Embarking on the path towards financial stability and independence is a pursuit that requires careful consideration, precision, and a holistic understanding of one’s financial landscape. With a myriad of personal finance tips and tricks circulating in the digital realm, it can be overwhelming to navigate through the noise and discern the best course of action for your unique circumstances. Fear not, for you have arrived at a destination that will equip you with the tools and knowledge to create a bespoke financial plan that will empower you to achieve your aspirations.

In this enlightening discourse, we will delve into the art of crafting a personalized economic roadmap, tailored to encapsulate your individual financial objectives and guide you towards a state of financial empowerment. By unlocking the secrets to smart money management through strategic planning and insightful decision-making, you will no longer be a mere passenger on the rollercoaster of financial uncertainty, but rather the captain of your own financial ship, skillfully navigating the vast oceans of fiscal responsibility.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreWithin the intricate web of personal finance, there lies a profound essence of self-discovery and empowerment as you embark on the journey to master the language of money. As we journey together in this article, we will unravel the core principles that underpin a personalized financial roadmap, empowering you to not only understand the intricacies of budgeting but also ascertain the importance of establishing a strong foundation for long-term financial success.

- Assessing Your Financial Situation

- Understanding Your Income

- Analyzing Your Expenses

- Setting Financial Goals

- Identifying Short-Term and Long-Term Goals

- Prioritizing Your Goals

- Creating a Realistic Budget

- Estimating Your Monthly Income

- Allocating Funds to Essential Expenses

- Allocating Funds to Discretionary Expenses

- Questions and answers

Assessing Your Financial Situation

Understanding your current financial state is the first step towards creating a personalized budget plan. By evaluating your financial situation, you can gain clarity on your income, expenses, debts, and overall financial health.

