Financial stability plays a vital role in ensuring a secure and prosperous future. It encompasses various aspects of our lives, including our ability to meet daily expenses, reach our long-term goals, and weather unforeseen financial storms. One key factor in achieving this stability is the state of our bank account balance, which serves as a cornerstone of our overall financial well-being.

When we discuss the concept of a healthy bank account balance, we’re referring to a state where our financial assets hold sufficient value to cover our expenses and provide a cushion during emergencies.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreHaving a healthy bank account balance is essential for several reasons. Firstly, it allows us to have greater control over our finances and minimize the risk of falling into unnecessary debt. With proper management of our bank account balance, we can pay our bills promptly and avoid burdening ourselves with high-interest loans or credit card debts.

Furthermore, a well-maintained bank account balance provides us with the freedom and flexibility to pursue our long-term financial goals. Whether it’s saving for retirement, purchasing a home, or starting a business, having a healthy financial cushion gives us the opportunity to invest in our future without excessive financial strain.

In addition to the immediate benefits, maintaining a healthy bank account balance contributes to our overall financial stability. It serves as a safety net during uncertain times, such as job loss, health emergencies, or unexpected expenses. A well-balanced bank account ensures that we have the means to handle unforeseen financial setbacks and avoid potential hardships.

In conclusion, upholding a well-maintained bank account balance is a crucial aspect of achieving financial stability. It empowers us to control our finances, pursue our long-term aspirations, and safeguard ourselves against unexpected challenges. By understanding the significance of maintaining a healthy bank account balance, we can take proactive steps towards securing a sound financial future.

- Why a Healthy Bank Account Balance is Crucial for Financial Stability

- Understanding the Significance of Maintaining Adequate Funds

- The Impact of a Strong Financial Cushion on Overall Financial Well-being

- The Role of a Sufficient Bank Account Balance in Emergency Situations

- The Relationship between a Healthy Bank Account Balance and Long-Term Financial Goals

- Tips for Achieving and Maintaining a Robust Bank Account Balance

- Creating a Realistic Budget to Support Financial Stability

- Implementing Savings Strategies for Continual Growth

- Managing Expenses and Minimizing Debt to Preserve a Healthy Balance

- Common Pitfalls to Avoid for a Secure Bank Account Balance

- Questions and answers

Why a Healthy Bank Account Balance is Crucial for Financial Stability

Ensuring a strong and stable financial future is heavily dependent on maintaining a sufficient amount of funds in your bank account. Achieving and maintaining a balanced bank account plays a crucial role in maintaining financial stability, as it provides a solid foundation for long-term financial success.

Having a healthy bank account balance translates to having a reliable financial safety net. It enables you to cover unexpected expenses that may arise, such as medical emergencies or home repairs, without resorting to high-interest loans or incurring debt. By having sufficient funds readily available, you are better equipped to navigate financial challenges and avoid the stress often associated with financial instability.

Furthermore, a substantial bank account balance allows you to allocate funds towards important financial goals, such as saving for retirement, purchasing a home, or investing in higher education. This not only brings you closer to achieving your aspirations but also provides a sense of security and peace of mind knowing that you are actively working towards a financially secure future.

By maintaining a healthy bank account balance, you also gain the ability to take advantage of potential investment opportunities. Whether it’s investing in stocks, bonds, or real estate, having a sufficient amount of funds in your account gives you the flexibility to allocate capital towards potentially profitable ventures. This can help grow your wealth and further solidify your financial stability in the long run.

Moreover, a healthy bank account balance signifies financial discipline and responsible money management. It demonstrates your ability to live within your means, save diligently, and avoid unnecessary debt. By consistently maintaining a balanced account, you develop good financial habits that can positively impact your overall financial health and well-being.

In conclusion, a healthy bank account balance is vital for attaining and maintaining financial stability. It serves as a cushion for unexpected expenses, supports your financial goals, enables investment opportunities, and reflects responsible financial management. Striving to maintain a balanced bank account is a key component of building financial security and ensuring a prosperous future.

Understanding the Significance of Maintaining Adequate Funds

In today’s fast-paced and uncertain financial landscape, having enough funds at your disposal is crucial for securing your financial well-being and achieving stability. The ability to maintain adequate funds in your bank account plays a vital role in managing your expenses effectively, ensuring a strong financial foundation, and enabling you to navigate unexpected financial challenges with confidence.

