Unlocking the pathway to financial triumph is a pursuit many individuals embark upon with unwavering determination. However, the journey toward prosperity is often perceived as an enigma, shrouded in a veil of mystery. In this captivating exploration, we delve into the secrets that lie beneath the surface of building substantial wealth, revealing an array of ingenious strategies that have withstood the test of time.

Embarking on the quest for financial success requires more than just a stroke of luck or blind faith; it necessitates a calculated approach. During our expedition, we will unearth an assortment of unconventional methods that can be seamlessly integrated into your everyday life. These methods, when fully embraced, have the power to transform your financial reality and catapult you towards the realm of opulence.

Revolutionize Your Health & Lifestyle!

Dive into the world of Ketogenic Diet. Learn how to lose weight effectively while enjoying your meals. It's not just a diet; it's a lifestyle change.

Learn MorePrepare to be captivated as we disclose the hidden truths behind attaining financial abundance. Delving into the heart of financial achievement, we will uncover the innovative techniques utilized by the most affluent individuals throughout history. By adopting these time-honored principles, you will unlock a limitless array of opportunities and propel yourself towards the pinnacle of monetary triumph.

- Discover the Path to Financial Success: Effective Strategies for Wealth Building

- Saving for the Future: Essential Money Management Tips

- Budgeting: A Crucial Step towards Financial Stability

- Create a monthly budget to track your income and expenses

- Identify areas where you can reduce unnecessary expenses

- Set realistic savings goals and make regular contributions

- Investing Wisely: Grow Your Wealth with Smart Financial Decisions

- Educate yourself about different investment options, such as stocks, bonds, and real estate

- Consult with a financial planner to create a customized investment strategy

- Diversify your investment portfolio to minimize risk and maximize potential returns

- Embracing Frugality: Simple Ways to Save Money and Boost Your Net Worth

- Questions and answers

Discover the Path to Financial Success: Effective Strategies for Wealth Building

In the pursuit of financial success, it is crucial to understand and implement effective strategies that can pave the way for building wealth. By adopting the right approaches and making informed decisions, individuals can set themselves on a path towards financial prosperity.

The first step in the journey towards financial success is to develop a solid plan. This entails defining clear goals and objectives, identifying opportunities for growth, and devising a roadmap that outlines the necessary steps to achieve these aspirations. Additionally, it is essential to establish a realistic timeline and regularly reassess and adjust the plan as circumstances evolve.

Another key strategy for wealth building is to focus on diversification. Investing in a mix of different asset classes can help mitigate risks and maximize potential returns. By allocating funds across various investment vehicles, such as stocks, bonds, real estate, and mutual funds, individuals can build a well-balanced portfolio that offers both stability and growth opportunities.

Furthermore, it is crucial to cultivate a savings habit and adhere to a disciplined approach to personal finance. This entails consistently setting aside a portion of income for savings and resisting the temptation to indulge in excessive spending or impulsive purchases. By prioritizing saving and living within one’s means, individuals can accumulate wealth over time and build a solid financial foundation.

Additionally, harnessing the power of education and continuous learning is paramount in the quest for financial success. Staying informed about the latest market trends, mastering investment strategies, and acquiring valuable financial knowledge can provide individuals with a competitive edge and better equip them to make informed decisions regarding their wealth-building endeavors.

| Effective Strategies for Wealth Building: |

|---|

| 1. Develop a solid plan |

| 2. Focus on diversification |

| 3. Cultivate a savings habit |

| 4. Harness the power of education and continuous learning |

Saving for the Future: Essential Money Management Tips

Securing a prosperous future requires sound money management techniques. This section presents essential tips on how to save money effectively and prepare for long-term financial stability. By making smart financial decisions and adopting healthy saving habits, individuals can create a robust foundation for their future.

