Embracing a transformative financial journey requires a strategic approach that goes beyond conventional methods. Embarking on the 52-Week Money Saving Challenge presents a unique opportunity to revolutionize your wealth management practices and achieve long-term monetary stability. This article serves as a compass, offering invaluable insights and alternative strategies to attain success in your financial endeavors.

Uncover the secrets of a successful endeavor: Thinking beyond weeks.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreWhile the challenge may be structured around a year’s timeframe, genuine triumph lies in diverting our focus beyond the concept of mere weeks. Developing a comprehensive perspective entails adopting a broader mindset, integrating strong financial habits beyond this short-term endeavor. By placing emphasis on overall financial resilience and adaptability, we transcend the limitations of the challenge and work towards fostering sustainable wealth management practices.

Discovering alternative paths to saving: Breaking free from traditional confines.

Achieving remarkable success in the 52-Week Money Saving Challenge necessitates exploring innovative approaches to saving money. Do not confine yourself to the conventional strategies that might leave you feeling confined and restricted. Embrace creative solutions such as shifting priorities, identifying budget leaks, and reevaluating your spending habits. By applying these unconventional tactics, you will harness the power of versatility and maximize your savings potential.

Unleashing the power of perseverance: A mindset that propels you towards triumph.

Embarking on the 52-Week Money Saving Challenge requires unwavering determination, resilience, and a relentless drive for financial independence. Cultivating a mindset that embraces challenges as opportunities cultivates personal growth and an unwavering commitment to success. Throughout this transformative journey, it is essential to remind yourself of the long-term benefits awaiting you upon completion, empowering you to stay motivated and overcome any obstacles along the way.

- Creating a Successful Saving Strategy

- Set Realistic Saving Goals

- Break It Down Into Manageable Weekly Amounts

- Automate Your Savings

- Staying Motivated Throughout the Journey

- Reward Yourself for Milestones

- Track Your Progress Regularly

- Join a Supportive Community

- Overcoming Potential Obstacles

- Adjusting for Unexpected Expenses

- Find Creative Ways to Cut Costs

- Stay Focused and Avoid Temptations

- Maximizing Your Savings at the End of the Journey

- Questions and answers

Creating a Successful Saving Strategy

Developing an effective plan for managing your finances and setting aside funds for future goals is vital in today’s fast-paced world. A well-thought-out saving strategy can provide a sense of security and help you achieve your dreams. This section will outline some key steps to consider when creating a winning approach to saving without explicitly referring to the specific details of the 52 Week Money Saving Challenge.

1. Define Your Financial Goals:

Before diving into any saving strategy, it’s crucial to have a clear understanding of what you’re trying to achieve. By identifying your short-term and long-term financial goals, you can determine how much money you need to save and over what period of time. By setting specific targets, you can stay motivated and focused on the end result.

2. Analyze Your Current Spending Habits:

Take a close look at your current spending patterns to identify areas where you can cut back and save money. This could involve reducing discretionary expenses or finding innovative ways to reduce your day-to-day costs. By objectively assessing your spending habits, you can uncover opportunities for increased savings.

3. Create a Realistic Budget:

Once you have a clear understanding of your financial goals and spending habits, it’s time to create a budget that aligns with your objectives. This budget should account for your income, expenses, and savings targets. A well-structured budget will help you track your progress, make informed financial decisions, and ensure that you stick to your saving strategy.

4. Automate Your Savings:

To ensure regular and consistent savings, consider automating the process. Set up automatic transfers from your checking account to a designated savings account. This approach eliminates the temptation to skip or delay deposits, making it easier to stay on track with your saving goals.

5. Seek Professional Advice:

If you’re unsure about the best approach to saving or need expert guidance, consider consulting a financial advisor. They can provide personalized advice based on your unique situation and help you create a tailored saving strategy that aligns with your needs and objectives.

A successful saving strategy requires careful planning, commitment, and adaptability. By defining your goals, analyzing your spending habits, creating a realistic budget, automating your savings, and seeking professional advice when needed, you can establish a solid foundation for financial success.

