In today’s fast-paced world, it can be challenging to keep track of our finances and ensure that we are making smart financial decisions. With the constant flow of expenses and income, it’s no wonder that many of us find ourselves struggling to stay on top of our budgets. However, there is a solution that can help us regain control and achieve financial success.

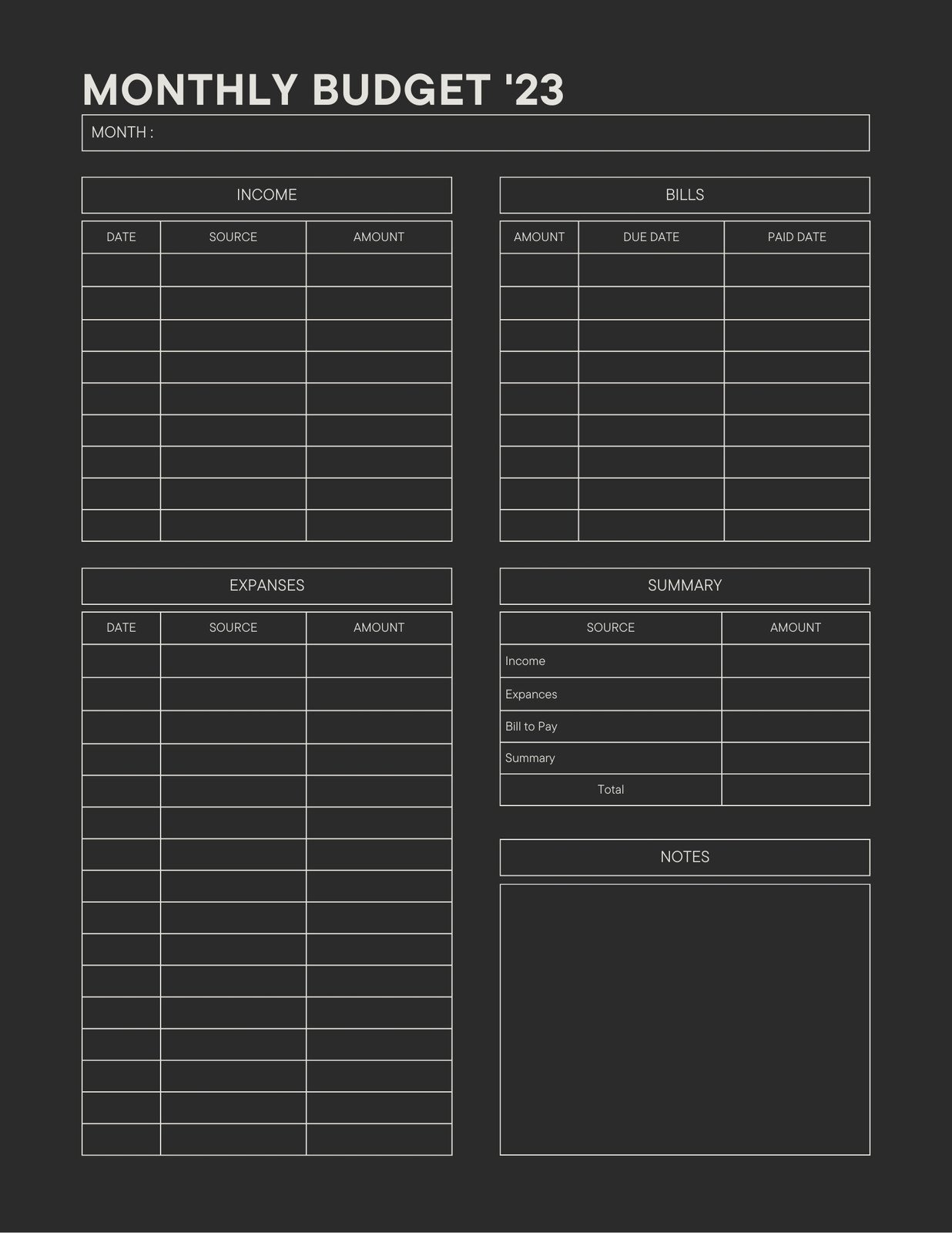

Introducing an innovative tool that will revolutionize the way you manage your money – an intuitive and user-friendly budget planner template. With its remarkable features and streamlined design, this organizational tool will empower you to take charge of your finances effortlessly.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MorePicture a world where your financial future is no longer a mystery but a well-planned journey towards success. Imagine effortlessly organizing your expenses, tracking your income, and identifying areas where you can save more money. With the help of a budget planner template, this dream can become a reality.