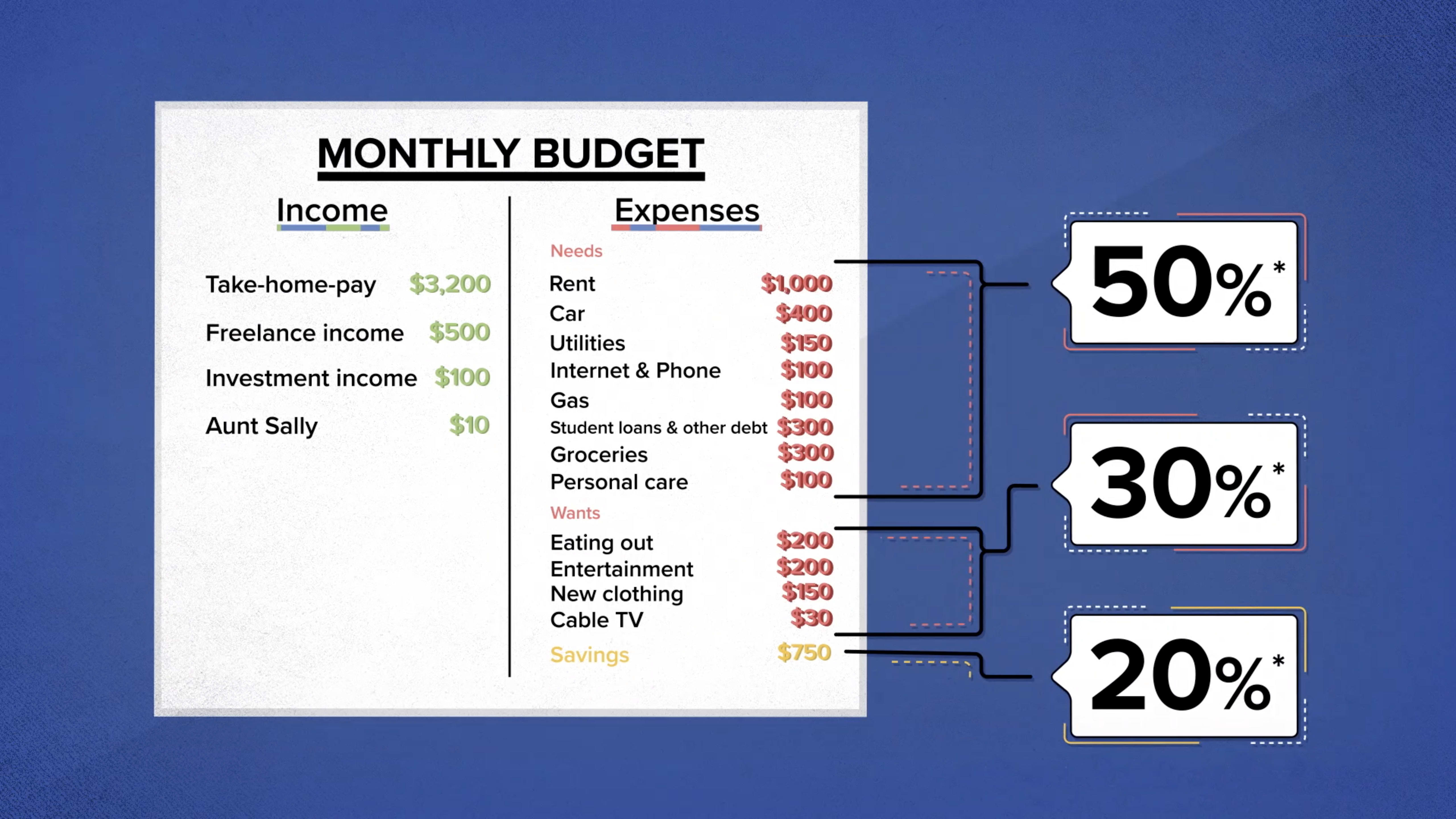

Begin by examining your income sources. This includes not just your primary salary or wages, but also any additional sources of income such as investments or side gigs. Taking note of these various income streams will provide a comprehensive picture of the money coming into your bank account.

Next, analyze your expenses. This involves categorizing your spending into different areas, such as housing, transportation, utilities, groceries, entertainment, and so on. By breaking down your expenses into categories, you can identify areas where you may be overspending or opportunities for potential savings.

It is also important to assess your existing debts. List out all loans, credit card balances, and any other outstanding financial obligations. Understanding the amount you owe and the interest rates associated with each debt will help you prioritize your repayments and develop a plan to effectively manage your liabilities.

Furthermore, consider evaluating your assets. Take stock of your savings, investments, and any valuable possessions you own. This will enable you to understand your overall net worth and evaluate whether your current financial situation aligns with your long-term financial goals.

Finally, take into account any future financial goals or major life events that may impact your budget. Whether it is saving for a down payment on a house, planning for a wedding, or preparing for retirement, considering these goals will help you determine how to allocate your income and expenses.

| Income | Expenses | Debts | Assets |

|---|---|---|---|

| Primary Salary/Wages | Housing | Loans | Savings |

| Investments | Transportation | Credit Card Balances | Investments |

| Side Gigs | Utilities | Other Outstanding Obligations | Valuable Possessions |

Understanding Your Income

In this section, we will delve into the essential concept of comprehending your earnings. It is crucial to have a clear understanding of the funds that come into your possession, as this forms the foundation for your personalized budgeting journey. By gaining insights into the various sources of income and their patterns, you can make informed decisions to optimize your financial planning.

Income, in its broader sense, refers to the monetary resources that you receive on a regular basis. This can encompass various forms such as wages, salaries, bonuses, tips, commissions, investments, rental income, and more. Understanding the diversity of your income streams helps you establish a comprehensive view of your financial inflows and identify potential areas for improvement.

It is important to consider the frequency and stability of your income sources. Some income streams may be fixed and predictable, such as a monthly salary, while others may fluctuate, like bonuses or freelance earnings. Evaluating the patterns and trends of your income will help you anticipate and plan for any irregularities or seasonal variations.

Furthermore, it is crucial to differentiate between net and gross income. Gross income refers to the total amount of money you earn before any deductions or taxes are applied. Net income, on the other hand, represents the actual amount you take home after all required deductions. Understanding the distinction between these two forms of income gives you a more accurate depiction of your financial position.

