Establishing a well-structured financial plan plays a paramount role in securing solidity in one’s economic outlook and fostering lasting fiscal resilience. By implementing a comprehensive budgeting framework, individuals can systematically allocate their resources towards realizing their long-term financial aspirations. This strategic approach, which emphasizes prudent financial management, empowers people to navigate through the complexities of the ever-evolving economic landscape effortlessly.

Ascertaining financial stability necessitates a proactive stance towards managing available funds. Embedding a budgeting culture equips individuals with the requisite knowledge and skills to make informed decisions and exercise optimal control over their financial affairs. By carefully tracking income, expenses, and investments, individuals can identify patterns, eliminate unnecessary expenditures, and maximize their savings potential. Consequently, this deliberate financial planning methodology facilitates the achievement of short-term objectives while concurrently paving the way for long-term fiscal security.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreIntegrating a structured budgeting approach into one’s daily life unveils the hidden potential for financial growth and stability. This proven method empowers people to envision their financial goals, whether it be purchasing a dream home, securing a comfortable retirement, or funding their children’s education. By intentionally allocating resources towards these aspirations, individuals take charge of their financial destiny, transforming mere dreams into tangible reality. Moreover, a thoughtfully constructed budget promotes accountability, encourages financial discipline, and helps individuals overcome obstacles that may otherwise hinder their progress towards sustained economic prosperity.

Undeniably, the act of formulating a financial plan serves as the bedrock for establishing a solid financial future. It serves as a compass, guiding individuals through the trials and tribulations of an unpredictable economic landscape. Adhering to a well-designed budget empowers people to weather financial storms, mitigate risks, and seize opportunities as they arise. In a world where financial stability is often elusive, constructing a strategic budget represents the cornerstone for attaining lasting fiscal well-being and paving the way for a prosperous tomorrow.

- The Significance of Establishing a Monetary Plan for Ensuring Sustainable Financial Security

- Benefits of Creating a Comprehensive Budget

- Improved Financial Awareness

- Control Over Spending Habits

- Better Goal Setting and Achievement

- Steps to Create an Effective Budget

- Evaluate Income and Expenses

- Prioritize Financial Goals

- Allocate Funds for Essential Expenses

- Set Aside Emergency Savings

- Questions and answers

The Significance of Establishing a Monetary Plan for Ensuring Sustainable Financial Security

Creating a well-structured financial strategy that spans over a lengthy period can play a crucial role in attaining enduring economic stability. By formulating a comprehensive budget and sticking to it diligently, individuals can significantly enhance their financial standing, ensuring a secure and prosperous future. The process of developing and maintaining a budget encompasses various essential aspects, including careful expenses analysis, regular savings allocation, and prudent decision-making.

A fundamental aspect of constructing a sustainable financial plan involves deeply understanding one’s spending patterns and identifying areas where adjustments can be made. By critically analyzing expenditures and distinguishing between essential needs and discretionary expenses, individuals can allocate their resources more effectively, leading to a better financial position in the long run. Furthermore, monitoring and tracking expenses allows individuals to make informed decisions about their financial priorities, promoting financial stability.

- Identifying and prioritizing financial goals: Setting clear and realistic financial goals is essential for effective long-term budgeting. Whether it is saving for retirement, purchasing a home, or funding education, clarifying these objectives enables individuals to allocate their income and resources accordingly.

- Creating an emergency fund: Establishing an emergency fund serves as a crucial component of long-term financial stability. By setting aside a certain amount of money for unexpected expenses, individuals can avoid accumulating debt or facing financial hardships during unforeseen circumstances.

- Implementing effective debt management strategies: Managing debt is integral to maintaining financial stability. Developing a plan to repay outstanding debts systematically and minimizing interest payments can provide individuals with a sense of control over their finances.

- Promoting regular savings: Prioritizing savings by setting aside a fixed portion of income on a consistent basis can contribute significantly to long-term financial security. Accumulating savings not only provides a safety net but also opens opportunities for investment and wealth generation.

- Seeking professional advice: Consulting with financial experts or seeking guidance from reputable financial institutions can offer valuable insights and strategies for effective budgeting and long-term financial planning.