Designed to cater to various financial needs and preferences, this extraordinary tool offers an array of customization options to suit your unique situation. Whether you have short-term financial goals or long-term aspirations, a budget planner template can assist you in creating a foolproof financial plan that caters to your individual needs.

- Effortless Budgeting

- Why Budgeting is Important

- The Benefits of Effective Budgeting

- Discover the Magic

- What is a Budget Planner Template

- How a Budget Planner Template Can Simplify Your Life

- Key Features of a Budget Planner Template

- Get Started Today

- Where to Find Budgeting Tools for Organizing Your Finances

- How to Customize a Budget Planner Template

- Tips for Successful Budgeting with a Template

- Questions and answers

Effortless Budgeting

In this section, we will explore the art of effortlessly managing your financial resources and creating a well-organized budget to meet your aims and desires. We will uncover practical techniques that will empower you to streamline your financial planning process without any hassle or stress. By delving into the tips and tricks shared, you will gain a deeper understanding of how to efficiently allocate your income and effectively monitor your expenses.

Through the exploration of various strategies, including practical examples and insightful anecdotes, you will discover a range of methods that will make budgeting more enjoyable and rewarding. By applying these techniques, you can create a financial framework that aligns with your lifestyle and goals, and ultimately leads to a sense of financial freedom and security.

Within this section, we will delve into the significance of setting realistic financial goals, identifying spending patterns, and cultivating healthy money habits. We will also explore the role of mindful spending and the importance of tracking and adjusting your budget to accommodate changing financial circumstances.

Furthermore, we will delve into the realm of digital budgeting tools and explore how you can leverage technology to automate and simplify the budgeting process. From mobile apps to online platforms, we will unravel the world of budget planner tools and uncover how they can revolutionize your financial management experience.

By implementing the strategies discussed in this section, you will be equipped with the knowledge and tools necessary to effortlessly manage your budget, reduce financial stress, and achieve your financial goals with confidence and ease. So, let’s dive in and embark on this transformative journey towards effortless budgeting!

Why Budgeting is Important

Budgeting plays a vital role in contemporary life, assisting individuals in managing their finances effectively and working towards their financial goals. This practice involves creating a financial plan that outlines income, expenses, and savings, enabling individuals to maintain control over their spending habits and make informed financial decisions.

Financial Stability: Establishing a budget provides financial stability by providing a clear picture of an individual’s cash flow. By tracking income and expenses, individuals can identify areas of overspending and make necessary adjustments to maintain stability and avoid debt. Budgeting helps individuals develop the habit of living within their means, cultivating financial independence and security.

Goal Achievement: Budgeting acts as a roadmap to achieving financial goals. By setting realistic and achievable targets, individuals can allocate their income towards savings, investments, and other essential expenses. This proactive approach enables individuals to make progress towards milestones such as buying a home, starting a business, or saving for retirement.

Debt Management: Budgeting is a powerful tool for managing and reducing debt. By identifying unnecessary expenses and reallocating funds towards debt repayment, individuals can create a plan to eliminate debt systematically. Budgeting also allows individuals to monitor debt and take preventive measures to avoid accumulating additional debt in the future.

Financial Awareness: Budgeting fosters financial awareness by providing a detailed understanding of income sources, spending patterns, and financial habits. Regular tracking of expenses encourages individuals to question discretionary spending and make conscious choices about their money. This increased awareness empowers individuals to make informed decisions that reflect their values and long-term financial objectives.

Emergency Preparedness: Budgeting helps individuals prepare for unforeseen circumstances and emergencies. By setting aside funds for contingencies, individuals can navigate unexpected situations without jeopardizing their financial stability. Having an emergency fund provides a financial safety net, reducing stress and ensuring peace of mind in challenging times.