By understanding the different aspects of your income, you can gain valuable insights into your financial standing and make informed decisions when creating your personalized budget plan. The next step in this guide will explore the significance of analyzing your expenses and how it relates to achieving your financial goals.

Analyzing Your Expenses

Understanding where your money goes is an important step in managing your finances effectively. This section will guide you through the process of analyzing your expenses, helping you gain a clear insight into your spending patterns without relying on predefined categories.

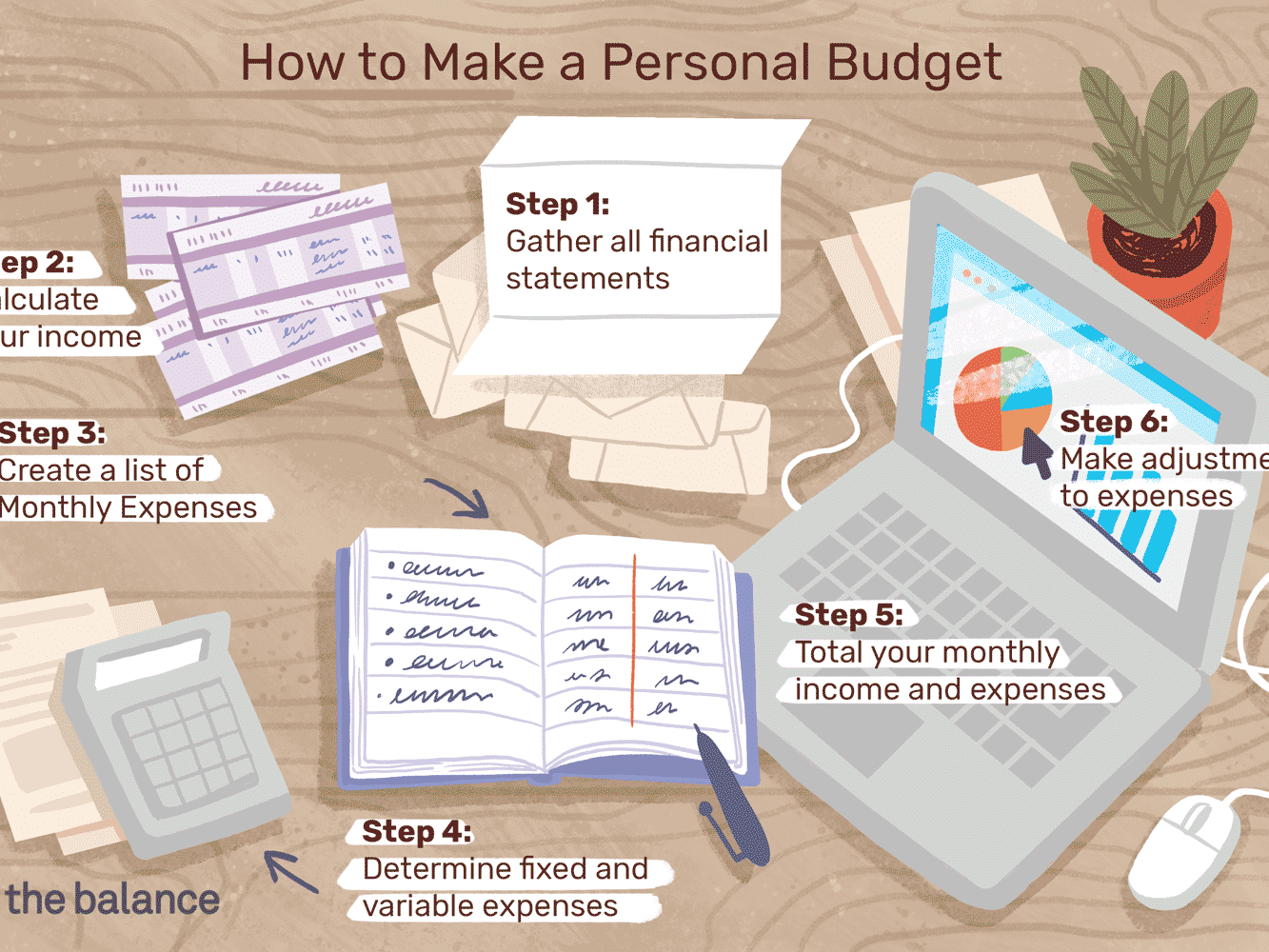

To begin, take a close look at your bank statements, credit card bills, and receipts from the past few months. By reviewing these documents, you’ll be able to identify your regular expenses as well as any unexpected or one-time costs. It’s essential to pay attention to both fixed expenses, such as rent or mortgage payments, utility bills, and loan repayments, as well as variable expenses like groceries, dining out, entertainment, and transportation.

Once you have a comprehensive list of expenses, categorize them based on their nature and frequency. This can be done by creating your own categories that reflect your unique spending habits. For example, you may have categories such as Housing, Transportation, Food and Dining, Healthcare, Entertainment, Personal Care, and so on.

