Living with financial obligations can have a profound impact on one’s emotions and overall well-being. The burden of money owed can evoke a range of powerful feelings, affecting individuals both psychologically and emotionally. Managing debt and finding effective ways to alleviate its weight is crucial for personal growth and long-term financial stability.

The psychological toll. Unresolved debt can trigger feelings of anxiety, shame, and fear, leading individuals into a never-ending cycle of stress and worry. The constant pressure to meet financial obligations can erode self-esteem, creating a sense of powerlessness and vulnerability. Moreover, the weight of debt can strain personal relationships, as individuals may feel embarrassed or judged by their financial predicament.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreConquering the burden. Fortunately, there are practical steps that can alleviate the emotional and psychological impact of debt. One effective approach is to adopt a proactive mindset and confront the issue head-on. Acknowledging the problem and seeking support from trusted friends, family, or financial professionals can provide a sense of relief and empowerment.

Breaking the cycle. Creating a realistic budget and sticking to it is another crucial step towards overcoming the psychological burden of debt. By carefully assessing income and expenses, individuals can identify opportunities for saving and allocate funds towards debt repayment. This sense of control can have a transformative impact on emotional well-being and lay the groundwork for long-term financial success.

- Understanding the Emotional Toll of Debt

- The Link Between Debt and Anxiety

- Impact of Debt on Mental Health

- Relationship Strain Caused by Financial Stress

- Overcoming Debt: Strategies for Healing and Recovery

- Creating an Attainable Financial Plan

- Debt Consolidation and Payment Plans

- Seeking Professional Assistance

- Mindset Shift: Changing Perspectives on Debt

- Breaking the Cycle of Shame and Guilt

- The Power of Positive Thinking

- Questions and answers

Understanding the Emotional Toll of Debt

In this section, we will explore the profound impact that debt can have on individuals’ emotional well-being, highlighting the various ways in which it affects their mental health and overall quality of life.

Debt is more than just a financial burden, it can also be emotionally and psychologically challenging. The weight of debt can bring about feelings of anxiety, stress, and even shame. Many individuals who find themselves in debt experience a wide range of negative emotions that can significantly impact their daily lives.

The emotional toll of debt can manifest in various ways. For some, it may result in constant worry and sleepless nights, as they struggle to find solutions to their financial challenges. Others may experience a sense of powerlessness and loss of control over their lives, as their debt becomes a dominating force that dictates their choices and limits their opportunities.

Moreover, the emotional toll of debt can also lead to strained relationships and social isolation. Fear and shame associated with debt can contribute to a reluctance to seek support or share their struggles with loved ones, further exacerbating feelings of loneliness and emotional distress.

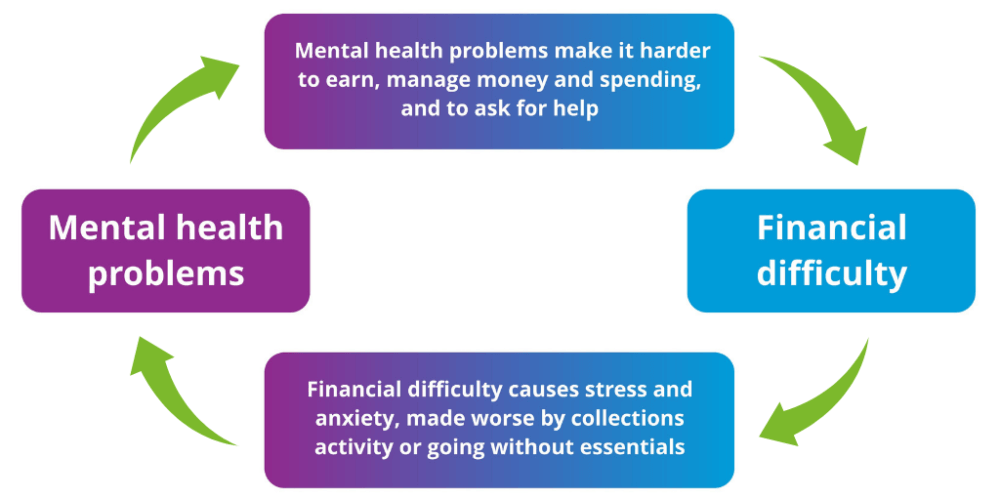

To add to the complexity, the emotional impact of debt can become a vicious cycle. As negative emotions increase, individuals may resort to unhealthy coping mechanisms, such as overspending or avoiding financial responsibilities, which can further worsen their financial situation and perpetuate the emotional distress.