In conclusion, constructing a budget tailored to one’s financial goals and adhering to it diligently is paramount for achieving long-term financial stability. By understanding personal spending patterns, prioritizing financial goals, managing debt effectively, and allocating resources efficiently, individuals can establish a solid foundation for their future economic well-being.

Benefits of Creating a Comprehensive Budget

Having a comprehensive budget can provide numerous advantages when it comes to managing your financial situation over the long term. Creating a thorough budget allows you to effectively allocate your available resources, make informed financial decisions, and ensure economic stability for the future.

One key benefit of a comprehensive budget is that it helps you gain a clear understanding of your income and expenses. By tracking your earnings and expenditures, you can identify any potential gaps or areas where you may be overspending. This allows you to adjust your spending habits accordingly, ensuring that your financial resources are being utilized in the most efficient and effective way.

Another advantage of creating a comprehensive budget is that it enables you to set achievable financial goals. By accurately assessing your income and expenses, you can establish realistic targets for savings, debt reduction, or investments. This not only helps you stay motivated, but it also provides a roadmap for your financial journey, making it easier to track your progress and celebrate milestones along the way.

Additionally, a comprehensive budget promotes accountability and empowers you to make informed financial decisions. By having a clear overview of your financial situation, you can evaluate the potential outcomes of different choices and prioritize your expenditures accordingly. This allows you to make choices that align with your long-term financial goals, ultimately leading to greater financial stability and security.

Moreover, a comprehensive budget also allows you to anticipate and prepare for financial challenges or unexpected expenses. By analyzing your income and expenses, you can identify areas where you can create an emergency fund or allocate funds for unforeseen circumstances. This provides a safety net and reduces financial stress, as you are better equipped to handle unexpected events without disrupting your overall financial stability.

- Efficiently allocate available resources.

- Gain clarity on income and expenses.

- Set achievable financial goals.

- Promote accountability and informed decision-making.

- Anticipate and prepare for financial challenges.

In conclusion, creating a comprehensive budget offers a multitude of benefits, ranging from effectively managing your finances to achieving long-term financial stability. With the ability to allocate resources efficiently, set goals, make informed decisions, and prepare for unexpected circumstances, a comprehensive budget serves as a valuable tool in securing your financial well-being.

Improved Financial Awareness

In today’s fast-paced world, it is crucial to cultivate a better understanding of our financial well-being. By enhancing our financial awareness, we can navigate the complex landscape of personal finance with confidence and make informed decisions for our long-term financial stability. This section focuses on the importance of developing a deeper understanding of our financial situation and the benefits it brings to our overall financial health.

One of the key aspects of improved financial awareness is gaining a clear comprehension of our income and expenses. By meticulously tracking our cash flows, we can identify areas where we can cut back on unnecessary spending and redirect those resources towards savings and investments. This proactive approach not only helps us achieve our financial goals faster but also ensures we have a safety net for unexpected expenses.

Another facet of enhanced financial awareness is establishing a realistic budget tailored to our unique circumstances. A well-structured budget provides a roadmap for managing our income and expenses, ensuring that we live within our means and avoid falling into debt. It allows us to prioritize our financial objectives, such as saving for retirement or purchasing a home, and allocate our resources accordingly. By consciously aligning our spending with our long-term goals, we can make progress towards financial stability and build a solid foundation for the future.

Furthermore, improved financial awareness enables us to develop a deeper understanding of financial concepts and strategies. By expanding our knowledge about various investment options, tax planning, and debt management techniques, we can make informed decisions that maximize our financial potential. This knowledge empowers us to achieve a higher level of control over our financial destiny and minimize the risk of falling victim to predatory financial practices.

Overall, developing improved financial awareness is a vital aspect of securing our long-term financial stability. By actively seeking to understand our financial situation, tracking our cash flows, creating a realistic budget, and expanding our financial knowledge, we can make sound financial decisions, protect our financial well-being, and pave the way for a brighter financial future.

Control Over Spending Habits

One crucial aspect of achieving long-term financial stability is gaining control over our spending habits and making conscious choices about how we use our resources. By developing a mindful approach to our expenses, we can ensure that our hard-earned money is being used wisely and in alignment with our financial goals.

Understanding our spending patterns

In order to gain control over our spending habits, it is essential to first understand our current patterns of expenditure. By closely examining our financial records and tracking our expenses, we can identify any unhealthy spending patterns or areas where we are overspending. This analysis enables us to make informed decisions about where to cut back and where to prioritize our resources.

