Discovering the hidden potential of an investment strategy that harnesses the force of compounding can be akin to finding a precious key that unlocks long-lasting financial prosperity. The awe-inspiring magic lies within the simple concept of generating earnings not only on the initial investment but also on the accumulated interest over time. By allowing your money to work diligently for you, through the power of exponential growth, one can pave the way for a future rich in opportunities and abundance.

Imagine a scenario where every dollar you set aside, no matter how modest, has the innate ability to multiply and yield bounty beyond your wildest dreams. Akin to a small seed blossoming into a majestic tree, the beauty of compound interest lies in its ability to foster exponential growth, quietly and consistently, even while you sleep. As your wealth gradually compounds, the forces of time and discipline collaborate harmoniously to create a financial trajectory that not only secures your present but also builds a strong foundation for the future you envision.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MoreWith each passing year, the strength of compound interest strengthens its grip, allowing your savings to flourish and amplify its impact. The profound magic lies in the cyclical nature of this phenomenon; as interest is earned, it is reinvested, leading to even greater returns. The paths to long-term financial solidity are illuminated when one comprehends the vital importance of nurturing a sustainable strategy that aligns with your goals and aspirations.

The Power of Compound Interest

The remarkable ability of compound interest to generate long-term wealth is truly remarkable. It possesses the unique capability to magnify the value of initial investments over time, creating a snowball effect that can lead to substantial financial growth. This section explores the immense potential of compound interest and its role in building a solid financial foundation.