Set Realistic Saving Goals

Creating attainable savings targets is essential for successfully mastering the 52 Week Money Saving Challenge. By setting realistic goals, you can increase your chances of accomplishing them and stay motivated throughout the challenge.

- Define your financial objectives: Before starting the challenge, take some time to identify your specific financial goals. Whether you aim to save for a vacation, a down payment on a house, or an emergency fund, having a clear idea of what you want to achieve will help you set realistic saving goals.

- Assess your current financial situation: Evaluate your income, expenses, and existing savings to determine how much you can comfortably save each week. Consider your monthly bills, debts, and other financial obligations to ensure that your saving goals align with your current financial capabilities.

- Break down your goals into manageable increments: Rather than fixing a large amount to save each week, consider dividing your target into smaller, more achievable increments. For example, if your goal is to save $1,000 by the end of the year, you can aim to save approximately $20 per week. Breaking down your goals makes them less overwhelming and easier to track.

- Track your progress: Keep a record of your savings each week to monitor your progress. This will help you stay accountable and motivated to continue saving. Use a journal, spreadsheet, or a mobile app to track your savings and visualize how close you are to reaching your goals.

- Adjust your goals when necessary: Life circumstances and unexpected expenses may arise during the challenge. It’s important to be flexible and adjust your saving goals accordingly. If you encounter difficulties, such as a medical emergency or car repair, reassess your savings targets and make necessary adjustments without losing sight of your long-term goals.

By setting realistic saving goals, you can make the most of the 52 Week Money Saving Challenge and improve your financial future. Remember, every small step towards your goals counts, and consistency is key in achieving financial success.

Break It Down Into Manageable Weekly Amounts

When it comes to successfully completing the 52 Week Money Saving Challenge, one effective strategy is to break it down into manageable weekly amounts. By dividing the total savings goal into smaller increments, it becomes much more attainable and less overwhelming.

Instead of focusing on the large sum that needs to be saved over the course of a year, individuals can set aside a specific amount each week that fits within their budget and financial capabilities. This approach allows for better planning and prevents the temptation to give up on the challenge due to feeling like it’s too difficult or unattainable.

Breaking it down into manageable weekly amounts also provides a sense of accomplishment and progress. Each week, as the designated amount is saved, individuals can see their savings grow. This continuous positive reinforcement can help them stay motivated and engaged in the challenge.

Moreover, the concept of breaking it down into weekly amounts allows for flexibility and adjustment. As financial situations may change throughout the year, individuals can modify their weekly savings to ensure they are still on track towards their overall goal. This adaptability makes the challenge more sustainable and adaptable to various circumstances.

In summary, breaking the 52 Week Money Saving Challenge into manageable weekly amounts is a practical and effective way to achieve financial goals. It brings a sense of structure, motivation, and flexibility to the saving process, making it more attainable and sustainable in the long run.

Automate Your Savings

Streamline and simplify your savings journey by automating your savings. This effective strategy allows you to effortlessly save money without the need for constant manual efforts. By setting up automatic transfers or direct deposits, you can ensure a consistent and regular contribution to your savings account.

Through automation, you can eliminate the risk of forgetting to save or being tempted to spend the money earmarked for savings. Instead, your savings will grow steadily, week after week, without any additional effort on your part. It’s like having a dedicated financial assistant who diligently puts money aside for your future.

A great way to automate your savings is by setting up recurring transfers from your checking account to a designated savings account. This can be done through your bank’s online banking system, or by contacting your bank directly. By specifying the frequency and amount of the transfers, you can tailor it to fit your individual financial goals and capacity. Whether it’s a fixed amount or a percentage of your income, automation ensures consistent savings contributions.

Another option is to arrange for direct deposit from your employer to allocate a portion of your paycheck directly into your savings account. This method allows you to save money before it even reaches your hands, increasing the likelihood of building substantial savings over time. Additionally, some employers may offer matching contributions to your savings, which can further accelerate your progress towards financial security.