Creating a budget

Once we have a clear understanding of our spending patterns, it is crucial to create a budget that reflects our financial goals and priorities. A budget serves as a roadmap for our financial choices, helping us allocate our resources efficiently and prevent overspending. It allows us to plan for both short-term needs and long-term goals, such as saving for retirement or paying off debt.

Implementing self-discipline

Controlling our spending habits requires self-discipline and a commitment to sticking to our budget. This entails making conscious choices about our purchases, distinguishing between wants and needs, and practicing delayed gratification when necessary. By developing healthy spending habits and resisting unnecessary expenses, we can avoid debt accumulation and establish a solid foundation for long-term financial stability.

Seeking support and accountability

Changing spending habits can be challenging, and it can be helpful to seek support and accountability in our journey towards financial stability. Seeking guidance from a financial advisor or participating in support groups can provide us with valuable insights, strategies, and encouragement to stay on track with our financial goals. Engaging in open conversations with trusted friends or family members about our financial goals can also contribute to our success in controlling our spending habits.

Conclusion

Taking control over our spending habits is a vital step in building a solid foundation for long-term financial stability. By understanding our spending patterns, creating a budget, implementing self-discipline, and seeking support, we can gain control over our finances and make informed choices that align with our goals and values. With a mindful approach to our expenses, we can pave the way towards a secure financial future.

Better Goal Setting and Achievement

Enhancing Goal Setting and Accomplishment

Achieving financial stability for the long term requires more than just creating a budget. It also entails setting meaningful and attainable goals, and diligently working towards achieving them. By improving your goal-setting skills, you can increase your chances of long-term financial success and fulfillment.

When setting goals, it is important to be specific and clear about what you want to achieve. Identifying the desired outcome helps provide a sense of direction and purpose. Furthermore, breaking down larger goals into smaller, actionable steps can make them more manageable and easier to accomplish.

Goal setting should also involve prioritization. By determining which goals are most important to you, you can allocate your resources and efforts accordingly. Prioritization allows you to focus on what truly matters, helping you make progress towards your most significant goals.

Another crucial aspect of successful goal setting is regularly reviewing and reassessing your progress. By monitoring your achievements and making necessary adjustments, you can stay on track and ensure that you are moving towards your desired financial outcomes. Periodic evaluations also enable you to celebrate milestones and identify areas where you may need to put in extra effort.

Additionally, it is important to remain motivated and committed to your goals. Surrounding yourself with positive influences and utilizing visualization techniques can help maintain your enthusiasm and drive. Continuously reminding yourself of the reasons why achieving your financial goals is important to you will serve as a powerful motivator.

In summary, effective goal setting is essential for long-term financial stability. By being clear and specific, prioritizing tasks, regularly monitoring progress, and staying motivated, you can enhance your goal-setting abilities and increase the likelihood of accomplishing your financial aspirations.

Steps to Create an Effective Budget

Setting up a comprehensive and well-structured budget is vital for achieving financial stability in the long run. By following a few essential steps, you can develop an effective budget that will allow you to manage your finances efficiently and reach your financial goals.

- Assess your current financial situation: Start by evaluating your income, expenses, and existing debt. Understanding your financial standing will help you determine how much money you have available for savings, investments, and necessary expenses.

- Set clear financial goals: Define specific and realistic objectives that you want to achieve through your budget. Whether it’s saving for a down payment on a house, paying off debt, or building an emergency fund, having clear goals will provide you with motivation and direction.