Next, consider the significance of each expense category in relation to your overall budget. Are there any areas where you consistently overspend? Are there expenses that could be reduced or eliminated altogether? Identify potential ways to cut back and prioritize your spending accordingly.

Don’t forget to account for irregular expenses, such as annual subscriptions, vacations, or holiday gifts, by incorporating them into your budget plan. This will help you anticipate and allocate funds for these expenses, preventing any last-minute financial strains.

Remember: analyzing your expenses is an ongoing process. Regularly reviewing your spending patterns will allow you to make informed decisions and adjust your budget as needed to achieve your financial goals.

Take control of your finances by thoroughly examining your expenses, categorizing them appropriately, and making thoughtful adjustments to your budget plan. This understanding will empower you to make more informed financial choices and achieve greater financial stability.

Setting Financial Goals

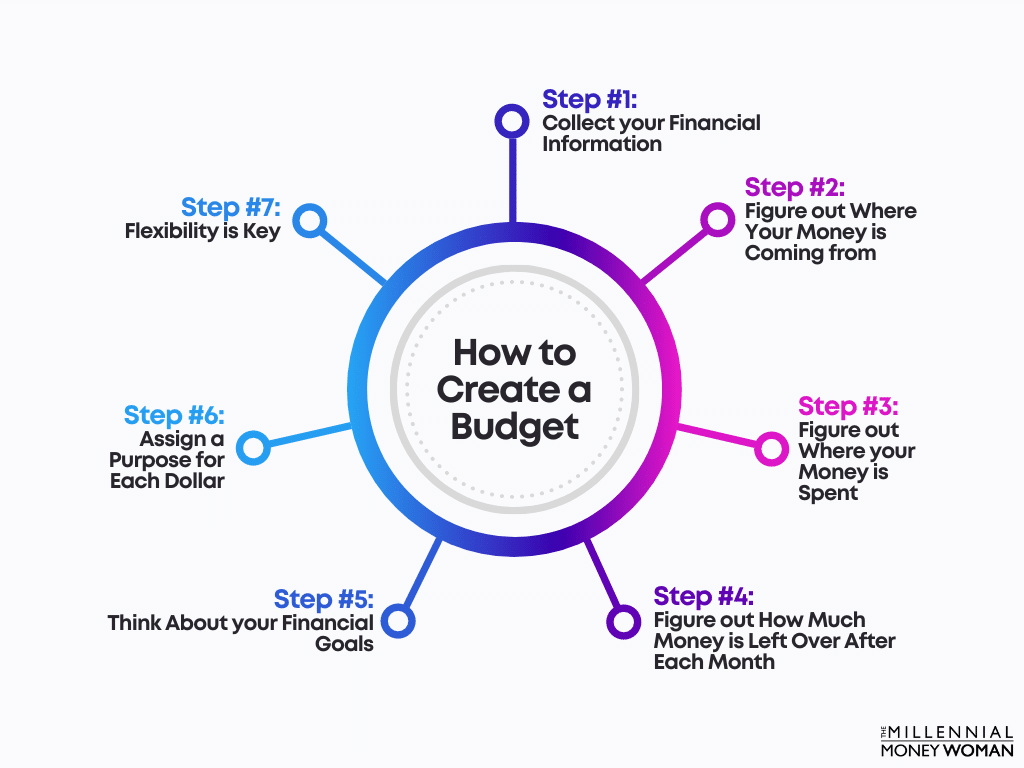

Mapping out your financial future starts with setting clear and attainable financial goals. These goals serve as the building blocks of your personalized budget plan, enabling you to take control of your finances and work towards a secure financial future. By identifying your priorities and aspirations, you can establish a roadmap to guide your financial decisions and actions.