By having a sufficient balance in your bank account, you gain the peace of mind knowing that you are prepared for any unforeseen circumstances that may arise. Whether it’s an emergency expense, a sudden job loss, or an unexpected medical bill, having adequate funds allows you to handle these situations without resorting to high-interest loans or accumulating debt.

Additionally, maintaining adequate funds in your bank account allows you to take advantage of opportunities that may come your way. Whether it’s investing in a promising business venture, pursuing further education, or making a significant purchase, having the necessary funds readily available empowers you to seize these opportunities and move closer to achieving your financial goals.

Furthermore, adequate funds in your bank account provide a sense of stability and security. They act as a safety net during uncertain economic times, giving you the flexibility to navigate through financial downturns and unforeseen expenses. This stability allows you to maintain a positive credit history, improves your financial standing, and increases your eligibility for better borrowing options, such as lower interest rates on loans or credit cards.

In conclusion, understanding the significance of maintaining adequate funds is essential for financial stability. By ensuring you have enough funds in your bank account, you can effectively manage your expenses, tackle unexpected financial challenges, seize opportunities, and enhance your overall financial well-being.

The Impact of a Strong Financial Cushion on Overall Financial Well-being

A robust financial safety net can significantly contribute to an individual’s overall sense of financial security and stability. By maintaining a sufficient balance in their bank account, individuals can enjoy a greater peace of mind, increased resilience to financial emergencies, and a higher level of flexibility in managing their personal finances.

One of the key advantages of having a healthy bank account balance is the enhanced ability to weather unexpected expenses. Life is filled with unforeseen events such as medical emergencies, car repairs, or job loss. These circumstances can often lead to financial strain and stress. However, with a well-maintained bank account balance, individuals can more easily cover these expenses without having to rely heavily on credit or borrowing, thereby reducing the risk of accruing debt or falling into financial hardship.

In addition, a healthy bank account balance allows for greater flexibility in financial decision-making. It provides individuals with the freedom to seize opportunities and make investments that can contribute to long-term financial growth. Whether it’s starting a business, pursuing higher education, or simply taking advantage of a good deal, having resources readily available can open doors that might otherwise remain closed. This financial freedom empowers individuals to shape their financial future and achieve their goals.

Moreover, maintaining a strong bank account balance fosters a sense of confidence and control over one’s financial circumstances. It eliminates the constant worry or anxiety associated with living paycheck to paycheck and provides a buffer against financial instability. By having a financial cushion, individuals can focus on building their wealth, planning for the future, and pursuing their aspirations with a greater sense of security and optimism.

In conclusion, a healthy bank account balance has a profound impact on overall financial well-being. It not only provides peace of mind and protection against unexpected expenses but also grants individuals the flexibility and freedom to make informed financial decisions. By prioritizing the maintenance of a strong bank account balance, individuals can set themselves on a path towards long-term financial stability and success.

The Role of a Sufficient Bank Account Balance in Emergency Situations

During unexpected, unforeseen events that arise suddenly and demand immediate attention, having a substantial amount of funds available in one’s bank account plays a crucial role in ensuring financial stability and security. In times of emergencies, a well-maintained bank account balance provides individuals with the necessary resources to address and overcome challenging circumstances effectively.

Having a sufficient bank account balance during emergencies presents several advantages. Firstly, it enables individuals to cover unexpected expenses without resorting to high-interest loans or credit cards, thereby preventing the accumulation of debt. Additionally, a well-funded bank account grants individuals the ability to quickly access their funds to address critical needs such as medical emergencies, home repairs, or unexpected job loss, providing peace of mind in stressful situations.

Adequate savings also offer protection against the unpredictable nature of emergencies. Without a stable bank account balance, individuals may find themselves vulnerable and unable to handle unexpected financial burdens. By having a sufficient reserve, individuals can better navigate through challenging periods, maintain their financial well-being, and avoid falling into dire financial situations.

Furthermore, a substantial bank account balance in emergency situations offers individuals a sense of stability and security. It allows them to act promptly and make informed decisions without compromising their financial standing. With the assurance of readily available funds, individuals can focus on resolving the emergency at hand, reducing stress and ensuring a smoother transition back to normalcy.