Overall, budgeting plays a pivotal role in personal finance management, acting as a tool for financial stability, goal achievement, debt management, financial awareness, and emergency preparedness. By harnessing the power of budgeting, individuals can take control of their financial lives and achieve long-term financial success.

The Benefits of Effective Budgeting

When it comes to managing our finances, effective budgeting can bring about numerous advantages that go beyond the simple act of tracking expenses and income. By implementing a well-designed budgeting system, individuals can experience a range of benefits that positively impact their financial stability and overall quality of life.

One of the primary advantages of effective budgeting is the ability to gain control over one’s financial situation. By carefully examining income and expenses, individuals can develop a clear understanding of where their money is going and make informed decisions on how best to allocate funds. This sense of control can help eliminate financial stress and provide a solid foundation for future financial goals.

Another key benefit of effective budgeting is the ability to prioritize spending and savings. With a budget in place, individuals can identify their financial priorities, whether it’s paying off debt, saving for retirement, or investing in education. By allocating specific amounts towards these priorities, individuals can ensure that their long-term goals are being met while avoiding unnecessary expenses.

In addition, effective budgeting can also lead to increased savings and the ability to build an emergency fund. By carefully monitoring expenses and finding areas where costs can be reduced, individuals can free up more money to put towards savings. This can provide a financial safety net in the event of unexpected expenses or job loss, ensuring that individuals have the resources they need to weather financial challenges.

Furthermore, effective budgeting can help individuals make more informed financial decisions. By closely monitoring income and expenses, individuals can identify patterns and trends in their spending habits. This knowledge can be invaluable when considering major financial decisions such as purchasing a home, starting a business, or investing in the stock market. With a clear understanding of their financial situation, individuals can make informed choices that align with their long-term goals.

In conclusion, the benefits of effective budgeting extend far beyond the mere act of tracking money. By gaining control over finances, prioritizing spending and savings, building savings, and making informed financial decisions, individuals can experience increased financial stability and peace of mind. Investing time and effort into creating and maintaining an effective budget can yield significant rewards and pave the way for a brighter financial future.

Discover the Magic

In this section, we will delve into the enchanting world of effective financial management. Prepare to be captivated as we explore the secrets of effortlessly controlling your expenses and achieving financial freedom. Here, the focus is not on mere budgeting or rigidly following a template; rather, it is about unleashing the magical potential of a well-crafted financial strategy.

Unlocking the magic begins with understanding the power of conscious spending. By connecting with our values and priorities, we can make intentional choices that lead to a more fulfilling and financially secure life. Through the use of thoughtful planning and informed decision-making, we can transform our relationship with money into a source of empowerment and joy.

Within this transformative journey, it is essential to embrace the dynamic nature of our financial landscape. Circumstances fluctuate, goals evolve, and unexpected opportunities arise. With an open mindset and adaptable approach, we can harness the magic of flexibly navigating these changes without compromising our financial well-being.

Additionally, establishing a strong foundation built on clarity and organization is crucial in this magical quest. By crafting a personalized system that suits our individual needs, we can effortlessly track income and expenses, analyze patterns, and make informed adjustments. This systematic approach not only helps us stay on track but also provides a sense of stability and control over our financial destiny.

Lastly, as we uncover the magic of financial management, it is important to honor the significance of self-reflection and self-care. Taking the time to assess our progress, celebrate achievements, and learn from any setbacks enables us to cultivate a healthy and sustainable relationship with money. By integrating mindfulness into our financial journey, we can discover a newfound sense of balance and tranquility.

Prepare to embark on an extraordinary adventure as we venture into the realm of financial magic. Through the exploration of conscious spending, adaptability, organization, and self-reflection, we will unveil the transformative power of a well-crafted financial strategy. Let the enchantment of this journey guide you towards a future of abundance and financial freedom.

What is a Budget Planner Template

A budget planner template is a tool that facilitates the organization and management of personal or business finances. It serves as a structured framework that allows individuals to track income, expenses, savings, and debt. This template can be customized to suit individual needs and can be used to create a comprehensive financial plan.

A budget planner template provides a systematic approach to managing finances by breaking down income and expenses into categories and subcategories. It helps individuals gain a clearer understanding of their financial situation, identify areas of overspending or underspending, and make informed decisions to achieve their financial goals.