When setting financial goals, it’s important to focus on both short-term and long-term objectives. Short-term goals provide immediate direction and satisfaction, while long-term goals help create a vision for your future financial stability. By balancing these two types of goals, you can ensure that your budget plan covers your immediate needs and also aligns with your bigger aspirations, such as buying a house, starting a business, or saving for retirement.

- Prioritize: Start by prioritizing your financial goals based on their importance to you. Determine what matters most, whether it’s paying off debt, saving for a dream vacation, or building an emergency fund.

- Be Specific: Set goals that are specific and measurable. Instead of saying you want to save money, define how much you want to save within a certain time frame. This way, you can track your progress and stay motivated.

- Set Deadlines: Assign realistic deadlines to your financial goals. Deadlines create a sense of urgency and help you stay committed to your plan. Break down long-term goals into smaller milestones to make them more manageable and achievable.

- Consider Financial Constraints: Take into account your current income and expenses when setting your goals. Be realistic about what you can comfortably afford and adjust your expectations accordingly. Remember that it’s okay to start small and gradually increase your goals as your financial situation improves.

- Review and Revise: Regularly review your financial goals and make adjustments as necessary. Life circumstances change, and so do your priorities. Make sure your goals remain relevant and aligned with your evolving financial situation.

Setting financial goals is a crucial step in creating a personalized budget plan. By defining your aspirations and mapping out a clear path towards achieving them, you are setting yourself up for financial success and enabling yourself to make confident and informed financial decisions.

Identifying Short-Term and Long-Term Goals

Mapping out your aspirations and objectives is a crucial step in crafting a tailored financial blueprint. By identifying both short-term and long-term goals, you can gain clarity on what you hope to achieve and set yourself on a path towards financial success.

Short-term goals encompass your immediate desires and aspirations that you aim to accomplish within a limited timeframe. These objectives may include saving for a vacation, purchasing a new gadget, or paying off existing debts. By setting tangible short-term goals, you can maintain a sense of motivation and track your progress towards achieving financial milestones.

On the other hand, long-term goals involve envisioning your future and planning for significant life events or milestones that may require substantial financial resources. Such goals may include buying a house, saving for retirement, starting a family, or launching a business. Identifying and setting long-term goals can provide you with a sense of purpose and enable strategic financial planning over an extended period.

Remember that the key to effective goal setting lies in specificity and feasibility. Clearly defining your goals and breaking them down into measurable steps can make them more attainable. It is advisable to prioritize your goals based on urgency, importance, and personal aspirations.

Once you have identified your short-term and long-term goals, you can align them with your budgeting efforts. This will allow you to allocate resources accordingly, ensuring that you have the necessary funds to work towards your aspirations while covering essential expenses and saving for the future.

In summary, identifying short-term and long-term goals forms a crucial part of creating a personalized financial strategy. By understanding your aspirations and breaking them down into achievable objectives, you can stay motivated, track your progress, and make informed financial decisions that align with your vision for the future.

Prioritizing Your Goals

Setting priorities is essential when it comes to managing your personal finances effectively. By establishing clear goals and placing them in order of importance, you can create a solid foundation for your budget plan. Prioritizing your goals allows you to focus your resources and efforts on the most significant aspects of your financial life, ensuring that you are making progress towards what matters most to you.

Determining your priorities

When determining your priorities, it’s crucial to reflect on your values, dreams, and long-term aspirations. Consider what truly matters to you and what you want to achieve both in the short and long term. This can include financial milestones such as debt reduction, saving for a down payment on a house, starting a business, or planning for retirement. By evaluating your goals and their significance, you can gain clarity on what deserves your attention and resources.