In conclusion, it cannot be stressed enough how important it is to maintain a substantial bank account balance for financial stability during emergency situations. The ability to rely on personal funds allows individuals to meet unexpected expenses, protect themselves from financial vulnerability, and maintain a sense of security. It is crucial to prioritize saving and conscientiously build a healthy bank account balance to safeguard against any unforeseen circumstances that may arise.

The Relationship between a Healthy Bank Account Balance and Long-Term Financial Goals

Having a well-maintained bank account balance is directly linked to achieving long-term financial objectives. A substantial amount of money in your bank account acts as a foundation for building a secure and stable future. It is crucial to recognize the correlation between a healthy bank account balance and the ability to meet long-term financial aspirations.

When you have a healthy bank account balance, you not only have the means to cover immediate expenses and emergencies but also the opportunity to invest in your future. This financial stability enables you to take calculated risks and seize potential opportunities for growth and success. Moreover, a healthy bank balance gives you peace of mind, knowing that you have a safety net in case unexpected financial challenges arise.

Furthermore, a healthy bank account balance plays a vital role in achieving long-term financial goals, such as purchasing a house, planning for retirement, or starting a business. These objectives require substantial financial resources that cannot be achieved overnight. By consistently maintaining a healthy bank account balance, you are creating a strong financial base that can support your long-term aspirations.

In addition, a healthy bank account balance can also help you avoid debt and minimize the need for borrowing money. When you have enough savings in your account, you are less likely to rely on credit cards or loans to cover expenses or make significant purchases. This reduces the financial burden of interest payments and allows you to allocate your funds towards achieving your long-term goals instead.

| Benefits of a Healthy Bank Account Balance: |

|---|

| 1. Financial security |

| 2. Investment opportunities |

| 3. Peace of mind |

| 4. Support for long-term financial goals |

| 5. Avoidance of debt |

In conclusion, maintaining a healthy bank account balance is crucial for achieving long-term financial goals. It provides financial security, enables investment opportunities, and reduces the need for borrowing. By prioritizing the preservation of a healthy bank account balance, you are setting yourself up for a more stable and prosperous future.

Tips for Achieving and Maintaining a Robust Bank Account Balance

Building and sustaining a substantial sum in your bank account is fundamental for financial security. To help you develop a solid financial foundation, consider the following suggestions:

1. Prioritize disciplined spending: Cultivate the habit of evaluating your purchases and distinguishing between needs and wants. Being mindful of your spending patterns and making conscious decisions can alleviate the risk of overspending and accumulating unnecessary debt.

2. Create a realistic budget: A well-structured budget is an invaluable tool for organizing your finances. Identify your income sources, allocate funds for necessary expenses such as bills, groceries, and loan repayments, and establish a savings goal. Adhering to your budget will help you track your expenses and ensure you are on track to achieve your financial objectives.

3. Save diligently: Setting aside a portion of your income on a regular basis is imperative for financial stability. Aim to save a specific percentage or amount of your earnings each month and automate this process if possible. This practice will gradually build your savings and provide a safety net for unexpected expenses or emergencies.

4. Minimize unnecessary fees: Keep a vigilant eye on the fees associated with your bank accounts, credit cards, and other financial services. Research and compare different options to ensure you are utilizing accounts that offer minimal fees and maximum benefits. By minimizing unnecessary charges, you can retain more money in your bank account.

5. Increase your income: Consider exploring additional sources of income to bolster your bank account balance. This could involve taking up a part-time job, freelancing, or starting a side business. The additional earnings can contribute to your financial stability and enhance your ability to save and invest.

6. Regularly review and reassess: Periodically assess the state of your bank account to evaluate your progress and identify areas for improvement. Analyze your expenses, review your budget, and make necessary adjustments to ensure you are consistently moving towards your financial goals.

Incorporating these tips into your financial habits can go a long way in establishing and maintaining a healthy bank account balance. By adopting disciplined spending, implementing a practical budget, saving diligently, minimizing fees, increasing your income, and regularly reviewing your account status, you can achieve financial stability and secure a brighter future.

Creating a Realistic Budget to Support Financial Stability

In this section, we will explore the significance of establishing a practical financial plan that contributes to maintaining a stable economic situation. By developing a well-rounded budget, individuals can effectively manage their personal finances and work towards achieving long-term financial stability.