| Tip | Explanation |

|---|---|

| 1. Budgeting | Establish a monthly budget to track income and expenses. This helps identify areas where expenses can be reduced to increase savings. |

| 2. Automate Savings | Set up automatic transfers from your paycheck or checking account to a dedicated savings account. This eliminates the temptation to spend and ensures consistent savings. |

| 3. Minimize Debts | Pay off high-interest debts as soon as possible to avoid accumulating unnecessary interest payments. Prioritize debt repayment to free up more funds for savings. |

| 4. Cut Unnecessary Expenses | Identify and eliminate discretionary expenses that do not contribute significantly to your well-being or financial goals. Pouring the saved money into savings accounts will lead to long-term rewards. |

| 5. Plan for Emergencies | Create an emergency fund to cover unexpected expenses, such as medical bills, car repairs, or job loss. Aim for three to six months’ worth of living expenses and keep this fund separate from regular savings. |

| 6. Maximize Retirement Contributions | Contribute the maximum allowed amount to retirement accounts, such as a 401(k) or Individual Retirement Account (IRA). Take advantage of employer matches and tax advantages to grow retirement savings. |

| 7. Invest Wisely | Consider investing in low-cost index funds or exchange-traded funds (ETFs) to grow wealth over time. Diversify investments to manage risk effectively. |

| 8. Periodic Review | Regularly review and adjust your financial plan based on changing circumstances and goals. Make necessary modifications to ensure savings remain on track. |

Gaining control of your finances and saving for a secure future requires discipline and dedication. By implementing these essential money management tips, individuals can take proactive steps toward long-term financial well-being.

Budgeting: A Crucial Step towards Financial Stability

Effective management of your finances plays a pivotal role in attaining a stable financial future. One key element in this process is budgeting, which serves as a crucial step towards achieving financial stability. Creating and following a budget allows you to have a clear understanding and control over your income, expenses, and savings, ensuring you make informed financial decisions. By implementing a budgeting strategy, you can prioritize your spending, cut unnecessary costs, and allocate your resources wisely, ultimately paving the way towards a secure financial future.

With budgeting, you gain a comprehensive view of your financial situation. By examining your income, expenses, and debts, you can identify areas where you are overspending, spot potential savings opportunities, and uncover areas where you may need to make adjustments. This process enables you to align your financial goals with your current financial situation, enabling you to effectively plan and allocate resources accordingly.

- Tracking your expenses is an essential component of budgeting. By keeping a record of your expenses, you can develop awareness about your spending habits and identify areas where you can cut back. This practice helps you make conscious decisions about your purchases and better control your spending, ensuring that your money is directed towards your financial goals.

- Creating a budget allows you to prioritize your spending. By allocating a specific amount for each expense category, such as housing, transportation, groceries, and entertainment, you can ensure that your necessities are met while still leaving room for discretionary spending. This practice helps you maintain a balanced financial life and avoid overspending in any specific area.

- Having a budget in place enables you to plan for the future effectively. By setting financial goals, such as saving for emergencies, retirement, or a specific purchase, you can allocate a portion of your income towards these objectives. Budgeting allows you to track your progress towards these goals and make adjustments as necessary, helping you stay on track towards achieving long-term financial stability.

- Budgeting provides a sense of financial control and reduces financial stress. With a budget, you have a clear understanding of your expenses and can make informed decisions about your financial choices. By embracing budgeting as a regular practice, you can reduce the anxiety associated with financial uncertainty and confidently work towards your financial goals.

In conclusion, budgeting serves as a vital step towards achieving financial stability. By implementing a budgeting strategy, you can gain control over your finances, track your expenses, prioritize your spending, plan for the future, and reduce financial stress. Embracing budgeting as a habit will empower you to make informed financial decisions and pave the way towards a successful and secure financial future.

Create a monthly budget to track your income and expenses

![]()

One of the essential steps towards achieving financial stability is to create a monthly budget that allows you to effectively track your income and expenses. By establishing a budget, you can gain a clear understanding of your financial situation and make informed decisions about how to allocate your resources.

A monthly budget serves as a financial roadmap, providing you with a holistic view of your financial health and enabling you to set achievable goals. By tracking your income, you can identify potential sources of revenue and make informed decisions about increasing your earnings. Similarly, monitoring your expenses helps you identify areas of excessive spending and make necessary adjustments to improve your financial situation.

Creating a monthly budget involves taking a comprehensive inventory of your income sources, including your salary, investment returns, and any additional income streams. Equally important is tracking your monthly expenses, which may include rent or mortgage payments, utility bills, groceries, transportation costs, and discretionary spending. By categorizing these expenses, you can identify areas where you may be overspending and take steps to curtail unnecessary costs.

Once you have identified your income and expenses, it is crucial to set realistic financial goals. Whether you aim to pay off debt, save for a down payment on a house, or invest in your education, a well-defined budget allows you to allocate funds towards these objectives. By establishing priorities and making conscious financial decisions, you can work towards attaining your goals while maintaining financial stability.