Ranking your goals

Once you have identified your goals, it’s time to rank them in order of priority. Start by considering the time sensitivity and urgency of each objective. Some goals may require immediate attention, while others can be addressed gradually over time. Additionally, take into account the long-term impact and emotional importance of each goal in your life. This ranking will serve as a roadmap for allocating your financial resources and efforts, ensuring that the most critical goals receive the necessary attention.

Revisiting and adjusting priorities

Remember that priorities may change over time. Life circumstances, financial situations, and personal aspirations evolve, which means your goals may need to be adjusted accordingly. Regularly revisit and evaluate your priorities to ensure they align with your current needs and desires. It’s essential to be flexible and open to adapting your budget plan to accommodate any shifting priorities that may arise.

Emphasizing the importance of balance

While prioritizing your financial goals is crucial, it’s equally important to maintain a sense of balance. Allocating all your resources to achieving one goal may neglect other areas of your life that require attention. Strive to strike a balance between short-term and long-term goals, as well as between financial aspects and other aspects of your well-being. By finding equilibrium, you can lead a fulfilling and financially responsible life.

In conclusion, prioritizing your goals is an integral part of creating a personalized budget plan. By determining your priorities, ranking them, and adjusting as needed, you can ensure that your financial efforts are aligned with what truly matters to you. Remember to maintain balance and regularly review your priorities to adapt to any changes that may arise. By doing so, you can stay on track towards achieving financial success while enjoying a well-rounded and fulfilling life.

Creating a Realistic Budget

In order to effectively manage your finances and achieve your financial goals, it is crucial to develop a practical budget that aligns with your personal circumstances and objectives. By creating a balanced spending plan that reflects your income, expenses, and savings, you can establish a solid foundation for financial stability and success.

Achieving a realistic budget starts with understanding your financial reality. It requires a clear assessment of your income sources and an honest evaluation of your spending patterns. By identifying your fixed expenses, such as rent or mortgage payments, utilities, and loan payments, you can determine the minimum amount needed to cover your basic needs.

Once your fixed expenses are accounted for, it’s important to evaluate your discretionary spending. This includes expenses such as dining out, entertainment, and travel. While these expenses may add enjoyment to your life, it’s essential to assess whether they align with your financial goals and make adjustments if necessary. This evaluation allows you to prioritize your spending and ensure that your budget realistically reflects your priorities.

Creating a realistic budget also involves planning for unexpected or irregular expenses. It is wise to set aside a portion of your income for emergency funds to cover unexpected expenses, such as medical bills or car repairs. Furthermore, considering irregular expenses, such as annual insurance premiums or property taxes, and factoring them into your budget can prevent financial stress and help you maintain control over your finances.

Throughout the budgeting process, it’s important to be flexible and adaptable. Financial circumstances can change, and it’s crucial to regularly review and adjust your budget to reflect any changes in income, expenses, or goals. By staying proactive and regularly monitoring your budget, you can maintain a realistic financial plan that truly supports your financial well-being.

In summary, creating a realistic budget is a fundamental step towards achieving financial stability and achieving your financial goals. By accurately assessing your income, evaluating your expenses, and planning for unexpected costs, you can develop a spending plan that reflects your priorities and financial circumstances. Remember to remain flexible and adjust your budget as needed to ensure its continued relevancy and effectiveness.

Estimating Your Monthly Income

When it comes to managing your finances effectively, one of the first steps is to accurately estimate your monthly income. Understanding how much money you have coming in each month is crucial for creating a budget that aligns with your financial goals. In this section, we will explore the various sources of income you may have and provide tips on how to estimate them.

1. Employment Income: If you work a regular job, your employment income is likely to be your primary source of monthly earnings. This can include your salary, hourly wages, or any bonuses or commissions you receive. Be sure to take into account any deductions or taxes that may be applicable.

2. Side Hustles and Freelance Work: Many people have additional sources of income outside of their regular employment. This can include side hustles, freelance work, or even income from renting out property. Take stock of any extra income streams you may have and estimate how much they contribute to your monthly earnings.