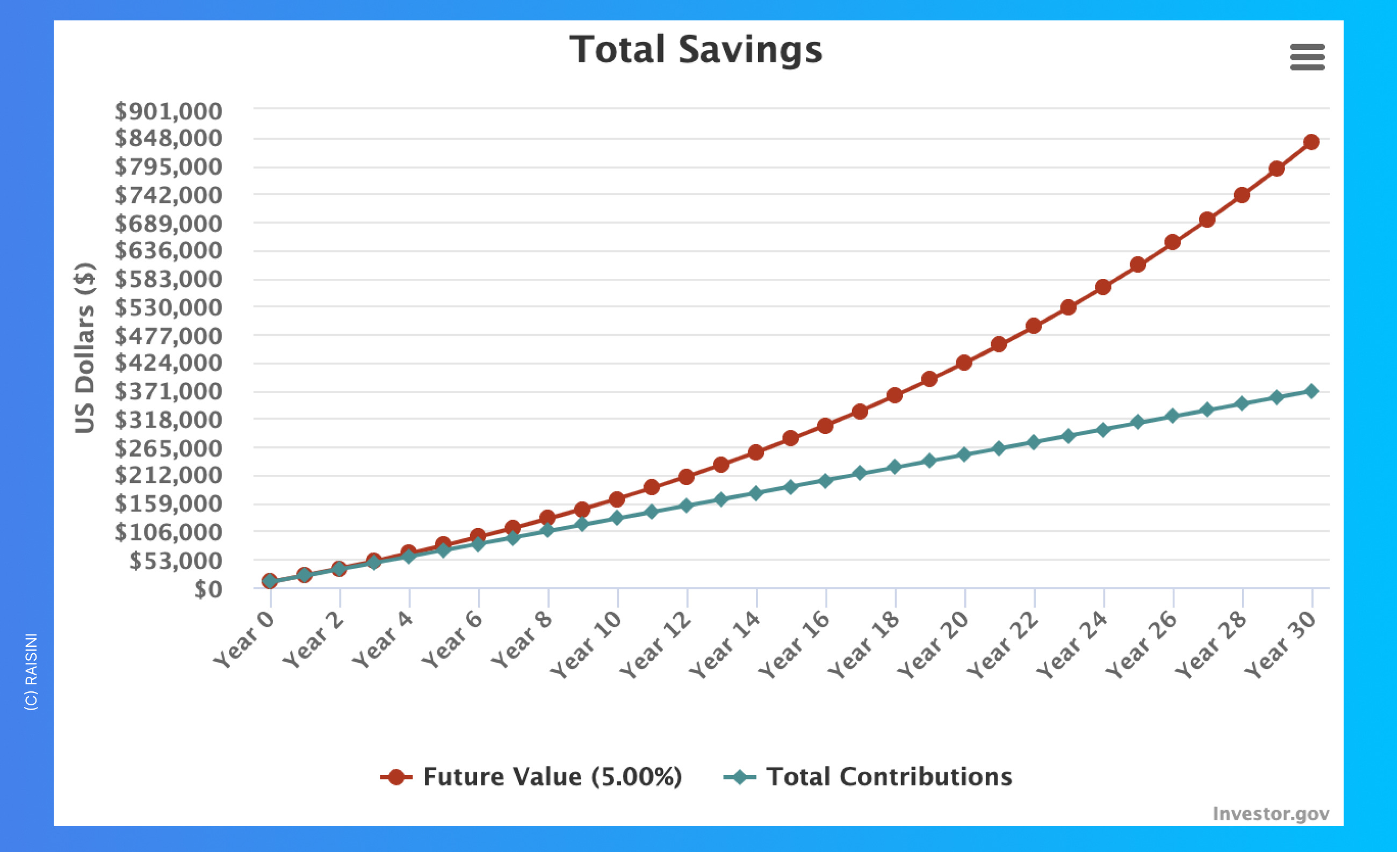

Compound interest, sometimes referred to as exponential growth, is a financial concept that allows individuals to earn interest on both their initial investment and the accumulated interest. Unlike simple interest, which is calculated only on the principal amount, compound interest takes into account the growing total value of the investment. As time progresses, the interest generated from the previous periods is added to the principal, leading to increasingly higher returns in subsequent periods.

When it comes to long-term financial planning, the power of compound interest cannot be understated. Through consistent saving and reinvesting, individuals can take full advantage of this phenomenon. Even small contributions made regularly can grow significantly over time due to the compounding effect. The earlier one starts saving, the greater the potential for wealth accumulation, as time is an essential factor in harnessing the power of compound interest.

- Compound interest has the potential to transform small, regular investments into substantial sums of money.

- It allows individuals to harness the force of time to their advantage, benefiting from the compounding effect.

- Compound interest acts as a catalyst for financial growth, helping individuals to achieve their long-term goals.

- By continuously reinvesting the returns generated by compound interest, one can create a cycle of wealth accumulation.

- Compound interest serves as a powerful motivator for individuals to prioritize saving and wise investment decisions.

In conclusion, understanding and leveraging the power of compound interest can unlock the potential for long-term financial success. By making regular contributions and allowing their investments to compound over time, individuals can establish a strong financial foundation and create the possibility for significant wealth accumulation. The key lies in starting early and remaining committed to a disciplined savings strategy.

Unlocking Long-Term Wealth

Discovering the pathway to long-term prosperity holds tremendous potential for individuals seeking financial security. By harnessing the power of continuous growth, accumulating wealth over time becomes more than a possibility, but a concrete reality. This section delves into the strategies and techniques that can unlock the doors to sustainable financial success.

Developing the prowess to generate lasting wealth relies on a combination of shrewd planning, disciplined saving, and savvy investment choices. It involves nurturing resources to their fullest potential, steadily multiplying and expanding them for future benefits. By implementing this approach, individuals can establish a solid foundation from which their long-term financial growth can prosper.

A key aspect of unlocking long-term wealth lies in the cultivation of financial literacy. Understanding concepts related to investing, budgeting, and compounding interest empowers individuals to make informed decisions. By honing this knowledge and remaining adaptable to changing markets and economic developments, one can confidently navigate the intricate pathways towards wealth accumulation.

Persistence and consistency are fundamental to unlocking long-term wealth. Consistently saving, maintaining consistent contributions towards investment accounts, and adhering to a disciplined financial regimen establish the cornerstone of sustainable prosperity. This steadfast commitment allows for the gradual accumulation of assets, enabling the compounding effect to magnify returns exponentially over time.

Moreover, unlocking long-term wealth necessitates mitigating risks while embracing opportunities. A judicious balance must be struck between preserving capital and seizing potential avenues for growth. Diversification, careful asset allocation, and informed decision-making are vital in minimizing risks and maximizing returns. By carefully evaluating risk and reward, individuals can position themselves to take advantage of favorable market conditions and safeguard against unforeseen downturns.