Tracking your budget on a monthly basis is essential for assessing your progress and making necessary adjustments. Evaluate your income and expenses regularly to ensure that you are sticking to your budget and identify areas where you may need to cut back or increase your allocation. Utilizing tools such as online budgeting apps or spreadsheet templates can further simplify the process and provide real-time insights into your financial situation.

- Regularly review your budget.

- Identify areas of overspending.

- Adjust your budget to accommodate unexpected expenses.

- Allocate funds towards your financial goals.

- Seek professional advice if needed.

By creating and consistently monitoring a monthly budget, you can take control of your finances and establish a solid foundation for financial success. It empowers you to make informed decisions, prioritize your spending, and work towards achieving your long-term goals. Start your journey towards financial stability today by building a monthly budget tailored to your unique circumstances.

Identify areas where you can reduce unnecessary expenses

Understanding how to minimize non-essential spending is crucial in achieving financial stability and building wealth. By identifying areas where you can cut back on unnecessary expenses, you can allocate more resources towards your financial goals and secure a more prosperous future.

| Category | Potential Savings |

|---|---|

| 1. Dining Out | Consider reducing the frequency of eating at restaurants and opting for home-cooked meals instead. Not only will this help save money, but it also allows you to have better control over your nutrition choices. |

| 2. Entertainment | Look for cost-effective alternatives for leisure activities such as streaming services, local events, or free recreational areas. Cutting back on expensive outings can lead to significant savings over time. |

| 3. Subscription Services | Review your monthly subscriptions and identify which ones you can do without. Consider canceling unused or rarely utilized subscriptions to free up extra funds each month. |

| 4. Impulse Purchases | Avoid making impulsive buying decisions by implementing a wait and evaluate strategy. Take time to think critically about whether a purchase is necessary or if it can be postponed or eliminated entirely. |

| 5. Utility Bills | Conserve energy and reduce utility bills by implementing energy-efficient habits, such as turning off lights when not in use, using programmable thermostats, or utilizing natural light sources whenever possible. |

| 6. Transportation | Consider carpooling, using public transportation, or biking instead of relying solely on your vehicle. Not only can this save you money on fuel and maintenance costs, but it also contributes to reducing your carbon footprint. |

Identifying these areas and taking mindful steps towards reducing unnecessary expenses can make a significant impact on your financial well-being. Remember, small changes in spending habits can accumulate into substantial savings over time, allowing you to build wealth and achieve long-term financial success.

Set realistic savings goals and make regular contributions

Saving money is an essential habit for building wealth and achieving financial stability. In order to effectively save, it is important to set realistic savings goals and make regular contributions towards those goals.

By setting savings goals, you give yourself a clear target to work towards. These goals should be attainable and tailored to your specific financial situation. It is important to consider factors such as your income, expenses, and lifestyle when determining your savings goals. By setting realistic goals, you increase your chances of success and avoid feeling overwhelmed or discouraged.

In addition to setting goals, making regular contributions towards your savings is crucial. This means consistently putting aside a portion of your income towards your savings account or investment portfolio. By making regular contributions, you ensure that you are consistently working towards your goals and building your wealth over time.

One way to facilitate regular contributions is to automate your savings. This can be done by setting up automatic transfers from your checking account to your savings account on a specific date each month. By automating your savings, you remove the temptation to spend the money and make saving a priority.

Another effective strategy is to track your progress. This involves regularly reviewing your savings goals and assessing how close you are to achieving them. Tracking your progress allows you to stay motivated and make any necessary adjustments along the way.

Lastly, it is important to celebrate milestones along your savings journey. Whether it’s reaching a certain amount saved or achieving a specific goal, acknowledging your accomplishments can provide a sense of satisfaction and further motivate you to continue saving.

- Set realistic savings goals tailored to your financial situation

- Make regular contributions towards your savings

- Automate your savings to ensure consistency

- Track your progress and make adjustments as needed

- Celebrate milestones and stay motivated

Investing Wisely: Grow Your Wealth with Smart Financial Decisions

Maximizing your financial potential and securing a prosperous future requires making wise investment decisions. By employing savvy strategies and maintaining a disciplined approach, you can steadily grow your wealth and achieve long-term financial stability.