It is crucial to recognize the emotional toll of debt in order to effectively address and overcome it. By understanding the psychological effects, individuals can develop strategies to manage their emotions and seek appropriate support. Taking proactive steps towards financial literacy, seeking professional guidance, and adopting healthy coping mechanisms can all contribute to breaking the cycle of emotional burden caused by debt.

The Link Between Debt and Anxiety

When financial obligations accumulate and become unmanageable, a profound connection emerges between debt and anxiety. Individuals burdened by overwhelming financial obligations experience a psychological state characterized by worry, fear, and unease. This anxiety can be triggered by the constant thought of impending bill payments, the pressure to meet financial deadlines, and the uncertainty of ever being debt-free.

Anxiety

Anxiety, in this context, refers to a persistent feeling of unease or apprehension that arises from the stress and strain associated with debt. It manifests as a pervasive worry about one’s ability to make payments, fears of facing financial consequences, and a constant sense of pressure to resolve outstanding debts. The emotional toll of anxiety can be both mentally and physically exhausting, often resulting in sleep disturbances, irritability, and difficulty concentrating on daily tasks.

Debt as a Trigger

Debt serves as a significant trigger for anxiety due to the immense burden it places on individuals. The weight of financial obligations can create a sense of helplessness and a perceived lack of control over one’s financial situation. Moreover, the constant reminder of debt through creditor communications or financial statements can intensify the anxiety experienced by individuals.

Impact on Mental Health

The link between debt and anxiety has a profound impact on mental health. The persistent worry, fear, and insecurity associated with debt can lead to increased stress levels, depression, and a decreased sense of self-worth. Individuals may feel trapped in a cycle of anxiety, unable to break free from the financial burden that constantly looms over their lives.

Breaking the Cycle

Overcoming anxiety caused by debt requires a proactive approach. Seeking professional guidance, such as financial counseling or therapy, can provide individuals with the tools to manage their financial situation effectively and alleviate anxiety. Additionally, implementing strategies such as budgeting, debt consolidation, and prioritizing payments can help individuals regain control over their finances and reduce anxiety levels. It is crucial to address the underlying emotional factors that contribute to anxiety and develop a sustainable plan to overcome debt.

In conclusion, the strong connection between debt and anxiety highlights the detrimental psychological impact of financial obligations. Recognizing and understanding this link is essential in developing effective strategies to address both the financial and emotional aspects of debt, ultimately freeing individuals from the burden of anxiety.

Impact of Debt on Mental Health

Debt can have a profound effect on an individual’s mental well-being, influencing their thoughts, emotions, and overall quality of life. The burden of financial obligations can create significant stress, anxiety, and depression, leading to a range of psychological challenges that may impair daily functioning and relationships.

Emotional Distress: Debt often triggers a variety of negative emotions, such as fear, shame, and guilt. Individuals may feel overwhelmed and trapped by their financial situation, experiencing a constant sense of worry and insecurity. The emotional weight of debt can lead to sleep disturbances, mood swings, and difficulties concentrating, further exacerbating psychological distress.

Strained Relationships: The impact of debt is not limited to an individual’s personal well-being. Financial troubles can strain relationships with partners, family members, and friends. The stress and tension associated with managing debt can lead to conflicts, loss of trust, and feelings of resentment, negatively affecting both the individual and their loved ones.

Self-Worth and Identity: Debt can profoundly impact an individual’s sense of self-worth and identity. Many individuals associate their financial stability or success with their overall value as a person. The weight of debt can lead to feelings of failure, low self-esteem, and a loss of identity, as individuals may question their abilities and accomplishments.

Isolation and Stigma: The psychological impact of debt often leads to social isolation and a sense of shame. Individuals may withdraw from social activities and relationships due to their perceived inability to meet financial obligations. Moreover, societal stigma surrounding debt can add to the feelings of shame, further isolating individuals and hindering their ability to seek support.