3. Investments and Dividends: If you have investments in stocks, bonds, or mutual funds, you may receive regular dividends or interest income. These can fluctuate based on market conditions, so it’s important to estimate an average monthly income from these sources.

4. Rental Income: If you own property and rent it out, the rental income can significantly contribute to your monthly earnings. Keep track of the rent you receive and factor it into your income estimation.

5. Government Assistance: Depending on your situation, you may be eligible for various forms of government assistance such as unemployment benefits, social security payments, or disability income. These sources can provide a reliable monthly income, but it’s essential to understand the eligibility criteria and any potential changes in the benefit amount.

Remember, when estimating your monthly income, it’s crucial to be realistic and conservative. Overestimating your earnings can lead to budgeting errors and financial stress. By considering all possible sources of income and accurately estimating them, you can create a more precise and effective budget plan.

Allocating Funds to Essential Expenses

When it comes to managing your finances, one of the crucial steps is ensuring that you allocate your funds wisely to cover essential expenses. This means strategically assigning your available money to meet your basic needs and obligations, without overspending or going into debt.

To begin with, it is important to prioritize your essential expenses. These are the recurring payments that you must make to ensure your basic needs are met and your life functions smoothly. Examples include rent or mortgage payments, utility bills, groceries, transportation costs, and insurance premiums.

Once you have identified your essential expenses, it is helpful to create a budget category for each of them. This allows you to track and monitor your spending in a structured manner. Consider using a spreadsheet or budgeting app to organize your expenses and ensure that you allocate the appropriate amount of funds to each category.

When allocating funds to essential expenses, it is crucial to be realistic and practical. Take into account your income and prioritize your needs over wants. It may require making sacrifices in other areas of your budget, such as cutting back on discretionary expenses like entertainment or dining out, in order to ensure that your essential expenses are covered.

Another tip for effective fund allocation is to review and reassess your essential expenses periodically. As your situation and priorities may change over time, it is important to regularly evaluate whether your current allocations still reflect your needs and goals. Adjustments may need to be made to ensure that your funds are allocated in the most optimal way.

Lastly, implementing strategies to reduce your essential expenses can also be beneficial in the long run. This can involve seeking out cost-saving opportunities, such as shopping for deals and discounts, comparing prices, and finding ways to conserve energy and resources. By minimizing your essential expenses, you can free up more funds for other financial goals or unexpected expenses.

- Prioritize your essential expenses.

- Create budget categories for each expense.

- Be realistic and practical.

- Regularly review and reassess your allocations.

- Implement strategies to reduce essential expenses.

By effectively allocating funds to essential expenses, you can ensure that your financial resources are being utilized efficiently and appropriately, providing you with greater peace of mind and the foundation for achieving your financial goals.

Allocating Funds to Discretionary Expenses

In this section, we will explore the process of distributing money towards discretionary expenses, allowing you to make informed choices about how you spend your funds. When it comes to managing your budget effectively, it is crucial to allocate a portion of your income to discretionary expenses. These expenses can include entertainment, dining out, hobbies, and other non-essential purchases that add enjoyment and fulfillment to your life.

Understanding the Importance of Discretionary Expenses

Discretionary expenses play an integral role in your overall financial well-being by allowing you to indulge in activities and experiences that enhance your quality of life. These expenses are different from essential expenses like rent, utilities, and groceries, which are necessary for day-to-day living. Allocating funds to discretionary expenses ensures that you have the flexibility to enjoy life’s pleasures without compromising your financial stability.

Identifying Your Discretionary Expenses

It is important to identify and categorize your discretionary expenses to gain a better understanding of your spending habits. Take the time to evaluate your past expenditure and determine which expenses fall into the discretionary category. This can include things like going to the movies, eating out at restaurants, purchasing new clothing or gadgets, or traveling.

Setting Realistic Limits

Once you have identified your discretionary expenses, it is essential to set realistic limits within your budget. Determine the amount of money you can comfortably allocate towards these expenses without jeopardizing your financial goals or necessary obligations. By setting limits, you can prioritize your spending and ensure that you do not overspend in this category.

