

1. Set Clear Goals: Define your saving objectives, whether it’s for emergencies, buying a house, or planning a dream vacation. Having a clear target in mind will motivate you to save consistently.

2. Create a Budget: Track your expenses and prioritize your spending. Identify areas where you can cut back and allocate those funds towards savings. Remember, every penny saved adds up!

3. Automate Your Savings: Take advantage of technology by setting up automatic transfers to your savings account. This ensures that a portion of your income is saved without any effort on your part.

4. Embrace Frugality: Look for ways to live a simpler and more cost-effective lifestyle. Explore thrift stores, meal planning, and DIY projects to reduce unnecessary expenses and save money on everyday items.

5. Track Your Progress: Regularly monitor your savings and celebrate your milestones. Seeing the progress you’ve made will motivate you to continue saving and help you stay on track towards your goals.

6. Find Additional Sources of Income: Consider picking up a side gig or freelance work to supplement your primary income. The extra money can be directly allocated towards your savings, accelerating your progress.

7. Seek Expert Advice: Consult with a financial advisor or attend workshops and seminars on personal finance. Educating yourself about money management strategies will empower you to make informed decisions and maximize your savings potential.

Remember, saving money is a journey that requires commitment and discipline. By implementing these tips, you are laying the groundwork for a brighter and more financially secure future.

Questions and answers

What is the 52 Week Money Saving Challenge?

The 52 Week Money Saving Challenge is a popular savings strategy that encourages individuals to save money on a weekly basis. It involves saving a specific amount of money each week, starting from $1 in the first week and adding an additional dollar each subsequent week. By the end of the 52 weeks, you will have saved a total of $1,378.

How can I start the 52 Week Money Saving Challenge?

Starting the 52 Week Money Saving Challenge is simple. In the first week, you save $1. In the second week, you save $2, and you continue increasing the amount by $1 each week. You can do this by either setting aside cash or transferring the specific amount to a separate savings account. It’s important to stay consistent and commit to the challenge throughout the entire year.

What are the benefits of the 52 Week Money Saving Challenge?

The 52 Week Money Saving Challenge provides several benefits. Firstly, it encourages individuals to develop a savings habit and commit to long-term financial goals. It also helps you build an emergency fund or save for a specific future purchase. Additionally, the challenge is flexible, allowing individuals to adjust the amounts to fit their budget and savings goals.

Can I start the 52 Week Money Saving Challenge at any time?

Yes, you can start the 52 Week Money Saving Challenge at any time. While many people choose to start at the beginning of the year, you have the flexibility to begin whenever it suits you best. The challenge can be adapted to fit your schedule and financial situation, so feel free to customize the starting point based on your preferences.

What if I can’t save the increasing amounts each week?

If you find it difficult to save the increasing amounts each week, you have a few options. Firstly, you can modify the challenge to fit your financial capacity by choosing smaller increments. For example, you can start with $0.50 or $0.25 instead of $1. Alternatively, you can save a fixed amount each week that is feasible for you. The key is to create a realistic savings plan that you can stick to consistently.

How does the 52-week money saving challenge work?

The 52-week money saving challenge is a simple and effective way to save money over the course of a year. Each week, you save a specific amount that corresponds with the number of the week. For example, in the first week, you save $1, in the second week, you save $2, and so on. By the end of the 52 weeks, you will have saved a total of $1,378.

Can I participate in the 52-week money saving challenge if I have a limited income?

Absolutely! The beauty of the 52-week money saving challenge is that you can customize it to fit your financial situation. If the suggested amount for each week is too high, you can start with a lower amount and gradually increase it as you are able to. The key is consistency and making an effort to save regularly, no matter the amount.