Automating your savings not only makes the process effortless, but it also helps you develop a consistent savings habit. By removing the need for manual transfers, you can focus on other aspects of your financial journey, such as budgeting, investing, or debt repayment. By embracing automation, you can take full control of your finances and pave the way for long-term financial success.

| Benefits of Automating Your Savings |

| 1. Consistent and regular savings contributions. |

| 2. Reduced risk of forgetting or being tempted to spend savings. |

| 3. Effortlessly grow your savings week after week. |

| 4. Tailor the frequency and amount of transfers to fit your goals. |

| 5. Build a consistent savings habit. |

Staying Motivated Throughout the Journey

Ensuring a continuous drive and determination is crucial to successfully completing the 52 Week Money Saving Challenge. The path towards financial stability and reaching your savings goal requires unwavering commitment and focus. Here are some essential strategies to help you stay motivated throughout the challenge:

- Set Clear and Achievable Goals: Begin by defining specific savings targets and breaking them down into smaller milestones. This approach will make your progress more tangible and provide a sense of accomplishment as you tick off each milestone.

- Create Accountability: Find an accountability partner, such as a friend or family member, who can cheer you on throughout the challenge. Regular check-ins and discussions about your progress will keep you motivated and provide the necessary support when faced with obstacles.

- Track Your Progress: Utilize a visual tracking method, such as a savings chart or spreadsheet, to monitor your progress. Seeing the incremental growth of your savings can be highly motivating and reinforce your commitment to the challenge.

- Reward Yourself: Celebrate your milestones by rewarding yourself with small, non-financial treats. This could be treating yourself to a relaxing spa day, a favorite movie night, or even indulging in a delicious meal. These rewards will provide a sense of gratification and keep your motivation levels high.

- Seek Inspiration: Surround yourself with sources of inspiration and success stories from others who have completed similar challenges. Engage with online communities or read books and articles that emphasize the importance of financial discipline and savings. This exposure will remind you of the potential rewards and the long-term benefits of staying on track.

- Stay Positive: Along the journey, you may encounter setbacks or moments of doubt. It is essential to maintain a positive mindset and not let these obstacles deter you from your goal. Practice gratitude for the progress you have made and focus on the ultimate financial freedom that awaits you.

- Adjust as Needed: Remember that life can bring unexpected changes or challenges. If necessary, adapt your savings plan to accommodate any unforeseen circumstances. Stay flexible and be willing to make adjustments while staying committed to your overall objective.

By implementing these strategies and staying motivated throughout the 52 Week Money Saving Challenge, you are setting yourself up for financial success and a brighter future.

Reward Yourself for Milestones

As you progress through the 52-week money saving challenge, it is important to acknowledge and celebrate your milestones along the way. By rewarding yourself for reaching certain targets, you can stay motivated and increase your chances of successfully completing the challenge.

When it comes to rewarding yourself, think about what brings you joy and satisfaction. It could be treating yourself to a favorite meal at a restaurant, indulging in a spa day, or purchasing a small item that you’ve been eyeing for a while. The key is to choose rewards that are meaningful to you and align with your personal interests and desires.

Create a milestone rewards system that matches your progress in the challenge. For example, you could set smaller milestones for every 10 weeks completed and plan a reward that corresponds to the significance of reaching that point. As you reach larger milestones, such as the halfway mark or the final week, consider treating yourself to a bigger or more extravagant reward.

One way to track your progress and reward yourself is by using a visual representation, such as a table or a checklist. Each time you achieve a milestone, mark it off and allow yourself to bask in the satisfaction of your accomplishments. This visual reminder can serve as a source of motivation and encouragement as you continue on the challenging journey of saving money.

Remember, rewarding yourself for milestones is not only about the tangible benefits you receive, but also about recognizing the hard work and discipline you’ve put into the savings challenge. Celebrating your achievements can boost your self-confidence and reinforce positive habits, making it easier to stay on track and complete the 52-week money saving challenge successfully.