When it comes to managing money, having a realistic budget is key. A budget provides a structured framework that enables individuals to allocate income towards different expenses, savings, and financial goals. With a well-thought-out budget, individuals can gain better control over their spending habits, minimize unnecessary expenses, and prioritize important financial obligations.

A realistic budget helps individuals make informed decisions regarding their finances. It allows them to understand their current financial situation, evaluate their income and expenses, and identify areas where adjustments can be made. By tracking and analyzing their spending patterns, individuals can identify potential areas of improvement and make necessary changes to align their expenses with their financial goals.

A budget serves as a guide that helps individuals plan for unexpected situations and emergencies. By setting aside funds for emergency savings, individuals can establish a safety net to rely upon during challenging times. Having a financial cushion in place not only provides peace of mind but also acts as a proactive measure to maintain financial stability.

Furthermore, a realistic budget promotes long-term financial planning and goal setting. It allows individuals to allocate funds towards achieving their aspirations, such as buying a house, paying off debts, or saving for retirement. By incorporating these goals into the budget, individuals can break them down into smaller, actionable steps and track their progress over time.

In conclusion, creating a realistic budget plays a crucial role in supporting financial stability. It allows individuals to gain control over their finances, make informed decisions, plan for emergencies, and work towards achieving long-term financial goals. By establishing a budget that reflects their financial situation and aspirations, individuals can pave the way for a more secure and stable financial future.

Implementing Savings Strategies for Continual Growth

Savings strategies are vital for achieving ongoing prosperity and financial security. By implementing effective methods to grow your savings, you can ensure a steady and sustainable increase in your wealth over time. In this section, we will explore various tactics and techniques that can help you build a strong financial foundation.

One key aspect of implementing savings strategies is the ability to exercise self-discipline and prioritize your financial goals. Developing a habit of setting aside a portion of your income regularly and consistently will enable you to accumulate funds for future needs, emergencies, or long-term aspirations. Emphasizing the importance of saving and making it a part of your financial routine is essential for long-term growth and stability.

Another valuable approach to maximize your savings is by identifying and minimizing unnecessary expenses. By carefully assessing your expenditures, you can determine areas where you can cut back or make more cost-effective choices. This could include reducing discretionary spending, finding ways to save on monthly bills, or seeking alternatives for expensive habits or indulgences. By redirecting these saved funds into your savings account, you can accelerate the growth of your financial resources.

Opening a separate savings account dedicated solely to your savings goals can also significantly contribute to your financial growth. This segregated account allows you to track your progress, monitor your savings, and develop a clearer vision of your financial objectives. Additionally, by earning interest on your savings, your money can work for you and multiply over time, further enhancing the growth potential of your savings.

It is also worth considering automated savings options to ensure consistency in your savings efforts. Setting up automatic transfers from your primary account to your savings account can remove the temptation to spend the money and make saving a seamless part of your financial routine. By making saving effortless and consistent, you can make significant strides towards achieving your long-term financial goals.

In conclusion, implementing effective savings strategies is crucial for continual growth and financial success. By cultivating the habit of saving, minimizing expenses, creating dedicated savings accounts, and automating your savings efforts, you can secure a solid financial future and pave the way for a lifetime of financial stability.

Managing Expenses and Minimizing Debt to Preserve a Healthy Balance

Effectively managing expenses and minimizing debt are crucial steps towards maintaining a stable financial position. By carefully monitoring and controlling your spending habits, you can avoid unnecessary expenses, reduce debt, and preserve a healthy bank balance for long-term financial stability.

One of the key strategies for managing expenses is creating and sticking to a budget. By understanding your income and tracking your expenses, you can identify areas where you might be overspending and make necessary adjustments. This budgeting process allows you to allocate your resources wisely and prioritize essential expenses while cutting back on non-essential ones.

Another important aspect of managing expenses is practicing mindful spending. This means being conscious of your purchasing decisions and focusing on needs rather than wants. Before making any significant purchase, consider whether it aligns with your financial goals and if it’s truly necessary. By avoiding impulsive buying and prioritizing essential expenses, you can prevent unnecessary depletion of your bank account balance.

Minimizing debt is equally essential for maintaining a healthy balance. High levels of debt can eat into your income and limit your financial flexibility. A proactive approach to debt management involves paying off existing debts systematically and avoiding new debt except when absolutely necessary. Prioritizing debt repayment can help free up funds for savings and investment, contributing to long-term financial stability.