Impact on Mental Well-being: Over time, the constant stress and emotional toll of debt can contribute to the development or exacerbation of mental health conditions, such as anxiety disorders, depression, and even substance abuse. The cycle of debt and deteriorating mental health can create a vicious cycle, making it even more challenging for individuals to regain control of their financial and psychological well-being.

Recognizing the detrimental effects of debt on mental health is crucial in developing effective strategies to address and overcome this issue. Understanding the various psychological challenges individuals face when burdened with debt is a vital step toward providing support, promoting financial literacy, and fostering long-term well-being.

Relationship Strain Caused by Financial Stress

Experiencing financial stress can often create tension and strain within relationships, impacting the emotional well-being of those involved. The pressure of debt and financial obligations can lead to a variety of challenges that affect the dynamics between partners, including communication breakdown, increased conflict, and feelings of insecurity and resentment.

Communication breakdown: Financial strain can make it difficult for individuals to effectively communicate their needs and concerns to their partners. The stress of debt may cause individuals to withdraw or become defensive, hindering open and honest communication. This breakdown in communication can lead to misunderstandings, unresolved issues, and a lack of emotional support, further straining the relationship.

Increased conflict: Financial stress can be a significant source of conflict within relationships. Disagreements about money management, differing spending habits, or the inability to meet financial goals can escalate into heated arguments. This constant tension can erode trust and create a negative cycle of conflict, further weakening the relationship.

Feelings of insecurity and resentment: The strain of financial stress can create feelings of insecurity and resentment within a relationship. Individuals may feel anxious about their financial future, leading to a sense of instability and fear. Additionally, if one partner is shouldering a larger financial burden or is perceived to be contributing less, it can breed feelings of resentment and imbalance in the relationship.

It is crucial for individuals and couples to recognize and address the impact of financial stress on their relationship. By acknowledging the challenges posed by debt and financial strain, couples can work together to develop strategies for effective communication, conflict resolution, and mutual support. Seeking professional help, such as financial counseling or couples therapy, can also provide valuable guidance and tools to navigate these difficult circumstances and strengthen the relationship in the face of financial stress.

Overcoming Debt: Strategies for Healing and Recovery

In the realm of resolving financial liabilities and finding emotional restoration, individuals must navigate a path that encompasses more than just monetary concerns. This section will explore various approaches to overcoming debt, focusing on strategies for healing and recovery. By addressing the psychological and emotional impacts of indebtedness, individuals can embark on a journey towards regaining financial stability and overall well-being.

| Strategies for Healing and Recovery |

|---|

|

1. Self-reflection and Acceptance One of the initial steps towards overcoming debt is engaging in self-reflection and accepting the reality of the situation. Accepting responsibility for past financial decisions and acknowledging any negative emotions associated with debt is vital for growth. |

|

2. Developing a Financial Plan Creating a comprehensive financial plan is crucial for individuals who wish to regain control over their finances. This entails assessing income, expenses, and debt obligations to establish a clear path towards debt repayment and financial stability. |

|

3. Seeking Professional Help For individuals overwhelmed by the psychological impact of debt, seeking professional help is often a beneficial step. Financial counselors, therapists, or debt management agencies can provide guidance, support, and practical techniques to address the emotional burdens associated with indebtedness. |

|

4. Building a Support Network Surrounding oneself with a supportive network of friends, family, or support groups can significantly aid in the journey towards debt recovery. Sharing experiences, seeking advice, and receiving encouragement from others facing similar challenges can provide a sense of camaraderie and motivation to keep moving forward. |

|

5. Practicing Self-care and Stress Management Debt can often lead to increased levels of stress and anxiety. Engaging in self-care activities, such as exercise, meditation, and maintaining a healthy lifestyle, can help individuals manage these emotions. Formulating healthy coping mechanisms and stress management techniques can contribute to overall emotional well-being. |

The journey towards overcoming debt is a complex and multifaceted one. By incorporating these strategies for healing and recovery, individuals can cultivate a healthier relationship with their financial circumstances, rebuild their lives, and pave the way for a brighter future free from the shackles of debt.

Creating an Attainable Financial Plan

In this section, we will explore the process of developing a practical and achievable budget to effectively manage your financial resources. Having a realistic budget can greatly contribute to reducing the psychological burden caused by debt and pave the way towards financial stability.