Above all, enjoy the process and savor the feeling of progressing towards your financial goals. By rewarding yourself for milestones, you can make the money saving challenge more enjoyable and increase your chances of long-term success.

Track Your Progress Regularly

Monitoring your advancement on a regular basis is key to successfully completing the 52 Week Money Saving Challenge. By regularly tracking your progress, you can stay motivated, make necessary adjustments, and ensure you stay on track to achieve your financial goals.

One effective way to track your progress is by maintaining a comprehensive record or journal. Keeping a log of your savings journey allows you to accurately monitor your deposits, withdrawals, and overall financial growth. Additionally, it enables you to reflect on your progress and identify any patterns or trends that may influence your saving habits.

| Week | Savings |

|---|---|

| 1 | $10 |

| 2 | $20 |

| 3 | $30 |

| 4 | $40 |

Another method to track your progress is by visualizing your savings growth using charts or graphs. Creating a visual representation of your financial journey can provide a clear and motivating snapshot of your progress. Whether it’s a line graph, bar chart, or pie chart, choose a format that resonates with you and clearly showcases your achievements.

Additionally, technology can be a valuable tool in tracking your progress. Utilize budgeting apps or online spreadsheets to easily input and analyze your savings data. Many apps offer features such as reminders and notifications to keep you accountable and on track. Explore different apps or online tools to find one that suits your preferences and goals.

Lastly, don’t forget to regularly celebrate milestones along your savings journey. Recognizing and rewarding yourself for reaching targets can boost your motivation and propel you further towards your ultimate financial success. Whether it’s treating yourself to a small indulgence or rewarding yourself with a meaningful experience, acknowledge your accomplishments and use them as fuel to continue saving.

In conclusion, tracking your progress regularly is essential in mastering the 52 Week Money Saving Challenge. By maintaining a comprehensive record, visualizing your growth, utilizing technology, and celebrating milestones, you can stay motivated, overcome obstacles, and achieve financial success.

Join a Supportive Community

When embarking on a financial journey like the 52 Week Money Saving Challenge, it’s important to surround yourself with like-minded individuals who can provide support, motivation, and guidance along the way. Connecting with a supportive community can make a significant difference in your success and keep you engaged and focused on achieving your savings goals.

Find Your Tribe: Seek out online forums, social media groups, or local meetups that cater to individuals who are committed to saving money and improving their financial well-being. By joining these communities, you can exchange ideas, share experiences, and gain valuable insights from others who are on a similar journey.

Stay Accountable: Being a part of a supportive community helps you stay accountable to your saving goals. Engage with others regularly, share your progress, and receive constructive feedback. Knowing that others are taking notice of your efforts can increase your motivation and determination to stay on track.

Receive Encouragement: Challenges and setbacks are inevitable on any savings journey. However, having a supportive community can provide the encouragement and support you need to overcome these obstacles and stay motivated. Whether it’s celebrating small victories or offering words of encouragement during tough times, having a group of individuals who understand your struggles and are rooting for your success can make all the difference.

Share Strategies: A diverse community offers a wealth of resources and strategies that can help you optimize your savings journey. Learn from others’ experiences, gather tips and tricks, and adapt strategies that align with your own financial goals. By sharing your own strategies, you can also contribute to the community and help others achieve their saving milestones.

Build Lasting Connections: Joining a supportive community not only provides a platform for learning and growth but can also cultivate lasting friendships. Interacting with individuals who share similar aspirations can foster new connections and create a network of support beyond just financial goals. Together, you can celebrate achievements, cheer each other on, and build a strong community that extends beyond the 52 Week Money Saving Challenge.

By joining a supportive community, you’ll have the opportunity to connect with individuals who are passionate about saving money. You’ll receive the support, encouragement, and resources you need to consistently progress towards your financial goals. Embrace the power of community and unlock your full potential on your savings journey!