Exploring Cost-Cutting Strategies

While indulging in discretionary expenses is important for your well-being, it is also essential to find ways to save money within this category. Consider exploring cost-cutting strategies such as finding discounted activities or dining options, utilizing coupons or deals, or opting for less expensive alternatives. These strategies will allow you to enjoy your discretionary expenses while still maintaining financial responsibility.

By properly allocating funds to discretionary expenses, you can strike a balance between enjoying life’s pleasures and maintaining financial stability. Making conscious choices about how you spend your money will enable you to create a budget plan that reflects your values and priorities, ensuring a more fulfilling and sustainable financial future.

Questions and answers

What is a personalized budget plan?

A personalized budget plan is a financial strategy tailored specifically to an individual or a household’s unique financial situation and goals. It involves analyzing income, expenses, and savings, and creating a plan to allocate money effectively.

Why is it important to create a personalized budget plan?

Creating a personalized budget plan is important because it helps individuals take control of their finances, manage their money wisely, and work towards their financial goals. It provides a clear understanding of income, expenses, debt obligations, and savings, which helps individuals make informed financial decisions.

How can I start creating a personalized budget plan?

You can start by gathering all the necessary financial information, including income sources, bills, debts, and monthly expenses. Then, analyze your expenses and prioritize your financial goals. Create spending categories, allocate money to each category, and track your spending regularly to ensure you stay on track with your budget plan.

What are some tips for sticking to a personalized budget plan?

To stick to a personalized budget plan, it is important to track your expenses regularly, avoid unnecessary spending, and make adjustments if needed. It can also be helpful to set specific financial goals, create a timeline for achieving those goals, and consistently review and reassess your budget plan to ensure it remains effective.

Can a personalized budget plan help me save money?

Yes, a personalized budget plan can be a great tool for saving money. By tracking your expenses, identifying areas where you can cut back, and allocating a portion of your income towards savings, you can develop good financial habits and build up your savings over time.

How can I create a personalized budget plan?

Creating a personalized budget plan involves several steps. First, assess your income and expenses to get a clear picture of your financial situation. Next, identify your financial goals and prioritize them. Then, track your spending habits, categorize expenses, and evaluate where you can cut back. Creating a budget spreadsheet or using budgeting apps can help with this process. Finally, review and adjust your budget regularly to ensure it aligns with your goals and lifestyle.

What are some effective ways to track my spending habits?

There are several effective ways to track your spending habits. You can start by keeping receipts and tracking your expenses manually in a notebook or using a spreadsheet. Alternatively, you can use budgeting apps that automatically categorize your expenses by linking them to your bank account. Another useful method is to set spending limits on different categories and use cash envelopes to allocate a specific amount for each expense. Find the method that works best for you and helps you stay organized and aware of your spending.

Is it important to have financial goals when creating a budget plan?

Yes, having financial goals is crucial when creating a budget plan. Financial goals give you a clear direction and purpose for your budgeting efforts. They can include short-term goals like saving for a vacation or a down payment on a house, as well as long-term goals like building an emergency fund or saving for retirement. Setting goals helps you stay motivated and focused on achieving financial stability and success.

What are some common budgeting mistakes to avoid?

There are several common budgeting mistakes to avoid. One mistake is not tracking your expenses regularly, which can lead to overspending and losing control of your budget. Another mistake is not having a realistic budget that aligns with your income and financial goals. It’s important to be honest with yourself about your spending habits and adjust your budget accordingly. Additionally, neglecting to prioritize saving and not accounting for unexpected expenses are also common mistakes. Being proactive and flexible with your budget will help you avoid these pitfalls.

How often should I review and adjust my budget?

It is recommended to review and adjust your budget on a monthly basis, especially when you are just starting out. This allows you to track your progress, identify any areas of overspending, and make necessary adjustments. However, as you become more comfortable with budgeting, you can choose to review and adjust it less frequently, such as every few months or whenever there are significant changes in your income or expenses. The key is to ensure your budget remains realistic and continues to support your financial goals.