Using a budget planner template, individuals can allocate funds for various purposes such as monthly bills, savings, investments, and leisure activities. It allows for better control and organization of finances, enabling users to prioritize expenditures and make adjustments when necessary.

Moreover, a budget planner template provides a historical record of financial transactions, making it easier to evaluate spending patterns and identify areas where adjustments can be made to save money.

In summary, a budget planner template is a valuable tool that helps individuals take control of their finances. It offers a structured approach to managing income, expenses, savings, and debt, allowing users to make informed decisions and work towards their financial goals.

How a Budget Planner Template Can Simplify Your Life

Imagine a life free from the stress and complexity of managing your finances. A life where financial decisions are made effortlessly, allowing you to focus on what truly matters. This is the transformative power of a budget planner template.

By utilizing a budget planner template, you can simplify the process of organizing and tracking your expenses. It provides a structured framework that enables you to set financial goals, allocate resources, and monitor your progress with ease. With the help of intuitive categorization and visualizations, you can gain a clear understanding of your financial situation and make informed decisions.

The convenience of a budget planner template lies in its flexibility and adaptability. Whether you are managing personal finances, planning a household budget, or organizing expenses for a small business, this versatile tool can be tailored to suit your specific needs. With customizable sections and fields, you can easily personalize the template to align with your unique financial circumstances.

Moreover, a budget planner template serves as a valuable resource for developing healthy financial habits. It prompts you to regularly review your expenses, identify areas of improvement, and make necessary adjustments. By fostering discipline and accountability, it empowers you to make responsible financial choices and work towards long-term financial stability.

In a world where financial matters can often seem overwhelming, a budget planner template offers a beacon of simplicity. It eliminates the need for complex spreadsheets or burdensome paperwork, streamlining the process of budgeting and allowing you to reclaim your time and energy. With its user-friendly interface and straightforward design, it makes financial management accessible to individuals of all backgrounds and skill levels.

In conclusion, embracing a budget planner template can revolutionize your approach to financial management. It provides a user-friendly and customizable tool that simplifies the complexities of budgeting, empowering you to take control of your finances and achieve your financial goals effortlessly. Experience the transformative power of a budget planner template and unlock a life of financial simplicity and peace of mind.

Key Features of a Budget Planner Template

In the realm of organizing your finances and achieving financial stability, a budget planner template emerges as a powerful tool to help individuals seamlessly manage their money. Built with a myriad of essential elements, a budget planner template serves as a guiding light, allowing users to effortlessly track, monitor, and control their expenses.

Here are some key features that make a budget planner template an invaluable asset in achieving financial goals:

- User-Friendly Interface: A budget planner template comes with a user-friendly interface, making it easy for anyone to navigate and utilize its features. Whether you are a tech-savvy individual or a beginner, the intuitive design ensures a hassle-free experience.

- Expense Tracking: One of the fundamental features of a budget planner template is its ability to track expenses. With the help of categories and subcategories, users can accurately record their spending, ensuring they have a comprehensive overview of where their money is going.

- Income Management: A budget planner template allows users to manage their income effectively. It enables users to input their various sources of income, ensuring they have a clear understanding of their earning potential.

- Goal Setting: Setting financial goals is crucial in ensuring long-term financial success. A budget planner template provides a platform to set realistic goals, whether it be saving for a down payment, paying off debt, or planning for retirement.

- Savings and Investments: A budget planner template helps users allocate their funds towards savings and investments. It offers a dedicated space to track progress and set aside money for future endeavors.

- Visual Representation: Visual representation through charts and graphs is an effective way to understand and analyze financial data. A budget planner template incorporates visual elements to provide users with clear insights into their spending habits and financial progress.

In conclusion, a budget planner template offers a range of features that empower individuals to take control of their finances. With its user-friendly interface, expense tracking capabilities, income management tools, goal setting features, savings and investment tracking, and visual representation options, a budget planner template becomes an indispensable tool for creating financial stability and achieving financial goals.

Get Started Today

Take the first step towards transforming your financial future by getting started today. Begin your journey towards effortless money management with simple and effective strategies. With a little planning and commitment, you can achieve your financial goals and live the life you desire.