1. Knowledge is Power:

Expand your financial know-how by staying informed about the latest trends, market shifts, and investment opportunities. Read books, attend seminars, and follow reputable financial experts to gain insights into different investment options. Understanding the intricacies of stocks, bonds, real estate, and other investment vehicles empowers you to make informed decisions that align with your financial goals.

2. Diversify Your Portfolio:

One of the key tenets of investing is diversification. By spreading your investments across different asset classes, industries, and geographical regions, you can mitigate risks and ensure a balanced portfolio. Consider allocating your funds in stocks, bonds, mutual funds, real estate, and alternative investments like commodities or cryptocurrencies. Diversification allows you to capitalize on market opportunities while minimizing potential losses.

3. Take a Long-Term Approach:

Investing wisely requires adopting a long-term perspective. Instead of chasing short-term gains, focus on building a solid foundation for your financial future. Make well-researched investment decisions based on sound fundamentals and market analysis. Avoid making impulsive decisions driven by market fluctuations or the latest investment fads. Patience and discipline are key traits of successful long-term investors.

4. Seek Professional Guidance:

Consider seeking the expertise of a financial advisor or wealth manager who can provide personalized advice tailored to your specific financial situation and goals. A professional can help you navigate the complex world of investments, create a customized investment plan, and monitor your portfolio’s performance. Their experience and knowledge can prove invaluable in making informed and strategic financial decisions.

5. Embrace Risk Management:

Investing inherently involves risk, but wise investors understand the importance of risk management. Consider your risk tolerance and create an investment strategy that aligns with your comfort level. Regularly reassess your portfolio to ensure it remains balanced and aligned with your risk profile and financial goals. By effectively managing risk, you can safeguard your wealth from excessive volatility and potential downturns.

While there are no foolproof formulas for investment success, following these smart financial decisions can significantly enhance your chances of growing your wealth over time. By continuously educating yourself, diversifying your investments, taking a long-term approach, seeking professional guidance, and practicing risk management, you can embark on a prosperous financial journey and make your money work for you.

Educate yourself about different investment options, such as stocks, bonds, and real estate

Expand your knowledge on a variety of investment opportunities and make informed decisions about your financial future. By understanding the different investment options available to you, such as stocks, bonds, and real estate, you can create a well-balanced and diversified investment portfolio that aligns with your goals and risk tolerance.

Investing in stocks allows you to own a share of ownership in a company, giving you the potential for capital appreciation and dividends. It’s important to research and analyze individual stocks, as well as the overall market trends, to make informed investment choices.

Bonds, on the other hand, are fixed-income securities that offer a predetermined interest rate over a specific period of time. They provide a steady and predictable income stream, making them attractive to risk-averse investors. Understanding different types of bonds, such as government bonds or corporate bonds, can help you determine the most suitable investment options for your financial goals.

Real estate investments can provide both income and potential long-term capital appreciation. Whether investing in residential properties, commercial properties, or real estate investment trusts (REITs), it’s crucial to assess market conditions, conduct thorough due diligence, and consider factors such as location, rental income potential, and property management.

| Investment Option | Description |

|---|---|

| Stocks | Ownership in a company with potential for capital appreciation and dividends. |

| Bonds | Fixed-income securities that offer a predetermined interest rate over a specific period of time. |

| Real Estate | Investments in properties for rental income and potential long-term capital appreciation. |

By becoming knowledgeable about these different investment options, you can make informed decisions, diversify your portfolio, and increase your chances of building long-term wealth. Remember to consult with financial advisors and conduct thorough research before making any investment decisions to align your choices with your personal financial goals and risk tolerance.

Consult with a financial planner to create a customized investment strategy

Partnering with a qualified financial advisor is a prudent step towards making informed decisions about your financial future. By seeking the guidance of an experienced professional, you can develop a tailored investment strategy that aligns with your unique goals and circumstances.

Working closely with a financial planner allows you to gain insights into various investment opportunities, understand the potential risks, and make sound investment choices. They possess the expertise to analyze your current financial situation, evaluate your risk tolerance, and design a personalized plan that maximizes your potential for long-term wealth accumulation.

With a personalized investment strategy, you can confidently navigate the complex world of investment options, such as stocks, bonds, real estate, or mutual funds, with the assurance that your decisions align with your financial objectives. A financial advisor can help you diversify your portfolio, balancing risk and reward while considering your desired timeframe for achieving financial milestones.

Moreover, a seasoned financial advisor can offer valuable advice on tax-efficient investment strategies and help you optimize your financial resources. They can identify potential tax benefits and guide you on how to minimize tax liabilities while maximizing your investment returns.