Overcoming Potential Obstacles

When following the 52 Week Money Saving Challenge, it’s important to be prepared for potential obstacles that may arise along the way. By recognizing and addressing these hurdles, you can stay motivated and successfully achieve your savings goals. Here are some strategies to overcome the challenges that may come your way:

- Stay committed: Upholding a strong commitment to the challenge will help you overcome any obstacles that may deter you from saving. Remind yourself regularly of the long-term benefits that the challenge will bring.

- Create a budget: Developing a clear and realistic budget will help you overcome financial obstacles. By properly allocating your income towards savings and daily expenses, you can navigate unexpected expenditures more effectively.

- Adapt to changing circumstances: Life is full of unexpected twists and turns. When facing financial hurdles such as unexpected bills or emergencies, be adaptable and find alternative ways to stay on track with your savings plan.

- Seek support: Sharing your challenges and goals with others can provide valuable support and encouragement. Whether it’s a friend, family member, or an online community, having a support system in place will help you stay motivated and overcome any obstacles.

- Track your progress: Regularly monitoring your progress is vital in overcoming obstacles. Use a journal, spreadsheet, or a mobile app to track your savings journey and celebrate milestones along the way. This visual representation of your progress will keep you motivated and focused on the end goal.

- Practice patience: The 52 Week Money Saving Challenge requires a long-term commitment. On some weeks, the amount to save may feel significant, while others may appear small. Practicing patience and staying consistent will help you overcome the temptation to quit when faced with challenges.

- Stay motivated: It’s essential to continuously remind yourself of the reasons why you embarked on this savings challenge. Visualize the financial freedom, security, or goal you are working towards and use this motivation to power through any obstacles.

By incorporating these strategies into your savings journey, you can overcome potential obstacles and achieve success in the 52 Week Money Saving Challenge. Remember, perseverance and determination are key to accomplishing your financial goals.

Adjusting for Unexpected Expenses

Unexpected expenses can arise in our lives at any time, disrupting our financial plans and causing stress. It is important to be prepared for these situations and have strategies in place to adapt and adjust our savings goals accordingly.

When faced with unexpected expenses, it is essential to reassess our spending habits and prioritize our financial needs. This may involve cutting back on non-essential expenses, such as dining out or entertainment, to free up additional funds for emergencies. By making small sacrifices in our day-to-day spending, we can create a safety net to handle unexpected costs without derailing our overall savings goals.

Creating an emergency fund is another critical step in adjusting for unexpected expenses. By setting aside a portion of our income specifically for unforeseen situations, we can protect ourselves from financial hardships. Regularly contributing to this fund, even in small increments, helps build a safety net that can be tapped into when needed. It is advisable to automate these contributions by setting up automatic transfers from our main bank account to ensure consistency and discipline in saving.

In addition to an emergency fund, exploring insurance options can also provide peace of mind when it comes to unexpected expenses. Whether it is health insurance, car insurance, or home insurance, having coverage can protect us financially in the event of accidents, illnesses, or natural disasters. It is crucial to review our insurance policies regularly to ensure they are up to date and adequately cover our needs.

Another approach to adjusting for unexpected expenses is to diversify our income streams. Relying solely on a single source of income can leave us vulnerable in times of financial turmoil. Exploring alternative sources of income, such as freelancing, renting out a room, or starting a side business, can provide an additional cushion when unexpected expenses arise. Diversifying our income not only provides financial security but also opens up new opportunities for growth and advancement.

In conclusion, unexpected expenses are an inevitable part of life, but by adjusting our financial plans and adopting proactive strategies, we can effectively navigate through them. By reassessing our spending habits, creating an emergency fund, exploring insurance options, and diversifying our income streams, we can better prepare ourselves for any financial curveballs that come our way.

Find Creative Ways to Cut Costs

Discover innovative methods to reduce expenses and save money without compromising your lifestyle. Instead of resorting to traditional money-saving techniques, explore unique and imaginative strategies that can help you achieve your financial goals.

One approach to cutting costs is to think outside the box and challenge conventional spending patterns. Look for alternative ways to meet your needs and desires while avoiding unnecessary expenses. Embrace your creativity and consider unconventional solutions that can lead to significant savings.