Start by outlining your income and expenses. Determine your monthly income from various sources such as your job, investments, or side hustles. Next, list down all your regular expenses, including bills, groceries, transportation, and entertainment.

Identify areas where you can cut back or make adjustments to save money. Look for alternatives that offer similar benefits at a lower cost. Consider reducing discretionary expenses and prioritize your needs over wants.

Use a budget planner tool or template to create a comprehensive budget. This will help you track your income and expenses, set financial goals, and monitor your progress. Choose a template that suits your preferences and customize it according to your specific needs.

Stay committed to your budget and review it regularly. Make necessary adjustments as your financial situation changes. Remember that budgeting is not a one-time task but an ongoing process to ensure financial stability and success.

By taking the initiative to get started on your budgeting journey today, you are taking control of your finances and paving the way towards a more secure and fulfilling future. Don’t wait any longer, start now and experience the positive impact of budgeting on your financial well-being.

Where to Find Budgeting Tools for Organizing Your Finances

Looking for efficient budget planning tools that will simplify your financial management? You’re in luck! There are a plethora of resources available online to help you get started on your budgeting journey. Whether you prefer a digital solution or a printable template, you can easily find budget planning tools that fit your needs.

One popular option to locate budget planner templates is to explore websites that specialize in personal finance and budgeting. These websites often offer a variety of pre-designed templates that can be customized to suit your specific financial goals and preferences.

Another avenue to find budget planner templates is through online communities and forums dedicated to personal finance. These platforms allow users to share their own budget planning templates or recommend resources they have found helpful. It’s a great way to tap into a community of like-minded individuals striving for financial success.

Additionally, many software applications and mobile apps include built-in budget planner templates. These tools often come with added features such as expense tracking, goal setting, and automatic calculations to make budgeting even easier and more efficient.

Don’t forget about the power of social media! Many personal finance influencers and bloggers share free budget planner templates on their platforms. They may offer downloadable PDFs or even spreadsheet templates that you can use to organize your finances.

Finally, if you have a creative streak, consider designing your own budget planner template. You can use design software or even simple tools like Microsoft Excel or Google Sheets to create a customized template that reflects your unique budgeting style.

With the wealth of resources available, finding a budget planner template that suits your needs should be a breeze. Take the time to explore different options and find the one that works best for you, and you’ll be well on your way to effortlessly managing your finances.

How to Customize a Budget Planner Template

Creating a personalized budget planner template that perfectly aligns with your financial goals and preferences is easier than you might think. In this section, we will explore the steps to customize a budget planner template to suit your individual needs.

Gather your financial information: Begin by gathering all the necessary financial information, such as your monthly income, expenses, savings goals, and any outstanding debts. This step will help you gain a clear understanding of your financial situation and what areas you need to focus on.

Identify budget categories: Next, identify the different categories that you want to include in your budget planner template. These categories can range from basic expenses like groceries and utilities to specific savings goals or debts you want to tackle. Customize them according to your unique financial circumstances.

Add income and expense fields: Once you have identified your budget categories, add income and expense fields to your template. This will allow you to track your monthly income sources and allocate funds for each expense category. Make sure to include fields for both fixed and variable expenses.

Set budget targets: Setting budget targets is an essential part of customizing a budget planner template. Determine how much you want to allocate to each expense category and set realistic goals for savings. This step will help you stay on track with your financial plans.

Include tracking mechanisms: Incorporate tracking mechanisms in your template to monitor and track your expenses and income throughout the month. This can be as simple as inserting a column to record actual spending or using color-coding to easily identify different expense categories.

Personalize the design: Give your budget planner template a personal touch by customizing the design elements. You can choose different font styles, colors, or even insert relevant icons to make it visually appealing and easier to navigate. Remember, a visually appealing planner can also motivate you to stay committed to your financial goals.

Review and revise: Finally, regularly review and revise your customized budget planner template to ensure it continues to meet your changing financial needs. Be open to making adjustments and improvements as needed to make it more effective in managing your finances.