Remember, building wealth requires a strategic approach that factors in your unique circumstances and goals. By consulting with a financial advisor and developing a personalized investment strategy, you can set yourself on a path towards achieving your long-term financial aspirations.

Diversify your investment portfolio to minimize risk and maximize potential returns

In this section, we’ll explore the importance of diversification in your investment portfolio to mitigate risk and enhance potential returns. By diversifying your holdings, you can spread out your investments across various asset classes, industries, and geographical locations, reducing your exposure to any single investment.

When you diversify your portfolio, you effectively reduce the impact of market fluctuations on your overall investment performance. By investing in a mix of different assets, such as stocks, bonds, mutual funds, real estate, and commodities, you can lower the risk of losing money in case one particular investment underperforms.

Furthermore, diversification allows you to tap into various industries and sectors, enabling you to benefit from the growth potential of different markets. For instance, allocating funds into both technology and healthcare stocks reduces the risk of losing out on potential gains if one sector experiences a downturn while the other thrives.

| Benefits of portfolio diversification: | Key considerations: |

|---|---|

|

|

It’s important to note that while diversification can help minimize risk, it does not guarantee protection against all losses. Diversifying your portfolio requires careful consideration of your investment goals and risk tolerance, as well as ongoing monitoring and adjustments to maintain an optimal allocation.

In conclusion, diversifying your investment portfolio is a crucial strategy for minimizing risk and maximizing potential returns. By spreading your investments across various assets and sectors, you can shield yourself from the volatility of individual investments and position yourself for long-term financial success.

Embracing Frugality: Simple Ways to Save Money and Boost Your Net Worth

Adopting a frugal lifestyle can be a game-changer when it comes to improving your financial situation. This section will explore effective strategies and practical tips to help you save money and steadily increase your net worth. By making smart choices and embracing frugality, you can gain greater control over your finances and pave the way for future prosperity.

1. Prioritize Needs Over Wants

One of the fundamental aspects of embracing frugality is distinguishing between your needs and wants. By prioritizing your needs, such as essential living expenses and debt repayments, you can allocate your financial resources wisely. This approach allows you to save more and avoid unnecessary or impulsive spending that can hinder your progress towards building wealth.

2. Practice Mindful Spending

Mindful spending involves being intentional and aware of your expenditures. It means considering the value and long-term impact of each purchase. Before making a buying decision, take a moment to evaluate if the item or service aligns with your goals and values. This habit helps you avoid impulse buys and saves money in the long run.

3. Cut Down on Unnecessary Expenses

Identify areas where you can reduce or eliminate unnecessary expenses. Look for opportunities to downsize your living arrangements, switch to more cost-effective alternatives, or renegotiate contracts and subscriptions. By minimizing expenses that don’t contribute significantly to your overall well-being, you can redirect those funds towards savings and investments.

4. Adopt a DIY Mentality

Take advantage of your skills and resources to tackle tasks and projects yourself instead of hiring someone else. Whether it’s cooking meals at home, repairing household items, or maintaining your vehicle, embracing a do-it-yourself mentality can lead to significant savings. Not only will you save money on labor costs, but you’ll also gain valuable skills along the way.

5. Utilize Discounts, Coupons, and Rewards

Make it a habit to explore available discounts, coupons, and rewards programs before making a purchase. Whether it’s clipping coupons from newspapers, signing up for loyalty programs, or using cashback apps, these methods can help you save money on everyday expenses. Even small discounts can accumulate over time and contribute to your financial stability.

By incorporating these simple yet effective strategies into your daily life, you can embrace frugality and successfully save money while steadily increasing your net worth. Remember, small changes can yield significant results when it comes to building wealth and achieving financial success.

Questions and answers

What are some practical tips for building wealth?

Some practical tips for building wealth include creating a budget, saving a percentage of your income, investing wisely, and continuously improving your financial knowledge.

How can I save more money?

To save more money, you can start by tracking your expenses, looking for ways to cut back on non-essential spending, automating your savings, and finding creative ways to increase your income.

Is investing necessary for building wealth?

Investing is an important component of building wealth. By investing in stocks, real estate, or other profitable ventures, you can grow your wealth over time and take advantage of compound interest.

What are some ways to increase my financial knowledge?