Another effective way to reduce costs is to embrace a minimalist lifestyle. Streamline your belongings and focus on only what truly brings you joy and adds value to your life. By decluttering and simplifying your surroundings, not only will you free up physical space, but you will also gain a clearer understanding of your priorities, allowing you to make more mindful spending decisions.

Furthermore, take advantage of technology to save money. Utilize online platforms and apps that offer discounts, coupons, and special offers. Research different money-saving websites and forums to find deals and promotions. Consider subscribing to newsletters or following social media accounts that share cost-cutting tips and exclusive offers.

Additionally, try DIY (do-it-yourself) projects to reduce expenses. Instead of outsourcing tasks or purchasing ready-made products, consider learning new skills and creating items yourself. Whether it’s cooking homemade meals, making your own cleaning supplies, or fixing minor household issues, embracing a hands-on approach can lead to significant savings over time.

Lastly, consider exploring alternative transportation options to save money on commuting and travel expenses. This could include carpooling with colleagues or using public transportation instead of owning a car. Additionally, consider biking or walking for shorter distances, not only saving money on transportation but also benefiting your health and the environment.

By thinking creatively and exploring unique methods to cut costs, you can achieve your financial goals while maintaining a fulfilling lifestyle. Incorporate these suggestions into your everyday life and watch as your savings grow over time.

Stay Focused and Avoid Temptations

Remaining committed to your financial goals without succumbing to distractions is essential for successfully completing the 52 Week Money Saving Challenge. It is crucial to stay focused and avoid temptations that may hinder your progress or derail your savings journey. By staying disciplined and making mindful choices, you can ensure that you stay on track and achieve your goals.

One way to stay focused is by establishing a clear vision of what you want to achieve with this challenge. Visualize the end result and remind yourself of the benefits that saving money will bring. Whether it’s a dream vacation, a down payment for a house, or a safety net for emergencies, keeping your objectives in mind will help you resist temptations to spend unnecessarily.

Another technique to avoid temptations is by adopting a proactive approach to managing your finances. Create a budget that aligns with your savings goals and stick to it diligently. By allocating specific amounts towards savings each week, you create a mental barrier against impulsive spending. When facing the temptation to buy unnecessary items, remind yourself of the progress you have made so far and the impact it will have on reaching your financial aspirations.

It’s also important to identify and eliminate triggers that may lead to impulsive spending. Take note of situations, places, or even certain friends or family members that tend to influence you to deviate from your savings plan. By being aware of these triggers, you can develop strategies to avoid them or find alternative ways to engage socially or seek entertainment that aligns with your financial goals.

Lastly, consider finding an accountability partner or joining a community of individuals who are also participating in the 52 Week Money Saving Challenge. By sharing your progress, challenges, and successes with others, you create a support system that can help you stay focused and motivated. Additionally, hearing about the experiences and strategies of others can provide valuable insights and inspiration to overcome any temptations that may arise along the way.

Maximizing Your Savings at the End of the Journey

As you approach the culmination of the 52 Week Money Saving Challenge, it is essential to strategize how to make the most of your accumulated funds. With a potent blend of shrewd planning and informed decision-making, you can optimize your savings for an impressive finale. Let’s explore some valuable insights to help you maximize your savings at the culmination of this formidable endeavor.

1. Unleash the Power of Compound Interest: At this juncture, it is crucial to acknowledge the potential of compound interest, which enables your savings to grow exponentially over time. By wisely investing your funds, you can harness the remarkable power of compounding and elevate the final sum significantly. Consider exploring various investment options that align with your risk tolerance and long-term financial goals.

2. Seek Out Lucrative Deals: As the final weeks approach, it is an opportune moment to scour the market for enticing deals and discounts. Be vigilant in your endeavors to secure the best possible prices for the items you need or desire. Utilize online platforms, compare prices, and leverage your negotiation skills to stretch your savings even further.