In conclusion, customizing a budget planner template allows you to design a financial tool that works best for you. By gathering your financial information, identifying categories, setting budget targets, and personalizing the design, you can create a budget planner that empowers you to take control of your finances and achieve your financial goals.

Tips for Successful Budgeting with a Template

Creating and managing a budget can be a daunting task, but with the help of a well-designed budget template, it can become a hassle-free and efficient process. To make the most of your budgeting experience, here are some practical tips to consider:

- Start with your financial goals in mind: Before diving into the budgeting process, it’s important to identify your short-term and long-term financial goals. This will give you a clear direction and purpose for creating a budget.

- Track your expenses diligently: To gain a comprehensive understanding of your spending habits, track all your expenses carefully. This includes everything from fixed monthly bills to discretionary purchases. It’s important to be as detailed as possible to identify areas where you can cut back and save.

- Create realistic categories: When using a budget template, make sure to customize the categories based on your unique circumstances. This will allow you to allocate funds accurately and track your progress towards each specific financial goal.

- Be flexible and adaptable: As life is unpredictable, your budget should be flexible enough to accommodate any unexpected expenses or changes in income. Regularly review and adjust your budget to reflect any new financial circumstances.

- Use visualization techniques: A budget template can provide a visual representation of your financial situation. Take advantage of graphs and charts to easily identify patterns and areas of improvement.

- Set realistic expectations: While budgeting can help you achieve financial goals, it’s important to set realistic expectations. Be patient with your progress and remember that small positive changes can make a significant difference in the long run.

- Seek support and accountability: Share your budgeting journey with a trusted friend or family member who can provide support and hold you accountable. Discussing your financial goals and challenges can help you stay motivated and on track.

- Review and reflect regularly: Budgeting is an ongoing process. Dedicate time regularly to review your budget, assess your progress, and make adjustments as needed. Regular reflection will allow you to make informed financial decisions and continue working towards your goals.

Incorporating these tips into your budgeting routine while utilizing a well-designed template will help you achieve successful and stress-free financial management.

Questions and answers

What is a budget planner template?

A budget planner template is a pre-designed document that helps individuals or households track their income, expenses, and savings in an organized manner.

How can a budget planner template help me?

A budget planner template can help you by providing a structured format to track your income and expenses, allowing you to easily identify areas where you can save money and make adjustments to ensure financial stability.

Are budget planner templates easy to use?

Yes, budget planner templates are designed to be user-friendly and easy to use. They typically come with pre-filled categories and formulas that automate calculations, making it simple for anyone to track their finances.

Where can I find a budget planner template?

There are various sources where you can find budget planner templates. They can be downloaded for free from websites, or you can purchase more advanced templates from online marketplaces or office supply stores.

Is it necessary to use a budget planner template?

While it is not necessary to use a budget planner template, it can be extremely beneficial for individuals or households looking to manage their finances effectively. It provides a structured approach to budgeting and helps visualize where your money is going.

What is a budget planner template?

A budget planner template is a pre-designed document or digital tool that helps individuals or businesses track their income, expenses, and savings. It provides a structured layout for organizing financial information and enables better financial management.

How can a budget planner template help me manage my finances?

A budget planner template can help you manage your finances by providing a clear overview of your income and expenses. It allows you to track where your money is going, identify areas where you can cut back, and set savings goals. By using a budget planner template, you can make informed financial decisions and stay on track with your financial goals.

Are there different types of budget planner templates available?

Yes, there are various types of budget planner templates available to cater to different needs. Some templates are designed for personal budgeting, while others are specifically tailored for businesses or specific financial goals. You can find templates in different formats, such as Excel spreadsheets, printable worksheets, or online budgeting tools.

Do I need to have advanced Excel skills to use a budget planner template?

No, you don’t need advanced Excel skills to use a budget planner template. Many templates are user-friendly and require basic knowledge of Excel or other spreadsheet software. Templates often come with instructions or pre-filled formulas to make budgeting easier for beginners.

Can I customize a budget planner template to fit my specific needs?

Yes, most budget planner templates can be customized to fit your specific needs. You can add or remove categories, adjust formulas, and personalize the layout to suit your preferences. This flexibility allows you to create a budget planner template that aligns with your unique financial situation and goals.