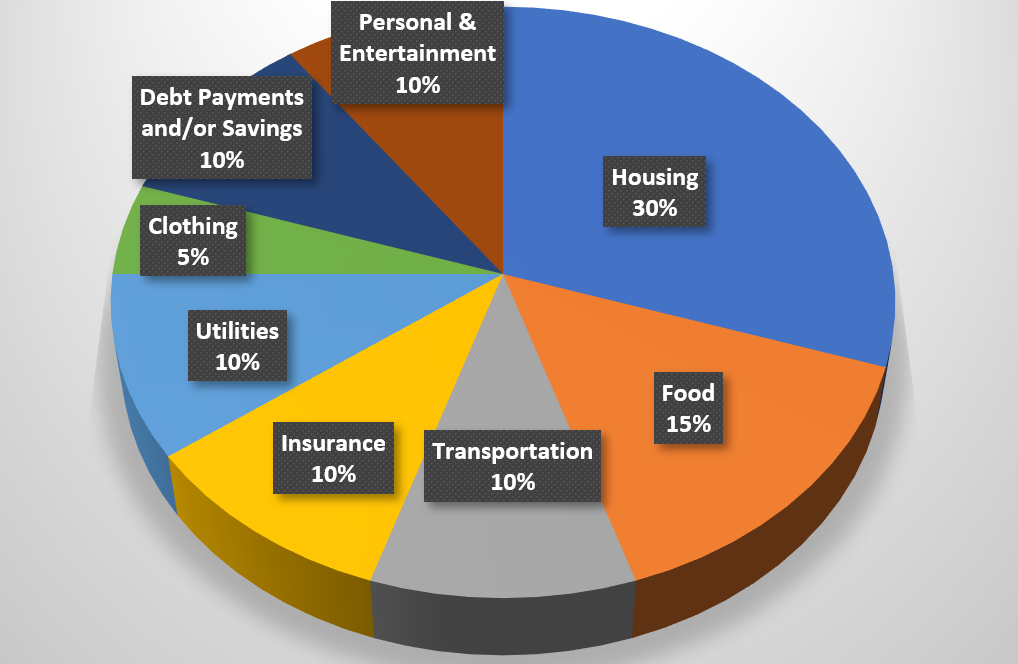

- Create a budget framework: Develop a framework that outlines your income sources and categories for expenses. Consider dividing your budget into fixed expenses (such as rent or mortgage payments) and variable expenses (such as groceries or entertainment). Allocating a specific amount to each category will help you prioritize and control your spending.

- Track your income and expenses: Keep meticulous records of your income and expenses to monitor your financial progress. Take advantage of online tools, budgeting apps, or spreadsheets to track your spending habits and identify areas where you can cut back or reduce unnecessary expenses.

- Make adjustments and prioritize savings: Regularly review your budget to identify areas for improvement and make necessary adjustments. Prioritize saving a portion of your income each month to build an emergency fund or contribute to long-term investments.

- Seek professional guidance if necessary: If you’re struggling with managing your finances or need expert advice, consider consulting a financial advisor. They can provide additional insights, offer personalized recommendations, and assist you in creating a more effective budgeting strategy.

By following these steps diligently and consistently, you can create an effective budget that will promote financial stability and help you work towards your long-term financial goals. Remember, the key is to remain disciplined and consistently review and adjust your budget as needed.

Evaluate Income and Expenses

Examining your earnings and expenditures is a vital step in achieving long-term financial stability and creating a solid budget for the future. By carefully evaluating your income and expenses, you can gain a clear understanding of your financial situation and make informed decisions about how to allocate your resources.

When assessing your income, take into account all of the various streams of money that flow into your life, including your salary, investments, side jobs, and any other sources of revenue. It is crucial to have a comprehensive understanding of how much money you are bringing in each month, as this forms the foundation of your financial stability.

Next, it is essential to thoroughly analyze your expenses to get a complete picture of where your money is going. Identify both essential and discretionary expenditures, such as rent or mortgage payments, groceries, utility bills, transportation costs, entertainment, dining out, and other discretionary spending. By categorizing and quantifying your expenses, you can identify areas where you may be overspending and opportunities to save.

Consider employing various tools and methods to track and evaluate your income and expenses effectively. Utilize spreadsheets, budgeting apps, or online financial platforms to input and categorize your earnings and expenditures accurately. Regularly review this information to identify trends, patterns, and potential areas for improvement.

Evaluating your income and expenses not only provides you with a comprehensive understanding of your financial situation but also empowers you to make informed decisions about how to manage your money. By being aware of your cash flow, you can allocate your resources more effectively, prioritize your financial goals, and work towards long-term financial stability.

Prioritize Financial Goals

Establishing clear and achievable financial goals is a vital step in ensuring long-term financial stability and success. By prioritizing your financial aspirations, you can create a roadmap that guides your decisions and actions towards achieving these objectives.

One of the most effective ways to prioritize financial goals is by determining their significance and urgency. Consider what is most important to you in terms of your financial well-being and future aspirations. Identify goals that align with your values and long-term vision for financial stability, and give them the appropriate level of importance and attention they deserve.