3. Revisit Your Budget: As you near the completion of this journey, it’s worthwhile to reassess your budget and identify areas where you can make additional cutbacks. Evaluate your spending habits and prioritize your expenditures to ensure your savings reach their fullest potential. Consider embracing frugal living choices and allocating a percentage of your savings towards attaining long-term financial security.

4. Embrace the Power of Automation: Utilizing automation tools can simplify the process of saving and maximize your progress. Investigate software or apps that automatically allocate a portion of your income towards your savings. By making regular contributions effortlessly, you can effortlessly reach your savings goals without the risk of forgetting or deterring from your chosen path.

5. Celebrate Your Accomplishments: Finally, take a moment to celebrate your dedication and perseverance throughout this challenging journey. Reward yourself for achieving your savings goals by treating yourself to a small indulgence. This celebration not only serves as a motivation boost but also allows you to enjoy the fruits of your disciplined savings habits.

By applying these strategies, you can ensure that your savings journey concludes on a high note, providing a solid stepping stone towards future financial accomplishments. Remain steadfast in your commitment, and let the final weeks serve as a testament to your unwavering determination and financial prowess.

Questions and answers

What is the 52 Week Money Saving Challenge?

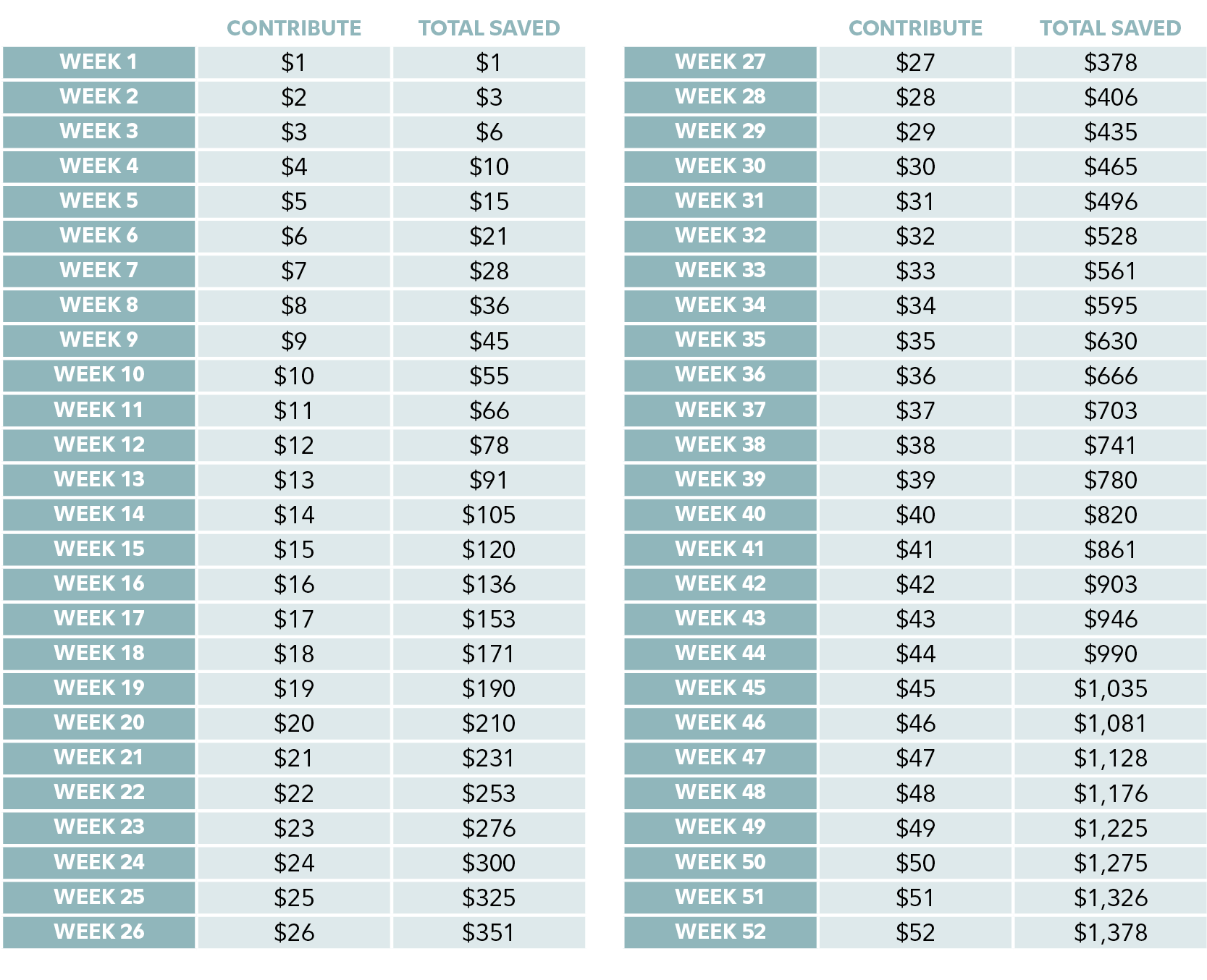

The 52 Week Money Saving Challenge is a popular savings method where you save a certain amount of money each week for a whole year. The amount you save increases incrementally every week, starting with $1 in week 1 and reaching $52 in week 52. By the end of the challenge, you will have saved a total of $1,378.

How can I stay motivated throughout the 52 Week Money Saving Challenge?

Staying motivated can be a challenge, but there are a few tips that can help. Firstly, set a clear goal for why you want to save money. Whether it’s for a specific purchase or building an emergency fund, having a purpose will keep you focused. Secondly, track your progress visually by using a savings chart or a savings app. Seeing the progress you’ve made can be incredibly motivating. Finally, consider finding an accountability partner or joining a support group to keep you motivated and on track.

What are some creative ways to save money for the 52 Week Money Saving Challenge?