When it comes to crafting a realistic budget, it is essential to comprehensively evaluate your income, expenses, and financial goals. It is crucial to consider the various aspects of your financial situation and identify areas where you can make adjustments to improve your financial well-being gradually.

Start by assessing your sources of income, including salaries, additional sources of revenue, or benefits. List all your income sources and determine the total amount per month or per specified time frame. It is important to have a clear understanding of your income to set a realistic foundation for your budget.

Next, carefully examine your expenses and categorize them based on necessity, such as housing, utilities, food, transportation, and any outstanding debt payments. It is essential to prioritize essential expenses and ensure they are covered adequately within your budget. Additionally, identify areas in which you can reduce discretionary spending and allocate those resources towards debt repayment or savings.

Creating a budgeting strategy that includes specific financial goals can also be extremely beneficial. Whether it’s paying off debt, saving for emergencies, or investing in your future, having concrete objectives will help you stay motivated and better align your financial decisions with your long-term aspirations.

- Identify areas where you can cut expenses:

- Reduce dining out and prioritize home-cooked meals

- Limit unnecessary subscription services

- Opt for more cost-effective transportation options

- Consolidate or refinance high-interest debts to reduce overall payments

Maintaining a realistic budget requires ongoing monitoring and adjustment. Regularly review your financial plan to ensure it remains applicable and adjust it as necessary, considering any changes in your income or expenses. By adopting this proactive approach, you can effectively manage your debt and work towards achieving long-term financial stability.

Debt Consolidation and Payment Plans

Exploring Strategies to Manage and Resolve Debt

When faced with overwhelming financial obligations, individuals often turn to debt consolidation and payment plans as effective methods to regain control of their finances. These strategies aim to streamline multiple debts into a single manageable payment, simplifying the repayment process and reducing the psychological burden associated with mounting financial obligations.

Debt consolidation involves combining various debts, such as credit card balances, personal loans, or medical bills, into one consolidated loan or credit line. This consolidation process typically results in a lower overall interest rate, making monthly payments more affordable. By consolidating debts, individuals can simplify their financial responsibilities, making it easier to track and manage their progress towards becoming debt-free.

| Benefits of Debt Consolidation | Payment Plans |

|---|---|

| 1. Reduced interest rates | 1. Structured repayment schedule |

| 2. Simplified repayment process | 2. Affordable monthly payments |

| 3. Potential improvement of credit score | 3. Ability to negotiate with creditors |

Payment plans, on the other hand, involve working with creditors or debt management companies to establish a structured repayment schedule. These plans provide individuals with a clear roadmap towards debt resolution, helping them break free from the cycle of missed payments and late fees. By adhering to a payment plan, individuals can regain control of their finances, restore their sense of stability, and alleviate the stress associated with ongoing debt.

Both debt consolidation and payment plans serve as valuable tools for individuals seeking to overcome the psychological impact of debt. These strategies offer practical solutions to manage financial obligations while minimizing the emotional toll associated with overwhelming debt. By exploring these options, individuals can take proactive steps towards achieving financial freedom and a healthier mindset.

Seeking Professional Assistance

When confronted with the overwhelming psychological burden of debt, many individuals may find it beneficial to seek professional assistance. By consulting with experts in financial counseling and mental health, individuals can receive guidance and support tailored to their specific needs. This section explores the importance of seeking professional assistance and highlights the benefits it can provide in terms of alleviating the psychological impact of debt and finding effective ways to overcome it.

Professional assistance offers a valuable resource for individuals struggling with debt, providing a range of services to address both the financial and psychological aspects of their situation. Financial counselors can offer expert advice on budgeting, debt management strategies, and negotiating with creditors, helping individuals regain control over their finances. Additionally, mental health professionals can provide crucial emotional support, helping individuals navigate the feelings of stress, anxiety, and shame that often accompany debt.

One significant advantage of seeking professional assistance is the opportunity for personalized guidance. Professionals can assess an individual’s unique circumstances and create a customized action plan to address their specific needs and goals. This tailored approach can significantly enhance the effectiveness of debt management strategies and increase the individual’s chances of successfully overcoming their debt burden.