In addition to managing expenses and minimizing debt, it’s important to periodically review and reassess your financial situation. Regularly reviewing your budget and tracking your financial progress allows you to identify any areas where you may need to make further adjustments. It also provides an opportunity to celebrate achievements and set new financial goals to continue preserving a healthy bank account balance.

- Create and stick to a budget to manage expenses

- Practice mindful spending by prioritizing needs over wants

- Minimize debt by paying off existing debts and avoiding new debt

- Regularly review and reassess your financial situation

Common Pitfalls to Avoid for a Secure Bank Account Balance

In the pursuit of maintaining a stable and robust financial condition, there are certain pitfalls that individuals must be mindful of in order to avoid jeopardizing their bank account balance. Engaging in practices that lead to negative consequences can be detrimental to overall financial well-being.

- Excessive Spending: Overspending on unnecessary items or luxuries can quickly deplete a bank account balance. It is important to prioritize needs over wants and avoid impulsive purchases to ensure a healthy financial state.

- Failure to Budget: Neglecting to create and follow a budget can often result in financial instability. Without a concrete plan in place, it becomes difficult to manage expenses and maintain a consistent bank account balance.

- Uncontrolled Debt: Accumulating high levels of debt, especially through loans or credit cards, can significantly impact a bank account balance. Interest payments may consume a substantial portion of income, leaving little room for savings and future financial security.

- Inadequate Emergency Fund: Not having a sufficient emergency fund can lead to using a bank account balance to cover unexpected expenses. This can result in depletion of funds meant for other financial goals and leave individuals financially vulnerable.