In essence, unlocking long-term wealth demands a comprehensive approach encompassing financial literacy, discipline, and sound decision-making. By consistently enhancing one’s knowledge, remaining committed to long-term goals, and finding the right balance between risk and reward, individuals can unlock the immense potential for lasting prosperity.

Maximizing Returns

In this section, we will explore a powerful strategy to enhance your financial growth and achieve higher returns on your investments. By employing a proactive approach and making informed decisions, you can significantly increase the value of your savings over time.

One key aspect of maximizing returns is diversification. By spreading your investments across a variety of assets and markets, you reduce the risk of losing all your money in case of a downturn. This strategy allows you to take advantage of different market conditions, potentially increasing your overall gains and minimizing potential losses.

Additionally, staying informed and keeping track of market trends is crucial. Being aware of the latest developments in various industries and sectors will help you identify emerging opportunities and make better-informed investment decisions. Regularly reviewing your portfolio and adjusting it accordingly can lead to higher returns in the long run.

Another approach to maximizing returns is to invest in growth-oriented assets. While these investments may come with higher risks, they also have the potential for significant long-term gains. Growth-oriented assets include stocks of companies with promising growth prospects, emerging technologies, and innovative industries that have the potential to outperform the market.

Moreover, taking advantage of investment vehicles that offer compounding benefits can have a substantial impact on your returns. Compounding refers to the process of reinvesting your profits or earnings, allowing them to generate additional returns over time. By harnessing the power of compounding, you can enjoy accelerated growth and accumulate significant wealth over the long term.

In summary, maximizing returns involves diversifying your investments, staying informed, investing in growth-oriented assets, and leveraging the power of compounding. By implementing these strategies, you can unlock the full potential of your savings and achieve long-term financial success.

Patience for Prosperity

In the pursuit of financial well-being and the accumulation of wealth, a valuable quality to possess is patience. Without patience, it can be challenging to fully appreciate the immense potential and long-term benefits that come with a key savings strategy and the power of compound interest.

When we think of patience, we often associate it with waiting, endurance, and perseverance. It is the ability to withstand delays or difficulties while maintaining a steadfast focus on our goals. In the context of wealth-building, patience plays a fundamental role in realizing the full potential of our savings over time.

Instead of seeking instant gratification or immediate results, cultivating patience allows us to adopt a forward-thinking mindset. By embracing delayed gratification, we can avoid impulsive decisions and short-term gains that may hinder our long-term financial growth.

Patience enables us to weather the inevitable ups and downs of the financial markets, staying calm and steady during periods of volatility. It allows us to stay invested and maintain our commitment to our savings strategy, even when faced with temporary setbacks or fluctuations.

Furthermore, patience empowers us to take advantage of the power of compound interest. With compound interest, our money grows not only on our original savings but also on the accumulated interest over time. This compounding effect can significantly enhance our wealth accumulation and generate substantial returns.

By remaining patient and consistent in our savings habits, we create a virtuous cycle. Our initial contributions, combined with the compounded interest, continue to multiply and generate long-term wealth. This cycle of patience and prosperity can potentially change our financial outlook and provide us with greater financial security and freedom in the future.

- Patience allows us to control our impulses and avoid impulsive spending.

- Patience empowers us to withstand market fluctuations and stay committed to our long-term financial goals.

- Patience helps us take full advantage of the benefits of compound interest.

- Patience cultivates a forward-thinking mindset and encourages delayed gratification.

- Patience creates a virtuous cycle of consistent savings and long-term wealth accumulation.

In conclusion, patience is not only a virtue but a crucial attribute in unlocking the potential of a key savings strategy and harnessing the power of compound interest. By embracing patience, we can navigate the challenges of wealth-building with resilience, maintain a long-term perspective, and ultimately pave the way for lasting prosperity.

A Key Savings Strategy

Within the realm of wealth accumulation, there exists a powerful technique that can greatly enhance your financial journey. This strategy, often overlooked and underutilized, holds the potential to unlock a variety of long-term benefits. By diligently adopting this method, individuals are able to establish a solid foundation for their financial future.