Furthermore, professional assistance provides a non-judgmental and confidential environment for individuals to discuss their financial struggles openly. This safe space allows individuals to express their concerns and fears without fear of shame or criticism. By sharing their experiences with professionals, individuals can gain a sense of validation and develop a clearer understanding of their feelings, enabling them to tackle the psychological impact of debt more effectively.

| Benefits of Seeking Professional Assistance: |

|

In conclusion, seeking professional assistance is a vital step in overcoming the psychological impact of debt. By accessing the expertise and support provided by financial and mental health professionals, individuals can develop effective strategies to manage their debt and alleviate the associated emotional burden. With personalized guidance and a safe space for open discussions, individuals can regain control over their finances and improve their overall well-being.

Mindset Shift: Changing Perspectives on Debt

In this section, we will explore the transformative power of a change in mindset when it comes to our perspectives on debt. By reframing our thoughts and beliefs about debt, we can unlock a new way of approaching and managing our financial obligations.

Shifting our mindset regarding debt involves adopting alternative viewpoints that challenge conventional notions. This means breaking free from the societal conditioning that often associates debt with shame, failure, and a lack of responsibility. Instead, we can embrace a mindset that recognizes debt as a tool for growth, a temporary bridge between our current situation and our desired future.

By shifting our perspective, we can view debt as an opportunity rather than a burden. It allows us to invest in ourselves, our education, or our businesses, ultimately paving the way for personal and professional advancement. Seeing debt as a means to achieve our goals empowers us to make strategic decisions and take calculated risks that can lead to long-term financial success.

A mindset shift also entails changing our language and self-talk around debt. Instead of using negative and disempowering language like I am drowning in debt, we can reframe our thoughts and say, I am actively managing my financial commitments. This shift in language helps us take ownership of our situation and promotes a sense of control and empowerment.

By changing our perspectives on debt and embracing a growth-oriented mindset, we can overcome the psychological burdens often associated with it. This shift allows us to approach debt as a tool for financial growth and liberation, opening up new possibilities and opportunities for a brighter future.

Breaking the Cycle of Shame and Guilt

Empowering individuals to free themselves from the detrimental emotions associated with their financial obligations.

Guilt and shame often accompany the experience of indebtedness, creating a destructive cycle that can hinder financial well-being and overall mental health. These negative emotions can arise from various sources, such as unexpected financial setbacks, poor money management skills, or societal pressures. Breaking free from this cycle is essential to regain control over one’s financial situation and restore a sense of self-worth and empowerment.

Understanding the sources of guilt and shame

Indebtedness can trigger feelings of guilt, as individuals may blame themselves for their financial struggles, perceiving it as a personal failure or a reflection of their worth. This internalization of debt can lead to shame, as individuals may feel judged or stigmatized by society for their financial circumstances.

Challenging and reframing negative beliefs

Overcoming guilt and shame requires a conscious effort to challenge negative beliefs and replace them with more empowering ones. By reframing their perspective, individuals can recognize that their financial situation does not define their entire worth or character. It is important to acknowledge that everyone faces financial challenges at some point in life and seeking assistance or learning from past mistakes is a sign of strength, not weakness.

Developing a proactive mindset

Breaking the cycle of shame and guilt involves taking proactive steps towards financial stability and growth. This includes creating a realistic budget, seeking professional guidance, and actively managing debts. By embracing a proactive mindset, individuals can regain a sense of control over their financial situation and gradually eliminate feelings of guilt and shame.

Building a support system

Breaking free from the cycle of shame and guilt requires a supportive network of individuals who can provide encouragement, guidance, and understanding. Sharing experiences with trusted friends, family, or support groups can help individuals realize that they are not alone in their struggles. Additionally, seeking professional counseling or therapy can provide invaluable assistance in navigating and overcoming the emotional challenges associated with debt.

Cultivating self-compassion and resilience

Lastly, it is crucial for individuals to cultivate self-compassion and resilience as they work towards overcoming guilt and shame related to debt. Recognizing the progress made, celebrating small successes, and practicing self-care can contribute to building resilience and maintaining a positive mindset throughout the journey towards achieving financial freedom.

The Power of Positive Thinking

Harnessing the immense power of optimistic thoughts can enable individuals to overcome the psychological burden imposed by accumulated debt. By cultivating a mindset that emphasizes the brighter aspects of life and focuses on potential solutions, individuals can effectively navigate the challenges associated with financial obligations.