Additionally, it is essential to evaluate the feasibility of each goal. Assess your current financial situation, including income, expenses, and savings, to determine if certain goals can be realistically achieved within a given timeframe. Adjust your expectations and timelines accordingly to ensure that you set yourself up for success.

Another crucial aspect of prioritizing financial goals is considering the potential impact they may have on your overall financial stability. Some goals, such as paying off high-interest debt or building an emergency fund, may require immediate attention to reduce financial vulnerability and establish a solid foundation. Balancing short and long-term goals is key to maintaining stability while also working towards future aspirations.

Furthermore, it is important to regularly review and reassess your priorities as your financial situation and personal circumstances evolve. Life events, such as career changes, marriage, or starting a family, may necessitate a shift in priorities. Stay flexible and adaptable in your goal-setting process to ensure your financial plan remains aligned with your current needs and objectives.

In conclusion, prioritizing financial goals is critical for long-term financial stability. By assigning importance, evaluating feasibility, considering the impact, and remaining adaptable, you can create a roadmap that leads to financial success and fulfillment.

Allocate Funds for Essential Expenses

Ensure the proper distribution of funds towards crucial expenditures to secure your long-term financial stability. By prioritizing necessary expenses, you can effectively manage your budget and achieve financial security.

Allocate wisely

Make informed decisions when allocating your funds to essential expenses. Evaluate your financial situation and determine which expenses are vital for your well-being and long-term stability. Prioritize necessities such as housing, utilities, transportation, and healthcare.

Ensure a safety net

Set aside a portion of your budget to create an emergency fund that provides a safety net during unexpected circumstances. Accumulating savings for unforeseen events, such as medical emergencies or job loss, can help you maintain financial stability in the long run.

Establish a debt repayment plan

If you have outstanding debts, allocate a portion of your budget towards repaying them. Create a structured debt repayment plan that includes making regular payments to reduce outstanding balances. Prioritize paying off high-interest debts first to save money in the long term.

Invest in yourself

Allocate funds towards personal and professional development to enhance your skills and knowledge. Investing in yourself can lead to increased earning potential and better long-term financial prospects. Consider allocating a portion of your budget towards education, certifications, and training that align with your career goals.

Regularly review and adjust

Review your budget periodically to ensure that your allocation of funds aligns with your financial goals and priorities. Adjustments may be necessary as circumstances change over time. Regularly assessing and re-evaluating your financial plan will help you stay on track towards achieving long-term financial stability.

Embrace financial discipline

Cultivate strong financial habits and discipline to effectively allocate funds for essential expenses. Track your expenses diligently, avoid impulse purchases, and stick to your budget. By practicing financial discipline, you can ensure that your essential expenses are consistently prioritized and allocated accordingly.

Set Aside Emergency Savings

Creating a financial safety net for unexpected expenses is a crucial aspect of securing long-term financial stability. It is essential to establish a fund specifically dedicated to handling emergency situations, ensuring that you are prepared for unforeseen circumstances without jeopardizing your overall financial well-being. By setting aside emergency savings, you can effectively protect yourself from potential financial setbacks and maintain your peace of mind.

| Benefits of Having Emergency Savings |

|---|

| 1. Financial Security |

| 2. Peace of Mind |

| 3. Avoiding High-Interest Debt |

Having emergency savings provides you with a sense of financial security. It ensures that you have a safeguard to rely on when unexpected expenses arise, such as medical emergencies, car repairs, or sudden job loss. With a dedicated fund, you can handle these situations without having to resort to taking on unnecessary debts or loans.

Moreover, emergency savings offer peace of mind. Knowing that you have a financial cushion to fall back on in times of crisis can significantly reduce stress and anxiety. It allows you to navigate through challenging circumstances with greater ease and confidence, enabling you to focus on finding solutions instead of worrying about the financial implications.

Building emergency savings also helps you avoid high-interest debt. Instead of relying on credit cards or loans to cover unexpected expenses, having a readily accessible fund eliminates the need for borrowing. This, in turn, prevents the accumulation of debt and the accompanying interest payments that can quickly spiral out of control.