One of the fundamental components of this key savings strategy is the act of consistently setting money aside over time. By doing so, individuals are able to tap into the power of compounding, which allows their savings to grow exponentially. This compounding effect ensures that not only the initial capital earns interest, but that the interest itself also earns interest, leading to a snowball effect over an extended period.

Another vital aspect of this approach is the notion of regular contributions. By consistently allocating a portion of one’s income towards savings, individuals can maximize the potential returns of their investments. This disciplined approach ensures that steady progress is made towards long-term wealth accumulation. Additionally, through regular contributions, individuals are able to take advantage of dollar-cost averaging, a strategy that can mitigate the impact of market fluctuations.

Furthermore, this key savings strategy emphasizes the importance of diversification. By spreading savings across a range of investment vehicles, individuals can minimize risk and optimize returns. This diversification can be achieved through a combination of stocks, bonds, mutual funds, and other financial instruments. By investing in various assets with different levels of risk and return, individuals can create a balanced financial portfolio.

Lastly, this strategy encourages individuals to be mindful of their spending habits. By practicing frugality and limiting unnecessary expenses, individuals can free up more funds to save and invest. This awareness and restraint in spending can greatly contribute to the success of this key savings strategy.

In conclusion, adopting a key savings strategy is paramount to unlocking long-term wealth and financial freedom. By consistently setting money aside, making regular contributions, diversifying investments, and practicing mindful spending, individuals can set themselves on a path towards financial prosperity.

Consistent Contributions

Consistent Contributions are a key component in achieving long-term financial prosperity. By regularly setting aside money and taking advantage of the power of compounding, individuals can steadily grow their wealth over time.

Achieving financial success requires commitment and discipline. Regularly allocating a fixed amount of money towards savings or investments allows individuals to take full advantage of the compounding effect. Putting aside even a small amount of money consistently can lead to substantial growth over time.

Consistency in contributions also helps individuals develop good financial habits. By prioritizing regular savings, individuals can build a strong foundation for their financial future. Consistent contributions create a sense of discipline and responsibility, making it easier to stay on track towards achieving long-term financial goals.

- Set a specific goal for your savings contributions and stick to it. Whether it’s a monthly or yearly target, having a concrete target can help you stay focused and motivated.

- Automate your contributions to make it easier and more convenient. Setting up automatic transfers or direct deposits ensures that you consistently put money towards your savings without having to actively remind yourself.

- Take advantage of employer-sponsored retirement plans or other savings vehicles that offer employer matching contributions. This not only boosts your savings but also provides additional motivation to contribute consistently.

- Review and adjust your contributions regularly. As your financial situation evolves, it’s important to reassess and potentially increase your contributions to ensure continued progress towards your financial goals.

- Stay disciplined and avoid the temptation to dip into your savings for non-essential expenses. Consistency is key, and maintaining a steadfast approach to saving will yield greater long-term benefits.

In conclusion, consistent contributions form the backbone of a successful savings strategy. By making regular contributions and harnessing the power of compounding, individuals can unlock long-term wealth and achieve financial prosperity.

Choosing the Right Investment Vehicle

When it comes to growing your wealth over the long term, selecting the appropriate investment vehicle is essential. Whether you’re starting with a small amount or have a significant sum to invest, making the right choice can make a significant difference in achieving your financial goals.

There are various options available when it comes to investment vehicles, ranging from stocks and bonds to real estate and mutual funds. Each option comes with its own set of advantages and risks, so it’s crucial to thoroughly understand them before making a decision.

One common investment vehicle is stocks, which are shares of ownership in a company. Investing in stocks provides the opportunity to participate in a company’s growth and share profits through stock price appreciation and dividends. However, stock prices can be volatile and influenced by market conditions, so thorough research and diversification are vital.

Bonds, on the other hand, are debt securities issued by governments or companies. When you invest in bonds, you are essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal amount upon maturity. Bonds offer a more predictable income stream and can be a safer investment option compared to stocks.

Real estate is another investment vehicle that has the potential to generate long-term wealth. Investing in rental properties or real estate investment trusts (REITs) can provide a steady stream of passive income through rental payments or dividends while potentially appreciating in value over time. However, real estate investments require careful consideration of location, property management, and market conditions.