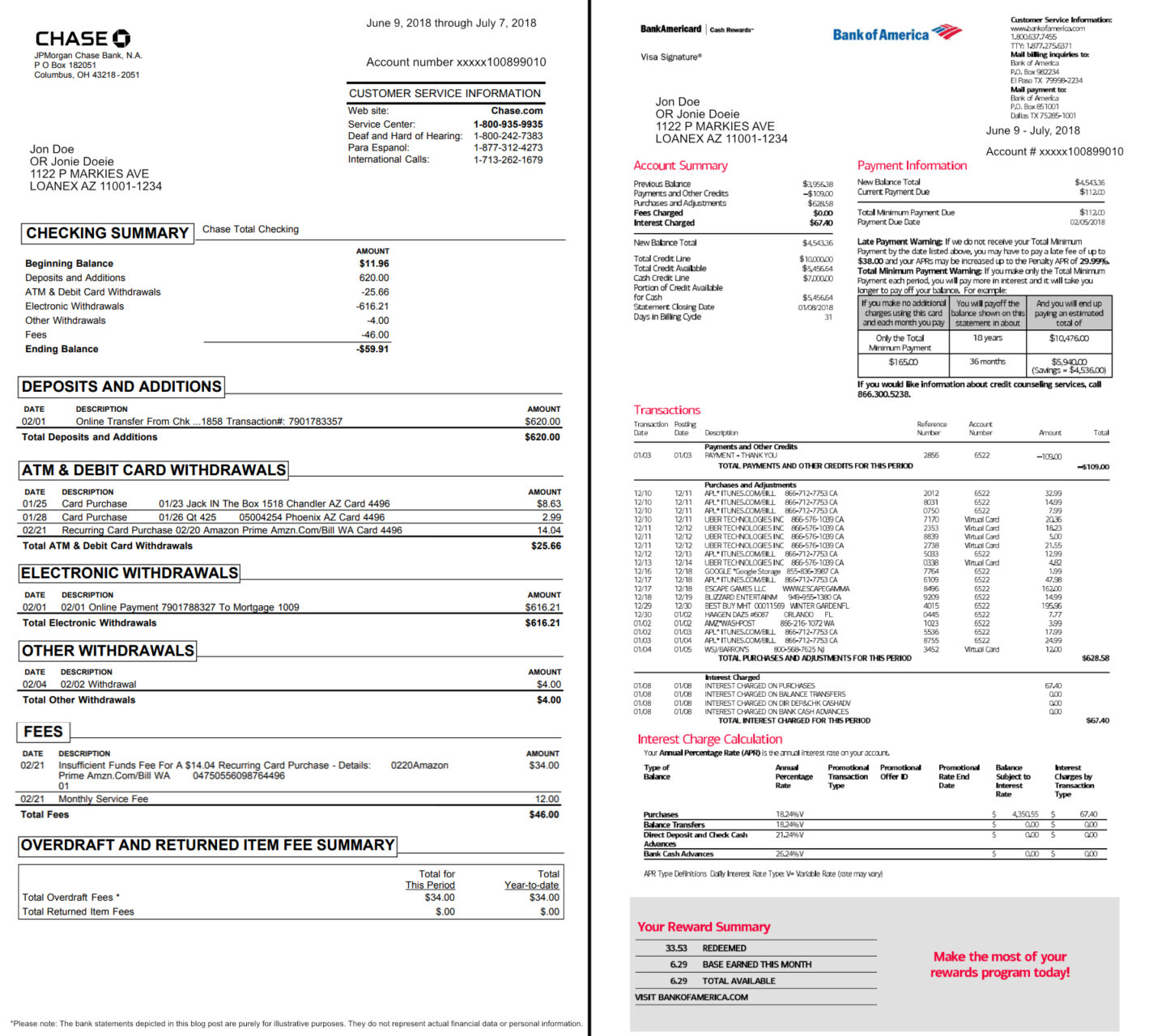

- Neglecting to Monitor Expenses: Failing to keep track of expenses can lead to a distorted view of financial health. Regularly reviewing bank statements and identifying areas where unnecessary spending occurs is crucial in maintaining a healthy bank account balance.

- Overreliance on Credit: Excessively relying on credit cards or loans instead of using available funds can lead to increased debt and interest payments. This dependency can negatively impact the bank account balance in the long run.

By actively avoiding these common pitfalls, individuals can work towards maintaining a secure bank account balance, thereby ensuring greater financial stability and peace of mind. Prioritizing smart financial decisions and responsible spending habits are key to achieving long-term financial goals.

Questions and answers

Why is it important to maintain a healthy bank account balance?

Maintaining a healthy bank account balance is important for financial stability because it ensures that you have enough funds to cover your expenses and emergencies, avoid overdraft fees, and save for future goals.

How can maintaining a healthy bank account balance contribute to financial stability?

Maintaining a healthy bank account balance contributes to financial stability by providing a buffer against unexpected expenses, helping you build an emergency fund, and ensuring that you have a solid financial foundation for achieving your long-term goals.

What are the consequences of not maintaining a healthy bank account balance?

Not maintaining a healthy bank account balance can result in overdraft fees, bounced checks, and limited access to credit. It can also lead to financial stress, inability to cover expenses, and difficulty in achieving financial goals.

What strategies can I use to maintain a healthy bank account balance?

There are several strategies you can use to maintain a healthy bank account balance, including budgeting, tracking your expenses, automating savings, avoiding unnecessary fees, and regularly reviewing your financial situation.

How can maintaining a healthy bank account balance affect my overall financial well-being?

Maintaining a healthy bank account balance can greatly improve your overall financial well-being by providing peace of mind, reducing financial stress, allowing you to take advantage of opportunities, and helping you achieve your short-term and long-term financial goals.

Why is maintaining a healthy bank account balance important?

Maintaining a healthy bank account balance is important because it provides financial stability. It allows you to cover unexpected expenses, avoid overdraft fees, and save for the future.

What are the consequences of not maintaining a healthy bank account balance?

Not maintaining a healthy bank account balance can lead to financial stress and instability. You may face overdraft fees, late payment charges, and even have difficulty obtaining loans or credit in the future.

How can maintaining a healthy bank account balance help with budgeting?

Maintaining a healthy bank account balance helps with budgeting because it allows you to track your income and expenses effectively. It gives you a clear picture of how much money you have available for essential expenses, savings, and discretionary spending.

What tips or strategies can help in maintaining a healthy bank account balance?

There are several tips and strategies to maintain a healthy bank account balance. These include creating a budget and sticking to it, automating savings, tracking your expenses, avoiding unnecessary expenses, and regularly reviewing your accounts to catch any errors or fraudulent activities.

Is there an optimal amount one should strive to maintain in their bank account?

While the optimal amount may vary depending on individual circumstances, financial experts generally recommend having enough funds to cover 3-6 months’ worth of living expenses. This provides a safety net in case of emergencies or unexpected job loss.