In conclusion, setting aside emergency savings is a crucial step towards achieving long-term financial stability. It provides you with the necessary financial security, peace of mind, and helps you avoid unnecessary debt. By proactively building and maintaining an emergency fund, you are ensuring that you have a solid foundation to withstand any unexpected financial challenges that may come your way.

Questions and answers

Why is building a budget important for long-term financial stability?

Building a budget is important for long-term financial stability because it helps individuals track their income and expenses, prioritize financial goals, and ensure that they are spending within their means. By creating a budget, individuals can effectively manage their finances, save for the future, and reduce the risk of debt or financial difficulties.

How can budgeting contribute to financial stability?

Budgeting can contribute to financial stability by providing a clear overview of one’s financial situation. By carefully planning and allocating money to different expenses, individuals can ensure that they have enough funds to cover their necessities and also save for emergencies or long-term goals. Budgeting helps individuals make informed financial decisions, avoid overspending, and ultimately achieve financial stability.

What are the key steps to building an effective budget?

Building an effective budget involves several key steps. Firstly, individuals need to identify their sources of income and calculate their total monthly earnings. Then, they should track their expenses and categorize them, distinguishing between fixed and variable costs. Next, individuals should analyze their spending patterns and identify areas where they can cut back or save money. Finally, they should allocate funds to different categories, set realistic financial goals, and regularly review and adjust their budget as needed.

How can budgeting help individuals save money in the long run?

Budgeting can help individuals save money in the long run by providing a structured plan for managing their finances. By carefully tracking expenses and setting spending limits, individuals can identify areas where they are overspending and make necessary adjustments. Budgeting also encourages saving by allocating a certain portion of income towards savings or investments. Over time, these small savings can accumulate and contribute to long-term financial stability and the achievement of financial goals.

What are some common challenges people face when trying to stick to a budget?

Sticking to a budget can be challenging for various reasons. Some common challenges include impulse buying, lack of discipline, unexpected expenses, and difficulty in prioritizing financial goals. Temptations to spend on unnecessary items or indulge in instant gratification can often lead to budget deviations. Additionally, unforeseen expenses like medical emergencies or household repairs can disrupt a budget if not accounted for. However, with proper planning, self-control, and regular budget reviews, these challenges can be overcome, and individuals can achieve long-term financial stability.

What is the importance of building a budget for long-term financial stability?

Building a budget for long-term financial stability is crucial because it helps individuals and families achieve their financial goals. It allows them to track their income and expenses, identify areas where they can save money, and allocate funds for future needs such as emergencies, retirement, or education. By having a budget, people can make informed financial decisions and avoid going into debt or overspending.

How can building a budget contribute to long-term financial stability?

Building a budget contributes to long-term financial stability by providing a clear understanding of one’s financial situation. It allows individuals to identify unnecessary expenses and make adjustments to save more money. A budget also helps in setting financial goals and tracking progress towards achieving them. By following a budget consistently, people can build an emergency fund, pay off debt, and save for retirement, ultimately leading to long-term financial stability.

What are some tips for building a budget for long-term financial stability?

There are several tips for building a budget for long-term financial stability. Firstly, it is important to track all income and expenses accurately. This can be done by keeping receipts, using budgeting apps, or maintaining a spreadsheet. Secondly, it is crucial to prioritize expenses and focus on needs rather than wants. Creating a separate category for savings is also necessary. It is advisable to review the budget regularly, make necessary adjustments, and seek professional advice if needed.

Can building a budget help in achieving long-term financial goals?

Yes, building a budget can significantly help in achieving long-term financial goals. By creating a budget, individuals can allocate funds towards their specific goals, such as buying a house, starting a business, or saving for retirement. It provides a roadmap for saving and investing money effectively. Tracking expenses through a budget also helps ensure that individuals stay on track with their financial goals, make necessary adjustments, and avoid unnecessary spending.

Is it necessary to consult a financial advisor when building a budget for long-term financial stability?

While it is not mandatory, consulting a financial advisor can be beneficial when building a budget for long-term financial stability. A financial advisor can provide expert guidance based on an individual’s specific financial circumstances and goals. They can help analyze income, expenses, and suggest appropriate allocation of funds. Additionally, they can assist in identifying potential ways to save money, reduce debt, and make the most of investments. Seeking professional advice can provide a comprehensive approach to building a budget and ensuring long-term financial stability.