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They offer instant diversification and are managed by professional fund managers. Mutual funds can be a suitable option for those looking for a hands-off approach to investing.

In conclusion, choosing the right investment vehicle is crucial when it comes to unlocking long-term wealth. Understanding the various options available, their advantages, and risks can help you make informed decisions aligned with your financial objectives. Remember to consider your risk tolerance, investment timeframe, and financial goals before making any investment decisions.

Diversification for Growth

In order to maximize your long-term financial gains, it is crucial to adopt a strategy of diversification. Diversification involves spreading your investments across a variety of different assets or markets, instead of relying on a single investment avenue. This approach helps to mitigate risks and increase the potential for growth.

By diversifying your investment portfolio, you are essentially minimizing the impact of any one particular investment on your overall financial well-being. This can help to protect your investments from potential losses and provide stability during periods of market volatility. Without the reliance on a single investment, you can take advantage of the varied opportunities offered by different asset classes and sectors.

A diversified portfolio typically includes a mix of stocks, bonds, real estate, commodities, and other investment vehicles. This allows you to benefit from the potential growth of various sectors while safeguarding against a downturn in any one market. The key is to carefully allocate your investments across different assets in a way that aligns with your risk tolerance and financial goals.

Furthermore, diversification can also provide opportunities for enhanced returns. By investing in different asset classes, you may have exposure to investments that offer higher potential returns than others. This can help to boost the overall performance of your portfolio and increase your long-term wealth.

It is important to note that diversification does not guarantee profits or protect against losses. However, it is a prudent strategy that can help to manage risk and maximize potential gains. By spreading your investments across different assets and sectors, you can unlock the growth potential of a well-diversified portfolio and navigate the ever-changing financial landscape with confidence.

Questions and answers

What is compound interest?

Compound interest is the concept of earning interest on both the initial amount of money deposited, as well as the accumulated interest over time. When interest is added to the principal amount and then continues to earn interest, the result is exponential growth of savings over time.

How does compound interest help in unlocking long-term wealth?

Compound interest helps in unlocking long-term wealth by allowing your savings to grow exponentially over time. Due to the compounding effect, even small contributions made regularly can result in significant wealth accumulation in the long run.

What is a key savings strategy that can harness the power of compound interest?

A key savings strategy that can harness the power of compound interest is consistent and disciplined saving habits. By consistently saving a portion of your income and allowing it to grow over time, you can take full advantage of the compounding effect and unlock long-term wealth.

Is compound interest only beneficial for long-term savings goals?

No, compound interest is beneficial for both short-term and long-term savings goals. While it is true that the longer the time period, the greater the compounding effect, even shorter time periods can still result in substantial growth of savings through compound interest.

Does compound interest work the same way for investments as it does for savings accounts?

No, compound interest may work differently for investments compared to savings accounts. While both can benefit from the power of compounding, investments often come with additional risks and higher potential returns. Therefore, the specific dynamics of compound interest may vary depending on the type of investment and market conditions.

How does compound interest work?

Compound interest is a concept where the interest earned on an initial investment is reinvested and added to the original principal amount. Over time, this allows for exponential growth of the investment.

What are the benefits of using compound interest as a savings strategy?

Compound interest helps individuals accumulate wealth over the long term by maximizing the growth potential of their investments. It allows for the compounding of interest over time, leading to increased returns compared to simple interest.

Is compound interest only applicable to financial investments?

No, compound interest can be applied to various types of investments, including savings accounts, bonds, stocks, and even real estate. It is a powerful tool for growing wealth regardless of the investment vehicle chosen.

Are there any risks associated with compound interest?

While compound interest is generally considered a beneficial savings strategy, there are some risks to be aware of. These include inflation, market fluctuations, and potential investment losses. It is important to diversify investments and understand the potential risks involved.

How can individuals incorporate compound interest into their savings plan?

Individuals can start by consistently saving a portion of their income and investing it wisely in assets that generate compound interest. It is important to start early to take advantage of the time factor and allow the investment to grow over a longer period. Regular contributions and reinvesting dividends or interest earned also help maximize the power of compound interest.