Positive thinking is a potent tool that can shape one’s perspective, influencing actions and outcomes. It involves consciously directing attention towards positive aspects, such as opportunities for growth, personal strengths, and the potential to turn a difficult situation into a learning experience.

Embracing the power of positive thinking allows individuals to reframe their perceptions of debt, transforming it from a source of despair and anxiety into an opportunity for personal growth and empowerment. By acknowledging that debt is a temporary setback and maintaining an optimistic outlook for the future, individuals can maintain their motivation and determination to overcome financial difficulties.

Furthermore, positive thinking empowers individuals to proactively seek strategies and solutions for debt management, as opposed to succumbing to feelings of helplessness or hopelessness. It encourages individuals to take decisive steps towards financial stability, such as creating a realistic budget, seeking professional advice, or actively exploring additional sources of income.

Developing a practice of positive affirmations can also be a powerful tool in overcoming the psychological impact of debt. By consciously repeating statements that reinforce self-belief, confidence, and financial abundance, individuals can gradually reprogram their subconscious mind and cultivate a mindset that is conducive to attracting positive outcomes.

In conclusion, the power of positive thinking cannot be underestimated when it comes to overcoming the psychological toll of debt. By adopting a mindset that focuses on optimism, individuals can transform their perception of debt, proactively seek solutions, and ultimately pave the way for financial freedom and emotional well-being.

Questions and answers

What are some common psychological effects of being in debt?

Being in debt can lead to various psychological effects such as stress, anxiety, depression, and feelings of guilt and shame. It can also negatively impact one’s self-esteem and overall mental well-being.

How does debt affect relationships?

Debt can significantly strain relationships. Financial stressors can lead to frequent arguments, mistrust, and even breakups or divorces. It is common for individuals in debt to feel embarrassed or ashamed, which may make them hesitant to talk about their financial situation with their partner.

What are some effective ways to overcome debt?

There are several effective ways to overcome debt. These include creating a budget, cutting down expenses, increasing income through additional work or side hustles, seeking professional financial advice, consolidating debts, and prioritizing high-interest debts for repayment.

Can debt affect one’s mental health?

Yes, debt can have a significant impact on mental health. It can lead to increased stress levels, anxiety disorders, depression, and even suicidal thoughts. The constant worry about debt and the feeling of being trapped can severely affect one’s overall well-being.

Is it normal to feel overwhelmed by debt?

Yes, it is normal to feel overwhelmed by debt. Many people commonly experience feelings of overwhelm, helplessness, and hopelessness when faced with substantial financial obligations. It is important to seek support and take necessary steps towards managing and overcoming debt in such situations.

How does debt affect a person’s mental health?

Debt can have a significant impact on a person’s mental health. It can lead to feelings of stress, anxiety, and depression. The constant worry about repaying the debt and the fear of financial instability can take a toll on one’s emotional well-being.

What are some effective strategies to overcome debt?

There are several effective strategies to overcome debt. Firstly, creating a budget and sticking to it can help in managing expenses and saving money. Secondly, prioritizing debt payments and considering debt consolidation or negotiation can be beneficial. Thirdly, seeking professional advice from credit counselors or financial experts can provide guidance on debt management and repayment plans.

Can debt impact relationships?

Yes, debt can have a significant impact on relationships. Financial stress caused by debt can lead to arguments, mistrust, and even the breakdown of relationships. The pressure of dealing with debt can strain both personal and professional relationships, highlighting the need for open communication and shared financial goals.

Are there any psychological warning signs that indicate the psychological impact of debt?

There are several warning signs that indicate the psychological impact of debt. These include constant worry about finances, difficulty sleeping, feelings of shame or embarrassment, loss of appetite, irritability, and a decline in overall mental well-being. If these signs persist, it is important to seek support and take steps to address the impact of debt on mental health.

How can one prevent the negative psychological impact of debt?

Preventing the negative psychological impact of debt involves taking steps to manage finances effectively. This includes budgeting, saving money, avoiding unnecessary expenses, and seeking help or advice when needed. It is also crucial to maintain a positive mindset and practice self-care to reduce stress associated with debt.