To increase your financial knowledge, you can read books and articles on personal finance, attend seminars or workshops, seek advice from financial professionals, and actively educate yourself about various investment options.

How long does it take to become financially successful?

The time it takes to become financially successful varies for each individual. It depends on factors such as your current financial situation, income, expenses, investment choices, and dedication to following proven strategies for building wealth. It may take several years or even decades to achieve significant financial success.

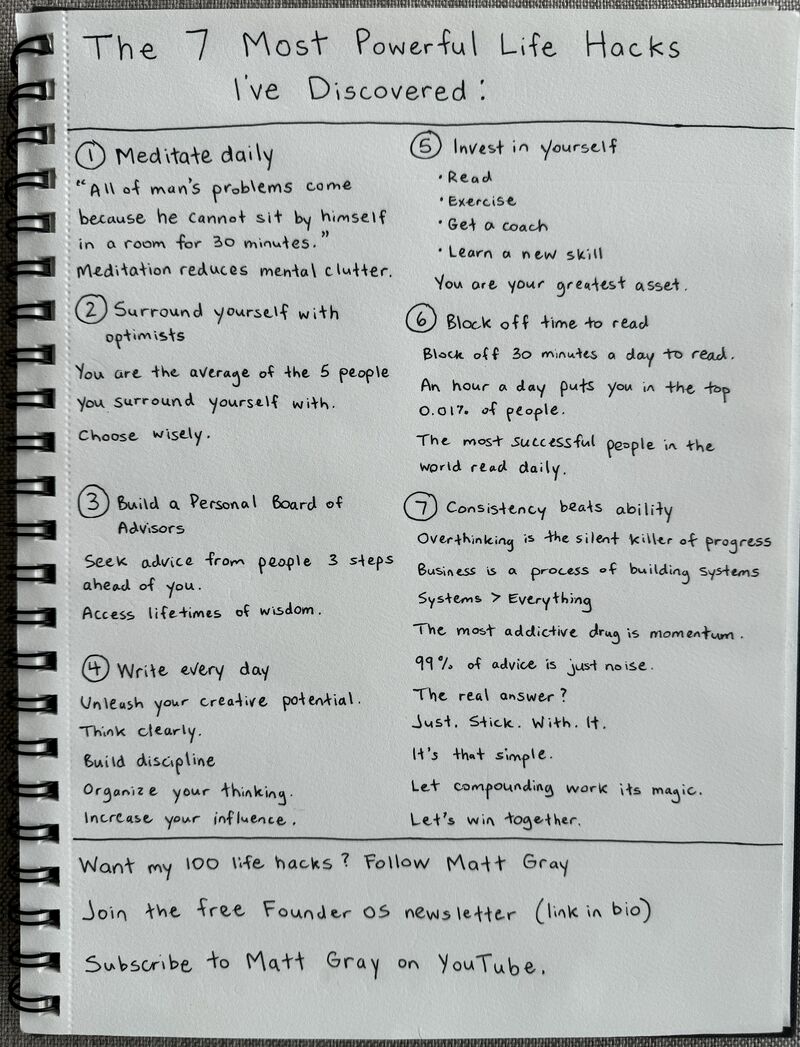

What are some life hacks for building wealth?

Some proven life hacks for building wealth include creating a budget and sticking to it, saving and investing regularly, reducing unnecessary expenses, diversifying income streams, and continuously educating oneself about personal finance.

How can I create a budget and effectively stick to it?

Creating a budget involves tracking your income and expenses, setting financial goals, prioritizing spending, and allocating funds accordingly. To effectively stick to your budget, you need to have discipline, regularly review and adjust your budget, avoid impulse purchases, and track your progress.

What are some practical ways to save and invest regularly?

Practical ways to save and invest regularly include automating monthly contributions to a savings or investment account, setting specific savings goals, cutting back on unnecessary expenses, paying off high-interest debt, and seeking professional advice on suitable investment options.

How can I reduce unnecessary expenses?

To reduce unnecessary expenses, you can start by identifying and tracking your spending habits, distinguishing between needs and wants, comparing prices and shopping for deals, negotiating bills and subscriptions, cutting back on eating out and entertainment, and avoiding impulse purchases.

Why is it important to diversify income streams?

Diversifying income streams is important because it helps reduce financial risk and provides multiple sources of revenue. By having different sources of income, such as a side business, rental property, or investments, you are less reliant on a single source and can better withstand any setbacks or economic downturns.