There are numerous creative ways to save money. Here are a few ideas: 1) Cut down on eating out and cook homemade meals instead. 2) Cancel unused subscriptions or memberships. 3) Try a no-spend challenge for a certain period of time, where you only buy essentials. 4) Shop at thrift stores or second-hand markets for clothing and household items. 5) Use coupons or shop during sales to save on everyday purchases.

Can I start the 52 Week Money Saving Challenge at any time of the year?

Yes, you can start the challenge at any time of the year. You don’t have to start in January. Simply adjust the weekly savings amounts to match the remaining weeks of the year. For example, if you start in June, week 1 will be $25, and week 26 will be $1. The important thing is to stay consistent and committed to saving each week.

What happens if I miss a week or can’t save the designated amount?

If you miss a week or can’t save the designated amount, don’t worry. The most important thing is to keep going and not give up. You can either catch up by saving more in future weeks, or you can adjust the amount for the next week without falling too far behind. The goal is to develop a savings habit, so don’t let a minor setback discourage you.

What is the 52 Week Money Saving Challenge?

The 52 Week Money Saving Challenge is a popular money-saving method where you save a specific amount of money each week for an entire year. The amount you save increases by a small increment each week, starting from $1 in the first week.

How does the 52 Week Money Saving Challenge work?

The challenge follows a simple pattern. In the first week, you save $1, in the second week, you save $2, and so on. By the 52nd week, you will be saving $52. Over the course of the year, you will be able to save a total of $1,378 by gradually increasing the amount you set aside each week.

What are the benefits of the 52 Week Money Saving Challenge?

The 52 Week Money Saving Challenge offers several benefits. Firstly, it helps you develop a saving habit and encourages financial discipline. Secondly, it allows you to build an emergency fund or save for a specific goal, such as a vacation or a down payment for a house. Lastly, the incremental approach makes it an achievable and less overwhelming saving method.

Can I customize the 52 Week Money Saving Challenge?

Absolutely! The 52 Week Money Saving Challenge can be customized based on your financial situation and goals. If saving the full $1,378 seems difficult, you can start with a lower amount and gradually increase it over time. Additionally, you can reverse the challenge and start with the larger amounts first if that fits your budget better. The key is to personalize the challenge in a way that works for you.